CGN Power Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CGN Power Bundle

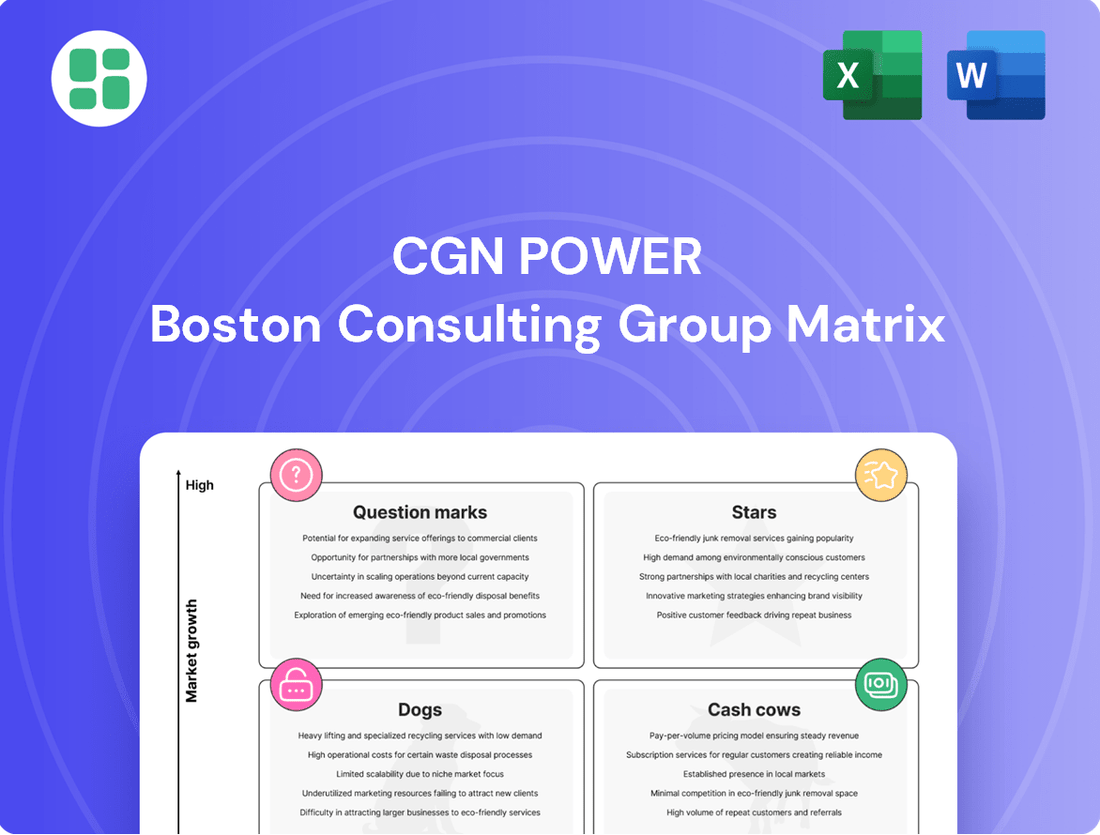

Curious about CGN Power's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't settle for a partial view; purchase the full BCG Matrix for a comprehensive analysis, detailed quadrant placements, and actionable insights to drive your investment decisions.

Stars

CGN Power's Hualong One (HPR1000) reactor technology is a clear Star in its portfolio. This third-generation, domestically designed nuclear reactor is central to China's ambitious nuclear power expansion. Its advanced safety systems and cost-effectiveness position it for substantial future growth.

The Hualong One's market presence is growing, with several units under construction and recently achieving commercial operation. This demonstrates CGN Power's strong market position and the technology's high growth potential in both domestic and international markets.

The ongoing construction of new nuclear power units, like Ningde Unit 5 and Lufeng Unit 1, demonstrates CGN's dedication to growing its foundational nuclear energy business. These projects are situated in a rapidly expanding sector, fueled by China's strong emphasis on energy independence and achieving its carbon reduction targets, placing CGN at the forefront of new nuclear capacity development.

CGN Power's international clean energy expansion is a significant driver, with investments in renewables like solar and wind spanning 16 countries. This aggressive push into global markets, particularly in regions like Southeast Asia and Latin America, signifies a high-growth trajectory and an increasing market presence. For instance, by the end of 2023, CGN's overseas renewable energy capacity had reached approximately 16 GW, a testament to their global ambitions.

Strategic successes in markets such as Laos, South Africa, Thailand, and Brazil highlight CGN's capability to leverage and export its established renewable energy supply chains. These ventures, while demanding substantial capital investment, are positioned to yield considerable future returns as the global demand for clean energy continues to surge. The company's commitment to these international projects underscores their role in the global energy transition.

Advanced Nuclear Technology Development

CGN Power's substantial investment in advanced nuclear technology development, including Small Modular Reactors (SMRs), positions these initiatives as potential Stars in its BCG portfolio. The company's commitment to R&D, evidenced by its significant spending, aims to capture future market share in next-generation nuclear power. This focus on innovation is crucial for long-term growth, even as these technologies mature.

- R&D Investment: CGN Power has consistently allocated significant capital towards research and development, focusing on next-generation nuclear technologies.

- SMR Development: The company is actively pursuing the development and potential deployment of Small Modular Reactors (SMRs), targeting future market leadership.

- Long-Term Growth Potential: Continuous innovation in advanced nuclear tech is intended to secure a strong position in the evolving global energy landscape.

Integrated Nuclear Fuel Cycle Services

CGN Power's involvement in integrated nuclear fuel cycle services positions it as a Star within the BCG matrix. This comprehensive approach encompasses uranium mining and milling, conversion, enrichment, fuel fabrication, and spent fuel management, catering to China's rapidly expanding nuclear power program.

China's nuclear energy capacity is projected to reach approximately 55 GW by 2025, with further significant growth anticipated beyond that. This expansion directly fuels the demand for nuclear fuel, making CGN's integrated services highly strategic. For instance, CGN's subsidiary, China National Nuclear Corporation (CNNC), is a key player in fuel fabrication, supplying a substantial portion of domestic reactor fuel needs.

- Strategic Importance: CGN's integrated fuel cycle services are crucial for China's energy security and self-sufficiency in nuclear power development.

- Market Growth: The ongoing construction of new nuclear reactors in China creates a robust and expanding market for all stages of the nuclear fuel cycle.

- Comprehensive Offering: By managing multiple stages of the fuel cycle, CGN offers a complete solution, enhancing its competitive advantage and revenue potential.

- CNNC's Role: China National Nuclear Corporation, a related entity, plays a vital role in fuel fabrication, underscoring the strength of the national nuclear fuel supply chain CGN operates within.

CGN Power's Hualong One (HPR1000) reactor technology represents a significant Star. This advanced, domestically developed nuclear reactor is fundamental to China's nuclear power expansion plans, with its strong safety features and competitive pricing suggesting considerable future growth potential.

The Hualong One is increasingly visible in the market, with multiple units under construction and some already in commercial operation. This success highlights CGN Power's strong market standing and the technology's high growth prospects both within China and internationally.

CGN Power's international clean energy ventures, encompassing solar and wind investments across 16 countries, also mark them as a Star. This aggressive global expansion, particularly in regions like Southeast Asia and Latin America, indicates a high-growth trajectory and an expanding market footprint. By the close of 2023, CGN's overseas renewable energy capacity had reached approximately 16 GW, underscoring their global ambitions.

CGN Power's investment in advanced nuclear technologies, such as Small Modular Reactors (SMRs), positions these efforts as potential Stars. The company's dedication to research and development, backed by substantial spending, aims to secure future market share in next-generation nuclear power, a crucial strategy for long-term growth.

| Technology/Service | BCG Category | Key Indicators |

| Hualong One (HPR1000) | Star | Domestic design, advanced safety, cost-effective, growing market presence, international export potential. |

| International Renewables (Solar, Wind) | Star | Investments in 16 countries, ~16 GW overseas capacity by end-2023, strategic market successes (Laos, South Africa, etc.). |

| Integrated Nuclear Fuel Cycle Services | Star | Comprehensive services (mining to spent fuel management), supports China's nuclear expansion (~55 GW by 2025 projection), strong domestic demand. |

| Advanced Nuclear Tech (SMRs) | Star | Significant R&D investment, focus on next-generation tech, aiming for future market leadership. |

What is included in the product

CGN Power's BCG Matrix analyzes its business units based on market share and growth, guiding investment decisions.

CGN Power BCG Matrix provides a clear, visual snapshot of your portfolio, instantly relieving the pain of complex strategic analysis.

Cash Cows

CGN Power's 28 operational nuclear power units across China are its core cash cows. These facilities are in a stable, high-demand market, consistently delivering significant power output. In 2024, their cumulative feed-in capacity reached 227.284 billion kilowatt-hours, a healthy 6.13% rise from the previous year, underscoring their reliable revenue generation.

CGN Power's nuclear energy operations are its undisputed cash cows. Selling electricity generated from its nuclear power plants in China and Hong Kong consistently delivers robust, high-margin cash flows. This core business provides the financial stability needed to fuel the company's growth and reward investors.

In 2024, CGN Power reported a solid operating revenue of RMB 86.804 billion, marking a 5.16% increase. While conventional energy segments faced some margin pressure, the overall financial performance underscores the dependable nature of its electricity sales, solidifying its position as a reliable generator of consistent revenue.

CGN's operational nuclear units consistently achieve high average capacity factors, reaching 91.91% in 2024. This demonstrates highly efficient and reliable performance, a hallmark of a cash cow.

This operational excellence in a mature market minimizes maintenance costs relative to output, maximizing the cash generated from these assets. The proven track record of plant reliability and safety further solidifies their cash cow status.

Established Domestic Market Leadership

CGN Power's established domestic market leadership positions its nuclear power segment firmly as a Cash Cow within the BCG matrix. As China's largest nuclear power operator, CGN benefits from a dominant market share in a sector that is both strategic for national energy security and heavily supported by government policy.

This strong foothold in a mature, low-growth market segment translates into predictable and stable revenue streams. The company's state-owned enterprise status further underpins this stability, offering advantages in securing financing and navigating regulatory landscapes, reducing the need for substantial reinvestment to maintain its position.

- Dominant Market Share: CGN Power is China's largest nuclear power operator, indicating a significant competitive advantage and a stable customer base.

- Mature Industry: The nuclear power sector in China, while growing, represents a mature segment where CGN has already established its presence and operational efficiencies.

- Steady Income Generation: The established market position ensures consistent cash flow with lower investment requirements compared to high-growth sectors.

- SOE Status: Being a state-owned enterprise provides a layer of financial stability and strategic backing from the government.

Dividend Payouts and Shareholder Returns

CGN Power's dedication to steadily growing its dividend payouts, evidenced by a planned final cash dividend of RMB 0.095 per share for 2024, highlights its robust cash-generating capabilities. This consistent shareholder return is a hallmark of cash cow businesses, those that generate substantial free cash flow exceeding their operational needs.

This strategy allows CGN Power to reward investors while still maintaining financial flexibility. The company's ability to sustain and increase these payouts reflects the mature and stable nature of its operations, a key characteristic of a cash cow within the BCG framework.

- Dividend Payout Commitment: Planned final cash dividend of RMB 0.095 per share for 2024.

- Cash Generation: Excess cash generation supports consistent dividend increases.

- Shareholder Returns: Prioritizes returning capital to investors.

- BCG Matrix Alignment: Demonstrates characteristics of a mature cash cow business.

CGN Power's nuclear energy operations are its undisputed cash cows, consistently generating substantial, high-margin cash flows from electricity sales in China and Hong Kong. This core business provides the financial stability needed to fuel growth and reward investors.

In 2024, CGN Power's 28 operational nuclear units achieved a cumulative feed-in capacity of 227.284 billion kilowatt-hours, a 6.13% increase year-over-year, demonstrating their reliable revenue generation. These units consistently achieve high average capacity factors, reaching 91.91% in 2024, a hallmark of efficient cash cow performance.

The company's operational excellence in a mature market minimizes maintenance costs relative to output, maximizing cash generation. This strong foothold in a stable, low-growth sector translates into predictable revenue streams, further solidified by its state-owned enterprise status.

CGN Power's commitment to shareholder returns is evident in its planned final cash dividend of RMB 0.095 per share for 2024, reflecting robust cash-generating capabilities and a strategy to return excess capital to investors.

| Metric | 2024 Value | Year-over-Year Change |

| Cumulative Feed-in Capacity (billion kWh) | 227.284 | +6.13% |

| Average Capacity Factor (%) | 91.91 | N/A |

| Operating Revenue (RMB billion) | 86.804 | +5.16% |

| Planned Dividend per Share (RMB) | 0.095 | N/A |

What You’re Viewing Is Included

CGN Power BCG Matrix

The CGN Power BCG Matrix preview you are viewing is the exact, fully finalized document you will receive upon purchase. This comprehensive report is ready for immediate strategic application, containing no watermarks or placeholder content. You'll gain access to a professionally formatted analysis designed to illuminate your business portfolio's strategic positioning.

Dogs

Aging or less efficient ancillary assets within CGN's portfolio, while not explicitly highlighted in recent strategic discussions, could represent a category needing careful management. These might include older conventional power generation units or smaller, non-core infrastructure investments that no longer align with the company's focus on nuclear power and expanding renewable energy sources.

Such assets, by their nature, often exhibit lower operational efficiency and potentially higher maintenance costs compared to newer, more advanced facilities. If these segments are in low-growth markets and contribute minimally to overall revenue or strategic objectives, they would typically fall into the BCG matrix's 'Dogs' quadrant, requiring a decision on divestment or significant operational overhaul.

Peripheral Non-Core Investments with Stagnant Returns represent ventures outside CGN Power's main focus areas, such as nuclear and major renewables, that haven't gained significant traction. These might include minority stakes in unrelated technology or niche energy projects. For instance, if CGN Power had a small investment in a small-scale biofuels initiative that saw minimal market adoption, it would fall into this category.

These investments are typically characterized by low market share within stagnant or declining niche markets. They generate very little cash flow, thus not contributing meaningfully to the company's overall financial health. In 2023, CGN Power reported overall revenue growth, but specific smaller, non-core ventures may have shown negligible or negative returns, highlighting the need for strategic review.

The primary implication for CGN Power is that these peripheral investments often tie up capital inefficiently. Divesting these assets can free up valuable resources that could be redirected towards core business growth or more promising strategic opportunities. Such a move aligns with optimizing capital allocation for maximum shareholder value.

CGN Power's early international market entries that haven't captured substantial market share or encountered significant regulatory hurdles could be classified as underperforming foreign market entries. These ventures might be characterized by prolonged periods of low returns and sluggish growth, consuming valuable resources without yielding the anticipated strategic or financial advantages.

Obsolete or Non-Strategic Technologies

CGN Power's Dogs category would encompass legacy technologies or services that are becoming obsolete. Think of older nuclear reactor designs that are no longer competitive or cost-effective compared to newer, more efficient models. These might also include certain auxiliary services or components that are being phased out due to technological advancements in nuclear or renewable energy sectors. For example, if CGN still maintains operations related to older, less efficient fuel enrichment processes, these would likely be considered Dogs.

These operations would typically exhibit diminishing market relevance and very low growth prospects. They require minimal new investment, but consequently, they also offer negligible returns. The strategic decision for CGN would be to manage these assets for cash flow until they can be phased out or divested. For instance, CGN's 2023 annual report might detail specific legacy assets that are being retired or have significantly reduced operational capacity due to their non-strategic nature.

- Legacy Nuclear Technologies: Older reactor designs with lower efficiency or higher operational costs compared to current generation reactors.

- Obsolete Support Services: Maintenance or component supply for nuclear plants that are being decommissioned or are no longer in active development.

- Diminishing Market Share: Technologies or services that have been superseded by more advanced or cost-effective alternatives in the energy market.

High-Cost, Low-Contribution Support Functions

Within CGN Power's BCG Matrix, high-cost, low-contribution support functions represent areas that drain resources without directly fueling the company's primary objectives in nuclear power and major renewables. These might include certain administrative departments or small, non-scalable business units that incur substantial operational expenditures. For instance, if a support department's budget in 2024 was $5 million but its direct impact on revenue generation or strategic advancement in core energy sectors was negligible, it would fall into this category.

These functions are typically characterized by their inefficiency relative to the costs they impose. The emphasis for such units is not on further investment but on rigorous optimization or potential divestment. The goal is to enhance cost-effectiveness, perhaps by implementing new technologies or restructuring processes, or to exit these non-core activities entirely if they cannot be made more efficient.

- Cost Drain: Support functions with high operational expenditure, such as a legacy IT system maintenance costing $2 million annually, that do not directly support nuclear or renewable energy growth.

- Low Contribution: Units that do not generate significant revenue or provide a clear strategic advantage to CGN Power's core business.

- Inefficiency: Operations where the cost-to-output ratio is unfavorable, indicating a need for improvement or reduction.

- Optimization Focus: Strategies aimed at streamlining these functions, potentially through automation or outsourcing, to reduce their financial burden.

Dogs in CGN Power's portfolio represent business units or assets with low market share in slow-growing or declining sectors. These are typically legacy technologies or non-core investments that consume resources without generating substantial returns. For instance, older, less efficient nuclear components or peripheral ventures with stagnant growth would fit this description.

The strategic approach for these Dogs is usually to minimize investment and either divest them or manage them for cash until they can be phased out. This frees up capital for more promising ventures. In 2023, CGN Power continued its focus on expanding its nuclear and renewable energy capacity, suggesting that any remaining Dog assets would be under review for potential restructuring or exit.

These underperforming segments, while not the primary focus, require careful management to avoid becoming a drag on overall financial performance. Their low contribution to revenue and market share necessitates a clear strategy for either revitalization or disposal to optimize capital allocation.

CGN Power's 2024 strategic outlook likely involves further streamlining of its portfolio, potentially leading to the divestment of such legacy or non-core assets to enhance overall efficiency and shareholder value.

| Asset Category | Market Share | Growth Prospects | Strategic Implication |

| Legacy Nuclear Components | Low | Declining | Divest or manage for cash |

| Non-Core Ventures (e.g., niche energy tech) | Low | Stagnant | Divest or re-evaluate strategic fit |

| Obsolete Support Services | Low | Negligible | Phase out or outsource |

Question Marks

CGN's early-stage SMR development, likely in pilot phases as of mid-2025, falls into the question mark category of the BCG matrix. These ventures demand significant R&D and capital, with China aiming for SMR deployment by the early 2030s, signaling high future growth potential but currently minimal market share.

The substantial investment in SMR design and testing, estimated to be in the billions of dollars globally for similar projects, reflects the high risk and high reward profile. CGN's progress depends on navigating stringent regulatory hurdles and proving cost-competitiveness against established energy sources for widespread market acceptance.

CGN Power's ventures into new frontiers like offshore solar, exemplified by China's first offshore solar plant, represent high-risk, high-reward opportunities. These capital-intensive projects, like the 2023 launch of the 100 MW offshore floating solar farm in Jiangsu province, are designed to tap into emerging energy markets and technologies. Their current market share is minimal, but the potential for rapid growth is substantial if they can overcome technological and economic hurdles.

These pioneering projects, including large-scale solar photovoltaic deployments in emerging markets such as Laos and Brazil, are in the question mark phase of the BCG matrix. For instance, CGN's significant solar investments in Brazil, which saw substantial capacity additions in 2023, are aimed at establishing a strong foothold in a growing market. The substantial upfront investment required for such initiatives means their future trajectory, whether towards becoming market stars or failing to gain traction, hinges on their ability to prove market viability and achieve profitability.

CGN Power's aggressive entry into nascent international clean energy markets signifies a classic 'Question Mark' in the BCG matrix. These markets, while holding significant future promise, currently represent areas where CGN is building its presence and brand from the ground up.

These ventures demand substantial investment in marketing, sales, and local infrastructure to gain traction. For instance, CGN's reported international project pipeline, though growing, still represents a smaller portion of its overall capacity compared to established markets, highlighting the early stage of these new endeavors.

The success of these aggressive entries is not guaranteed, necessitating meticulous tracking of market adoption rates and competitive responses. CGN must be prepared to either increase its investment to capture market share or divest if the potential doesn't materialize as anticipated.

Advanced Nuclear Fuel Cycle Innovations

CGN Power's ventures into advanced nuclear fuel cycle innovations, such as fast reactor fuel reprocessing and the development of novel fuel types like thorium-based fuels, would likely be categorized as Question Marks. These initiatives represent significant future growth potential, aiming to enhance fuel efficiency and reduce waste. However, they are currently in the research and pilot stages, demanding substantial capital investment with uncertain commercial timelines.

These advanced fuel cycle technologies are crucial for the long-term sustainability of nuclear power. For instance, the development of Generation IV reactors, which often require advanced fuel cycles, is a key focus for many global nuclear energy players. While specific financial data for CGN Power's experimental fuel cycle projects are not publicly detailed, the global investment in advanced nuclear technologies is substantial, with projections indicating significant market growth in the coming decades as these technologies mature.

- High R&D Investment: Significant capital is allocated to research and development for advanced fuel reprocessing and new fuel designs, reflecting the early-stage nature of these technologies.

- Uncertain Commercialization: The path to widespread commercial adoption for technologies like pyroprocessing or molten salt reactors is still being defined, creating market uncertainty.

- Potential for Disruption: Successful development could lead to a more efficient and sustainable nuclear fuel cycle, offering a competitive advantage in the future energy landscape.

- Limited Current Market Share: These advanced concepts currently represent a negligible portion of the global nuclear fuel market, which is dominated by established uranium enrichment and fuel fabrication processes.

Digitalization and AI Integration in Energy Operations

CGN Power's strategic push into digitalization and AI integration within its energy operations is a clear indicator of a forward-looking approach, aiming to boost efficiency and optimize performance. This segment, while holding immense potential for future competitive advantage, is characterized by substantial upfront investments in cutting-edge technology and specialized talent. The full realization of these investments' return on investment (ROI) is still unfolding, positioning these initiatives as potential stars or question marks depending on market adoption and technological maturity.

These advanced technologies, including AI-driven predictive maintenance and smart grid solutions, are crucial for enhancing operational reliability and reducing costs. For instance, AI can analyze vast datasets to forecast equipment failures, allowing for proactive repairs and minimizing downtime. While the exact market share of CGN Power in these specific technological applications might still be developing, the company's commitment signals a significant investment in future growth engines.

- High Growth Potential: Digitalization and AI integration offer substantial opportunities to improve efficiency, reduce operational costs, and enhance grid stability.

- Significant Investment Required: These initiatives demand considerable capital outlay for technology infrastructure, software development, and skilled personnel.

- Nascent Market Share: CGN Power's penetration and market share in specialized digital and AI solutions within the energy sector are likely still in early stages of development.

- Future Competitive Advantage: Successful implementation and scaling of these technologies are expected to be key differentiators, driving future market leadership.

CGN Power's ventures into new energy technologies, such as small modular reactors (SMRs) and offshore solar farms, are classic Question Marks in the BCG matrix. These projects require substantial upfront investment with uncertain market adoption, reflecting high risk and high potential reward.

These initiatives, including the development of advanced nuclear fuel cycles and AI integration, are in their early stages. CGN's significant capital allocation to these areas, aiming for future market leadership, underscores their current low market share and high growth potential.

The company's strategic expansion into nascent international clean energy markets also falls into the Question Mark category. These endeavors demand considerable investment in building presence and brand recognition, with success contingent on market viability and profitability.

CGN Power's commitment to digitalization and AI within its operations, while offering significant future advantages, requires substantial initial investment. The return on these investments is still being realized, positioning them as potential future stars or question marks.

BCG Matrix Data Sources

Our CGN Power BCG Matrix is constructed using a blend of financial disclosures, market research reports, and industry growth forecasts to provide a comprehensive view of business unit performance.