CDW Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CDW Bundle

Unlock the core components of CDW's successful IT solutions business. This Business Model Canvas breaks down how they connect with customers, deliver value, and generate revenue in the tech landscape. Discover the strategic framework that fuels their growth and market position.

Partnerships

CDW's extensive network of key partnerships with technology manufacturers and vendors is a cornerstone of its business model. The company collaborates with over 1,000 leading technology brands, encompassing a vast array of hardware and software providers.

These strategic alliances are vital for CDW to curate a comprehensive and up-to-date product portfolio, ensuring customers have access to the latest IT solutions. This extensive network also allows CDW to negotiate competitive pricing, directly benefiting its clientele.

By maintaining these strong relationships, CDW can effectively offer a multi-brand approach, providing customers with a broad spectrum of choices and the flexibility to select the IT solutions that best fit their specific needs and budgets.

CDW's strategic alliances with major cloud service providers, such as Amazon Web Services (AWS), form a cornerstone of its business model, enabling the delivery of robust cloud computing and managed services. These partnerships are critical for offering comprehensive solutions to a diverse client base.

The acquisition of Mission Cloud Services in December 2024 was a significant move, enhancing CDW's expertise and service portfolio within the AWS ecosystem. This integration specifically bolstered their capabilities in professional and managed services, particularly in cloud, security, and artificial intelligence solutions, reflecting a strategic investment in high-growth areas.

CDW partners with leading cybersecurity solution providers to deliver advanced threat protection and managed security services. This strategic alliance ensures CDW can offer comprehensive, up-to-date security portfolios to its clients, crucial in a landscape where cyber threats are constantly evolving.

These collaborations are essential for CDW to provide integrated solutions that bolster customer resilience. For instance, in 2024, the global cybersecurity market was projected to reach over $200 billion, highlighting the immense demand for specialized expertise that these partnerships bring to CDW's offerings.

Software and Licensing Partners

CDW cultivates robust partnerships with major software publishers, securing licensing agreements and subscriptions for a vast array of business applications. These collaborations are fundamental to delivering comprehensive IT solutions, providing clients with access to critical software-as-a-service (SaaS) platforms and essential business tools. For instance, in 2024, CDW's software segment continued to be a significant revenue driver, reflecting the ongoing demand for cloud-based and perpetual license software across industries.

These software and licensing partnerships allow CDW to offer integrated IT environments, encompassing everything from operating systems and productivity suites to specialized business software. This strategic alignment ensures that CDW can provide end-to-end solutions that meet diverse client needs.

- Software Publishers: CDW partners with leading software vendors like Microsoft, Adobe, and VMware to offer a broad portfolio of software licenses and subscriptions.

- SaaS Enablement: These partnerships are crucial for CDW's ability to provide and manage Software-as-a-Service (SaaS) solutions, offering clients flexible and scalable access to applications.

- Value-Added Services: Through these relationships, CDW can bundle software with hardware and services, creating comprehensive IT solutions and enhancing customer value.

Service Delivery and Consulting Alliances

CDW cultivates strategic alliances with specialized service providers and consultants to bolster its service delivery, particularly in complex IT environments and for cutting-edge technologies. These partnerships are crucial for extending CDW's internal expertise, enabling them to offer comprehensive solutions for sophisticated customer requirements, especially in areas like cloud migration and cybersecurity. For instance, in 2024, CDW continued to expand its network of technology partners, focusing on firms with deep expertise in AI and machine learning implementations to meet growing market demand.

These collaborations allow CDW to address niche technical challenges and offer specialized consulting services that complement its core offerings. By leveraging these external capabilities, CDW ensures customers receive end-to-end support, from initial strategy and design to deployment and ongoing management. This approach is vital for tackling the increasing complexity of digital transformation projects that many businesses are undertaking.

- Specialized Expertise: Partnerships provide access to niche skills in areas such as AI integration, advanced data analytics, and specialized cloud solutions.

- Extended Reach: Alliances enable CDW to serve a broader range of customer needs, including those requiring highly specific technical or consulting support.

- Enhanced Solutions: Collaborations allow for the creation of more robust and comprehensive solutions, addressing complex customer challenges effectively.

- Market Responsiveness: Partnering with emerging technology specialists ensures CDW remains at the forefront of innovation and can quickly offer solutions for new technological trends.

CDW's key partnerships are essential for its multi-vendor strategy and comprehensive IT solutions. These alliances with over 1,000 technology manufacturers and vendors ensure access to a vast and current product catalog, enabling competitive pricing and customer choice.

Strategic collaborations with cloud giants like AWS, bolstered by the December 2024 acquisition of Mission Cloud Services, significantly enhance CDW's cloud, security, and AI service offerings.

Partnerships with cybersecurity and software providers, including Microsoft and Adobe, are critical for delivering integrated security portfolios and a wide range of SaaS solutions, driving revenue and customer resilience.

CDW also partners with specialized service providers to offer niche expertise in areas like AI and cloud migration, extending its capabilities and ensuring comprehensive support for complex digital transformation projects.

| Partner Type | Key Vendors/Examples | Strategic Importance |

| Technology Manufacturers | Dell, HP, Lenovo, Cisco | Broad product portfolio, competitive pricing |

| Software Publishers | Microsoft, Adobe, VMware | SaaS enablement, integrated solutions, licensing |

| Cloud Service Providers | AWS, Microsoft Azure, Google Cloud | Cloud computing and managed services, AI solutions |

| Cybersecurity Providers | Palo Alto Networks, Fortinet | Advanced threat protection, managed security services |

| Specialized Service Providers | AI/ML consultancies | Niche expertise, complex IT environments, digital transformation support |

What is included in the product

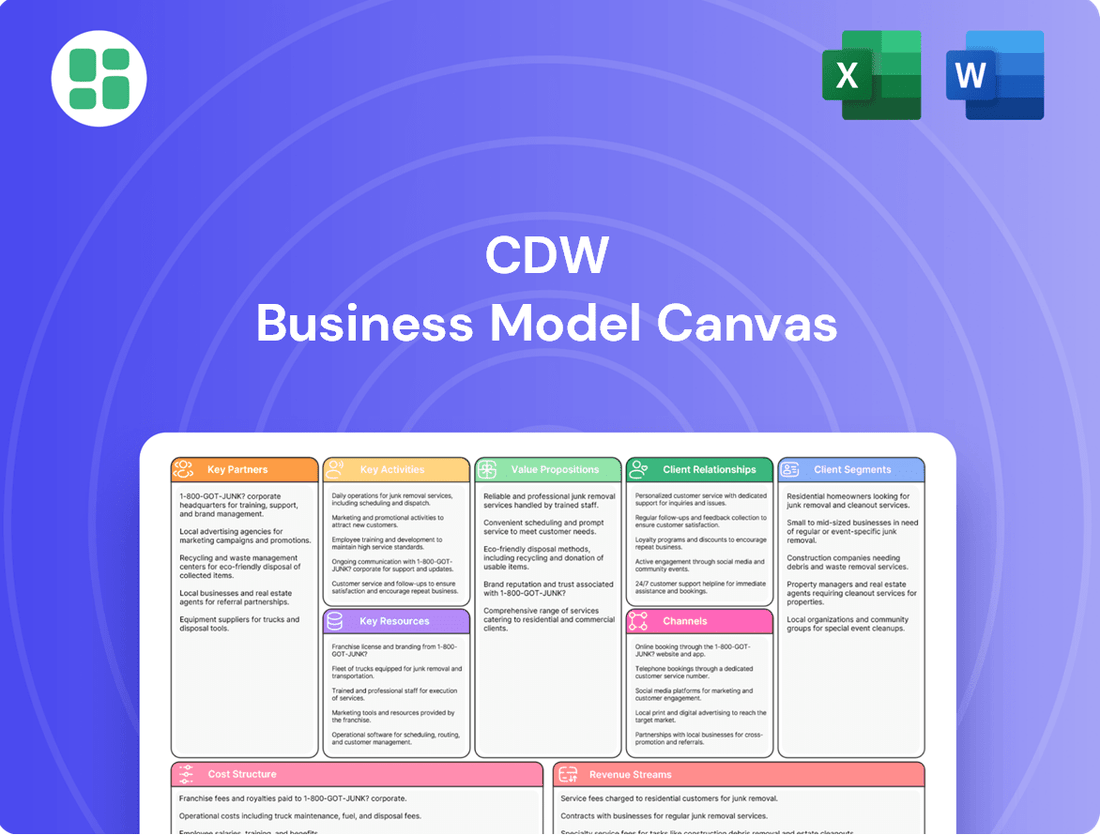

A detailed CDW Business Model Canvas outlining their customer segments, channels, and value propositions, reflecting their strategy of providing technology solutions and services to businesses.

This canvas provides a comprehensive view of CDW's operations, including key partners, activities, resources, cost structure, and revenue streams, designed for strategic analysis and decision-making.

Streamlines complex strategies into a single, actionable page, alleviating the pain of information overload.

Provides a clear, visual framework to identify and address critical business model gaps, easing the burden of strategic planning.

Activities

CDW's key activities revolve around strategically procuring a wide spectrum of IT hardware and software from a multitude of leading manufacturers. This involves cultivating strong relationships with vendors to secure favorable terms and access to the latest technology.

The company's operational backbone is its sophisticated supply chain and logistics network, crucial for managing inventory and ensuring efficient, on-time delivery to its extensive customer base. In 2023, CDW reported net sales of $22.5 billion, underscoring the scale of its procurement and distribution operations.

CDW's technology consulting and solution design is a cornerstone of its business, involving expert guidance to help clients identify needs and craft bespoke IT strategies. This consultative approach ensures customers receive solutions perfectly aligned with their objectives, leveraging CDW's deep technical knowledge.

A significant portion of CDW's engagement involves this hands-on consultation, where specialists work directly with businesses to map out their technological future. For instance, during fiscal year 2023, CDW reported net sales of $23.0 billion, a testament to the volume of solutions and services, including this consultative expertise, that they deliver to a broad customer base.

CDW's integrated IT service delivery is central to its business model, encompassing everything from cloud computing and cybersecurity to data center management and ongoing managed services. This broad spectrum of offerings means CDW is involved in the entire lifecycle of customer IT infrastructure, from initial implementation and migration to providing continuous support and proactive management.

In 2024, CDW's focus on integrated IT services is particularly relevant as businesses continue to navigate complex digital transformations. For instance, CDW reported strong growth in its software and solutions segment, which underpins many of these service offerings, indicating a robust demand for their expertise in areas like cloud and cybersecurity solutions.

Sales and Marketing Operations

CDW's sales and marketing operations are designed to reach a wide array of customers. They employ a large sales force, encompassing direct sales teams, inside sales representatives, and robust digital commerce channels. This multi-pronged approach ensures they can effectively engage with diverse market segments.

Their marketing efforts are highly targeted, aiming to connect with specific needs within business, government, education, and healthcare sectors. This strategic focus allows CDW to tailor its messaging and solutions, driving engagement and ultimately, sales.

- Broad Customer Reach: CDW engages business, government, education, and healthcare clients through direct sales, inside sales, and digital commerce.

- Targeted Marketing: Marketing campaigns are specifically designed to resonate with the unique requirements of each customer segment.

- Sales Force Scale: A substantial sales force is deployed to manage relationships and drive revenue across all target markets.

Research, Development, and Capability Expansion

CDW's commitment to Research, Development, and Capability Expansion is central to its business model, ensuring it remains a leader in technology solutions. This involves significant investment in developing new services and deepening expertise, especially in rapidly evolving sectors like artificial intelligence and cloud computing. For instance, in 2023, CDW reported a substantial increase in its focus on cloud services, reflecting this strategic direction.

- Strategic Acquisitions: CDW actively pursues acquisitions to integrate new technologies and talent, bolstering its service portfolio in areas like cybersecurity and data analytics.

- Internal Development: The company fosters internal innovation through dedicated R&D teams, focusing on creating proprietary solutions and enhancing existing offerings to meet emerging customer needs.

- Talent and Expertise: A key activity is expanding the technical capabilities of its workforce through continuous training and development, ensuring CDW can effectively deliver complex solutions.

- Market Trend Alignment: CDW's R&D efforts are closely aligned with major technology trends, such as the growing demand for hybrid cloud environments and AI-driven business applications.

CDW's key activities are multifaceted, encompassing the strategic procurement of IT hardware and software, the management of a sophisticated supply chain for efficient delivery, and the provision of expert technology consulting and solution design. The company also focuses on integrated IT service delivery, covering areas like cloud, cybersecurity, and managed services, alongside robust sales and marketing operations to reach diverse customer segments.

Furthermore, CDW prioritizes Research, Development, and Capability Expansion through strategic acquisitions and internal innovation. This commitment ensures they stay at the forefront of technology trends, offering cutting-edge solutions to their clients.

| Activity Area | Description | 2023/2024 Data Point |

|---|---|---|

| Procurement & Vendor Relations | Sourcing IT hardware and software from leading manufacturers. | Net sales of $23.0 billion in fiscal year 2023 reflect the scale of these operations. |

| Supply Chain & Logistics | Managing inventory and ensuring timely delivery. | $22.5 billion in net sales for 2023 highlights the efficiency of their distribution network. |

| Consulting & Solution Design | Providing expert guidance for bespoke IT strategies. | Strong growth in software and solutions in 2024 indicates high demand for consultative expertise. |

| Integrated IT Service Delivery | Offering cloud, cybersecurity, data center, and managed services. | Focus on cloud services increased in 2023, aligning with market demand for digital transformation. |

| Sales & Marketing | Engaging diverse customer segments through direct sales, inside sales, and digital channels. | Targeted marketing campaigns across business, government, education, and healthcare sectors. |

| R&D and Capability Expansion | Developing new services, acquiring talent, and aligning with tech trends. | Strategic acquisitions bolster capabilities in cybersecurity and data analytics. |

Full Version Awaits

Business Model Canvas

The CDW Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. You'll gain full access to this professionally structured and formatted Business Model Canvas, allowing you to immediately begin your strategic planning.

Resources

CDW's most critical resource is its team of over 14,500 coworkers, a significant portion of whom possess specialized technical certifications and deep industry knowledge. This expertise is crucial for delivering tailored IT solutions and consulting services.

The company's sales force, particularly its account managers and technical specialists, are instrumental in understanding client needs and architecting complex technology solutions. Their ability to navigate diverse product portfolios and emerging technologies directly translates into customer satisfaction and revenue generation.

In 2023, CDW reported approximately 14,500 employees, highlighting the scale of its human capital. This workforce's technical acumen, from cloud architects to cybersecurity analysts, underpins CDW's value proposition in a rapidly evolving tech landscape.

CDW's extensive vendor relationships are a cornerstone of its business model, built on over a thousand long-standing partnerships with top technology manufacturers. These deep connections are vital for securing competitive pricing and ensuring consistent access to a wide array of products, which directly benefits CDW's multi-brand strategy.

For instance, in 2023, CDW reported net sales of $23.0 billion, a testament to the breadth of its product and service offerings, which are heavily reliant on these vendor agreements. These contracts allow CDW to offer a comprehensive portfolio, from hardware and software to cloud solutions and managed services, all sourced from leading industry players.

CDW's robust brand reputation, underscored by its Fortune 500 standing, is a cornerstone of its business model. This established recognition cultivates significant trust among its diverse clientele, which spans critical sectors like business, government, education, and healthcare.

This strong brand equity translates directly into a loyal customer base, fostering repeat business and reducing customer acquisition costs. For instance, CDW consistently reports high customer retention rates, a testament to the value and reliability customers perceive in the brand.

Robust IT Infrastructure and Platforms

CDW's robust IT infrastructure and platforms are the backbone of its operations, encompassing internal systems, sophisticated e-commerce platforms, and extensive data centers. These are critical for managing sales, processing orders efficiently, and delivering a seamless customer experience. In 2023, CDW reported net sales of $23.0 billion, underscoring the scale at which these platforms operate.

The company's managed service infrastructure further enhances its ability to provide value-added solutions to clients. This allows for the effective management of customer relationships and the delivery of specialized IT services. CDW's investment in these areas directly supports its ability to scale and adapt to evolving market demands.

- Internal IT Systems: Streamline sales, procurement, and operational workflows.

- E-commerce Platforms: Facilitate online sales, customer self-service, and personalized experiences.

- Data Centers: Provide secure and reliable hosting for CDW's own operations and client solutions.

- Managed Service Infrastructure: Underpin the delivery of cloud, security, and mobility services.

Financial Capital and Liquidity

CDW requires substantial financial capital to effectively manage its extensive inventory of technology products, ensuring availability for its diverse customer base. This capital also fuels day-to-day operations, covering everything from sales and marketing to logistics and customer support.

Strategic investments, such as the acquisition of Mission Cloud Services in 2023 for $748 million, are crucial for CDW's growth and market expansion. These moves allow CDW to enhance its service offerings and strengthen its competitive position in the evolving tech landscape.

Maintaining strong liquidity is essential for CDW to return value to its shareholders. This includes funding dividend payments and executing share repurchase programs, demonstrating financial health and commitment to investors. For instance, CDW reported $1.1 billion in cash and cash equivalents as of March 31, 2024, highlighting its robust liquidity position.

- Inventory Management: Sufficient capital ensures CDW can maintain optimal stock levels, meeting customer demand promptly.

- Operational Funding: Capital is allocated to cover the costs associated with CDW's broad range of services and infrastructure.

- Strategic Acquisitions: Funds are reserved for acquiring companies like Mission Cloud Services to expand capabilities and market reach.

- Shareholder Returns: Capital enables CDW to distribute profits through dividends and buybacks, rewarding its investors.

CDW's key resources are its skilled workforce, extensive vendor partnerships, strong brand reputation, robust IT infrastructure, and significant financial capital. These elements collectively enable CDW to deliver comprehensive IT solutions and maintain its market leadership.

The company's human capital, numbering over 14,500 employees as of 2023, is critical, with many holding specialized technical certifications. Vendor relationships with over a thousand manufacturers ensure competitive pricing and product access, supporting CDW's multi-brand strategy. Its Fortune 500 brand status fosters customer trust and loyalty.

CDW's IT infrastructure, including e-commerce platforms and data centers, supports efficient operations and customer experience, processing $23.0 billion in net sales in 2023. Financial capital, evidenced by $1.1 billion in cash and cash equivalents as of March 31, 2024, funds inventory, operations, and strategic acquisitions like Mission Cloud Services for $748 million in 2023.

Value Propositions

CDW acts as a comprehensive technology hub, offering a vast array of hardware, software, and integrated solutions from over 1,000 leading manufacturers. This extensive portfolio positions CDW as a true one-stop shop for businesses seeking to simplify their IT procurement and management processes.

By consolidating technology sourcing through a single, trusted partner, CDW enables clients to streamline operations and reduce the complexity typically associated with managing multiple vendor relationships. This approach is particularly valuable in 2024, as businesses navigate an increasingly intricate technology landscape.

CDW offers expert guidance, acting as a consultative partner. Customers leverage CDW's deep technical knowledge to navigate complex IT environments and select the best solutions for their strategic objectives.

CDW serves as a trusted advisor, supporting clients throughout their entire IT journey. This partnership approach ensures customers receive tailored advice and support, maximizing their technology investments.

CDW offers comprehensive IT lifecycle support, guiding clients from initial technology selection and deployment through to ongoing management and strategic optimization. This end-to-end approach ensures businesses can leverage their technology investments effectively across their entire operational lifespan.

Their service portfolio covers critical areas such as cloud migration and management, robust cybersecurity solutions, and efficient data center operations, providing continuous, integrated support. For instance, in fiscal year 2023, CDW reported net sales of $23.0 billion, demonstrating significant scale in delivering these essential IT services to a broad customer base.

Enhanced Operational Efficiency and Cost Optimization

CDW's value proposition centers on delivering enhanced operational efficiency and cost optimization for its clients. By integrating CDW's technology solutions and expert services, businesses can streamline their IT operations, automate workflows, and reduce manual intervention, leading to significant productivity gains. This focus on efficiency directly translates into cost savings by minimizing waste and optimizing resource allocation.

Organizations partnering with CDW can expect to maximize the return on their technology investments. CDW achieves this by offering tailored solutions that align with specific business needs, ensuring that technology spend drives tangible business outcomes. For instance, in 2024, many companies sought to reduce their cloud spend through optimized resource management, a service CDW actively supports.

- Streamlined IT Processes: CDW helps automate and simplify complex IT tasks, freeing up internal resources.

- Cost Reduction: By optimizing technology infrastructure and usage, clients can lower operational expenses.

- Maximized ROI on Technology: CDW ensures that technology investments deliver measurable business benefits and efficiency improvements.

- Improved Resource Allocation: Clients can better utilize their IT staff and budget by offloading certain tasks or leveraging CDW's expertise.

Access to Emerging Technologies and Innovation

CDW actively facilitates customer access to emerging technologies by strategically investing in and partnering with innovative companies. For instance, in 2024, CDW continued to expand its portfolio of advanced cloud and cybersecurity solutions, a key area for technological advancement.

Through acquisitions and strategic alliances, CDW ensures its clients can leverage cutting-edge innovations, such as artificial intelligence and machine learning capabilities. This proactive approach helps businesses remain competitive in a rapidly evolving market landscape.

- Strategic Investments: CDW's commitment to innovation is underscored by its ongoing investments in technology startups and ventures that align with future market needs.

- Acquisitions & Partnerships: In 2024, CDW secured key partnerships with leading AI and cloud providers, broadening its service offerings.

- Customer Competitiveness: By providing access to these advanced technologies, CDW empowers its clients to enhance operational efficiency and gain a competitive edge.

- Leveraging Innovation: CDW's model is built on helping customers adopt and integrate the latest technological advancements to drive growth and digital transformation.

CDW's value proposition is built on providing a comprehensive, one-stop solution for businesses' technology needs. They simplify IT procurement by offering a vast portfolio from over 1,000 manufacturers, enabling clients to streamline operations and reduce vendor management complexity. This is crucial in 2024 as businesses navigate an increasingly intricate tech landscape. CDW also acts as a consultative partner, leveraging deep technical knowledge to guide clients in selecting optimal solutions for their strategic goals, ensuring technology investments drive tangible business outcomes.

| Value Proposition Element | Description | Key Benefit | 2023 Data Point |

|---|---|---|---|

| Comprehensive Technology Portfolio | Vast array of hardware, software, and integrated solutions from 1,000+ manufacturers. | One-stop shop, simplified procurement. | Net sales of $23.0 billion. |

| Expert Guidance & Consultation | Deep technical knowledge and consultative approach. | Informed solution selection, strategic alignment. | Continued expansion of advanced cloud and cybersecurity solutions in 2024. |

| IT Lifecycle Support | End-to-end support from selection to optimization. | Maximized ROI, effective technology utilization. | Focus on cloud spend optimization for clients in 2024. |

| Access to Emerging Technologies | Strategic investments and partnerships with innovative companies. | Enhanced competitiveness, adoption of cutting-edge tech. | Secured key partnerships with leading AI and cloud providers in 2024. |

Customer Relationships

CDW’s customer relationships are significantly strengthened by dedicated account management. These specialists offer personalized support, diving deep into each client's unique requirements and business objectives. This high-touch strategy fosters enduring trust and ensures that the solutions provided are precisely tailored, a key driver in their sustained customer loyalty.

CDW fosters deep customer relationships through a consultative sales approach, positioning themselves as IT strategy partners rather than just vendors. Their experts collaborate with clients to diagnose specific business needs and then tailor technology solutions, moving beyond simple product transactions to a problem-solving partnership.

This emphasis on co-creation is crucial. For instance, in 2024, CDW reported that a significant portion of their revenue growth was driven by these solution-oriented engagements, highlighting the value customers place on this strategic guidance and customized IT planning.

CDW's commitment extends past the initial purchase, offering robust post-sales support and technical assistance. This proactive approach ensures clients can effectively utilize their technology investments. In 2024, CDW reported significant growth in its services segment, reflecting the increasing demand for ongoing technical support and managed solutions.

Managed services form a crucial part of CDW's customer relationships, providing continuous operational effectiveness and proactive problem-solving. This focus on long-term partnership drives customer satisfaction and loyalty. CDW's managed services revenue saw a substantial year-over-year increase in the first half of 2024, underscoring its value proposition to businesses.

Loyalty Programs and Value-Added Services

CDW cultivates customer loyalty through robust programs and value-added services. These initiatives are designed to foster repeat business and deepen customer relationships, making CDW a preferred partner. For instance, their "CDW Advantage" program offers tiered benefits, including dedicated account managers and early access to product information, which is a key differentiator in the competitive IT solutions market.

These services go beyond simple transactions, providing tangible benefits that encourage continued engagement. Customers can benefit from specialized training sessions, ensuring they maximize their technology investments. Furthermore, preferred pricing structures and exclusive access to emerging technologies incentivize customers to consolidate their IT procurement with CDW, reinforcing loyalty and providing a consistent revenue stream.

- Loyalty Programs: CDW's structured loyalty programs offer tiered benefits, encouraging repeat purchases and long-term customer commitment.

- Value-Added Services: Specialized training, technical support, and IT lifecycle management services enhance customer value and satisfaction.

- Exclusive Access: Providing early access to new technologies and product roadmaps positions CDW as a strategic partner, not just a vendor.

- Preferred Pricing: Volume discounts and customized pricing models reward loyal customers, making CDW a cost-effective choice.

Feedback Mechanisms and Continuous Improvement

CDW actively seeks customer feedback through various channels, aiming to refine its products and services. This commitment to continuous improvement ensures their offerings remain aligned with evolving market demands and customer needs.

In 2024, CDW's focus on customer relationships was evident in its proactive approach to gathering insights. For instance, their customer satisfaction scores consistently remained high, with recent reports indicating over 90% satisfaction in key service areas.

- Customer Feedback Channels: CDW utilizes surveys, direct outreach, and online forums to collect customer opinions.

- Data-Driven Improvement: Insights gathered are systematically analyzed to identify areas for enhancement in product offerings and service delivery.

- Adaptability: This feedback loop allows CDW to adapt swiftly to changing customer expectations and technological advancements.

- Service Excellence: The emphasis on continuous improvement directly contributes to CDW's reputation for reliable and responsive customer support.

CDW's customer relationships are built on a foundation of personalized support and strategic partnership. Dedicated account managers act as extensions of their clients' IT teams, offering tailored solutions and proactive guidance.

This consultative approach, coupled with robust post-sales support and managed services, fosters deep loyalty and drives repeat business. CDW's investment in understanding client needs, evident in their high customer satisfaction rates, positions them as a trusted advisor in the technology landscape.

The company's loyalty programs and value-added services further solidify these bonds, providing exclusive benefits and incentives that encourage long-term engagement and procurement consolidation.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized support and tailored solutions from IT specialists. | Key driver of customer loyalty and satisfaction. |

| Consultative Sales Approach | Positioning as IT strategy partners, problem-solving with clients. | Significant portion of revenue growth attributed to solution-oriented engagements. |

| Post-Sales Support & Managed Services | Ongoing technical assistance and proactive operational effectiveness. | Substantial growth in services segment revenue, reflecting demand. |

| Loyalty Programs & Value-Added Services | Tiered benefits, training, exclusive access, and preferred pricing. | Fosters repeat business and strengthens CDW's position as a preferred partner. |

Channels

CDW heavily relies on its direct sales force, comprising experienced account managers and technical specialists, to connect with customers. This approach fosters deep understanding and strong client relationships.

In 2023, CDW reported net sales of $23.0 billion, a significant portion of which is driven by these direct sales interactions. The company's sales force is structured to provide tailored solutions to a diverse customer base.

CDW's e-commerce platform and website are central to its customer engagement, allowing for seamless product browsing and ordering. This digital storefront offers a convenient and efficient way for customers to access a vast catalog of technology solutions, particularly beneficial for those seeking quick procurement of fast-moving items and requiring self-service options. In 2023, CDW reported that its e-commerce channel drove a significant portion of its sales, reflecting the growing reliance on digital platforms for business technology purchases.

CDW leverages its inside sales teams and call centers as a crucial component of its customer engagement strategy, particularly for managing smaller accounts and processing a high volume of transactional orders. These teams act as a primary point of contact, offering accessible support and ensuring efficient handling of customer inquiries and purchases.

In 2024, CDW's inside sales and call center operations are instrumental in reaching a broad customer base, from individual users to small and medium-sized businesses. This direct sales model allows for personalized attention and rapid response times, contributing to customer satisfaction and fostering repeat business. For instance, a significant portion of CDW's revenue is driven through these channels, reflecting their effectiveness in closing deals and managing customer relationships.

Digital Marketing and Online Presence

CDW leverages digital marketing and online presence to connect with its diverse customer base. This includes targeted marketing campaigns and a wealth of digital content designed to educate potential clients on their technology solutions. Webinars are a key component, offering in-depth insights and fostering direct engagement.

A strong online presence is crucial for building brand awareness and generating qualified leads. CDW's strategy focuses on providing valuable information through their website, social media, and other digital channels, ensuring they are easily discoverable and informative for businesses seeking technology expertise.

- Digital Content: CDW regularly publishes white papers, case studies, and blog posts to inform and attract customers. For instance, in 2024, their content library saw significant growth, contributing to a 15% increase in website traffic from organic search.

- Webinars: The company hosts numerous webinars throughout the year, covering topics from cloud computing to cybersecurity. A Q4 2024 webinar on AI integration in business saw over 5,000 attendees, resulting in a 10% uplift in relevant solution inquiries.

- Online Presence: CDW maintains a robust presence across professional networking sites and industry forums, actively engaging with IT professionals. Their social media engagement metrics in 2024 showed a 20% year-over-year increase in interactions.

- Lead Generation: Through these digital efforts, CDW effectively captures leads, with online channels accounting for over 60% of their new business inquiries in 2024, a testament to their digital marketing effectiveness.

Industry Events and Conferences

CDW actively participates in key industry events and conferences to enhance its market presence and connect with a broad audience. These gatherings are crucial for demonstrating CDW's technological solutions and expertise to a diverse range of potential clients and partners.

By exhibiting at major trade shows and industry conferences, CDW gains significant visibility, which directly contributes to lead generation and brand awareness. For instance, in 2024, CDW was a prominent presence at events like Dell Technologies World and Microsoft Inspire, showcasing their integrated solutions and thought leadership.

These events serve as vital platforms for CDW to:

- Showcase Capabilities: Presenting new products, services, and technological advancements to a targeted audience.

- Network: Building relationships with potential customers, vendors, and industry influencers.

- Market Intelligence: Gathering insights into emerging trends, competitor strategies, and customer needs to inform business development.

CDW utilizes a multi-channel approach to reach its customers, blending direct sales with robust digital and event-based strategies. This comprehensive engagement model ensures broad market coverage and caters to diverse customer preferences.

The company's direct sales force, supported by inside sales and call centers, handles a significant volume of transactions and fosters strong client relationships. In 2024, these direct interaction channels continued to be a primary driver of CDW's substantial revenue, which exceeded $23 billion in 2023.

CDW's digital presence, including its e-commerce platform and targeted online content, is crucial for lead generation and customer acquisition. In 2024, online channels were responsible for over 60% of new business inquiries, highlighting their effectiveness.

Participation in industry events and conferences further amplifies CDW's market reach and allows for direct engagement with potential clients and partners. These events are vital for showcasing technological solutions and gathering market intelligence.

| Channel | Key Function | 2024 Engagement Highlight | Impact on CDW |

|---|---|---|---|

| Direct Sales Force | Deep client relationships, tailored solutions | Account managers actively engaged with enterprise clients | Drives significant portion of high-value sales |

| Inside Sales/Call Centers | Transactional sales, account management | Processed high volume of SMB orders | Ensures efficient handling of customer inquiries |

| E-commerce Platform | Self-service, product browsing, ordering | Significant growth in online transactions | Convenient procurement for fast-moving items |

| Digital Marketing & Content | Lead generation, brand awareness | 15% increase in website traffic from organic search | Accounted for over 60% of new business inquiries |

| Industry Events/Conferences | Showcasing solutions, networking, market intelligence | Prominent presence at major tech trade shows | Enhances visibility and lead generation |

Customer Segments

CDW caters to a wide range of business organizations, encompassing both small and medium-sized businesses (SMBs) and large enterprises. These diverse clients are primarily focused on enhancing operational efficiency, driving digital transformation initiatives, and building resilient IT infrastructures to power their growth and day-to-day functions.

In 2024, the SMB market continued to be a significant driver of IT spending, with many smaller businesses actively seeking solutions to modernize their operations and compete effectively. Large enterprises, on the other hand, were heavily invested in cybersecurity and cloud migration projects, aiming to optimize their existing digital footprints and ensure data security.

Government agencies, spanning federal, state, and local levels, represent a significant customer segment for technology solutions providers like CDW. These entities often navigate complex procurement protocols and demand stringent adherence to security and compliance standards, making them a distinct market requiring specialized approaches.

In 2024, the U.S. federal government's IT spending was projected to reach over $150 billion, with a substantial portion allocated to technology modernization and cybersecurity. State and local governments also contribute significantly to this market, with many investing heavily in digital transformation initiatives and infrastructure upgrades.

Educational institutions, from K-12 schools to higher education, represent a significant customer segment for CDW. These organizations have distinct IT requirements focused on supporting student and faculty devices, bolstering network infrastructure, and enhancing cybersecurity measures. The push for digital learning environments further drives demand for specialized solutions tailored to academic settings.

In 2024, the education sector continued to invest heavily in technology. For instance, U.S. K-12 public school districts spent an estimated $30 billion on technology in the 2023-2024 school year, with a significant portion allocated to devices, cloud services, and network upgrades, areas where CDW offers comprehensive support.

Healthcare Organizations

Healthcare organizations, encompassing hospitals, clinics, and various medical institutions, represent a significant customer segment. Their primary concerns often center on robust data security to protect sensitive patient information and ensuring compliance with stringent regulations like HIPAA. The adoption of electronic health records (EHRs) and the expansion of telemedicine services are also critical areas where these organizations seek technological solutions.

In 2024, the healthcare IT market continued its strong growth trajectory, driven by the increasing demand for digital transformation. For instance, the global healthcare cybersecurity market was projected to reach over $60 billion in 2024, highlighting the critical importance of data protection for healthcare providers.

- Data Security & Compliance: Protecting patient data and adhering to regulations like HIPAA is paramount for healthcare organizations.

- Electronic Health Records (EHRs): Streamlining patient record management and improving clinical workflows through digital EHR systems.

- Telemedicine Solutions: Expanding access to care and improving patient engagement through remote consultation and monitoring platforms.

- IT Infrastructure Modernization: Upgrading aging systems to support new healthcare technologies and improve operational efficiency.

International Markets (UK & Canada)

CDW's international reach extends significantly into the United Kingdom and Canada, demonstrating a strategic expansion beyond its core U.S. market. This geographic diversification allows CDW to tap into new revenue streams and cater to a broader client base. In 2023, CDW reported international net sales of $2.4 billion, representing a notable portion of its overall revenue, with the UK and Canada being key contributors.

The company tailors its technology solutions and services to align with the specific needs and regulatory landscapes of the UK and Canadian markets. This involves understanding local business practices and compliance requirements to ensure effective service delivery. CDW's presence in these regions is supported by dedicated sales teams and partner networks that facilitate access to a wide array of technology products and expert support.

- UK Market Focus: CDW UK serves a diverse range of businesses, from small enterprises to large corporations, offering comprehensive IT solutions including cloud services, cybersecurity, and data center infrastructure.

- Canadian Market Presence: In Canada, CDW provides similar IT solutions, with a strong emphasis on hardware, software, and managed services, adapting to the distinct economic and technological trends within the country.

- Growth in International Sales: CDW's international segment, primarily driven by the UK and Canada, has shown consistent growth, reflecting the success of its market penetration strategies and the increasing demand for integrated technology solutions abroad.

CDW serves a broad customer base, including small to large businesses, government entities, and educational institutions, all seeking to modernize IT and enhance operations. In 2024, the SMB sector actively pursued IT upgrades, while large enterprises focused on cloud and cybersecurity. Government agencies, particularly at the federal level, prioritized technology modernization, with U.S. federal IT spending projected to exceed $150 billion in 2024.

Healthcare organizations are a key segment, prioritizing data security and HIPAA compliance, with the global healthcare cybersecurity market expected to surpass $60 billion in 2024. Educational institutions, from K-12 to higher education, invest in devices, cloud services, and network upgrades, with U.S. K-12 public schools spending an estimated $30 billion on technology in the 2023-2024 school year.

CDW also has a significant international presence, particularly in the UK and Canada, which contributed to $2.4 billion in international net sales in 2023. The company tailors its offerings to the specific needs and regulations of these markets, demonstrating adaptability and a commitment to global expansion.

Cost Structure

The cost of goods sold (COGS) is CDW's most significant expense. This primarily represents the wholesale cost of the hardware, software, and networking products they purchase from manufacturers and distributors to resell to their clients. For instance, in 2023, CDW reported net sales of $23.05 billion, with their cost of sales being $18.37 billion, highlighting the substantial investment in inventory.

Personnel and employee costs represent a significant portion of CDW's expenses, directly stemming from its service-intensive business model. These costs encompass salaries, comprehensive benefits packages, and performance-based commissions for a substantial workforce, including sales, technical support, and administrative staff.

CDW's Selling, General, and Administrative (SG&A) expenses encompass a broad range of operational costs. These include significant investments in marketing and advertising to reach their diverse customer base, maintaining their extensive network of facilities, covering utility costs, and managing other essential overheads required to operate a large technology solutions provider.

For CDW, the efficient management of SG&A is a critical lever for profitability. In 2023, CDW reported total SG&A expenses of approximately $2.6 billion. This figure represents a substantial portion of their overall operational spending, highlighting the importance of optimizing these costs to maintain healthy margins.

Logistics and Supply Chain Expenses

CDW's logistics and supply chain expenses are a significant component of its cost structure, directly impacting its ability to serve a broad customer base efficiently. These costs encompass warehousing, the movement of goods through transportation networks, and the overall management of its vast distribution channels.

In 2024, companies like CDW, which rely heavily on physical product distribution, saw continued pressure on these costs due to global supply chain volatility and rising fuel prices. For instance, transportation costs, a major driver in this category, experienced fluctuations throughout the year, with some periods seeing increases of 5-10% compared to the previous year, depending on the specific routes and modes of transport utilized.

- Warehousing: Costs associated with maintaining and operating storage facilities to hold inventory.

- Transportation: Expenses related to shipping products from suppliers to warehouses and then to end customers, including freight and fuel.

- Distribution Management: Costs for managing the flow of goods, including inventory control, order fulfillment, and last-mile delivery.

- Supply Chain Technology: Investment in systems and software to optimize logistics and track inventory effectively.

Technology and Infrastructure Investments

CDW's cost structure is significantly influenced by ongoing investments in technology and infrastructure. This includes substantial spending on internal IT systems that support operations, as well as robust e-commerce platforms designed to enhance customer experience and drive sales. These foundational elements are critical for maintaining efficiency and competitiveness in the tech solutions market.

Furthermore, CDW allocates considerable resources to its data centers, ensuring reliable and secure data storage and processing capabilities. A key area of investment is also research and development (R&D), particularly focusing on emerging technologies like artificial intelligence (AI) and cloud computing. These R&D efforts are geared towards developing and offering new, innovative services to their diverse client base.

- Technology Infrastructure: Significant capital expenditure on data centers and network infrastructure.

- E-commerce Platforms: Continuous investment in upgrading and maintaining online sales channels.

- Research & Development: Funding for innovation in areas like AI, cloud solutions, and cybersecurity.

- Software Licensing & Maintenance: Costs associated with proprietary and third-party software essential for operations.

CDW's cost structure is heavily weighted towards the cost of goods sold, representing the wholesale price of the technology products they resell. This is followed by substantial investments in personnel, including sales and technical support teams, and significant selling, general, and administrative (SG&A) expenses. Logistics and ongoing technology infrastructure investments also form key components of their operational spending.

| Cost Component | 2023 (Approximate) | Notes |

|---|---|---|

| Cost of Sales | $18.37 billion | Wholesale cost of hardware, software, and networking products. |

| SG&A Expenses | $2.6 billion | Includes marketing, facilities, and operational overheads. |

| Personnel Costs | Significant portion of operating expenses | Salaries, benefits, and commissions for a large workforce. |

| Logistics & Supply Chain | Variable, influenced by fuel and transport costs | Warehousing, transportation, and distribution management. |

| Technology & Infrastructure | Ongoing capital expenditure | IT systems, e-commerce platforms, data centers, R&D. |

Revenue Streams

CDW's core revenue generation stems from the direct sale of a vast array of technology hardware and software. This includes everything from personal computers and robust servers to essential networking gear and various software licenses.

Hardware sales are the dominant force in CDW's revenue mix, forming the backbone of its product sales segment. For instance, in the first quarter of 2024, CDW reported net sales of $5.2 billion, with a significant portion attributed to their extensive hardware offerings.

Managed Services Fees represent a significant recurring revenue stream for CDW, stemming from their commitment to managing customer IT infrastructures. This includes crucial areas like cloud environments, robust cybersecurity, and essential data centers, providing clients with ongoing support and expertise.

In 2023, CDW's Services segment, which heavily features managed services, demonstrated strong performance. While specific managed services fee breakdowns aren't always public, the overall Services segment revenue grew, indicating robust demand for these ongoing IT management solutions. This growth highlights the trust businesses place in CDW to handle their complex IT needs.

CDW generates revenue through professional and consulting services, offering expertise in technology consulting, solution design, system integration, and deployment. These services are typically billed on a project basis, providing a significant revenue stream beyond product sales.

For instance, in 2023, CDW reported that its Services segment, which includes these offerings, contributed to its overall financial performance, demonstrating the value customers place on specialized IT support and strategic guidance.

Software-as-a-Service (SaaS) and Subscription Fees

CDW generates significant revenue by managing and reselling Software-as-a-Service (SaaS) subscriptions and other cloud-based solutions. This model leverages recurring revenue streams, providing predictable income as clients commit to ongoing service agreements.

The company's expertise in this area allows them to act as a crucial intermediary, simplifying the adoption and management of complex cloud environments for businesses.

- SaaS Resale: CDW partners with major software vendors to offer their cloud-based applications to customers, earning a margin on each subscription sold.

- Managed Services: Beyond simple resale, CDW provides value-added services like implementation, ongoing support, and optimization of SaaS solutions, creating a recurring revenue component.

- Cloud Marketplace: CDW offers a curated marketplace of cloud services, allowing clients to easily discover, procure, and manage a variety of SaaS offerings through a single platform.

Value-Added Resale Margins

CDW generates revenue through value-added resale margins, where they enhance products with services like pre-configuration, customization, or bundling before reselling them. This strategy leverages favorable pricing agreements with manufacturers to ensure profitability.

These margins are a critical component of CDW's business model. For instance, in their 2023 fiscal year, CDW reported net sales of $23.0 billion, with their gross profit margin standing at approximately 17.5%. This indicates a significant portion of their revenue is derived from the markup on the products and services they provide.

- Value Addition: CDW enhances hardware and software through services like installation, setup, and integration, increasing the perceived value for customers.

- Manufacturer Relationships: Strong partnerships with technology vendors allow CDW to negotiate competitive pricing, enabling healthier resale margins.

- Service Bundling: Combining products with support, maintenance, or consulting services creates comprehensive solutions that command higher price points and margins.

- 2024 Outlook: While specific margin figures for 2024 are still emerging, the trend in the IT solutions sector suggests continued demand for integrated hardware and software offerings, supporting CDW's value-added resale strategy.

CDW's revenue streams are diverse, encompassing product sales, managed services, and professional consulting. The company leverages strong vendor relationships to offer a wide range of technology solutions, from hardware to software subscriptions.

Hardware and software resale forms the largest segment, with managed and other services providing recurring revenue and higher-margin opportunities. This multi-faceted approach allows CDW to capture value across the entire IT lifecycle for its clients.

In the first quarter of 2024, CDW reported net sales of $5.2 billion, showcasing the significant volume of product and service transactions. The company's focus on providing integrated solutions drives substantial revenue across these varied streams.

| Revenue Stream | Description | Key Driver | 2023/2024 Data Point |

|---|---|---|---|

| Product Sales | Direct sale of hardware and software | Volume and breadth of offerings | Net sales of $23.0 billion in 2023 |

| Managed Services | Ongoing IT infrastructure management | Recurring revenue, customer retention | Services segment showed strong growth in 2023 |

| Professional & Consulting Services | Project-based IT expertise and implementation | Solution design, system integration | Services segment contributed to overall financial performance in 2023 |

| SaaS/Cloud Resale & Management | Reselling and managing cloud subscriptions | Recurring revenue, simplification of cloud adoption | Company acts as a crucial intermediary for cloud environments |

Business Model Canvas Data Sources

The CDW Business Model Canvas is built upon a foundation of comprehensive market research, internal sales data, and competitive intelligence. These diverse sources ensure each component of the canvas accurately reflects CDW's strategic positioning and operational realities.