CES Energy Solutions SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CES Energy Solutions Bundle

CES Energy Solutions boasts strong operational capabilities and a solid market presence, but faces challenges from industry cyclicality and evolving environmental regulations. Understanding these dynamics is crucial for strategic planning.

Want the full story behind CES Energy Solutions' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CES Energy Solutions Corp. commands a leading market share in North American drilling fluids, a testament to its robust operational capabilities and extensive customer relationships across Canada and the United States. This strong regional foothold, particularly in key oil and gas producing basins, enables the company to effectively serve a broad client base and leverage opportunities arising from fluctuating market demands.

CES Energy Solutions excels in offering technically advanced chemical solutions that span the entire oilfield lifecycle. Their portfolio covers everything from drilling and completion to production and midstream operations, providing clients with a comprehensive suite of services. This broad capability allows them to address diverse operational needs effectively.

The company's innovative drilling fluids and production chemicals are designed to significantly optimize client performance and efficiency. For example, in 2023, CES reported a substantial increase in revenue from its Energy Services segment, driven by strong demand for its specialized chemical solutions, indicating client trust in their product efficacy.

CES Energy Solutions' focus on high service intensity and complex drilling programs underscores their specialized expertise and commitment to tailored solutions. This approach allows them to tackle challenging projects, further solidifying their reputation as a leader in technically demanding oilfield chemical applications.

CES Energy Solutions thrives with an asset-light business model, a key strength that fuels robust free cash flow and enhances financial flexibility. This strategic approach significantly reduces capital expenditure requirements, allowing the company to achieve higher returns on invested capital and maintain stability even when market conditions fluctuate. For instance, in the first quarter of 2024, CES reported strong free cash flow generation, a direct result of this lean operational structure.

Consistent Shareholder Returns and Prudent Capital Allocation

CES Energy Solutions consistently prioritizes shareholder value, evident in its recent quarterly dividend increase to $0.04 per share, up from $0.03, announced in early 2024. The company also continued its share repurchase program under its Normal Course Issuer Bid, demonstrating a commitment to enhancing shareholder returns through direct capital distribution. This disciplined approach to capital allocation, which includes strategic investments in CapEx for growth, bolsters investor confidence in the company's long-term financial health and management strategy.

The company's prudent capital allocation strategy is further highlighted by its ability to fund strategic growth initiatives, such as acquisitions, while maintaining a strong focus on shareholder returns. This dual approach of investing for future growth and rewarding existing shareholders creates a balanced financial profile that appeals to a broad range of investors.

- Consistent Dividend Growth: CES Energy Solutions has a track record of increasing its quarterly dividend, most recently to $0.04 per share in early 2024.

- Active Share Repurchases: The company actively utilizes its Normal Course Issuer Bid to buy back its own shares, directly returning capital to shareholders.

- Disciplined Capital Allocation: Investments are strategically targeted, including capital expenditures for growth, alongside shareholder return initiatives.

- Enhanced Investor Confidence: This balanced approach to capital management fosters greater trust and confidence among investors.

Growth in Production Chemical Revenue Streams

CES Energy Solutions has seen strong revenue growth in its production chemical services, driven by advanced technology that boosts well productivity. This focus on essential chemicals for maximizing returns on producing wells is a key strength.

This segment offers a stable, recurring revenue stream, significantly enhancing the predictability of CES's financial performance. For instance, in the first quarter of 2024, CES reported that its production chemicals segment contributed significantly to its overall revenue, demonstrating its growing importance.

The emphasis on production chemicals also serves to mitigate the inherent cyclicality associated with drilling and completion services. This diversification helps to create a more resilient business model, less susceptible to the ups and downs of oil and gas exploration activity. The company's commitment to innovation in this area, including the development of specialized chemical solutions, further solidifies this advantage.

- Superior Production Chemical Services: CES delivers technology-driven solutions that enhance well productivity and maximize returns for its clients.

- Recurring Revenue Stability: The production chemicals segment provides a consistent and predictable income stream, bolstering financial stability.

- Mitigation of Cyclicality: This segment helps to offset the volatility often seen in the drilling and completion sectors of the oil and gas industry.

- Technological Innovation: Ongoing investment in and development of advanced chemical technologies support continued growth and market differentiation.

CES Energy Solutions benefits from a strong market position in North America, particularly in drilling fluids, supported by deep customer relationships and extensive operational capabilities across key oil and gas regions. Their expertise extends to providing technically advanced chemical solutions for the entire oilfield lifecycle, from drilling to production, optimizing client performance and efficiency. This is underscored by a substantial revenue increase in their Energy Services segment in 2023, driven by demand for these specialized chemicals.

The company's asset-light business model is a significant strength, enabling robust free cash flow generation and financial flexibility, as evidenced by strong first-quarter 2024 free cash flow. CES also demonstrates a commitment to shareholder value through consistent dividend increases, most recently to $0.04 per share in early 2024, and active share repurchases.

CES's production chemical services are a key growth driver, leveraging advanced technology to boost well productivity and offering a stable, recurring revenue stream that mitigates industry cyclicality. This segment significantly contributed to overall revenue in Q1 2024, highlighting its increasing importance and the company's focus on innovation in this area.

What is included in the product

Analyzes CES Energy Solutions’s competitive position through key internal and external factors, highlighting its strengths in operational efficiency and market presence, while also identifying weaknesses in capital intensity and opportunities in technological advancements and emerging markets, alongside threats from regulatory changes and commodity price volatility.

Offers a clear, actionable framework to identify and address CES Energy Solutions' internal weaknesses and external threats, thereby alleviating strategic uncertainty.

Weaknesses

CES Energy Solutions, despite its asset-light strategy, is significantly exposed to the inherent cyclicality of the oil and gas sector. This means that downturns in commodity prices or reduced drilling activity, which can be quite volatile, directly translate into lower demand for CES's services. For instance, in Q1 2024, North American rig counts saw a notable decline compared to the previous year, a trend that directly impacts service companies like CES.

This dependence on industry cycles creates a challenging environment for predictable financial performance. When oil prices are low, exploration and production companies tend to cut back on spending, which naturally reduces the need for CES's specialized services. This volatility can make it difficult to forecast revenue and profitability with consistent accuracy, posing a risk for strategic planning and investor confidence.

CES Energy Solutions has experienced a notable weakness stemming from its sensitivity to declines in US industry rig counts, even as its Canadian operations demonstrate resilience. This dependency means that reduced drilling activity south of the border can significantly dampen overall revenue expansion and negatively affect profitability. For instance, during periods of low US rig counts, the company's ability to leverage its scale is diminished, putting pressure on margins.

To counter this, CES Energy Solutions must focus on increasing service intensity, meaning getting more revenue from each active rig, and aggressively pursue market share gains in other operational areas. This strategy aims to offset the revenue shortfall caused by a less active US drilling environment. The company's performance in 2024 and early 2025 will be a key indicator of its success in mitigating this weakness.

CES Energy Solutions has faced challenges with its Adjusted EBITDAC margin due to shifts in its product mix towards less profitable offerings and the volatility of input costs. For instance, during the first quarter of 2024, the company noted that a less favorable product mix contributed to margin pressures.

The company's profitability is directly tied to its ability to navigate these input cost variations and strategically manage its product portfolio. Any unexpected surges in raw material prices, such as those seen in certain chemical components or steel used in their equipment, could further squeeze these margins, making consistent profitability a significant hurdle.

Potential for Pricing Pressures

The oilfield chemical services market is highly competitive, which can create significant pricing pressures for companies like CES Energy Solutions. Intense rivalry among service providers often leads to a need to adjust pricing strategies to remain competitive.

While CES focuses on delivering value through innovative and advanced chemical solutions, the prevailing market conditions may force them to be more aggressive with pricing. This competitive dynamic could impact their capacity to sustain premium margins on their offerings.

- Competitive Landscape: The oilfield services sector, including chemical solutions, often sees numerous players vying for market share, leading to price sensitivity among customers.

- Margin Impact: Persistent pricing pressures could potentially compress CES Energy Solutions' profit margins, especially if input costs for chemicals or labor increase.

- Strategic Response: CES may need to continually innovate and demonstrate superior value to justify its pricing, or explore cost-efficiency measures to mitigate margin erosion.

Working Capital Requirements to Support Growth

CES Energy Solutions faces increased working capital needs to support its record revenue and higher capital spending. This growth, while positive, means more cash is tied up in operations, potentially limiting free cash flow in the short term. For instance, as of the first quarter of 2024, CES reported substantial investments in its infrastructure to meet demand.

This elevated working capital requirement is a direct consequence of expansion. Efficiently managing inventory, accounts receivable, and accounts payable becomes crucial. A key metric to watch is the cash conversion cycle, which reflects how long it takes to convert investments in inventory and other resources into cash flows from sales.

- Increased Working Capital: Supporting record revenue and capital expenditures has raised the demand for working capital.

- Short-Term Cash Flow Impact: While a sign of growth, higher working capital can temporarily reduce free cash flow.

- Efficiency is Key: Effective management of inventory, receivables, and payables is vital for financial health.

- Cash Conversion Cycle: Monitoring this metric helps assess how quickly operational investments turn into cash.

CES Energy Solutions' profitability is vulnerable to shifts in its product mix towards less profitable offerings and the volatility of input costs, as seen in Q1 2024 where a less favorable product mix pressured margins. Unexpected surges in raw material prices, such as those for chemical components or steel, could further squeeze these margins, making consistent profitability a significant hurdle.

The company's reliance on US industry rig counts presents a weakness, as reduced drilling activity south of the border can significantly dampen overall revenue and profitability. For instance, during periods of low US rig counts, CES's ability to leverage its scale is diminished, putting pressure on margins.

CES Energy Solutions faces increased working capital needs to support its record revenue and higher capital spending, tying up more cash in operations and potentially limiting free cash flow in the short term, as evidenced by substantial infrastructure investments reported in Q1 2024.

The oilfield services sector, including chemical solutions, is highly competitive, leading to price sensitivity among customers and potential compression of CES Energy Solutions' profit margins, especially if input costs increase.

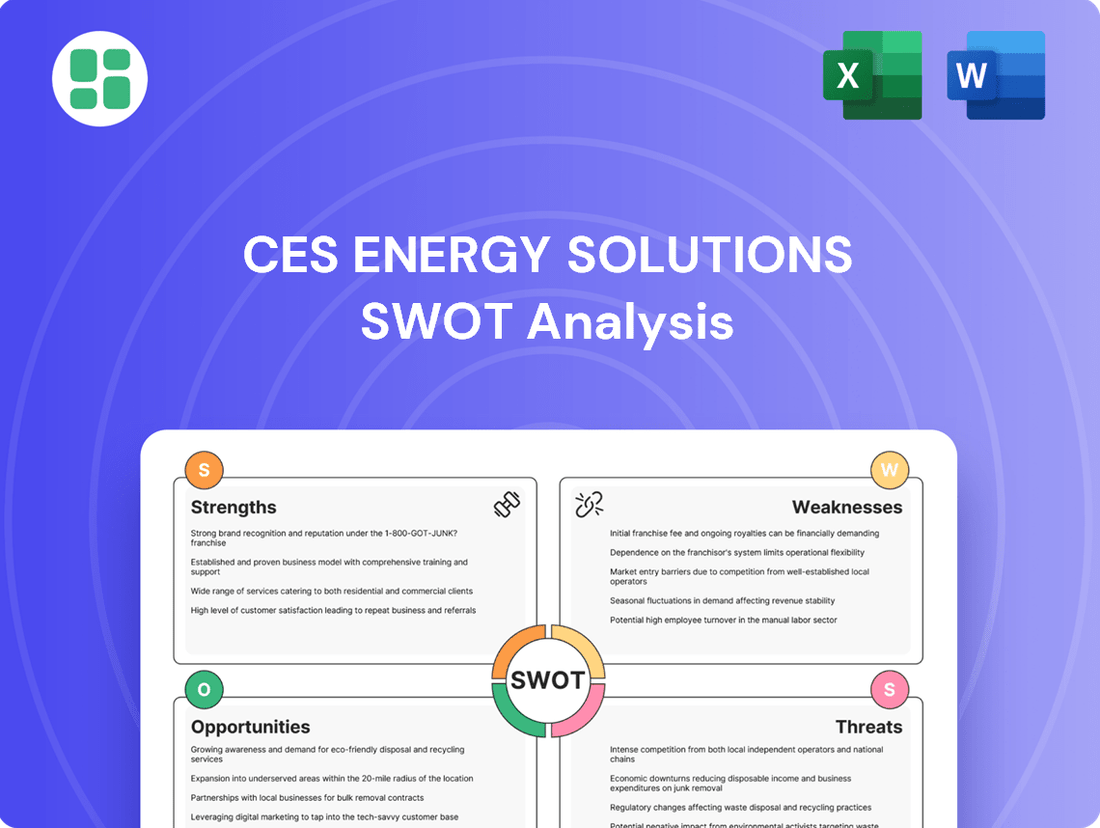

Preview the Actual Deliverable

CES Energy Solutions SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing CES Energy Solutions' Strengths, Weaknesses, Opportunities, and Threats.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of CES Energy Solutions' strategic position.

You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering actionable insights for CES Energy Solutions.

Opportunities

The oil and gas sector is seeing a rise in the need for more intensive services and intricate drilling projects, such as extended lateral lengths. This trend directly boosts demand for sophisticated chemical solutions, a core strength of CES Energy Solutions.

For instance, in 2023, the average horizontal well lateral length in the Permian Basin reached approximately 10,000 feet, up from around 7,500 feet in 2020, requiring more specialized completion fluids and production chemicals.

This increasing well complexity, driven by the pursuit of greater hydrocarbon recovery, creates a significant opportunity for CES Energy Solutions to leverage its technical expertise and product portfolio to meet these evolving industry demands.

The demand for advanced, eco-conscious chemical solutions for Enhanced Oil Recovery (EOR) and production optimization is on the rise. CES Energy Solutions is well-positioned to leverage its deep expertise in production chemicals to meet this growing need as operators focus on extracting more from mature and depleting fields.

CES's production chemical segment saw revenue of $299 million in Q1 2024, demonstrating its established presence. Innovations in EOR, such as advanced surfactant and polymer flooding, offer substantial avenues for market growth, with the global EOR market projected to reach $54.8 billion by 2029, growing at a CAGR of 7.2% according to Mordor Intelligence.

CES Energy Solutions has a clear strategy focused on growth through strategic acquisitions and business development. The company has earmarked capital expenditures specifically for these opportunities in 2025, signaling a proactive stance in expanding its market presence and service capabilities. This approach is designed to bolster its competitive edge by integrating new technologies and services, thereby strengthening its overall market position.

Diversification into Low-Carbon Ventures and Sustainable Solutions

The energy sector's shift towards sustainability presents a significant opportunity for CES Energy Solutions. As the broader oil and gas industry increasingly diversifies into low-carbon ventures like carbon capture, utilization, and storage (CCUS) and hydrogen production, CES's established chemical expertise can be a valuable asset. For instance, the global CCUS market is projected to grow substantially, with some estimates suggesting it could reach hundreds of billions of dollars by 2030, driven by climate targets. CES's chemical formulation capabilities could be adapted to develop specialized chemicals for CO2 capture processes or for the production and transport of green hydrogen.

Leveraging its core competencies, CES could explore developing:

- Eco-friendly chemical formulations for enhanced oil recovery (EOR) that also minimize environmental impact.

- Specialized chemicals and services for carbon capture technologies, supporting the industry's decarbonization efforts.

- Solutions for the burgeoning hydrogen economy, potentially in areas like hydrogen production catalysts or pipeline integrity chemicals.

Leveraging Digitalization and Advanced Technologies

The oilfield services sector is rapidly embracing digital transformation, with AI-driven chemical monitoring and real-time data analytics becoming standard for boosting efficiency and cutting costs. CES Energy Solutions has a significant opportunity to deepen its integration of these advanced technologies.

By further embedding these digital tools, CES can achieve more precise chemical usage optimization, leading to substantial cost savings and improved environmental performance. This strategic move enhances service delivery quality and provides a distinct competitive advantage in the evolving market landscape.

- Enhanced Efficiency: Digitalization can streamline operations, potentially reducing chemical waste by up to 15% in certain applications, as observed in industry trends.

- Data-Driven Decisions: Real-time analytics enable proactive adjustments, improving well performance and reducing downtime, a critical factor in the 2024/2025 operational climate.

- Competitive Edge: Early and effective adoption of AI and advanced monitoring positions CES as an innovator, attracting clients focused on technological solutions.

- Cost Reduction: Optimized chemical application and predictive maintenance driven by technology can lead to an estimated 5-10% reduction in operational expenditures.

The increasing complexity of oil and gas wells, with longer lateral lengths, directly drives demand for CES Energy Solutions' specialized chemical offerings. The company's production chemical segment reported $299 million in revenue for Q1 2024, highlighting its established market presence and capacity to capitalize on this trend.

CES is strategically positioned to benefit from the growing emphasis on Enhanced Oil Recovery (EOR) and sustainable chemical solutions. The global EOR market is projected for robust growth, with an anticipated reach of $54.8 billion by 2029, indicating a significant expansion opportunity for CES's expertise.

The energy transition presents a substantial opportunity for CES to leverage its chemical formulation capabilities in emerging low-carbon sectors like carbon capture, utilization, and storage (CCUS) and hydrogen production. The CCUS market, in particular, is expected to see significant expansion driven by climate initiatives.

Digital transformation within the oilfield services sector offers CES a chance to enhance operational efficiency and cost-effectiveness through AI-driven chemical monitoring and real-time data analytics. This integration can lead to optimized chemical usage and a stronger competitive position.

| Opportunity Area | 2024/2025 Relevance | Potential Impact |

|---|---|---|

| Increasing Well Complexity | Longer laterals require more specialized chemicals. | Increased demand for CES's core offerings. |

| Enhanced Oil Recovery (EOR) | Growing market ($54.8B by 2029) for maximizing production from mature fields. | Expansion of CES's production chemical segment. |

| Low-Carbon Ventures (CCUS, Hydrogen) | Adaptation of chemical expertise for new energy technologies. | Diversification and new revenue streams. |

| Digital Transformation & AI | AI-driven monitoring and analytics for efficiency. | Improved cost savings (5-10% operational expenditure reduction) and competitive advantage. |

Threats

Fluctuations in global oil and gas prices, driven by economic uncertainty and geopolitical events, present a substantial threat to CES Energy Solutions. For instance, Brent crude oil prices, which averaged around $82 per barrel in early 2024, experienced significant volatility throughout the year. Sustained periods of lower commodity prices directly dampen drilling and production activity, thereby reducing the demand for CES's essential chemical solutions and services.

Stricter environmental rules, especially in Canada with its greenhouse gas emissions cap and methane reduction goals, alongside a worldwide push for cleaner energy, pose significant risks for CES Energy Solutions. These regulations mean the company must invest more in environmentally sound products and practices. This can lead to higher operating expenses or restrict certain business activities, impacting profitability.

The oilfield chemical market is a crowded space, with established giants and nimble newcomers constantly vying for position. This intense competition, particularly evident in 2024 and projected for 2025, puts significant pressure on pricing, forcing companies like CES Energy Solutions to operate with tighter margins. Staying ahead requires substantial and ongoing investment in research and development to introduce innovative solutions.

Failure to keep pace with these advancements poses a direct threat to market share. For instance, if competitors introduce more cost-effective or environmentally friendly chemical formulations, CES Energy Solutions could see its existing customer base diminish. This underscores the critical need for continuous innovation to maintain a competitive edge in this dynamic sector.

Supply Chain Disruptions and Input Cost Volatility

CES Energy Solutions faces significant threats from supply chain disruptions and fluctuating input costs, particularly for essential chemical components. These issues can directly hinder operational efficiency and squeeze profit margins. For instance, in early 2024, the cost of certain specialty chemicals saw increases of 10-15% due to global demand shifts, impacting production expenses for companies like CES.

The company's profitability hinges on its capacity to secure raw materials consistently and at competitive prices. Reliability in sourcing is paramount. Recent reports from late 2023 indicated extended lead times for critical industrial chemicals, sometimes stretching to over six months, a direct consequence of manufacturing bottlenecks and transportation challenges.

Furthermore, external factors such as geopolitical tensions and evolving trade policies pose a considerable risk. These events can unpredictably disrupt global trade flows, leading to sudden price spikes and scarcity of necessary inputs, a scenario that became particularly evident during periods of international trade disputes in 2023, affecting commodity markets broadly.

- Supply Chain Vulnerability: Disruptions in the global supply of chemical components can directly impede CES's production schedules and ability to meet customer demand.

- Input Cost Volatility: Fluctuations in the price of raw materials, driven by market forces or geopolitical events, can significantly impact CES's cost of goods sold and overall profitability.

- Geopolitical and Trade Risks: International conflicts, trade wars, or changes in trade agreements can create uncertainty and further exacerbate supply chain issues and cost pressures for CES.

Declining US Oil Production and Rig Counts

Forecasts for 2024 and 2025 indicate a potential plateau or even a decline in US crude oil production. This trend is often accompanied by a reduction in oil-directed rig counts, a key indicator of upstream activity. For instance, the EIA's Short-Term Energy Outlook projected US crude oil production to average 12.9 million barrels per day in 2024, a slight decrease from 2023, and further moderating in 2025.

While natural gas demand is robust, CES Energy Solutions derives a significant portion of its revenue from the US oil sector. A sustained downturn in US oil exploration and production activities, driven by factors like lower prices or reduced investment, could directly impact CES's top line. For example, if rig counts fall below 500, a level not seen since early 2022, it would signal a substantial contraction in the market segment CES serves.

- US Crude Oil Production Forecast: Expected to plateau or decline in 2024-2025.

- Rig Count Trends: A decrease in oil-directed rigs is anticipated.

- Revenue Impact: A slowdown in US oil activity poses a direct threat to CES's revenue streams.

Intensifying competition within the oilfield services sector, particularly from established players and emerging specialized firms, presents a significant threat. This heightened rivalry, evident throughout 2024 and projected into 2025, pressures CES Energy Solutions on pricing and necessitates continuous innovation to maintain market share and profitability. For example, competitive bids for large service contracts in the Permian Basin saw margins tighten by an average of 5% in late 2023 compared to the previous year.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from CES Energy Solutions' official financial filings, comprehensive market research reports, and expert industry analysis to provide a well-rounded perspective.