CES Energy Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CES Energy Solutions Bundle

CES Energy Solutions operates in an industry shaped by the significant bargaining power of its customers and the constant threat of substitute services. Understanding these dynamics is crucial for any stakeholder.

The full Porter's Five Forces Analysis reveals the real forces shaping CES Energy Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CES Energy Solutions depends on a variety of raw materials and specialized chemicals. When there are few dominant suppliers for essential or unique chemical components, their bargaining power can be substantial.

This concentration can drive up CES's input costs if these suppliers wield considerable influence over pricing and availability. For instance, in 2023, the cost of key chemicals used in the oil and gas sector, like methanol, saw significant fluctuations due to supply chain constraints, impacting companies like CES.

Switching costs for CES Energy Solutions (CES) play a significant role in the bargaining power of its suppliers. If CES faces substantial expenses or disruptions when changing to a new supplier, such as the need to reformulate products, re-qualify materials, or reconfigure its supply chain, suppliers gain leverage. These high switching costs can make CES hesitant to seek alternative providers, even if current suppliers increase prices, thereby strengthening the suppliers' position.

The uniqueness of inputs for CES Energy Solutions significantly impacts supplier bargaining power. If suppliers provide highly differentiated or patented raw materials, like specialized chemicals with unique performance characteristics crucial for CES's advanced solutions, their leverage grows. For instance, proprietary chemical formulations that are difficult for CES to replicate elsewhere inherently strengthen a supplier's position.

Threat of Forward Integration by Suppliers

Suppliers in the oil and gas sector, particularly those providing specialized chemicals or equipment, could indeed integrate forward into the market that CES Energy Solutions operates within. This would mean they start offering their own chemical solutions directly to oil and gas producers, effectively becoming competitors. While this is a less likely scenario for suppliers of basic commodity chemicals, those manufacturing unique or proprietary components might find it appealing if the downstream market shows significant profit potential.

For instance, if a supplier develops a highly effective, proprietary drilling fluid additive, they might see an opportunity to market and sell the complete fluid solution themselves, bypassing intermediaries like CES. This threat is amplified if suppliers possess strong R&D capabilities and established customer relationships within the energy sector.

- Forward Integration Threat: Suppliers can become direct competitors by moving into CES Energy Solutions' market.

- Key Drivers: This threat is more pronounced for suppliers of specialized or proprietary products.

- Market Attractiveness: The potential for high profits in the downstream oil and gas chemical solutions market incentivizes forward integration.

Importance of CES to Suppliers

The significance of CES Energy Solutions as a customer directly influences the bargaining power of its suppliers. When CES constitutes a substantial portion of a supplier's overall revenue, that supplier is likely to have diminished leverage. This is because the supplier's reliance on CES's business makes them more amenable to CES's terms.

Conversely, if CES represents a minor segment of a supplier's client base, CES's ability to negotiate favorable terms is considerably limited. In such scenarios, suppliers are less concerned about losing CES as a customer, thereby strengthening their own bargaining position.

For instance, in 2023, CES Energy Solutions reported total cost of sales amounting to $1.9 billion. The distribution of this spending across various suppliers would determine how much influence CES holds with each individual supplier. A supplier that derives, say, 20% of its annual sales from CES would naturally possess less bargaining power than one for whom CES accounts for only 2% of its revenue.

- Supplier Dependence: If CES is a major client, suppliers are incentivized to offer competitive pricing and favorable terms to retain their business.

- Market Share: The supplier's market share and the availability of alternative suppliers for CES's needs also impact this dynamic.

- CES's Purchasing Volume: Larger purchase volumes by CES can also increase its bargaining power, especially if it can commit to long-term contracts.

Suppliers of specialized chemicals and equipment to CES Energy Solutions can exert significant bargaining power, especially when they provide unique or proprietary inputs. High switching costs for CES, coupled with the potential for suppliers to integrate forward into CES's market, further amplify this leverage. The extent to which CES represents a significant portion of a supplier's revenue directly impacts this dynamic, with larger clients generally holding more negotiation power.

In 2023, CES Energy Solutions' cost of sales was $1.9 billion. If a key supplier for CES accounts for a substantial percentage of its own sales, that supplier's bargaining power over CES is reduced. Conversely, if CES is a small client for a supplier, the supplier can dictate terms more assertively.

| Factor | Impact on CES Energy Solutions | Example/Data Point |

|---|---|---|

| Supplier Concentration | Increases supplier power if few suppliers exist for critical inputs. | Fluctuations in methanol costs in 2023 due to supply chain issues impacted oil and gas sector input costs. |

| Switching Costs | High switching costs empower suppliers by making it difficult for CES to change providers. | Costs associated with reformulating products or re-qualifying materials increase supplier leverage. |

| Input Uniqueness | Proprietary or highly differentiated inputs strengthen supplier bargaining position. | Difficult-to-replicate chemical formulations give suppliers an advantage. |

| Forward Integration Threat | Suppliers becoming direct competitors reduces CES's market position. | A supplier of drilling fluid additives might offer complete fluid solutions directly to producers. |

| CES's Customer Significance | If CES is a minor client, supplier power increases; if a major client, CES's power increases. | A supplier relying heavily on CES for revenue will be more accommodating to CES's terms. |

What is included in the product

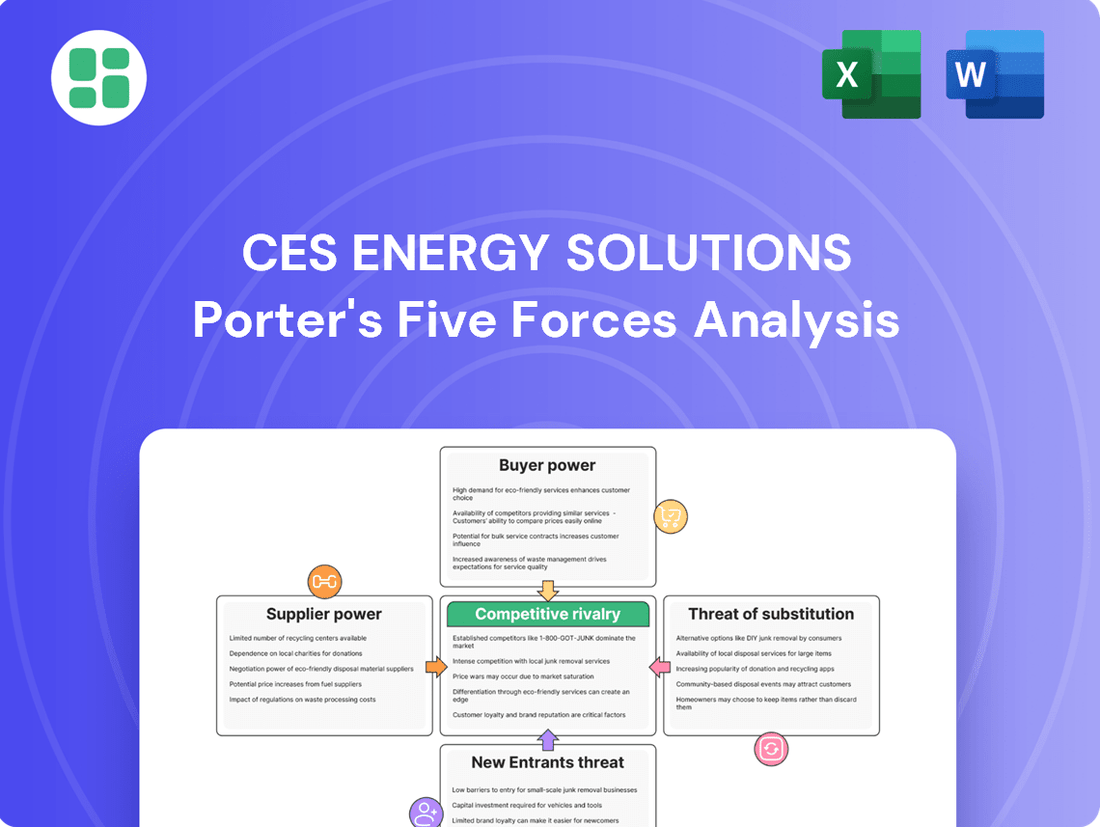

This analysis of CES Energy Solutions highlights the intense competition within the energy services sector, the significant bargaining power of large oil and gas clients, and the moderate threat of new entrants due to capital requirements and established relationships.

Gain immediate clarity on competitive pressures with a visual, easy-to-understand breakdown of each of Porter's Five Forces, empowering swift strategic adjustments for CES Energy Solutions.

Customers Bargaining Power

CES Energy Solutions' customer base is largely concentrated within the North American oil and gas sector. If a few major producers account for a substantial percentage of CES's revenue, these key clients wield significant bargaining power. This leverage enables them to negotiate for reduced pricing, more favorable contract terms, or tailored service packages, directly impacting CES's profitability.

Customer switching costs for CES Energy Solutions, while present, may not be a significant deterrent for larger clients in the oil and gas sector. These costs, such as re-testing and requalification, can add up, but the potential for better pricing or more innovative solutions from competitors can outweigh them. For instance, a major oil producer might invest a few thousand dollars in testing a new chemical, a relatively small amount compared to their overall operational budget.

Oil and gas producers are acutely aware of the volatile commodity market they operate in, making them highly sensitive to costs. This sensitivity directly translates into significant pressure on suppliers like CES Energy Solutions to provide competitive pricing and cost-effective solutions, as their own profitability hinges on these factors.

For instance, in 2024, the average West Texas Intermediate (WTI) crude oil price experienced considerable swings, impacting producers' ability to absorb higher service costs. This market volatility amplifies the bargaining power of customers, as they actively seek suppliers who can demonstrate tangible cost savings and efficiency improvements to maintain their margins.

Availability of Substitute Products/Services for Customers

Customers wield significant bargaining power when they can readily access substitute chemical solutions or possess the in-house capabilities to achieve comparable outcomes. This availability of alternatives directly impacts CES Energy Solutions' ability to dictate pricing and terms.

While CES Energy Solutions provides specialized chemical treatments for the energy sector, the presence of numerous other oilfield chemical providers in the market intensifies this pressure. For instance, in 2024, the global oilfield chemicals market was valued at approximately $37.8 billion, indicating a highly competitive landscape with many players vying for market share.

- High Availability of Alternatives: The broad spectrum of oilfield chemical suppliers means customers can switch providers with relative ease if pricing or service levels are not met.

- In-House Capability Development: Larger energy companies may invest in developing their own chemical expertise and solutions, reducing their reliance on external providers like CES.

- Commoditization Risk: For less specialized chemical products, the risk of commoditization is higher, further empowering customers to seek the lowest-cost option.

- Impact on Pricing Power: The ease with which customers can source alternatives directly constrains CES Energy Solutions' ability to command premium pricing for its specialized offerings.

Customer's Threat of Backward Integration

Large oil and gas companies possess the financial muscle to consider backward integration, potentially developing their own chemical manufacturing and blending facilities. This capability would allow them to produce the chemicals CES Energy Solutions currently supplies, directly impacting CES's market share and pricing power. For instance, a major oil producer with substantial capital reserves, like ExxonMobil or Shell, could allocate a portion of its annual capital expenditure towards building such integrated operations.

While the upfront investment and need for specialized chemical expertise are significant barriers, the mere threat of major clients integrating backward can pressure CES to maintain competitive pricing. This is particularly relevant in 2024, where fluctuating commodity prices and operational efficiencies are paramount for exploration and production companies. CES must continually demonstrate its value proposition to mitigate this risk.

- Threat of Backward Integration: Major oil and gas clients could develop in-house chemical production capabilities.

- Investment Threshold: Significant capital and specialized expertise are required for clients to integrate backward.

- Competitive Pressure: CES must maintain competitive pricing to deter clients from this integration strategy.

- 2024 Context: Economic volatility in 2024 amplifies the importance of cost control for CES's clients, increasing the potential for integration.

CES Energy Solutions' customers, primarily large oil and gas producers, possess considerable bargaining power due to the availability of alternative suppliers and the potential for in-house production. This power is amplified by the industry's sensitivity to costs, especially in the volatile commodity markets of 2024. Consequently, CES must consistently offer competitive pricing and demonstrate value to retain these crucial clients.

| Factor | Impact on CES Energy Solutions | Customer Leverage |

|---|---|---|

| Customer Concentration | High reliance on a few key clients. | Clients can demand better terms due to their significant revenue contribution. |

| Availability of Alternatives | Numerous competitors in the oilfield chemicals market. | Customers can easily switch providers if pricing or service is unsatisfactory. |

| Switching Costs | Relatively low for many standard chemical applications. | Customers are less hesitant to explore new suppliers offering better value. |

| Price Sensitivity | Directly linked to volatile oil and gas prices. | Customers exert pressure for cost reductions to maintain their own profitability. |

Preview the Actual Deliverable

CES Energy Solutions Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details CES Energy Solutions' Porter's Five Forces Analysis, thoroughly examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of competitive rivalry within its industry.

Rivalry Among Competitors

The oil and gas chemical solutions sector in North America is populated by a number of significant companies. These include global giants such as Schlumberger, Halliburton, and Baker Hughes, which possess substantial resources and market share, often dwarfing smaller entities like CES Energy Solutions.

While the broader oilfield chemicals market anticipates growth, the specific niches CES Energy Solutions operates within, such as drilling, completion, and production chemicals, may see divergent growth trajectories. For instance, the North American drilling fluids market, a key area for CES, was projected to grow at a compound annual growth rate (CAGR) of around 3.5% from 2023 to 2028, according to some market analyses.

This uneven growth can naturally heighten competitive pressures. When certain segments experience slower expansion or even contraction, companies like CES must fight more aggressively for market share. This intensified rivalry can lead to price wars or increased spending on innovation and marketing to differentiate offerings and secure contracts.

CES Energy Solutions highlights its technically advanced and innovative chemical solutions, often customized for specific client requirements. The extent to which these offerings are truly unique and hard for rivals to copy directly influences the intensity of competition. For instance, if CES can consistently develop proprietary formulations that offer superior performance or cost savings, it can lessen direct price wars.

In 2024, the energy services sector saw continued emphasis on specialized solutions. Companies like CES that can demonstrate tangible benefits from their differentiated chemical programs, such as improved well productivity or reduced environmental impact, are better positioned to command premium pricing and maintain market share against competitors offering more commoditized products.

Exit Barriers

High exit barriers in the oil and gas chemical solutions sector significantly influence competitive rivalry. These barriers, including specialized, high-cost assets like blending facilities and extensive logistics networks, make it difficult and expensive for companies to leave the market. For instance, CES Energy Solutions, like its peers, likely has substantial capital tied up in these operational areas.

The presence of long-term contracts also acts as a powerful exit barrier. Companies are often committed to fulfilling these agreements, even during periods of reduced profitability. This commitment forces them to remain active competitors, potentially leading to prolonged periods of intense price competition or service innovation as firms fight to maintain market share rather than incur penalties or abandon invested capital.

- Specialized Assets: Significant investment in custom-built blending facilities and distribution infrastructure.

- Long-Term Contracts: Commitments to major oil and gas producers that are costly to break.

- Capital Intensity: High upfront costs for specialized equipment and transportation fleets.

- Brand Reputation: Established relationships and trust within the industry are hard to replicate or abandon.

Switching Costs for Customers Among Competitors

Low switching costs among chemical solution providers can significantly heat up competition. When it's simple for a customer to jump from one company to another, they're more likely to do so if they find a better deal or service elsewhere. This dynamic directly fuels competitive rivalry.

For instance, if a client can easily switch from CES Energy Solutions to a competitor without incurring substantial fees, retraining, or significant integration challenges, the pressure on CES to maintain competitive pricing and service levels increases. This ease of movement empowers customers and amplifies the competitive landscape.

- Low Switching Costs: Customers can readily shift between chemical solution providers without significant financial penalties or operational disruptions.

- Price Sensitivity: Easy switching makes customers more sensitive to price differences, forcing competitors to offer more aggressive pricing.

- Service & Innovation Pressure: Companies must continuously innovate and improve service quality to retain customers who can easily explore alternatives.

Competitive rivalry within the North American oil and gas chemical sector is intense, driven by the presence of large, established players like Schlumberger and Halliburton, which possess significant resources. CES Energy Solutions, while a key player in its niches, faces pressure from these giants and other specialized providers. The market's reliance on technical differentiation and customized solutions means companies must constantly innovate to maintain an edge, as commoditized offerings are easily undercut.

High exit barriers, stemming from substantial investments in specialized assets and long-term contracts, compel companies to remain active competitors, often leading to price competition. Furthermore, low switching costs for customers empower them to readily move between providers, intensifying the need for competitive pricing and superior service from companies like CES Energy Solutions.

| Competitor Type | Key Characteristics | Impact on CES Energy Solutions |

|---|---|---|

| Global Oilfield Service Giants | Vast resources, broad service offerings, significant market share | Intense pressure on pricing and innovation; potential for CES to focus on specialized niches |

| Regional/Specialized Chemical Providers | Targeted expertise, agile operations, strong local relationships | Direct competition in specific service areas; CES must demonstrate superior technical value |

| New Entrants | Potentially disruptive technologies, lower overhead | Threat of market share erosion if CES does not adapt to new innovations |

SSubstitutes Threaten

The threat of substitutes for CES Energy Solutions' chemical products is significant, primarily stemming from alternative chemical formulations and emerging technologies. Companies are continuously innovating, developing more efficient or environmentally benign chemicals that could potentially replace CES's current offerings in oil and gas operations.

For instance, advancements in bio-based drilling fluids or water-based fracturing fluids present a direct challenge to traditional chemical solutions. The market is dynamic, and the adoption rate of these substitutes depends on their cost-effectiveness, performance parity, and regulatory acceptance. In 2024, the global specialty chemicals market, which includes oilfield chemicals, was valued at approximately $700 billion, indicating a large and competitive landscape where innovation can quickly shift market share.

Technological advancements are a significant threat to CES Energy Solutions, particularly in areas where new methods can replace traditional chemical treatments. For instance, innovations in mechanical wellbore cleaning or advanced filtration systems can reduce the demand for the chemical solutions CES provides for tasks like scale and corrosion management.

The increasing sophistication of non-chemical treatments for well integrity and production optimization presents a direct substitute. Companies are exploring and adopting these alternatives, which could lead to a decline in the market share for chemical-based solutions. For example, the global market for water treatment chemicals, a segment relevant to oil and gas operations, was valued at approximately $70 billion in 2023 and is projected to grow, but the *rate* of growth could be impacted by these emerging technological substitutes.

Shifting industry practices pose a significant threat to CES Energy Solutions. If oil and gas companies adopt new extraction methods that require fewer chemicals, demand for CES's core services could decline. For instance, innovations in drilling technology that naturally reduce wellbore problems might lessen the need for specialized drilling fluids and completion chemicals, directly impacting CES's revenue streams.

Environmental Regulations and Green Alternatives

The increasing stringency of environmental regulations and a heightened industry emphasis on sustainability are fueling a growing demand for green or bio-based chemical alternatives. These emerging options present a significant threat to CES Energy Solutions if the company cannot swiftly adapt or provide competitive sustainable solutions.

For instance, in 2024, the global market for bio-based chemicals was projected to reach approximately $100 billion, with significant growth anticipated in the coming years. This trend indicates that companies failing to innovate in this space risk losing market share to competitors offering more environmentally friendly products.

- Growing Demand for Bio-based Chemicals: The market for sustainable chemical alternatives is expanding rapidly, driven by consumer preferences and regulatory pressures.

- CES's Adaptation Challenge: CES Energy Solutions faces a critical need to develop or acquire competitive green chemical solutions to counter this threat.

- Potential Market Share Erosion: Failure to innovate in sustainable alternatives could lead to a decline in CES's market position as competitors capture this growing segment.

In-house Capabilities of E&P Companies

The threat of substitutes for CES Energy Solutions, particularly concerning in-house capabilities within Exploration and Production (E&P) companies, is a significant consideration. While the majority of E&P firms rely on specialized service providers for chemical solutions, larger, well-capitalized players may opt to develop or expand their internal chemical management and supply capabilities. This could involve in-house blending of basic chemicals or even research and development into proprietary chemical formulations, thereby reducing their reliance on external vendors.

For instance, a major E&P company might invest in facilities to handle bulk chemical procurement and custom blending, directly competing with services offered by CES. This strategic shift can be driven by a desire for greater cost control, supply chain security, or the development of unique chemical solutions tailored to specific operational needs. In 2024, the industry has seen continued emphasis on operational efficiency, which could accelerate such in-house investments.

- Reduced Demand: In-house capabilities directly reduce the pool of potential customers for CES in specific chemical segments.

- Cost Savings for E&Ps: Larger E&Ps may find it more economical to manage certain chemical needs internally, especially for high-volume, standardized products.

- Proprietary Solutions: The development of unique, in-house chemical formulations can create a competitive disadvantage for external suppliers.

- Strategic Vertical Integration: Some E&Ps might view chemical management as a core competency, leading to greater vertical integration and less outsourcing.

The threat of substitutes for CES Energy Solutions is amplified by the rise of non-chemical or technologically advanced alternatives in oil and gas operations. Innovations in mechanical wellbore cleaning and advanced filtration systems can directly reduce the need for chemical treatments for issues like scale and corrosion. Furthermore, shifts in industry practices, such as new drilling technologies that inherently minimize wellbore problems, can also lessen the demand for CES's core chemical offerings.

The growing emphasis on sustainability is a significant driver for bio-based and environmentally friendly chemical substitutes. In 2024, the global bio-based chemicals market was projected to reach approximately $100 billion, highlighting a substantial opportunity for companies offering greener solutions. CES faces the challenge of adapting to this trend, as failure to innovate in sustainable alternatives could lead to market share erosion.

Larger Exploration and Production (E&P) companies might also develop in-house chemical management capabilities, reducing their reliance on external providers like CES. This vertical integration, driven by a desire for cost control and supply chain security, could see E&Ps investing in facilities for bulk chemical procurement and custom blending. In 2024, the focus on operational efficiency may accelerate these in-house investments among major players.

| Substitute Type | Examples | Market Data/Trend (2024) | Impact on CES |

|---|---|---|---|

| Alternative Chemical Formulations | Bio-based drilling fluids, water-based fracturing fluids | Global specialty chemicals market (incl. oilfield) ~$700 billion | Potential displacement of existing CES products. |

| Technological Advancements | Mechanical wellbore cleaning, advanced filtration systems | N/A specific to this substitute | Reduced demand for chemical treatments for well integrity. |

| Sustainable/Green Alternatives | Bio-based chemicals | Global bio-based chemicals market projected ~$100 billion | Risk of market share loss if CES does not offer competitive green solutions. |

| In-house E&P Capabilities | Internal chemical blending, proprietary formulations | Industry focus on operational efficiency | Reduced customer base for CES in specific segments. |

Entrants Threaten

Entering the oil and gas chemical solutions sector demands significant upfront capital. Companies need to invest heavily in research and development to create effective chemical formulations, build or acquire blending plants, and purchase specialized transportation and application equipment. For instance, establishing a new blending facility can easily cost millions of dollars, not to mention the ongoing investment in a secure and efficient supply chain for raw materials.

The oil and gas sector presents substantial regulatory barriers for new companies. These include stringent environmental protection laws, rigorous safety protocols for chemical handling, and extensive licensing procedures. For instance, in 2024, the Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act and Clean Water Act, requiring significant investment in compliance for any new entrant handling chemicals.

Established players like CES Energy Solutions boast deeply entrenched distribution networks and robust relationships with major oil and gas producers. For instance, in 2024, CES continued to leverage its extensive infrastructure, which is crucial for timely delivery of essential chemicals and services.

Newcomers face a significant hurdle in accessing these vital channels. Building the trust and operational capacity required to compete with CES's established presence would demand substantial investment and time, making market entry particularly challenging.

Proprietary Technology and Expertise

CES Energy Solutions' emphasis on technically advanced chemical solutions creates a significant barrier to entry. The development of proprietary chemical formulations and the accumulation of specialized expertise in various well conditions require substantial research and development investment, often spanning years. This deep technical knowledge and intellectual property are not easily replicated by potential competitors, making it difficult for new entrants to match CES's offerings and performance.

The high upfront costs associated with R&D and the lengthy process of establishing a strong intellectual property portfolio deter many new companies from entering the market. For instance, companies in this sector might invest millions annually in research to refine existing products and develop novel solutions. This financial commitment and the time lag in achieving market-ready, differentiated products serve as a robust defense against new entrants seeking to disrupt CES Energy Solutions' market position.

- Proprietary Formulations: CES invests heavily in creating unique chemical blends tailored for specific oil and gas extraction challenges, which are protected by patents and trade secrets.

- R&D Investment: In 2023, the company reported significant expenditures on research and development, aiming to enhance efficiency and environmental performance of its chemical services, a cost barrier for newcomers.

- Accumulated Expertise: Decades of operational experience have allowed CES to build deep technical knowledge regarding diverse reservoir conditions and chemical applications, a valuable intangible asset.

Brand Loyalty and Reputation

In the oil and gas sector, where reliability and safety are paramount, established companies like CES Energy Solutions enjoy significant advantages due to strong brand loyalty and a solid reputation built over time. Newcomers face a considerable hurdle in convincing clients to switch from trusted, proven providers.

For instance, in 2024, the energy services market continues to reward companies with a track record of consistent performance and safety compliance. New entrants must invest heavily in demonstrating their capabilities and establishing credibility, a process that can be lengthy and costly.

- Brand Loyalty: Existing customer relationships are difficult for new entrants to penetrate.

- Reputation for Safety: A strong safety record is non-negotiable, and new firms must prove theirs.

- Performance Track Record: Demonstrating consistent operational excellence is key to gaining trust.

- Cost of Building Trust: New entrants face substantial marketing and operational costs to build a comparable reputation.

The threat of new entrants for CES Energy Solutions is moderate due to high capital requirements and regulatory hurdles. Significant investments in R&D, blending facilities, and specialized equipment, coupled with stringent environmental and safety regulations, create substantial barriers. For example, establishing a new blending facility can cost millions, and compliance with 2024 EPA regulations requires ongoing investment.

| Barrier Type | Description | Example Cost/Impact |

| Capital Requirements | Investment in R&D, blending plants, and equipment. | Millions for a new blending facility. |

| Regulatory Hurdles | Environmental laws, safety protocols, licensing. | Compliance with EPA regulations (e.g., Clean Air Act). |

| Proprietary Technology | Unique chemical formulations and expertise. | Years of R&D investment; millions annually. |

| Brand Loyalty & Reputation | Established relationships and proven track record. | Lengthy and costly process to build trust. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CES Energy Solutions is built upon a foundation of comprehensive data, including annual reports, SEC filings, and industry-specific market research from firms like IHS Markit and Wood Mackenzie.

We also incorporate insights from financial news outlets, competitor press releases, and data from energy sector analytics platforms to provide a nuanced understanding of the competitive landscape.