CES Energy Solutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CES Energy Solutions Bundle

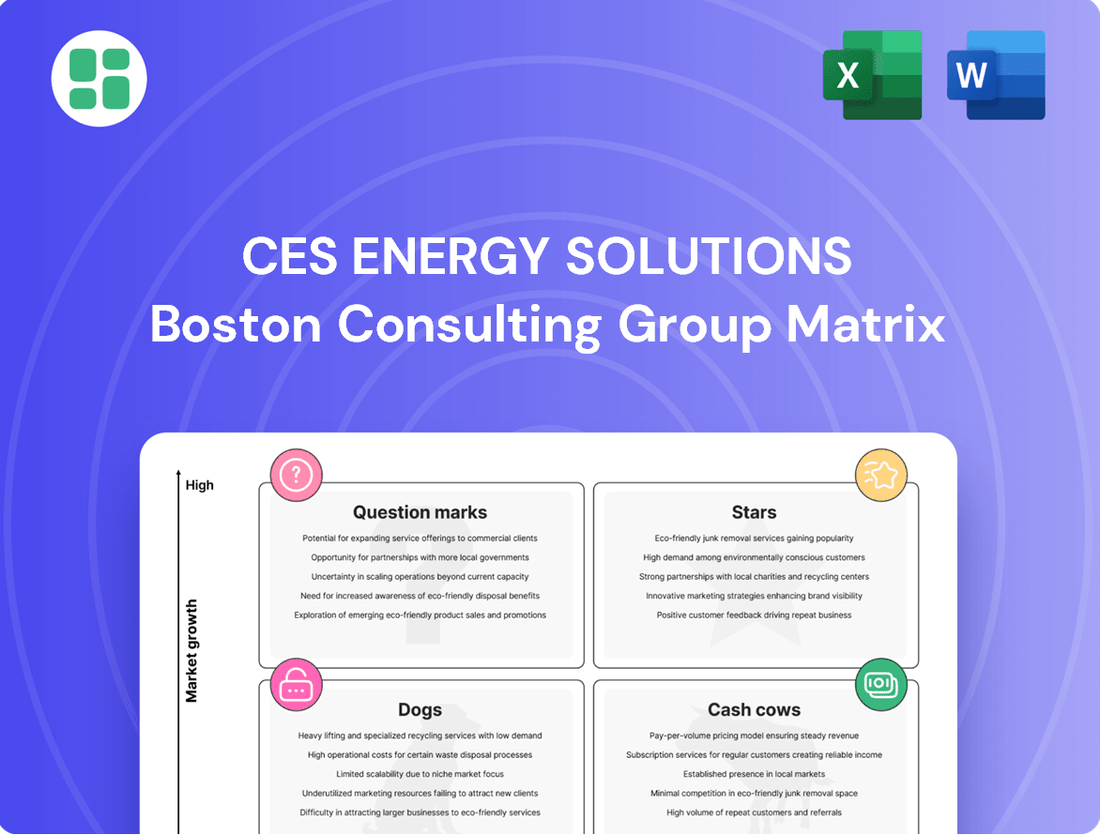

Curious about CES Energy Solutions' market performance? Our BCG Matrix preview highlights key product categories, offering a glimpse into their potential for growth and profitability. Understand where their offerings fit—whether as Stars, Cash Cows, Dogs, or Question Marks—and unlock the strategic advantage of this essential analysis.

Don't stop at the preview; dive into the full CES Energy Solutions BCG Matrix report. Gain detailed quadrant placements, data-backed recommendations, and a clear roadmap to optimize your investment and product decisions for maximum impact.

Stars

CES Energy Solutions is a key player in advanced completion and stimulation chemicals for unconventional plays. These specialized chemicals are essential for maximizing oil and gas recovery in challenging North American formations. In 2024, the demand for these high-performance solutions remained robust, driven by continued activity in plays like the Permian Basin and the Montney. CES's focus on innovation and technical expertise positions it well to capture market share in this high-growth segment.

As the oil and gas industry pushes to extract more from challenging wells, specialized production enhancement chemicals are becoming crucial. CES Energy Solutions is well-positioned with its expertise in creating and supplying these tailored chemical solutions, designed to boost performance right at the wellhead and pump-jack. This strategic focus addresses critical issues such as flow assurance and corrosion, particularly in demanding operational environments, allowing CES to capture a significant share of this specialized and expanding market.

The JCAM Catalysts division within CES Energy Solutions operates in a specialized segment of catalyst manufacturing. Its inclusion diversifies CES's offerings beyond core oilfield chemicals. If JCAM's specific market niche is experiencing substantial growth and it commands a strong market share within that niche, it would qualify as a Star in the BCG matrix.

Catalysts are fundamental to refining and petrochemical operations, driving efficiency and enabling key chemical transformations. JCAM's position in high-growth, high-share catalyst markets means it likely requires significant investment to maintain and expand its competitive edge, a characteristic of Star business units that consume cash for continued expansion.

For instance, the global catalyst market, particularly for specialized refining catalysts, has seen robust growth. In 2024, projections indicated continued expansion driven by demand for cleaner fuels and more efficient petrochemical processes. JCAM's strategic value is amplified by its capacity to extend CES Energy Solutions' market presence into these critical industrial sectors.

Environmentally Friendly & Sustainable Chemical Solutions

Environmentally Friendly & Sustainable Chemical Solutions represent a significant growth area for CES Energy Solutions. With heightened regulatory scrutiny and a strong industry push towards ESG principles, the demand for biodegradable oilfield chemicals is on the rise. For instance, the global market for green chemicals is projected to reach over $100 billion by 2027, indicating substantial opportunity.

CES Energy Solutions is well-positioned to capitalize on this trend by developing and expanding its portfolio of technically advanced, eco-friendly products. This strategic focus allows the company to meet increasingly stringent environmental regulations and capture a leading market share in this expanding segment. By investing in green chemistry, CES can solidify its position as a leader in sustainable energy, addressing the growing need for environmentally responsible operational practices.

- Market Growth: The global market for green chemicals is experiencing robust expansion, driven by environmental awareness and regulatory mandates.

- ESG Focus: Increasing emphasis on Environmental, Social, and Governance (ESG) criteria by investors and operators fuels demand for sustainable oilfield solutions.

- CES Opportunity: CES Energy Solutions can leverage its technical expertise to develop and market innovative, biodegradable chemical products.

- Competitive Advantage: Early investment in green chemistry can provide CES with a significant competitive edge in the evolving energy landscape.

Integrated Digital Solutions for Chemical Optimization

CES Energy Solutions is strategically positioned to capitalize on the oil and gas sector's digital transformation with its integrated digital solutions for chemical optimization. This segment represents a significant growth opportunity, driven by the industry's need for enhanced efficiency through automation and smart chemical management.

The company's approach, which combines digital platforms with AI-driven predictive dosing, directly addresses the demand for real-time adjustments and improved performance in chemical applications. This positions CES Energy Solutions as a leader in a high-growth market focused on optimizing chemical usage and efficacy.

- Market Growth: The global oilfield chemicals market is projected to reach approximately $45 billion by 2028, with digital solutions representing a substantial and rapidly expanding segment.

- CES's Offering: Integration of digital platforms and AI for predictive chemical dosing enhances operational efficiency and reduces waste, a key differentiator.

- Competitive Advantage: CES Energy Solutions' focus on real-time monitoring and AI-driven adjustments allows for superior performance and cost savings for clients.

- Future Outlook: This segment is expected to continue its strong growth trajectory as digitalization becomes increasingly critical for operational success in the energy sector.

CES Energy Solutions' advanced completion and stimulation chemicals are Stars, exhibiting high market growth and strong market share. Similarly, their specialized production enhancement chemicals are also Stars, addressing critical operational needs in demanding environments and capturing significant market share. The JCAM Catalysts division, if operating in a high-growth niche with a strong position, would also be classified as a Star, diversifying CES's portfolio into key industrial sectors.

The company's commitment to environmentally friendly and sustainable chemical solutions, along with its integrated digital solutions for chemical optimization, further solidify its Star status. These segments are experiencing robust expansion, driven by regulatory demands, ESG principles, and the industry's digital transformation. CES's technical expertise and innovative offerings position them to lead in these high-growth, high-share areas.

| Business Unit | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| Completion & Stimulation Chemicals | High | High | Star |

| Production Enhancement Chemicals | High | High | Star |

| JCAM Catalysts (Niche Dependent) | High | High | Star |

| Environmentally Friendly Chemicals | High | High | Star |

| Digital Solutions for Chemical Optimization | High | High | Star |

What is included in the product

This BCG Matrix overview for CES Energy Solutions details each business unit's position, guiding strategic decisions for investment, divestment, or maintenance.

A clear BCG Matrix visualizes CES Energy Solutions' portfolio, alleviating the pain of strategic uncertainty.

This tool simplifies complex business unit performance, offering a pain-relief solution for resource allocation decisions.

Cash Cows

CES Energy Solutions' standard drilling fluid systems in North America are clear Cash Cows. The company commands a significant 42% market share in Canada and 23% in the US for these essential products as of Q1 2025.

These are mature, foundational offerings within the oil and gas sector, experiencing consistent demand. CES's strong market position ensures reliable and substantial cash flow generation with minimal need for aggressive marketing spend, as these fluids are a fundamental requirement for all drilling operations.

CES Energy Solutions' provision of essential production chemicals, such as corrosion inhibitors and demulsifiers, for conventional and mature wells represents a strong cash cow. These products are vital for maintaining well integrity and optimizing oil-water separation in established production assets, a segment characterized by low market growth but consistent demand.

The company's deep-rooted relationships with producers, coupled with the proven effectiveness of its chemical solutions in these mature fields, solidify CES's high market share and ensure steady revenue streams. For instance, in 2023, CES reported that its Production Chemicals segment generated substantial, stable earnings, contributing significantly to the company's overall financial health.

Midstream pipeline integrity chemicals are a cornerstone of CES Energy Solutions' stable, high-market share offerings. These chemical solutions are crucial for maintaining the safety and efficiency of oil and gas transportation through pipelines, a sector characterized by consistent, ongoing maintenance demands.

This segment acts as a cash cow for CES due to its mature market position and the essential nature of pipeline integrity. The company's established expertise in this area translates into predictable revenue streams, requiring relatively low reinvestment to sustain its strong market share.

For instance, in 2024, the midstream sector continued to rely heavily on such chemical treatments to prevent corrosion and ensure flow assurance, underpinning the steady demand for CES's products in this category.

Routine Wellbore Cleanout and Remediation Services

CES Energy Solutions' routine wellbore cleanout and remediation services are firmly positioned as Cash Cows within its portfolio. These services are fundamental to sustaining production in both conventional and unconventional oil and gas wells, ensuring ongoing operational efficiency. The demand for these essential maintenance tasks remains consistent across the company's extensive well inventory.

These services, while not experiencing rapid market expansion, represent a stable and reliable revenue stream. CES Energy Solutions benefits from a high market share in this segment due to its established infrastructure and a strong reputation for dependable execution. This consistent demand and market leadership translate into predictable and substantial cash generation for the company.

- Consistent Demand: Wellbore cleanout and remediation are ongoing necessities for production maintenance.

- Stable Market Share: CES Energy Solutions holds a strong position in this essential service sector.

- Reliable Cash Flow: These services contribute significantly to the company's stable cash generation.

- Industry Need: Essential for maintaining efficiency in both conventional and unconventional wells.

Established Chemical Blending and Logistics Infrastructure

CES Energy Solutions' established chemical blending and logistics infrastructure significantly contributes to its status as a cash cow within the BCG framework. This vertically integrated model, spanning North America, streamlines operations and reduces costs. For instance, in 2023, the company reported revenue of $2.1 billion, with its Energy Services segment, which heavily relies on this infrastructure, demonstrating consistent performance.

The efficiency of this supply chain is a key differentiator in the mature chemical solutions market. It allows for cost-effective blending and timely delivery, a crucial factor for clients operating in demanding environments. This operational prowess translates into strong free cash flow generation, which can then be reinvested or used to support other business units.

Key aspects of this cash cow include:

- Vertically Integrated Operations: Control over blending and logistics from start to finish.

- Extensive North American Network: Broad reach for efficient distribution.

- Cost Minimization: Streamlined processes lead to reduced operational expenses.

- Reliable Delivery: Ensures timely supply for client operations, fostering strong customer relationships.

CES Energy Solutions' standard drilling fluid systems in North America are clear Cash Cows. The company commands a significant 42% market share in Canada and 23% in the US for these essential products as of Q1 2025.

These are mature, foundational offerings within the oil and gas sector, experiencing consistent demand. CES's strong market position ensures reliable and substantial cash flow generation with minimal need for aggressive marketing spend, as these fluids are a fundamental requirement for all drilling operations.

CES Energy Solutions' provision of essential production chemicals, such as corrosion inhibitors and demulsifiers, for conventional and mature wells represents a strong cash cow. These products are vital for maintaining well integrity and optimizing oil-water separation in established production assets, a segment characterized by low market growth but consistent demand.

The company's deep-rooted relationships with producers, coupled with the proven effectiveness of its chemical solutions in these mature fields, solidify CES's high market share and ensure steady revenue streams. For instance, in 2023, CES reported that its Production Chemicals segment generated substantial, stable earnings, contributing significantly to the company's overall financial health.

Midstream pipeline integrity chemicals are a cornerstone of CES Energy Solutions' stable, high-market share offerings. These chemical solutions are crucial for maintaining the safety and efficiency of oil and gas transportation through pipelines, a sector characterized by consistent, ongoing maintenance demands.

This segment acts as a cash cow for CES due to its mature market position and the essential nature of pipeline integrity. The company's established expertise in this area translates into predictable revenue streams, requiring relatively low reinvestment to sustain its strong market share.

For instance, in 2024, the midstream sector continued to rely heavily on such chemical treatments to prevent corrosion and ensure flow assurance, underpinning the steady demand for CES's products in this category.

CES Energy Solutions' routine wellbore cleanout and remediation services are firmly positioned as Cash Cows within its portfolio. These services are fundamental to sustaining production in both conventional and unconventional oil and gas wells, ensuring ongoing operational efficiency. The demand for these essential maintenance tasks remains consistent across the company's extensive well inventory.

These services, while not experiencing rapid market expansion, represent a stable and reliable revenue stream. CES Energy Solutions benefits from a high market share in this segment due to its established infrastructure and a strong reputation for dependable execution. This consistent demand and market leadership translate into predictable and substantial cash generation for the company.

- Consistent Demand: Wellbore cleanout and remediation are ongoing necessities for production maintenance.

- Stable Market Share: CES Energy Solutions holds a strong position in this essential service sector.

- Reliable Cash Flow: These services contribute significantly to the company's stable cash generation.

- Industry Need: Essential for maintaining efficiency in both conventional and unconventional wells.

CES Energy Solutions' established chemical blending and logistics infrastructure significantly contributes to its status as a cash cow within the BCG framework. This vertically integrated model, spanning North America, streamlines operations and reduces costs. For instance, in 2023, the company reported revenue of $2.1 billion, with its Energy Services segment, which heavily relies on this infrastructure, demonstrating consistent performance.

The efficiency of this supply chain is a key differentiator in the mature chemical solutions market. It allows for cost-effective blending and timely delivery, a crucial factor for clients operating in demanding environments. This operational prowess translates into strong free cash flow generation, which can then be reinvested or used to support other business units.

Key aspects of this cash cow include:

- Vertically Integrated Operations: Control over blending and logistics from start to finish.

- Extensive North American Network: Broad reach for efficient distribution.

- Cost Minimization: Streamlined processes lead to reduced operational expenses.

- Reliable Delivery: Ensures timely supply for client operations, fostering strong customer relationships.

| Segment | Market Growth | Market Share | Cash Flow Generation |

| Drilling Fluids (NA) | Low | High (42% Canada, 23% US - Q1 2025) | Strong & Stable |

| Production Chemicals | Low | High | Substantial & Consistent (2023 Segment Earnings) |

| Midstream Pipeline Chemicals | Low | High | Predictable Revenue Streams |

| Wellbore Cleanout & Remediation | Low | High | Predictable & Substantial |

| Chemical Blending & Logistics | Mature Market | High (Infrastructure) | Strong Free Cash Flow |

What You’re Viewing Is Included

CES Energy Solutions BCG Matrix

The CES Energy Solutions BCG Matrix preview you are viewing is the precise, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises—just the complete, analysis-ready report designed for strategic decision-making.

Rest assured, the BCG Matrix for CES Energy Solutions that you see here is the exact file you will download upon completing your purchase. It has been meticulously prepared by industry experts, ensuring it's ready for immediate integration into your business strategy or client presentations.

What you are currently previewing is the definitive CES Energy Solutions BCG Matrix report that will be yours once you complete the purchase. This professional, actionable document is instantly downloadable, allowing you to leverage its insights without delay for your strategic planning.

Dogs

Outdated or generic drilling mud additives, often based on older, easily replicated technologies, would likely be categorized in the Dogs quadrant of the BCG Matrix for CES Energy Solutions. These segments face fierce price competition, leading to slim profit margins and a struggle to gain significant market share. For example, basic barite weighting agents, a staple for decades, now see numerous suppliers, driving down prices and profitability.

The market for these commoditized additives offers limited growth prospects. CES Energy Solutions would find that continued investment in these areas yields minimal returns, making them prime candidates for divestiture or a sharp focus on cost reduction to maintain any viability. In 2024, the global drilling fluids market, while substantial, saw a significant portion of its value tied to specialized, high-performance additives rather than these generic components.

CES Energy Solutions' services focused on declining conventional oil and gas fields, particularly those with minimal remaining production, likely fall into the 'Dog' category of the BCG Matrix. The demand for specialized chemical solutions in these mature fields is inherently low, making market share gains difficult to achieve. For instance, as of Q1 2024, the average production decline rate in many established conventional basins exceeded 10% year-over-year, directly impacting the need for new chemical treatments.

The shrinking market size and reduced operational activity in these mature fields mean that resources invested here offer limited growth potential for CES. This aligns with the 'Dog' profile, where low market growth and low relative market share characterize the business segment. In 2023, CES reported that its Production Services segment, which includes offerings to mature fields, saw revenue growth of only 2% compared to a 15% growth in its Drilling Services segment, highlighting the disparity.

Strategically, CES might consider divesting or minimizing investment in these 'Dog' areas to reallocate capital towards more promising, high-growth segments within its portfolio. The company's focus on innovation in areas like enhanced oil recovery (EOR) for less mature fields or expanding its services in the midstream sector demonstrates a strategic shift away from these low-return conventional declining assets.

CES Energy Solutions may have niche chemical products that, despite potential early market growth, haven't gained significant traction. These might be offerings where CES struggles to differentiate itself, leading to a low market share. For example, a specialized drilling fluid additive introduced in 2023, while targeting a growing segment, might have seen only a 2% market penetration by early 2024 due to strong competition from established players.

These products can become resource drains, consuming capital and management attention without delivering substantial returns. If a particular line of completion chemicals, for instance, represents only 0.5% of CES's total revenue in Q1 2024, despite being in a theoretically expanding market, it could be a prime candidate for a Dog.

The core issue is the lack of a compelling unique selling proposition that resonates with customers. Consider a new line of biodegradable surfactants launched in late 2023; if sales in the first half of 2024 amounted to less than 1% of the projected market size for such products, it signals a failure to capture market share, potentially due to pricing, performance, or distribution challenges.

Legacy Product Lines without R&D Investment

Legacy Product Lines without R&D Investment in CES Energy Solutions would fall into the Dogs category of the BCG Matrix. These are typically older chemical products that have not received significant research and development funding, leading to a decline in their competitive standing against newer technologies.

These products are often found in mature, low-growth markets where their market share is shrinking due to technological advancements by competitors. For instance, a chemical additive that was once a market leader but now faces competition from more efficient, environmentally friendly alternatives would be a prime example.

CES Energy Solutions might have legacy product lines that represent a declining portion of their revenue. In 2023, for example, the company reported total revenue of $1.6 billion. If a specific legacy product line saw a significant year-over-year revenue decline, say by 15%, it would reinforce its classification as a Dog.

- Declining Market Share: Products with minimal R&D are susceptible to losing ground to innovative competitors.

- Low Market Growth: These products often operate in stagnant or shrinking market segments.

- Resource Drain: Continued investment in legacy products can divert capital from more promising ventures.

- Technological Obsolescence: Lack of R&D leads to outdated solutions that fail to meet evolving customer needs.

Highly Competitive, Low-Margin Commodity Chemicals

Highly competitive, low-margin commodity chemicals would likely fall into the Dogs quadrant for CES Energy Solutions. This segment operates within the broader commodity chemicals market, characterized by intense competition and undifferentiated products.

CES's participation in this space suggests a low market share due to a lack of a distinct competitive advantage. For instance, in 2024, the global commodity chemicals market experienced price volatility, with some basic chemicals seeing profit margins as low as 1-3%.

- Low Market Share: CES likely holds a small percentage of the total market for these commodity chemicals.

- Intense Competition: Numerous players offer similar products, driving down prices and margins.

- Low Profitability: These products generate minimal profits and cash flow, often requiring significant capital investment for production.

- Cash Traps: The low returns make them potential cash traps, draining resources without substantial growth potential.

Products in the Dogs quadrant for CES Energy Solutions are those with low market share and low market growth, often due to being outdated or facing intense competition. These segments, like generic drilling mud additives or services for declining conventional oil fields, yield minimal returns and can be resource drains.

For example, CES's Production Services segment, which caters to mature fields, saw only 2% growth in 2023 compared to 15% for its Drilling Services segment, illustrating the disparity in growth potential. Similarly, legacy product lines lacking R&D investment face technological obsolescence and declining revenue, potentially representing a shrinking portion of the company's overall income.

| Product/Service Area | BCG Quadrant | Rationale | 2023/2024 Data Point |

|---|---|---|---|

| Generic Drilling Mud Additives | Dog | Low market growth, high competition, slim margins | Global drilling fluids market value tied to specialized additives, not generics. |

| Services for Declining Conventional Fields | Dog | Low demand, difficult market share gains, shrinking market size | Production Services segment grew 2% in 2023 vs. 15% for Drilling Services. |

| Legacy Product Lines (Low R&D) | Dog | Technological obsolescence, declining competitive standing | A specific legacy product line saw a 15% year-over-year revenue decline in 2023. |

Question Marks

The chemicals sector for Carbon Capture, Utilization, and Storage (CCUS) represents a burgeoning opportunity within the broader energy landscape. While CES Energy Solutions, as a traditional oilfield chemical provider, may currently hold a modest market share in this specialized area, its potential for growth is substantial. This segment is propelled by a global imperative for decarbonization, driving demand for innovative chemical solutions.

Developing and commercializing chemicals tailored for CO2 absorption, efficient transport, and diverse utilization pathways demands significant capital outlay for research and development. However, the long-term prospects for companies that can establish a strong foothold in this emerging market are exceptionally promising, offering potentially high returns on investment.

CES would need to commit substantial resources to R&D and robust market development strategies to carve out a significant presence. For instance, by 2024, the global CCUS market was projected to reach over $10 billion, with significant growth anticipated in the coming years, underscoring the strategic importance of investing in this sector.

Advanced nanotechnology-based chemical solutions represent a burgeoning frontier in the oil and gas sector, offering innovative applications like nano-surfactants for enhanced oil recovery and smart nanoparticles for real-time reservoir monitoring. This niche area holds substantial growth potential, driven by the promise of significantly improved performance over traditional chemical treatments.

CES Energy Solutions' current market share in this highly specialized and research-intensive segment may be relatively modest. This is largely due to the early adoption phases of these cutting-edge technologies, which require substantial upfront investment to transition from laboratory development to broad commercial viability and establish market leadership.

The geothermal energy sector is a burgeoning market for specialized chemicals, driven by the global shift towards renewable energy sources. These chemicals are crucial for managing challenges like corrosion and scaling in geothermal wells, as well as optimizing fluid performance. For instance, the global geothermal power market was valued at approximately $33.7 billion in 2023 and is projected to grow significantly.

CES Energy Solutions possesses considerable expertise in drilling and production chemicals, a capability that could be leveraged for geothermal applications. However, given that geothermal is a relatively new area for many chemical providers, CES Energy Solutions' current market share in this specific niche is likely to be minimal. This presents a clear opportunity for strategic expansion.

This segment of the chemical market for geothermal energy represents a strategic diversification avenue for CES Energy Solutions. Capturing a meaningful share will necessitate initial investment in research, development, and market penetration efforts, positioning it as a potential star or question mark in a BCG matrix analysis, depending on future market adoption and CES's strategic execution.

Biocides and Water Treatment Solutions for Advanced Recycling

The demand for advanced biocides and water treatment solutions in oil and gas is surging due to a heightened emphasis on water management and recycling. These specialized chemicals are crucial for handling highly contaminated or difficult water streams, marking a high-growth segment.

While CES Energy Solutions likely has existing water treatment capabilities, its market share in the most advanced and complex recycling applications may be limited. This area presents a substantial opportunity for growth, provided CES can successfully innovate and scale its offerings to meet rigorous environmental and operational standards.

- Market Growth: The global water treatment chemicals market, including biocides for industrial applications, was projected to reach over $40 billion in 2024, with specialized segments like oil and gas recycling showing accelerated growth.

- CES Potential: CES Energy Solutions can leverage its existing infrastructure to develop and deploy next-generation biocides and treatment chemicals tailored for challenging recycling scenarios, potentially capturing a significant share of this expanding market.

- Innovation Driver: Regulatory pressures and the drive for operational efficiency in the oil and gas sector are pushing the need for more effective and sustainable water treatment technologies, creating a fertile ground for CES's advanced recycling solutions.

Chemicals for Hydrogen Production and Storage

The burgeoning hydrogen economy, with its focus on green and blue hydrogen, is rapidly creating a significant market for specialized chemicals. These chemicals are crucial for processes like electrolysis, carbon capture for blue hydrogen, and the safe storage of hydrogen. CES Energy Solutions, while currently holding a minimal or no market share in this nascent sector, possesses chemical expertise that could be strategically applied.

This area clearly falls into the Question Mark category of the BCG matrix for CES Energy Solutions. It signifies a high-growth potential market where the company currently has a low market share. Significant strategic investment, alongside key partnerships, will be essential for CES to develop the necessary chemical products and establish a competitive presence.

- Market Growth: The global hydrogen market is projected to reach over $250 billion by 2030, with a significant portion driven by green and blue hydrogen production.

- Chemical Demand: Electrolyzers, a key component of green hydrogen production, often require specialized catalysts and membranes, creating demand for advanced chemical solutions.

- Carbon Capture Needs: Blue hydrogen production relies on carbon capture technologies, which utilize chemicals like amines for CO2 absorption.

- Storage Solutions: Chemical hydrides and other materials are being explored for safe and efficient hydrogen storage, presenting further chemical opportunities.

The hydrogen economy represents a high-growth, emerging market where CES Energy Solutions currently has a minimal or non-existent market share. This sector, focused on green and blue hydrogen production, requires specialized chemicals for electrolysis, carbon capture, and storage. Significant strategic investment and partnerships are crucial for CES to develop competitive chemical products and establish a strong presence.

The global hydrogen market is anticipated to surpass $250 billion by 2030, with green and blue hydrogen production being key drivers. Electrolyzers, essential for green hydrogen, demand advanced catalysts and membranes, creating a need for innovative chemical solutions. Additionally, blue hydrogen production relies on carbon capture processes utilizing chemicals like amines.

CES Energy Solutions, with its existing chemical expertise, is well-positioned to explore opportunities in this dynamic market. However, the substantial upfront investment required for research and development in areas such as specialized membranes, catalysts, and advanced CO2 absorbents places this segment firmly in the Question Mark category of the BCG matrix.

The development of safe and efficient hydrogen storage solutions, involving chemical hydrides and other materials, also presents a significant chemical opportunity. By strategically investing in these areas, CES can aim to transform this Question Mark into a future Star.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.