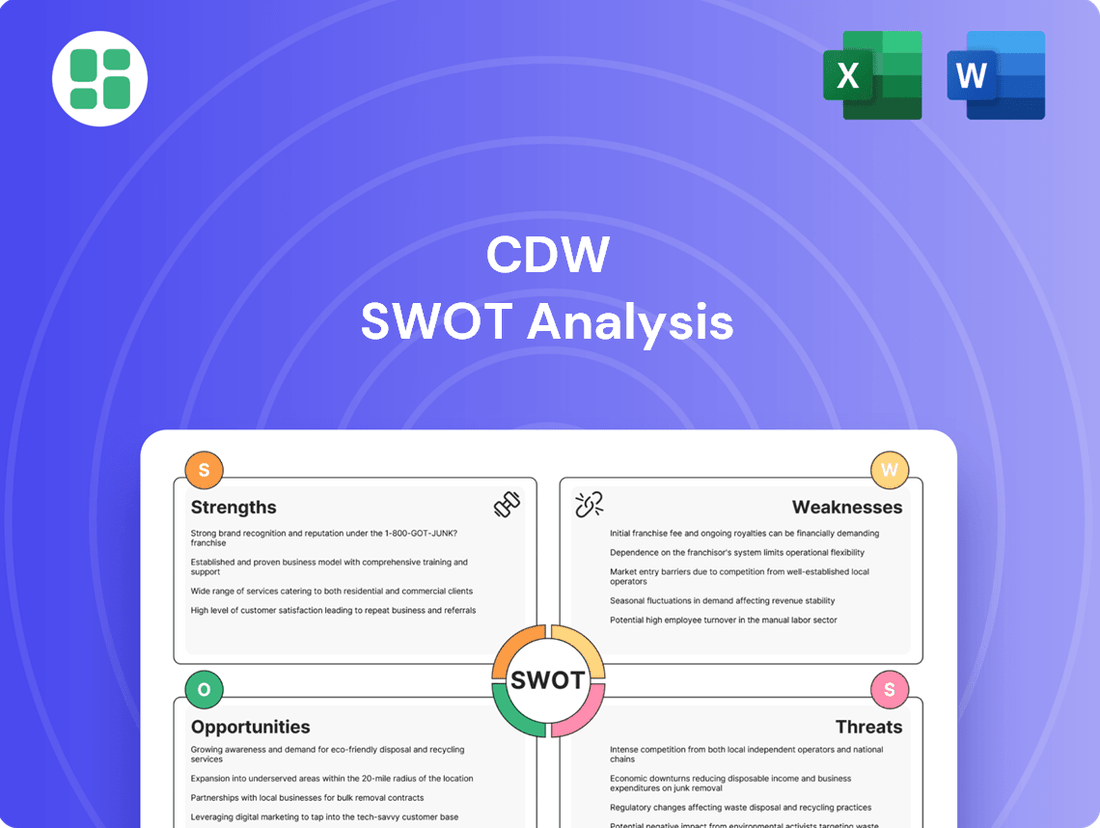

CDW SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CDW Bundle

CDW's strong market position and established customer relationships are key strengths, but its reliance on IT spending and increasing competition pose significant threats. Understanding these dynamics is crucial for navigating the evolving technology landscape.

Want the full story behind CDW's opportunities for expansion and potential weaknesses? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

CDW boasts a remarkably diverse and comprehensive technology portfolio, partnering with over 1,000 manufacturers to offer a vast range of hardware, software, and integrated IT solutions. This extensive selection positions CDW as a single source for a wide spectrum of customer technology requirements, streamlining the purchasing and management processes for their clients.

In fiscal year 2023, CDW reported net sales of $23.0 billion, underscoring the scale of its operations and the breadth of its product and service offerings that cater to a wide customer base.

CDW's strength lies in its broad and resilient customer base, spanning business, government, education, and healthcare sectors across the US, UK, and Canada. This diversification acts as a significant buffer against economic fluctuations in any single industry.

For instance, in the second quarter of 2025, CDW observed robust growth within its corporate and small business segments, which helped offset a slowdown experienced in the education sector. This adaptability highlights the company's ability to weather sector-specific challenges.

CDW differentiates itself by offering a comprehensive array of value-added services beyond simple product sales. These higher-margin offerings, including cloud computing, cybersecurity, data center management, and managed services, significantly bolster profitability. This strategic focus positions CDW as a trusted technology advisor, guiding clients through complex implementations and ongoing management to meet their business objectives.

Consistent Financial Performance and Shareholder Value

CDW has shown impressive financial stability, with net sales climbing in the first two quarters of 2025, exceeding what analysts had predicted. This consistent growth highlights the company's ability to navigate market dynamics effectively.

The company's dedication to its shareholders is evident in its sustained dividend payouts. CDW has a commendable track record of increasing its dividends for 12 consecutive years, demonstrating a reliable return on investment for its stakeholders.

- Strong Sales Growth: Q1 and Q2 2025 net sales increases, outperforming analyst forecasts.

- Shareholder Returns: 12 consecutive years of dividend increases, reflecting financial health and commitment to investors.

- Financial Resilience: Demonstrated ability to maintain and grow financial performance even in varying economic conditions.

Established Market Leadership and Strong Relationships

CDW's established market leadership is a significant strength, underscored by its Fortune 500 status and prominent position in the IT solutions sector. This leadership translates into strong brand recognition, a critical asset in a competitive technology landscape.

The company cultivates deep, long-standing relationships with both major technology manufacturers and its diverse customer base. These partnerships are crucial for accessing the latest products and services, ensuring CDW remains at the forefront of technological offerings.

CDW's client retention is notably high, with over half of its US Net sales in 2023 derived from account managers who have extensive tenure. This indicates a loyal customer base and effective relationship management, fostering repeat business and trust.

- Fortune 500 Status: Reinforces market authority and stability.

- Brand Recognition: Aids in customer acquisition and trust.

- Manufacturer Partnerships: Ensures access to a wide range of leading technology products.

- Customer Loyalty: Demonstrated by high sales from tenured account managers, indicating strong client relationships and repeat business.

CDW's extensive technology portfolio, featuring partnerships with over 1,000 manufacturers, allows it to serve as a single source for a wide array of customer IT needs. This comprehensive offering, combined with a broad and resilient customer base across business, government, education, and healthcare sectors, provides significant operational stability. The company's commitment to shareholder value is demonstrated by 12 consecutive years of dividend increases, reflecting strong financial health and consistent performance, as evidenced by exceeding analyst forecasts for net sales in Q1 and Q2 2025.

| Metric | 2023 (FY) | Q1 2025 (Est.) | Q2 2025 (Est.) |

|---|---|---|---|

| Net Sales | $23.0 billion | Exceeded Forecast | Exceeded Forecast |

| Dividend Growth | 12 Consecutive Years | N/A | N/A |

| Customer Segments | Business, Government, Education, Healthcare | Growth in Corporate/Small Business | Growth in Corporate/Small Business |

What is included in the product

Delivers a strategic overview of CDW’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats to understand its competitive position and future trajectory.

CDW's SWOT analysis acts as a pain point reliever by offering a structured framework to identify and address internal weaknesses and external threats, enabling proactive problem-solving and strategic mitigation.

Weaknesses

CDW has faced pressure on its gross profit margins, a trend observed in recent periods. This contraction is largely attributed to a shift in product mix, with a greater proportion of sales coming from lower-margin items such as notebooks and mobile devices.

Furthermore, the company has seen a decline in pricing rates across several product categories. While this might boost overall sales volume, it directly impacts the profitability earned on each individual sale, creating a challenge for maintaining healthy gross profit levels.

CDW's reliance on third-party manufacturers, despite its broad product portfolio, introduces significant vulnerability. Disruptions in the supply chain, such as those experienced in 2021 and 2022 due to semiconductor shortages, directly impact CDW's ability to fulfill customer orders. This dependence means CDW is subject to the manufacturing capabilities and potential issues of its partners, which can affect product availability and delivery timelines. For instance, the global chip shortage in 2022 led to extended lead times for many technology products, impacting sales across the industry.

CDW operates in a fiercely competitive IT solutions market. This includes direct sellers, other large system integrators, and increasingly, hyperscalers like Amazon Web Services, Microsoft Azure, and Google Cloud, who are directly offering their own services. This crowded field puts constant pressure on pricing and demands continuous investment in innovation to stay ahead.

The need to differentiate in such a crowded space is significant. For instance, while CDW reported strong Q1 2024 results with net sales of $5.2 billion, a 6.6% increase year-over-year, the competitive intensity means maintaining this growth requires strategic agility and a keen focus on value-added services beyond just product resale.

Sensitivity to Macroeconomic Conditions

CDW's financial performance is notably sensitive to broader macroeconomic shifts. Economic uncertainty, rising interest rates, and persistent inflation can directly influence customer IT spending, often leading to more cautious purchasing decisions and delayed investments.

This economic volatility directly impacts overall IT budgets. For instance, in early 2024, many businesses continued to grapple with the effects of elevated interest rates, which can increase the cost of capital for IT projects and upgrades, potentially dampening demand for CDW's solutions.

- Economic Uncertainty: Businesses may postpone large IT investments during periods of economic slowdown or instability.

- Interest Rate Hikes: Higher borrowing costs can reduce the attractiveness of financing new technology solutions.

- Inflationary Pressures: Increased operational costs for CDW and its clients can strain IT budgets.

Vulnerabilities in Specific Customer Segments

CDW's revenue streams, while diversified, show susceptibility in specific markets. For instance, the Education sector saw a significant sales dip in the second quarter of 2025, highlighting a vulnerability to sector-specific economic pressures or budget cycles. This uneven performance across segments can temper overall growth and necessitates focused recovery plans.

These sector-specific challenges are not isolated incidents. The company's reliance on certain public sector verticals, like Education, means that shifts in government funding or institutional spending priorities can directly impact performance. For example, a 5% year-over-year contraction in education sales for Q2 2025 underscores this dependency.

- Sector-Specific Downturns: CDW experienced a notable 5% year-over-year decline in sales within the Education segment during Q2 2025.

- Uneven Growth Patterns: This vulnerability creates inconsistent growth trajectories across CDW's diverse customer base.

- Need for Targeted Strategies: Addressing these sector-specific weaknesses requires tailored approaches to mitigate risks and capitalize on emerging opportunities within those markets.

CDW faces pressure on its gross profit margins due to a product mix shift towards lower-margin items like notebooks and mobile devices. Declining pricing rates across several categories further impact profitability per sale, even if overall sales volume increases.

The company's reliance on third-party manufacturers creates supply chain vulnerabilities, as seen with semiconductor shortages in 2021-2022 impacting order fulfillment. Intense competition from direct sellers, system integrators, and hyperscalers necessitates continuous innovation and puts pressure on pricing.

Economic uncertainty, rising interest rates, and inflation can dampen customer IT spending and delay investments, impacting CDW's revenue. Furthermore, sector-specific downturns, such as the 5% year-over-year decline in education sales in Q2 2025, highlight vulnerabilities to market-specific economic pressures and funding cycles.

| Weakness | Impact | Example/Data |

| Margin Pressure | Reduced profitability per sale | Shift to lower-margin products (notebooks, mobile devices) |

| Supply Chain Dependence | Risk of order fulfillment delays | Impact of 2021-2022 semiconductor shortages |

| Intense Competition | Pricing pressure, need for constant innovation | Competition from hyperscalers (AWS, Azure, Google Cloud) |

| Macroeconomic Sensitivity | Reduced IT spending by customers | Impact of interest rates on IT project financing |

| Sector-Specific Vulnerability | Uneven revenue performance | 5% year-over-year decline in Education sales (Q2 2025) |

Full Version Awaits

CDW SWOT Analysis

This is the actual CDW SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full CDW SWOT report you'll get. Purchase unlocks the entire in-depth version.

This preview reflects the real CDW SWOT analysis document—professional, structured, and ready to use.

Opportunities

The market's appetite for advanced technologies like cloud computing, AI, and cybersecurity is booming, creating a significant opportunity. CDW is actively investing in these high-growth sectors, aiming to capture a larger share of the evolving IT spending landscape.

For instance, the global cloud computing market was projected to reach $1.3 trillion by 2025, and cybersecurity spending was expected to exceed $250 billion in 2024. CDW's focus on these areas directly aligns with these substantial market trends.

Businesses and government agencies are still heavily invested in digital transformation, focusing on moving workloads to the cloud, upgrading to Windows 10, and modernizing their IT infrastructure. This ongoing shift creates a steady stream of projects and revenue potential for CDW. For instance, in Q1 2024, CDW reported a 12.1% increase in net sales for its Software and Cloud segment, underscoring the strong demand for these services.

The increasing complexity of IT environments is fueling a significant demand for managed services and expert IT consulting. This trend presents a prime opportunity for CDW to deepen its market penetration.

CDW can capitalize on this by expanding its portfolio of higher-margin service offerings. This strategic shift moves the company beyond traditional product sales towards building more robust, recurring revenue streams through ongoing support and advisory relationships.

For instance, in 2023, CDW saw its services revenue grow by 18.5%, reaching $3.1 billion. This growth highlights the strong market appetite for their expertise and the potential for further expansion in this lucrative segment.

Strategic Acquisitions and Partnerships

CDW has significant opportunities to bolster its capabilities and expand its market presence through strategic acquisitions. For instance, the acquisition of Mission Cloud Services in 2023 brought substantial AI and AWS expertise, directly addressing growing market demands.

Further strengthening its competitive moat, CDW has pursued partnerships, such as the one with Asato Corporation, to integrate AI-powered IT asset intelligence into its offerings. These strategic moves are crucial for staying ahead in the rapidly evolving technology landscape.

- Acquisition of Mission Cloud Services (2023): Enhanced AI and AWS capabilities.

- Partnership with Asato Corporation: Integration of AI-powered IT asset intelligence.

- Focus on Cloud and Security: Continued investment in high-growth areas.

- Expansion into New Verticals: Targeting emerging industries with tailored solutions.

Significant Untapped Market Share Potential

CDW operates within a massive IT market, estimated to be around $440 billion, yet its current market share is surprisingly modest. This fragmentation presents a significant opportunity for CDW to expand its reach. The company's comprehensive portfolio of solutions and services positions it well to attract a larger slice of this considerable pie.

This untapped potential is a key driver for CDW's strategic initiatives. By focusing on specific growth areas and leveraging its established reputation, CDW can actively pursue market share gains. For instance, the increasing demand for cloud services and cybersecurity solutions within this broad market offers fertile ground for expansion.

- Vast Addressable Market: CDW's total addressable market is approximately $440 billion.

- Fragmented Landscape: The IT market remains highly fragmented, with many smaller players.

- Growth Opportunity: CDW's current market share is relatively low, indicating significant room for expansion.

- Strategic Focus: CDW can capitalize on this by targeting underserved segments and expanding its service offerings.

The increasing demand for advanced technologies like cloud, AI, and cybersecurity presents a significant growth avenue for CDW. The company is strategically investing in these areas, aligning with projected market expansions. For example, the global cloud market is anticipated to reach $1.3 trillion by 2025, and cybersecurity spending was expected to surpass $250 billion in 2024.

CDW's expansion of its higher-margin services, including managed IT and consulting, offers a strong opportunity to build recurring revenue. This focus is already showing results, with services revenue growing 18.5% to $3.1 billion in 2023, demonstrating strong market acceptance of their expertise.

Strategic acquisitions and partnerships are key to CDW's growth strategy, enhancing its capabilities and market reach. The acquisition of Mission Cloud Services in 2023 bolstered its AI and AWS expertise, while partnerships like the one with Asato Corporation integrate advanced AI capabilities, keeping CDW competitive.

The IT market, estimated at $440 billion, remains fragmented, offering CDW substantial room for market share expansion. By leveraging its comprehensive offerings and targeting underserved segments, CDW is well-positioned to capture a larger portion of this vast market.

Threats

The IT solutions landscape is intensely competitive, featuring numerous established vendors and nimble newcomers, which directly translates into persistent pricing pressure and the potential for market share erosion for CDW. Competitors frequently employ more aggressive pricing strategies or develop niche, specialized offerings that can undermine CDW's more comprehensive market approach.

For instance, in the first quarter of 2024, the IT services market saw continued growth, but with significant price sensitivity reported by many clients seeking cost optimization. This environment means that competitors who can undercut CDW on price or offer highly tailored, cost-effective solutions pose a direct threat to CDW’s revenue streams and customer retention.

The relentless speed of technological evolution poses a significant threat, as CDW's existing product lines and service offerings risk rapid obsolescence. For instance, the emergence of advanced generative AI capabilities in 2024 and 2025 necessitates constant adaptation. Failure to proactively invest in research, development, and strategic partnerships to integrate these innovations could lead to a substantial competitive disadvantage.

Lingering macroeconomic uncertainties, such as persistent inflation and elevated interest rates, continue to pose a challenge. For instance, the Federal Reserve maintained its benchmark interest rate at 5.25%-5.50% through early 2024, impacting borrowing costs for businesses and potentially dampening IT investment. Geopolitical tensions also create an unpredictable environment, leading to cautious client behavior and potentially reduced IT spending across various sectors.

Cybersecurity Risks and Data Breaches

The escalating complexity of cyber threats poses a substantial danger to CDW's internal systems and the sensitive data entrusted by its clients. A significant data breach could result in substantial financial penalties, severe damage to CDW's reputation, and considerable legal exposure.

Cybersecurity incidents are becoming more frequent and impactful across the IT services sector. For instance, in 2023, the average cost of a data breach globally reached $4.45 million, according to IBM's Cost of a Data Breach Report. This underscores the potential financial fallout for companies like CDW if their defenses are compromised.

- Sophisticated Threats: CDW must continually adapt to evolving cyberattack methods.

- Reputational Damage: A breach erodes customer trust, impacting future business.

- Financial & Legal Repercussions: Costs include remediation, fines, and potential lawsuits.

Supply Chain Fragility and Component Shortages

CDW, despite its efforts to diversify suppliers, faces ongoing risks from global supply chain disruptions and persistent component shortages. These issues can directly impact CDW's capacity to secure and deliver the technology products its customers rely on, potentially leading to extended lead times and increased operational expenses.

The ongoing volatility in the tech supply chain, exemplified by semiconductor shortages that continued to affect various industries throughout 2023 and into early 2024, presents a significant threat. For instance, the global semiconductor market, while showing signs of recovery, still experienced supply constraints for certain advanced chips critical for high-performance computing and networking equipment, which are core to CDW's offerings.

- Supply Chain Volatility: Geopolitical events and natural disasters can rapidly alter the availability and cost of essential IT components.

- Component Shortages: Continued demand for advanced semiconductors and other critical parts can outstrip supply, delaying product fulfillment.

- Increased Costs: Supply chain pressures often translate to higher procurement costs, which may need to be passed on to customers or absorbed, impacting margins.

- Customer Dissatisfaction: Product delays and stockouts can lead to frustration and potential loss of business if competitors can fulfill orders more reliably.

Intense competition, rapid technological shifts, and macroeconomic instability present significant hurdles for CDW. Competitors' aggressive pricing and specialized offerings can erode market share, while the fast pace of innovation risks making existing products obsolete. Economic headwinds, including inflation and high interest rates, may curb IT spending, further complicating CDW's growth trajectory.

| Threat Category | Specific Risk | Impact on CDW | 2024/2025 Data Point |

|---|---|---|---|

| Competition | Aggressive pricing and niche offerings | Market share erosion, pricing pressure | IT services market saw continued price sensitivity in Q1 2024. |

| Technology | Rapid obsolescence of products/services | Loss of competitive advantage | Emergence of advanced generative AI necessitates constant adaptation. |

| Economic | Inflation, high interest rates, geopolitical uncertainty | Reduced IT investment, cautious client behavior | Federal Reserve maintained rates at 5.25%-5.50% through early 2024. |

| Cybersecurity | Data breaches, system compromises | Financial penalties, reputational damage, legal exposure | Average cost of a data breach reached $4.45 million globally in 2023. |

| Supply Chain | Disruptions, component shortages | Delivery delays, increased operational costs | Semiconductor shortages persisted for critical advanced chips into early 2024. |

SWOT Analysis Data Sources

This CDW SWOT analysis is built upon a robust foundation of data, drawing from internal financial reports, comprehensive market intelligence, and expert industry evaluations to provide a clear and actionable strategic overview.