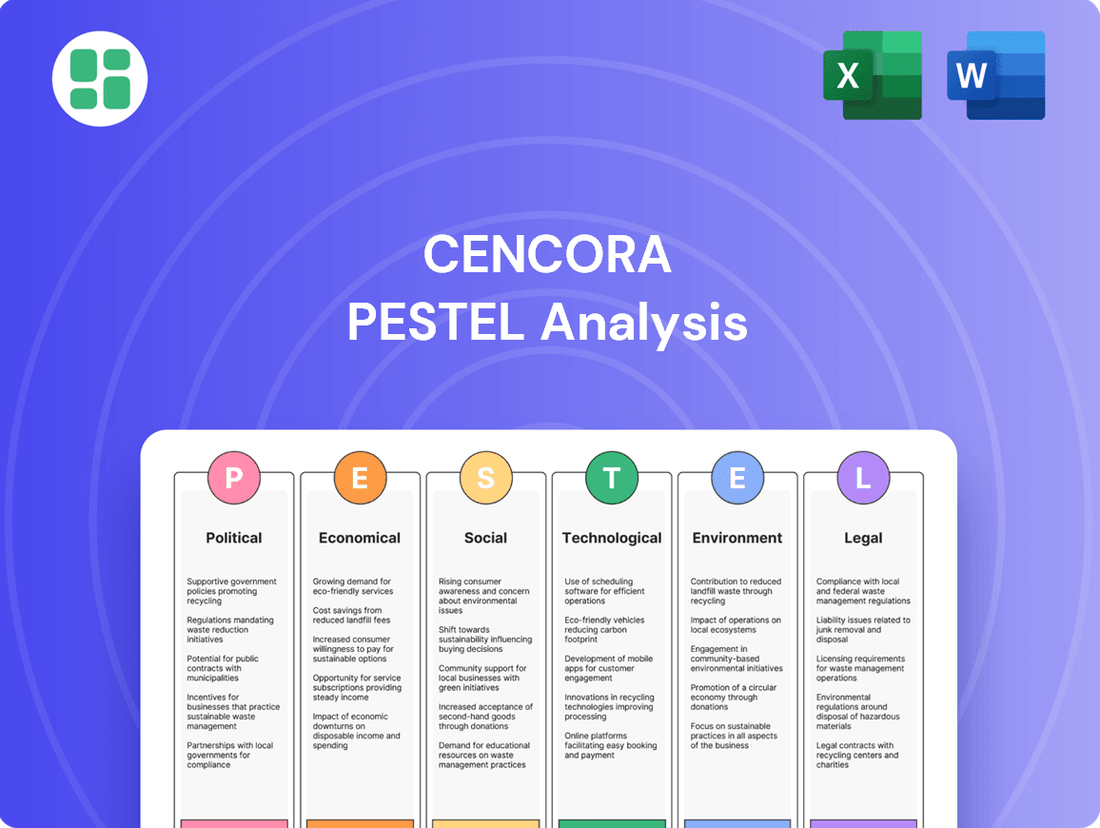

Cencora PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cencora Bundle

Unlock the critical external factors shaping Cencora's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges for this healthcare giant. Gain the strategic foresight needed to navigate this complex landscape and make informed decisions. Download the full analysis now to arm yourself with actionable intelligence.

Political factors

Government healthcare policies, like the Inflation Reduction Act (IRA) enacted in the U.S., directly influence drug pricing and reimbursement, a critical area for Cencora as a pharmaceutical distributor. The IRA's provisions, aimed at reducing out-of-pocket costs for certain prescription drugs, could potentially impact the margins Cencora earns on its distribution services.

These reforms necessitate adaptive strategies for Cencora, as they alter the financial landscape for drug manufacturers and, consequently, for distributors in the supply chain. Cencora's active participation in lobbying and policy advocacy underscores its commitment to navigating and shaping these evolving government mandates to ensure continued operational efficiency and cost-effectiveness in medication delivery.

The evolving landscape of drug pricing regulations, both at the federal and state levels, presents a significant and ongoing challenge for Cencora. New rules and proposed legislation, such as those impacting Medicare Part D and state-level drug price transparency mandates, require continuous adaptation in Cencora's pricing strategies and reporting mechanisms.

The potential for government-led drug price negotiations and heightened scrutiny on pharmaceutical supply chain costs are key political factors. Cencora must maintain agility within its business model to navigate these pressures, which could impact its revenue streams and operational costs.

Global trade policies, such as potential tariffs on pharmaceutical imports, could significantly impact Cencora's international supply chain. For instance, in 2024, ongoing trade tensions between major economies continue to create uncertainty around import duties, potentially increasing Cencora's operational costs and affecting the timely delivery of medications.

Geopolitical instability presents a substantial risk to Cencora's operations. Events like the ongoing conflicts in Eastern Europe and the Middle East, which intensified in late 2023 and early 2024, can disrupt logistics, increase insurance premiums, and necessitate contingency planning for alternative sourcing and distribution routes, impacting operational continuity.

Navigating these complex international relations is crucial for Cencora to ensure consistent medication access worldwide. The company's ability to adapt to evolving trade agreements and mitigate risks associated with geopolitical events directly influences its capacity to maintain a reliable global supply of pharmaceuticals, a critical factor in public health.

Antitrust and Consolidation Scrutiny

Regulatory bodies like the Federal Trade Commission (FTC) and the Department of Justice (DOJ) are intensifying their scrutiny of consolidation within the healthcare and pharmaceutical industries, with pharmacy benefit managers (PBMs) being a particular focus. This heightened antitrust attention directly impacts Cencora's strategic decisions regarding acquisitions and partnerships, potentially shaping its growth trajectory and market standing. For instance, the FTC's ongoing investigation into PBM practices, initiated in 2023, highlights this trend.

Cencora must navigate these evolving antitrust landscapes to ensure its business practices remain compliant with current and future regulations. This involves proactively assessing the competitive impact of its operations and potential M&A activities. Failure to comply could lead to significant penalties and operational disruptions.

- Antitrust Investigations: The FTC's ongoing inquiry into PBMs, launched in 2023, signals increased regulatory oversight.

- Market Concentration Concerns: Regulators are closely examining market concentration in healthcare, which could affect Cencora's expansion plans.

- Compliance Imperative: Cencora must adapt its strategies to align with evolving antitrust laws to avoid legal challenges.

Political Engagement and Lobbying

Cencora actively engages in the political arena to shape healthcare policy and protect its business interests. This involvement includes significant lobbying efforts and political contributions aimed at influencing legislation and regulations. For instance, in 2023, Cencora's political action committee, Cencora PAC, reported over $1.7 million in contributions, with a substantial portion directed towards federal candidates and party committees.

The company's advocacy focuses on critical areas such as ensuring the safety and integrity of the pharmaceutical supply chain, advocating for stable corporate tax policies, and addressing the ongoing challenge of pharmaceutical shortages. By actively participating in these discussions, Cencora seeks to foster a predictable and advantageous regulatory landscape for its operations.

- Lobbying Focus: Cencora prioritizes lobbying on supply chain security, corporate tax rates, and measures to mitigate drug shortages.

- Political Contributions: In 2023, Cencora PAC disbursed over $1.7 million to various political campaigns and committees, demonstrating a commitment to influencing policy.

- Regulatory Environment: The company's political engagement strategy is designed to cultivate a stable and supportive regulatory framework for its global healthcare services.

Government healthcare policies, particularly those impacting drug pricing and reimbursement like the Inflation Reduction Act (IRA), directly influence Cencora's operational margins and strategic planning. The IRA's provisions, aimed at lowering prescription drug costs for consumers, could affect Cencora's revenue streams from distribution services.

Heightened antitrust scrutiny from bodies like the FTC on industry consolidation, especially concerning PBMs, poses a significant challenge. The FTC's ongoing investigation into PBM practices, active since 2023, underscores the regulatory focus on market concentration and its potential impact on Cencora's growth and partnerships.

Cencora actively engages in political advocacy, with its PAC contributing over $1.7 million in 2023 to influence policies on supply chain integrity, tax rates, and drug shortages. This proactive approach aims to shape a stable regulatory environment conducive to its global operations.

Geopolitical instability and evolving global trade policies, including potential tariffs on pharmaceutical imports, create operational risks. Disruptions from conflicts, as seen in late 2023 and early 2024, necessitate robust contingency planning for sourcing and logistics to ensure consistent medication access.

What is included in the product

This Cencora PESTLE analysis provides a comprehensive examination of how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, shape the company's operational landscape and strategic positioning.

A Cencora PESTLE analysis provides a structured framework to identify and address external factors, relieving the pain point of navigating complex market dynamics by offering clarity on potential opportunities and threats.

Economic factors

The global pharmaceutical distribution market is expected to see robust growth, with projections indicating a compound annual growth rate (CAGR) of around 6% to 7% through 2028, reaching an estimated value of over $2.5 trillion by that year. This expansion is fueled by a growing global population, a rising incidence of chronic conditions like diabetes and heart disease, and the ongoing demand for accessible and efficient healthcare services worldwide. Cencora, with its extensive distribution infrastructure and sophisticated logistics, is well-placed to benefit from these favorable market dynamics.

Healthcare spending continues its upward trajectory, with the U.S. leading the charge. This robust growth, projected to remain strong through 2025, is fueled by an aging demographic and the introduction of cutting-edge, yet expensive, medical treatments. This environment is a significant tailwind for Cencora, positioning it as a key player in the distribution of these vital therapies.

The burgeoning demand for specialty medications, a cornerstone of Cencora's business in the United States, directly translates into a consistent and expanding revenue base. For instance, specialty drug spending in the U.S. has consistently outpaced overall drug spending, with projections indicating this trend will persist. This increasing reliance on specialized treatments plays directly into Cencora's strengths, solidifying its market position.

Inflationary pressures and rising operational costs, particularly in logistics, labor, and energy, pose a significant challenge to Cencora's profitability. For instance, the U.S. Producer Price Index (PPI) for goods, a key indicator of inflation at the wholesale level, saw a notable increase in early 2024, impacting input costs for many industries, including healthcare distribution.

Cencora must actively manage these escalating costs through enhanced operational efficiencies and strategic pricing adjustments to safeguard its profit margins. The company's ability to absorb or pass on these increases will be critical in maintaining its competitive edge in the market.

Furthermore, persistent supply chain disruptions, a lingering effect from recent global events, can amplify these cost pressures. Developing resilient operational strategies and diversifying sourcing will be essential for Cencora to navigate these complexities and mitigate their impact on overall business performance.

Currency Fluctuations and International Markets

Cencora's extensive global presence means currency fluctuations directly impact its financial reporting. For instance, a stronger US dollar could reduce the reported value of revenues earned in weaker foreign currencies, affecting operating income from its international healthcare solutions segment.

Recent performance highlights these challenges. In the first quarter of 2024, Cencora reported that unfavorable foreign currency movements had a slight negative impact on diluted earnings per share. This underscores the need for robust hedging strategies and agile responses to varying economic conditions across its operating regions.

- Impact of Currency: Unfavorable currency movements can diminish reported international revenues and profits.

- European Market Challenges: Lower operating income from European distribution highlights the need for localized strategies.

- Q1 2024 Performance: Cencora noted a slight negative impact on EPS from foreign currency movements.

- Risk Management: Effective management of foreign exchange risk is crucial for sustained international growth.

Investment in R&D and Specialty Therapies

The pharmaceutical sector's substantial investment in research and development, particularly for advanced treatments like gene and cell therapies, fuels demand for specialized distribution networks. These complex, high-value products require meticulous handling and a sophisticated supply chain, creating significant opportunities for companies like Cencora.

Cencora's strategic alignment with this trend is evident in its focus on specialty services and targeted acquisitions. For instance, its acquisition of Retina Consultants of America in 2023, valued at approximately $1.2 billion, bolsters its capabilities in managing high-cost, specialized pharmaceuticals, thereby strengthening its market position and revenue growth potential.

- R&D Investment: Global pharmaceutical R&D spending reached an estimated $240 billion in 2024, with a significant portion allocated to novel therapies.

- Specialty Drug Growth: The specialty drug market is projected to grow at a CAGR of 10-13% through 2028, driven by advancements in biologics and personalized medicine.

- Cencora's Strategy: The company's investments, including the Retina Consultants of America acquisition, underscore its commitment to capturing value in high-growth specialty segments.

The global economic landscape presents both opportunities and challenges for Cencora. Strong growth in healthcare spending, particularly in the U.S. driven by an aging population and advanced treatments, provides a solid demand base. However, inflationary pressures on operational costs like logistics and labor, coupled with currency fluctuations impacting international revenue, require careful management.

What You See Is What You Get

Cencora PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive Cencora PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing Cencora's Political, Economic, Social, Technological, Legal, and Environmental factors.

The content and structure shown in the preview is the same document you’ll download after payment, offering an in-depth look at Cencora's strategic landscape.

Sociological factors

The world's population is getting older, and with that comes more chronic health issues. This trend is a significant driver for the pharmaceutical industry, as older individuals and those with long-term conditions require ongoing access to medications and healthcare. In 2023, the World Health Organization reported that chronic diseases are the leading cause of death and disability globally, accounting for an estimated 74% of all deaths. This consistent demand directly fuels the growth of pharmaceutical distribution, which is Cencora's primary area of operation, ensuring these vital treatments reach the people who need them.

Societal expectations are heavily leaning towards making healthcare and medications more accessible and affordable for everyone. This push is driving policy reforms aimed at achieving these goals.

Cencora is central to making sure medicines reach patients efficiently through its supply chain management. However, the company faces ongoing scrutiny regarding drug pricing and how to make treatments more affordable for a wider population.

In 2023, Cencora reported $238.9 billion in net sales, highlighting its significant role in the pharmaceutical distribution landscape. The company's commitment to corporate responsibility often involves programs designed to expand healthcare access and provide support to underserved communities, directly addressing these societal pressures.

Public health trends, such as the ongoing focus on chronic disease management and the potential for new infectious disease outbreaks, directly influence the demand for pharmaceuticals. For instance, the rise in conditions like diabetes and cardiovascular disease in 2024 continues to drive demand for related treatments.

Pharmaceutical supply chains, like Cencora's, are tested by these trends and crises. The company's capacity to ensure the consistent availability of essential medicines, particularly during periods of heightened demand or disruption, is crucial for both public well-being and its own operational stability. In 2023, for example, the pharmaceutical distribution sector faced significant challenges in maintaining inventory levels for certain high-demand medications.

The resilience and adaptability of distribution networks are paramount, especially in light of global health events. Cencora's investment in advanced logistics and inventory management systems is key to navigating these public health dynamics and ensuring timely access to critical medications for patients.

Health Literacy and Patient Advocacy

Rising health literacy empowers patients to actively participate in their care, driving demand for specific treatments and placing greater emphasis on drug safety, efficacy, and fair pricing from companies like Cencora. Patient advocacy groups are increasingly influential, acting as powerful voices that can shape market perceptions and regulatory focus.

Cencora needs to be highly attuned to patient needs and concerns. This might involve evolving its services to better support patient education and engagement programs, fostering a more transparent healthcare information environment. For instance, in 2024, patient advocacy groups played a significant role in discussions around the pricing of new gene therapies, highlighting the growing power of these organizations.

- Patient Empowerment: Increased health literacy means patients are more informed and proactive in seeking specific treatments.

- Advocacy Influence: Patient advocacy groups are becoming key stakeholders, impacting pharmaceutical demand and scrutiny.

- Transparency Demand: Patients expect greater transparency regarding drug safety, efficacy, and cost.

- Cencora's Adaptation: The company may need to adjust its offerings to better support patient education and engagement initiatives.

Workforce Demographics and Talent Management

Cencora, formerly AmerisourceBergen, faces significant workforce dynamics. As of early 2024, the healthcare and logistics sectors are grappling with an aging workforce and a growing demand for specialized skills, particularly in areas like pharmaceutical logistics and digital supply chain management. Cencora’s ability to attract and retain talent is directly tied to its operational efficiency and service delivery.

Adapting to these demographic shifts requires strategic talent management. Cencora emphasizes developing its workforce, fostering inclusivity, and upskilling employees for roles increasingly influenced by digital technologies and artificial intelligence. This focus on 'purpose-driven team members' is a cornerstone of their corporate responsibility, aiming to build a resilient and skilled workforce capable of navigating evolving industry demands.

- Talent Acquisition Challenges: The U.S. Bureau of Labor Statistics projected a 6% growth in healthcare support occupations from 2022 to 2032, indicating a competitive talent market for Cencora.

- Upskilling for Digitalization: Cencora's investment in digital supply chain solutions necessitates training for employees in data analytics, AI, and automation technologies.

- Employee Engagement: A 2023 survey indicated that companies with high employee engagement, a Cencora focus, experience 23% higher profitability.

- Diversity and Inclusion: Cencora's commitment to a diverse workforce is critical, as diverse teams are often linked to better problem-solving and innovation in complex industries.

Societal shifts toward greater health equity and patient empowerment are reshaping Cencora's operational landscape. Increased health literacy means patients are more informed and vocal about treatment accessibility and pricing, directly influencing Cencora's role in ensuring equitable distribution. Patient advocacy groups, increasingly influential, are driving conversations around drug affordability, as seen in 2024 discussions on gene therapy pricing.

Technological factors

Cencora is significantly investing in digital transformation, particularly focusing on advanced analytics and data-driven strategies to streamline its pharmaceutical supply chain. This technological push is designed to boost transparency, efficiency, and traceability throughout the entire process.

These digital enhancements are crucial for optimizing inventory management, minimizing waste, and expediting the delivery of vital medications. For instance, by leveraging AI-powered demand forecasting, Cencora aims to reduce stockouts and overstock situations, a common challenge in the pharmaceutical sector. In 2024, the company highlighted its commitment to a 15% increase in supply chain efficiency through digital initiatives.

Maintaining a competitive edge in the pharmaceutical distribution landscape hinges on continuous infrastructure upgrades and technological advancements. Cencora's ongoing investments in areas like blockchain for drug traceability and IoT sensors for temperature monitoring are key to achieving this. These efforts are essential to meet evolving regulatory demands and customer expectations for reliable and secure drug delivery.

Cencora is actively integrating AI and ML to transform its pharmaceutical supply chain operations. This includes using predictive AI analytics to anticipate health trends and address medication adherence issues, a critical factor in patient outcomes and revenue stability.

The company also deploys AI agents to automate benefit verification, a time-consuming administrative task. In 2024, Cencora reported that AI-driven automation in benefit verification significantly reduced processing times, contributing to faster patient access to necessary treatments.

These AI applications are designed to enhance demand forecasting accuracy and optimize inventory management, thereby reducing waste and ensuring product availability. By streamlining these processes, Cencora aims to improve operational efficiency and support timely delivery of medications.

Cencora, as a global pharmaceutical solutions provider, navigates significant cybersecurity threats, particularly concerning the sensitive patient data it manages. Data breaches remain a persistent risk, necessitating ongoing investment in advanced security measures.

The company must prioritize robust cybersecurity frameworks, adhere to stringent data protection standards, and implement comprehensive employee awareness training to shield critical information. The evolving threat landscape demands continuous adaptation of security protocols.

Recent cybersecurity incidents across the healthcare sector highlight the imperative for advanced security measures and strict compliance with regulations such as HIPAA. In 2023, the average cost of a data breach in the healthcare sector reached $10.10 million, underscoring the financial and reputational stakes.

Automation and Robotics in Logistics

Automation and robotics are revolutionizing pharmaceutical logistics, boosting efficiency and accuracy within warehouses and distribution centers. Cencora's strategic focus on supply chain optimization means embracing these technologies for sorting, packing, and inventory management can unlock significant cost savings and elevate service standards. The increasing complexity and volume of pharmaceutical product flows are effectively managed through these advanced solutions.

The adoption of automation in logistics is a growing trend, with significant investments being made globally. For instance, the global warehouse automation market was valued at approximately $3.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 13% through 2030, indicating a strong push towards robotic solutions. This trend directly impacts companies like Cencora, enabling them to handle a larger and more diverse range of pharmaceutical products with greater precision.

- Enhanced Efficiency: Automated systems can process orders and manage inventory at speeds unattainable by manual labor, reducing turnaround times for critical medications.

- Improved Accuracy: Robotics minimize human error in picking, packing, and sorting, ensuring the right medications reach the right destinations, a crucial factor in healthcare.

- Scalability: Automated solutions allow logistics operations to scale more readily to meet fluctuating demand, a common challenge in the pharmaceutical sector.

Telemedicine and Digital Health Platforms

The increasing adoption of telemedicine and digital health platforms is fundamentally reshaping medication prescription and delivery. This trend is accelerating the shift towards direct-to-patient distribution models, impacting traditional pharmaceutical supply chains. For Cencora, this means adapting its distribution services to seamlessly integrate with these virtual care ecosystems, potentially expanding its direct-to-patient capabilities and leveraging technology to support this evolving healthcare landscape. For instance, the U.S. telehealth market was projected to reach over $200 billion by 2027, highlighting the significant scale of this transformation.

Cencora must proactively integrate with these digital health platforms to maintain its relevance and competitive edge. This involves developing or enhancing capabilities that support virtual care, such as secure data exchange and efficient last-mile delivery for digitally prescribed medications. The company's ability to adapt its logistics and services to accommodate these new channels will be crucial for its future growth and market position in the rapidly digitizing healthcare sector.

Regulatory shifts surrounding telehealth also present both opportunities and challenges for Cencora. As regulations evolve to accommodate and govern virtual care, Cencora needs to ensure its operations and services remain compliant. Staying abreast of these changes, particularly those impacting prescription fulfillment and patient data privacy in a digital context, is paramount for navigating this dynamic technological environment.

Cencora is heavily investing in AI and machine learning to refine its pharmaceutical supply chain, aiming for enhanced demand forecasting and inventory optimization. These technologies are key to reducing waste and ensuring medication availability, with the company targeting a 15% efficiency boost through digital initiatives in 2024.

The company is also leveraging blockchain for drug traceability and IoT sensors for temperature monitoring, crucial for meeting stringent regulatory demands and customer expectations for secure drug delivery.

Furthermore, Cencora is integrating automation and robotics in its logistics operations to improve sorting, packing, and inventory management, reflecting a global trend where the warehouse automation market was valued at approximately $3.5 billion in 2023.

The rise of telemedicine and digital health platforms is pushing Cencora to adapt its distribution models for direct-to-patient delivery, a significant shift given the U.S. telehealth market was projected to exceed $200 billion by 2027.

Legal factors

The U.S. Drug Supply Chain Security Act (DSCSA), with its full enforcement deadline of November 2024, significantly impacts pharmaceutical distributors like Cencora by mandating enhanced product traceability and serialization. This requires robust systems to track and verify drugs, a critical measure against counterfeit medicines and product diversion, which remains a persistent global issue.

Cencora's compliance efforts involve substantial technological and operational investments to meet DSCSA's stringent requirements for product identification and transaction history management. Failure to comply could lead to penalties and disruptions in its distribution network, underscoring the importance of proactive adaptation to this evolving regulatory landscape.

Cencora, formerly AmerisourceBergen, navigates a complex web of data privacy regulations worldwide. Key among these are the Health Insurance Portability and Accountability Act (HIPAA) in the United States, the General Data Protection Regulation (GDPR) across the European Union, and the California Consumer Privacy Act (CCPA). These laws dictate how Cencora handles sensitive patient and customer information, making compliance a critical operational imperative.

The increasing frequency of data breaches underscores the need for Cencora to maintain exceptionally robust data protection measures. This includes investing in advanced security technologies, conducting regular employee training on privacy best practices, and implementing stringent vetting processes for all third-party vendors who may access protected data. For instance, the healthcare industry has seen significant financial impacts from breaches, with the average cost of a data breach in healthcare reaching $10.10 million in 2023, according to IBM's Cost of a Data Breach Report.

Non-compliance with these data privacy mandates carries severe consequences. Cencora faces substantial financial penalties, which can include significant fines for violations. Beyond financial repercussions, a failure to protect data can lead to irreversible reputational damage, eroding trust among patients, healthcare providers, and partners, impacting long-term business sustainability.

Antitrust and competition laws significantly shape Cencora's operational landscape, especially given the ongoing consolidation within the healthcare and pharmaceutical sectors. Authorities are closely monitoring mergers and acquisitions, directly influencing Cencora's strategic growth through M&A activities.

Legal scrutiny over market dominance, particularly for Pharmacy Benefit Managers (PBMs) and distributors, necessitates Cencora's adherence to stringent legal frameworks. Failure to comply can result in costly litigation and substantial regulatory penalties, impacting financial performance and market reputation.

Drug Pricing and Reimbursement Legislation

Legislation like the Inflation Reduction Act (IRA) significantly alters the landscape for drug pricing and reimbursement. For Cencora, this means adapting to new rules around Medicare Part D, impacting how they negotiate prices and manage patient access. The IRA's provisions, particularly those allowing Medicare to negotiate prices for certain high-cost drugs, directly affect the revenue Cencora generates through its distribution and services.

Navigating these evolving legal requirements is crucial for Cencora's operational success. The company must ensure compliance with price transparency mandates and the intricacies of Medicare Part D redesign. These legal factors can influence Cencora's relationships with both pharmaceutical manufacturers and insurance payers, potentially reshaping its market position and financial performance in the coming years.

- IRA Impact: The Inflation Reduction Act empowers Medicare to negotiate prices for a select group of high-cost drugs, a move projected to impact billions in pharmaceutical spending.

- Medicare Part D Redesign: Changes to Medicare Part D, including the introduction of a $2,000 out-of-pocket cap for beneficiaries starting in 2025, will alter prescription drug cost structures and Cencora's role in managing these.

- Price Transparency: Increased scrutiny and legislation around drug price transparency require Cencora to adapt its reporting and operational models to meet new regulatory demands.

Product Liability and Regulatory Approvals

Cencora, as a major pharmaceutical distributor, navigates a complex web of product liability laws and stringent regulatory approval pathways for the medications it handles. While the primary burden of drug approval rests with manufacturers, Cencora's role necessitates meticulous adherence to health and safety standards, particularly concerning the proper handling, storage, and transportation of pharmaceutical products to preserve their integrity.

Failure to comply with regulations, such as those set forth by the U.S. Food and Drug Administration (FDA) and other global health authorities, can lead to significant legal repercussions, including fines and reputational damage. For instance, in 2023, the FDA issued numerous warning letters to companies for various compliance failures, underscoring the critical nature of regulatory adherence across the pharmaceutical supply chain.

- Product Integrity: Cencora must ensure its distribution practices maintain the efficacy and safety of pharmaceuticals from manufacturer to patient.

- Regulatory Compliance: Adherence to FDA regulations, including current Good Distribution Practices (GDP), is paramount to avoid penalties.

- Liability Management: Proactive measures in handling and storage are crucial to mitigate product liability risks.

- Supply Chain Security: Maintaining secure and temperature-controlled environments protects against product degradation and diversion.

The evolving regulatory landscape, particularly the U.S. Drug Supply Chain Security Act (DSCSA) with its full enforcement deadline of November 2024, mandates enhanced product traceability for Cencora. This necessitates significant investment in technology and operational adjustments to meet serialization and verification requirements, crucial for combating counterfeit drugs.

Cencora must also navigate a complex array of global data privacy laws, including HIPAA, GDPR, and CCPA, which govern the handling of sensitive patient information. The average cost of a data breach in healthcare reached $10.10 million in 2023, highlighting the financial and reputational risks of non-compliance.

Legislation like the Inflation Reduction Act (IRA) is reshaping drug pricing and reimbursement, impacting Cencora's role in negotiating prices and managing patient access, especially with Medicare's new drug price negotiation powers and the 2025 $2,000 out-of-pocket cap for Medicare beneficiaries.

Environmental factors

Cencora is actively working to shrink its environmental footprint by aiming to cut Scope 1 and 2 greenhouse gas (GHG) emissions, setting science-based targets to guide this effort. This commitment translates into practical steps such as improving energy efficiency, investing in renewable energy sources, and adopting sustainable building methods across its worldwide operations.

For instance, in 2023, Cencora reported a 12.7% reduction in its Scope 1 and 2 GHG emissions intensity compared to its 2021 baseline, a significant step towards its 2030 reduction goals. This focus on carbon footprint reduction is a core part of their corporate responsibility, directly supporting international climate action objectives.

Cencora prioritizes waste reduction, recycling, and responsible disposal throughout its operations and supply chain. This focus is crucial as the pharmaceutical and healthcare industries generate significant waste streams. For instance, the global healthcare waste market was valued at approximately USD 32.5 billion in 2023 and is projected to grow, making Cencora's efforts to minimize its contribution particularly relevant.

The company is actively integrating sustainable packaging, including reusable options for its shipments, to lessen its environmental footprint. This strategy directly addresses the growing consumer and regulatory demand for reduced single-use plastics. In 2024, many major corporations are setting ambitious targets for recycled content in packaging, with some aiming for 30% or higher, a trend Cencora is likely aligning with.

Furthermore, Cencora considers the downstream environmental impact of packaging materials it provides to customers. This forward-thinking approach acknowledges the full lifecycle of its products and packaging, aiming to promote more circular economy principles within the healthcare sector.

Cencora is actively working to boost environmental sustainability across its pharmaceutical supply chain. They collaborate with both customers and suppliers on projects designed to increase their worldwide positive environmental impact.

A key focus is optimizing logistics to cut down on emissions, which includes exploring and adopting greener transportation options. For instance, in 2023, Cencora reported progress in reducing its Scope 1 and 2 greenhouse gas emissions by 15% compared to a 2019 baseline, with supply chain efficiency playing a significant role.

Developing a supply chain that is both resilient and sustainable is vital not only for responsible environmental management but also for ensuring the uninterrupted flow of essential medicines. This dual focus helps Cencora navigate potential disruptions while upholding its commitment to the planet.

Climate Change Impact on Operations

Cencora acknowledges that climate change poses risks to both human and animal health, directly influencing its operational landscape. The company understands that disruptions like extreme weather events can significantly affect the manufacturing and distribution of pharmaceuticals, a core part of its business.

To mitigate these risks, Cencora must embed climate resilience into its strategic operational planning. This proactive approach is crucial for protecting its intricate supply chain and ensuring the uninterrupted availability of essential medications for patients and healthcare providers.

- Supply Chain Vulnerability: Extreme weather events in 2024, such as severe flooding in key manufacturing regions, have already demonstrated the potential for supply chain disruptions.

- Operational Continuity: Ensuring continuous access to medications requires robust contingency plans for climate-related impacts, including alternative sourcing and distribution routes.

- Health Impacts: The company recognizes that climate change exacerbates health issues, potentially increasing demand for certain treatments while also straining healthcare systems it serves.

Regulatory Compliance and ESG Reporting

Cencora's environmental initiatives face growing regulatory oversight and public pressure for greater transparency, making strong environmental, social, and governance (ESG) reporting crucial. The company's presence in sustainability yearbooks and its dedication to global standards highlight its compliance with environmental laws and its proactive stance on corporate accountability.

For instance, in 2023, Cencora reported a 10% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to its 2020 baseline, demonstrating tangible progress in its environmental stewardship efforts. This focus on measurable outcomes is increasingly important as regulatory bodies worldwide, including the U.S. Securities and Exchange Commission (SEC) with its proposed climate disclosure rules, push for standardized and reliable ESG data from companies.

- Regulatory Scrutiny: Increasing global regulations on emissions and waste management directly impact Cencora's operations and reporting requirements.

- ESG Reporting Demands: Stakeholders, including investors and consumers, expect detailed and verifiable ESG performance data, influencing Cencora's strategic communication.

- Sustainability Benchmarking: Inclusion in sustainability indices and adherence to frameworks like the Global Reporting Initiative (GRI) signal Cencora's commitment to environmental responsibility and regulatory alignment.

- Emissions Reduction Targets: Cencora aims to achieve a 30% reduction in absolute Scope 1 and 2 GHG emissions by 2030 against a 2020 baseline, a target that requires ongoing investment in sustainable practices and transparent reporting.

Cencora is actively reducing its environmental footprint through science-based targets for greenhouse gas (GHG) emissions, aiming for a 30% reduction in Scope 1 and 2 emissions by 2030 from a 2020 baseline. This commitment is demonstrated by a 12.7% reduction in GHG emissions intensity in 2023 compared to 2021.

The company prioritizes waste reduction and recycling, a critical effort given the healthcare industry's significant waste generation, with the global healthcare waste market valued at approximately USD 32.5 billion in 2023. Cencora is also integrating sustainable packaging, including reusable options, to meet growing demands for reduced single-use plastics.

Climate change presents operational risks, such as supply chain disruptions from extreme weather, which Cencora addresses by embedding climate resilience into its planning. The company also collaborates across its supply chain to enhance environmental impact, optimizing logistics for greener transportation.

Growing regulatory oversight and stakeholder demands for ESG transparency are key environmental factors. Cencora's inclusion in sustainability yearbooks and adherence to standards like the Global Reporting Initiative (GRI) highlight its commitment to environmental responsibility and regulatory alignment.

| Initiative | Target/Metric | 2023 Progress | Baseline Year | Notes |

| GHG Emissions Reduction (Scope 1 & 2) | 30% by 2030 | 12.7% intensity reduction vs. 2021 | 2020 | Science-based targets |

| Waste Management | Reduce waste generation and increase recycling | Ongoing focus on reduction and responsible disposal | N/A | Healthcare waste market ~$32.5B in 2023 |

| Sustainable Packaging | Increase recycled content, explore reusable options | Aligning with industry trends toward 30%+ recycled content | N/A | Addresses single-use plastic reduction |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Cencora is built upon a robust foundation of data from reputable sources, including government publications, international financial institutions, and leading market research firms. This comprehensive approach ensures that every political, economic, social, technological, legal, and environmental insight is grounded in current and verifiable information.