CGN Power Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CGN Power Bundle

CGN Power faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers being key considerations. Understanding these dynamics is crucial for navigating the energy sector.

The complete report reveals the real forces shaping CGN Power’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of specialized nuclear reactor components, safety systems, and advanced instrumentation wield considerable influence. This power stems from the highly technical and proprietary nature of their offerings, with few global manufacturers capable of producing these critical items. CGN Power, for instance, frequently depends on a select group of domestic and international vendors for its advanced nuclear technology requirements.

The bargaining power of nuclear fuel (uranium) suppliers for CGN Power is significant due to the concentrated nature of the global uranium market. A few major mining companies and specialized conversion and enrichment facilities control a substantial portion of the supply chain, giving them considerable leverage.

Geopolitical risks and the technical complexity of processing uranium also bolster supplier power. China, while developing its domestic uranium resources, still depends on international markets, exposing CGN Power to global supply disruptions and price volatility. For instance, in 2023, the spot price of uranium saw considerable fluctuations, driven by supply concerns and increased demand from utilities looking to secure long-term contracts, indicating the sensitivity of the market to supplier actions.

The nuclear power sector, including companies like CGN Power, relies heavily on a specialized workforce. This includes highly trained engineers, scientists, and technicians essential for every stage, from initial design and construction to ongoing operation and maintenance. The demand for this expertise often outstrips supply.

This scarcity of specialized talent translates directly into increased bargaining power for suppliers of this human capital. Consulting firms and educational institutions that can provide this niche expertise can therefore negotiate higher fees and more favorable contract terms. In 2023, the global nuclear workforce was estimated to be around 1 million people, with a significant portion requiring advanced degrees and specialized certifications, underscoring the value of this skilled labor.

Construction and Engineering Services

For the construction of new nuclear power plants, CGN Power relies on a limited number of highly specialized engineering and construction firms. These companies possess the unique expertise, advanced technology, and stringent certifications necessary for nuclear projects, which are inherently complex and capital-intensive. This concentration of specialized capabilities gives these suppliers significant leverage.

The bargaining power of these construction and engineering service providers is amplified by the long project durations and the substantial upfront investment required for nuclear power plant development. For instance, the average construction cost for a new nuclear reactor in 2024, according to industry reports, can range from $5 billion to over $10 billion, depending on the technology and location. This high barrier to entry for new competitors further solidifies the position of established players.

- Limited Number of Qualified Suppliers: Few firms globally can undertake nuclear power plant construction.

- High Switching Costs: Changing contractors mid-project is extremely costly and time-consuming.

- Specialized Expertise: Nuclear construction requires unique skills and regulatory approvals.

- Project Scale and Complexity: The immense size and technical demands of these projects concentrate power with experienced firms.

Government-Controlled Entities and Domestic Localization

In China, the nuclear power sector's supply chain is heavily influenced by government-controlled entities. Many critical suppliers for nuclear technology and infrastructure are state-owned enterprises, meaning their operations and pricing can be tied to national strategic objectives rather than purely market forces. This can create a unique dynamic where supply availability and cost might be less responsive to typical market pressures.

While China has made significant strides in localizing its nuclear equipment supply chain, a considerable portion of advanced components and specialized services still relies on domestic, government-influenced suppliers. For CGN Power, this means navigating relationships with entities that may prioritize national development goals, potentially impacting negotiation leverage. For instance, the localization rate for key nuclear island equipment has been reported to exceed 85% in recent years, showcasing the government's push for self-sufficiency.

- Government Oversight: Key suppliers are often state-owned, aligning operations with national strategic priorities.

- Localization Impact: China's success in localizing nuclear equipment supply chains (over 85% for key components) reduces reliance on foreign suppliers but concentrates power with domestic, government-linked entities.

- Pricing and Terms: Supplier pricing and supply terms may be influenced by national policy rather than solely market competition.

The bargaining power of suppliers to CGN Power is substantial, particularly for specialized nuclear components and fuel. A limited number of global manufacturers and uranium producers, coupled with the technical complexities and high switching costs, grant these suppliers significant leverage. For example, the global nuclear workforce, estimated at 1 million in 2023, highlights the scarcity of specialized talent, increasing the power of those who provide it.

Furthermore, the concentrated nature of the uranium market and geopolitical risks contribute to supplier strength. China's reliance on international markets for some uranium needs exposes CGN Power to price volatility. The high cost of constructing new nuclear plants, with average costs in 2024 ranging from $5 billion to over $10 billion per reactor, also empowers the few specialized engineering and construction firms capable of undertaking such projects.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on CGN Power |

|---|---|---|

| Specialized Reactor Components | Proprietary technology, few global manufacturers | High dependence, potential for price increases |

| Nuclear Fuel (Uranium) | Concentrated market, geopolitical risks | Price volatility, supply chain security concerns |

| Specialized Workforce | Scarcity of skilled engineers and technicians | Increased labor costs, competition for talent |

| Engineering & Construction Firms | High project costs ($5-10B+ per reactor in 2024), unique expertise | Significant leverage in contract negotiations |

What is included in the product

This analysis meticulously examines the five competitive forces impacting CGN Power, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Instantly identify and mitigate competitive threats with a dynamic visualization of all five forces, enabling proactive strategic adjustments.

Customers Bargaining Power

CGN Power's primary customers are state-owned grid operators and provincial power companies in China. These entities often function as monopolistic or oligopolistic buyers, giving them considerable bargaining power. Their critical role in electricity distribution and the regulated power market structure amplifies their leverage over power producers like CGN Power.

The pricing for nuclear power is largely influenced by government policies and established long-term power purchase agreements. For instance, in 2023, the average on-grid electricity price for nuclear power in China remained relatively stable, reflecting these regulatory frameworks. This stability, while predictable, means CGN Power has limited ability to unilaterally adjust prices upwards, thus concentrating bargaining power with the buyers.

While grid operators do hold significant bargaining power, the fundamental nature of nuclear energy and the vast infrastructure needed for its integration present substantial hurdles for switching. The base-load reliability of nuclear power means that replacing it with similarly consistent, large-scale alternatives involves immense costs and complex logistical planning, effectively locking in existing energy supply arrangements.

CGN Power's customer bargaining power is significantly influenced by regulated pricing for nuclear electricity in China. These government-set tariffs, while limiting direct price negotiation with consumers, offer a predictable and stable revenue foundation for the company. For instance, in 2023, the average on-grid electricity price for nuclear power in China remained relatively stable, reflecting this regulatory environment.

The immense and expanding demand for electricity across China, fueled by ongoing economic growth and the increasing electrification of industries and daily life, further diminishes customer bargaining power. This robust demand ensures a consistent and high utilization rate for CGN Power's nuclear generation facilities, as seen with the continued increase in China's total electricity consumption, which surpassed 9 trillion kilowatt-hours in 2023.

National Energy Security Priorities

Customers, especially governments, place a high value on national energy security and a stable supply, which nuclear power, like that provided by CGN Power, reliably delivers as a consistent base-load energy source. This strategic imperative means customers are less likely to exert significant downward price pressure, as maintaining supply is paramount.

The strategic importance of nuclear energy for national security can translate into more favorable contract terms for CGN Power, ensuring sustained demand for its electricity output. For instance, in 2023, China's installed nuclear power capacity reached approximately 55.5 gigawatts, highlighting the state's commitment to nuclear as a key energy pillar.

- State as Primary Customer: Governments often are the largest, if not sole, purchasers of nuclear power, giving them substantial bargaining power but also a vested interest in the long-term viability and stability of the supplier.

- Energy Security Imperative: The drive for energy independence and reliability in 2024 means customers are willing to accept less flexible pricing in exchange for guaranteed baseload power, reducing CGN Power's vulnerability to price wars.

- Long-Term Contracts: Nuclear power projects involve massive upfront investment and long operational lifespans, necessitating long-term power purchase agreements that lock in demand and provide revenue stability for CGN Power.

Limited Direct Customer Choice

CGN Power's customers, primarily end-users of electricity in China, have very limited direct choice regarding their power source. They receive electricity from the national grid, meaning they don't select specific generators like CGN Power. This lack of direct selection significantly curtails the bargaining power of individual consumers.

The absence of direct customer choice at the retail level shifts the power dynamic. Instead of end-users negotiating with power producers, the large state-owned grid companies act as the primary procurers of electricity. These grid operators, such as State Grid Corporation of China and China Southern Power Grid, hold substantial bargaining power when purchasing power from generators.

- Limited Consumer Choice: In China, most electricity consumers are connected to the national grid and do not select their power provider.

- Grid Companies as Intermediaries: State-owned grid companies are the primary buyers of electricity from generators.

- Centralized Procurement: This structure centralizes purchasing power with a few large entities, not individual end-users.

- Impact on CGN Power: CGN Power negotiates with these grid companies, not directly with the millions of end consumers.

CGN Power's customers, primarily large state-owned grid operators in China, wield significant bargaining power due to the monopolistic nature of electricity distribution. These entities, like State Grid Corporation of China, are the sole purchasers of electricity from generators, centralizing procurement and amplifying their leverage. The regulated pricing structure, with government-set tariffs for nuclear power, further limits CGN Power's ability to negotiate prices unilaterally, as evidenced by the stable on-grid electricity prices in 2023.

While customers have substantial power in price negotiations, the high switching costs and the critical need for reliable baseload power, which nuclear energy provides, create a degree of customer stickiness. China's robust electricity demand, exceeding 9 trillion kilowatt-hours in 2023, ensures a consistent market for CGN Power's output, mitigating some of the buyer leverage.

The strategic importance of nuclear energy for national security and energy independence, a key focus for China in 2024, also influences customer behavior. This imperative means customers are less likely to push for significant price reductions, prioritizing supply stability over cost savings. China's commitment to nuclear power is underscored by its installed capacity reaching approximately 55.5 gigawatts in 2023.

| Customer Type | Bargaining Power Factors | CGN Power's Mitigating Factors |

|---|---|---|

| State-Owned Grid Operators | Monopolistic distribution, centralized procurement, regulated pricing | High switching costs for grid operators, strategic importance of nuclear power, long-term contracts |

| End Consumers | Very limited direct choice, receive power from grid | N/A (power is purchased by grid operators) |

What You See Is What You Get

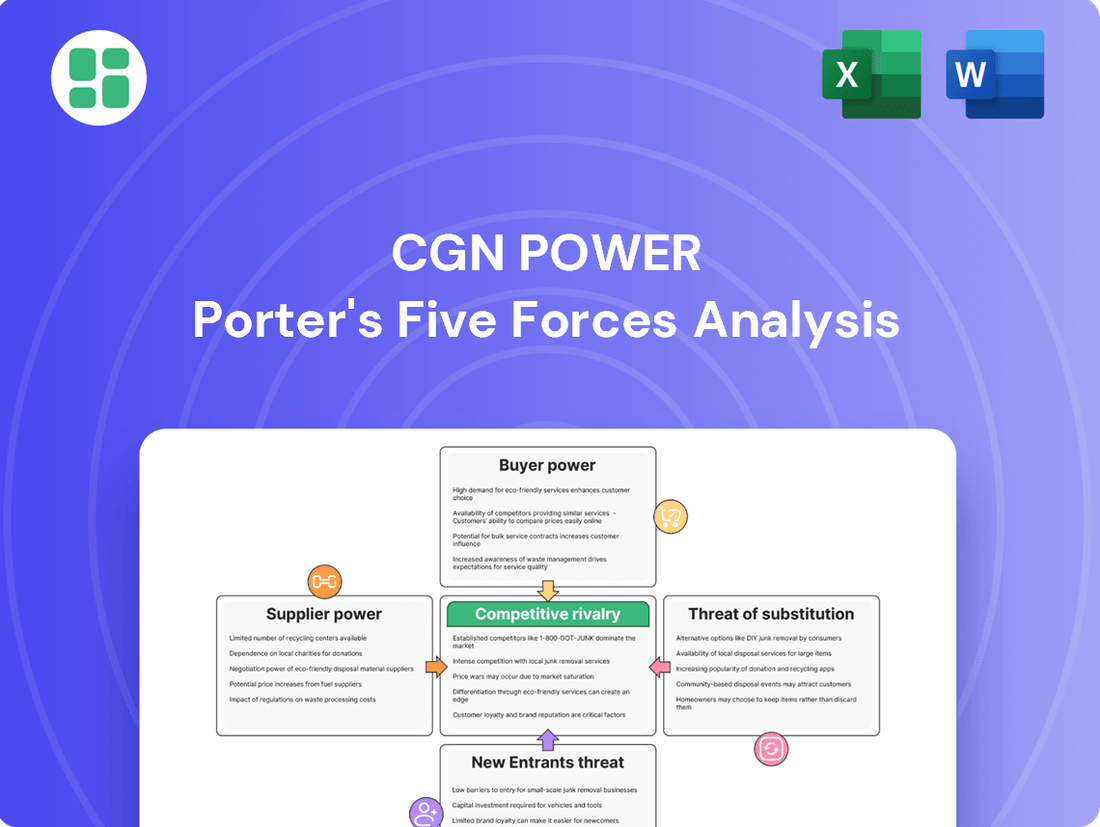

CGN Power Porter's Five Forces Analysis

This preview showcases the comprehensive CGN Power Porter's Five Forces Analysis, providing a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

Competitive rivalry in China's nuclear power sector is significantly shaped by the dominance of state-owned enterprises (SOEs). CGN Power, alongside giants like China National Nuclear Corporation (CNNC) and State Power Investment Corporation (SPIC), operates within an oligopolistic framework. This structure means that while competition exists, it's often influenced by government directives and project allocations rather than intense price wars.

In 2023, CGN Power reported operating revenue of RMB 124.4 billion, showcasing its substantial market presence. The sector’s growth, driven by China's energy transition goals, means these SOEs are key players in developing new nuclear capacity, with government planning playing a crucial role in directing investment and managing competitive dynamics.

CGN Power operates in an industry with exceptionally high fixed costs, primarily due to the substantial capital required for constructing, operating, and maintaining nuclear power plants. These immense upfront investments create a strong incentive for CGN Power and its competitors to achieve high capacity utilization to spread these costs over a larger output.

This cost structure, coupled with the strategic importance of nuclear energy for China's energy security and decarbonization efforts, discourages aggressive price competition among the limited number of major players. Securing long-term power purchase agreements is crucial for ensuring stable revenue streams and covering these significant fixed expenditures, which further reduces the inclination for price wars.

In 2023, CGN Power reported total assets of approximately RMB 575.8 billion, highlighting the scale of investment in its infrastructure. The company's commitment to nuclear power, a key component of China's net-zero emissions target by 2060, underscores the sector's strategic value, fostering a more cooperative competitive environment among its participants.

China's ambitious nuclear expansion plans, with numerous new reactors approved and under construction, suggest a growing market rather than a stagnant one, which can temper rivalry among existing players. For instance, by the end of 2023, China had 55 nuclear reactors under construction, a global high, with plans to add significantly more in the coming years.

The government actively approves and allocates projects to key players like CGN Power, ensuring a pipeline of work and reducing direct head-to-head competition for new sites. This strategic allocation means that competition is less about winning bids for scarce projects and more about efficient execution and technological advancement within assigned mandates.

Focus on Technological Advancement and Localization

Competitive rivalry in the nuclear power sector, particularly in China, is intense and centers on technological innovation and achieving complete domestic production. Major players are constantly striving for leadership in areas like reactor design, safety standards, and operational efficiency. This is evident in the development of indigenous reactor models such as Hualong One and CAP1000, showcasing a commitment to homegrown technological prowess.

China's strategic objective of 100% localization for nuclear equipment manufacturing further intensifies this domestic competition. This drive aims to reduce reliance on foreign suppliers and build a robust, self-sufficient industrial base. For instance, by 2023, the localization rate for key components in new nuclear power projects had reached over 85%, with a target of 100% for the next generation of reactors.

This focus on technological advancement and localization creates a dynamic competitive landscape where companies vie for market share through superior engineering and manufacturing capabilities. The success of these indigenous designs is crucial for China's ambitious nuclear expansion plans, which aim to significantly increase its installed nuclear capacity in the coming years.

- Technological Differentiation: Companies compete on the advancement and reliability of their reactor designs, such as the Hualong One and CAP1000.

- Localization Drive: A key competitive factor is the ability to achieve 100% localization of nuclear equipment, fostering domestic industrial strength.

- Safety and Efficiency Benchmarks: Superior safety performance and improved operational efficiency are critical metrics in the rivalry.

- Market Share Growth: Success in technological development and localization directly translates to a stronger position in China's rapidly expanding nuclear market.

Inter-Fuel Competition (Indirect Rivalry)

CGN Power, while not facing intense direct rivalry from other nuclear power providers, contends with significant indirect competition from a diverse energy landscape. This includes established sources like coal and hydropower, alongside rapidly growing renewables such as wind and solar power.

However, nuclear energy's unique position as a consistent, low-carbon base-load power source sets it apart. This inherent stability and environmental advantage mean that while renewables contribute to the overall energy mix, they often struggle to fully replace nuclear's role in providing uninterrupted power, especially during peak demand or when intermittent sources are unavailable.

For instance, in 2023, China's total installed power generation capacity reached approximately 2,920 GW, with coal still holding a substantial share, but renewable energy sources like wind and solar saw significant additions. Nuclear power, though a smaller percentage, provides a critical foundation of reliable energy, making direct substitution for its base-load function challenging for these other sources.

- Indirect Competition: CGN Power faces rivalry from coal, hydropower, wind, and solar energy sources.

- Unique Value Proposition: Nuclear power offers stable, low-carbon base-load energy, differentiating it from intermittent renewables.

- Energy Security Role: Nuclear's reliability is crucial for energy security, limiting direct substitution for base-load demand.

- Market Context (2023): China's power capacity was around 2,920 GW, with renewables growing but nuclear providing essential base-load stability.

Competitive rivalry within China's nuclear power sector is characterized by a concentrated market dominated by state-owned enterprises (SOEs). CGN Power, alongside CNNC and SPIC, operates in an oligopoly where government planning heavily influences project allocation and competitive dynamics, rather than aggressive price competition.

The immense capital expenditure required for nuclear plant construction and operation creates high fixed costs, incentivizing CGN Power and its peers to maximize capacity utilization. This cost structure, combined with nuclear energy's strategic importance for China's energy security and decarbonization goals, discourages price wars among the limited number of major players.

CGN Power's competitive landscape is also shaped by a strong emphasis on technological innovation and domestic production. Companies vie for leadership in reactor design, safety, and efficiency, with a significant push towards 100% localization of nuclear equipment manufacturing. By 2023, the localization rate for key nuclear components had surpassed 85%, aiming for full self-sufficiency in next-generation reactors.

| Key Player | 2023 Revenue (RMB billion) | 2023 Total Assets (RMB billion) |

|---|---|---|

| CGN Power | 124.4 | 575.8 |

| CNNC (Estimated)* | ~150-170 | ~700-800 |

| SPIC (Estimated)* | ~180-200 | ~900-1000 |

*Note: CNNC and SPIC figures are estimates based on available public information and industry reports for 2023, as precise comparable data may vary.

SSubstitutes Threaten

The rapid expansion and falling costs of renewable energy, particularly solar and wind power in China, pose a substantial long-term threat to traditional power generation methods, including nuclear energy. By the end of 2023, China's installed renewable energy capacity had surpassed 50% of its total installed power generation capacity, a significant milestone.

China's commitment to a greener energy future is evident in its massive investments and annual additions of renewable capacity, which directly influence the overall energy landscape and can reduce demand for nuclear power. For instance, in 2024, China continued its aggressive build-out of solar and wind farms, adding hundreds of gigawatts of new capacity.

Despite China's ambitious decarbonization targets, coal-fired power plants continue to represent a significant threat of substitution for CGN Power. As of 2024, coal still accounts for approximately 55% of China's total energy consumption, underscoring its persistent dominance due to widespread availability and deeply entrenched infrastructure.

While the Chinese government is actively promoting renewable energy sources, it also maintains substantial investments in coal power. This is primarily driven by the need for energy security and grid stability, particularly as a crucial backup for the intermittent nature of solar and wind power. In 2023, new coal-fired power capacity additions in China reached a record high, signaling the ongoing reliance on this traditional energy source.

Natural gas presents a significant threat of substitution for CGN Power, especially in regions where it's readily available and cost-competitive. While a fossil fuel, its lower emissions compared to coal and greater operational flexibility than nuclear power make it an appealing alternative for electricity generation. For instance, in 2023, natural gas accounted for approximately 42% of the US electricity generation mix, demonstrating its substantial role.

The price volatility of natural gas, driven by global supply and demand dynamics, can also influence its attractiveness as a substitute. When natural gas prices are low, it can become a more compelling option for utilities seeking to balance their energy portfolios or meet peak demand, potentially diverting investment away from nuclear projects like those CGN Power operates.

Energy Storage Technologies

The threat of substitutes for CGN Power, particularly from advancements in energy storage technologies, is a significant factor to consider. As battery storage solutions and other energy storage innovations continue to improve and become more cost-effective, they are increasingly capable of supporting intermittent renewable energy sources like solar and wind. This enhanced reliability and dispatchability mean these renewables can more directly compete with, and potentially replace, traditional base-load power generation, including nuclear power.

The declining costs of energy storage are particularly impactful. For instance, the average cost of lithium-ion battery packs for utility-scale storage has seen a dramatic decrease, dropping by over 90% in the past decade according to some industry reports. This trend suggests that by 2025 and beyond, grid-scale storage will play a crucial role in balancing supply and demand, potentially diminishing the perceived necessity for new, large-scale base-load power plants.

- Advancing Storage Capabilities: Innovations in battery chemistry and design are boosting energy density and lifespan, making storage more viable for grid stabilization.

- Cost Reduction Trajectory: Continued declines in battery manufacturing costs are projected, making stored renewable energy economically competitive with traditional power sources.

- Grid Integration: Improved software and grid management systems are enabling seamless integration of renewables with storage, enhancing their substitutability for base-load power.

- Policy Support: Government incentives and renewable energy mandates in various markets are accelerating the adoption of storage solutions, further amplifying this threat.

Government Policy and Decarbonization Goals

China's ambitious 2060 carbon neutrality target significantly shapes the energy landscape, directly influencing the threat of substitutes for CGN Power. This policy actively encourages a transition away from fossil fuels, including coal and natural gas, by prioritizing nuclear energy as a clean power source.

This governmental push for decarbonization, while reducing the appeal of traditional fossil fuel power plants, simultaneously fuels the growth of renewable energy sources like solar and wind. As of early 2024, China's installed renewable energy capacity continued its rapid expansion, with solar and wind power leading the charge, potentially capturing a larger share of new electricity demand, thereby acting as a more potent substitute for CGN Power's nuclear offerings.

- Government Policy Impact: China's 2060 carbon neutrality goal is a key driver favoring nuclear and renewables over fossil fuels.

- Renewable Energy Growth: Rapid expansion of solar and wind capacity in 2023 and early 2024 presents a growing substitute threat for new power generation.

- Strategic Shift: Policy supports nuclear power, but the concurrent rise of renewables means they are increasingly viable alternatives for meeting future energy needs.

The increasing affordability and efficiency of renewable energy sources, particularly solar and wind, present a growing threat of substitution for CGN Power's nuclear offerings. By the end of 2023, China's installed renewable capacity had exceeded 50% of its total, a testament to this shift. This trend is expected to continue, with hundreds of gigawatts of new solar and wind capacity added in 2024 alone, directly impacting the demand for traditional power generation.

Energy storage advancements further bolster the substitutability of renewables. As battery costs have plummeted by over 90% in the last decade, grid-scale storage is becoming a more viable solution for managing the intermittency of solar and wind. This enhanced reliability allows renewables to more effectively compete as base-load power alternatives.

While coal remains a dominant energy source in China, accounting for roughly 55% of consumption in 2024, its long-term role is challenged by decarbonization goals. Conversely, natural gas, despite its fossil fuel status, offers lower emissions and greater flexibility than nuclear, making it a competitive substitute, especially when prices are favorable.

| Energy Source | 2023 China Installed Capacity (GW) | 2024 China New Capacity Additions (GW, est.) | Key Substitute Factor |

|---|---|---|---|

| Solar Power | ~600+ | ~200+ | Falling costs, government support |

| Wind Power | ~400+ | ~100+ | Grid integration with storage |

| Coal Power | ~1,100+ | ~50+ | Energy security, grid stability (but declining long-term) |

| Natural Gas | ~130+ | ~10+ | Lower emissions than coal, operational flexibility |

Entrants Threaten

The nuclear power industry presents a formidable barrier to entry due to exceptionally high capital requirements. Constructing a new nuclear power plant involves staggering upfront investments, often running into tens of billions of dollars. For instance, the Vogtle Electric Generating Plant in the United States, a project that began construction in 2009, has seen its costs escalate significantly, with final estimates well over $30 billion by 2024, highlighting the immense financial undertaking.

These massive capital outlays cover everything from intricate plant design and rigorous safety engineering to the lengthy and complex licensing processes mandated by regulatory bodies. The extended construction timelines, frequently spanning a decade or more, further amplify the financial burden and risk, making it exceedingly difficult for new companies or smaller entities to even consider entering the market.

The nuclear power sector is characterized by exceptionally stringent regulatory frameworks and licensing requirements, acting as a significant barrier to entry. These regulations, covering safety, environmental protection, and security, are among the most rigorous globally. For instance, in the United States, the Nuclear Regulatory Commission (NRC) oversees a comprehensive licensing process that can take many years and involve substantial capital investment for new entrants.

The sheer complexity and cost associated with meeting these demanding standards, including extensive environmental impact assessments and detailed safety protocols, effectively deter potential new competitors. This high barrier means that only well-capitalized and technically proficient organizations can realistically consider entering the market.

The threat of new entrants in the nuclear power sector is significantly constrained by immense technological complexity and the need for specialized expertise. Developing, operating, and maintaining nuclear power plants demands a deep understanding of nuclear physics, engineering, and stringent safety protocols, requiring a highly skilled workforce that is not easily replicated.

New companies would face substantial hurdles in acquiring or developing the proprietary knowledge and human capital essential for safe and efficient operations. For instance, the U.S. nuclear industry employs approximately 60,000 workers, with a significant portion in specialized technical roles, highlighting the depth of expertise required.

Government Control and State Ownership

The threat of new entrants in China's nuclear power sector, specifically concerning CGN Power, is significantly mitigated by stringent government control and state ownership. The nuclear industry is a strategic national asset, and market entry is heavily regulated, primarily favoring established state-owned enterprises.

New project approvals and operational licenses are not readily available, creating a substantial barrier. For instance, in 2023, China continued its focus on expanding its nuclear fleet, with new reactor construction permits being highly selective, underscoring the difficulty for new, non-state-affiliated entities to enter the market.

- State-Owned Dominance: The Chinese government designates a select few state-owned enterprises, including CGN Power, as the primary developers and operators of nuclear power plants.

- Strategic National Priorities: Entry is contingent on alignment with national energy security and strategic development goals, rather than solely on competitive market forces.

- Limited Licensing: The issuance of new construction permits and operating licenses is a tightly controlled process, making it exceedingly difficult for new players to gain a foothold.

Established Supply Chains and Infrastructure

CGN Power, like other established nuclear energy providers, benefits significantly from deeply entrenched supply chains and infrastructure. These aren't easily replicated by newcomers. Think about the decades it takes to build reliable partnerships with specialized nuclear equipment manufacturers and to develop the intricate systems needed for fuel procurement and waste disposal. For instance, in 2023, the global nuclear fuel market was valued at approximately $18 billion, with a few key suppliers dominating. New entrants would face immense difficulty in securing competitive pricing and consistent supply within this specialized and regulated sector.

The capital investment required to build comparable infrastructure is staggering, creating a substantial barrier. New companies would need to navigate complex regulatory approvals for every stage, from manufacturing components to managing radioactive materials. This process can take many years and billions of dollars, a hurdle that existing, experienced players have already overcome.

- Established Relationships: CGN Power leverages long-standing partnerships with key suppliers, ensuring preferential access and pricing for critical components and services.

- Infrastructure Integration: The company's integrated infrastructure for nuclear fuel supply, operational support, and waste management represents a significant sunk cost and operational advantage.

- Regulatory Hurdles: New entrants must overcome extensive and time-consuming regulatory approvals for every aspect of nuclear operations, from site selection to waste disposal, a process that favors incumbents with proven track records.

- Capital Intensity: The immense capital expenditure required to build and maintain nuclear facilities and their associated supply chains acts as a formidable deterrent to potential new market participants.

The threat of new entrants for CGN Power is exceptionally low, primarily due to the colossal capital requirements and the highly regulated nature of the nuclear industry. Building a nuclear plant demands tens of billions of dollars, with projects like the Vogtle plant in the US exceeding $30 billion by 2024, showcasing the immense financial barrier.

Stringent government control and state ownership in China, where CGN Power operates, further restrict market entry. Approvals for new projects are highly selective, favoring established state-owned enterprises aligned with national energy goals, as seen in the limited new reactor construction permits issued in 2023.

Specialized expertise and deeply entrenched supply chains also act as significant deterrents. Newcomers would struggle to acquire the necessary technical skills, as evidenced by the approximately 60,000 specialized workers in the US nuclear industry, and to replicate CGN Power's established relationships with key suppliers in the global nuclear fuel market, valued at around $18 billion in 2023.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CGN Power leverages data from annual reports, investor presentations, and official company disclosures to understand their competitive landscape.

We also incorporate insights from industry-specific market research reports and government energy sector publications to provide a comprehensive view of the forces impacting CGN Power.