CES Energy Solutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CES Energy Solutions Bundle

Navigate the complex external forces shaping CES Energy Solutions's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both opportunities and challenges. Gain a strategic advantage by leveraging these expert insights to refine your own market approach. Download the full PESTLE analysis now for actionable intelligence that drives informed decision-making.

Political factors

Government energy policies in Canada and the United States are pivotal for CES Energy Solutions, directly shaping the demand for its services in the oil and gas sector. For example, a potential shift in US policy under a second Trump administration could see deregulation, potentially boosting oil and gas exploration and production, especially on federal lands and offshore areas, and lifting restrictions on liquefied natural gas (LNG) exports.

Meanwhile, Canada's federal and provincial governments are actively pursuing climate initiatives, including carbon pricing and stringent methane emission reduction targets. Proposed regulations aim for a significant 75% cut in methane emissions by 2030, which could create increased demand for CES Energy Solutions' specialized chemical treatments designed to mitigate these emissions.

Global geopolitical tensions significantly influence crude oil prices, directly impacting CES Energy Solutions' client base. For instance, stable oil prices between $74 and $90 per barrel in 2024 supported strong industry financial health and capital spending.

However, increasing geopolitical risks, such as those observed in mid-June 2025, can add a risk premium to oil prices. This volatility can alter drilling and completion activity, affecting demand for CES Energy Solutions' services.

Trade agreements and tariffs significantly influence CES Energy Solutions' operations, particularly given its strong presence in Canada and the United States. Changes in these relationships, such as potential tariffs on goods exchanged between the two nations, present a direct risk. For instance, the prospect of a 25% tariff on Canadian and Mexican goods, as discussed in political discourse leading up to the 2024 US election, could substantially increase operational costs and impact employment within the oil and gas sector.

Regulatory Changes Specific to Oilfield Services

The regulatory environment for oilfield services, especially concerning chemical applications, is in constant flux. The U.S. Environmental Protection Agency (EPA) is actively working to update its wastewater discharge regulations for oil and gas extraction, a move anticipated in 2024-2025, with a focus on incorporating advanced technologies for water reuse and potentially reducing energy costs. This presents a significant opportunity for CES Energy Solutions to leverage its expertise in chemical solutions for produced water treatment and recycling, aligning with new environmental standards.

These evolving regulations, particularly those impacting chemical usage and water management in the oil and gas sector, are critical for CES Energy Solutions. The EPA's initiative to modernize wastewater discharge rules is expected to drive demand for innovative chemical treatments that facilitate water reuse and meet stricter environmental compliance. For instance, the agency's evaluation of modern technologies could directly benefit companies offering advanced solutions for produced water management.

- EPA Modernization: U.S. EPA is updating wastewater discharge regulations for oil and gas extraction facilities, with potential finalization in 2024 or 2025.

- Focus on Water Reuse: The regulatory overhaul aims to promote sustainable water reuse by assessing new technologies.

- Opportunity for CES: CES Energy Solutions can capitalize by offering compliant chemical solutions for produced water treatment and recycling.

- Cost and Sustainability: The changes are intended to lower energy costs while enhancing environmental sustainability in operations.

Political Support for Traditional Energy vs. Energy Transition

The political landscape presents a critical duality for CES Energy Solutions, with varying degrees of support for traditional energy versus the energy transition. For instance, in the United States, initiatives like Project 2025 signal a potential push to bolster oil and gas operations and potentially ease methane emission regulations, a move that could benefit CES's conventional services. This contrasts with global trends and other national policies heavily favoring decarbonization and significant investments in renewable energy infrastructure.

This divergence in political priorities directly impacts the strategic direction of companies like CES. While optimizing conventional production remains a viable strategy in politically supportive environments, the long-term viability necessitates an adaptation towards low-carbon solutions. For example, the International Energy Agency reported in 2024 that global investment in clean energy technologies reached $2 trillion, highlighting a significant shift in capital allocation driven by policy and market demand.

- Policy Divergence: Political agendas globally are split between supporting fossil fuels and driving the energy transition, creating market uncertainty.

- US Policy Example: Project 2025 in the US aims to boost oil and gas, potentially impacting demand for traditional services.

- Global Investment Trends: In 2024, global clean energy investment surpassed $2 trillion, indicating a strong policy and market push towards decarbonization.

- Strategic Adaptation: CES Energy Solutions must navigate these contrasting political climates by balancing existing services with new low-carbon offerings.

Government policies in Canada and the US significantly influence CES Energy Solutions' market. For instance, the US EPA's 2024-2025 updates to wastewater discharge regulations for oil and gas extraction, focusing on water reuse and new technologies, present opportunities for CES's chemical solutions. Conversely, Canada's stringent methane emission reduction targets, aiming for a 75% cut by 2030, could boost demand for CES's emission-mitigating treatments.

Geopolitical stability and trade relations are also key political factors. Stable oil prices in 2024, ranging from $74 to $90 per barrel, supported industry spending. However, increasing global tensions in mid-2025 can introduce price volatility, impacting drilling activity and CES's service demand. Potential tariffs between Canada and the US, like the discussed 25% on goods, could also raise operational costs.

The political landscape shows a divergence in energy priorities, with some nations, like the US under Project 2025, favoring fossil fuel expansion, while others push for decarbonization. This contrast is evident in global clean energy investments, which reached $2 trillion in 2024, underscoring a policy-driven shift towards renewables that CES must navigate by balancing traditional and low-carbon offerings.

What is included in the product

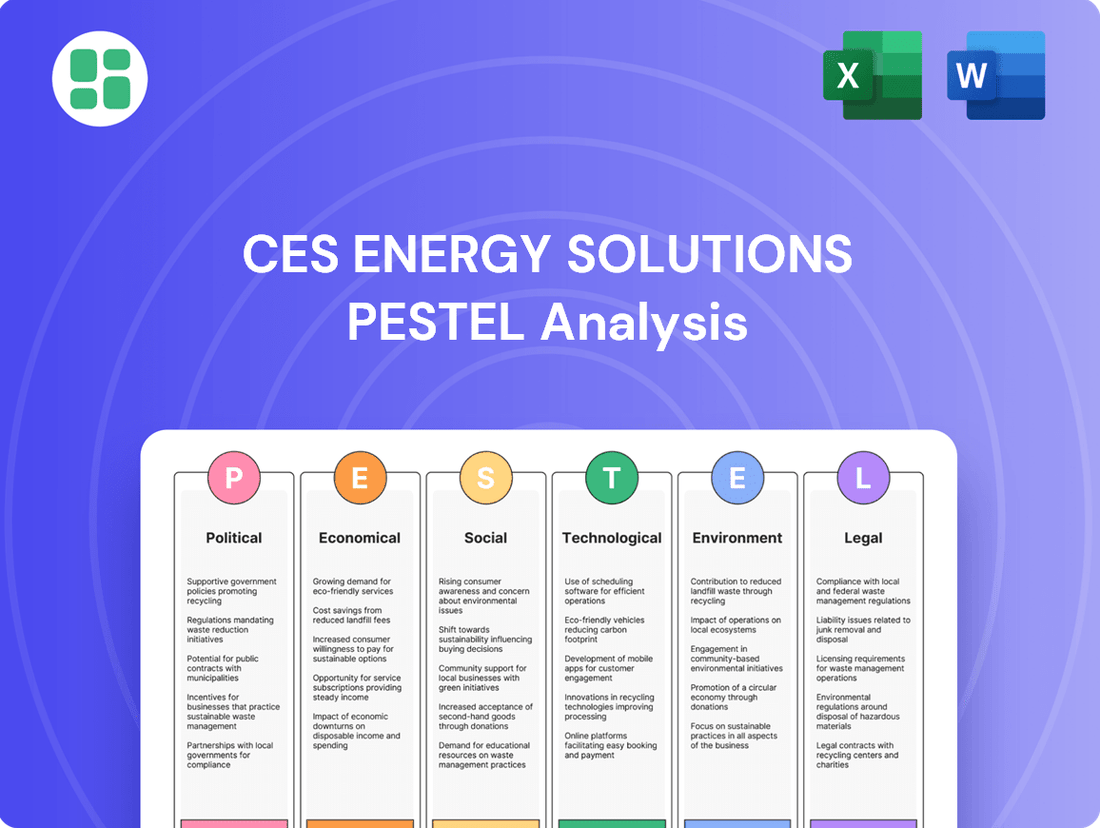

This PESTLE analysis thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing CES Energy Solutions, providing a comprehensive understanding of the external landscape.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities within the energy sector.

A concise, actionable PESTLE analysis for CES Energy Solutions, highlighting key external factors to mitigate risks and identify growth opportunities.

Economic factors

Global oil and natural gas price volatility directly impacts CES Energy Solutions. While Brent crude experienced relative stability in 2024, projections for 2025 and 2026 indicate a potential dip in oil prices, contrasting with an anticipated rise in natural gas prices from their current low points.

Lower crude oil prices often translate to decreased drilling and completion expenditures by exploration and production companies. This reduction in activity directly curtails the demand for specialized oilfield chemical services, a core offering of CES Energy Solutions.

Conversely, an uptick in natural gas prices could incentivize increased production of associated gas. This scenario would likely boost demand for CES Energy Solutions' services, particularly those supporting natural gas extraction and processing operations.

Inflationary pressures are a significant concern for CES Energy Solutions. For instance, the Consumer Price Index (CPI) in Canada, a key market for CES, saw an annual increase of 2.7% in April 2024, down from 2.9% in March, but still indicating elevated costs for raw materials used in chemical blending and for general service delivery. This directly impacts CES's operational expenses.

Higher interest rates, as implemented by the Bank of Canada, directly influence CES's clients in the oil and gas sector. With the policy interest rate at 5.00% as of June 2024, financing new projects or expansions becomes more expensive for producers. This can lead to a slowdown in capital expenditures, reducing demand for CES's specialized services and equipment.

Broader macroeconomic weakness, often signaled by slowing GDP growth, can further dampen overall energy consumption and investment. For example, if global economic activity contracts, demand for oil and gas may decrease, indirectly impacting CES's business by reducing the need for production optimization and associated services.

Economic growth rates in Canada and the US are crucial for CES Energy Solutions, as they directly influence energy demand. For instance, the US economy was projected to grow by 1.9% in 2024, while Canada's GDP was expected to expand by 1.2% in the same year. These figures indicate a moderate but positive growth environment, which generally supports higher energy consumption.

A strong economic expansion in both nations typically translates to increased industrial activity and consumer spending, both of which drive up the need for energy. This, in turn, boosts demand for CES's specialized chemical solutions and services used in oil and gas extraction and production. Higher drilling and production activities directly benefit CES's revenue streams.

Conversely, any economic slowdown or recession in either Canada or the US could significantly dampen energy demand. A contraction in economic output would likely lead to reduced industrial output and lower consumer spending, consequently decreasing the need for oil and gas. This would directly impact CES Energy Solutions by lowering demand for their chemical products and services, potentially affecting their profitability and operational scale.

Supply Chain Disruptions and Raw Material Costs

The cost and availability of essential raw materials for chemical blending represent a significant economic consideration for CES Energy Solutions. Fluctuations in these inputs directly influence operational expenses and, consequently, profit margins. For instance, the price of key components like methanol and various surfactants can be highly volatile, impacting the cost-effectiveness of their service offerings.

Supply chain disruptions, a persistent challenge in recent years, further compound these economic pressures. Global events can impede the timely delivery of necessary chemicals, leading to project delays and increased logistical costs. The complex dynamics of global markets and the export volumes of oilfield chemicals highlight the intricate interdependencies that CES Energy Solutions must navigate to ensure consistent service delivery and manage its supply chain effectively.

- Raw Material Volatility: Prices for key chemicals like methanol, a common blending component, saw significant swings in 2024, with some reports indicating increases of over 15% in certain regions due to upstream production issues.

- Supply Chain Bottlenecks: Shipping container availability and port congestion, while showing some improvement from peak 2022 levels, continued to affect lead times for chemical imports into North America throughout early 2025, adding an average of 5-10% to landed costs.

- Export Market Influence: The export market for oilfield chemicals, particularly from major producing nations, directly impacts domestic availability and pricing. Shifts in global demand, such as increased demand from the Middle East in late 2024, can tighten supply for North American operations.

Capital Expenditure Trends by Oil and Gas Producers

The willingness of oil and gas producers to invest in capital expenditures (CapEx) is a critical driver for companies like CES Energy Solutions, directly impacting demand for their specialized chemicals and services. When producers increase their CapEx, it signals a greater need for drilling, completion, and production activities, which in turn boosts the need for the essential chemicals CES provides.

The industry has indeed witnessed a notable uptick in CapEx, with oilfield services reporting robust performance throughout 2023 and into 2024. This trend is a positive indicator for CES Energy Solutions, as their financial health is intrinsically linked to these investment cycles. For instance, the company's strong Q4 2024 results were largely attributed to elevated service intensity levels, a direct consequence of increased upstream investment.

- Increased Upstream Investment: Many major oil and gas companies, including those in North America, have signaled plans for higher capital spending in 2024 compared to 2023, with some projecting double-digit percentage increases.

- Service Intensity Growth: The demand for more complex well completions and extended production phases directly correlates with higher consumption of production chemicals, benefiting service providers like CES.

- CES Financial Performance: CES Energy Solutions reported a significant increase in revenue and profitability in late 2023 and early 2024, mirroring the broader industry's CapEx rebound.

- Outlook for 2025: Early indications suggest continued, albeit potentially more measured, CapEx growth in 2025, contingent on commodity price stability and regulatory environments.

Global economic growth directly influences energy demand, impacting CES Energy Solutions. Stronger economies in Canada and the US, with projected GDP growth of 1.2% and 1.9% respectively for 2024, generally support higher oil and gas consumption, benefiting CES. Conversely, economic slowdowns could reduce demand for their specialized services.

Inflationary pressures, evidenced by Canada's CPI at 2.7% in April 2024, increase CES's operational costs for raw materials and delivery. Higher interest rates, with the Bank of Canada's policy rate at 5.00% in June 2024, make financing more expensive for CES's clients, potentially slowing capital expenditures and demand for CES services.

CES Energy Solutions is heavily influenced by oil and natural gas price fluctuations. While Brent crude prices were stable in 2024, forecasts suggest a potential dip in 2025-2026, contrasting with expected increases in natural gas prices. Lower oil prices can reduce drilling activity, decreasing demand for CES's chemical services.

The cost and availability of raw materials like methanol are critical. Supply chain disruptions, though improving, still impact lead times and costs for chemical imports into North America. The export market for oilfield chemicals also affects domestic availability and pricing, with increased demand from regions like the Middle East influencing supply.

| Economic Factor | 2024 Projection/Status | Impact on CES Energy Solutions |

| Global GDP Growth | Moderate positive growth expected | Supports energy demand, potentially increasing service needs |

| Inflation (Canada CPI) | 2.7% (April 2024) | Increases operational costs for raw materials and delivery |

| Interest Rates (Bank of Canada) | 5.00% (June 2024) | Raises financing costs for clients, potentially reducing CapEx and demand |

| Oil Prices | Stable in 2024, potential dip 2025-2026 | Lower prices can reduce drilling activity and demand for chemical services |

| Natural Gas Prices | Low, expected to rise | Higher prices may incentivize production, boosting demand for CES services |

| Raw Material Costs | Volatile (e.g., methanol price increases) | Affects operational expenses and profit margins |

| Supply Chain Issues | Improving but still present | Can cause delays and increase logistical costs for chemical imports |

Preview the Actual Deliverable

CES Energy Solutions PESTLE Analysis

The preview you see here is the exact CES Energy Solutions PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting CES Energy Solutions.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic decision-making.

Sociological factors

Public sentiment and increasing pressure for Environmental, Social, and Governance (ESG) compliance are significantly reshaping the oil and gas industry. CES Energy Solutions, like its peers, faces heightened scrutiny regarding its environmental footprint and social responsibility, impacting operational strategies and investor relations.

This societal shift is directly driving demand for more sustainable and environmentally friendly chemical formulations and operational practices. For instance, the global ESG investing market reached an estimated $35.3 trillion in assets under management by the end of 2023, demonstrating a clear financial imperative for companies to align with these values.

Consequently, such pressures influence R&D priorities and product development within CES Energy Solutions, pushing for innovations that reduce emissions and enhance overall environmental performance in their service offerings.

The oil and gas industry, including oilfield services, is grappling with a shrinking and aging workforce. Many experienced professionals are nearing retirement, and there's a noticeable decrease in younger generations pursuing careers in the energy sector. This demographic shift creates a significant challenge for companies like CES Energy Solutions in finding and keeping qualified personnel.

This scarcity of skilled labor directly impacts operational efficiency and the capacity to expand services. For instance, a 2024 report indicated that roughly 40% of the oil and gas workforce is expected to retire in the next decade, exacerbating existing skill gaps in areas like specialized drilling and equipment maintenance.

CES Energy Solutions, like many in the oil and gas sector, must actively cultivate strong community ties. Negative perceptions regarding environmental stewardship, particularly concerning wastewater management and chemical use in hydraulic fracturing, can directly jeopardize its social license to operate.

For instance, in 2024, public scrutiny of water disposal practices in key operating regions intensified, with some communities advocating for stricter regulations. CES Energy Solutions' commitment to transparent communication and demonstrable environmental responsibility is therefore paramount to maintaining operational continuity and avoiding costly project delays or outright opposition.

Health and Safety Concerns for Chemical Handling

The inherent nature of chemical handling necessitates a robust focus on health and safety. CES Energy Solutions must prioritize worker well-being and community safety, especially given the advanced chemical solutions they employ. This commitment is crucial for maintaining operational integrity and public trust.

Adherence to stringent occupational health and safety (OHS) standards is non-negotiable. A proactive safety culture directly impacts employee retention and reduces the likelihood of costly incidents. For instance, in 2024, the oil and gas sector saw a continued emphasis on safety training, with many companies investing upwards of 5% of their operational budget into OHS programs to mitigate risks associated with chemical usage.

- Worker Safety: Implementing comprehensive training programs for chemical handling and emergency response is vital.

- Community Impact: Ensuring containment protocols and environmental safeguards are in place protects nearby populations.

- Regulatory Compliance: Staying abreast of and exceeding evolving OHS regulations is a key sociological expectation.

- Reputation Management: A strong safety record enhances CES Energy Solutions' social license to operate.

Consumer Demand for Energy

Consumer demand for energy, particularly from sectors like transportation and industry, directly impacts CES Energy Solutions by setting the pace for oil and gas production. As global populations grow and economies develop, the need for reliable energy sources intensifies, prompting increased investment in upstream activities that require specialized chemical solutions.

The International Energy Agency (IEA) projected in late 2024 that global primary energy demand would continue its upward trend through 2025, driven by emerging economies. This sustained demand translates into a consistent need for services and products like those offered by CES Energy Solutions to support efficient extraction and production operations.

- Growing Global Population: Expected to surpass 8 billion people by mid-2025, increasing overall energy consumption.

- Industrialization in Emerging Markets: Nations in Asia and Africa are expanding their industrial bases, requiring more energy for manufacturing and infrastructure.

- Transportation Sector Reliance: Despite shifts towards alternatives, fossil fuels remain dominant in global transportation, underpinning demand for oil and gas.

- Energy Transition Dynamics: While the transition to renewables is ongoing, the immediate future still sees significant demand for oil and gas, creating opportunities for companies supporting these sectors.

The societal expectation for ethical business practices and corporate responsibility is a significant driver for CES Energy Solutions. Public perception, influenced by environmental concerns and community well-being, directly impacts a company's social license to operate. This means demonstrating a commitment to safety, transparency, and positive community engagement is crucial for maintaining operations and investor confidence.

The increasing emphasis on Environmental, Social, and Governance (ESG) criteria is reshaping industry norms, with investors increasingly favoring companies that align with sustainable practices. By 2024, the global ESG investing market was valued in the trillions, underscoring the financial imperative for CES Energy Solutions to prioritize these aspects in its operations and reporting.

Furthermore, the demographic shifts within the workforce present a challenge, with an aging population of skilled workers and a declining interest from younger generations in the energy sector. This talent scarcity directly affects operational capacity and necessitates proactive strategies for recruitment and retention.

CES Energy Solutions must navigate public sentiment regarding its environmental impact, particularly concerning chemical usage and water management. Maintaining a strong reputation requires transparent communication and demonstrable commitment to minimizing ecological footprints, especially as communities in 2024 voiced increased concerns over water disposal practices.

Technological factors

Continuous innovation in drilling techniques, like advanced horizontal drilling and hydraulic fracturing, is a major technological driver. These methods significantly increase the demand for specialized, high-performance chemical solutions to maximize efficiency and output from unconventional resources.

CES Energy Solutions plays a crucial role by leveraging its expertise in custom chemical design, blending, and delivery. This capability is essential for optimizing the performance of these cutting-edge drilling and completion operations, ensuring clients achieve their production goals.

For instance, the Permian Basin, a key region for unconventional oil and gas production, saw significant advancements in drilling efficiency throughout 2024. Innovations in downhole tools and fluid chemistries, areas where CES operates, contributed to an average drilling time reduction of approximately 10% for horizontal wells compared to 2023, directly impacting chemical demand.

The oil and gas industry is seeing a significant push towards environmentally friendly chemical formulations, with a focus on biodegradability and reduced environmental impact. This shift is directly influenced by increasingly strict environmental regulations worldwide.

CES Energy Solutions, a key player in oilfield chemical services, is responding by prioritizing research and development into these advanced, sustainable chemistries. For example, by 2024, the global market for green chemicals in the oil and gas sector was projected to reach billions, indicating substantial investment and demand for eco-conscious solutions.

The oil and gas sector is rapidly embracing digitalization and automation, with significant investments flowing into AI and advanced analytics. For instance, by the end of 2024, it's projected that over 70% of oilfield services companies will have implemented AI-powered solutions for at least one operational area, aiming to boost efficiency and reduce costs.

CES Energy Solutions can capitalize on this trend by integrating AI-driven chemical monitoring and dosing systems. These systems optimize chemical usage, leading to substantial cost savings and improved operational control, a key differentiator in a competitive market.

By leveraging these advanced technologies, CES Energy Solutions can enhance its service delivery, offering clients data-driven insights and more predictable outcomes. This strategic adoption of digital tools is crucial for maintaining a competitive edge and meeting evolving client demands for efficiency and performance optimization in 2025.

Innovation in Waste Treatment and Recycling

Technological advancements in treating and reusing produced water from oil and gas extraction are rapidly gaining traction. The U.S. Environmental Protection Agency (EPA) is actively evaluating modern technologies, signaling a potential for increased regulatory flexibility regarding the beneficial reuse of this water. This evolving landscape creates a significant opportunity for companies like CES Energy Solutions to leverage their expertise in chemical solutions for advanced water treatment and recycling processes.

CES Energy Solutions can capitalize on this trend by offering innovative chemical treatments that enhance the efficiency and effectiveness of produced water recycling. The market for these solutions is growing, driven by both environmental regulations and the economic benefits of water reuse. For instance, the global produced water treatment market was valued at approximately $10.5 billion in 2023 and is projected to reach over $15 billion by 2028, according to industry reports.

- Advanced Chemical Formulations: CES can develop and market specialized chemical solutions designed to remove contaminants, reduce scaling, and improve the overall quality of recycled produced water for various industrial applications.

- Regulatory Compliance Support: By offering technologies that align with EPA's evaluation criteria for beneficial reuse, CES can provide clients with solutions that facilitate smoother regulatory approvals.

- Cost-Effective Water Management: The ability to effectively treat and reuse produced water can lead to substantial cost savings for oil and gas operators by reducing their reliance on freshwater sources and minimizing disposal costs.

- Environmental Stewardship: Investing in and promoting advanced water treatment technologies aligns with growing industry and societal demands for more sustainable and environmentally responsible oil and gas operations.

Competitive Landscape Driven by New Chemical Technologies

The oilfield chemicals sector is intensely competitive, with innovation being the primary driver of success. Companies that excel in creating and implementing cutting-edge chemical solutions for improved oil recovery (EOR), effective corrosion prevention, and reliable flow assurance are positioned to capture significant market share.

CES Energy Solutions' strategic commitment to research and development is paramount for sustaining its market leadership. This focus allows the company to address the dynamic and evolving demands of the energy industry, ensuring its offerings remain relevant and competitive.

For instance, the global oilfield chemicals market was valued at approximately $35.2 billion in 2023 and is projected to reach around $51.6 billion by 2030, growing at a CAGR of about 5.6%. This growth underscores the importance of technological advancement.

- EOR Technologies: Advancements in chemical EOR methods, such as polymer flooding and surfactant flooding, are crucial for maximizing hydrocarbon extraction from mature fields.

- Corrosion Inhibition: Novel inhibitor formulations that offer superior protection in increasingly harsh operating environments are in high demand.

- Flow Assurance: Development of chemicals that prevent hydrate formation and wax deposition is essential for maintaining efficient production, especially in deepwater and cold climates.

- Sustainability Focus: A growing trend towards environmentally friendly and biodegradable chemical solutions presents both a challenge and an opportunity for innovation.

Technological advancements in drilling and extraction continue to drive demand for specialized chemical solutions, with innovations in horizontal drilling and hydraulic fracturing requiring high-performance fluids. CES Energy Solutions leverages its custom chemical design capabilities to optimize these operations, contributing to increased efficiency and output.

The industry's shift towards environmentally friendly chemical formulations, emphasizing biodegradability, is a significant technological trend. CES is investing in R&D for sustainable chemistries, aligning with a global green chemicals market projected for substantial growth, with billions invested by 2024.

Digitalization and AI are transforming oilfield services, with over 70% of companies expected to implement AI solutions by the end of 2024 for operational improvements. CES can integrate AI-driven systems for chemical monitoring and dosing, enhancing efficiency and cost savings.

Advancements in produced water treatment and recycling technologies are creating new opportunities, supported by regulatory evaluations for beneficial reuse. CES can offer innovative chemical treatments to enhance water recycling, tapping into a growing market valued at over $10.5 billion in 2023.

| Technology Area | Impact on CES Energy Solutions | Market Data/Projections (2024-2025) |

|---|---|---|

| Advanced Drilling Techniques | Increased demand for specialized, high-performance chemicals for unconventional resources. | Permian Basin drilling efficiency improved ~10% in 2024; driving chemical demand. |

| Environmentally Friendly Chemicals | Opportunity to develop and market biodegradable and low-impact formulations. | Global green chemicals market in oil & gas projected for billions in investment by 2024. |

| Digitalization & AI | Integration of AI for chemical monitoring and dosing to optimize usage and costs. | Over 70% of oilfield services companies to implement AI by end of 2024. |

| Produced Water Treatment | Offering chemical solutions for enhanced water recycling and reuse. | Produced water treatment market valued at ~$10.5 billion in 2023, with growth expected. |

Legal factors

Stringent environmental regulations, especially concerning greenhouse gas emissions, methane reduction, water usage, and waste disposal, significantly affect CES Energy Solutions and its clientele. For example, the U.S. Environmental Protection Agency (EPA) is updating wastewater discharge rules for oil and gas extraction, pushing for advanced treatment and reuse technologies.

Canada, meanwhile, has pledged to cut methane emissions by 40-45% from 2005 levels by 2030, a target that will necessitate innovative solutions from companies like CES Energy Solutions to help their clients comply and reduce their environmental footprint. These evolving regulatory landscapes directly influence operational costs and strategic planning for the energy sector.

Laws governing occupational health and safety are critical for companies like CES Energy Solutions, which handle and manufacture chemicals. These regulations, such as those enforced by OSHA in the United States, mandate strict safety protocols to protect workers from hazardous substances and processes. Failure to comply can lead to significant fines; for instance, OSHA reported over $3.5 billion in penalties for workplace safety violations in 2023.

CES Energy Solutions must adhere to rigorous OHS standards to ensure the safety of its employees and operations, especially given the nature of its chemical products and services. This includes implementing comprehensive training programs, providing appropriate personal protective equipment, and maintaining safe working environments. For example, companies in the chemical manufacturing sector often face specific guidelines related to chemical handling and emergency response procedures.

Compliance with these OHS laws is essential not only for employee well-being but also to avoid costly penalties and maintain a responsible operating profile. In 2024, the U.S. Bureau of Labor Statistics indicated that the manufacturing sector experienced a record-low injury and illness rate, highlighting the effectiveness of robust OHS programs.

Regulations like the Toxic Substances Control Act (TSCA) in the US and Canada's equivalent chemical management frameworks are critical for CES Energy Solutions. These rules govern how chemical substances are registered, handled, transported, and disposed of, directly impacting operational legality and risk management.

Compliance with these evolving regulations is non-negotiable for CES Energy Solutions to maintain its license to operate and avoid significant penalties. For instance, the US EPA's TSCA Work Plan continues to identify and assess chemicals for potential risks, requiring companies to stay abreast of new requirements and potential restrictions impacting their product lines.

Permitting and Licensing Requirements

Operating within the oil and gas industry, especially across diverse Canadian and US regions, necessitates strict adherence to a complex web of permitting and licensing regulations. These legal frameworks are crucial for CES Energy Solutions, impacting everything from initiating new projects to expanding existing operations.

The specific requirements vary significantly by province and state, often involving environmental impact assessments, drilling permits, and operational licenses. For instance, in Alberta, Canada, the Alberta Energy Regulator (AER) oversees a comprehensive permitting process for oil and gas activities, which can involve lengthy review periods. Similarly, in Texas, the Railroad Commission of Texas (RRC) manages a similar, though distinct, set of regulations and approvals.

- Jurisdictional Variance: Permitting processes differ substantially between Canadian provinces (e.g., Alberta, British Columbia) and US states (e.g., Texas, North Dakota), affecting project timelines and costs.

- Environmental Compliance: Obtaining permits often requires detailed environmental assessments and adherence to strict environmental protection standards, influencing operational feasibility.

- Regulatory Changes: Evolving environmental and safety regulations can introduce new compliance burdens and necessitate adjustments to operational plans, potentially impacting CES Energy Solutions' ability to secure necessary approvals efficiently.

Contractual Obligations and Liability

CES Energy Solutions is bound by numerous contractual agreements with its oil and gas clients. These contracts detail specific performance standards, including uptime guarantees for equipment and service delivery timelines. For instance, in 2024, a significant portion of CES's revenue is tied to long-term service contracts, often with penalties for non-compliance with agreed-upon metrics.

Liability clauses within these contracts are paramount. They define the extent of CES's responsibility in case of operational failures, environmental incidents, or damages. Managing these liabilities effectively is critical, as significant claims could impact financial stability. In 2023, the company reported managing a portfolio of contracts where potential liabilities were carefully assessed and provisioned for, reflecting the inherent risks in the sector.

Compliance with regulatory requirements is also a core component of these contractual obligations. This includes adherence to environmental, health, and safety (EHS) standards mandated by both government bodies and client-specific policies. CES's commitment to these standards, often verified through audits as part of contract renewal processes, directly influences its ability to secure and maintain business. For example, in Q1 2025, several contract renewals were contingent on demonstrated compliance with updated emissions regulations.

- Performance Guarantees: Contracts often stipulate service uptime and delivery efficiency targets, with financial implications for failing to meet them.

- Liability Limitations: Clauses define the scope of CES's financial responsibility in the event of operational mishaps or damages, a key risk management factor.

- Compliance Mandates: Adherence to EHS regulations and client-specific operational standards is a non-negotiable aspect of contractual agreements.

- Contractual Risk: The legal framework of these agreements necessitates robust oversight to mitigate potential financial and reputational damage from breaches or claims.

CES Energy Solutions operates within a legal framework that mandates rigorous compliance with environmental protection laws, particularly concerning emissions and waste management. For instance, in 2024, the U.S. EPA continued to enforce stricter wastewater discharge regulations for the oil and gas sector, impacting operational procedures and technology investments. Canada's commitment to methane emission reductions by 2030 also necessitates innovative solutions from CES to support client compliance.

Occupational health and safety (OHS) laws are paramount for CES, given its chemical handling operations. Regulations enforced by bodies like OSHA in the U.S. require strict safety protocols, with significant penalties for violations. In 2023, OSHA levied over $3.5 billion in penalties for safety breaches, underscoring the financial and operational imperative for CES to maintain robust OHS programs. The U.S. Bureau of Labor Statistics reported a record low injury rate in manufacturing in 2024, demonstrating the effectiveness of strong safety measures.

CES must navigate complex permitting and licensing requirements across various Canadian provinces and U.S. states, with processes varying significantly. For example, Alberta's Energy Regulator (AER) and Texas's Railroad Commission (RRC) have distinct approval pathways that influence project timelines and operational feasibility. These jurisdictional variances, coupled with evolving environmental standards, directly affect CES's ability to secure necessary operational approvals efficiently.

Contractual obligations form a significant legal aspect for CES Energy Solutions, with performance guarantees and liability clauses being critical. In 2024, a substantial portion of CES's revenue was tied to long-term service contracts, often including penalties for non-compliance. The company's 2023 financial reports highlighted careful management of potential liabilities within its contract portfolio, reflecting the inherent risks in the energy services sector.

Environmental factors

Government climate change policies, including carbon pricing and net-zero emission targets, are reshaping the oil and gas landscape. Canada, for instance, aims to cut greenhouse gas emissions by 40-45% below 2005 levels by 2030 and reach net-zero by 2050, directly affecting companies like CES Energy Solutions.

These stringent environmental regulations necessitate that CES Energy Solutions innovate and provide services that enable clients to achieve their emissions reduction goals. This includes offering technologies and solutions that lower the carbon intensity of oil and gas operations.

Water usage in drilling and hydraulic fracturing, especially in areas facing scarcity, presents a major environmental challenge. In 2024, the energy sector continued to grapple with the sustainability of its water footprint, with a growing emphasis on responsible consumption.

Regulatory bodies are actively updating rules to broaden the acceptable regions for treated wastewater reuse. This shift underscores the critical need for sophisticated water treatment technologies and effective recycling programs, a trend expected to intensify through 2025.

CES Energy Solutions' suite of water treatment and management services is therefore becoming increasingly indispensable. Their solutions directly address the growing demand for efficient water handling in energy operations, aligning with both environmental stewardship and operational necessities.

Environmental regulations governing the handling and disposal of chemical byproducts and wastewater from oil and gas activities are increasingly stringent. CES Energy Solutions, through its specialized services, helps clients navigate these complex rules, ensuring their operations remain compliant and environmentally sound. For instance, the U.S. Environmental Protection Agency (EPA) consistently updates its regulations, impacting how companies manage drilling fluids and produced water, with fines for non-compliance potentially reaching tens of thousands of dollars per day.

Biodiversity Protection and Land Use Impact

Oil and gas extraction, the core business of many of CES Energy Solutions' clients, directly impacts biodiversity and land use. This can lead to significant environmental scrutiny and public opposition, potentially delaying or halting projects. For instance, in 2024, several major oil and gas development projects faced increased regulatory hurdles and public protests due to concerns over habitat fragmentation and endangered species protection, impacting the demand for related services.

While CES Energy Solutions focuses on chemical solutions, the environmental footprint of its clients' operations indirectly affects its own social license to operate. Negative publicity surrounding environmental damage caused by clients can erode public trust and create a more challenging operating environment. The increasing focus on ESG (Environmental, Social, and Governance) factors by investors means that companies with supply chains linked to environmentally sensitive activities face greater pressure.

CES Energy Solutions must navigate the evolving landscape of land use regulations and biodiversity protection mandates. These regulations, which are becoming stricter globally, can influence where and how its clients can operate, thereby affecting the demand for CES's services. For example, new legislation in 2025 is expected to further restrict development in ecologically sensitive areas, requiring more sophisticated environmental mitigation strategies from the oil and gas sector.

- Increased Regulatory Scrutiny: Growing public awareness and stricter environmental laws in 2024-2025 have led to more rigorous environmental impact assessments for energy projects.

- Impact on Project Viability: Concerns over biodiversity loss and land degradation can lead to project cancellations or significant delays, directly affecting the market for oilfield services.

- ESG Investor Pressure: Investors are increasingly divesting from companies with poor environmental records, pushing clients to adopt more sustainable practices, which can influence their service needs.

- Demand for Sustainable Solutions: CES Energy Solutions may see increased demand for chemical solutions that minimize environmental impact or aid in remediation efforts.

Focus on Reducing Environmental Footprint of Oil and Gas Production

There's a significant industry-wide drive to lessen the environmental impact of oil and gas extraction. This involves a concerted effort to cut down on emissions, use resources more wisely, and embrace greener operational methods. For instance, in 2023, the International Energy Agency reported that methane emissions from oil and gas operations were a key focus, with many companies setting targets for reduction.

CES Energy Solutions plays a vital part by offering advanced chemical solutions designed to boost operational efficiency and minimize environmental harm. These solutions are critical for helping their clients achieve their sustainability objectives. For example, their specialized chemicals can reduce water usage in hydraulic fracturing, a key area of environmental concern.

- Emission Reduction: CES Energy Solutions' products can help clients lower greenhouse gas emissions, aligning with global climate goals.

- Resource Optimization: Their chemical technologies aim to improve the efficiency of oil and gas recovery, thereby optimizing resource utilization.

- Sustainable Practices: By providing environmentally conscious chemical solutions, CES supports the broader industry shift towards more sustainable operations.

Environmental regulations are tightening globally, pushing companies like CES Energy Solutions' clients to reduce emissions and improve water management. Canada's commitment to cutting greenhouse gases by 40-45% by 2030 directly influences the demand for CES's eco-friendly solutions.

Stricter rules on wastewater and chemical byproduct disposal, exemplified by the EPA's evolving regulations, necessitate advanced treatment technologies. CES's expertise in water management and recycling is crucial for client compliance and operational sustainability through 2025.

Biodiversity and land use concerns are increasingly impacting project viability, leading to delays and heightened scrutiny. CES must adapt its offerings to support clients navigating these environmental challenges and public opposition.

| Environmental Factor | Impact on CES Energy Solutions | 2024-2025 Data/Trend |

|---|---|---|

| Climate Change Policies | Increased demand for emission reduction solutions | Canada's 2030 emission targets drive innovation in low-carbon services. |

| Water Management Regulations | Growing need for advanced water treatment and recycling | Stricter wastewater reuse rules and focus on water scarcity. |

| Biodiversity & Land Use | Potential project delays for clients, affecting service demand | Increased regulatory hurdles and public opposition to new developments. |

| ESG Investor Pressure | Clients seek suppliers with strong environmental performance | Growing investor focus on supply chain sustainability. |

PESTLE Analysis Data Sources

Our PESTLE analysis for CES Energy Solutions is built upon a comprehensive review of data from government energy agencies, international financial institutions, and leading market research firms. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the energy sector.