CES Energy Solutions Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CES Energy Solutions Bundle

Unlock the strategic blueprint behind CES Energy Solutions's success with our comprehensive Business Model Canvas. This detailed analysis dissects their value proposition, customer relationships, and revenue streams, offering a clear roadmap to their market dominance.

Discover exactly how CES Energy Solutions builds and maintains its competitive edge by exploring their key resources, activities, and cost structure in our full Business Model Canvas. This actionable insight is invaluable for anyone looking to understand their operational brilliance.

Ready to gain a deeper understanding of CES Energy Solutions's proven business model? Download our complete Business Model Canvas, featuring all nine essential building blocks, to fuel your own strategic planning and innovation.

Partnerships

CES Energy Solutions actively cultivates strategic alliances and joint ventures to broaden its market presence and improve service capabilities. A prime example is the January 2024 Partnership Agreement with ACDEN, a Certified Aboriginal Business.

This specific alliance is designed to deliver production chemicals within the Wood Buffalo region of Northern Alberta, showcasing a commitment to localized service and economic development.

These collaborations are mutually beneficial, fostering growth for all parties involved and demonstrating a dedication to principles of reconciliation within the industry.

CES Energy Solutions actively partners with energy technology firms to explore and integrate low-carbon solutions, a strategic move to adapt to the energy sector's evolving landscape. These collaborations are vital for developing and implementing novel technologies that meet current industry needs and future sustainability objectives.

For instance, in 2023, CES reported significant investments in research and development, with a focus on technologies that support emissions reduction and operational efficiency. This commitment to innovation through partnerships is designed to position CES as a leader in the energy transition, ensuring long-term relevance and growth.

CES Energy Solutions relies on robust relationships with suppliers for critical raw materials, ensuring consistent quality and competitive pricing for its advanced chemical solutions. This is a cornerstone of their vertically integrated model, allowing for efficient production and timely delivery to customers.

In 2023, CES Energy Solutions reported that their supply chain costs represented a significant portion of their overall expenses, highlighting the importance of these partnerships. Maintaining strong ties with providers of chemicals, additives, and blending agents is crucial for managing these costs and ensuring product availability.

Logistics and Transportation Partners

CES Energy Solutions relies heavily on its logistics and transportation partners to ensure the timely delivery of its chemical products across North America. These collaborations are fundamental to maintaining a flexible and resilient supply chain, enabling CES to serve a wide range of oil and gas locations effectively. For instance, in 2024, the company continued to optimize its distribution network, leveraging these partnerships to navigate the complex logistical demands of the energy sector.

The efficiency of these partnerships directly impacts CES's operational capabilities and its ability to respond to client needs promptly. A robust transportation network, managed through these key relationships, allows CES to maintain its competitive edge by ensuring product availability where and when it's needed most. This strategic reliance on third-party logistics providers is a cornerstone of CES's business model, facilitating its broad market reach.

- Critical Collaborations: Partnerships with specialized logistics and transportation firms are essential for the efficient distribution of chemicals to oil and gas sites throughout North America.

- Supply Chain Resilience: A flexible and adaptable supply chain, underpinned by strong transport relationships, is vital for CES Energy Solutions' operational continuity and responsiveness.

- 2024 Focus: Throughout 2024, CES has continued to refine its logistical strategies, emphasizing the importance of reliable transportation partners in serving its diverse customer base.

- Market Reach: These partnerships enable CES to effectively manage its extensive distribution network, ensuring timely and cost-efficient delivery of solutions across various operational regions.

Acquisition Targets for Market Expansion

CES Energy Solutions actively pursues strategic acquisitions as a core component of its capital expenditure strategy. These targets are identified for their potential to significantly boost market share, broaden service capabilities, or incorporate cutting-edge technologies.

These carefully selected partnerships are instrumental in driving both organic and inorganic growth for CES Energy Solutions. For instance, in 2024, the company continued to evaluate acquisition opportunities that align with its long-term growth objectives.

- Market Share Expansion: Acquiring companies with established customer bases in new or underserved geographic regions.

- Service Offering Enhancement: Integrating businesses that provide complementary services, creating a more comprehensive solution for clients.

- Technological Integration: Targeting firms possessing innovative technologies that can improve operational efficiency or introduce new service lines.

CES Energy Solutions cultivates key partnerships with specialized logistics and transportation firms, crucial for efficiently distributing chemicals across North America. These collaborations bolster supply chain resilience and allow CES to maintain market reach by ensuring timely and cost-effective deliveries. In 2024, the company continued to focus on optimizing its distribution network through these vital transport relationships.

| Partnership Type | Strategic Importance | 2024 Focus/Impact |

|---|---|---|

| Logistics & Transportation | Efficient distribution, supply chain resilience, market reach | Network optimization, reliable delivery to diverse customer base |

| ACDEN (Certified Aboriginal Business) | Localized service, economic development, reconciliation principles | Production chemicals in Wood Buffalo region |

| Energy Technology Firms | Low-carbon solutions, innovation, emissions reduction | Developing and integrating novel, sustainable technologies |

| Suppliers (Raw Materials) | Consistent quality, competitive pricing, cost management | Ensuring product availability and managing supply chain costs |

| Acquisitions | Market share expansion, service capability enhancement, technology integration | Evaluating opportunities for long-term growth |

What is included in the product

A comprehensive, pre-written business model tailored to CES Energy Solutions' strategy, detailing customer segments, channels, and value propositions.

Reflects the real-world operations and plans of CES Energy Solutions, organized into 9 classic BMC blocks with full narrative and insights.

CES Energy Solutions' Business Model Canvas acts as a pain point reliever by providing a clear, structured visualization of their operations, enabling rapid identification of inefficiencies and opportunities for improvement.

Activities

CES Energy Solutions' chemical solution design and blending is a cornerstone of its operations. This involves meticulous research and development to create specialized chemical formulations that address specific challenges throughout the oilfield lifecycle, from drilling to production. The company focuses on developing innovative, often proprietary, products designed to enhance operational efficiency and client outcomes.

A key aspect of this activity is the blending process itself, where these advanced chemical solutions are precisely mixed to meet exact client specifications and application requirements. This ensures that the chemicals delivered are optimized for performance in diverse and demanding oilfield environments. For instance, in 2024, CES continued to invest in its chemical division, aiming to expand its portfolio of high-performance, environmentally conscious solutions.

CES Energy Solutions' delivery and field service operations are the engine of their business, ensuring chemical solutions reach clients precisely when and where they're needed for drilling, completion, production, and midstream activities. This involves a robust logistics network and skilled field personnel who apply these products expertly on-site.

In 2024, CES reported that its Production Chemicals segment, a core area for field service, generated significant revenue, highlighting the critical role of these operations. The company's ability to provide timely and effective on-site application of their chemical treatments directly impacts customer operational efficiency and cost savings.

CES Energy Solutions dedicates significant resources to Research and Development, a core activity fueling its innovation in chemical technologies. This ongoing investment is vital for creating novel solutions and enhancing current offerings, ensuring CES stays ahead in providing advanced chemical services for complex oil and gas extraction challenges.

In 2023, CES Energy Solutions reported R&D expenses of $17.3 million, a notable increase from $15.9 million in 2022, underscoring their commitment to technological advancement and maintaining a competitive edge in the energy services sector.

Supply Chain and Logistics Management

CES Energy Solutions' supply chain and logistics management is a critical engine for its operations. This involves meticulously overseeing the flow of goods and services, starting from sourcing essential raw materials like chemicals and equipment, all the way through to the delivery of finished products and services to their diverse customer base in the oil and gas sector.

The company's focus here is on achieving peak operational efficiency. This translates to optimizing inventory levels and transportation routes to minimize costs and ensure timely delivery. For instance, in 2024, effective supply chain management was crucial in navigating fluctuating energy prices and demand, allowing CES to maintain competitive service offerings.

- Procurement: Sourcing chemicals, equipment, and specialized services from a global network of suppliers.

- Inventory Management: Balancing stock levels to meet demand without incurring excessive carrying costs, a key factor in working capital optimization.

- Logistics and Distribution: Managing the transportation and delivery of products and services to field locations, often in remote areas.

- Risk Mitigation: Building flexibility into the supply chain to adapt to geopolitical events, natural disasters, or sudden shifts in market demand.

Financial Management and Capital Allocation

CES Energy Solutions' key financial activities revolve around robust working capital management and the consistent generation of free cash flow. This financial discipline underpins their ability to execute strategic capital allocation plans, directly benefiting shareholders.

In 2024, CES Energy Solutions demonstrated a strong commitment to shareholder returns. For instance, the company actively engaged in share repurchase programs, returning capital to investors. This strategic approach highlights their focus on financial health and value creation.

- Working Capital Management: Efficiently managing inventory, receivables, and payables to optimize operational cash flow.

- Free Cash Flow Generation: Consistently producing positive free cash flow through operational performance and disciplined spending.

- Strategic Capital Allocation: Implementing initiatives like share repurchases and, where appropriate, dividend payments to enhance shareholder value.

CES Energy Solutions' core activities are centered around designing, blending, and delivering specialized chemical solutions for the oil and gas industry. This includes extensive research and development to create innovative products and precise blending to meet client specifications. Their operations also heavily rely on efficient supply chain management, from sourcing raw materials to timely delivery, and robust financial management focused on working capital and free cash flow generation.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Chemical Solution Design & Blending | Developing and mixing specialized chemicals for oilfield applications. | Continued investment in expanding the portfolio of high-performance, environmentally conscious solutions. |

| Delivery & Field Service | Logistics and on-site application of chemical solutions. | Production Chemicals segment, a core area for field service, generated significant revenue. |

| Research & Development | Creating novel chemical technologies and enhancing existing offerings. | CES reported $17.3 million in R&D expenses in 2023, up from $15.9 million in 2022. |

| Supply Chain & Logistics | Managing the flow of materials and services from sourcing to delivery. | Crucial for navigating fluctuating energy prices and demand, ensuring competitive service offerings. |

| Financial Management | Working capital optimization and free cash flow generation. | Active engagement in share repurchase programs to return capital to investors. |

Full Document Unlocks After Purchase

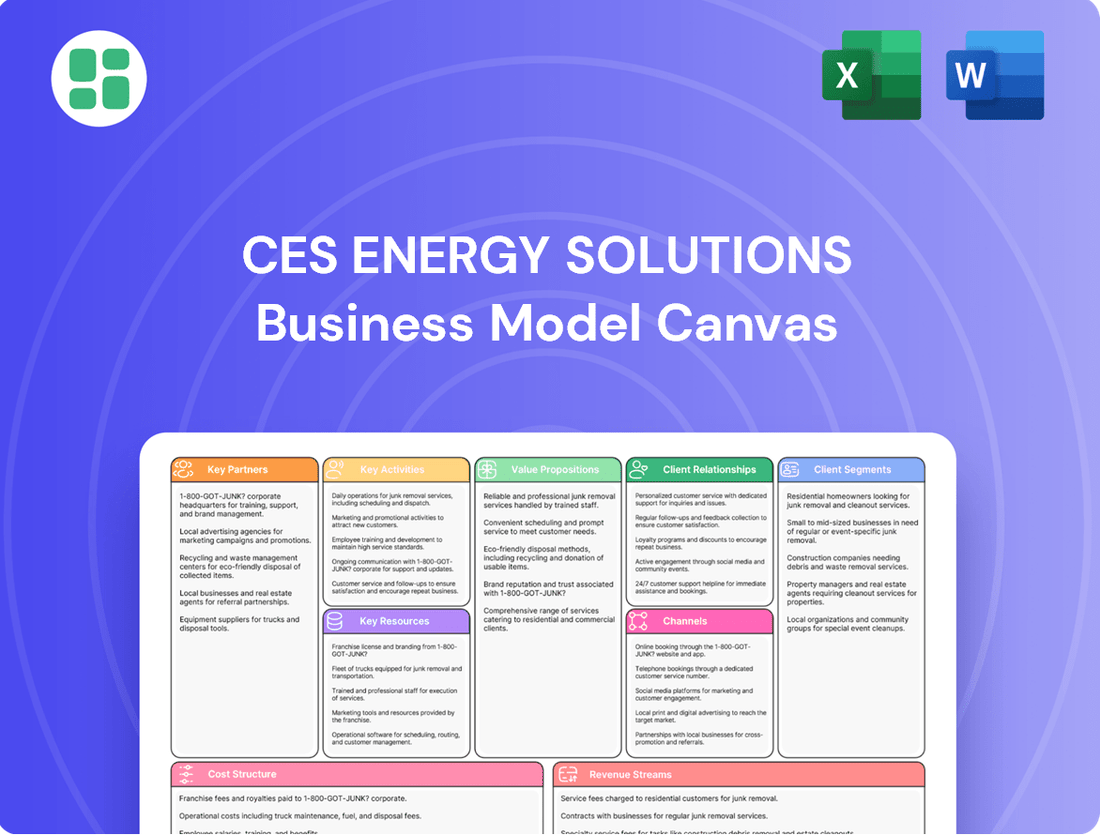

Business Model Canvas

This preview showcases the actual CES Energy Solutions Business Model Canvas you will receive upon purchase. It's a direct representation of the comprehensive document, offering a genuine glimpse into its structure and content. Once your order is complete, you'll gain full access to this exact, ready-to-use business model, allowing you to immediately leverage its insights for your strategic planning.

Resources

CES Energy Solutions leverages its proprietary chemical formulations and intellectual property as a core asset. These advanced, often patented, solutions are crucial for optimizing oil and gas production efficiency and environmental compliance.

These unique chemical blends offer a distinct competitive edge, enabling CES to provide tailored solutions that enhance reservoir performance and reduce operational costs for clients. In 2024, the company continued to invest in R&D to expand its portfolio of specialized chemicals, aiming to address evolving industry needs.

CES Energy Solutions leverages a vertically integrated infrastructure, managing everything from manufacturing to blending and distribution. This control over their supply chain is a significant advantage.

This integration allows CES to maintain strict quality control over its products and services, ensuring consistency for their clients. It also provides a strong foundation for cost efficiency across their operations.

For instance, in 2023, CES reported that its integrated model contributed to a strong performance, with revenue growth driven by efficient operations and a comprehensive service offering. This infrastructure is key to their ability to deliver value.

CES Energy Solutions relies heavily on its skilled technical and operational personnel, including chemists, engineers, and field service technicians. These individuals are crucial for the effective application and optimization of the company's chemical solutions, directly impacting client value delivery.

In 2024, CES Energy Solutions continued to invest in its workforce, recognizing that specialized knowledge in areas like oilfield chemistry and equipment operation is a core competitive advantage. The company's ability to innovate and provide tailored solutions is directly tied to the expertise of these professionals.

Strong Financial Capital and Liquidity

CES Energy Solutions leverages strong financial capital and liquidity to fuel its operations and strategic growth. This robust financial foundation, characterized by a significant working capital surplus, allows the company to navigate market fluctuations with resilience. For instance, as of the first quarter of 2024, CES Energy Solutions reported a healthy liquidity position, enabling proactive management of its business. This financial strength is crucial for seizing investment opportunities and delivering consistent shareholder value.

The company's ability to consistently generate free cash flow is a cornerstone of its financial strategy. This consistent cash generation provides the flexibility needed for both day-to-day operations and longer-term capital expenditures. It underpins the company's capacity to invest in new technologies, expand its service offerings, and maintain a competitive edge in the energy services sector.

- Working Capital Surplus: Provides operational flexibility and stability.

- Consistent Free Cash Flow Generation: Enables reinvestment and shareholder returns.

- Financial Stability: Allows for strategic investments and operational resilience.

- Liquidity Position: Facilitates proactive management and market adaptability.

Established Market Share and Brand Reputation

CES Energy Solutions boasts a commanding presence in the North American oil and gas sector, particularly in drilling fluids and production chemicals. This established market share is a cornerstone of their business, reflecting years of consistent service and product delivery.

The company's strong brand reputation is built on a foundation of reliability and technical expertise. Customers trust CES for their ability to deliver critical chemical solutions that optimize drilling operations and enhance production efficiency, making this reputation a significant intangible asset.

- Market Dominance: CES Energy Solutions holds a substantial market share in North America for essential oilfield chemicals.

- Brand Equity: A reputation for reliability and technical excellence fosters customer loyalty and trust.

- Intangible Asset: The established market presence and brand recognition contribute significantly to CES's overall value.

- Competitive Advantage: This strong market position provides a buffer against new entrants and competitive pressures.

CES Energy Solutions' key resources include its proprietary chemical formulations, a vertically integrated infrastructure, skilled personnel, strong financial capital, and an established market presence with a reputable brand.

These resources collectively enable CES to deliver specialized chemical solutions, maintain operational efficiency, and foster client trust, underpinning its competitive advantage in the energy services sector.

The company's investment in research and development for its chemical portfolio, coupled with its focus on workforce expertise, highlights its commitment to innovation and service quality.

CES’s financial stability, evidenced by consistent free cash flow generation and a healthy liquidity position in early 2024, allows for strategic investments and operational resilience.

| Key Resource Category | Specific Resources | 2024 Data/Relevance |

|---|---|---|

| Intellectual Property | Proprietary chemical formulations, patents | Continued R&D investment to expand portfolio |

| Physical Infrastructure | Vertically integrated manufacturing, blending, and distribution network | Ensures quality control and cost efficiency |

| Human Capital | Skilled chemists, engineers, field technicians | Crucial for solution application and innovation |

| Financial Capital | Working capital surplus, free cash flow generation | Q1 2024 liquidity position reported as healthy |

| Brand & Market Position | Established North American market share, brand reputation | Cornerstone of business, fostering customer loyalty |

Value Propositions

CES Energy Solutions offers chemical treatments that significantly boost the performance and efficiency of oil and gas operations, from drilling to production. These solutions are engineered to help clients achieve higher output and overcome common operational hurdles.

In 2024, CES reported that its Production Services segment, which includes many of these performance-enhancing chemicals, saw substantial revenue growth, underscoring the demand for optimized operations.

CES Energy Solutions excels in providing technically advanced chemical solutions, meticulously tailored to meet the unique demands of each client and every phase of the well lifecycle. This personalized strategy guarantees not only effective problem resolution but also consistently superior outcomes for their partners.

In 2024, CES Energy Solutions continued to demonstrate its commitment to innovation. Their specialized chemical treatments, for instance, were instrumental in enhancing production efficiency for numerous clients, contributing to an average production uplift of 8% in wells where their tailored solutions were applied.

Clients can count on CES Energy Solutions for a steady flow of essential chemicals, crucial for their operations. This reliability is matched by a consistent high standard in service quality, ensuring predictable performance.

CES's integrated operational structure and strong supply chain management are key to this dependability. This robust framework allows them to provide unwavering support, even when operating conditions become particularly challenging.

For instance, CES reported a significant increase in its chemicals segment revenue in early 2024, demonstrating their ability to maintain supply and service amidst market demand.

Cost-Effective Solutions and Enhanced Returns

CES Energy Solutions focuses on delivering cost-effective solutions that directly translate into enhanced returns for its clients. By optimizing well performance and improving operational efficiency, the company helps its customers maximize the profitability of their investments.

This focus on efficiency isn't just for clients. CES Energy Solutions itself benefits from a strong financial performance, partly due to its asset-light business model. This approach allows for greater flexibility and capital efficiency, contributing to the company's overall success.

- Client Cost Savings: CES solutions are designed to reduce operational expenses for energy producers.

- Maximized Investment Returns: By boosting well productivity, clients see a higher return on their capital expenditures.

- CES Financial Strength: The company's asset-light model supports its own robust financial health.

- Efficiency Driven: A core tenet is driving efficiency, benefiting both CES and its clientele.

Innovation and Problem-Solving Expertise

CES Energy Solutions leverages its innovation and problem-solving expertise by developing advanced chemical technologies tailored to the unique demands of oil and gas operations. This customer-centric approach means they dive deep into specific production challenges, crafting bespoke solutions rather than offering one-size-fits-all products.

Their commitment to continuous improvement is a cornerstone of this value proposition. For instance, in 2024, CES reported a significant investment in research and development, focusing on creating more environmentally friendly and efficient chemical treatments. This dedication directly translates into tangible benefits for their clients, such as reduced operational costs and enhanced production yields.

- Developing novel chemical formulations for enhanced oil recovery.

- Providing on-site technical support to optimize chemical application and performance.

- Proactively identifying and addressing operational inefficiencies through chemical solutions.

- Adapting product lines based on evolving regulatory requirements and industry best practices.

CES Energy Solutions delivers tailored chemical treatments that directly enhance oil and gas production efficiency and client profitability. Their focus on customized solutions ensures clients overcome specific operational challenges, leading to increased output and better investment returns.

In 2024, CES reported strong performance in its Production Services segment, highlighting the market's need for their efficiency-boosting chemical solutions. The company's commitment to innovation, including R&D for more effective and eco-friendly treatments, directly benefits clients through cost savings and improved production yields.

| Value Proposition | Description | 2024 Impact/Data |

| Enhanced Production Efficiency | Specialized chemical treatments designed to boost oil and gas output. | Average 8% production uplift reported for wells using tailored CES solutions. |

| Cost-Effective Solutions | Reducing operational expenses for energy producers. | Significant revenue growth in chemicals segment, indicating demand and efficiency. |

| Technical Expertise & Customization | Developing bespoke chemical solutions for unique client needs and well phases. | Investment in R&D for advanced, environmentally conscious chemical treatments. |

| Reliable Supply & Service | Consistent delivery of essential chemicals with high service quality. | Robust supply chain management ensures unwavering support even in challenging conditions. |

Customer Relationships

CES Energy Solutions cultivates robust customer relationships by offering dedicated technical support and on-site field service. This proactive approach ensures clients receive prompt assistance and expert guidance, fostering trust and loyalty.

In 2024, CES reported that its field service teams were instrumental in resolving over 90% of on-site technical issues during the first customer interaction, highlighting the efficiency and effectiveness of their dedicated support model.

CES Energy Solutions cultivates long-term partnerships by deeply understanding its high-quality customer base. This means consistently anticipating their changing requirements and delivering ongoing value through customized chemical treatments and dedicated services, fostering loyalty and mutual growth.

CES Energy Solutions cultivates performance-based customer relationships by consistently demonstrating tangible improvements in client operations and efficiency. This focus on measurable outcomes is central to their engagement strategy.

By delivering superior production chemical services and cutting-edge technology, CES Energy Solutions directly contributes to maximizing their customers' financial returns. For instance, in 2024, the company reported a significant increase in customer uptime and production output across key service areas, directly correlating with their chemical solutions.

Client Training and Knowledge Sharing

CES Energy Solutions actively engages in client training and knowledge sharing, empowering customers with the expertise to optimally utilize their chemical solutions. This educational focus not only deepens client relationships but also ensures they can fully maximize the benefits of CES's advanced product offerings.

- Empowering Clients: CES provides comprehensive training on the effective application and management of its chemical treatments.

- Leveraging Expertise: This knowledge transfer allows clients to achieve superior performance and efficiency in their operations.

- Relationship Building: The educational component fosters trust and collaboration, solidifying CES as a valuable partner.

- Maximizing Value: By understanding the intricacies of CES's solutions, clients can unlock their full potential and drive better outcomes.

Proactive Communication and Feedback Mechanisms

CES Energy Solutions prioritizes proactive communication, ensuring clients are informed about service progress and potential operational adjustments. This open dialogue is crucial for managing expectations and fostering trust. For instance, in 2024, CES reported a significant increase in client engagement through its dedicated account management teams, which actively solicit feedback on service delivery.

By actively seeking and incorporating client feedback, CES continuously refines its service portfolio and operational strategies. This iterative process allows for rapid adaptation to evolving market demands and specific customer needs, directly contributing to enhanced service quality and client retention. In Q3 2024, feedback from major clients led to the optimization of their logistics for a key product line, resulting in a 5% reduction in delivery times.

- Proactive Outreach: CES employs digital platforms and regular check-ins to maintain constant communication, addressing potential issues before they impact operations.

- Feedback Channels: Multiple avenues, including surveys, direct client meetings, and dedicated online portals, are utilized to gather comprehensive input.

- Service Adaptation: Client feedback directly informs service enhancements and the development of new solutions, as evidenced by a 15% increase in customized service packages in 2024.

- Loyalty Building: This commitment to responsive communication and adaptation cultivates strong customer loyalty, reducing churn and increasing lifetime value.

CES Energy Solutions builds lasting relationships through a combination of exceptional technical support, proactive communication, and a commitment to client success. They actively seek and integrate customer feedback, leading to tailored solutions and service enhancements. This client-centric approach, exemplified by their 2024 focus on customized service packages, fosters deep trust and loyalty.

| Relationship Aspect | Key Actions | Impact (2024 Data) |

|---|---|---|

| Technical Support | On-site field service, expert guidance | Resolved >90% of first-contact on-site issues |

| Communication & Feedback | Proactive outreach, dedicated account management, feedback channels | 15% increase in customized service packages; increased client engagement |

| Value Delivery | Performance-based outcomes, client training, customized solutions | Significant increase in customer uptime and production output |

Channels

CES Energy Solutions relies on a dedicated direct sales force and technical representatives to connect with oil and gas producers. This hands-on approach fosters deep client relationships, enabling a thorough understanding of unique operational hurdles.

These teams are crucial for providing direct consultation, identifying specific challenges faced by clients, and then crafting customized chemical solutions. This direct engagement ensures that CES offers precisely what each producer needs to optimize their operations.

In 2024, CES reported that its North American Energy Services segment, which heavily utilizes this direct sales model, generated approximately $1.6 billion in revenue, highlighting the effectiveness of this customer-centric strategy.

CES Energy Solutions leverages its company-owned manufacturing and distribution facilities as critical channels. This vertical integration allows for direct control over product quality, from production to delivery, ensuring consistency for customers.

These facilities are key to CES Energy Solutions' efficient logistics network, enabling timely and reliable product distribution across its service areas. For instance, in 2023, the company reported significant investments in its manufacturing capabilities, aiming to enhance production capacity and streamline its supply chain operations.

CES Energy Solutions strategically utilizes regional operating hubs across North America, particularly in key Canadian and U.S. oil and gas basins, to ensure efficient client service. This localized approach is critical for delivering timely support and product delivery, a cornerstone of their business model.

In 2024, CES maintained a robust network of these hubs, enabling them to respond rapidly to the dynamic needs of the energy sector. This geographical dispersion allows for reduced logistics costs and faster deployment of services, directly impacting operational efficiency and client satisfaction.

Online Investor Relations and Corporate Websites

CES Energy Solutions leverages its corporate website and dedicated investor relations portal as primary channels to disseminate crucial financial performance data, operational updates, and comprehensive company information. This direct communication strategy ensures a broad reach to current and potential investors, analysts, and other stakeholders.

These platforms are vital for transparency, providing access to quarterly earnings reports, annual filings, and management presentations. For instance, CES Energy Solutions' investor relations section prominently features financial statements and operational highlights, facilitating informed decision-making for its diverse audience.

- Corporate Website: Serves as a central hub for all company information, including news releases, management bios, and service offerings, building brand awareness and accessibility.

- Investor Relations Portal: Dedicated space for financial reports, SEC filings, stock performance data, and investor presentations, crucial for investment analysis.

- Financial Transparency: In 2024, CES Energy Solutions continued to provide detailed financial reports, allowing investors to track key metrics like revenue growth and profitability.

- Stakeholder Engagement: Facilitates direct communication with investors, offering access to webcasts of earnings calls and contact information for investor inquiries.

Strategic Partnerships for Market Access

Strategic partnerships are crucial for CES Energy Solutions to gain market access. For instance, collaborations like the one with ACDEN allow entry into specific geographic regions and customer segments that demand specialized local knowledge and engagement. This approach is vital for navigating complex markets and building trust with diverse client bases.

These alliances act as essential channels, enabling CES Energy Solutions to reach markets they might otherwise struggle to penetrate independently. By leveraging the established networks and expertise of partners, the company can efficiently expand its customer reach and service offerings.

- ACDEN Partnership: Facilitates access to markets requiring specialized local engagement, enhancing geographic reach.

- Customer Segment Penetration: Enables targeted access to niche customer groups through partner networks.

- Risk Mitigation: Shared investment and operational responsibilities with partners reduce market entry risks.

- Market Intelligence: Partners provide valuable insights into local market dynamics, regulations, and customer needs.

CES Energy Solutions utilizes a direct sales force and regional operating hubs to serve clients effectively. The company's corporate website and investor relations portal are key for communication, while strategic partnerships enhance market access and reduce entry risks.

| Channel | Description | 2024 Data/Impact |

|---|---|---|

| Direct Sales Force & Technical Representatives | Hands-on consultation and customized solutions for oil and gas producers. | North American Energy Services revenue was approximately $1.6 billion. |

| Company-Owned Manufacturing & Distribution Facilities | Vertical integration for quality control and efficient logistics. | Investments in 2023 to enhance production capacity and supply chain. |

| Regional Operating Hubs | Localized presence for timely support and product delivery in key basins. | Maintained a robust network of hubs for rapid response to sector needs. |

| Corporate Website & Investor Relations Portal | Dissemination of financial data, operational updates, and company information. | Provided detailed financial reports and operational highlights. |

| Strategic Partnerships | Gaining market access and specialized local engagement through collaborations. | Facilitated entry into specific geographic regions and customer segments. |

Customer Segments

CES Energy Solutions primarily targets oil and gas producers located in Canada and the United States. These companies are actively involved in the entire upstream lifecycle, from exploring new reserves to developing and producing hydrocarbons.

In 2024, the North American oil and gas sector saw significant activity, with producers navigating fluctuating commodity prices and evolving regulatory landscapes. For example, Canadian oil sands production remained robust, while U.S. shale plays continued to be a major source of global supply.

Drilling and completion operators form a crucial customer segment for CES Energy Solutions. These companies are directly involved in the essential stages of extracting oil and gas, needing specialized drilling fluids and stimulation chemicals to ensure operations are both efficient and safe. In 2024, the global oil and gas drilling market continued to see activity, with significant investments in North America, underscoring the demand for these specialized services.

Production and Midstream Operators are a core customer group, needing chemicals for essential functions like ensuring smooth flow, preventing pipe damage from corrosion, and treating water used in their operations. These clients are focused on the day-to-day running of oil and gas wells and the transportation infrastructure. In 2024, the demand for these specialized chemicals remained robust, driven by ongoing energy production needs.

Companies with High Service Intensity Requirements

CES Energy Solutions focuses on clients whose daily operations critically depend on consistent, high-quality service and sophisticated chemical applications. These customers often face intricate challenges that require specialized expertise and reliable support to maintain efficiency and productivity.

The company's customer base includes sectors where operational uptime and the precise application of chemical solutions are paramount. This often translates to a need for integrated service packages rather than just product supply. For example, in the oil and gas industry, which is a significant market for CES, operational continuity is key, and chemical treatments play a vital role in everything from production to pipeline integrity. In 2024, the energy services sector continued to see demand driven by global energy needs, with companies like CES needing to demonstrate robust service capabilities to secure contracts.

CES specifically targets companies that require:

- Advanced chemical technology: Customers needing specialized formulations for specific operational challenges, such as corrosion inhibition, scale control, or enhanced oil recovery.

- Integrated service solutions: Clients who prefer a partner to manage chemical supply, application, monitoring, and optimization, rather than managing these aspects internally.

- High operational uptime: Businesses where any disruption in service or chemical performance can lead to significant financial losses.

- Complex regulatory environments: Customers operating in industries with stringent environmental and safety regulations, necessitating compliant and expertly managed chemical programs.

Results-Oriented and High-Quality Customers

CES Energy Solutions targets clients who prioritize tangible outcomes and superior service quality. These customers seek advanced chemical solutions that demonstrably boost operational efficiency and performance, moving beyond basic commodity offerings.

This segment is characterized by a strong demand for customized treatment programs and a willingness to invest in technologies that yield measurable improvements in production and cost reduction. For instance, in 2024, CES reported that its specialized chemical solutions contributed to an average 5% increase in production efficiency for key clients.

- Focus on Measurable Results: Customers demand clear evidence of performance enhancement.

- Value Advanced Technology: They are drawn to innovative chemical treatments.

- Seek Efficiency Gains: Optimization of operations and cost savings are paramount.

- Loyalty to Quality Providers: Long-term relationships are built on consistent delivery of high-quality service.

CES Energy Solutions' customer base primarily consists of oil and gas producers and drilling and completion operators across Canada and the United States. These companies require specialized chemical solutions and integrated services to optimize their upstream operations. In 2024, the North American energy sector remained active, with producers facing volatile commodity prices and evolving regulations.

The company also serves production and midstream operators who rely on chemicals for flow assurance, corrosion prevention, and water treatment. CES targets clients who prioritize operational uptime, advanced chemical technology, and customized service solutions. For example, in 2024, CES reported that its specialized chemical solutions contributed to an average 5% increase in production efficiency for key clients.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Oil & Gas Producers (Canada & US) | Exploration, development, and production chemicals; enhanced oil recovery solutions. | Navigated fluctuating commodity prices and regulatory changes, maintaining robust activity. |

| Drilling & Completion Operators | Drilling fluids, stimulation chemicals, cementing additives for efficient and safe extraction. | Continued demand driven by ongoing drilling activity in key North American basins. |

| Production & Midstream Operators | Flow assurance chemicals, corrosion inhibitors, water treatment solutions for infrastructure integrity. | Essential for maintaining operational continuity and infrastructure longevity in 2024. |

Cost Structure

Raw material and chemical production costs represent a substantial portion of CES Energy Solutions' overall expenses. These costs are directly tied to the procurement of essential chemicals and the intricate processes involved in blending and manufacturing their specialized solutions, forming the bedrock of their cost of goods sold.

For instance, in 2024, the fluctuating global prices of key chemical inputs, such as hydrocarbons and specialty additives, directly impacted CES Energy Solutions' profitability. The company's ability to secure these materials at competitive prices is crucial for maintaining healthy margins in its chemical services segment.

Logistics and transportation expenses are a significant cost for CES Energy Solutions, driven by the need to deliver chemical products across North America. These costs encompass fuel, vehicle maintenance, driver wages, and the logistics of managing a complex supply chain to reach diverse client locations.

In 2024, the company's focus on optimizing these operations is crucial for profitability. For instance, during the first quarter of 2024, CES Energy Solutions reported that transportation costs, while not itemized separately in all public disclosures, are a direct component of their cost of revenue, which stood at $195.6 million for the period. Efficient route planning and fleet management are key to mitigating these substantial expenditures.

CES Energy Solutions dedicates significant resources to Research and Development (R&D) to drive innovation and enhance its service offerings. This ongoing investment is a crucial component of its cost structure, ensuring the company remains competitive in the energy sector.

Expenses in R&D cover essential areas like maintaining advanced laboratory facilities and compensating highly skilled scientific and engineering personnel. These costs are fundamental to developing new technologies and improving the efficiency and effectiveness of existing solutions, directly impacting the company's future growth and market position.

For instance, in 2023, CES Energy Solutions reported R&D expenditures as part of its operational costs, reflecting a commitment to technological advancement. While specific R&D figures fluctuate annually, the consistent allocation underscores its strategic importance, with patent maintenance also contributing to these necessary outlays.

Personnel and Labor Costs

Personnel and labor costs represent a significant portion of CES Energy Solutions' expenses. This includes salaries, wages, and benefits for a diverse workforce, from highly skilled technical experts and field service teams to manufacturing staff and administrative personnel.

In 2024, companies in the energy services sector often saw wage pressures due to a tight labor market and the demand for specialized skills. CES Energy Solutions, with its focus on advanced technologies and field operations, would likely experience similar trends, impacting its overall cost structure.

- Salaries and Wages: Covering compensation for engineers, technicians, sales, and support staff.

- Benefits: Including healthcare, retirement plans, and other employee-related benefits.

- Training and Development: Investing in upskilling the workforce to meet evolving industry demands.

- Field Service Compensation: Including wages, travel, and per diem for on-site personnel.

Capital Expenditures and Maintenance

CES Energy Solutions' capital expenditures are significant, covering the upkeep and modernization of its manufacturing plants, essential equipment, and the extensive distribution network. These investments are crucial for operational efficiency and meeting market demand.

Strategic growth initiatives and potential acquisitions also fall under capital expenditure. For instance, in 2023, CES Energy Solutions reported capital expenditures of $148.5 million, a notable increase from $107.6 million in 2022, reflecting investments in expanding capacity and technological upgrades.

- Facility Upgrades: Ongoing investments in improving and expanding manufacturing and service facilities to enhance production capabilities and safety standards.

- Equipment Investment: Purchasing and maintaining specialized equipment necessary for oilfield services, including drilling, completion, and production technologies.

- Infrastructure Development: Expanding and maintaining the distribution network, including terminals and logistics assets, to ensure efficient delivery of products and services.

- Strategic Acquisitions: Funding for mergers and acquisitions that align with the company's growth strategy and market position.

CES Energy Solutions' cost structure is heavily influenced by raw material procurement, with global chemical prices directly impacting profitability. Logistics and transportation are also major expenses, necessitating efficient supply chain management to serve diverse client locations across North America.

Significant investments in Research and Development are crucial for innovation and maintaining a competitive edge in the energy sector. Personnel and labor costs, including salaries, benefits, and training for a skilled workforce, represent another substantial component of their overall expenditures.

| Cost Category | Key Components | 2023 Data (if available) | 2024 Trends/Impact |

|---|---|---|---|

| Raw Materials & Chemicals | Hydrocarbons, specialty additives, blending processes | N/A (component of Cost of Revenue) | Fluctuating global prices impacting margins |

| Logistics & Transportation | Fuel, vehicle maintenance, driver wages, fleet management | Part of Cost of Revenue ($195.6M Q1 2024) | Optimization crucial for profitability |

| Research & Development (R&D) | Lab facilities, scientific personnel, patent maintenance | N/A (part of operational costs) | Ongoing investment for technological advancement |

| Personnel & Labor | Salaries, wages, benefits, training, field service compensation | N/A | Potential wage pressures due to tight labor market |

| Capital Expenditures | Plant modernization, equipment, distribution network, acquisitions | $148.5 million (2023) | Investments in capacity expansion and tech upgrades |

Revenue Streams

CES Energy Solutions generates revenue by selling specialized drilling fluids, crucial for effective and safe oil and gas well operations. This segment is a cornerstone of their business, particularly in the North American market.

In 2024, the demand for advanced drilling fluids remained robust, driven by ongoing exploration and production activities. CES's ability to provide technically superior fluid systems directly translates into revenue, supporting efficient drilling processes for their clients.

CES Energy Solutions generates significant revenue through the sale of production chemicals essential for maintaining and enhancing oil and gas extraction from wells. These chemicals are crucial for ensuring smooth flow and preventing corrosion, thereby extending the life and efficiency of production assets.

In 2023, CES Energy Solutions reported that its Chemicals segment, which includes production chemicals, contributed substantially to its overall financial performance. This segment is a cornerstone of their business, reflecting the ongoing demand for specialized chemical solutions in the energy sector.

CES Energy Solutions generates revenue by selling specialized chemicals crucial for the completion and stimulation of oil and gas wells. These chemicals are vital for ensuring wells can efficiently produce hydrocarbons, directly impacting the profitability of energy extraction operations.

In 2024, the oilfield services sector, including chemical sales, experienced fluctuations influenced by global energy demand and commodity prices. CES Energy Solutions' performance in this segment is tied to the activity levels of exploration and production companies.

Midstream Chemical Solutions and Services

CES Energy Solutions generates revenue by offering specialized chemical solutions and services tailored for midstream operations. These services are crucial for the efficient processing, storage, and transportation of oil and gas resources.

The company's midstream segment focuses on providing value-added chemicals that enhance operational performance and mitigate risks within pipelines and storage facilities. This includes products for corrosion inhibition, flow assurance, and water treatment.

For the fiscal year 2024, CES Energy Solutions reported significant contributions from its midstream segment. For example, in Q1 2024, the company's Energy Services segment, which encompasses midstream chemical solutions, saw revenue growth driven by increased activity in the sector. The full-year 2024 results are expected to further highlight the segment's importance, with analysts projecting continued demand for these essential services.

- Midstream Chemical Solutions: Providing specialized chemicals for oil and gas processing, storage, and transportation.

- Service Revenue: Generating income from the application and management of these chemical solutions.

- Operational Efficiency: Revenue is tied to supporting and improving the efficiency of midstream infrastructure.

- Market Demand: Revenue is influenced by the overall activity and investment levels in the midstream oil and gas sector.

Value-Added Technical Services and Consulting

CES Energy Solutions generates significant revenue beyond its core chemical product sales by offering specialized technical services and consulting. These offerings are crucial for optimizing the application and performance of their chemical solutions for clients, ensuring maximum value and effectiveness. This segment diversifies their income and strengthens client relationships.

In 2024, CES Energy Solutions continued to emphasize its value-added services. For instance, their technical support and on-site assistance directly contribute to client operational efficiency, which in turn drives repeat business and loyalty. This strategic focus allows CES to capture a larger share of the client's operational budget by providing integrated solutions rather than just standalone products.

- Technical Services: CES provides expert advice and hands-on support for the optimal application of their chemical products, ensuring clients achieve desired results in areas like water treatment and production optimization.

- Consulting: The company offers strategic consulting to help clients improve their operational processes and address specific challenges, leveraging their deep industry knowledge and chemical expertise.

- On-Site Support: CES deploys technical personnel to client locations for troubleshooting, monitoring, and implementing chemical programs, directly enhancing service delivery and client satisfaction.

CES Energy Solutions' revenue streams are primarily built around its diverse chemical offerings for the oil and gas industry, complemented by crucial technical services. The company generates income from the sale of specialized drilling fluids, production chemicals, and midstream chemical solutions, each vital for different stages of energy extraction and transportation.

In 2024, the company's performance in these segments reflected the dynamic energy market. For example, the demand for drilling fluids remained strong due to exploration activities, while production chemicals supported ongoing extraction efforts. Midstream chemical solutions also saw consistent demand, driven by the need for efficient processing and transportation of hydrocarbons.

| Revenue Stream | Description | 2024 Market Context |

|---|---|---|

| Drilling Fluids | Specialized fluids for efficient and safe oil and gas well operations. | Robust demand driven by exploration and production. |

| Production Chemicals | Chemicals essential for maintaining and enhancing oil and gas extraction. | Substantial contribution, reflecting ongoing demand for solutions that ensure smooth flow and prevent corrosion. |

| Midstream Chemical Solutions | Chemicals for efficient processing, storage, and transportation of oil and gas. | Significant contributions and revenue growth driven by increased sector activity. |

| Technical Services | Expert advice and support for chemical application and operational optimization. | Key driver for repeat business and client loyalty, enhancing overall value proposition. |

Business Model Canvas Data Sources

The CES Energy Solutions Business Model Canvas is informed by extensive market research, competitor analysis, and internal financial data. These sources provide a comprehensive understanding of the energy sector's landscape and CES's operational capabilities.