CDW Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CDW Bundle

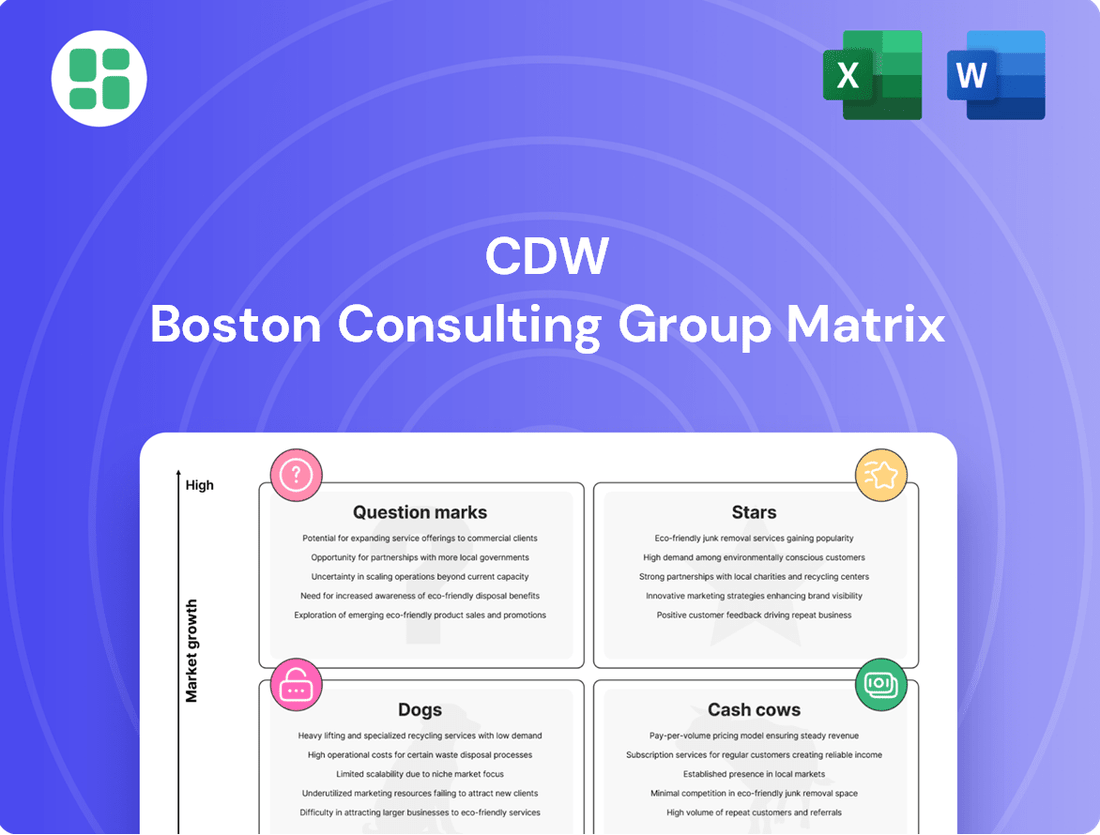

Curious about CDW's strategic product positioning? Our preview offers a glimpse into how their offerings might fit into the BCG Matrix – identifying potential Stars, Cash Cows, Dogs, or Question Marks. Unlock the full picture and gain actionable insights into their portfolio's health and future potential.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for CDW.

Stars

CDW's advanced cybersecurity solutions, encompassing threat detection, incident response, and robust security architecture, position it strongly within the market.

The cybersecurity sector is booming, with global spending projected to reach $231.2 billion in 2024, driven by escalating threats and stringent regulations.

CDW's strategic partnerships and deep expertise have secured it a substantial market presence, a testament to its capabilities in this vital domain.

Ongoing investment in next-generation technologies and skilled professionals will further cement CDW's leadership in providing advanced cybersecurity.

The market for cloud migration and optimization services is booming, driven by businesses seeking agility and cost-efficiency. In 2024, the global cloud computing market was projected to reach over $800 billion, with migration services forming a significant portion of this growth. CDW's expertise in guiding companies through hybrid cloud solutions and optimizing cloud spend places it squarely in a high-growth, high-market-share quadrant.

The AI and Data Analytics Infrastructure segment is a clear Star for CDW. Businesses are heavily investing in these capabilities, driving significant market growth. CDW's expertise in integrating high-performance computing and data warehousing solutions positions them strongly in this high-demand area.

The global AI market was valued at approximately $200 billion in 2023 and is projected to reach over $1.8 trillion by 2030, according to various industry reports. This rapid expansion underscores the Star status of the infrastructure supporting these technologies.

Digital Workplace Transformation

Digital Workplace Transformation is a star in the CDW BCG Matrix, reflecting its high market growth and CDW's strong market share.

Solutions like unified communications, collaboration tools, and device management are in high demand as companies embrace remote and hybrid work. CDW's broad range of offerings in this area positions it well for continued success.

The market for digital workplace solutions is expanding rapidly. For example, the global unified communications and collaboration market was valued at approximately $128.2 billion in 2023 and is projected to reach $244.9 billion by 2030, growing at a compound annual growth rate of 9.7%.

- High Demand for Remote and Hybrid Work Solutions: Unified communications, collaboration tools, and device management are key.

- CDW's Strong Market Position: CDW has significant share due to its comprehensive portfolio and expertise.

- Market Growth: The digital workplace market is experiencing robust expansion.

- Revenue Driver: These offerings are crucial for CDW's ongoing growth and revenue generation.

Managed Services for Complex IT Environments

Managed services for complex IT environments, focusing on network, security, and cloud, represent a significant growth sector. Organizations are increasingly offloading these demanding operations to reduce their internal burden. CDW's managed services are well-positioned in this high-growth area, offering continuous support and optimization for sophisticated IT infrastructures.

These offerings are crucial for generating predictable, recurring revenue streams. By consistently supporting clients' intricate IT needs, CDW also cultivates deeper, more strategic relationships, solidifying its role as an essential partner.

- Strong Market Position: CDW's expertise in managing complex network, security, and cloud environments places it favorably in a growing outsourcing market.

- Recurring Revenue: Managed services inherently provide a stable and predictable revenue base, enhancing financial stability.

- Customer Retention: Ongoing support and optimization foster strong customer loyalty and reduce churn.

- Strategic Partnerships: CDW moves beyond transactional sales to become a vital strategic IT partner for its clients.

CDW's cybersecurity solutions are a definite Star, given the sector's explosive growth and CDW's strong market presence. The global cybersecurity market is projected to reach $231.2 billion in 2024, fueled by increasing threats and regulations. CDW's advanced offerings in threat detection, incident response, and security architecture, bolstered by strategic partnerships, solidify its leadership in this vital area.

| CDW Business Area | BCG Category | Market Growth | CDW Market Share | Rationale |

| Cybersecurity Solutions | Star | High | High | Rapidly expanding market driven by escalating threats; CDW's advanced solutions and partnerships provide a competitive edge. |

| AI and Data Analytics Infrastructure | Star | Very High | High | Global AI market projected to exceed $1.8 trillion by 2030; CDW's infrastructure integration capabilities align with this massive growth. |

| Digital Workplace Transformation | Star | High | High | Unified communications market expected to reach $244.9 billion by 2030; CDW's comprehensive portfolio caters to hybrid work demands. |

| Managed Services | Star | High | High | Increasing IT outsourcing trend; CDW's expertise in complex environments ensures recurring revenue and strong client relationships. |

What is included in the product

The CDW BCG Matrix analyzes product portfolio performance based on market growth and share.

It guides strategic decisions on investment, divestment, and resource allocation for each category.

Quickly identify underperforming "Dogs" and "Cash Cows" to reallocate resources effectively.

Cash Cows

CDW's core business of reselling traditional hardware like desktops and laptops acts as a significant cash cow. Even though these markets are mature with low growth, CDW maintains a strong market share thanks to its vendor relationships and distribution capabilities. This steady income stream is crucial for funding expansion into more dynamic sectors.

CDW's standard software licensing and renewals represent a classic cash cow. Sales of widely used enterprise software, from operating systems to office suites, provide a steady stream of income. In 2023, CDW reported significant revenue from software sales, demonstrating the enduring demand for these essential business tools.

As a major reseller for top software publishers, CDW enjoys a substantial market share in this mature, yet stable, sector. The predictable cycle of license renewals is a key contributor to consistent, reliable cash flow, requiring minimal additional marketing spend to maintain.

Basic networking and connectivity solutions, including switches, routers, and fundamental Wi-Fi, represent CDW's cash cows. These products operate in a mature market with limited growth prospects, but CDW's deep-seated expertise and vast customer relationships have secured them a leading market position.

These essential offerings consistently produce substantial cash flow, which is crucial for funding CDW's investments in other, higher-growth areas of its technology solutions. For instance, CDW reported revenue of $23.0 billion in 2023, with a significant portion attributed to its networking and security segments, highlighting the stable cash generation from these mature product lines.

Data Center Infrastructure (Non-Cloud Specific)

CDW's non-cloud specific data center infrastructure, encompassing power, cooling, storage, and rack systems, holds a dominant market share. This segment continues to be a reliable revenue generator, catering to businesses that maintain on-premise data centers. The demand remains robust as many organizations still prefer or require traditional infrastructure alongside cloud adoption.

- Stable Revenue: This segment offers predictable income streams due to established customer relationships and ongoing maintenance needs.

- Market Dominance: CDW's strong position in providing essential on-premise components ensures continued sales.

- Enterprise Reliance: A significant portion of businesses still invest in and upgrade their physical data center hardware.

Legacy IT Support and Maintenance Contracts

Legacy IT support and maintenance contracts represent a significant Cash Cow for CDW. These long-term agreements, especially with established clients for their existing IT infrastructure, are a bedrock of recurring revenue. While the market for these services might not be experiencing explosive growth, CDW's substantial installed base and strong customer retention ensure a dominant market share, making these contracts a highly reliable source of income.

These contracts are characterized by their stability and predictability. For instance, CDW reported that a substantial portion of its revenue is recurring, underscoring the importance of these service agreements. The high customer retention rates, often exceeding 90%, mean that CDW can count on this revenue stream year after year, providing a solid financial foundation for the company.

- Recurring Revenue Stream: Long-term support and maintenance contracts generate consistent, predictable income for CDW.

- High Customer Retention: Established clients tend to renew these contracts, benefiting from existing relationships and service continuity.

- Dominant Market Share: CDW's broad installed base in legacy systems allows it to maintain a strong position in this low-growth market.

- Financial Stability: The steady cash flow from these contracts provides a reliable financial base, supporting other business initiatives.

CDW’s established hardware resale, particularly for desktops and laptops, functions as a significant cash cow. Despite the low growth in these mature markets, CDW’s strong vendor partnerships and efficient distribution maintain its market dominance. This consistent revenue stream is vital for funding investments in emerging technology sectors.

Standard software licensing and renewals are another prime example of CDW’s cash cows. The consistent demand for essential business software, including operating systems and productivity suites, generates reliable income. In 2023, CDW’s software sales contributed substantially to its overall revenue, reflecting the ongoing need for these foundational tools.

CDW's core offerings in basic networking equipment, such as routers and switches, and essential Wi-Fi solutions are considered cash cows. While this market is mature with limited growth, CDW’s deep industry expertise and extensive customer base ensure a leading market position. These products generate substantial and predictable cash flow, which is critical for CDW’s strategic investments in higher-growth areas.

| Product Category | Market Maturity | CDW's Position | Cash Flow Generation |

|---|---|---|---|

| Desktops & Laptops Resale | Mature | Strong Market Share | Stable, Significant |

| Software Licensing & Renewals | Mature | Major Reseller | Consistent, Predictable |

| Basic Networking & Wi-Fi | Mature | Leading Market Position | Substantial, Reliable |

What You See Is What You Get

CDW BCG Matrix

The CDW BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive analysis tool, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and ready-to-use resource. You can confidently use this preview as a direct representation of the high-quality BCG Matrix report that will be yours to download and implement in your business planning. This ensures transparency and immediate value, allowing you to leverage strategic insights without delay.

Dogs

CDW may hold a small market share concerning outdated on-premise software solutions, particularly those lacking essential cloud integration and modern functionalities. As the business landscape increasingly favors SaaS and cloud-native applications, the demand for these legacy systems is experiencing a sharp decline.

For instance, a 2024 Gartner report indicated that spending on traditional on-premise software is projected to decrease by 3% year-over-year, while cloud application spending is expected to grow by 18%. This trend suggests that continued investment in outdated on-premise solutions would likely generate minimal returns.

Consequently, these offerings represent prime candidates for divestiture or a significant reduction in strategic focus within CDW's portfolio, aligning with the principles of a BCG matrix where low growth and low market share businesses are typically managed for cash or divested.

Commoditized peripheral sales, like basic keyboards and mice, often fall into the Dog quadrant of the BCG matrix. In these markets, price is king, and CDW's strength in complex solutions doesn't give it a significant edge. This leads to a smaller market share in a space that's not growing much and has a lot of competition.

These types of products typically offer very thin profit margins. For instance, in 2024, the global market for computer peripherals, excluding high-end gaming gear, saw intense price competition, with average margins on standard mice and keyboards hovering around 5-10%. This low profitability means these sales can tie up valuable resources that could be better used elsewhere.

Niche hardware categories facing obsolescence, such as standalone fax machines or specific legacy tape backup systems, often find themselves in the Dog quadrant of the BCG Matrix. These products are being steadily replaced by newer, more integrated technologies, leading to a sharp decline in demand. For instance, the global fax machine market, while still existing, has seen a significant contraction, with many businesses migrating to digital document solutions.

The diminishing demand and low market share for these legacy items signify they are likely cash traps. Companies holding onto such products may find their resources are better allocated elsewhere. In 2024, many IT departments are actively retiring older hardware, including tape drives, as cloud storage and solid-state drives offer more efficient and cost-effective alternatives.

Basic Break-Fix IT Services (Non-Contractual)

Basic break-fix IT services, offered on an ad-hoc basis and outside of contractual agreements, likely represent a low-growth, low-market-share segment for CDW within the BCG matrix.

This area is characterized by a highly fragmented market with numerous local competitors, making it difficult to achieve significant scale or profitability. CDW's strategic direction prioritizes more advanced, value-added solutions, positioning these basic services as less central to its growth objectives.

For instance, while the overall IT services market continues to expand, the specific segment of uncontracted break-fix work may see slower growth compared to managed services or cloud solutions. In 2024, the IT services industry saw continued investment in areas like cybersecurity and cloud migration, with break-fix services forming a smaller, less strategic piece of the pie for larger providers like CDW.

- Low Market Share: Fragmented nature of break-fix services limits CDW's dominance.

- Low Growth Potential: Market preference shifts towards proactive managed services.

- High Competition: Numerous small, local IT shops compete directly.

- Strategic Misalignment: Focus on higher-margin, integrated solutions.

Unsupported or Obsolete Technology Consulting

Consulting services focused on technologies that are phasing out or have minimal market adoption would fall into the Dogs category of the CDW BCG Matrix. CDW's market share in these niche, declining areas is likely quite small. Investing in maintaining or promoting these outdated services is generally inefficient, as clients are actively migrating to more current solutions.

For instance, consider consulting for legacy mainframe systems or outdated operating systems. While some specialized support might still exist, the overall market demand is shrinking. In 2024, many IT departments are prioritizing cloud migration and modern infrastructure, making investments in obsolete technology consulting a poor strategic choice for CDW.

- Low Market Share: CDW's participation in consulting for obsolete technologies is minimal, reflecting a shrinking client base.

- Declining Demand: Market trends show a clear shift away from legacy systems towards newer, more efficient technologies.

- Resource Reallocation: Discontinuing these services allows CDW to redirect valuable resources towards growth areas.

- Strategic Focus: Abandoning Dog categories enables a sharper focus on profitable and future-oriented consulting practices.

Products or services in the Dog quadrant, like commoditized peripherals or niche legacy hardware, typically yield low profit margins. For example, in 2024, the profit margins on standard computer mice and keyboards were around 5-10%. These offerings often tie up resources that could be better invested in high-growth areas.

These segments are characterized by intense competition and declining demand, making them poor candidates for further investment. CDW's strategic focus is on higher-value, integrated solutions rather than these low-margin, low-growth offerings.

Divesting or significantly reducing focus on these Dog categories allows CDW to reallocate resources toward more profitable and strategically aligned business areas, optimizing its overall portfolio performance.

As of 2024, CDW's portfolio likely includes several offerings that fit the Dog category, such as basic IT support for outdated systems and consulting on technologies with minimal market adoption. These areas represent a small market share and face declining demand, as evidenced by the IT industry's shift towards cloud and managed services.

| Category | Market Share | Growth Potential | Profitability | Strategic Implication |

| Legacy Hardware Support | Low | Declining | Low | Divest or minimize |

| Commoditized Peripherals | Low | Stagnant | Very Low | Manage for cash or divest |

| Obsolete Technology Consulting | Very Low | Shrinking | Low | Discontinue and reallocate resources |

| Basic Break-Fix IT Services | Low | Low | Low | Reduce focus, prioritize managed services |

Question Marks

Emerging quantum computing infrastructure represents a high-growth potential market, though CDW's current footprint is likely minimal. This segment falls into the Question Mark category of the BCG Matrix due to its nascent stage and uncertain future dominance, despite the immense projected growth.

The quantum computing market is anticipated to experience substantial expansion, with some projections suggesting it could reach tens of billions of dollars by the early 2030s. CDW's involvement in providing the necessary infrastructure, such as specialized cooling systems or high-performance networking, is currently speculative.

To transition this into a Star, CDW would need to invest heavily in research and development and forge strategic alliances with quantum hardware providers and software developers. Early market entry and establishing a strong technological foundation are crucial for capturing future market share in this rapidly evolving field.

Developing or reselling hyper-specialized AI applications for emerging niche industries, like AI for rare disease drug discovery in biotech, could represent a Question Mark for CDW. While the market growth for such targeted solutions is projected to be substantial, CDW's current market penetration in these highly specific verticals may be minimal. This strategy necessitates significant investment in deep industry knowledge and the creation of custom AI solutions to capture market share.

Blockchain offers significant potential to revolutionize enterprise supply chains by enhancing transparency, traceability, and efficiency. This technology can streamline processes, reduce fraud, and improve overall visibility, creating a more robust and trustworthy supply network. The global blockchain in supply chain market was valued at approximately $1.2 billion in 2023 and is projected to reach $12.5 billion by 2028, demonstrating substantial growth.

For CDW, specialized blockchain solutions for enterprise supply chains likely represent a nascent but high-potential area. While the market is expanding rapidly, CDW's current market share in this niche segment might be relatively small as adoption is still in its early stages for many enterprises. Building this capability requires significant upfront investment in specialized talent and proof-of-concept projects to showcase tangible benefits.

Sustainable IT and Green Computing Solutions

The IT industry is increasingly focused on sustainability, driven by environmental consciousness and evolving regulations. This trend positions 'green IT' as a significant growth area. For instance, the global green IT market was valued at approximately $23.7 billion in 2023 and is projected to reach $60.6 billion by 2030, reflecting a compound annual growth rate of 14.5%.

Within the CDW BCG Matrix, sustainable IT and green computing solutions likely fall into the 'Question Mark' category. While the demand is escalating, CDW's current market share in this specialized segment may be nascent compared to its established IT infrastructure and services. This indicates a need for strategic investment to capitalize on the burgeoning market.

- Growing Market: The global market for green IT solutions is experiencing robust expansion, projected to more than double by 2030.

- Emerging Segment: CDW's presence in specialized green IT solutions may still be developing, presenting an opportunity for market penetration.

- Strategic Investment: To shift this segment from a 'Question Mark' to a 'Star', focused investment in developing and marketing energy-efficient IT infrastructure and practices is crucial.

- Environmental Drivers: Increasing environmental concerns and regulatory mandates are key factors fueling the demand for sustainable IT.

Edge Computing and IoT Platform Integration

The integration of edge computing with IoT platforms presents a significant opportunity for CDW, but it also positions it as a potential Question Mark within the BCG matrix. The edge computing market is booming, projected to reach $250.6 billion by 2027, a substantial increase from $44.1 billion in 2020, driven by the insatiable demand for real-time data processing from the ever-growing number of IoT devices. CDW's ability to seamlessly connect and manage these complex IoT ecosystems at the edge, where data is generated, will be critical for its success in this dynamic space.

To capitalize on this growth, CDW must strategically invest in developing specialized expertise and forging key partnerships. This is crucial because the technical complexities of IoT platform integration at the edge require a deep understanding of networking, cybersecurity, and data management tailored for distributed environments. Without these foundational elements, CDW risks lagging behind competitors who are aggressively building out their edge capabilities.

- Market Growth: The global edge computing market is expected to grow from $44.1 billion in 2020 to $250.6 billion by 2027, indicating a strong demand for edge solutions.

- IoT Proliferation: The increasing number of connected IoT devices, estimated to exceed 29 billion by 2030, necessitates edge processing for efficiency and speed.

- Integration Challenges: CDW's success hinges on its ability to integrate diverse IoT platforms with edge infrastructure, a technically demanding task.

- Strategic Investment: Significant investment in specialized skills and partnerships is required for CDW to establish a leading position in the edge computing and IoT integration market.

The burgeoning field of AI-powered cybersecurity solutions presents a classic 'Question Mark' scenario for CDW. While the market for advanced threat detection and response is expanding rapidly, with the global cybersecurity market expected to reach over $300 billion by 2024, CDW's current penetration in highly specialized AI-driven security offerings might be limited. This segment requires substantial investment in developing or acquiring cutting-edge AI capabilities and establishing strong partnerships with AI security innovators to gain significant market share.

CDW's foray into providing advanced analytics for predictive maintenance in industrial sectors, such as manufacturing or energy, also fits the 'Question Mark' profile. The market for industrial IoT and analytics is projected for strong growth, with some estimates placing it in the hundreds of billions of dollars by the late 2020s. However, CDW's current footprint in delivering these highly specialized, data-intensive solutions might be nascent, necessitating a focused strategy on building domain expertise and robust data science capabilities.

| Segment | Market Growth Potential | CDW's Current Position | BCG Matrix Category |

|---|---|---|---|

| AI-Powered Cybersecurity | High (>$300B by 2024) | Potentially Low/Developing | Question Mark |

| Industrial IoT Analytics (Predictive Maintenance) | High (>$100B by late 2020s) | Potentially Low/Developing | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial statements, market research reports, and industry growth trends, to provide a clear strategic overview.