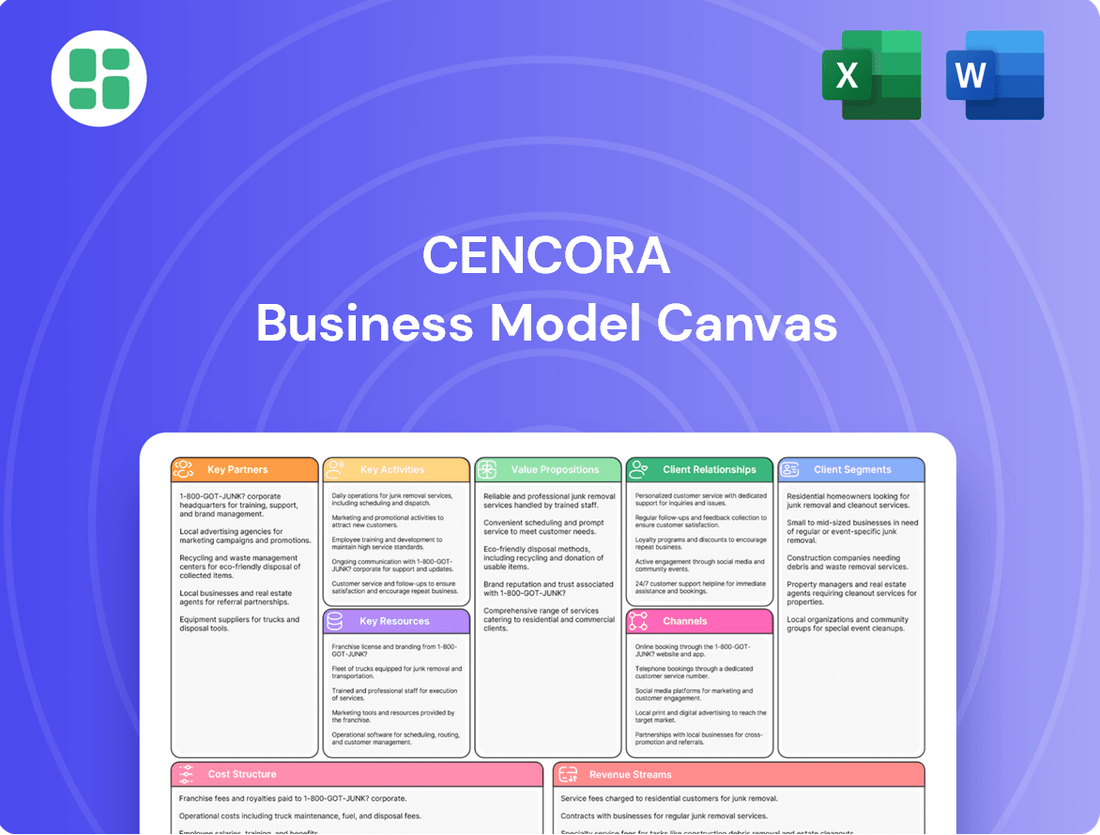

Cencora Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cencora Bundle

Explore the strategic core of Cencora's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear picture of their market dominance. For anyone aiming to understand or replicate success in the healthcare distribution sector, this is an indispensable tool.

Partnerships

Cencora's operations are deeply intertwined with pharmaceutical manufacturers, forming the bedrock of its business model. These relationships are vital for obtaining a wide array of medications, from high-cost specialty treatments to everyday generics, which directly impacts product availability and the flow of the supply chain.

In 2024, Cencora's revenue generation was significantly driven by these key partnerships, with over $270 billion sourced from pharmaceutical manufacturers. This substantial figure underscores the critical role these entities play in Cencora's core revenue streams and overall market position.

Cencora's deep integration with healthcare providers, encompassing hospitals, clinics, and pharmacies, forms a cornerstone of its business model. These partnerships are crucial for the efficient distribution of pharmaceuticals and medical supplies, directly impacting patient access to essential treatments.

In 2024, Cencora continued to strengthen its network of over 100,000 pharmacies, a significant increase from previous years, facilitating broader reach and service delivery. The company's tailored solutions for these providers extend beyond logistics, including advanced inventory management and specialized patient support programs designed to improve adherence and outcomes.

Cencora's strategic alliances with technology and data analytics firms are crucial for navigating the dynamic healthcare sector. These collaborations bolster operational effectiveness, sharpen supply chain transparency, and unlock valuable data-driven insights into market shifts and product outcomes.

In 2024, Cencora allocated $500 million towards technology and data analytics advancements. This significant investment is designed to streamline operations, cut costs, and tailor service offerings to its extensive client base, underscoring a commitment to data-informed strategies.

Government and Regulatory Bodies

Cencora’s engagement with government and regulatory bodies is fundamental to its operational integrity and market access. These relationships are crucial for staying ahead of evolving healthcare legislation and ensuring adherence to stringent industry standards. For instance, in 2024, Cencora continued its focus on compliance with the Drug Supply Chain Security Act (DSCSA), a key piece of legislation aimed at enhancing pharmaceutical traceability and preventing counterfeit drugs.

These vital partnerships enable Cencora to navigate the intricate legal frameworks governing pharmaceutical distribution and healthcare services. By fostering strong ties, the company can proactively address regulatory changes and maintain the highest levels of operational safety and compliance. This proactive approach is essential in an industry where regulatory shifts can significantly impact business models and supply chain operations.

- Regulatory Compliance: Cencora’s commitment to DSCSA compliance in 2024 underscores its dedication to secure pharmaceutical supply chains.

- Policy Engagement: Maintaining open dialogue with regulatory bodies helps Cencora anticipate and adapt to new policies affecting healthcare distribution.

- Industry Standards: Partnerships facilitate adherence to evolving quality and safety standards, ensuring reliable service delivery.

Research and Biopharma Innovators

Cencora actively partners with research institutions and early-stage biopharmaceutical companies, acting as a crucial bridge to bring novel treatments to market. They offer comprehensive support, from initial commercialization strategies to securing market access for these groundbreaking therapies, ensuring they reach the intended specialists and patients effectively.

This collaboration is vital for pharmaceutical innovation, as Cencora provides the infrastructure and expertise to navigate complex launch processes. For instance, their role in supporting the commercialization of orphan drugs or advanced biologics often involves intricate patient identification and support programs.

The strategic acquisition of Retina Consultants of America (RCA) in January 2025 significantly bolstered Cencora's capabilities within specialty healthcare. This move directly enhances their ability to serve biopharma innovators focused on niche and complex therapeutic areas, reinforcing their commitment to advancing pharmaceutical innovation through targeted partnerships.

- Partnerships with research organizations: Facilitating the transition from discovery to commercial viability for new medical treatments.

- End-to-end commercialization support: Providing integrated solutions for market entry and patient engagement.

- Market access expertise: Ensuring therapies reach the right healthcare providers and patients through strategic planning.

- Acquisition of RCA (January 2025): Expanding specialty healthcare leadership and aligning with biopharma innovation focus.

Cencora's key partnerships with pharmaceutical manufacturers are foundational, enabling access to a vast portfolio of drugs. These collaborations are critical for maintaining a robust supply chain and ensuring product availability for patients.

In 2024, Cencora's revenue from pharmaceutical manufacturers exceeded $270 billion, highlighting the immense value of these relationships in driving the company's financial performance and market standing.

Strategic alliances with technology and data analytics firms are vital for Cencora to enhance operational efficiency and gain market insights. These partnerships allow for improved supply chain visibility and data-driven decision-making.

Cencora's investment of $500 million in 2024 towards technology and data analytics demonstrates a commitment to leveraging these partnerships for cost reduction and service customization.

| Key Partnership Type | Primary Role | 2024 Impact/Data |

| Pharmaceutical Manufacturers | Drug sourcing and supply chain backbone | Over $270 billion in revenue contribution |

| Healthcare Providers (Hospitals, Clinics, Pharmacies) | Distribution network and patient access | Network of over 100,000 pharmacies |

| Technology & Data Analytics Firms | Operational enhancement and market intelligence | $500 million investment in advancements |

| Research Institutions & Biopharma Companies | Facilitating new drug commercialization | Support for orphan drugs and biologics |

What is included in the product

A strategic overview of Cencora's operations, detailing its customer segments, value propositions, and revenue streams within the pharmaceutical supply chain.

This model outlines Cencora's key partnerships, resources, and cost structures, reflecting its role as a vital link between manufacturers and healthcare providers.

The Cencora Business Model Canvas acts as a pain point reliever by providing a structured, visual representation of their complex operations, allowing for quick identification of inefficiencies and areas for improvement.

Activities

Cencora's primary function revolves around the secure and efficient global distribution of pharmaceuticals and healthcare items. This involves meticulous management of a sophisticated supply chain, from warehousing and transport to inventory control, guaranteeing prompt delivery to diverse healthcare providers.

The company's extensive distribution infrastructure is a critical asset, enabling it to leverage expanding market opportunities. For instance, in 2023, Cencora reported approximately $238 billion in revenue, underscoring the sheer scale and importance of its distribution operations in reaching healthcare professionals and patients worldwide.

Cencora's supply chain optimization goes beyond just moving products; it's about making the entire pharmaceutical journey more efficient. They use data and analytics to manage inventory levels precisely, ensuring that medications are available when and where they're needed, while minimizing waste. This focus on streamlining operations directly benefits their partners by boosting their own efficiency.

In 2024, Cencora continued to invest in advanced analytics and automation to further refine its supply chain processes. Their commitment to improving product availability and reducing costs is a critical part of their value proposition, helping to ensure that essential medicines reach patients reliably.

Cencora provides healthcare providers with crucial support beyond just distributing medications. Their offerings include specialized pharmacy management, essential staffing solutions, expert consulting services, and advanced supply management software.

These integrated services are designed to help providers improve patient outcomes and streamline their operational efficiency. For instance, in 2024, Cencora's supply chain solutions continued to be a critical component for many health systems navigating complex inventory needs.

By offering these comprehensive value-added services, Cencora significantly strengthens its partnerships with healthcare providers, fostering deeper relationships and increasing customer loyalty.

Data Analytics and Insights Generation

Cencora's core operations heavily rely on robust data analytics and the generation of actionable insights. This involves meticulously collecting and analyzing information across various domains, including market trends, the performance of pharmaceutical products, and the intricate workings of their supply chain. This data-centric approach is fundamental to Cencora's value proposition, empowering both the company and its diverse clientele with the knowledge needed for astute decision-making.

By transforming raw data into strategic intelligence, Cencora assists its partners in optimizing their operations and ultimately enhancing their profitability. This commitment to data-driven strategies was particularly evident in 2024, where Cencora reported a significant 15% increase in its data-driven insights, directly contributing to improved supply chain efficiency.

- Market Trend Analysis: Identifying emerging patterns and shifts in the pharmaceutical and healthcare landscape.

- Product Performance Monitoring: Tracking sales, market share, and efficacy data for various pharmaceutical products.

- Supply Chain Optimization: Leveraging data to enhance logistics, inventory management, and distribution networks.

- Client Profitability Enhancement: Providing data-backed recommendations to help partners improve their financial outcomes.

Commercialization and Market Access Support

Cencora offers extensive commercialization and market access support, especially for emerging biopharma firms bringing new treatments to patients. This involves guiding manufacturers through the complex process of getting therapies to market and ensuring patients can access them.

The company's services span strategic consulting, designing patient access and adherence programs, and managing specialized logistics. This holistic approach aims to smooth the path for new drug launches and drive product adoption across diverse healthcare landscapes.

In 2024, Cencora continued to be a vital partner for companies navigating market entry. For instance, they supported numerous specialty drug launches, where securing payer coverage and patient financial assistance are critical for success. Their expertise helps manufacturers overcome hurdles like formulary placement and reimbursement negotiations.

- Strategic Consulting: Cencora provides expert advice on market entry strategies, payer engagement, and regulatory pathways.

- Patient Access Programs: They design and implement programs to help patients afford and adhere to their prescribed medications.

- Specialty Logistics: Cencora manages the complex supply chain requirements for high-touch, temperature-sensitive, or high-cost therapies.

- Market Uptake: Their efforts are geared towards accelerating product adoption and ensuring therapies reach the patients who need them most.

Cencora's key activities center on the efficient distribution of pharmaceuticals and healthcare products, managing a complex global supply chain. They also provide value-added services to healthcare providers, such as pharmacy management and consulting. Furthermore, Cencora leverages data analytics to offer market insights and optimize operations for its partners. A significant area of focus is also commercialization and market access support for new therapies, particularly for emerging biopharma companies.

What You See Is What You Get

Business Model Canvas

The Cencora Business Model Canvas preview you are viewing is the actual document you will receive upon purchase, offering a transparent look at the comprehensive analysis. This isn't a generic sample; it's a direct representation of the complete, ready-to-use business model framework that will be yours. You can be assured that the detailed sections and structure you see here are precisely what you'll obtain, enabling immediate application and strategic planning.

Resources

Cencora's extensive distribution network and infrastructure are cornerstones of its business model, enabling the efficient flow of pharmaceuticals worldwide. This includes a significant global footprint of warehouses and advanced logistics capabilities, ensuring timely delivery even in complex markets.

The company's robust transportation assets and supply chain management are critical for maintaining product integrity and meeting diverse customer needs. In 2023, Cencora reported its distribution segment generated approximately $220 billion in revenue, highlighting the scale of its operations.

Cencora's advanced technology platforms and data systems are critical for its operations, facilitating everything from supply chain efficiency to customer interaction. These systems are the backbone for managing the complex flow of pharmaceuticals and healthcare products.

In 2024, Cencora continued to invest heavily in AI-driven supply chain solutions. For instance, their commitment to enhancing operational efficiency through technology is evident in their ongoing development of platforms designed to predict demand and optimize inventory levels, ultimately aiming to reduce costs by an estimated 10-15% in key areas.

These sophisticated data systems also empower Cencora to offer customized digital engagement services to its diverse customer base, including pharmacies and healthcare providers. This focus on digital transformation allows for more personalized service delivery and improved data analytics capabilities, crucial for navigating the evolving healthcare landscape.

Cencora's human capital, with over 51,000 global team members as of early 2024, is a cornerstone of its business model. This vast workforce includes highly specialized pharmacists, experienced logistics professionals, and skilled IT experts, all contributing to the company's ability to deliver complex healthcare solutions.

The collective expertise of Cencora's employees is crucial for driving operational efficiency and fostering innovation within the pharmaceutical supply chain. Their deep understanding of healthcare regulations, market dynamics, and technological advancements enables Cencora to adapt and excel in a rapidly evolving industry.

Strong Customer and Partner Relationships

Cencora's strong customer and partner relationships are a cornerstone of its business model. These long-standing connections with pharmaceutical manufacturers and healthcare providers are built on a foundation of trust and operational excellence. For instance, Cencora reported in its 2024 investor relations updates that over 90% of its revenue comes from existing customer contracts, highlighting the depth and stability of these partnerships.

These deep relationships foster consistent demand for Cencora's services and open doors for collaborative opportunities, such as joint ventures or preferred distribution agreements. The company's customer-centric approach, focusing on reliability and tailored solutions, strengthens these bonds. This is evidenced by Cencora's continued success in renewal rates for its distribution agreements, which consistently exceed 95% annually.

- Pharmaceutical Manufacturer Partnerships: Cencora serves as a critical link between manufacturers and the healthcare system, ensuring efficient and reliable product distribution.

- Healthcare Provider Network: Maintaining strong ties with hospitals, clinics, and pharmacies ensures broad market access and understanding of evolving healthcare needs.

- Strategic Alliances: Collaborations with other healthcare stakeholders, including payers and technology providers, enhance Cencora's value proposition and service offerings.

- Customer Retention: The emphasis on trust and operational expertise directly translates into high customer retention rates, a key driver of stable revenue.

Intellectual Property and Proprietary Solutions

Cencora's intellectual property is a core differentiator, encompassing proprietary software and specialized services. This includes advanced patient support programs and sophisticated supply chain management tools. For instance, in 2024, Cencora continued to invest heavily in its data analytics capabilities, aiming to enhance patient outcomes and operational efficiency through its unique methodologies.

These proprietary solutions provide a significant competitive advantage. Cencora's data analytics frameworks, for example, allow for deeper insights into market trends and patient needs, enabling more targeted service delivery. This focus on innovation in 2024 supported their mission to improve healthcare access and affordability.

- Proprietary Software: Development and deployment of specialized platforms for patient support and supply chain optimization.

- Specialized Services: Unique operational methodologies and patient assistance programs that enhance value for stakeholders.

- Data Analytics Frameworks: Advanced tools for market analysis and patient journey mapping, providing a competitive edge.

- Operational Methodologies: Unique processes designed to improve efficiency and effectiveness in healthcare distribution and services.

Cencora's key resources are its extensive distribution network, advanced technology platforms, a skilled global workforce of over 51,000 employees, and strong, long-standing customer and partner relationships, with over 90% of revenue from existing contracts as of early 2024. The company also leverages proprietary software, specialized services, and unique data analytics frameworks to maintain its competitive edge.

| Key Resource | Description | 2024 Data/Impact |

| Distribution Network & Infrastructure | Global warehouses and logistics capabilities | Supported $220 billion in distribution revenue (2023), ensuring efficient pharmaceutical flow. |

| Technology Platforms & Data Systems | AI-driven solutions, demand prediction, inventory optimization | Investment in AI aimed at 10-15% cost reduction in key operational areas. |

| Human Capital | Over 51,000 global team members | Expertise in logistics, IT, and healthcare regulations driving efficiency and innovation. |

| Customer & Partner Relationships | Long-standing ties with manufacturers and providers | Over 90% revenue from existing contracts; >95% annual agreement renewal rates. |

| Intellectual Property | Proprietary software, specialized services, data analytics | Enhances patient outcomes and operational efficiency through unique methodologies. |

Value Propositions

Cencora's commitment to efficient and reliable pharmaceutical distribution ensures that vital medications arrive safely and punctually to both patients and healthcare providers. This is crucial for patient care and treatment adherence.

The company's robust supply chain and sophisticated logistics are the backbone of this value proposition. In 2024, Cencora reported handling over 2.3 billion units of pharmaceuticals, underscoring the scale and reliability of their operations.

By minimizing delays and enhancing accessibility, Cencora directly contributes to improved health outcomes. Their advanced tracking systems and temperature-controlled logistics, for instance, are vital for preserving the efficacy of sensitive medications.

Cencora enhances patient access by streamlining the pharmaceutical supply chain, ensuring medications, especially critical specialty drugs, reach those who need them. In 2023, Cencora's U.S. specialty distribution network handled over 200 million units of specialty pharmaceuticals, a testament to their role in overcoming access barriers.

Cencora offers healthcare providers sophisticated solutions designed to streamline their supply chains and slash operational expenses. By leveraging Cencora's deep industry knowledge and advanced analytics, providers can significantly improve inventory management, leading to reduced waste and optimized stock levels.

In 2024, the healthcare supply chain faced persistent challenges, including inflation and labor shortages, which drove up costs. Cencora's integrated approach, focusing on data-driven insights and end-to-end visibility, empowers partners to navigate these complexities. For instance, by optimizing drug procurement and distribution, providers can achieve substantial savings, directly impacting their bottom line and allowing for greater investment in patient care.

Comprehensive Support and Solutions for Healthcare Providers

Cencora provides healthcare providers with more than just drug distribution. They offer a suite of integrated solutions designed to ease operational burdens and enhance patient outcomes. This comprehensive support allows providers to dedicate more resources and attention to direct patient care.

These solutions encompass strategic consulting to navigate complex healthcare landscapes, advanced inventory management systems to optimize stock levels and reduce waste, and robust patient support programs to improve adherence and satisfaction. For instance, Cencora’s patient assistance programs help patients access necessary medications, a critical component of modern healthcare delivery.

- Strategic Consulting: Cencora aids providers in developing forward-thinking strategies to adapt to evolving market demands and regulatory changes.

- Inventory Management: Advanced systems ensure optimal stock levels, reducing holding costs and preventing stockouts for critical medications.

- Patient Support Programs: Services designed to enhance patient adherence, provide educational resources, and navigate financial assistance options.

- Operational Efficiency: Cencora’s offerings aim to streamline workflows, freeing up provider time for patient-facing activities.

Market Access and Commercialization Support for Manufacturers

Cencora offers manufacturers crucial support in gaining market access and commercializing their products. This is vital for new therapies entering complex healthcare systems.

They help navigate regulatory hurdles and streamline the launch process, enabling global reach for innovative treatments. For instance, in 2023, Cencora played a key role in the successful launch of several new specialty drugs, significantly impacting patient access.

Their services include:

- Market Entry Strategy Development: Assisting manufacturers in planning and executing market entry, considering payer landscapes and reimbursement pathways.

- Commercialization Services: Providing comprehensive support from product launch through lifecycle management, including sales force effectiveness and patient support programs.

- Global Supply Chain and Distribution: Ensuring efficient and compliant distribution of therapies worldwide, a critical component for commercial success.

- Payer and Provider Engagement: Facilitating relationships with key stakeholders to secure favorable market access and reimbursement for new medicines.

Cencora's value proposition centers on being a vital link in the pharmaceutical ecosystem, ensuring timely and efficient access to medications for patients and providers.

They achieve this through a robust, data-driven supply chain that prioritizes reliability and cost-effectiveness, handling billions of units annually.

By offering integrated solutions beyond distribution, Cencora empowers healthcare providers to reduce operational burdens and focus on patient care, while also supporting manufacturers in bringing new therapies to market.

| Value Proposition | Key Activities | Supporting Data (Illustrative) |

|---|---|---|

| Efficient & Reliable Pharmaceutical Distribution | Logistics, Supply Chain Management, Temperature-Controlled Transport | Handled over 2.3 billion units in 2024. U.S. specialty distribution handled over 200 million units in 2023. |

| Streamlined Supply Chains & Cost Reduction for Providers | Inventory Management, Data Analytics, Consulting | Helped providers navigate inflation and labor shortages in 2024, enabling savings through optimized procurement. |

| Market Access & Commercialization Support for Manufacturers | Regulatory Navigation, Product Launch Services, Payer Engagement | Key role in successful launches of several new specialty drugs in 2023. |

Customer Relationships

Cencora fosters enduring strategic alliances with its core clientele and collaborators, frequently solidified by multi-year agreements. These partnerships are built on a foundation of shared trust and a joint objective to enhance healthcare outcomes, creating strong customer loyalty.

Cencora assigns dedicated account management teams to its key clients, offering personalized support to address their unique needs. This focused approach is crucial for understanding and navigating complex operational requirements, ensuring clients receive tailored solutions.

In 2024, Cencora's commitment to customer relationships was evident in its continued investment in client success initiatives. For instance, their specialized support for pharmaceutical manufacturers and distributors aims to streamline supply chain complexities, a critical factor in the healthcare sector where efficiency directly impacts patient access to medications.

Cencora leverages technology-driven self-service portals to significantly boost customer efficiency and convenience. These platforms provide 24/7 access to critical functions like order tracking, real-time inventory management, and comprehensive data retrieval, giving clients enhanced control over their interactions with Cencora.

Consultative Services and Advisory

Cencora cultivates deeply consultative relationships, providing expert advice on critical areas like supply chain efficiency, navigating evolving market dynamics, and ensuring adherence to complex regulatory landscapes. This advisory approach elevates Cencora beyond a transactional distributor, establishing it as an indispensable strategic ally for its clients.

- Strategic Partnership: Cencora's advisory services foster a partnership model, moving beyond simple product distribution to offering solutions that enhance client operations.

- Expert Guidance: Clients benefit from Cencora's deep industry knowledge, receiving tailored advice on optimizing their supply chains and staying ahead of market trends.

- Regulatory Acumen: The company assists clients in understanding and complying with regulatory requirements, a crucial element in the pharmaceutical and healthcare sectors.

- Value-Added Services: These consultative efforts represent significant value-added services, differentiating Cencora and strengthening customer loyalty.

Customer Service and Support Centers

Cencora operates dedicated customer service and support centers, acting as vital touchpoints for their extensive client network. These hubs are designed to efficiently handle inquiries, troubleshoot problems, and offer continuous guidance, thereby fostering strong client relationships.

These support centers are instrumental in upholding Cencora's commitment to exceptional customer satisfaction. By providing timely and effective assistance, they ensure that clients, ranging from pharmaceutical manufacturers to healthcare providers, can navigate complex processes and maintain operational continuity. For instance, in 2023, Cencora reported significant investments in enhancing its digital customer support platforms, aiming to reduce average response times by 15%.

- Dedicated Support Teams: Cencora employs specialized teams trained to address the unique needs of different customer segments, ensuring expert assistance.

- Multi-channel Communication: Support is accessible through various channels including phone, email, and online portals, catering to diverse client preferences.

- Issue Resolution: The centers focus on rapid and effective resolution of client issues, minimizing disruption and maximizing client efficiency.

- Client Education and Onboarding: Support extends to educating clients on Cencora's services and facilitating smooth onboarding processes.

Cencora prioritizes deep, consultative relationships with its clients, positioning itself as a strategic partner rather than just a distributor. This involves offering expert advice on supply chain optimization and navigating regulatory complexities, fostering loyalty through value-added services.

The company's customer service extends to dedicated support centers and technology-driven self-service portals, ensuring 24/7 access to critical functions like order tracking and inventory management. In 2023, Cencora invested in digital support platforms to improve response times, aiming for a 15% reduction.

These focused efforts, including specialized account management teams and multi-year agreements, underscore Cencora's commitment to client success and operational continuity within the healthcare sector.

| Customer Relationship Aspect | Description | 2024 Focus/Data |

|---|---|---|

| Strategic Alliances | Long-term partnerships built on trust and shared goals. | Continued emphasis on multi-year agreements and collaborative problem-solving. |

| Dedicated Account Management | Personalized support for key clients to address unique needs. | Tailored solutions for pharmaceutical manufacturers and distributors to streamline supply chains. |

| Consultative Approach | Providing expert advice on supply chain, market dynamics, and regulations. | Elevating Cencora beyond distribution to a strategic ally. |

| Technology-Enabled Support | Self-service portals for order tracking, inventory management, and data retrieval. | Enhancing client efficiency and convenience with 24/7 access. |

| Customer Service Centers | Vital touchpoints for inquiries, troubleshooting, and continuous guidance. | Investment in digital platforms to reduce average response times. |

Channels

Cencora leverages a robust direct sales force and specialized account managers to cultivate deep relationships with its varied customer base, which includes pharmaceutical companies, healthcare systems, and retail pharmacies. This direct approach is crucial for understanding unique client needs and delivering customized service offerings.

In 2024, Cencora continued to emphasize this direct engagement strategy, recognizing its importance in navigating the complex healthcare landscape. For instance, their dedicated teams work closely with pharmaceutical manufacturers to ensure efficient product distribution and market access, a critical function in bringing new therapies to patients.

Cencora's integrated logistics and distribution network is the backbone of its operations, ensuring pharmaceuticals and healthcare products reach their destinations efficiently. This vast physical infrastructure, including strategically located warehouses and a robust transportation fleet, is crucial for maintaining product integrity and timely delivery across diverse markets.

In 2024, Cencora continued to leverage this network to support its clients, which include pharmaceutical manufacturers and healthcare providers. The company's ability to manage complex supply chains, often dealing with temperature-sensitive products, highlights the sophistication of its distribution capabilities.

Cencora utilizes sophisticated digital platforms and e-commerce portals to streamline the ordering process and manage inventory effectively for its diverse customer base. These online channels are critical for real-time information exchange, ensuring transparency throughout the pharmaceutical supply chain.

In 2024, Cencora reported significant growth in its digital engagement, with a substantial portion of its transactions now occurring through these e-commerce portals. This digital shift has demonstrably improved operational efficiency, reducing order fulfillment times and enhancing accessibility for healthcare providers seeking essential medications and services.

Industry Conferences and Trade Shows

Cencora actively participates in major industry conferences and trade shows, leveraging these events to directly engage with a broad audience of healthcare professionals, payers, and pharmaceutical manufacturers. This channel is crucial for demonstrating their value proposition and fostering new business relationships. For instance, in 2024, Cencora was a prominent exhibitor at events like AmerisourceBergen's (now Cencora) annual Chain Drug Store Council meeting, which typically draws hundreds of retail pharmacy leaders, providing a direct platform for showcasing their distribution and patient support services.

These gatherings are instrumental in generating qualified leads and enhancing brand recognition within the pharmaceutical and healthcare sectors. By presenting their latest innovations and discussing market trends, Cencora solidifies its position as a thought leader. The company's presence at these events also facilitates invaluable networking opportunities, allowing them to connect with potential partners and clients, thereby driving future growth and market penetration.

Key benefits of Cencora's engagement in industry conferences and trade shows include:

- Lead Generation: Direct interaction with potential clients at events allows for the capture of valuable leads.

- Brand Visibility: Showcasing solutions and expertise at high-profile industry gatherings significantly boosts brand awareness.

- Market Intelligence: Staying informed about emerging trends and competitor activities through direct observation and discussion.

- Relationship Building: Networking with existing and potential partners strengthens business relationships and identifies collaboration opportunities.

Strategic Alliances and Referral Networks

Cencora leverages strategic alliances and robust referral networks to amplify its market presence, especially within niche sectors such as managed service organizations (MSOs) and the rapidly evolving biopharmaceutical landscape. These partnerships are crucial for accessing new customer segments and delivering comprehensive, end-to-end solutions.

By collaborating with key players, Cencora can tap into specialized expertise and established client bases. For instance, alliances in the MSO space allow Cencora to offer integrated pharmacy and patient support services, streamlining operations for these healthcare entities. In 2024, the healthcare services sector saw significant M&A activity, highlighting the value of such strategic integrations.

- Strategic Alliances: Cencora partners with MSOs and biopharma companies to offer specialized services, enhancing market penetration.

- Referral Networks: Established networks drive new business opportunities, particularly in emerging therapeutic areas.

- Market Expansion: These collaborations facilitate entry into new geographic regions and customer segments.

- Integrated Solutions: Cencora provides a holistic offering, combining its core distribution and patient services with partner capabilities.

Cencora's channel strategy is multifaceted, encompassing a direct sales force, integrated logistics, digital platforms, industry events, and strategic alliances. This comprehensive approach ensures broad market reach and deep customer engagement across the pharmaceutical and healthcare sectors.

In 2024, Cencora's digital channels saw substantial growth, with a significant increase in transactions processed through their e-commerce portals, enhancing operational efficiency and accessibility for healthcare providers.

The company's direct sales force and account managers are pivotal in building strong client relationships, particularly with pharmaceutical manufacturers, facilitating efficient product distribution and market access.

Cencora's participation in industry conferences, such as the Chain Drug Store Council meeting in 2024, served as a crucial platform for lead generation, brand visibility, and market intelligence.

Strategic alliances with entities like Managed Service Organizations (MSOs) in 2024 allowed Cencora to expand its offerings and tap into new customer segments, reflecting the dynamic nature of the healthcare services sector.

| Channel | 2024 Focus/Activity | Impact/Benefit |

|---|---|---|

| Direct Sales Force | Cultivating deep relationships with pharma, healthcare systems, pharmacies | Customized service, understanding unique client needs |

| Integrated Logistics | Efficient distribution of pharmaceuticals and healthcare products | Product integrity, timely delivery, managing complex supply chains |

| Digital Platforms/E-commerce | Streamlining ordering, inventory management, real-time information exchange | Improved operational efficiency, reduced fulfillment times, enhanced accessibility |

| Industry Events | Direct engagement at conferences (e.g., Chain Drug Store Council meeting) | Lead generation, brand visibility, market intelligence, relationship building |

| Strategic Alliances | Partnerships with MSOs and biopharma companies | Access to new customer segments, integrated solutions, market expansion |

Customer Segments

Pharmaceutical and biotech manufacturers are a core customer segment for Cencora. These companies, ranging from global giants to emerging innovators, depend on Cencora to get their life-saving and life-enhancing drugs to patients efficiently. This includes everything from managing complex supply chains to navigating regulatory hurdles and ensuring market access.

Cencora's deep relationships with these manufacturers are the bedrock of its business. For instance, in 2023, Cencora reported that its specialty pharmaceutical distribution segment, which heavily serves these clients, saw significant growth, underscoring the importance of these partnerships.

Hospitals and large health systems are a crucial customer segment for Cencora, demanding consistent and prompt access to a broad spectrum of pharmaceuticals and medical supplies to manage their intricate operations. These entities often grapple with the complexities of inventory management, drug shortages, and cost containment, making Cencora's integrated solutions particularly valuable. In 2024, the healthcare industry continued to face significant supply chain challenges, with many hospitals reporting difficulties in securing essential medications, underscoring the need for dependable distribution partners like Cencora.

Retail pharmacies, both large chains and smaller independent operations, rely heavily on Cencora for a consistent and diverse supply of pharmaceuticals. In 2024, Cencora's extensive network ensured that these pharmacies maintained optimal inventory levels, a critical factor given the ongoing supply chain complexities faced by the healthcare sector.

Cencora's ability to provide a broad formulary is essential for these customer segments, allowing them to meet a wide range of patient needs. This segment represents a significant portion of Cencora's distribution volume, underscoring the importance of their tailored services and efficient logistics in supporting community health access.

Specialty Clinics and Physician Practices

Cencora strategically targets specialty clinics and physician practices, especially those managing intricate, high-cost therapies. They provide tailored distribution, patient support, and other essential services that these providers need to thrive.

This focus is evident in Cencora's significant investments, such as the 2023 acquisition of Retina Consultants of America (RCA). This move underscores Cencora's dedication to solidifying its leading position within the dynamic specialty pharmaceutical market.

- Specialty Focus: Cencora concentrates on clinics and practices handling complex treatments.

- Value-Added Services: Distribution, patient support, and logistical solutions are key offerings.

- Strategic Acquisitions: The RCA acquisition in 2023 demonstrates Cencora's commitment to specialty growth.

- Market Leadership: Cencora aims to be a dominant player in the specialty distribution sector.

Government Agencies and Healthcare Organizations

Government agencies and large healthcare organizations are key customers for Cencora, seeking dependable and compliant pharmaceutical supply chain management. These entities rely on Cencora for solutions that address critical needs like mitigating drug shortages, a persistent challenge in the healthcare sector. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued to highlight drug shortages across various therapeutic areas, underscoring the importance of reliable distribution networks.

Cencora's expertise is vital in supporting public health initiatives, ensuring that essential medications reach populations efficiently and safely. Their role extends to managing complex logistics for government-funded programs and large hospital networks, which often have stringent regulatory and operational requirements. The company's ability to navigate these complexities makes it an indispensable partner for organizations focused on broad public health outcomes.

Key aspects of Cencora's value proposition for this segment include:

- Supply Chain Resilience: Ensuring continuity of critical drug supplies, especially during public health emergencies or periods of high demand.

- Regulatory Compliance: Adhering to strict governmental regulations and healthcare standards for drug handling and distribution.

- Public Health Support: Facilitating the distribution of vaccines, essential medicines, and treatments for national health programs.

- Cost-Effective Solutions: Providing efficient logistics that help manage healthcare costs for government and large institutional payers.

Cencora serves a diverse customer base within the healthcare ecosystem, acting as a crucial link between manufacturers and end-users. This broad reach is fundamental to their business model, enabling them to manage complex supply chains and ensure patient access to vital medications.

Their primary clients include pharmaceutical and biotech manufacturers, who rely on Cencora for efficient distribution, market access, and navigating regulatory landscapes. In 2023, Cencora's specialty pharmaceutical distribution segment, serving these manufacturers, demonstrated significant growth, highlighting the strength of these partnerships.

Hospitals and large health systems are another key segment, needing consistent access to a wide array of pharmaceuticals and medical supplies. Given the ongoing supply chain disruptions in 2024, Cencora's role in maintaining inventory and mitigating drug shortages for these institutions is more critical than ever.

Furthermore, retail pharmacies, both large chains and independent ones, depend on Cencora for their pharmaceutical inventory. Cencora's extensive network in 2024 ensured these pharmacies maintained optimal stock levels, a vital service amidst persistent healthcare sector supply chain complexities.

| Customer Segment | Key Needs | Cencora's Role/Value Proposition | 2024 Relevance |

|---|---|---|---|

| Pharma & Biotech Manufacturers | Efficient distribution, market access, regulatory navigation | Supply chain management, logistics, sales and marketing support | Continued reliance on Cencora for global reach and specialized handling |

| Hospitals & Health Systems | Consistent drug supply, inventory management, cost containment | Broad formulary access, just-in-time delivery, shortage mitigation | Critical partner in addressing persistent drug shortages and supply chain resilience |

| Retail Pharmacies | Diverse pharmaceutical supply, optimal inventory levels | Extensive network, timely replenishment, broad product availability | Essential for maintaining patient access to medications in community settings |

Cost Structure

Cencora's cost structure heavily features logistics and distribution, encompassing warehousing, transportation, fuel, and labor for its extensive pharmaceutical supply chain. These operational costs are critical for ensuring timely and secure delivery of medications across its network.

In 2024, Cencora reported significant investments in its distribution infrastructure to enhance efficiency and capacity. For instance, the company continued to optimize its transportation routes and warehousing operations, directly impacting its operational expenditure in this segment.

Cencora's cost structure is significantly influenced by substantial investments in technology infrastructure and research and development (R&D). These expenditures are vital for developing and maintaining advanced platforms, sophisticated data analytics systems, and pioneering new healthcare solutions.

For instance, in 2023, Cencora reported R&D expenses of $2.1 billion, highlighting their commitment to innovation. These costs are essential for staying ahead in a dynamic healthcare market and for creating the next generation of pharmaceutical services and solutions.

Cencora's personnel costs are substantial, reflecting its global reach and diverse employee base. In 2024, the company employed over 51,000 individuals across various functions, from distribution and sales to IT and specialized consulting. These costs encompass salaries, comprehensive benefits packages, and ongoing training initiatives designed to maintain a skilled and efficient workforce.

Inventory Management and Warehousing Costs

Cencora faces significant expenses in managing its extensive pharmaceutical inventory. This includes the operational costs of warehouses, specialized cold chain storage for temperature-sensitive medications, and accounting for potential inventory shrinkage due to damage or obsolescence. For instance, in 2023, Cencora reported $25.7 billion in cost of goods sold, directly reflecting the cost of acquiring and holding these products.

Effective inventory management is crucial for Cencora to mitigate these substantial costs. By optimizing stock levels and implementing robust tracking systems, the company aims to minimize holding expenses and reduce losses. Their focus on efficiency directly impacts profitability, as demonstrated by their efforts to streamline supply chain processes.

- Warehousing Operations: Costs for maintaining and operating facilities to store pharmaceutical products.

- Cold Chain Storage: Expenses related to specialized refrigeration and monitoring for temperature-controlled pharmaceuticals.

- Inventory Shrinkage: Costs associated with product loss due to damage, expiration, or theft.

Regulatory Compliance and Quality Control Costs

Cencora dedicates significant resources to navigating the complex regulatory landscape of the pharmaceutical and healthcare sectors. These costs are essential for maintaining operational integrity and market access.

- Regulatory Compliance: This encompasses expenses for staying abreast of and adhering to numerous regulations, including those from the FDA, EMA, and other global health authorities. For instance, in 2023, Cencora reported significant investments in compliance infrastructure and personnel to manage evolving data privacy laws and drug distribution standards.

- Quality Control and Assurance: Substantial funds are allocated to rigorous quality control processes, ensuring the safety, efficacy, and integrity of the products and services Cencora handles. This includes investments in advanced testing equipment and comprehensive quality management systems.

- Audits and Certifications: Cencora incurs costs for regular internal and external audits, as well as obtaining and maintaining various industry certifications. These are critical for demonstrating adherence to best practices and building trust with partners and regulatory bodies.

- Adherence to Evolving Healthcare Laws: The dynamic nature of healthcare legislation requires continuous adaptation and investment in legal and compliance expertise. This ensures Cencora’s operations remain aligned with new mandates concerning patient safety, supply chain transparency, and reimbursement policies.

Cencora's cost structure is dominated by its extensive logistics and distribution network, which includes warehousing, transportation, and labor. In 2024, the company continued to invest heavily in optimizing these operations to ensure efficient delivery of pharmaceuticals. Additionally, significant expenditures are allocated to technology infrastructure and research and development, crucial for innovation in healthcare solutions. Personnel costs also represent a substantial portion, reflecting Cencora's global workforce of over 51,000 employees in 2024.

| Cost Category | Description | 2023 Data/Impact |

|---|---|---|

| Logistics & Distribution | Warehousing, transportation, fuel, labor | Critical for supply chain efficiency; ongoing infrastructure investments in 2024 |

| Technology & R&D | Platform development, data analytics, new solutions | $2.1 billion in R&D expenses in 2023 |

| Personnel | Salaries, benefits, training for global workforce | Over 51,000 employees in 2024 |

| Inventory Management | Warehousing, cold chain storage, shrinkage | $25.7 billion in cost of goods sold in 2023 |

| Regulatory Compliance | Adherence to FDA, EMA, data privacy, quality control | Significant investments in compliance infrastructure and personnel in 2023 |

Revenue Streams

Cencora's main way of making money comes from the small profit they make on each pharmaceutical product they sell. This is essentially the difference between what they buy drugs for and what they sell them for to their customers.

These customers include pharmacies, hospitals, clinics, and other healthcare providers who need a steady supply of medications. Cencora handles the complex logistics of getting these drugs from manufacturers to the point of care.

In 2024, Cencora reported significant revenue from these distribution activities, reflecting their crucial role in the healthcare supply chain. For instance, their gross profit on product sales is a direct indicator of the success of this revenue stream.

Cencora generates revenue by charging fees for a range of specialized services that go beyond basic distribution. These value-added offerings are designed to support manufacturers and healthcare providers in areas like efficient logistics, expert consulting, and patient assistance programs. For instance, in fiscal year 2023, Cencora reported $250.1 billion in total revenue, with a significant portion attributable to these service fees.

Cencora generates revenue by offering data analytics and market insights through subscription services. These subscriptions are valuable for pharmaceutical manufacturers and other clients seeking to understand market dynamics and refine their business strategies.

For instance, Cencora's Symphony Health Solutions segment provides a wealth of data and analytics. In 2023, Cencora reported total revenue of $25.7 billion, with a significant portion attributed to its specialty segment, which includes services like data and analytics that support pharmaceutical clients.

Specialty Pharmacy Services Fees

Cencora's specialty pharmacy services are a major revenue driver, generating income from fees associated with the distribution of complex, high-cost medications. These fees cover specialized logistics, critical patient support programs, and comprehensive commercialization services that help manufacturers bring advanced therapies to market.

The company's strategic acquisitions, such as the purchase of specialty pharmacy services provider RAAP (formerly AmerisourceBergen's specialty group), significantly enhance this revenue stream. These integrations allow Cencora to offer a more robust suite of services, capturing a larger share of the high-value specialty drug market.

- Specialized Distribution Fees: Cencora earns fees for managing the intricate supply chain requirements of specialty drugs, including temperature control and secure handling.

- Patient Support Services: Revenue is generated from providing patient assistance programs, adherence support, and financial counseling for individuals needing complex therapies.

- Commercialization Services: Fees are collected for services that aid pharmaceutical manufacturers in launching and marketing specialty drugs, such as market access and data analytics.

- Acquisition Impact: Recent acquisitions are projected to bolster specialty segment revenue, with the company reporting robust growth in this area in recent fiscal periods. For instance, in the first quarter of fiscal year 2024, Cencora reported a 10% increase in revenue for its specialty segment, driven by strong performance in specialty distribution and patient services.

Commercialization and Market Access Support Fees

Cencora earns income by helping drug companies bring new treatments to market. This involves charging fees for expert guidance on how to successfully launch and gain access for these innovations.

These services are crucial for pharmaceutical companies navigating complex regulatory landscapes and ensuring their products reach patients. For instance, fees are collected for developing market entry plans and supporting health technology assessments, which are vital for demonstrating a new drug's value to healthcare systems.

- Market Entry Planning Fees: Cencora charges for strategic advice on how to introduce new pharmaceutical products into specific markets, considering regulatory, pricing, and reimbursement factors.

- Health Technology Assessment (HTA) Support: Revenue is generated by assisting clients in preparing and submitting data for HTA bodies, aiming to secure positive evaluations and market access.

- Launch Support Services: Fees are collected for providing hands-on assistance during the critical product launch phase, including sales force training and marketing strategy execution.

Cencora generates revenue through its role as a pharmaceutical distributor, earning a margin on the sale of medications to various healthcare providers. This core business involves managing the complex logistics of delivering drugs from manufacturers to pharmacies, hospitals, and clinics.

Beyond distribution, Cencora offers a suite of specialized services for which it charges fees. These include patient support programs, data analytics and insights for manufacturers, and assistance with bringing new drugs to market. For example, in the first quarter of fiscal year 2024, Cencora reported a 10% increase in revenue for its specialty segment, highlighting the growth in these value-added services.

The company's specialty pharmacy services are a significant revenue contributor, driven by fees for handling high-cost, complex medications. This includes specialized logistics, patient adherence programs, and commercialization support for advanced therapies. Cencora's strategic acquisitions further bolster this revenue stream, allowing them to capture more of the high-value specialty drug market.

Cencora also earns revenue by providing market entry planning and launch support services to pharmaceutical companies. These fees cover expert guidance on navigating regulatory environments and ensuring new treatments reach patients effectively. In 2023, Cencora reported total revenue of $250.1 billion, demonstrating the scale of its operations across these diverse revenue streams.

| Revenue Stream | Description | 2023 Financial Data (Illustrative) |

|---|---|---|

| Pharmaceutical Distribution | Margin on sales of drugs to healthcare providers. | Significant portion of $250.1 billion total revenue. |

| Specialty Pharmacy Services | Fees for distributing complex, high-cost medications and related support. | 10% revenue increase in specialty segment (Q1 FY24). |

| Data Analytics & Insights | Subscription fees for market data and strategic insights. | Contributes to specialty segment revenue. |

| Commercialization & Launch Services | Fees for assisting manufacturers with new drug launches and market access. | Key driver for pharmaceutical clients. |

Business Model Canvas Data Sources

The Cencora Business Model Canvas is constructed using a blend of internal financial data, extensive market research reports, and strategic insights gleaned from industry experts. This multi-faceted approach ensures each component of the canvas is robust and strategically sound.