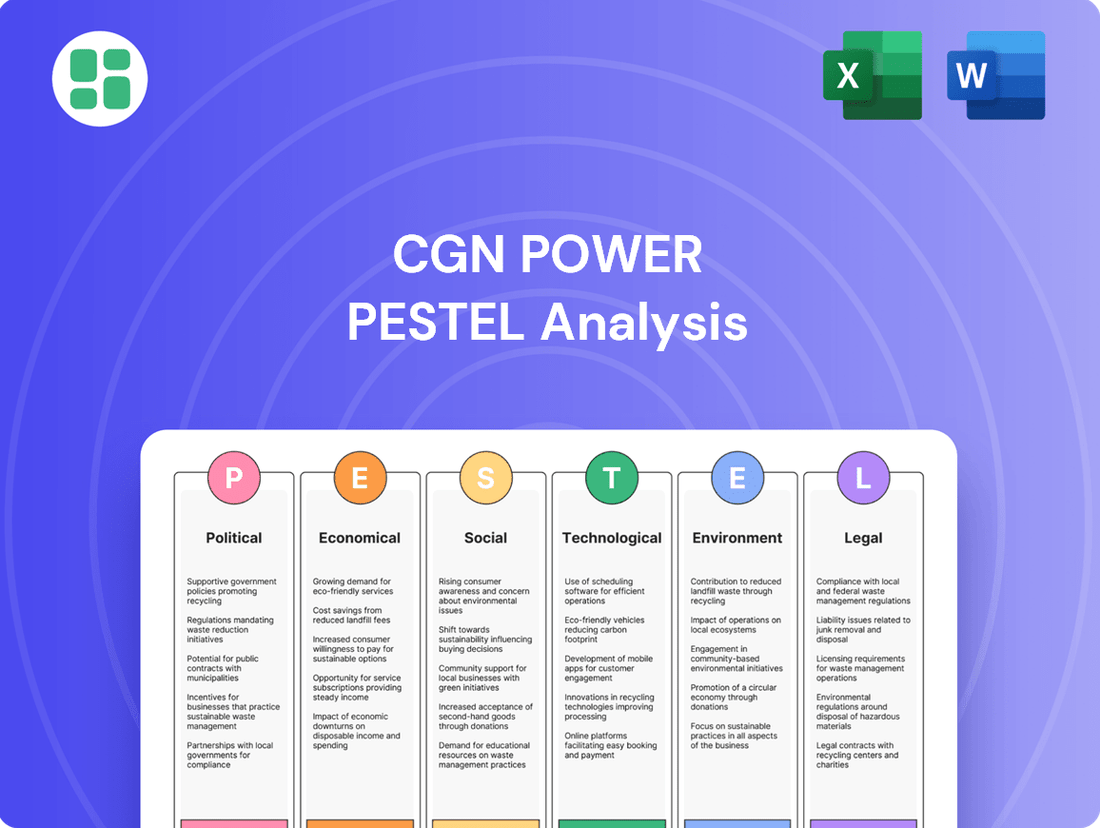

CGN Power PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CGN Power Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping CGN Power's strategic landscape. Our comprehensive PESTLE analysis provides actionable intelligence to navigate these forces effectively. Gain a competitive edge by understanding the external environment that dictates CGN Power's opportunities and threats. Download the full version now for immediate strategic clarity.

Political factors

The Chinese government's strong endorsement of nuclear power is a cornerstone for CGN Power's operations. This support is evident in national energy strategies, which prioritize nuclear as a key component for energy security and emissions reduction. For instance, China's 14th Five-Year Plan (2021-2025) outlined ambitious targets for nuclear power capacity, aiming to reach 70 GW by 2025, a significant increase from the approximately 51 GW operational capacity as of late 2023.

Government policies often translate into direct financial and regulatory advantages for state-backed enterprises like CGN Power. This includes favorable loan conditions, streamlined approval processes for new projects, and consistent long-term planning that provides market certainty. Such backing is crucial for the capital-intensive nature of nuclear power development, ensuring project viability and sustained growth in the sector.

China's strategic push for energy security heavily favors nuclear power, aiming to significantly decrease dependence on imported fossil fuels. This national priority directly bolsters CGN Power's mission, as the company is central to delivering a secure and domestically controlled energy source.

The government's commitment to energy self-sufficiency is a powerful driver for the nuclear sector. In 2023, China's installed nuclear power capacity reached 55.5 gigawatts, with further expansion plans indicating strong policy support for companies like CGN Power.

China's commitment to peak carbon emissions before 2030 and reach carbon neutrality by 2060 creates a favorable political landscape for CGN Power. This national drive towards decarbonization directly supports the growth of non-fossil fuel energy, including nuclear power.

CGN Power, being a significant player in the nuclear energy sector, is well-placed to align with and contribute to these ambitious environmental goals. Government policies prioritizing low-carbon energy development are crucial drivers for the company's future expansion and operational strategy.

Regulatory Oversight and Centralized Planning

China's nuclear power sector operates under rigorous government supervision, with state bodies like the National Nuclear Safety Administration (NNSA) overseeing licensing, safety standards, and project approvals. This centralized control ensures new plant development aligns with national energy strategies and safety protocols, providing a stable, albeit controlled, operating environment.

Centralized planning significantly shapes the expansion of nuclear capacity. For instance, China's 14th Five-Year Plan (2021-2025) targeted an installed nuclear power capacity of 70 GW by 2025, a substantial increase from the approximately 53 GW operational capacity at the end of 2023. This top-down approach minimizes market volatility related to project initiation and scale.

- Stringent Oversight: Licensing and safety regulations are strictly enforced by state agencies like the NNSA.

- Centralized Planning: National development priorities dictate the pace and scale of nuclear projects.

- Reduced Uncertainty: The strict regulatory framework offers a predictable environment for industry participants.

- Capacity Targets: China aims for 70 GW of nuclear capacity by 2025, reflecting state-driven expansion.

International Cooperation and Geopolitical Relations

China's nuclear power sector, including CGN Power, actively pursues international collaboration to advance technology, develop projects, and uphold safety standards. This global engagement is crucial for sharing best practices and fostering innovation within the industry.

Geopolitical shifts and evolving trade policies significantly shape the international market for Chinese nuclear technology, such as the Hualong One reactor. For instance, trade agreements and sanctions can directly impact the feasibility and cost of exporting these advanced reactors to new markets.

The Chinese government's diplomatic initiatives aimed at promoting nuclear energy globally directly influence CGN Power's prospects for expanding its international market presence. These efforts can open doors for new project bids and strategic partnerships.

- International Partnerships: CGN Power has engaged in partnerships with countries like the UK and Pakistan for nuclear projects, demonstrating its global reach.

- Technology Exports: The Hualong One reactor, a key export product, has seen deployment in projects like the Karachi Nuclear Power Plant in Pakistan, highlighting China's growing nuclear technology export capabilities.

- Diplomatic Influence: China's Belt and Road Initiative often includes energy cooperation, potentially creating further opportunities for CGN Power's international ventures.

The Chinese government's strong backing for nuclear power, as articulated in its national energy strategies and the 14th Five-Year Plan, is a primary political driver for CGN Power. This policy focus aims to enhance energy security and achieve ambitious decarbonization targets, with China targeting 70 GW of nuclear capacity by 2025, up from 55.5 GW in 2023.

Rigorous government oversight by bodies like the National Nuclear Safety Administration (NNSA) ensures compliance with stringent safety standards and aligns new projects with national energy plans, creating a predictable regulatory environment.

China's diplomatic efforts and initiatives like the Belt and Road Initiative actively promote nuclear energy exports, creating international opportunities for CGN Power, exemplified by the Hualong One reactor's deployment in Pakistan.

| Policy Area | Key Initiatives/Targets | Impact on CGN Power |

|---|---|---|

| Energy Security & Decarbonization | 14th Five-Year Plan (2021-2025) targets 70 GW nuclear capacity by 2025. China aims for carbon neutrality by 2060. | Direct support for CGN Power's expansion and project pipeline. |

| Regulatory Framework | Strict oversight by NNSA for licensing and safety. | Ensures operational stability and compliance, reducing project uncertainty. |

| International Cooperation & Exports | Promotion of Hualong One reactor technology globally. Belt and Road Initiative energy cooperation. | Opens avenues for international project development and technology sales. |

What is included in the product

This CGN Power PESTLE analysis meticulously examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's strategic landscape.

It provides actionable insights for identifying emerging threats and capitalizing on opportunities within the global energy sector.

A clear, actionable summary of CGN Power's PESTLE analysis, presented in an easily digestible format, alleviates the pain of sifting through complex data, enabling faster strategic decision-making.

Economic factors

The sheer scale of capital needed for nuclear power infrastructure is a defining economic characteristic. Building and maintaining these facilities demands billions of dollars, making access to funding absolutely critical for companies like CGN Power.

CGN Power's ability to undertake its ambitious projects hinges on securing substantial financial backing. This often comes from state-backed financial institutions and collaborative public-private partnerships, highlighting the intertwined nature of government support and private enterprise in this sector.

The cost and availability of capital directly impact CGN Power's growth trajectory and its bottom line. For instance, fluctuating interest rates or changes in the willingness of financial institutions to lend can significantly alter project feasibility and profitability forecasts.

China's ongoing economic expansion is a significant driver for electricity demand, creating a substantial market for CGN Power's operations. For instance, China's GDP grew by 5.2% in 2023, signaling continued industrial and commercial activity that requires ample power.

Government-regulated electricity tariffs and long-term power purchase agreements offer CGN Power a degree of revenue predictability. These mechanisms help shield the company from short-term market volatility, ensuring a stable income base for its nuclear power generation.

However, any shifts in overall energy demand patterns or modifications to government pricing policies could directly influence CGN Power's financial results. For example, a slowdown in industrial output or a change in the tariff structure could affect revenue streams.

CGN Power's financial health hinges on its capacity to secure funding for new ventures, effectively manage its debt, and generate robust operating cash flows. In 2023, the company reported total debt of approximately RMB 258.1 billion, highlighting the importance of efficient debt management.

Access to both domestic and international capital markets, alongside potential government support like subsidies or favorable loans, is vital for CGN Power's ongoing expansion. This financial stability underpins its ability to maintain current operations and fund future growth initiatives.

Cost Competitiveness of Nuclear Energy

The cost competitiveness of nuclear energy for CGN Power is a critical economic factor, constantly benchmarked against alternatives like coal, natural gas, and renewables. While nuclear plants demand substantial upfront investment, their extended operational lifespans, often exceeding 60 years, and relatively stable fuel costs can lead to lower levelized costs of electricity (LCOE) over the long term, especially when carbon pricing mechanisms are in place. For instance, in 2023, the LCOE for new nuclear power plants in some regions was estimated to be competitive with new coal and gas plants, particularly when factoring in carbon emissions costs.

CGN Power’s strategy focuses on cost optimization throughout the project lifecycle. This includes efficient construction management, streamlined operational processes, and strategic fuel procurement. By improving operational efficiency and exploring advanced reactor designs that may reduce construction and maintenance expenses, CGN Power aims to bolster the economic viability of its nuclear assets against fluctuating fossil fuel prices and the increasing integration of intermittent renewable sources.

- Upfront Capital Costs: Nuclear power plants require significant initial investment, with new builds often costing tens of billions of dollars.

- Operational and Fuel Costs: Once operational, nuclear plants generally have lower operating and fuel costs compared to fossil fuel plants, contributing to long-term cost competitiveness.

- Carbon Pricing Impact: The introduction or increase of carbon taxes or emissions trading schemes makes nuclear energy more economically attractive by penalizing carbon-intensive alternatives.

- LCOE Benchmarking: In 2024, projections indicate that the levelized cost of electricity for new nuclear projects in China could range from $50-$70 per megawatt-hour, making it competitive with new coal power plants when carbon costs are considered.

Global Economic Trends and Trade

Broader global economic shifts, such as persistent inflation and fluctuating interest rates, present a complex backdrop for CGN Power. For instance, the International Monetary Fund (IMF) projected global inflation to moderate but remain elevated in 2024, impacting project financing costs and operational expenses. Rising interest rates, a trend seen across major economies in 2023 and continuing into 2024, can significantly increase the cost of capital for large-scale nuclear projects.

Economic slowdowns, whether regional or global, directly influence electricity demand growth, a critical factor for CGN Power's revenue projections. A projected slowdown in global GDP growth for 2024, as indicated by various economic forecasts, could temper the expansion of electricity consumption, particularly in developing markets where CGN Power has significant interests. This also affects the availability and cost of international financing crucial for capital-intensive nuclear ventures.

Global trade tensions and supply chain disruptions remain a persistent concern for the nuclear industry. The stability of the international supply chain for specialized nuclear components and raw materials, such as enriched uranium, is vital for project execution. Geopolitical events in 2023 and early 2024 have highlighted vulnerabilities in these supply chains, potentially leading to project delays and increased costs for CGN Power.

- Global Inflation Forecast: IMF's World Economic Outlook projected global inflation at 5.9% for 2024, down from 6.9% in 2023, but still above pre-pandemic levels.

- Interest Rate Environment: Major central banks, including the US Federal Reserve and the European Central Bank, maintained higher interest rates through much of 2023 and signaled a cautious approach to cuts in early 2024.

- Global GDP Growth: The IMF anticipated global GDP growth to slow from 3.0% in 2023 to 2.9% in 2024.

- Supply Chain Risks: Ongoing geopolitical tensions, particularly concerning energy security, continue to pose risks to the reliable sourcing of nuclear fuel and equipment.

The economic landscape for CGN Power is shaped by the immense capital requirements of nuclear projects, with financing often secured through state-backed institutions and public-private partnerships. The cost and availability of this capital directly influence project feasibility and profitability, as seen with fluctuating interest rates impacting borrowing costs.

China's robust economic expansion, evidenced by a 5.2% GDP growth in 2023, fuels electricity demand, creating a strong market for CGN Power. However, shifts in energy demand or government tariff policies, such as regulated pricing, can impact revenue predictability.

CGN Power's financial strategy emphasizes cost competitiveness, aiming for a lower levelized cost of electricity (LCOE) through efficient operations and potentially advanced reactor designs. In 2023, the company managed approximately RMB 258.1 billion in total debt, underscoring the critical need for effective debt management and access to capital markets.

| Economic Factor | 2023 Data/Projection | Impact on CGN Power |

|---|---|---|

| China GDP Growth | 5.2% (2023) | Drives electricity demand, supporting CGN Power's market. |

| Global Inflation | Projected 5.9% (2024) | Increases operational and financing costs. |

| Global GDP Growth | Projected 2.9% (2024) | Potential slowdown in electricity demand growth. |

| CGN Power Total Debt | ~RMB 258.1 billion (2023) | Highlights the importance of efficient debt management and capital access. |

| New Nuclear LCOE (China) | $50-$70/MWh (2024 Projection) | Indicates competitiveness against fossil fuels, especially with carbon pricing. |

What You See Is What You Get

CGN Power PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive CGN Power PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing detailed insights into the Political, Economic, Social, Technological, Legal, and Environmental factors affecting CGN Power.

The content and structure shown in the preview is the same document you’ll download after payment, ensuring you get a complete and actionable PESTLE analysis for CGN Power.

Sociological factors

Public perception is a critical factor for CGN Power, directly impacting its social license to operate. Surveys in 2024 indicate a mixed but generally improving public sentiment towards nuclear energy in key markets, with a growing recognition of its role in decarbonization efforts. For instance, a recent poll in a major European nation showed a 5% increase in support for new nuclear builds compared to the previous year.

However, concerns about safety and the long-term management of nuclear waste remain significant hurdles. Incidents or perceived lack of transparency can quickly erode public trust, leading to protests and political opposition, as seen in past instances affecting project timelines. CGN Power's proactive community engagement and robust safety communication strategies are therefore essential to counter these anxieties and foster acceptance.

Global high-profile nuclear incidents, like the 2011 Fukushima disaster, have significantly amplified public apprehension regarding nuclear energy safety. This heightened awareness means CGN Power faces ongoing pressure to demonstrate unwavering commitment to stringent safety protocols and advanced reactor technologies. For instance, by the end of 2024, CGN Power reported a 99.9% operational safety record across its facilities, a figure crucial for public trust.

CGN Power's projects, like the Taishan Nuclear Power Plant, directly and indirectly generate substantial employment. For instance, the construction phase of such large-scale projects can employ thousands, with operational roles continuing for decades, providing stable, high-skilled jobs in local areas.

These employment opportunities translate into significant economic benefits for surrounding communities. Local procurement of goods and services during construction and operation further injects capital into the regional economy, supporting small and medium-sized enterprises and fostering overall economic development.

CGN Power's commitment to local hiring and sourcing can cultivate strong community relations. By contributing to job creation and economic growth, the company can build trust and support, which is crucial for the long-term success and social acceptance of its nuclear facilities.

Corporate Social Responsibility (CSR)

Societal expectations for companies to operate responsibly are particularly pronounced in the nuclear industry, covering environmental protection, ethical conduct, and community involvement. CGN Power's dedication to Corporate Social Responsibility (CSR), which includes efforts beyond its primary business activities, can significantly boost its public image and strengthen ties with various stakeholders. For instance, in 2023, CGN Power reported investing ¥2.1 billion in environmental protection and community development initiatives, demonstrating a tangible commitment to social value. This focus is crucial for long-term business sustainability.

Demonstrating social value is becoming a key differentiator for companies aiming for sustainable growth. CGN Power's CSR strategy often highlights its contributions to local economies through job creation and support for educational programs. In 2024, the company announced plans to increase its investment in social programs by 15%, aiming to further integrate its operations with community well-being.

- Environmental Stewardship: CGN Power's commitment to minimizing its environmental footprint, including waste management and emissions control, aligns with growing public concern over climate change.

- Ethical Practices: Upholding high standards of corporate governance and transparency builds trust with investors, employees, and the public.

- Community Engagement: Active participation in local communities through social investment and dialogue fosters goodwill and social license to operate.

- Sustainable Operations: Integrating CSR into its core business strategy supports long-term viability and enhances brand reputation in an increasingly conscious market.

Demographic Shifts and Energy Consumption Patterns

China's demographic landscape is a key driver of energy demand. With a population exceeding 1.4 billion, even modest growth translates into significant energy needs. Urbanization rates, which reached approximately 65% by the end of 2023, further concentrate this demand, requiring robust power infrastructure in cities.

Rising living standards are directly linked to increased per capita energy consumption. As more households gain access to modern appliances and transportation, the demand for stable and increasingly clean electricity intensifies. This trend is particularly evident in the growing middle class, which is projected to continue expanding through 2025.

- Population Growth: China's population, while slowing, still adds millions of people annually, increasing baseline energy needs.

- Urbanization: The continued migration to cities concentrates energy demand and necessitates advanced grid infrastructure.

- Rising Living Standards: Increased disposable income fuels demand for electricity-intensive goods and services.

- Lifestyle Changes: Greater adoption of electric vehicles and smart home technologies will further shape energy consumption patterns.

CGN Power's strategic focus on expanding its clean energy portfolio, including nuclear and renewables, directly addresses these evolving demographic and lifestyle trends. By providing reliable and cleaner power sources, the company supports China's ongoing societal development and its commitment to sustainable energy practices.

Public perception of nuclear energy remains a significant sociological factor for CGN Power, influencing its social license to operate. While surveys in 2024 indicated a growing acceptance of nuclear power for its decarbonization potential, with one European nation seeing a 5% rise in support for new builds, concerns over safety and waste disposal persist.

The enduring impact of past incidents like Fukushima continues to shape public apprehension, compelling CGN Power to maintain rigorous safety standards and transparent communication. The company's reported 99.9% operational safety record by late 2024 is a key metric for building and maintaining public trust.

CGN Power's role as a major employer, particularly through large-scale projects like the Taishan Nuclear Power Plant, generates substantial economic benefits and goodwill within local communities. These projects provide thousands of stable, high-skilled jobs and stimulate regional economies through local procurement, fostering positive societal relationships.

Societal expectations for corporate responsibility are high in the nuclear sector. CGN Power's investment of ¥2.1 billion in environmental protection and community initiatives in 2023, alongside plans for a 15% increase in social program investment in 2024, demonstrates a commitment to social value that enhances its public image and stakeholder relations.

Technological factors

China's indigenous Hualong One (HPR1000) reactor design represents a significant technological leap for CGN Power, with multiple units operational or under construction. This Generation III+ reactor technology boasts enhanced safety systems and greater fuel efficiency compared to older designs. By mid-2024, over 20 Hualong One reactors were in operation or construction globally, underscoring its growing importance.

Technological advancements in nuclear waste management are paramount for the safe and efficient handling of radioactive materials, including spent fuel reprocessing and geological disposal. These innovations directly address significant environmental and public safety concerns tied to nuclear energy production.

CGN Power's commitment to investing in cutting-edge waste treatment technologies is crucial for ensuring its long-term operational viability and maintaining public trust. For instance, by 2024, China's nuclear waste management sector is projected to see substantial growth, with ongoing development in deep geological repositories and advanced reprocessing techniques.

Technological advancements in nuclear safety systems are crucial for CGN Power. For instance, the development of digital instrumentation and control systems offers enhanced reliability over older analog systems, reducing the likelihood of human error. These upgrades are vital for maintaining operational integrity and preventing incidents.

The integration of artificial intelligence and advanced diagnostics is transforming nuclear plant operations. AI can predict equipment failures before they occur, allowing for proactive maintenance, which is a significant step up from reactive repairs. This not only boosts safety but also improves overall plant efficiency and uptime, a key factor in cost-effectiveness.

CGN Power's commitment to adopting these cutting-edge solutions is essential for its long-term success. By investing in the latest safety technologies, the company can ensure the secure and efficient operation of its nuclear facilities, meeting stringent regulatory requirements and public expectations. For example, in 2023, the global nuclear industry saw increased investment in digital twin technology for plant monitoring, a trend CGN Power is likely following.

Research and Development (R&D) Investment

Significant investment in research and development is crucial for CGN Power to enhance current nuclear technologies and pioneer next-generation reactors, such as Generation IV designs and Small Modular Reactors (SMRs). This forward-looking approach also encompasses investigating novel applications for nuclear energy. CGN Power’s dedication to R&D is fundamental to maintaining its technological edge and agility in a dynamic energy sector, extending its innovation beyond conventional large-scale reactor designs.

CGN Power's strategic R&D investments are geared towards securing its future competitiveness. For instance, the company has been actively involved in advancing SMR technology, which promises greater flexibility and potentially lower upfront costs compared to traditional large reactors. This focus aligns with global trends towards more adaptable and scalable nuclear solutions.

- R&D Focus: Development of Generation IV reactors and Small Modular Reactors (SMRs).

- Strategic Goal: Maintain technological leadership and adaptability in the evolving energy landscape.

- Innovation Scope: Exploration of new applications for nuclear energy beyond large-scale reactors.

Cybersecurity in Nuclear Operations

The increasing digitalization of CGN Power's control systems and operational networks elevates cybersecurity to a paramount technological concern. Protecting against sophisticated cyber threats is no longer optional but essential for maintaining the integrity, safety, and unwavering reliability of nuclear operations. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the significant financial and operational risks involved.

CGN Power must therefore commit to continuous and substantial investment in robust cybersecurity measures. This proactive approach is vital to safeguard its critical infrastructure against potential breaches that could disrupt power generation or compromise safety protocols. The International Atomic Energy Agency (IAEA) has also emphasized the growing importance of cybersecurity in nuclear facilities, issuing guidelines to address these evolving technological challenges.

Key technological considerations for CGN Power's cybersecurity strategy include:

- Advanced Threat Detection: Implementing AI-powered systems to identify and neutralize cyber threats in real-time.

- Network Segmentation: Isolating critical operational technology (OT) networks from information technology (IT) networks to limit the impact of a breach.

- Secure Software Development: Ensuring all software used in control systems is developed with security as a core principle.

- Regular Audits and Penetration Testing: Proactively identifying vulnerabilities through independent security assessments.

CGN Power's technological advancement is heavily influenced by the development and deployment of the Hualong One (HPR1000) reactor, a significant indigenous design. This Generation III+ technology enhances safety and fuel efficiency, with over 20 units in operation or construction globally by mid-2024.

Legal factors

CGN Power's operations are strictly governed by China's national nuclear safety regulations, overseen by the National Nuclear Safety Administration (NNSA). These regulations cover every stage, from initial design and construction to ongoing operation and eventual decommissioning, ensuring a high level of safety. Failure to comply can lead to severe penalties and operational disruptions.

Adherence to these rigorous safety standards is paramount and directly influences project execution, potentially impacting timelines and increasing capital expenditure. For instance, any updates or amendments to the NNSA's safety directives in 2024 or 2025 could necessitate costly retrofits or changes in operational procedures for existing and planned facilities.

CGN Power must strictly follow China's national environmental protection laws, covering areas like air emissions, solid waste disposal, wastewater discharge, and biodiversity preservation. For instance, the Environmental Protection Law of the People's Republic of China mandates stringent standards for pollutants. Failure to comply can result in significant fines, with penalties for exceeding emission limits potentially reaching millions of yuan.

New power generation projects require thorough environmental impact assessments (EIAs) before approval. These assessments, often detailed multi-year studies, evaluate potential effects on air quality, water resources, and local ecosystems. Ongoing monitoring of emissions and environmental performance is also a legal requirement to ensure continued compliance and maintain operational permits.

Adherence to these environmental regulations is fundamental for CGN Power to secure and retain its operating licenses. Non-compliance can lead to substantial penalties, project delays, or even the suspension of operations, impacting financial performance and investor confidence. For example, in 2023, several companies faced substantial fines for exceeding emission standards, highlighting the enforcement rigor.

CGN Power's nuclear projects are subject to rigorous, multi-stage licensing and approval procedures mandated by governmental bodies. These approvals are critical for everything from choosing a site to obtaining permits for construction, operation, and even the handling of nuclear fuel. For instance, in 2024, the approval timeline for new nuclear projects in many developed nations continues to be a significant hurdle, often extending several years.

Any unforeseen delays or modifications within these legal frameworks can substantially disrupt project timelines and negatively affect the financial projections of CGN Power. For example, a shift in regulatory requirements for waste management, which occurred in some European countries in late 2023, could add millions to construction costs and extend project completion dates by months, impacting the overall economic feasibility.

International Nuclear Treaties and Agreements

CGN Power's operations are significantly influenced by China's commitment to international nuclear treaties. For instance, adherence to the Treaty on the Non-Proliferation of Nuclear Weapons (NPT) underpins the global framework for peaceful nuclear energy utilization. China's active participation in international safety conventions, such as those managed by the International Atomic Energy Agency (IAEA), sets common operational standards and promotes a secure nuclear industry worldwide. In 2023, China continued its engagement with the IAEA, participating in various technical cooperation projects and review missions, reinforcing its commitment to global nuclear safety and security.

These international frameworks are crucial for CGN Power as they foster international credibility and enable vital global cooperation in areas like technology sharing and regulatory best practices. China's consistent compliance helps to build trust with other nations, which is essential for securing international partnerships and investments in its nuclear energy projects. For example, the ongoing development of the Hualong One reactor design, which aims for international certification, directly benefits from China's engagement with international nuclear standards and regulatory bodies.

- NPT Adherence: China's commitment to the Treaty on the Non-Proliferation of Nuclear Weapons ensures its nuclear activities are aligned with global non-proliferation goals, fostering international trust.

- IAEA Engagement: Active participation in IAEA safety conventions and technical cooperation programs helps CGN Power adopt and maintain high international safety standards.

- Global Cooperation: Compliance with international agreements facilitates technology transfer and collaborative research, crucial for CGN Power's advanced reactor development.

- Credibility: Upholding treaty obligations enhances CGN Power's international reputation, supporting its efforts to secure foreign investment and partnerships in the global nuclear market.

Liability and Insurance Frameworks

Legal frameworks dictating liability for nuclear incidents and mandatory insurance are paramount for operators like CGN Power. These regulations ensure sufficient funds are available for compensation should an accident occur, safeguarding the public and environment. For instance, many countries mandate specific levels of financial protection, often in the billions of dollars, to cover potential damages from nuclear events.

CGN Power must adhere to these financial protection mechanisms. This includes understanding and meeting the insurance requirements set forth by national and international bodies. For example, the Paris Convention on Third Party Liability in the Field of Nuclear Energy establishes a framework for liability and compensation, with member states often setting their own coverage limits. As of recent reports, these limits can range significantly, with some jurisdictions requiring coverage exceeding €1.5 billion for a single nuclear incident.

- Nuclear Liability Conventions: Adherence to international conventions like the Paris Convention and the Vienna Convention is crucial for CGN Power, defining liability limits and compensation mechanisms.

- Mandatory Insurance Coverage: Operators are legally required to maintain specific levels of insurance or financial security, often in the hundreds of millions to billions of dollars, to cover potential damages from nuclear incidents.

- Regulatory Compliance: CGN Power must navigate and comply with national nuclear safety and liability laws, which dictate operational standards, incident reporting, and financial preparedness.

- Risk Mitigation: These legal and insurance frameworks are designed to mitigate the financial and environmental risks associated with nuclear power generation, ensuring accountability and public safety.

CGN Power operates under stringent Chinese nuclear safety regulations enforced by the National Nuclear Safety Administration (NNSA), covering all lifecycle stages from design to decommissioning. Compliance is non-negotiable, with violations leading to severe penalties and operational halts, directly impacting project timelines and capital expenditure, especially with potential regulatory updates in 2024-2025.

Environmental protection laws in China mandate rigorous standards for emissions, waste, and biodiversity, with penalties for non-compliance potentially reaching millions of yuan, as exemplified by significant fines levied in 2023. Thorough environmental impact assessments are legally required for new projects, with ongoing monitoring essential for maintaining operating licenses, underscoring the financial and reputational risks of non-adherence.

The company navigates complex, multi-stage licensing and approval processes for its nuclear projects, with approval timelines often extending for years, as seen in 2024 for new projects globally. Any shifts in legal frameworks, such as waste management regulations experienced in Europe in late 2023, can add significant costs and delays, impacting financial feasibility.

CGN Power's adherence to international nuclear treaties, including the NPT and IAEA safety conventions, is vital for global credibility and cooperation, as demonstrated by China's 2023 engagement with the IAEA. This compliance facilitates technology sharing and partnerships, crucial for advanced reactor development like the Hualong One, and bolsters international investment prospects.

Environmental factors

CGN Power’s nuclear operations are a cornerstone of China’s ambitious carbon emission reduction targets, significantly contributing to the nation's climate change mitigation efforts. As of the end of 2023, CGN Power's installed nuclear capacity reached 25.9 GW, playing a vital role in displacing substantial amounts of fossil fuel-based power generation.

This displacement directly translates into lower greenhouse gas emissions, with the company's nuclear fleet avoiding an estimated 100 million tonnes of CO2 equivalent annually. Such a contribution is critical for China to achieve its goal of peaking carbon dioxide emissions before 2030 and achieving carbon neutrality by 2060.

The safe and long-term management of radioactive waste, particularly spent nuclear fuel, presents a significant environmental hurdle for CGN Power. The company must navigate stringent environmental regulations governing the handling, storage, and ultimate disposal of these hazardous materials, ensuring minimal risk to ecosystems and public health.

CGN Power's commitment to environmental stewardship necessitates ongoing investment in cutting-edge waste management technologies. For instance, the company is exploring advanced reprocessing techniques and deep geological repositories to mitigate the long-term environmental footprint of nuclear operations, aligning with global best practices and evolving regulatory landscapes.

Nuclear power generation, including CGN Power's operations, is inherently water-intensive, primarily for cooling. In 2023, the global average water withdrawal for thermal power plants was approximately 25 billion cubic meters annually, highlighting the scale of this demand. CGN Power's commitment to efficient water usage, such as employing closed-loop cooling systems, is crucial for mitigating environmental impact on local water sources and aquatic life.

Adhering to stringent regulatory standards for water discharge quality is paramount for CGN Power. For instance, in China, regulations often limit thermal pollution and chemical content in discharged water to protect receiving water bodies. Failure to comply can result in significant fines and operational disruptions, underscoring the importance of robust water management practices.

Land Use and Ecological Impact

The construction of CGN Power's nuclear facilities, such as the Taishan Nuclear Power Plant, demands substantial land allocation, potentially affecting local biodiversity and ecosystems. For instance, the Taishan plant covers an area of approximately 2.4 square kilometers. Environmental impact assessments are therefore critical for identifying and mitigating any ecological disruptions that may arise from such large-scale projects.

CGN Power is committed to responsible site selection and the implementation of robust measures to safeguard surrounding natural habitats throughout the entire lifecycle of its power plants. This includes careful planning to minimize habitat fragmentation and the introduction of conservation programs where necessary.

- Land Use: CGN Power's projects require significant land footprints, with facilities like Taishan Nuclear Power Plant occupying substantial areas.

- Ecological Impact: Careful consideration is given to the potential effects on local ecosystems and biodiversity during site selection and operation.

- Mitigation Measures: Environmental impact assessments and ongoing monitoring are integral to minimizing and managing ecological disruptions.

- Biodiversity Protection: Strategies are employed to protect surrounding natural habitats and promote biodiversity conservation around operational sites.

Adaptation to Climate Change Impacts

While nuclear power is a key tool in reducing greenhouse gas emissions, CGN Power's facilities must also be robust against the physical impacts of climate change. Extreme weather events like increased flooding, prolonged heatwaves, and rising sea levels pose significant risks to nuclear infrastructure. For instance, the 2021 European floods highlighted vulnerabilities in energy infrastructure, with some power plants experiencing operational disruptions.

CGN Power must integrate climate resilience into its plant designs and operational procedures to maintain long-term safety and reliability. This includes investing in advanced cooling systems capable of withstanding higher ambient temperatures and reinforcing coastal facilities against sea-level rise. Proactive adaptation is essential for safeguarding these critical assets.

- Flood Defenses: Enhancing flood defenses for coastal and riverine nuclear sites, potentially incorporating higher seawalls and improved drainage systems.

- Cooling System Upgrades: Implementing more efficient and resilient cooling technologies that can operate effectively during extreme heat events, reducing the risk of shutdowns.

- Infrastructure Hardening: Strengthening buildings and critical infrastructure against high winds, storms, and other extreme weather phenomena.

CGN Power's nuclear operations are central to China's decarbonization strategy, with its 25.9 GW installed nuclear capacity at the end of 2023 significantly reducing reliance on fossil fuels. This clean energy generation is estimated to avoid 100 million tonnes of CO2 equivalent annually, a crucial step towards China's 2030 carbon peaking and 2060 carbon neutrality goals.

PESTLE Analysis Data Sources

Our CGN Power PESTLE Analysis is informed by a robust blend of official government publications, reputable industry associations, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the energy sector.