CDW Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CDW Bundle

CDW operates in a dynamic IT solutions market, facing moderate buyer power and intense rivalry from competitors. Understanding these forces is crucial for navigating the industry's landscape.

The complete report reveals the real forces shaping CDW’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CDW's extensive network of technology manufacturers, partnering with over 1,000 leading brands, significantly mitigates supplier bargaining power. This broad base, encompassing major hardware, software, and networking vendors, provides CDW with numerous sourcing alternatives, preventing any single supplier from dictating terms. For instance, in 2023, CDW's supplier relationships facilitated access to a vast array of products, ensuring competitive pricing and availability across its portfolio.

CDW's role as a vital distribution channel for technology manufacturers grants it significant bargaining power. For instance, in 2023, CDW reported net sales of $23.5 billion, underscoring its substantial market penetration. This extensive reach across business, government, education, and healthcare sectors means suppliers often depend on CDW to move considerable product volume and access diverse customer bases.

Suppliers recognize that CDW's established relationships and logistical capabilities are crucial for their own sales success. This reliance translates into leverage for CDW during price negotiations and terms of sale, as manufacturers value the sales volume and the value-added services CDW provides, such as technical support and tailored solutions.

While CDW works with numerous suppliers, a select group of major technology manufacturers wield significant influence due to their strong brand recognition and proprietary technologies. Companies like Microsoft, Dell, HP, and Cisco are prime examples, holding considerable sway in the market.

This dominance translates into bargaining power for these key suppliers, especially when it comes to essential or high-demand products that CDW relies on to serve its customer base. For instance, in 2023, the global PC market saw shipments from Dell and HP remain strong, indicating their continued importance in CDW's supply chain.

CDW's Strategic Supplier Relationships and Diversity Program

CDW strategically manages its supplier relationships to lessen their bargaining power. By fostering strong partnerships, CDW aims to secure favorable terms and ensure supply chain resilience.

The company's commitment to a supplier diversity program, with over $27.2 billion spent with diverse-owned businesses since 2007, further diversifies its supplier base. This broadens sourcing options and reduces reliance on any single supplier, thereby diminishing individual supplier leverage.

CDW's proactive approach to supplier management, including strategic relationship cultivation and diversity initiatives, directly counters the bargaining power of suppliers. This strategy is designed to enhance flexibility and create competitive advantages within its supply chain.

- Strategic Supplier Relationships: CDW actively cultivates deep partnerships with key suppliers.

- Supplier Diversity Program: Over $27.2 billion spent with diverse-owned businesses since 2007.

- Mitigating Supplier Power: Diversifying the supplier base reduces reliance and enhances negotiation leverage.

- Competitive Advantage: Flexible supply chains and strong supplier ties contribute to CDW's market position.

Potential for Direct Sales by Manufacturers

Large technology manufacturers, like Dell or HP, can choose to sell directly to their biggest clients, bypassing intermediaries such as CDW. This direct sales capability acts as a constant pressure, potentially capping the profit margins CDW can achieve on specific product lines.

For instance, in 2024, major PC manufacturers continued to emphasize their own direct-to-business sales channels, especially for volume deals. This strategy allows them to capture a larger share of the customer's spending and build closer relationships, directly impacting the value proposition of distributors.

- Direct Sales Threat: Manufacturers retain the ability to bypass distributors and sell directly to end-users.

- Margin Pressure: This direct channel limits the pricing power and potential margins for intermediaries like CDW.

- Enterprise Focus: The threat is particularly pronounced when dealing with large enterprise clients who are attractive targets for direct engagement.

- Competitive Landscape: This capability influences the overall competitive dynamics within the technology distribution market.

While CDW's vast supplier network generally limits individual supplier power, a few dominant technology manufacturers, such as Microsoft, Dell, HP, and Cisco, retain significant leverage. This is especially true for essential or high-demand products where CDW's customers have limited alternatives. For example, in 2023, the continued strength of PC shipments from Dell and HP highlighted their integral role in CDW's supply chain, giving them considerable influence over terms.

| Key Supplier | 2023 Relevance | Potential Leverage |

|---|---|---|

| Microsoft | Dominant in software and cloud services | Control over licensing and product roadmaps |

| Dell | Major hardware provider | Direct sales capabilities and volume discounts |

| HP | Significant PC and printer vendor | Brand loyalty and integrated solutions |

| Cisco | Leader in networking hardware | Proprietary technology and ecosystem |

What is included in the product

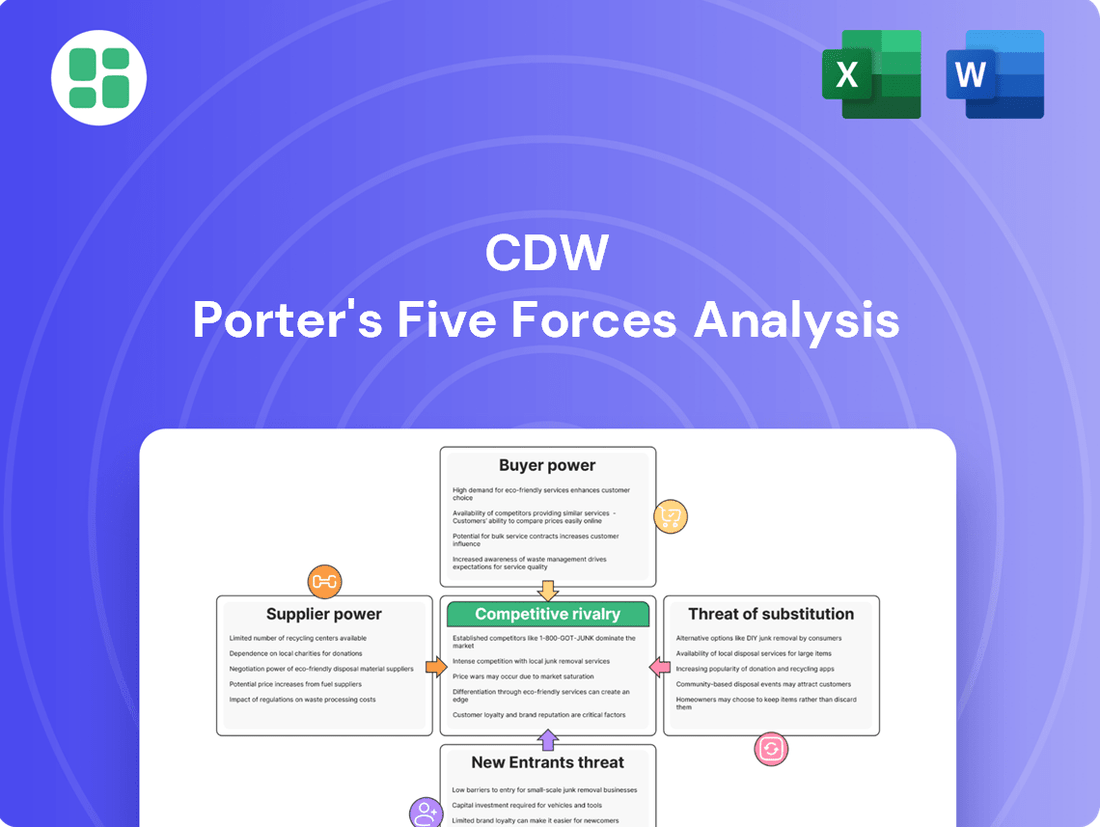

This CDW Porter's Five Forces Analysis dissects the competitive landscape by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry, all tailored to CDW's specific business model.

CDW's Porter's Five Forces analysis provides a clear, actionable framework to identify and mitigate competitive threats, transforming complex market dynamics into manageable strategic insights.

Customers Bargaining Power

CDW caters to a broad spectrum of clients, including corporations, small businesses, government agencies, educational institutions, and healthcare providers. This wide reach means that while individual large clients might wield considerable influence due to their substantial purchase volumes, the sheer number of CDW's over 250,000 customers collectively dilutes any single group's ability to exert significant pressure.

Customers, especially when buying common tech items like laptops and smartphones, are often very focused on price. This means they can push sellers to lower their prices.

For CDW, this price sensitivity is evident. In hardware segments, where products are less unique, they've seen their gross profit margins shrink a bit. This is a direct result of customers successfully negotiating lower prices on these less differentiated goods.

CDW's strategy of offering integrated IT solutions and managed services significantly raises the barriers for customers looking to switch providers. When a company's IT infrastructure, from hardware to software and ongoing support, is deeply intertwined with CDW's offerings, the effort and expense to disentangle and migrate to a competitor become substantial.

This complexity directly translates into higher switching costs for customers. For instance, imagine a business that relies on CDW for its cloud migration, cybersecurity, and ongoing network management. The data integration, system reconfigurations, and potential retraining required to move to a new vendor can easily run into tens or even hundreds of thousands of dollars, deterring many from making the change.

This inherent stickiness in CDW's service model is a powerful tool for customer retention. As of the first quarter of 2024, CDW reported a customer retention rate exceeding 90%, a testament to the value and integration they provide, making it difficult for competitors to lure away established clients.

Customer Access to Multiple IT Solution Providers

The IT solutions market is incredibly crowded, giving customers a wide array of choices. They can go directly to manufacturers, work with other resellers, or find niche service providers. This abundance of options significantly boosts customer bargaining power. For CDW, this means they must work harder to stand out by offering superior service and specialized knowledge to keep customers engaged.

In 2024, the IT solutions sector continued to see robust competition. For instance, the global IT services market was projected to reach over $1.3 trillion in 2024, according to various industry reports. This vast market size indicates a high number of players, from global giants to smaller, specialized firms, all vying for market share. This competitive landscape directly translates to increased leverage for buyers, as they can readily compare offerings and negotiate terms.

- Market Saturation: The sheer number of IT solution providers creates a buyer's market.

- Price Sensitivity: Customers can easily shop around, driving down prices and increasing pressure on providers like CDW.

- Information Availability: Online reviews, comparison sites, and industry reports empower customers with knowledge, further strengthening their position.

CDW's Value Proposition as a Trusted Advisor

CDW significantly mitigates customer bargaining power by positioning itself as a trusted advisor, particularly in complex IT domains like cloud, cybersecurity, and AI. This consultative approach helps customers optimize their technology investments, reducing their inclination to seek out alternative solutions or negotiate aggressively.

By offering full-lifecycle support, CDW further solidifies its value proposition. This comprehensive service model diminishes the perceived need for customers to manage multiple vendors, thereby consolidating their IT needs with CDW and lessening their leverage.

- Trusted Advisor Role: CDW's focus on providing expert guidance in areas like cloud migration and cybersecurity enhances customer loyalty.

- Full-Lifecycle Support: Offering end-to-end solutions from implementation to ongoing management reduces customer reliance on other providers.

- Reduced Vendor Proliferation: By consolidating IT needs, CDW limits customers' ability to play vendors against each other.

- Customer Retention: In fiscal year 2023, CDW reported a customer retention rate exceeding 90%, underscoring the effectiveness of its value-added services in reducing customer bargaining power.

CDW faces moderate customer bargaining power due to the fragmented IT solutions market and price sensitivity in hardware sales. However, CDW effectively counters this by offering integrated solutions and high switching costs, particularly in managed services. Their focus on becoming a trusted advisor in complex IT areas further solidifies customer relationships, as evidenced by their consistent over 90% customer retention rate.

| Factor | Impact on CDW | Mitigation Strategy |

|---|---|---|

| Price Sensitivity (Hardware) | Moderate pressure on margins | Focus on value-added services, bundled solutions |

| Switching Costs (Managed Services) | Low | Deep integration of IT infrastructure, consultative approach |

| Market Competition | High | Specialized expertise, end-to-end support, trusted advisor role |

| Customer Retention Rate (FY2023) | >90% | Demonstrates effectiveness of value-added services |

What You See Is What You Get

CDW Porter's Five Forces Analysis

The preview you see is the exact CDW Porter's Five Forces Analysis document you will receive immediately after purchase, ensuring full transparency and no surprises. This comprehensive analysis delves into the competitive landscape of CDW, meticulously detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You're looking at the actual, professionally formatted document, ready for your immediate use and strategic decision-making.

Rivalry Among Competitors

The IT solutions and services market is incredibly fragmented, meaning there are thousands of companies, often called value-added resellers, all competing for the same customers. This makes the landscape highly competitive.

Even though CDW is a major player, its share of the overall market is still quite small. For example, the global IT services market was valued at over $1.3 trillion in 2024, and CDW, while significant, doesn't dominate this vast space, highlighting the presence of many other competitors.

CDW navigates a highly competitive market, contending with other large IT solutions providers like Insight Enterprises and SHI International, both of which also offer broad portfolios of hardware, software, and services. These rivals often compete on price, breadth of offerings, and customer service, making it crucial for CDW to differentiate itself. For instance, Insight reported net sales of $10.4 billion in 2023, showcasing the scale of competition.

Furthermore, CDW must contend with the direct sales forces of major technology manufacturers, such as Dell, HP, and Microsoft, who can bypass resellers to reach customers directly. This presents a challenge as these manufacturers often have deep customer relationships and can offer bundled solutions. The landscape also includes specialized IT service and consulting firms that focus on specific technologies or industries, providing niche expertise that larger players may not match.

The presence of numerous smaller, niche players further intensifies competition. These smaller firms can be highly agile and responsive to specific customer needs, often carving out profitable segments by focusing on particular product lines or service specializations. This diverse competitive set requires CDW to maintain a flexible strategy and a keen understanding of evolving market dynamics.

Competition in the IT solutions space, where CDW operates, is fierce and multifaceted. Companies like CDW, Insight Enterprises, and SHI International are constantly vying for market share by differentiating themselves on service breadth, technical know-how, and pricing strategies. This intense rivalry means that success hinges on a company's ability to offer a wide array of products and services, backed by genuine expertise, all while remaining cost-competitive.

CDW's approach focuses on its vast product catalog and a consultative sales model, aiming to provide tailored solutions rather than just transactional sales. This strategy is crucial in a market where clients increasingly seek partners who can understand and address their complex IT needs. For instance, CDW reported net sales of $23.7 billion for the fiscal year ending December 31, 2023, demonstrating its significant market presence built on these competitive pillars.

Market Shift Towards Higher-Margin Services

The IT solutions landscape is rapidly evolving, with a marked pivot from traditional hardware sales to more lucrative, higher-margin services. This strategic shift is evident as companies increasingly prioritize offerings like cloud computing, robust cybersecurity solutions, and comprehensive digital transformation initiatives. By 2024, the demand for these services is projected to outpace hardware growth, intensifying competition among providers vying for market share in these value-added segments.

This industry-wide transformation fuels a more aggressive competitive rivalry, as players differentiate themselves through specialized service portfolios rather than solely on product offerings. Competitors are investing heavily in building expertise and capabilities in areas such as managed IT services, data analytics, and consulting, aiming to capture a larger share of the growing services market. This focus on service innovation and delivery excellence is becoming a key battleground.

- Shift to Services: The IT market is moving from hardware-centric to service-driven, with cloud and cybersecurity leading the charge.

- Margin Focus: Higher margins are found in services like digital transformation and managed solutions, attracting intense competitor focus.

- Intensified Rivalry: Competitors are actively developing and promoting these higher-margin services, leading to increased competition.

- 2024 Projections: Service revenue is expected to grow at a faster pace than hardware revenue in 2024, highlighting the strategic importance of these offerings.

CDW's Strategic Differentiation and Performance

CDW actively cultivates strong relationships with key technology vendors, ensuring access to a wide array of products and favorable terms. This, combined with a diverse customer base spanning various industries, allows CDW to mitigate risks associated with any single market segment.

The company’s strategic focus on high-growth sectors like artificial intelligence and cloud computing is a key differentiator. CDW anticipates outperforming the U.S. IT market growth by 200 to 300 basis points in 2025, demonstrating a proactive approach to capturing emerging opportunities.

- Vendor Partnerships: CDW leverages its strong ties with leading technology providers.

- Customer Diversification: A broad customer base reduces reliance on specific industries.

- Strategic Growth Areas: Focus on AI and cloud services drives future revenue.

- Market Outperformance Goal: Aiming to exceed U.S. IT market growth by 200-300 basis points in 2025.

The competitive rivalry within the IT solutions and services market is intense, driven by a fragmented landscape and the strategic shift towards higher-margin services. CDW, alongside major rivals like Insight Enterprises and SHI International, competes on service breadth, technical expertise, and pricing. The direct sales efforts of manufacturers such as Dell and HP, along with specialized niche players, further intensify this rivalry, requiring CDW to constantly innovate and differentiate its offerings.

CDW's net sales reached $23.7 billion in 2023, a testament to its ability to navigate this competitive environment. However, the global IT services market, valued at over $1.3 trillion in 2024, highlights the vastness of the market and the room for numerous players. Competitors like Insight Enterprises reported net sales of $10.4 billion in 2023, underscoring the significant scale of competition.

The market's pivot to services like cloud and cybersecurity is a key battleground, with higher margins attracting aggressive competition. CDW aims to outpace U.S. IT market growth by 200 to 300 basis points in 2025 by focusing on these high-growth areas, demonstrating a strategic response to the evolving competitive landscape.

| Competitor | 2023 Net Sales (USD Billions) | Key Competitive Focus |

|---|---|---|

| CDW | 23.7 | Broad portfolio, consultative sales, vendor partnerships |

| Insight Enterprises | 10.4 | Value-added solutions, cloud and data services |

| SHI International | (Data not publicly disclosed for 2023, but a major competitor) | Software licensing, hardware, cloud solutions |

SSubstitutes Threaten

Large organizations, including government bodies and major corporations, increasingly possess robust in-house IT departments. These internal teams can manage infrastructure and procure technology directly, bypassing third-party providers like CDW. For instance, in 2024, many Fortune 500 companies reported significant investments in expanding their internal IT talent and capabilities, aiming for greater control and cost efficiency.

Customers can bypass CDW and buy directly from tech giants like Dell, HP, or Microsoft, especially for common hardware or software and when buying in bulk. This direct route offers a compelling alternative, particularly for straightforward IT requirements.

The direct adoption of public cloud services by businesses presents a significant threat of substitutes for traditional IT solution providers. Organizations can now bypass intermediaries and procure computing power, storage, and software directly from hyperscale providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. This trend is accelerating; for instance, in 2024, global public cloud spending was projected to reach over $600 billion, indicating a massive shift in how IT resources are consumed.

Open-Source Software and Freemium Models

The rise of robust open-source software and freemium models presents a significant threat of substitutes for CDW. These alternatives, covering operating systems, databases, and collaboration tools, offer cost-effective options that divert customer spending away from traditional proprietary software licenses. For instance, the global open-source software market was valued at approximately $22.2 billion in 2023 and is projected to grow substantially, indicating a clear shift in IT solution preferences.

This trend directly impacts CDW's revenue streams derived from software sales and support. Customers can leverage free or low-cost open-source solutions, reducing their reliance on CDW's vendor partnerships. The increasing maturity and feature sets of these alternatives mean they are no longer niche options but viable replacements for many business needs.

- Open-Source Dominance: Linux distributions, for example, continue to gain market share in server environments, directly competing with Windows Server licenses CDW sells.

- Freemium SaaS Growth: Many Software-as-a-Service (SaaS) providers offer freemium tiers for basic functionalities, allowing businesses to start without upfront costs and potentially scale without engaging traditional resellers like CDW.

- Cost Savings Appeal: Businesses are increasingly motivated by cost reduction, making the zero or low cost of open-source and freemium models highly attractive substitutes for commercial software.

- Community Support: The strong community support and rapid development cycles of popular open-source projects further enhance their appeal as viable alternatives to paid support contracts.

Specialized Consulting Firms and Freelancers

Clients can bypass larger IT solution providers like CDW by engaging specialized consulting firms or individual freelancers for specific project needs. These independent entities offer focused expertise in areas such as cloud migration, data analytics, or managed security services, often at a competitive price point. For instance, the IT consulting market, excluding software development, was projected to reach over $300 billion globally in 2024, indicating a robust segment of specialized providers.

These alternatives provide niche skills without the overhead of a broad-spectrum IT vendor, making them attractive for businesses seeking highly targeted solutions. This trend is amplified by the gig economy, where skilled IT professionals can easily offer their services on a project basis. In 2023, the freelance platform Upwork reported a significant increase in demand for specialized IT skills, with cybersecurity and cloud computing roles seeing substantial growth.

- Focused Expertise: Freelancers and boutique firms offer deep knowledge in specific IT domains, allowing clients to access specialized skills for particular projects.

- Cost Efficiency: These alternatives can be more cost-effective than engaging a large, full-service provider, especially for short-term or project-specific engagements.

- Agility: Smaller, specialized teams or individual freelancers can often adapt more quickly to changing client requirements compared to larger organizations.

The threat of substitutes for CDW is significant as customers increasingly opt for direct procurement from tech manufacturers, leverage public cloud services, embrace open-source software, or engage specialized consultants and freelancers. These alternatives bypass traditional IT solution providers, impacting CDW's market share and revenue. For example, the growing preference for direct sales channels and the expanding capabilities of cloud platforms mean businesses have more options than ever to fulfill their IT needs without intermediaries.

| Substitute Category | Examples | Key Driver | 2024 Market Indicator |

|---|---|---|---|

| Direct Procurement | Dell, HP, Microsoft | Cost savings, bulk discounts | Continued strong direct sales for major hardware vendors |

| Public Cloud Services | AWS, Azure, Google Cloud | Scalability, flexibility, pay-as-you-go | Global public cloud spending projected over $600 billion |

| Open-Source Software | Linux, Apache, MySQL | Cost-effectiveness, customization | Open-source software market valued at ~$22.2 billion in 2023 |

| Specialized Consultants/Freelancers | Boutique IT firms, independent contractors | Niche expertise, project-specific solutions | IT consulting market projected over $300 billion globally |

Entrants Threaten

The IT solutions provider market, particularly for multi-brand offerings like CDW, demands significant upfront capital. Companies need to invest heavily in maintaining diverse inventory, building advanced logistics networks, and establishing comprehensive service infrastructures, including essential data centers and skilled technical support teams. This substantial financial commitment creates a formidable barrier to entry for potential new competitors.

The threat of new entrants is significantly mitigated by CDW's extensive vendor and partner ecosystem. New players would need to invest heavily and over a long period to establish relationships with the hundreds of technology manufacturers and software vendors that CDW currently partners with. CDW has meticulously built over 1,000 of these crucial alliances, a network that is nearly impossible for a newcomer to replicate quickly or effectively.

The need for a highly skilled technical and sales workforce presents a significant barrier to entry for new companies in the IT solutions and managed services sector. Building a team of experienced solutions architects, engineers, and support staff requires substantial investment in recruitment, training, and competitive compensation. For instance, in 2024, the average salary for a senior IT solutions architect in the US was reported to be around $160,000 annually, highlighting the considerable talent acquisition costs.

Attracting and retaining this specialized talent is an ongoing challenge. New entrants must compete with established players who often offer more robust benefits, career advancement opportunities, and a stronger brand reputation. Reports from early 2025 indicate a persistent shortage of cybersecurity and cloud computing experts, driving up demand and compensation for these roles, making it even more difficult for newcomers to assemble a competitive team.

Established Brand Reputation and Customer Trust

The threat of new entrants for CDW is significantly mitigated by its established brand reputation and the deep customer trust it has cultivated over more than 40 years. As a trusted partner in managing vital IT infrastructure, CDW has built a solid foundation of reliability.

Newcomers often struggle to replicate this level of credibility, which is crucial for securing the large, complex contracts typically awarded by diverse organizations. This established trust acts as a substantial barrier, making it challenging for new players to gain immediate traction in the market.

- Brand Loyalty: CDW's long-standing presence fosters significant brand loyalty, making customers hesitant to switch to unproven providers.

- Customer Trust: Over four decades, CDW has earned a reputation for dependability, a critical factor in IT procurement where system failures can be costly.

- Contractual Hurdles: New entrants face difficulties in overcoming the established relationships and contractual agreements CDW holds with its existing client base.

Economies of Scale in Procurement and Operations

CDW leverages substantial economies of scale in procurement, a significant barrier for potential new entrants. Its massive purchasing volumes translate into preferential pricing and terms from vendors, a competitive advantage that is difficult for newcomers to replicate. For instance, in 2023, CDW reported net sales of $23.0 billion, underscoring the sheer scale of its operations.

New companies entering the IT solutions market would face considerable challenges in matching CDW's cost efficiencies. Achieving similar purchasing power and operational streamlining requires substantial upfront investment and time, making it difficult to compete on price from the outset while ensuring profitability.

- Economies of Scale: CDW's vast procurement volume allows for better pricing and terms from suppliers.

- Cost Disadvantage for New Entrants: Startups lack the scale to negotiate similar favorable pricing, impacting their ability to compete on cost.

- Operational Efficiency: Large-scale operations enable CDW to optimize logistics and overhead, further reducing costs.

- Market Entry Barrier: The cost advantage derived from economies of scale acts as a significant deterrent to new competitors.

The IT solutions market is characterized by high capital requirements for inventory, logistics, and skilled personnel, creating substantial barriers for new entrants. CDW's established network of over 1,000 vendor alliances and its strong brand reputation, built over 40 years, further deter potential competitors. These factors, combined with significant economies of scale in procurement, position CDW favorably against newcomers.

| Barrier | Impact on New Entrants | CDW's Advantage |

|---|---|---|

| Capital Requirements | High initial investment for inventory, logistics, and infrastructure. | Established infrastructure and operational scale. |

| Vendor Relationships | Difficulty replicating CDW's 1,000+ alliances. | Extensive and deep partner ecosystem. |

| Brand Reputation & Trust | Challenging to build credibility for large contracts. | Over 40 years of cultivated customer trust and reliability. |

| Economies of Scale | Inability to match CDW's purchasing power and cost efficiencies. | $23.0 billion in net sales (2023) leading to preferential pricing. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from company financial statements, industry-specific market research reports, and publicly available regulatory filings to provide a comprehensive view of competitive dynamics.