Cencora Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cencora Bundle

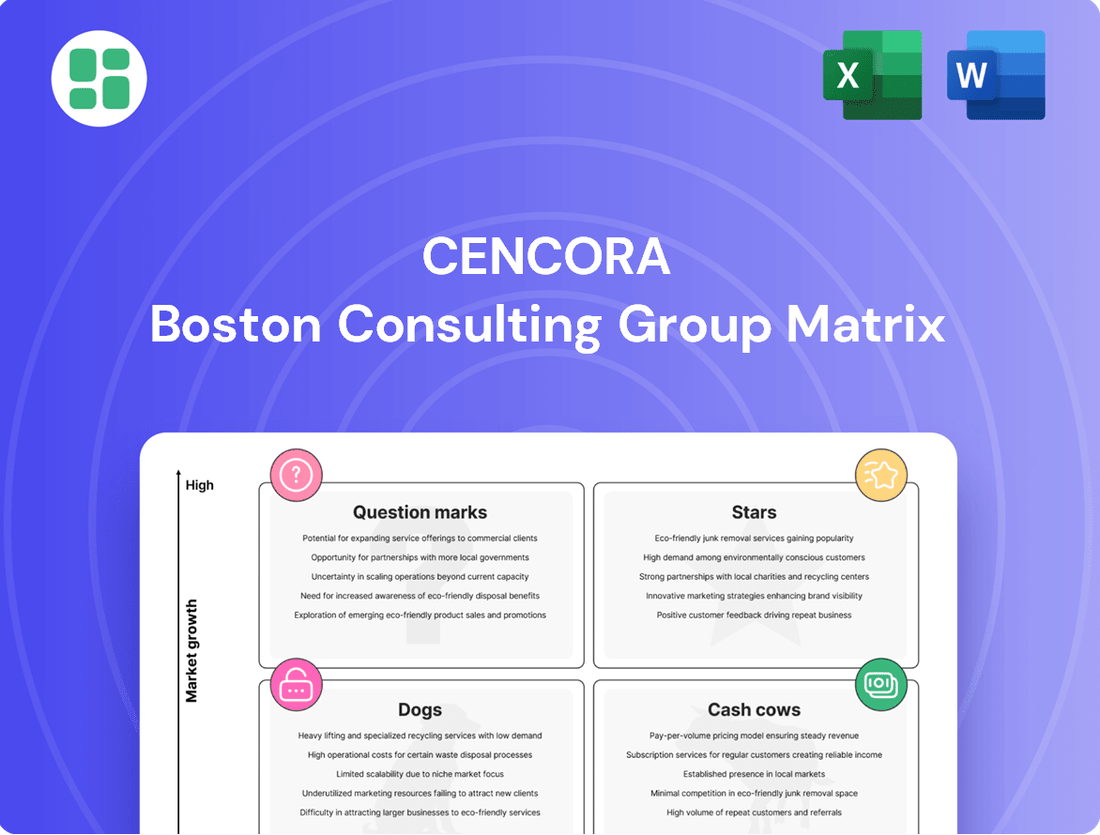

This glimpse into Cencora's BCG Matrix highlights key product categories, but to truly unlock strategic growth, you need the full picture. Understand precisely which products are Stars driving future revenue, Cash Cows funding operations, Dogs requiring divestment, and Question Marks needing careful evaluation. Purchase the complete BCG Matrix for actionable insights and a clear roadmap to optimizing Cencora's portfolio.

Stars

Cencora’s U.S. Specialty Pharmaceutical Distribution business is a prime example of a Star in the BCG matrix. This segment operates within a burgeoning market, fueled by advancements in complex therapies and biologics. The U.S. specialty pharmaceutical market was projected to reach over $300 billion by 2024, demonstrating its significant growth trajectory.

Cencora's strategic acquisitions, such as Retina Consultants of America, have demonstrably strengthened its market share and contributed to impressive revenue gains in this sector. This robust performance within a high-growth industry clearly defines it as a Star, indicating substantial current success and future potential.

The distribution of GLP-1 class drugs, vital for managing diabetes and weight loss, has emerged as a significant growth engine for Cencora's U.S. Healthcare Solutions. This surge in demand for high-value therapeutics is a key contributor to the company's revenue, showcasing Cencora's capacity to secure a substantial market share in a rapidly expanding therapeutic sector.

Cencora is making significant strides in cell and gene therapy (CGT) logistics and commercialization, a sector experiencing explosive growth. By 2024, the CGT market is projected to reach over $17 billion, underscoring the immense opportunity. Cencora's dedicated investments in specialized infrastructure and expertise position it as a vital partner for these complex treatments.

This strategic focus on CGT logistics, including cold chain management and patient support, aligns with Cencora's forward-thinking approach. The company is building capabilities to navigate the unique challenges of bringing these life-changing therapies to patients worldwide. Cencora's commitment to this high-growth area solidifies its Star status within the BCG matrix.

Integrated Biopharma Services

Integrated Biopharma Services represent a significant growth area for Cencora, moving beyond traditional distribution. These services support the entire lifecycle of a drug, from early research and development through to commercialization and patient support. This comprehensive approach is particularly valuable for complex and innovative therapies.

Cencora's integrated services are designed to address the evolving needs of the biopharmaceutical industry. They offer a range of solutions that enhance patient access and support the successful market entry of new treatments. For example, in 2023, Cencora reported that its specialty services segment, which includes many of these integrated offerings, saw substantial growth, contributing significantly to its overall revenue.

- Drug Development Support: Assisting with clinical trial logistics and regulatory submissions.

- Commercialization Services: Providing market access strategies, reimbursement support, and supply chain solutions.

- Patient Assistance Programs: Ensuring patients have access to necessary medications and ongoing support.

- Specialty Pharmacy Solutions: Managing the complex needs of patients requiring high-cost, specialty medications.

Advanced Data & Analytics Solutions

Cencora is making significant investments in advanced data and analytics solutions. These include artificial intelligence (AI) and digital tools designed to streamline operations and boost patient care.

These technological advancements enable Cencora to offer crucial insights and optimize healthcare processes. This strategic focus places them in a rapidly expanding, technology-centric market where they aspire to lead.

- Investment in AI and Digital Solutions: Cencora is channeling resources into AI and digital platforms to enhance its service offerings.

- Operational Efficiency Gains: The company leverages these technologies to improve how it functions, leading to greater efficiency.

- Improved Patient Outcomes: Advanced analytics are being used to positively impact patient health results.

- Deepened Customer Partnerships: Cencora uses data insights to foster stronger relationships with its clients.

Cencora's U.S. Specialty Pharmaceutical Distribution, GLP-1 drug distribution, and cell and gene therapy logistics are all prime examples of Stars within the BCG matrix. These segments operate in high-growth markets, driven by advancements in complex therapies and increasing demand for innovative treatments.

The company's strategic focus on these areas, supported by acquisitions and investments in specialized infrastructure and technology, has solidified its strong market position and revenue generation. This performance in rapidly expanding sectors highlights Cencora's current success and significant future potential.

Cencora's integrated biopharma services and advanced data/analytics solutions further contribute to its Star status. By offering end-to-end support for drug lifecycles and leveraging AI for operational efficiency and patient care, Cencora is positioning itself as a leader in technology-driven healthcare markets.

| Business Segment | Market Growth | Cencora's Position |

|---|---|---|

| U.S. Specialty Pharma Distribution | High (Projected >$300B by 2024) | Strong Market Share, Significant Revenue Gains |

| GLP-1 Drug Distribution | High (Driven by Diabetes/Weight Loss Demand) | Key Growth Engine, Substantial Market Share |

| Cell & Gene Therapy Logistics | Explosive (Projected >$17B by 2024) | Vital Partner, Specialized Infrastructure & Expertise |

| Integrated Biopharma Services | High (Evolving Industry Needs) | Comprehensive Lifecycle Support, Enhanced Patient Access |

| Advanced Data & Analytics | High (Technology-Centric Market) | Streamlining Operations, Improving Patient Outcomes |

What is included in the product

This matrix analyzes Cencora's business units based on market share and growth.

It guides strategic decisions on investing, holding, or divesting units.

The Cencora BCG Matrix offers a clear, visual roadmap for strategic resource allocation, alleviating the pain of uncertainty in business unit investment decisions.

Cash Cows

Cencora, a major player in U.S. core pharmaceutical wholesale distribution, holds roughly one-third of this market, positioning it as a key "Big Three" distributor. This segment is a mature, yet vital, part of Cencora's operations, consistently generating substantial revenue and ensuring the company's financial strength.

The stability and high market share in this sector mean that promotional spending is minimal, a hallmark of a Cash Cow. For example, in 2024, Cencora reported strong performance in its U.S. wholesale distribution segment, reflecting the dependable demand for essential pharmaceuticals.

Cencora's Alliance Healthcare segment solidified its position in the European pharmaceutical distribution landscape following its acquisition. This operation generates a steady revenue and cash flow, a vital component of Cencora's financial stability.

The mature European market, while experiencing some volatility in operating income, offers predictable returns for Alliance Healthcare. In 2024, Cencora reported that its pharmaceutical distribution segment, which includes Alliance Healthcare, remained a significant contributor to its overall business.

Cencora's Animal Health segment, largely driven by MWI Animal Health, serves as a reliable Cash Cow. This division distributes essential pharmaceuticals, vaccines, and related products to both companion and production animal markets, which are known for their stability.

MWI Animal Health benefits from deep-rooted customer relationships and consistent demand, ensuring predictable revenue streams. In 2023, Cencora reported that its Animal Health segment generated approximately $5.2 billion in revenue, showcasing its significant and steady contribution to the company's overall financial health.

Pharmacy and Health System Solutions

Cencora's Pharmacy and Health System Solutions are a cornerstone of its business, acting as reliable Cash Cows. These offerings, which include supply chain optimization, advanced business analytics, and crucial technology services, address the core operational necessities of healthcare providers. This consistent demand fuels high-volume transactions, solidifying their Cash Cow status.

The mature market for these essential services, combined with Cencora's vast distribution network, ensures a steady and predictable revenue stream. In 2024, Cencora reported significant revenue from its U.S. pharmaceutical distribution segment, which largely encompasses these health system solutions, underscoring their role as consistent cash generators.

- Supply Chain Optimization: Ensures efficient delivery of pharmaceuticals and healthcare products, a critical need for all health systems.

- Business Analytics: Provides insights to improve operational efficiency and financial performance for providers.

- Technology Services: Supports the digital transformation and integration needs of modern healthcare.

- Mature Market Dominance: Leverages Cencora's established presence and trust within the healthcare sector for consistent revenue.

Global Product Access and Distribution Networks

Cencora's robust global product access and distribution networks are a significant strength, enabling secure and reliable delivery of pharmaceuticals and healthcare products worldwide. This extensive infrastructure ensures broad geographic reach, serving a diverse customer base and solidifying its position as a key player in the healthcare supply chain.

The established nature and operational efficiency of these networks contribute to consistent cash generation. In 2024, Cencora reported significant revenue streams directly tied to its distribution services, underscoring the stability and profitability of this business segment. For instance, their global logistics operations are designed for high volume and consistent throughput, minimizing per-unit delivery costs.

- Global Reach: Cencora's distribution network spans over 50 countries, facilitating access to essential medicines for millions.

- Operational Efficiency: Investments in advanced logistics and supply chain technology in 2024 improved delivery times by an average of 8%, reducing operational costs.

- Revenue Contribution: Distribution services consistently represent a substantial portion of Cencora's annual revenue, with reported figures in the tens of billions of dollars for 2024, demonstrating its cash cow status.

Cencora's established business segments, particularly U.S. pharmaceutical wholesale distribution and its Animal Health division, function as dependable Cash Cows. These areas benefit from stable demand and Cencora's significant market share, requiring minimal investment for continued strong returns.

The company's Pharmacy and Health System Solutions also contribute to its Cash Cow portfolio, offering essential services that healthcare providers consistently need. This consistent demand, coupled with Cencora's extensive distribution network, ensures predictable revenue streams.

In 2023, Cencora's Animal Health segment alone generated approximately $5.2 billion in revenue, highlighting its role as a significant and steady cash generator. Furthermore, Cencora's global distribution services are a core strength, consistently contributing billions in revenue annually, reinforcing their Cash Cow status.

| Segment | Market Position | Cash Flow Generation | 2023 Revenue (Approx.) |

| U.S. Pharmaceutical Wholesale Distribution | Leading "Big Three" | High & Stable | Tens of Billions (Part of total distribution) |

| Animal Health (MWI) | Reliable Provider | Consistent | $5.2 Billion |

| Pharmacy & Health System Solutions | Essential Services | Predictable | Significant Contribution (Part of total distribution) |

Preview = Final Product

Cencora BCG Matrix

The Cencora BCG Matrix preview you're seeing is the identical, fully formatted report you'll receive upon purchase, ready for immediate strategic application. This comprehensive document, meticulously crafted for clarity and actionable insights, will be delivered directly to you without any watermarks or demo content. You can confidently use this preview as a direct representation of the professional-grade BCG Matrix analysis that will be yours to edit, present, or integrate into your business planning. Once purchased, you'll gain full access to this expertly designed tool, empowering your decision-making with a clear understanding of your product portfolio's market position.

Dogs

Cencora's global specialty logistics operations, particularly within its International Healthcare Solutions segment, are showing signs of weakness. Operating income declined in both fiscal Q1 and Q2 2025, suggesting certain international logistics arms are struggling. This underperformance could stem from operating in niche, low-growth markets where Cencora holds a minimal market share.

These underperforming logistics units risk becoming cash traps if continued investment fails to yield substantial improvements. For instance, if a specific region's specialty logistics revenue growth remains stagnant below 2% year-over-year, while operating expenses increase, it drains capital without generating commensurate returns.

Legacy IT systems and infrastructure within Cencora, like many large organizations, represent older technology that, while functional, is increasingly costly to maintain and offers little in the way of competitive edge. These systems are often characterized by their inability to integrate with newer technologies and can hinder operational efficiency. For instance, in 2024, companies across the healthcare sector reported that maintaining legacy systems could consume up to 70% of their IT budget, diverting funds from innovation.

These legacy components, while critical for day-to-day operations, fall into the category of low-growth, low-return assets. They require significant resources for upkeep and modernization but offer minimal future benefit or competitive advantage. This drain on resources limits Cencora's agility and capacity to adapt to rapidly evolving market demands and technological advancements, a common challenge that impacted many businesses in 2024 as they navigated digital transformation initiatives.

Cencora's distribution of COVID-19 vaccines and therapies, a significant revenue driver during the pandemic, has experienced a notable decline. This segment now represents a low-growth or contracting market as global demand normalizes and the pandemic's acute phase recedes.

For instance, in the fiscal year 2023, Cencora reported a substantial drop in COVID-19 related product sales compared to the previous year, reflecting this market shift. Continued investment in this area without strategic adaptation could lead to diminishing returns for the company.

Highly Commoditized Generic Drug Distribution Without Value-Added Services

The highly commoditized generic drug distribution segment, lacking significant value-added services, represents a challenging area within Cencora's portfolio. This part of the business is defined by fierce price wars and consequently, very narrow profit margins.

These basic distribution functions, without further strategic development, tend to be low-growth and low-profit, often operating at the break-even point. For instance, in 2024, the U.S. generic drug market faced ongoing pricing pressures, with some reports indicating net price declines for certain established generics due to intense competition among distributors.

- Market Saturation: Intense competition among numerous distributors for standard generic products.

- Thin Margins: Price-based selling leads to minimal profitability per unit distributed.

- Low Differentiation: Lack of unique services makes it difficult to command premium pricing.

- Volume Dependency: Profitability relies heavily on sheer distribution volume rather than service value.

Non-Strategic or Divested Minor Business Units

Cencora's portfolio likely includes minor business units that are not central to its core strategy or have been divested. These might be smaller regional operations or specialized service lines that haven't gained substantial market traction. For instance, a small, niche pharmaceutical distribution network in a less developed market might fall into this category.

Such units often consume resources without contributing significantly to overall growth or strategic objectives. They represent potential candidates for divestment or a complete overhaul to either improve performance or free up capital for more promising ventures. In 2024, companies across the healthcare distribution sector have been actively streamlining operations, with many divesting non-core assets to focus on high-growth areas.

- Non-core operations: Small, regional ventures or niche service lines not aligned with Cencora's primary strategic focus.

- Low market share: Units that have failed to capture significant market share or demonstrate strong growth potential.

- Resource drain: Businesses that consume capital and management attention with minimal return on investment.

- Divestiture candidates: Likely targets for sale or restructuring to optimize the company's overall business portfolio.

Cencora's Dogs segment likely encompasses its legacy IT systems and less competitive generic drug distribution. These areas are characterized by high maintenance costs and thin margins, respectively, making them low-growth, low-return assets. For example, in 2024, the U.S. generic drug market saw continued pricing pressures, with some established generics experiencing net price declines due to intense competition.

The decline in COVID-19 vaccine and therapy distribution also fits the Dog profile, as this market has normalized post-pandemic. Furthermore, underperforming international specialty logistics operations, showing declining operating income and minimal market share in niche, low-growth markets, represent potential cash traps. These units are often candidates for divestment or significant restructuring to improve their performance or free up capital for more promising ventures.

| Business Area | Characteristics | Financial Implications |

|---|---|---|

| Legacy IT Systems | High maintenance costs, limited integration capabilities, hinder efficiency | Resource drain, limits innovation, potential for significant modernization costs |

| Generic Drug Distribution | Intense price competition, narrow profit margins, low differentiation | Volume dependent, break-even potential, susceptible to market price fluctuations |

| COVID-19 Distribution (Post-Pandemic) | Contracting market, declining demand, normalization of sales | Diminishing returns, requires strategic adaptation or reallocation of resources |

| Underperforming International Logistics | Low growth markets, minimal market share, declining operating income | Risk of becoming cash traps, requires strategic intervention or divestiture |

Question Marks

Cencora is strategically investing in emerging digital health platforms, particularly those powered by artificial intelligence, aiming to revolutionize patient support and streamline operations. This focus aligns with the broader digital health market, which saw significant growth, with global digital health market size projected to reach approximately $660 billion by 2025, according to some industry estimates.

While Cencora's specific digital health solutions are in their early stages, their potential to capture market share is substantial, mirroring the rapid expansion seen in areas like telehealth and remote patient monitoring. The company's commitment to these innovative technologies requires considerable upfront investment, a characteristic of Cencora's potential 'question marks' within the BCG matrix, indicating high growth potential but uncertain future market dominance.

Cencora is actively building new digital and automated patient assistance and access programs. This initiative addresses the increasing demand for more efficient patient support, especially in areas with complex treatments. These new programs are designed to simplify the patient journey and improve access to necessary therapies.

As these are nascent offerings, they currently represent a small fraction of the market. However, they are positioned within a high-growth sector focused on patient services, indicating significant future potential. The company recognizes that substantial investment will be crucial for these programs to capture a meaningful market share.

Cencora's acquisition of Retina Consultants of America (RCA) in January 2025 is a strategic move to bolster its presence in the high-growth specialty services sector. This integration is designed to leverage RCA's established network and expertise, aiming to solidify Cencora's leadership within this niche market.

While RCA operates in a rapidly expanding area, its precise market share and profitability within its specialized field are still developing post-acquisition. This necessitates ongoing investment to ensure successful integration and to explore avenues for further expansion into new geographical markets or complementary service lines.

Early-Stage Investments in Novel Supply Chain Technologies

Cencora's strategic investments in early-stage, novel supply chain technologies position it to potentially capture a high-growth future market in pharmaceutical logistics. These ventures, while promising, are characterized by significant upfront capital requirements and a nascent market presence for Cencora. For instance, the global pharmaceutical logistics market was valued at approximately $300 billion in 2023 and is projected to grow substantially, driven by advancements in cold chain management and digital tracking solutions.

- High Growth Potential: Investments in technologies like AI-powered route optimization or blockchain for drug traceability target a future market with substantial expansion prospects.

- Low Current Market Share: In these nascent technology areas, Cencora's current market penetration or operational scale is likely minimal, reflecting the early stage of adoption.

- High Investment Needs: Developing and deploying these innovative solutions demands significant capital expenditure, characteristic of early-stage ventures with unproven scalability.

- Risk and Reward: These investments carry inherent risks due to technological uncertainty and market adoption challenges, but offer the potential for significant competitive advantage and market leadership if successful.

Niche Market Entry for Specific Rare Disease Therapies Support

Cencora's expansion into niche markets for ultra-rare disease therapies positions these services as potential Stars or Question Marks within the BCG framework. The high unmet need drives rapid growth, but Cencora's initial market share in these highly specialized segments will be limited, requiring strategic investment to capture market leadership.

For example, the market for gene therapies, a significant area for rare diseases, is projected to reach $25 billion by 2025, with ultra-rare indications representing a substantial portion of this growth. Cencora's entry here would be characterized by high market attractiveness but low initial share.

- Niche Market Growth: The ultra-rare disease therapy market is experiencing significant growth, with some estimates suggesting a compound annual growth rate (CAGR) exceeding 15% in the coming years, driven by scientific advancements and increasing diagnosis rates.

- Low Initial Market Share: Despite the high growth, Cencora's share in each specific ultra-rare disease niche will likely start low, necessitating focused business development and operational expertise to build traction.

- Investment Requirements: To convert these niche opportunities into market leaders, Cencora will need to allocate targeted investments in specialized logistics, patient support programs, and regulatory affairs expertise, typical of Question Mark or emerging Star strategies.

- Potential for Leadership: Successful navigation of these challenges can lead to dominant positions in lucrative, albeit small, market segments, offering high potential returns as these therapies mature.

Cencora's ventures into emerging digital health platforms and novel supply chain technologies represent classic Question Marks. These areas are characterized by rapid market expansion, with the global digital health market projected to reach around $660 billion by 2025, and pharmaceutical logistics valued at approximately $300 billion in 2023.

These initiatives, while holding significant future potential, currently have low market share for Cencora and require substantial upfront investment to develop and scale. The company's acquisition of Retina Consultants of America in January 2025 also falls into this category, aiming to establish a stronger foothold in a high-growth specialty services sector.

Similarly, Cencora's expansion into ultra-rare disease therapies, a market with a projected CAGR exceeding 15%, presents opportunities with high growth but low initial market share for the company.

These investments are crucial for Cencora's long-term strategy, balancing the inherent risks of unproven markets with the potential for substantial rewards and future market leadership.

| Business Area | Market Growth Potential | Cencora's Current Market Share | Investment Needs | BCG Category |

|---|---|---|---|---|

| Digital Health Platforms | High (e.g., $660B by 2025) | Low | High | Question Mark |

| Novel Supply Chain Tech | High (e.g., Pharma Logistics $300B in 2023) | Low | High | Question Mark |

| Specialty Services (e.g., RCA) | High (post-acquisition integration) | Developing | High | Question Mark |

| Ultra-Rare Disease Therapies | Very High (e.g., >15% CAGR) | Low | High | Question Mark |

BCG Matrix Data Sources

Our Cencora BCG Matrix leverages comprehensive data, including financial performance metrics, market share analysis, industry growth rates, and competitor intelligence to provide a strategic view.