CDW PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CDW Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping CDW's trajectory. Our expertly crafted PESTLE analysis provides the deep insights you need to anticipate market shifts and make informed strategic decisions. Download the full, actionable report now and gain a decisive advantage.

Political factors

Government IT spending is a major income source for CDW, especially in its public sector business. For instance, in 2023, CDW reported that its public sector segment generated approximately $7.9 billion in net sales, highlighting the importance of government budgets.

Changes in federal, state, and local government budgets, along with policy shifts towards digital modernization or specific tech projects, directly impact the number and nature of contracts available. The U.S. federal government's IT budget for fiscal year 2024 was projected to be around $150 billion, a significant pool of potential business.

CDW's ability to navigate these budget cycles and policy shifts is key to its sales strategy and planning within the government sector. Staying informed about upcoming budget allocations and legislative priorities, such as those related to cybersecurity or cloud migration, allows CDW to align its offerings effectively.

International trade policies, such as tariffs and import/export restrictions, directly influence the cost and availability of the hardware and software CDW sources from global suppliers. For instance, the US-China trade tensions leading to tariffs in 2019-2020 significantly impacted technology component pricing.

Geopolitical instability and supply chain disruptions, like those seen during the COVID-19 pandemic, have caused product delays and cost increases. In 2021, the global semiconductor shortage, exacerbated by these factors, led to extended lead times for many IT products CDW offers.

CDW's ability to navigate these volatile trade environments and maintain supply chain resilience is crucial for operational efficiency and profitability. Proactive monitoring of trade policies and strategic diversification of sourcing partners are key risk mitigation strategies.

Governments worldwide, including the U.S., are intensifying their focus on cybersecurity due to escalating national security threats and a surge in sophisticated cyberattacks. This heightened awareness translates into stricter regulations and compliance mandates for businesses and government entities alike. For instance, the Biden administration's Executive Order on Improving the Nation's Cybersecurity, issued in 2021, continues to shape federal agency requirements and influence the broader technology sector, impacting how companies like CDW must operate and the solutions they offer.

These evolving regulatory landscapes create a sustained demand for advanced cybersecurity solutions, a core area for CDW. The company is positioned to benefit from organizations seeking to meet stringent compliance standards, such as those outlined by the National Institute of Standards and Technology (NIST) frameworks, and to safeguard critical infrastructure. As of early 2024, cybersecurity spending is projected to grow significantly, with global expenditure expected to reach over $200 billion, underscoring the market opportunity for CDW.

CDW must remain agile, continuously adapting its product and service offerings to align with new and emerging legislative requirements. Staying informed about changes in data privacy laws, critical infrastructure protection mandates, and sector-specific cybersecurity standards is crucial for maintaining relevance and providing compliant solutions to its clientele. This proactive approach ensures CDW can effectively support its customers in navigating the complex and ever-changing cybersecurity regulatory environment.

Public Sector Procurement Rules and Frameworks

Government procurement rules are a significant factor for CDW, particularly in the public sector. These regulations often dictate how contracts are awarded, emphasizing transparency and competition. For instance, in the US, the Federal Acquisition Regulation (FAR) governs how federal agencies purchase goods and services, impacting CDW's sales strategies in this segment. The 2024 US federal budget allocated over $7 trillion, with a substantial portion directed towards technology procurement, creating a large but highly regulated market for CDW.

CDW must navigate complex bidding processes and ensure compliance with various certifications to secure government contracts. Many public sector entities operate under approved vendor lists or participate in cooperative purchasing agreements, which streamline the process but require prior qualification. For example, CDW's presence on GSA Schedules in the US or similar frameworks in other countries is crucial for accessing these markets. These frameworks often have specific reporting requirements and pricing constraints that CDW must adhere to.

- Federal Procurement Spending: US federal government IT spending was projected to reach $120 billion in 2024, with a significant portion flowing through established procurement vehicles.

- State and Local Government Opportunities: State and local government IT budgets are also substantial, with collective spending estimated in the tens of billions annually, often utilizing cooperative purchasing programs.

- Healthcare Sector Compliance: In healthcare, HIPAA compliance and specific data security certifications are paramount for technology providers like CDW to win contracts.

- Educational Technology Budgets: Educational institutions, particularly K-12 and higher education, represent a growing market for technology, often funded by specific grants and federal programs like E-Rate.

Political Stability and Economic Policy

Political stability is a cornerstone for CDW's growth, directly impacting IT infrastructure investment. In 2024, many developed economies, including the United States, maintained a relatively stable political landscape, fostering business confidence. For instance, the U.S. government's continued emphasis on cybersecurity initiatives and digital modernization, as evidenced by ongoing federal funding for IT upgrades, creates a predictable environment for CDW's public sector sales.

Government economic policies, particularly those concerning taxation and business incentives, significantly shape CDW's revenue streams. In the 2024 fiscal year, several countries offered tax credits for technology adoption and digital transformation. For example, the European Union's Digital Decade targets, supported by national recovery funds, encourage businesses to invest in cloud solutions and advanced networking, areas where CDW is a key provider.

Uncertainty in political environments can lead to cautious IT spending. Regions experiencing political instability or significant policy shifts might see businesses deferring large capital expenditures on IT infrastructure. This was observed in some emerging markets during 2024, where geopolitical tensions led to a slowdown in enterprise IT project rollouts, directly impacting sales cycles for companies like CDW.

- U.S. Federal IT Spending: Projected to reach over $140 billion in FY2024, with significant portions allocated to cloud migration and cybersecurity, benefiting CDW.

- EU Digital Decade Targets: Aiming for widespread adoption of advanced technologies by 2030, driving demand for IT services and hardware across member states.

- Corporate Tax Rates: Variations in corporate tax policies across CDW's operating regions can influence net profits and the availability of funds for IT reinvestment.

- Government Digital Transformation Programs: Many nations are actively promoting digital public services, creating substantial opportunities for IT solution providers.

Government IT spending remains a critical revenue driver for CDW, particularly within its public sector segment, which generated approximately $7.9 billion in net sales in 2023. Changes in government budgets and policy priorities, such as digital modernization initiatives, directly influence contract availability, with the U.S. federal government's IT budget projected at around $150 billion for fiscal year 2024.

Navigating government budget cycles and policy shifts is essential for CDW's sales strategy. Staying informed about upcoming budget allocations and legislative priorities, like cybersecurity or cloud migration, allows for effective alignment of offerings. The U.S. federal government's IT budget for FY2024 was projected to be over $140 billion, with substantial allocations for cloud migration and cybersecurity, areas where CDW excels.

Political stability directly impacts IT infrastructure investment, with many developed economies, including the U.S., maintaining a stable political landscape in 2024, fostering business confidence. Government economic policies, such as tax credits for technology adoption, also shape CDW's revenue streams; for example, the EU's Digital Decade targets encourage investment in cloud solutions and advanced networking.

| Factor | Description | Impact on CDW | 2024/2025 Data Point |

| Government IT Spending | Allocation of public funds towards technology infrastructure and services. | Direct revenue source, particularly for public sector sales. | U.S. Federal IT budget projected over $140 billion for FY2024. |

| Policy Shifts | Changes in government priorities and regulations affecting technology adoption. | Creates demand for specific solutions (e.g., cybersecurity, cloud). | EU Digital Decade targets driving cloud and network investment. |

| Procurement Regulations | Rules governing how governments purchase goods and services. | Requires compliance and strategic engagement with bidding processes. | FAR governs US federal purchases; GSA Schedules are key access points. |

| Political Stability | The degree of certainty and predictability in a nation's political environment. | Influences business confidence and IT investment levels. | Stable political landscapes in developed economies foster IT spending. |

What is included in the product

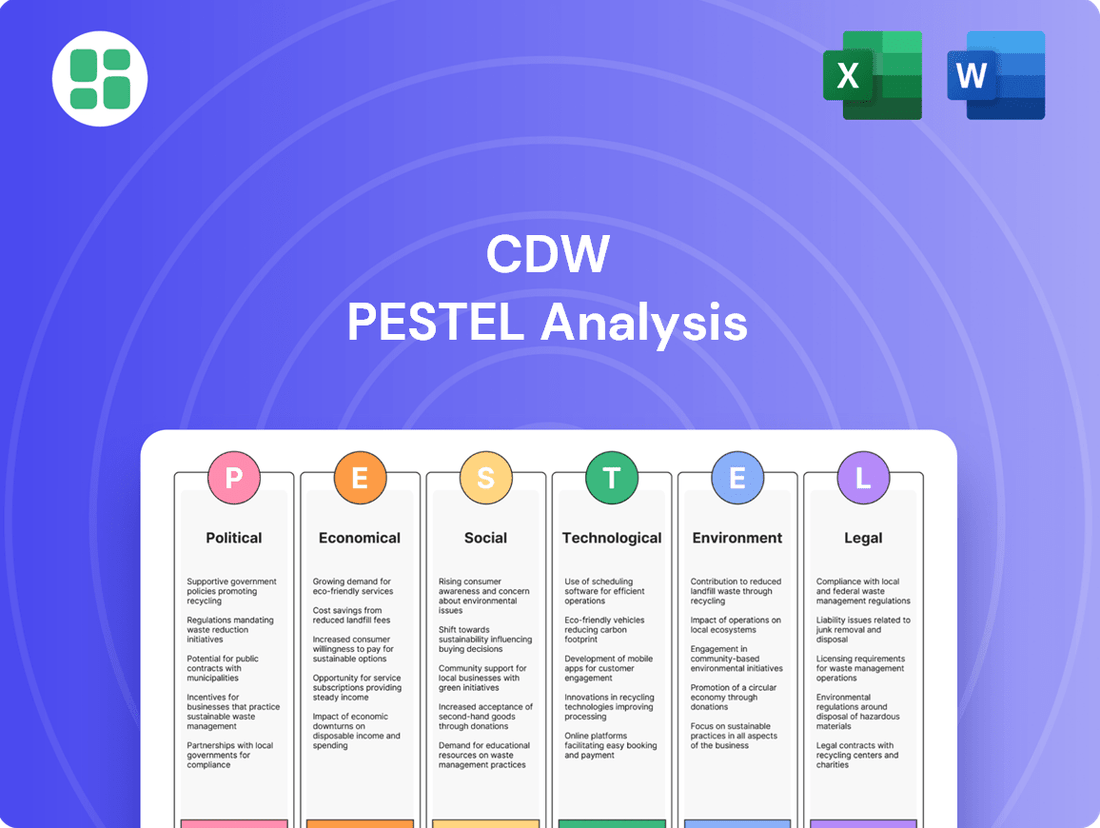

This CDW PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operating landscape, providing a comprehensive understanding of external forces.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

The overall economic health significantly influences CDW's performance. When the economy is strong, businesses are more likely to increase their IT expenditures, directly benefiting CDW. For instance, the U.S. GDP growth rate was approximately 2.5% in 2023, indicating a generally positive economic environment that supports higher technology spending.

Business confidence is a key driver for IT investment. High confidence levels encourage companies to commit to new hardware, software, and managed services, which are CDW's core offerings. A recent survey indicated that business confidence remained elevated in early 2024, suggesting continued demand for technology solutions.

Conversely, economic downturns or recessions can lead to reduced IT budgets and a slowdown in spending. CDW's revenue is therefore sensitive to these fluctuations, as client investment capacity directly correlates with their financial outlook. A slowdown in GDP growth or a dip in business sentiment can translate to lower sales for CDW.

Rising inflation in 2024 and 2025 directly impacts CDW by increasing operational expenses. For instance, a 3.5% inflation rate, as projected by some economists for late 2024, could significantly raise costs for labor, transportation, and the components CDW resells. This necessitates careful pricing adjustments to maintain healthy profit margins.

Higher interest rates, a tool used to combat inflation, pose a challenge for CDW's clientele. If benchmark rates remain elevated, businesses might scale back on large IT infrastructure purchases or cloud migrations, directly affecting CDW's sales pipeline. For example, a 1% increase in the Federal Funds Rate can translate to higher borrowing costs for CDW's customers.

CDW's strategy must involve proactive cost management and flexible pricing models. Enhancing supply chain efficiency and exploring long-term supplier contracts can buffer against escalating input costs. Simultaneously, offering financing solutions or tiered service packages can help customers manage their IT budgets amidst a higher interest rate environment.

Corporate IT spending is projected to reach $1.5 trillion globally in 2024, with a significant portion allocated to cloud services and cybersecurity. Public sector IT budgets, particularly in defense and infrastructure, are also seeing increases, with the US federal government planning over $150 billion in IT spending for fiscal year 2025, driven by modernization efforts.

The education sector is focusing on digital transformation, with K-12 and higher education institutions investing in hybrid learning solutions and network upgrades, estimated at over $30 billion in the US for 2024. Healthcare IT budgets are expanding, with a strong emphasis on telehealth platforms and data security, anticipating over $100 billion in global spending in 2024.

Supply Chain Costs and Product Availability

Global energy prices and raw material costs are critical economic factors influencing CDW's operations. For instance, the average price of Brent crude oil fluctuated significantly in late 2023 and early 2024, impacting transportation and manufacturing expenses across the IT sector. Similarly, the cost of key components like semiconductors and rare earth minerals directly affects the procurement prices of IT hardware. Labor availability in manufacturing hubs, particularly in Asia, also plays a crucial role; shortages or rising wages can lead to increased production costs for IT products.

Disruptions within the global technology supply chain, such as those experienced during the COVID-19 pandemic and geopolitical tensions, can result in higher procurement costs for CDW. These disruptions can also lead to product shortages for its customers, impacting sales and customer satisfaction. For example, the ongoing semiconductor shortage, while easing in some areas, continued to affect the availability of certain high-demand IT products throughout 2023 and into 2024.

- Rising Energy Costs: Global energy prices, a key input for manufacturing and logistics, directly impact the cost of IT hardware.

- Raw Material Volatility: Fluctuations in the cost of components like semiconductors and metals create uncertainty in product pricing.

- Labor Market Dynamics: Labor availability and wage growth in manufacturing regions influence the overall cost of producing IT equipment.

- Supply Chain Resilience: CDW's ability to manage supply chain risks and maintain strong vendor relationships is paramount to mitigating economic pressures.

Labor Market Conditions and Wage Inflation

The availability and cost of skilled IT professionals and sales staff are critical for CDW's operational efficiency and service delivery capabilities. Wage inflation within the technology sector directly influences personnel expenses, and a constrained labor market can hinder talent acquisition and retention efforts.

These dynamics significantly impact CDW's profitability and its capacity to scale its service portfolio and meet evolving customer demands. For instance, the U.S. Bureau of Labor Statistics reported a 4.1% increase in average hourly earnings for all employees in the private sector from May 2023 to May 2024, with technology-related fields often seeing higher-than-average growth.

- Skilled Labor Availability: CDW relies on a robust pool of IT specialists and sales talent to drive its business.

- Wage Inflation Impact: Rising wages in the tech sector can increase CDW's cost structure, affecting margins.

- Talent Acquisition Challenges: A tight labor market makes it more difficult and expensive to recruit and retain essential employees.

- Service Delivery Capacity: The ability to hire and keep skilled staff directly correlates with CDW's capacity to support its customers and expand services.

Economic factors significantly shape CDW's operating environment. Robust GDP growth, like the projected 2.3% for the US in 2024, generally translates to increased corporate IT spending, a direct boon for CDW. Conversely, economic slowdowns or recessions can contract IT budgets, impacting CDW's revenue streams.

Inflation and interest rates are critical considerations. For instance, the US inflation rate, hovering around 3.4% in early 2024, increases CDW's operational costs. Elevated interest rates, with the Federal Reserve maintaining rates in the 5.25%-5.50% range, can deter large IT investments by CDW's clients due to higher borrowing costs.

Global supply chain dynamics and commodity prices also play a vital role. Fluctuations in semiconductor prices, a core component of IT hardware, and rising energy costs for transportation directly affect CDW's procurement expenses and pricing strategies.

The labor market, particularly the availability and cost of skilled IT professionals, impacts CDW's service delivery and personnel expenses. Wage inflation in the tech sector, which saw average annual increases of over 5% in many areas during 2023-2024, necessitates careful talent management and compensation strategies for CDW.

| Economic Factor | Impact on CDW | Relevant Data (2024/2025 Projections) |

|---|---|---|

| GDP Growth | Drives IT spending | US GDP projected at 2.3% (2024) |

| Inflation Rate | Increases operational costs | US Inflation projected around 3.4% (early 2024) |

| Interest Rates | Affects client investment capacity | Federal Funds Rate range: 5.25%-5.50% (early 2024) |

| Semiconductor Costs | Influences hardware procurement costs | Market volatility expected, with some easing in supply |

| Skilled Labor Wages | Impacts personnel expenses | Tech sector wage growth >5% (2023-2024) |

Full Version Awaits

CDW PESTLE Analysis

The CDW PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of Political, Economic, Social, Technological, Legal, and Environmental factors impacting CDW.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

The shift towards remote and hybrid work, accelerated by events in recent years, has profoundly reshaped IT needs. This trend, which saw a significant portion of the workforce operating outside traditional office settings throughout 2023 and into 2024, drives continuous demand for collaboration software, robust cybersecurity for distributed networks, and scalable cloud services. Companies are investing heavily in solutions that enable seamless connectivity and productivity for employees regardless of location.

This paradigm shift directly benefits companies like CDW, which offer a suite of products and services catering to these new work models. For instance, the market for unified communications and collaboration (UCC) tools, essential for hybrid teams, was projected to reach over $100 billion globally by 2024. CDW's position in providing these critical technologies, alongside secure remote access solutions and cloud infrastructure, is therefore a key strategic advantage.

Digital literacy varies significantly, impacting how quickly businesses embrace new tech. For instance, a 2024 Pew Research Center study indicated that while 90% of US adults use the internet, digital skills proficiency still shows a considerable gap between age groups and educational attainment. This disparity directly affects how organizations, particularly those with less tech-savvy workforces, adopt cloud solutions or advanced cybersecurity measures, creating a need for tailored support.

As technology becomes more ingrained in daily operations, the demand for intuitive interfaces and comprehensive training escalates. In 2024, many companies reported that a lack of internal expertise was a primary barrier to digital transformation, with IT decision-makers highlighting the need for managed services and upskilling programs. This trend positions CDW to offer crucial support, helping clients navigate these challenges and optimize their technology investments by providing both the tools and the knowledge transfer.

The workforce is undergoing a significant shift, with Gen Z and younger Millennials entering the job market in increasing numbers. By 2025, it's projected that Gen Z will make up a substantial portion of the global workforce, bringing with them a strong preference for digital-first experiences and collaborative tools. This demographic change directly impacts the demand for technology solutions that are intuitive, mobile-accessible, and support remote or hybrid work models, areas where CDW can provide critical support to its clients.

Societal Data Privacy and Security Concerns

Societal awareness around data privacy and security has surged, making it a critical concern for businesses. This heightened public scrutiny directly fuels demand for robust cybersecurity measures and data protection strategies. For CDW, this translates into increased opportunities as they provide essential security solutions and expert consulting to help organizations safeguard sensitive data and uphold customer trust in an increasingly digital world.

The global cybersecurity market is a prime example of this trend. Projections indicate substantial growth, with reports suggesting the market could reach over $300 billion by 2025, and some forecasts even placing it closer to $400 billion by 2027, highlighting the immense investment driven by these societal concerns. CDW is well-positioned to capitalize on this expansion by offering a comprehensive suite of security products, managed services, and advisory capabilities that address the evolving threat landscape.

- Increased Demand for Cybersecurity Solutions: Public apprehension over data breaches directly correlates with higher spending on security technologies and services.

- Focus on Data Governance and Compliance: Organizations are prioritizing structured data management and adherence to regulations like GDPR and CCPA, creating a market for compliance-focused solutions.

- CDW's Role in Mitigating Risks: CDW's portfolio of security products and expert services helps clients navigate complex privacy regulations and defend against cyber threats, thereby building and maintaining public confidence.

- Growing Investment in Cloud Security: As more data moves to the cloud, investments in cloud-native security tools and services are escalating, an area where CDW offers significant expertise and solutions.

Demand for 'As-a-Service' Consumption Models

Societal shifts are increasingly favoring subscription-based and on-demand consumption, a trend evident across consumer markets and now significantly impacting business IT. This move away from substantial upfront capital investments towards flexible, scalable 'as-a-service' models for software, infrastructure, and platforms is a key driver in IT procurement.

CDW is well-positioned to capitalize on this demand. Its robust offerings in managed services and cloud solutions directly address this growing preference, enabling the company to deliver continuous value and secure recurring revenue streams. For instance, the global market for cloud computing services, encompassing IaaS, PaaS, and SaaS, was projected to reach over $600 billion in 2024, with continued strong growth expected.

- Growing preference for OpEx over CapEx: Businesses are actively seeking to shift IT spending from capital expenditures to operational expenditures for greater budget flexibility.

- Scalability and Agility: 'As-a-service' models offer businesses the ability to scale IT resources up or down as needed, enhancing agility in response to market changes.

- CDW's Strategic Alignment: CDW's investment in and expansion of its managed services and cloud capabilities directly supports this dominant societal and business trend.

Societal expectations around digital inclusion and accessibility are growing, influencing technology adoption. As of 2024, there's a significant push for technologies that accommodate diverse user needs, including those with disabilities, driving demand for accessible software and hardware. This societal emphasis on inclusivity means businesses must prioritize solutions that are user-friendly for all employees, impacting IT purchasing decisions.

CDW's ability to provide a broad range of accessible technology solutions and services, coupled with its expertise in implementing them, aligns directly with these evolving societal demands. The company's focus on offering products that meet accessibility standards, such as WCAG compliance for web applications, positions it as a valuable partner for organizations aiming to create equitable digital environments.

Technological factors

The rapid evolution of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping industries, driving a surge in demand for robust IT infrastructure. Businesses are increasingly seeking high-performance computing, sophisticated data analytics, and specialized AI software to harness these advancements. For instance, the global AI market is projected to reach $1.8 trillion by 2030, underscoring the scale of this transformation.

CDW is well-positioned to capitalize on this trend by offering the essential hardware, software, and integration services that facilitate AI adoption. By enabling clients to effectively implement AI and ML solutions, CDW can unlock significant growth opportunities, helping businesses leverage these powerful technologies for competitive advantage.

The cloud computing landscape is constantly changing, with hybrid and multi-cloud approaches becoming the norm. This shift means businesses need advanced tools and know-how to manage these complex setups effectively. Navigating these diverse platforms requires expertise to keep costs in check and maintain strong security and compliance, a challenge many organizations face.

CDW's role is pivotal here, offering a full suite of cloud services. From initial strategy and consultation to seamless migration and ongoing managed services, CDW helps clients tackle their cloud adoption challenges. For instance, in 2024, the global hybrid cloud market was projected to reach over $200 billion, highlighting the significant demand for such specialized support.

The cybersecurity threat landscape is perpetually evolving, with new and increasingly sophisticated attacks like ransomware, phishing, and supply chain exploits emerging constantly. This dynamic environment fuels a persistent and critical need for advanced cybersecurity solutions. For instance, the average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, underscoring the significant financial implications of inadequate defenses.

Organizations are compelled to continuously bolster their security postures, investing in cutting-edge threat detection technologies and refining their incident response strategies. CDW, with its comprehensive suite of cybersecurity products and specialized services, is strategically positioned to assist clients in navigating and mitigating these escalating risks, acting as a crucial ally in safeguarding their digital assets.

5G Deployment and Network Infrastructure Upgrades

The ongoing 5G deployment is a major technological driver, necessitating substantial upgrades in network infrastructure for both telecom companies and businesses. This expansion fuels demand for networking hardware, wireless solutions, and associated services, as organizations seek enhanced connectivity for new applications and improved operational efficiency. CDW is well-positioned to benefit by supplying the essential infrastructure and expertise that allow clients to harness the full potential of 5G.

The global 5G infrastructure market was valued at approximately $31.4 billion in 2023 and is projected to reach $121.7 billion by 2028, growing at a compound annual growth rate (CAGR) of 31.1% during that period. This significant market growth underscores the substantial investment and demand in this sector.

- Increased demand for high-performance networking equipment driven by 5G's enhanced speed and lower latency.

- Growth in wireless solutions and services to support the expanded connectivity needs of enterprises.

- Opportunities for CDW to provide integration and consulting services to help clients adopt and optimize 5G technology.

- The need for cybersecurity solutions to protect the expanded and more complex 5G networks.

Emergence of Edge Computing and Internet of Things (IoT)

The rapid expansion of the Internet of Things (IoT) is a significant technological driver, with projections indicating over 29 billion connected devices by 2026. This surge necessitates edge computing, which processes data closer to its origin, reducing latency and bandwidth demands. CDW is well-positioned to capitalize on this trend by offering integrated solutions for IoT infrastructure and edge deployments, enabling businesses to leverage real-time data analytics more effectively.

This technological evolution demands specialized hardware, software, and robust networking capabilities to manage the complexities of distributed data and applications. CDW's expertise in providing end-to-end solutions for IoT ecosystems, including secure device management and data analytics platforms, directly addresses these evolving business requirements. For instance, the global edge computing market was valued at approximately $17.1 billion in 2023 and is expected to reach over $150 billion by 2030, highlighting the immense growth potential.

- IoT Device Growth: Projections show over 29 billion connected devices by 2026, fueling demand for edge solutions.

- Edge Computing Market Expansion: The edge computing market is set for substantial growth, projected to exceed $150 billion by 2030 from $17.1 billion in 2023.

- CDW's Role: CDW offers comprehensive solutions for IoT and edge infrastructure, supporting businesses in harnessing real-time data.

The increasing sophistication of cyber threats requires continuous investment in advanced security solutions. In 2024, the average cost of a data breach reached $4.45 million, highlighting the critical need for robust cybersecurity measures. CDW offers a comprehensive portfolio of security products and services, positioning it to assist clients in mitigating these escalating digital risks.

Legal factors

Data privacy and protection regulations are becoming more numerous and stricter worldwide. Laws like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), along with numerous state-level rules, create significant compliance challenges for companies that handle personal information. For instance, by the end of 2023, over 100 countries had enacted comprehensive data protection laws, reflecting this global trend.

CDW's clients are actively seeking IT solutions and services that help them meet these complex legal requirements. This demand is fueling growth in areas like data encryption, robust access controls, effective data governance, and secure data management. In 2024, the global data privacy management software market was valued at approximately $2.5 billion and is projected to grow significantly.

Consequently, CDW must not only ensure its own internal operations comply with these evolving privacy laws but also provide solutions that enable its clients to achieve their own compliance goals. This dual responsibility is a critical legal factor influencing CDW's service offerings and operational strategies.

CDW must meticulously adhere to software licensing agreements, a crucial legal factor impacting its operations and customer relationships. Non-compliance can result in substantial financial penalties and protracted legal battles, as seen in the software industry's ongoing enforcement actions. For instance, in 2023, Microsoft continued its robust software asset management audits, highlighting the risks businesses face from improper licensing, with potential fines reaching millions.

Protecting intellectual property rights is equally paramount for CDW, safeguarding its proprietary service methodologies and innovative solutions. The company actively works to ensure its clients are properly licensed for the software they deploy, mitigating legal exposure for both parties. This focus on compliance is vital in an era where intellectual property theft can severely damage a company's competitive edge and innovative capacity.

Antitrust and competition law are increasingly shaping the technology landscape. Regulators worldwide are closely watching market dominance, mergers, and fair competition. For CDW, a reseller, this means potential indirect impacts from actions taken against its key technology partners, influencing its supply chain and partnership agreements.

For instance, the US Federal Trade Commission (FTC) has been particularly active, investigating large tech firms for alleged monopolistic practices. While CDW itself isn't typically the direct target, shifts in market power or new regulations imposed on its major suppliers, such as Microsoft or Dell, could alter pricing, product availability, or contractual terms, affecting CDW’s operational flexibility and competitive positioning.

Government Contract Compliance and Procurement Laws

CDW's significant presence in government, education, and healthcare sectors necessitates strict adherence to intricate procurement laws and contracting regulations. Navigating federal acquisition regulations (FAR), state procurement codes, and agency-specific rules is critical for securing public sector contracts. For instance, the U.S. federal government's IT spending alone was projected to reach over $115 billion in fiscal year 2024, highlighting the scale of these opportunities and the importance of compliance.

Failure to comply with these legal frameworks, including reporting requirements and contract terms, can result in substantial penalties, contract termination, or disqualification from future government bids. CDW must ensure its operations align with regulations like the Small Business Administration (SBA) rules or specific cybersecurity mandates for government contractors. A single compliance lapse could jeopardize millions in potential revenue.

Key legal considerations for CDW include:

- Federal Acquisition Regulation (FAR) Compliance: Adhering to FAR clauses for pricing, subcontracting, and reporting is essential for federal contracts.

- State and Local Procurement Codes: Understanding and complying with diverse state-specific bidding processes and contract terms.

- Cybersecurity Mandates: Meeting evolving government cybersecurity requirements, such as those outlined in NIST guidelines, for data protection.

- Reporting and Auditing: Ensuring accurate financial and performance reporting to government agencies and being prepared for audits.

Cybersecurity Liability and Breach Notification Laws

Cybersecurity liability and breach notification laws are increasingly complex, with regulators worldwide imposing stricter requirements. For instance, the GDPR in Europe mandates significant fines for data breaches, and similar legislation is expanding globally. In 2024, the average cost of a data breach reached an all-time high of $4.45 million, underscoring the financial risks companies face.

These evolving legal landscapes mean organizations must prioritize robust cybersecurity measures and comprehensive incident response plans to avoid severe penalties. CDW's expertise in security solutions directly addresses these concerns, helping clients navigate compliance and minimize their exposure to legal repercussions.

- Increased Regulatory Scrutiny: Governments are enacting and enforcing stricter data breach notification laws, like the California Privacy Rights Act (CPRA), which came into full effect in 2023, imposing significant penalties for non-compliance.

- Escalating Breach Costs: The financial fallout from data breaches continues to grow, with IBM's 2024 Cost of a Data Breach Report indicating a global average cost of $4.45 million, a 15% increase over three years.

- Demand for Proactive Solutions: Companies are actively seeking cybersecurity services that not only prevent breaches but also ensure they meet legal obligations for reporting and remediation, driving demand for CDW's security offerings.

- Liability for Negligence: Failure to implement reasonable security measures can lead to substantial legal liability, including class-action lawsuits from affected individuals and regulatory fines.

CDW must navigate a complex web of global data privacy laws, such as the EU's GDPR and the CCPA in California, which mandate strict data protection and handling. By late 2023, over 100 countries had implemented comprehensive data privacy legislation, creating a significant compliance burden for businesses that handle personal information.

The demand for IT solutions that ensure data privacy is escalating, with the global data privacy management software market valued at approximately $2.5 billion in 2024. CDW's ability to provide services like encryption and access controls helps clients meet these stringent legal requirements, positioning it as a key partner in compliance.

Software licensing compliance is another critical legal factor, with companies like Microsoft conducting rigorous audits in 2023 to ensure proper licensing, highlighting the substantial financial risks of non-compliance, potentially reaching millions in penalties.

Antitrust regulations are increasingly impacting the tech sector, with bodies like the US FTC scrutinizing market dominance. While CDW is a reseller, regulatory actions against its major technology partners could affect pricing and product availability, indirectly influencing CDW's operations and contractual agreements.

CDW's engagement with government sectors requires strict adherence to procurement laws, including the Federal Acquisition Regulation (FAR). The US federal government's IT spending was projected to exceed $115 billion in fiscal year 2024, underscoring the importance of compliance in securing these lucrative contracts.

Cybersecurity liability and breach notification laws are becoming more stringent, with the average cost of a data breach reaching $4.45 million in 2024. CDW's security solutions are vital for clients seeking to meet legal obligations for reporting and remediation, mitigating severe penalties and legal liability.

Environmental factors

CDW's clients, especially major corporations and government bodies, are increasingly factoring environmental, social, and governance (ESG) criteria into their purchasing. This shift directly fuels demand for energy-efficient IT equipment, eco-conscious supply chains, and proper e-waste disposal. For instance, in 2024, a significant percentage of Fortune 500 companies have publicly committed to net-zero emissions targets, directly influencing their IT vendor selection.

To remain competitive, CDW must showcase its own dedication to sustainability and provide solutions that assist clients in meeting their ESG objectives. This includes offering products with lower carbon footprints and services that support circular economy principles. CDW's 2023 sustainability report highlighted a 15% reduction in its operational carbon emissions, a metric that resonates with environmentally conscious buyers.

Increasing regulations around electronic waste (e-waste) are a significant environmental factor for CDW and its clients. For instance, by the end of 2024, many regions are expected to have enhanced Extended Producer Responsibility (EPR) schemes in place for electronics, pushing manufacturers and retailers to manage end-of-life products more actively.

These evolving laws often necessitate responsible recycling practices, the implementation of take-back programs, and strict limitations on hazardous materials within electronic devices. This creates a need for specialized services that can assist businesses in navigating these complex requirements.

CDW is well-positioned to address this by offering robust IT Asset Disposition (ITAD) services. These services help clients securely manage and dispose of old technology, ensuring compliance with environmental mandates and promoting participation in circular economy models, thereby reducing the overall environmental footprint of technology lifecycles.

The substantial energy demands of data centers and corporate IT infrastructure are a significant environmental concern, directly contributing to carbon emissions. This reality is increasingly pushing organizations towards more energy-efficient IT solutions. For instance, the global IT sector's carbon footprint was estimated to be around 2.1% of the total global emissions in 2023, a figure that highlights the urgency for change.

This environmental pressure fuels a growing demand for technologies that optimize power management, embrace virtualization, and leverage cloud services. These advancements are crucial for organizations aiming to reduce their overall energy footprint. By adopting these strategies, businesses can actively work towards sustainability goals.

CDW plays a vital role in this shift by offering solutions that enable clients to deploy greener IT infrastructure and enhance energy efficiency. Their offerings help businesses minimize their environmental impact, aligning operational needs with ecological responsibility. For example, CDW's services can assist in migrating workloads to more energy-efficient cloud environments, potentially reducing a company's IT energy consumption by up to 30%.

Climate Change Policies and Carbon Footprint Reduction

Governments worldwide are implementing stricter climate change policies, including carbon taxes and emissions reduction targets, directly impacting how businesses manage their IT infrastructure. For instance, the European Union's Fit for 55 package aims for a 55% net greenhouse gas emission reduction by 2030 compared to 1990 levels. This regulatory environment compels companies to re-evaluate their IT procurement and operational strategies to align with sustainability goals.

Businesses are actively pursuing carbon footprint reduction, with a significant focus on optimizing IT operations for energy efficiency and building more sustainable supply chains. A 2024 report indicated that 70% of IT decision-makers consider sustainability a key factor in their technology purchasing decisions. This trend is driving demand for cloud computing services that offer greater energy efficiency compared to on-premises data centers.

CDW is well-positioned to support clients in achieving their environmental objectives by providing eco-friendly IT products and services designed for lower emissions. This includes offering energy-efficient hardware, cloud solutions that optimize resource utilization, and services that facilitate the responsible disposal and recycling of electronic equipment. For example, CDW's sustainable IT solutions can help clients reduce their Scope 2 emissions by optimizing data center energy consumption.

Key areas where CDW assists clients in environmental efforts include:

- Energy-efficient hardware procurement: Offering servers, workstations, and networking equipment with improved power consumption metrics.

- Cloud migration services: Facilitating transitions to cloud environments known for their optimized energy usage and scalability.

- Sustainable IT lifecycle management: Providing services for responsible e-waste recycling and asset disposition.

- IT infrastructure optimization: Recommending solutions that reduce power usage and cooling requirements in data centers.

Supply Chain Environmental Impact and Transparency

The environmental impact of supply chains is under intense examination, covering everything from where raw materials come from to how products are made and shipped. For CDW, a company that resells IT products, this means its indirect environmental footprint is tied to the practices of its manufacturing partners. For instance, a significant portion of the electronics industry's greenhouse gas emissions originates from manufacturing processes.

Customers and regulators are increasingly pushing for more transparency about the environmental footprint of IT products. This is driving demand for companies like CDW to actively seek out and partner with vendors who demonstrate strong environmental responsibility. By promoting sustainable sourcing, CDW can align with these growing expectations and enhance its own corporate image.

- Growing pressure for supply chain sustainability: By 2025, it's estimated that over 70% of global companies will be reporting on their supply chain sustainability metrics, a significant jump from around 40% in 2023.

- CDW's indirect impact: As a reseller, CDW's Scope 3 emissions, which include those from its supply chain, are a key area of focus for environmental reporting and improvement initiatives.

- Customer demand for transparency: Surveys in late 2024 indicated that over 60% of B2B IT buyers consider a vendor's environmental credentials when making purchasing decisions.

- Regulatory trends: Emerging regulations, such as extended producer responsibility (EPR) schemes for electronics in various regions, will further necessitate greater supply chain environmental accountability.

Environmental factors significantly shape CDW's operational landscape, driven by increasing client demand for sustainable IT solutions and stricter global regulations. By 2025, a substantial majority of large corporations are expected to integrate ESG criteria into their procurement, directly influencing CDW's product and service offerings. The company's commitment to sustainability, demonstrated by its own emission reductions, is becoming a critical differentiator in the market.

PESTLE Analysis Data Sources

Our CDW PESTLE Analysis is built on a robust foundation of data from official government publications, reputable industry research firms, and leading economic institutions. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in current, verifiable information.