Cencora SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cencora Bundle

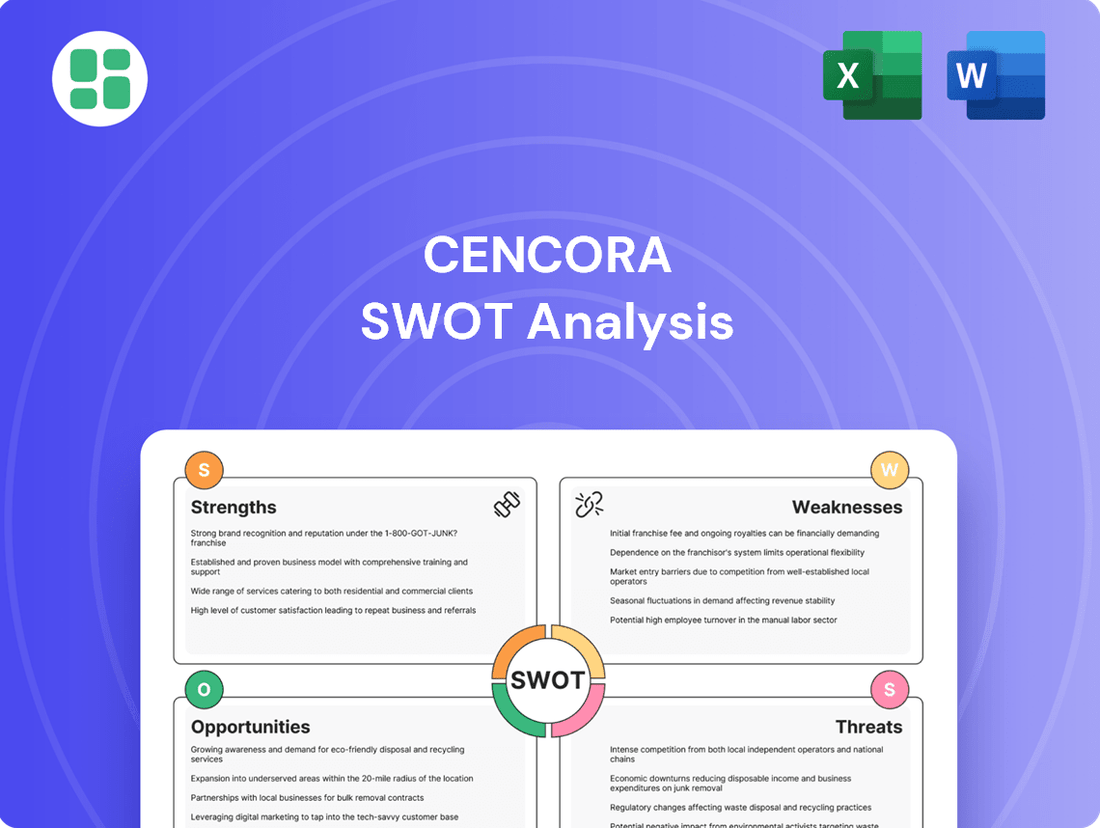

Cencora, a leader in pharmaceutical distribution, boasts significant strengths in its vast network and market reach, but also faces challenges in regulatory environments and competitive pressures. Understanding these dynamics is crucial for navigating the evolving healthcare landscape.

Want the full story behind Cencora's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cencora's global pharmaceutical distribution network is a cornerstone of its operational strength, facilitating the efficient and reliable delivery of medicines across the world. This expansive infrastructure is vital for linking drug manufacturers with healthcare providers and patients, ensuring broad market access and operational effectiveness in various regions.

In 2023, Cencora's distribution segment handled a significant volume of products, underscoring the scale of its operations and its critical role in the pharmaceutical supply chain. This established logistics and supply chain capability represents a substantial competitive advantage, allowing Cencora to serve a wide array of markets with speed and dependability.

Cencora's strength lies in its diverse healthcare services portfolio, extending beyond its core distribution business. This includes specialized offerings like patient support programs and consulting services, which are crucial for navigating the complex pharmaceutical landscape.

This diversification significantly reduces Cencora's dependence on any single revenue source. For example, in 2024, their specialty services segment continued to show robust growth, contributing to overall financial stability and demonstrating their ability to adapt to market needs.

By offering these comprehensive solutions, Cencora enhances its value proposition to clients, including pharmaceutical manufacturers and healthcare providers. These services are designed to meet the evolving demands of the healthcare sector, solidifying Cencora's position as a key partner.

Cencora, formerly AmerisourceBergen, boasts deeply entrenched, long-standing relationships with major pharmaceutical manufacturers and a vast network of healthcare providers worldwide. These vital connections are the bedrock of its operational strength, enabling the company to secure favorable supply agreements and collaborate on innovative projects. For instance, in fiscal year 2023, Cencora's revenue reached $262.1 billion, a testament to the volume and scale facilitated by these robust partnerships.

Critical Role in Pharmaceutical Supply Chain

Cencora's position as a critical intermediary in the pharmaceutical supply chain is a significant strength. They ensure medications reach patients efficiently and safely, which is vital for public health. This essential function creates a stable business model with substantial barriers to new entrants.

For instance, in fiscal year 2023, Cencora reported total revenue of $231.4 billion, underscoring the sheer volume and importance of the products they handle. Their extensive network and established relationships with manufacturers and providers solidify their indispensable role.

- Essential Link: Cencora connects pharmaceutical manufacturers with healthcare providers and patients, ensuring access to vital medicines.

- High Barriers to Entry: The complexity and regulatory nature of pharmaceutical distribution create significant hurdles for potential competitors.

- Scale and Reach: Their vast operational scale and broad geographic reach are difficult for rivals to replicate.

Expertise in Specialty Pharmaceutical Distribution

Cencora's deep understanding of specialty pharmaceutical distribution is a significant advantage. This is particularly important as the market sees a rise in complex, high-cost medications. Their proficiency in managing cold chain logistics, navigating strict regulatory landscapes, and ensuring precise, patient-specific deliveries sets them apart.

This specialized skill set allows Cencora to effectively serve a growing and valuable segment of the pharmaceutical industry. For instance, the global specialty pharmaceuticals market was valued at approximately $300 billion in 2023 and is projected to reach over $500 billion by 2030, highlighting the immense opportunity in this niche.

- Cold Chain Management: Ensuring product integrity for temperature-sensitive drugs.

- Regulatory Navigation: Expertise in complex compliance for specialty medications.

- Patient-Centric Delivery: Tailored logistics for individual patient needs.

- High-Value Market Access: Positioned to capitalize on the growing specialty drug sector.

Cencora's extensive global pharmaceutical distribution network is a primary strength, ensuring efficient medicine delivery worldwide and providing broad market access. This established logistics capability, handling significant product volumes as seen in their 2023 operations, creates a substantial competitive advantage. Their deep, long-standing relationships with major pharmaceutical manufacturers and healthcare providers globally, which contributed to their fiscal year 2023 revenue of $262.1 billion, are foundational to their operational strength and market position.

Cencora's expertise in specialty pharmaceutical distribution is a key differentiator, particularly with the increasing prevalence of high-cost, complex medications. Their proficiency in cold chain management, regulatory compliance, and patient-centric delivery is crucial for accessing this high-value market segment, which was valued at approximately $300 billion in 2023.

| Strength | Description | Supporting Data/Impact |

| Global Distribution Network | Expansive infrastructure for efficient and reliable medicine delivery worldwide. | Facilitates broad market access and operational effectiveness. |

| Established Relationships | Deep, long-standing ties with major pharmaceutical manufacturers and healthcare providers. | Secured favorable supply agreements; Fiscal Year 2023 revenue of $262.1 billion. |

| Specialty Distribution Expertise | Proficiency in managing complex logistics for high-value specialty medications. | Addresses growing market segment (approx. $300 billion in 2023); includes cold chain and regulatory navigation. |

What is included in the product

Delivers a strategic overview of Cencora’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Cencora's key challenges and leverage its strengths for improved market performance.

Weaknesses

Cencora's performance is closely linked to the pharmaceutical sector's well-being. A slowdown in drug innovation or stricter pricing regulations, for instance, could directly affect Cencora's revenue streams.

For example, in the first quarter of 2024, Cencora reported that its Pharmaceutical Distribution segment, which is heavily influenced by the pharma industry, saw a 2% decrease in revenue compared to the same period in 2023, highlighting this dependency.

This reliance means Cencora is susceptible to broader industry-wide challenges, such as patent expirations or increased competition among drug manufacturers, which can ripple through its business operations.

Cencora, as a significant entity in pharmaceutical distribution, faces considerable exposure to regulatory and legal scrutiny. The company operates within a tightly regulated healthcare sector, meaning constant adaptation to evolving rules concerning drug pricing, supply chain integrity, and the handling of controlled substances is paramount. For instance, in 2023, Cencora (then AmerisourceBergen) was involved in settlements related to its role in the opioid crisis, highlighting the potential financial and reputational consequences of non-compliance.

Failure to adhere to these complex regulations, or facing legal challenges, can lead to severe repercussions. These include substantial financial penalties, damage to the company's public image, and significant disruptions to its day-to-day operations. The ongoing need to invest heavily in compliance measures and maintain constant vigilance underscores this ongoing weakness.

Cencora operates in a highly consolidated pharmaceutical distribution sector, facing intense competition from a few dominant players. This rivalry can put significant pressure on profit margins, especially in the distribution of lower-margin generic drugs.

To stay competitive, Cencora must continually invest in advanced technology and operational efficiencies. The company also contends with pricing pressures from both drug manufacturers and healthcare providers, which can further impact its profitability and market position.

Potential for Supply Chain Disruptions

Cencora, despite its extensive distribution network, faces inherent vulnerabilities to global supply chain disruptions. Events like geopolitical tensions, severe weather, or unforeseen pandemics can significantly impede the flow of pharmaceuticals and healthcare products. For instance, the COVID-19 pandemic in 2020-2021 highlighted the fragility of global supply chains, leading to widespread product shortages across various industries, including healthcare, which directly impacts companies like Cencora.

These disruptions can manifest in several ways, including increased lead times, higher transportation costs, and a direct impact on product availability. Such challenges can strain Cencora's ability to meet customer demand consistently, potentially affecting revenue and market share. The company must continually invest in robust risk management strategies and diversified sourcing to mitigate these external threats.

The financial implications of these disruptions can be substantial. For example, a report from McKinsey in 2023 indicated that supply chain disruptions cost the global economy trillions of dollars. For Cencora, this could translate to increased inventory holding costs, expedited shipping expenses, and lost sales opportunities.

- Geopolitical Instability: Ongoing global conflicts or trade disputes can interrupt manufacturing and shipping routes.

- Natural Disasters: Earthquakes, floods, or hurricanes can damage production facilities and transportation infrastructure.

- Pandemic Risks: Future health crises could again lead to lockdowns, labor shortages, and manufacturing halts.

- Manufacturing Issues: Quality control failures or plant shutdowns at key suppliers can create product scarcity.

Operational Costs and Margin Pressures

Cencora's extensive global distribution network, while a strength, inherently carries substantial operational costs. These include the fixed expenses of maintaining warehouses and the variable costs associated with logistics and labor. For instance, in 2023, Cencora reported total operating expenses of $21.5 billion, reflecting the scale of its network.

The pharmaceutical distribution sector frequently experiences margin pressures. This is driven by intense contract negotiations with manufacturers and payers, evolving drug pricing trends, and the inherently high volume, low margin business model for certain distribution services. Cencora's gross profit margin for 2023 was 7.4%, indicating the tight margins typical in the industry.

To combat these pressures and maintain profitability, Cencora must continuously focus on optimizing its operations and implementing stringent cost control measures. This involves finding efficiencies in its supply chain and managing overheads effectively to ensure competitive pricing and sustained financial health.

- High Fixed and Variable Costs: Operating a global distribution network incurs significant expenses in logistics, warehousing, and labor.

- Industry Margin Pressures: Contract negotiations, drug pricing, and the high-volume/low-margin nature of services squeeze profitability.

- Need for Constant Optimization: Maintaining profitability requires ongoing efforts in cost control and operational efficiency.

Cencora's reliance on the pharmaceutical industry makes it vulnerable to shifts in drug innovation and pricing regulations, as seen in its Q1 2024 results where its Pharmaceutical Distribution segment revenue decreased by 2% year-over-year. The company also faces significant regulatory and legal risks, underscored by its 2023 settlements related to the opioid crisis, which highlight the financial and reputational costs of non-compliance. Intense competition within the consolidated pharmaceutical distribution market, particularly for lower-margin generics, puts constant pressure on Cencora's profit margins, necessitating continuous investment in technology and efficiency to maintain its market position.

| Weakness | Description | Impact | Example/Data |

| Industry Dependence | Heavy reliance on the pharmaceutical sector's performance. | Vulnerability to drug innovation slowdowns or pricing pressures. | Q1 2024 Pharmaceutical Distribution revenue down 2% YoY. |

| Regulatory & Legal Exposure | Operating in a highly regulated healthcare environment. | Risk of financial penalties, reputational damage, and operational disruptions from non-compliance. | 2023 opioid crisis settlements. |

| Intense Competition & Margin Pressure | Operates in a consolidated market with dominant players. | Squeezed profit margins, especially on generics, requiring constant efficiency investments. | 2023 Gross Profit Margin of 7.4%. |

Full Version Awaits

Cencora SWOT Analysis

The preview you see is the actual Cencora SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and ready for your strategic planning.

This is a real excerpt from the complete Cencora SWOT analysis. Once purchased, you’ll receive the full, editable version to leverage for your business insights.

You’re viewing a live preview of the actual Cencora SWOT analysis file. The complete version, offering comprehensive strategic insights, becomes available after checkout.

Opportunities

Cencora has a substantial opportunity to grow by entering emerging markets. These regions often see increasing healthcare spending and a rising need for pharmaceutical distribution and services, presenting new avenues for revenue. For instance, many African nations are investing heavily in healthcare infrastructure, creating fertile ground for Cencora's expansion.

Expanding into these developing economies allows Cencora to diversify its business away from reliance on more saturated, mature markets. This geographical diversification can lead to more stable long-term growth and reduce overall business risk.

To effectively tap into these markets, Cencora can pursue strategic alliances or acquisitions. Such moves can provide immediate market access and leverage local expertise, accelerating its presence and operational capabilities in these promising new territories.

The specialty and biologics distribution market is a significant growth area, projected to reach $640 billion by 2027, up from $360 billion in 2022. Cencora is well-positioned to leverage this expansion by strengthening its specialized distribution networks and patient support services for complex therapies.

This segment offers attractive profit margins, with specialty drug distribution often yielding gross margins between 10-15%, compared to single digits for traditional pharmaceuticals. Cencora's focus here aligns with a trend toward personalized medicine and treatments for rare diseases.

Cencora can significantly enhance its operations and customer offerings by investing more in data analytics, artificial intelligence, and digital supply chain technologies. This focus allows for optimized inventory management, more precise demand forecasting, and the development of personalized patient solutions, directly addressing evolving healthcare needs.

By harnessing advanced data analytics, Cencora can unlock deeper insights for its pharmaceutical manufacturing partners, providing them with a competitive edge. For instance, improved forecasting accuracy, driven by AI, can reduce waste and improve product availability, a critical factor in the pharmaceutical supply chain.

Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships present a significant opportunity for Cencora to bolster its market position and service portfolio. By targeting innovative healthcare technology firms, smaller, specialized distributors, or niche service providers, Cencora can effectively broaden its reach and tap into new therapeutic segments. This approach is a proven accelerator for growth and capability enhancement.

Mergers and acquisitions (M&A) can be instrumental in rapidly expanding Cencora's market share and integrating cutting-edge technologies. For instance, in 2023, the healthcare distribution sector saw substantial M&A activity, with companies seeking to consolidate and diversify their offerings to navigate evolving market demands. Cencora's proactive engagement in such opportunities could yield substantial returns.

- Expand Service Offerings: Acquire companies with complementary services, such as specialty pharmacy solutions or patient support programs.

- Gain Market Share: Target smaller distributors in underpenetrated geographic regions or specific therapeutic areas.

- Enhance Capabilities: Partner with or acquire technology firms specializing in data analytics, supply chain optimization, or digital health platforms.

- Enter New Markets: Explore acquisitions or joint ventures to establish a presence in emerging healthcare markets or specialized therapeutic niches.

Development of Value-Added Services

Cencora has a significant opportunity to expand its value-added services, moving beyond traditional drug distribution. This includes offering specialized consulting on market access, leveraging real-world data to demonstrate drug effectiveness, and implementing patient adherence programs. These services can command higher profit margins compared to distribution alone.

By developing these comprehensive solutions that span the entire drug lifecycle, Cencora can deepen its partnerships with pharmaceutical manufacturers. This strategic shift is projected to bolster recurring revenue streams, providing a more stable and predictable financial performance. For instance, the company's existing specialty services segment has shown robust growth, indicating a strong market appetite for such offerings.

- Market Access Consulting: Assisting manufacturers in navigating complex reimbursement landscapes and securing market entry.

- Real-World Evidence (RWE) Generation: Utilizing data analytics to provide insights into drug performance and patient outcomes post-launch.

- Patient Adherence Programs: Developing and managing programs to improve patient compliance with prescribed treatments, thereby enhancing therapeutic success.

Cencora can capitalize on the growing demand for specialty and biologics distribution, a market anticipated to reach $640 billion by 2027. By enhancing its specialized networks and patient support, Cencora can capture a larger share of this high-margin segment, which offers gross margins of 10-15% compared to single digits for traditional pharmaceuticals.

Investing in advanced technologies like AI and data analytics presents a significant opportunity for Cencora to optimize its supply chain, improve forecasting accuracy, and offer personalized patient solutions. This technological integration can provide pharmaceutical manufacturers with a competitive edge through reduced waste and improved product availability.

Strategic acquisitions and partnerships offer a clear path for Cencora to expand its market reach and service portfolio. By integrating innovative healthcare technology firms or smaller, specialized distributors, Cencora can accelerate growth and tap into new therapeutic areas, mirroring the consolidation trends seen in the healthcare distribution sector in 2023.

Cencora can also expand its value-added services beyond distribution, including market access consulting and real-world evidence generation. These services can command higher profit margins and deepen relationships with manufacturers, fostering more stable, recurring revenue streams.

Threats

The pharmaceutical sector is grappling with a growing wave of regulations, impacting everything from drug pricing to supply chain transparency, like the Drug Supply Chain Security Act (DSCSA) in the United States. Meeting these evolving compliance demands adds significant operational costs and complexity for companies like Cencora, potentially squeezing profit margins and necessitating considerable investment in technology and staffing.

Failure to adhere to these stringent rules can result in severe financial penalties and reputational damage. For instance, in 2023, the U.S. Food and Drug Administration (FDA) continued to emphasize robust supply chain security measures, a trend expected to intensify through 2025, directly affecting distribution partners.

Ongoing political and public pressure to lower drug costs presents a substantial threat. For instance, in the U.S., the Inflation Reduction Act of 2022 allows Medicare to negotiate prices for certain high-cost drugs, a move that could impact future revenue streams for pharmaceutical manufacturers and, by extension, their distribution partners like Cencora.

Changes in reimbursement policies from governments and private insurers can also compress distributor margins. If payers shift towards value-based care models or implement stricter prior authorization requirements, it could reduce the volume of certain drugs dispensed or alter payment structures, directly affecting Cencora's profitability.

Cencora, by its nature of handling sensitive patient and proprietary pharmaceutical information, is inherently exposed to significant cybersecurity risks. A single data breach could result in substantial financial penalties, potentially in the millions, alongside severe damage to its reputation and a critical erosion of customer trust.

The ongoing threat of sophisticated cyberattacks necessitates continuous and substantial investment in protecting its extensive digital infrastructure, a challenge that requires constant vigilance and adaptation to evolving threat landscapes.

Emergence of New Supply Chain Models

Disruptive supply chain models pose a significant threat to Cencora. The potential for manufacturers to adopt direct-to-patient distribution or for large healthcare systems to increase vertical integration could bypass traditional distributors. While these models are not yet widespread, they represent a long-term risk to Cencora's market share, requiring proactive adaptation.

New entrants, particularly those leveraging advanced technology, could introduce innovative supply chain solutions that challenge Cencora's established position. For instance, a company specializing in AI-driven logistics or blockchain-secured pharmaceutical tracking might offer a more efficient or transparent alternative, potentially fragmenting the market.

- Direct-to-Patient Models: Manufacturers exploring direct sales could reduce reliance on intermediaries, impacting distributor volumes.

- Vertical Integration by Healthcare Systems: Large hospital networks managing their own drug procurement and distribution could shrink the addressable market for companies like Cencora.

- Technological Disruption: Startups with novel logistics or supply chain management software could offer competitive advantages, potentially siphoning off business.

Economic Downturns and Healthcare Spending Cuts

Economic downturns pose a significant threat to Cencora. Global or regional recessions can trigger substantial cuts in healthcare spending by governments, insurers, and individuals, directly impacting pharmaceutical sales volumes. For instance, during periods of economic contraction, discretionary healthcare spending often shrinks, affecting the demand for non-essential treatments and services that Cencora distributes.

Budgetary constraints faced by healthcare providers, a common consequence of economic downturns, can also translate into more stringent contract negotiations. This could lead to reduced demand for Cencora's distribution and related services as providers seek cost efficiencies. For example, in late 2023 and early 2024, many healthcare systems reported increased financial pressures, leading to a more cautious approach to vendor contracts.

These macroeconomic shifts can have a direct and measurable impact on Cencora's financial performance and growth trajectory. Reduced spending power across the healthcare ecosystem directly affects the volume of products Cencora handles and the revenue generated from its services. The company's reliance on robust healthcare spending makes it particularly vulnerable to these cyclical economic pressures.

- Reduced Demand: Economic downturns can decrease patient volumes and prescription rates, lowering the overall demand for pharmaceuticals and healthcare products distributed by Cencora.

- Pricing Pressure: Governments and payers may implement stricter price controls or demand deeper discounts during economic hardship, squeezing margins for distributors like Cencora.

- Contract Renegotiations: Healthcare providers facing financial strain may seek to renegotiate terms with suppliers and distributors, potentially impacting Cencora's revenue and profitability.

- Investment Slowdown: Economic uncertainty can lead to reduced investment in new healthcare technologies and treatments, indirectly affecting the pipeline of products Cencora will distribute in the future.

Intensifying regulatory scrutiny and evolving compliance requirements, such as the continued implementation of the Drug Supply Chain Security Act (DSCSA) through 2025, present ongoing operational challenges and costs for Cencora. Furthermore, political pressure to lower drug prices, exemplified by the Inflation Reduction Act of 2022, directly threatens revenue streams by enabling price negotiations for high-cost drugs.

Cybersecurity threats remain a significant concern, with the potential for data breaches to incur millions in penalties and severely damage Cencora's reputation and customer trust. Disruptive supply chain models, including direct-to-patient distribution and increased vertical integration by healthcare systems, pose a long-term risk to Cencora's market share by potentially bypassing traditional distribution channels.

Economic downturns can lead to reduced healthcare spending, impacting pharmaceutical sales volumes and potentially forcing more stringent contract negotiations with healthcare providers facing financial strain, as observed in late 2023 and early 2024. This macroeconomic vulnerability can directly affect Cencora's revenue and growth trajectory.

SWOT Analysis Data Sources

This Cencora SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry analysis to provide a well-rounded and actionable strategic overview.