Castellum SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Castellum Bundle

Castellum's strengths lie in its robust security solutions and established market presence, but its vulnerabilities include potential reliance on specific technologies. Understanding these dynamics is crucial for navigating the competitive landscape.

Want the full story behind Castellum's opportunities for expansion and the threats it faces from emerging competitors? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Castellum boasts one of the largest listed property portfolios in the Nordic region, a significant strength that underpins its stability and growth potential. As of December 31, 2024, this vast collection of commercial properties, encompassing offices, public sector facilities, warehouses, and logistics centers, was valued at approximately SEK 155 billion.

This extensive and diversified asset base offers a robust foundation for consistent rental income and long-term value creation. The strategic spread across various property types and key Nordic growth markets, such as Sweden, Copenhagen, and Helsinki, effectively reduces exposure to sector-specific downturns or regional economic vulnerabilities.

Castellum's commitment to sustainability is a significant strength, with an ambitious goal of achieving climate neutrality by 2030. This forward-thinking approach positions the company favorably in a market increasingly prioritizing environmental responsibility.

The company's inclusion as the sole Nordic property and construction firm in the Dow Jones Sustainability Index (DJSI) underscores its leadership in ESG practices. This recognition validates its efforts and provides a competitive edge.

This robust ESG profile appeals to a growing segment of investors and tenants seeking sustainable investments, thereby enhancing Castellum's brand reputation and potentially improving access to favorable green financing options.

Castellum's financial health is robust, highlighted by a low loan-to-value ratio of 35.3% as of the first quarter of 2025. This indicates a conservative approach to leverage, providing a stable base for operations and future growth.

The company's strong interest coverage ratio of 3.2 times in Q1 2025 demonstrates its ability to comfortably service its debt obligations. This financial resilience is further bolstered by recent credit rating upgrades.

In February 2025, Standard & Poor's assigned Castellum an Investment Grade rating of BBB with a stable outlook. This was followed in May 2025 by Moody's upgrading the company to Baa2, also with a stable outlook. These positive assessments significantly enhance Castellum's standing in capital markets, facilitating access to more affordable financing for strategic initiatives.

Stable Rental Income and Positive Net Leasing

Castellum's core strength lies in its ability to generate consistent rental income, bolstered by a strong base of governmental tenants. This strategic tenant mix provides a significant degree of stability.

The company demonstrated this resilience in 2024, reporting a notable 10.2% year-on-year increase in income from property management. Furthermore, Castellum achieved positive net leasing for both the fourth quarter and the entirety of 2024, underscoring the ongoing demand for its properties even amidst market fluctuations.

- Stable Income Stream: A significant portion of Castellum's rental income is derived from governmental tenants, offering a predictable and reliable revenue source.

- Positive Net Leasing: The company achieved positive net leasing in Q4 2024 and for the full year, indicating successful leasing activities and tenant retention.

- Revenue Growth: Castellum experienced a 10.2% year-on-year increase in income from property management in 2024, highlighting operational efficiency and portfolio strength.

Strategic Investments and Project Development

Castellum's strategic investments and project development are key drivers for its future growth. The company is actively enhancing its portfolio by investing in both new construction and reconstruction projects. For instance, in 2024, Castellum made significant investments in these areas, signaling a commitment to expanding its asset base.

Looking ahead, Castellum has ambitious plans, including the development of the Infinity office property in Stockholm, with construction slated to begin in the third quarter of 2025. This project underscores the company's forward-thinking approach to real estate development.

Further demonstrating its growth strategy, Castellum completed the acquisition of five properties from Corem in June 2025 for SEK 1.7 billion. This acquisition significantly bolsters its portfolio and strengthens its market position.

- Strategic Investments: Castellum actively invests in new construction and reconstructions to improve portfolio quality.

- Project Pipeline: The Infinity office property in Stockholm, commencing construction in Q3 2025, highlights future development plans.

- Acquisition Growth: The SEK 1.7 billion acquisition of five properties from Corem in June 2025 showcases portfolio expansion.

Castellum's extensive property portfolio, valued at approximately SEK 155 billion as of December 31, 2024, provides a stable foundation for consistent rental income and long-term value creation across diverse Nordic markets. This diversification mitigates risks associated with sector-specific downturns.

The company's strong commitment to sustainability, aiming for climate neutrality by 2030 and its inclusion in the Dow Jones Sustainability Index, enhances its brand and appeal to ESG-conscious investors and tenants.

Castellum's financial health is robust, evidenced by a low loan-to-value ratio of 35.3% (Q1 2025) and strong interest coverage (3.2x in Q1 2025), supported by recent Investment Grade credit ratings from S&P (BBB) and Moody's (Baa2) in early 2025.

A significant portion of Castellum's rental income comes from stable governmental tenants, contributing to a 10.2% year-on-year increase in income from property management in 2024 and positive net leasing throughout the year.

Strategic investments, including the upcoming Infinity office property development in Stockholm (starting Q3 2025) and the SEK 1.7 billion acquisition of five properties from Corem in June 2025, demonstrate Castellum's focus on portfolio expansion and future growth.

| Strength | Description | Key Data/Metric |

| Extensive & Diversified Portfolio | Largest listed property portfolio in the Nordics, spanning various commercial property types and growth markets. | Valued at ~SEK 155 billion (Dec 31, 2024). |

| Sustainability Leadership | Commitment to climate neutrality by 2030 and recognition in the Dow Jones Sustainability Index. | DJSI inclusion, climate neutrality goal by 2030. |

| Financial Resilience | Low leverage and strong debt servicing capability, bolstered by recent credit rating upgrades. | LTV 35.3% (Q1 2025), Interest Coverage 3.2x (Q1 2025), BBB (S&P, Feb 2025), Baa2 (Moody's, May 2025). |

| Stable Income Generation | Significant rental income from governmental tenants and positive net leasing. | 10.2% YoY increase in income from property management (2024), positive net leasing (Q4 2024 & FY 2024). |

| Strategic Growth Initiatives | Active investment in new construction, reconstructions, and strategic acquisitions. | Infinity project (start Q3 2025), SEK 1.7 billion Corem acquisition (June 2025). |

What is included in the product

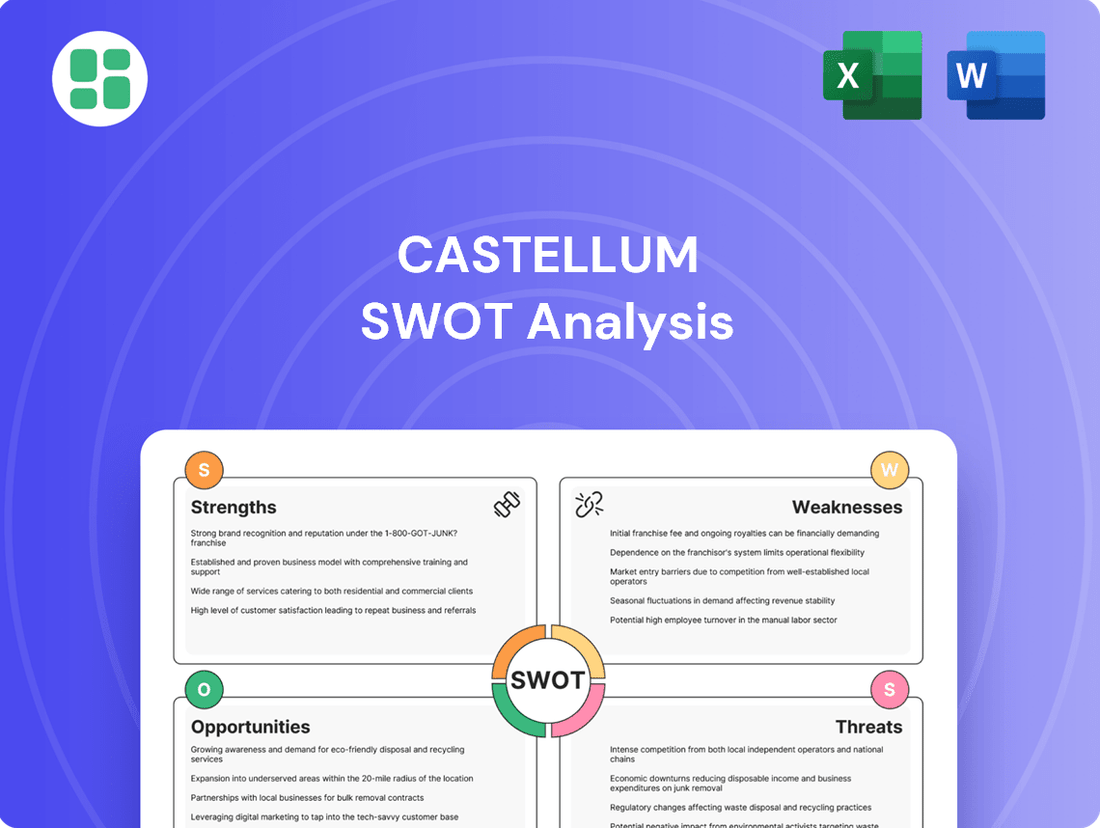

Analyzes Castellum’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

The Castellum SWOT Analysis simplifies complex strategic planning by offering a clear, actionable framework, reducing the overwhelm of identifying and addressing business challenges.

Weaknesses

Castellum's significant presence in Sweden and the broader Nordic region, while offering diversification, also means it's deeply tied to the cyclical real estate market. This means that economic shifts, like inflation spikes or interest rate hikes, can directly affect property values and how much people want to rent space.

Even with a projected economic rebound in Sweden for 2025, the real estate sector has recently navigated difficult periods. This vulnerability to economic cycles presents a persistent weakness, as past challenges could easily resurface and impact Castellum's performance.

Castellum's significant debt load makes it susceptible to interest rate shifts. While the company maintains a robust interest coverage ratio and has hedged a portion of its debt, the impact of rising rates is evident. For instance, in the first quarter of 2025, increased interest expenses directly affected income generated from property management.

Higher borrowing costs stemming from rate hikes can directly squeeze Castellum's profitability. This also means less capital is available for crucial activities like acquiring new properties or funding development projects, potentially hindering future growth.

Castellum experienced a notable dip in its property management income during the first quarter of 2025, with a 7.3% decrease compared to the prior year's first quarter. This downturn is largely due to escalating interest expenses and more significant costs associated with hedging foreign exchange rates.

Although Castellum's property management income saw an overall increase throughout 2024, this recent quarterly contraction signals persistent financial challenges that could impact its immediate profitability.

Negative Net Leasing in Q1 2025

Castellum faced a challenging rental market in the first quarter of 2025, evidenced by negative net leasing. New leases secured during this period amounted to SEK 137 million, which was significantly outpaced by lease terminations totaling SEK 321 million. This imbalance suggests a trend where more tenants are vacating or reducing their leased space than new tenants are entering or expanding.

The consequence of this negative net leasing is a direct impact on Castellum's occupancy and revenue streams. An increase in vacancy rates typically leads to a reduction in overall rental income, thereby pressuring the company's operational performance and profitability. This situation highlights a need for strategic adjustments to attract and retain tenants in the current economic climate.

- Negative Net Leasing: Q1 2025 saw SEK 137 million in new leases versus SEK 321 million in terminations.

- Market Conditions: This indicates a tenant-driven market with higher churn than new absorption.

- Financial Impact: Increased vacancies and reduced rental income put pressure on operational results.

Challenges in Specific Property Segments

While the logistics sector shows overall strength, specific markets present headwinds. For instance, Stockholm's industrial sector experienced elevated vacancy rates and substantial new supply in 2024, which consequently put a damper on rental growth. This indicates that not all segments are experiencing uniform positive momentum within the logistics space.

The office segment is also undergoing shifts, with a noticeable trend towards shorter lease terms and a demand for more adaptable spaces. Companies are increasingly prioritizing flexibility, leading to more frequent lease renegotiations in key business districts. These evolving tenant preferences can create operational complexities and constrain the pace of rental increases for properties in these areas.

- Stockholm Industrial Vacancy: In 2024, certain industrial markets, including Stockholm, saw vacancy rates rise, impacting rental growth.

- Office Lease Trends: A move towards shorter lease agreements and flexible office solutions is becoming prevalent.

- Renegotiation Frequency: Business hubs are experiencing an increase in lease renegotiations as companies adjust their space needs.

- Segmental Performance: These specific market dynamics suggest potential for slower rental growth and operational challenges in particular Castellum property segments.

Castellum's reliance on the Nordic real estate market exposes it to economic cycles, with recent data from Q1 2025 showing a 7.3% decrease in property management income year-over-year, partly due to rising interest expenses.

The company also faces challenges with tenant retention, as Q1 2025 recorded negative net leasing, with lease terminations (SEK 321 million) significantly exceeding new leases (SEK 137 million), impacting occupancy and revenue.

Specific market conditions, like elevated vacancy rates in Stockholm's industrial sector during 2024 and a trend towards shorter, more flexible office leases, further pressure rental growth and operational performance.

| Weakness | Description | Impact |

| Market Dependence | High exposure to Nordic real estate cycles. | Vulnerability to economic downturns, impacting property values and rental demand. |

| Tenant Churn | Negative net leasing in Q1 2025 (SEK 321M terminations vs. SEK 137M new leases). | Reduced occupancy, lower rental income, and pressure on operational results. |

| Segmental Headwinds | Stockholm industrial vacancy (2024), shorter office leases. | Constrained rental growth and increased operational complexity in specific segments. |

What You See Is What You Get

Castellum SWOT Analysis

This is the actual Castellum SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt of the comprehensive report. Once purchased, you'll unlock the full, detailed analysis, ready for your strategic planning.

Opportunities

Sweden's economic forecast for 2025 points towards a recovery, fueled by declining interest rates and rising real disposable incomes. Inflation is also expected to decelerate.

The Riksbank's initiated rate-cutting cycle in 2024, projected to extend into 2025, should stabilize long-term interest rates. This improved financing landscape benefits real estate firms like Castellum.

This environment fosters a more positive investor sentiment, likely stimulating investment in the Swedish property market and potentially leading to property value appreciation.

The Swedish logistics market is booming, driven by the ongoing surge in e-commerce and the need for resilient supply chains. Castellum's strategic investment in logistics properties places it at the forefront of this expansion, with well-situated assets becoming increasingly valuable.

Furthermore, the increasing demand for sustainable properties offers a significant opportunity. Castellum's established leadership in green building practices allows it to attract environmentally conscious tenants and investors, potentially leading to new development projects and enhanced property valuations.

Castellum is experiencing a surge in attractive investment prospects, a situation not seen in years, and is well-positioned to capitalize on them. The company's recent strategic move to acquire properties valued at SEK 1.7 billion, alongside ambitious undertakings like the Infinity project, signals a clear commitment to expansion through both strategic purchases and new developments.

The favorable shifts in the financing landscape, coupled with the anticipated revival of large-scale project development within the Swedish real estate market in 2025, provide a robust foundation for Castellum's growth ambitions.

Leveraging Sustainability Leadership for Competitive Advantage

Castellum's commitment to sustainability is a powerful differentiator. Its top rankings in the S&P Corporate Sustainability Assessment and inclusion in the Dow Jones Sustainability Indices highlight this leadership. This strong ESG (Environmental, Social, and Governance) standing is increasingly important for attracting investors.

This sustainability leadership translates into tangible financial benefits. It opens doors to a wider pool of investors specifically looking for ESG-compliant assets. Furthermore, it can provide access to green financing, often with more attractive interest rates, reducing the cost of capital. For example, in 2024, the global sustainable debt market saw significant growth, with green bonds alone reaching hundreds of billions of dollars, indicating strong investor appetite.

The positive impact extends to tenant relations and property performance. Tenants, particularly larger corporations, are increasingly prioritizing environmentally responsible office spaces. Castellum's strong sustainability credentials can therefore enhance its appeal to these tenants, leading to higher occupancy rates and more stable rental income streams. This focus on sustainability aligns with evolving market demands and can bolster long-term property valuations.

- Attracts ESG-focused investors: Castellum's high sustainability scores appeal to a growing segment of the investment community prioritizing ESG criteria.

- Access to favorable green financing: Strong ESG performance can unlock access to green bonds and loans, potentially lowering borrowing costs.

- Enhanced tenant appeal: Companies increasingly seek sustainable workplaces, boosting Castellum's ability to attract and retain tenants, thereby supporting occupancy and rental income.

Potential for Increased Transaction Volumes

The Swedish real estate market is showing signs of recovery, with forecasts pointing to a pickup in transaction volumes throughout 2025. This rebound is largely attributed to decreasing uncertainty surrounding interest rates and a more realistic alignment of price expectations between those looking to buy and sell. For Castellum, this presents a significant opportunity to capitalize on market dynamics.

This anticipated surge in activity allows Castellum to strategically divest assets that no longer fit its core portfolio. By offloading non-core properties during this period of increased demand, the company can aim for more favorable pricing. Furthermore, the revitalized market provides a conducive environment for acquiring new properties that align with Castellum's long-term growth strategy and portfolio optimization objectives, potentially leading to enhanced returns and a stronger market position.

- Market Rebound: Swedish real estate transactions expected to increase in 2025.

- Favorable Conditions: Receding interest rate uncertainty and improved price alignment.

- Strategic Divestment: Opportunity to sell non-core assets at better prices.

- Acquisition Potential: Acquire properties aligned with growth and optimization goals.

Castellum is well-positioned to benefit from a recovering Swedish real estate market, with transaction volumes expected to rise in 2025 due to decreasing interest rate uncertainty and better price alignment. This environment allows for strategic divestment of non-core assets at potentially higher prices and opportunistic acquisitions that align with the company's growth strategy, ultimately strengthening its portfolio and market standing.

| Opportunity | Description | 2024/2025 Relevance |

|---|---|---|

| Market Rebound & Transactions | Increased activity in the Swedish real estate market. | Forecasted pickup in transaction volumes for 2025. |

| Strategic Divestment & Acquisition | Selling non-core assets and acquiring strategic properties. | Opportunity for favorable pricing on divestments and portfolio enhancement through acquisitions. |

| Logistics Market Growth | Rising demand driven by e-commerce and supply chain needs. | Castellum's logistics properties are poised for increased value and rental income. |

| Sustainability Leadership | Strong ESG credentials attracting investors and tenants. | Access to green financing and higher tenant appeal, supporting valuations. |

Threats

Lingering economic uncertainty and inflationary pressures remain a significant threat to Castellum. While inflation has shown signs of cooling, a resurgence or a slower-than-expected economic recovery could negatively impact consumer and business confidence, potentially dampening rental demand and property values.

The Swedish economy, Castellum's primary market, is projected to grow in 2025, but this recovery is anticipated to be gradual, with a full rebound not expected until 2026. This prolonged period of slower growth could constrain Castellum's ability to increase rental income and achieve property value appreciation.

While the broader market might show resilience, Castellum faces a threat from rising vacancy rates in specific property types and locations. For instance, office spaces in areas with high new supply, such as Stockholm, are seeing increased vacancies. This trend, if it continues, could directly impact Castellum's rental income and the overall valuation of its properties in those segments.

The demand for more flexible and shorter lease agreements also adds to this uncertainty. This shift in tenant needs can make it harder for property owners like Castellum to secure long-term, stable rental income, potentially affecting profitability and requiring adjustments to leasing strategies.

As the Nordic real estate market shows signs of recovery, with investor optimism rising, competition for prime properties in key growth areas like Sweden, Copenhagen, and Helsinki is expected to heat up. This intensified competition could drive up acquisition costs for new assets, directly impacting Castellum's ability to expand its portfolio efficiently and potentially squeezing profit margins.

Regulatory Changes and Increased ESG Reporting Requirements

New regulations like the Corporate Sustainability Reporting Directive (CSRD) and the Energy Performance of Buildings Directive (EPBD) will mandate detailed ESG disclosures for Swedish listed real estate firms in their 2025 annual reports. This means companies must provide comprehensive data on environmental, social, and governance factors. While Castellum is recognized for its sustainability leadership, staying ahead of these evolving requirements and potentially upgrading properties to meet new energy efficiency standards could lead to increased expenses and administrative complexities.

The financial implications of these regulatory shifts are significant. For instance, the CSRD alone is expected to increase reporting costs for companies, with estimates suggesting a substantial rise in the time and resources dedicated to ESG data collection and verification. Castellum's commitment to sustainability is a strength, but the ongoing need to adapt to new legal frameworks and invest in energy efficiency upgrades, as mandated by directives like EPBD, presents a tangible threat to profitability and operational efficiency if not managed proactively.

- Increased Compliance Costs: Adapting to new ESG reporting standards, such as those introduced by CSRD, will necessitate investment in data management systems and expert personnel.

- Capital Expenditure for Energy Efficiency: Meeting stricter energy performance standards under EPBD may require significant capital outlays for building retrofits and renovations.

- Potential for Fines or Reputational Damage: Non-compliance with new environmental and reporting regulations could result in penalties and negatively impact Castellum's market standing.

- Administrative Burden: The complexity of new reporting requirements could strain internal resources, diverting focus from core business operations.

Geopolitical Risks and Market Volatility

Broader geopolitical tensions and unforeseen global events can introduce significant volatility into financial markets and investor sentiment. For instance, the ongoing conflict in Eastern Europe has contributed to energy price spikes and supply chain disruptions globally, impacting investor confidence. This volatility can directly affect Castellum's access to capital and the cost of financing, especially if international investors become more risk-averse.

While the Nordic region, including Sweden where Castellum operates, is generally considered stable, external shocks can still ripple through. A significant global downturn or a sudden shift in international trade policies could impact capital flows into the region. This could make it harder and more expensive for Castellum to secure the funding needed for its development projects and property acquisitions, potentially affecting property valuations.

Such geopolitical events often lead investors to seek refuge in perceived safer assets or markets. This could mean a reduction in foreign investment in the Nordic real estate sector, including opportunities for Castellum. For example, during periods of heightened global uncertainty, there's often a flight to quality, which might see capital diverted from commercial real estate towards government bonds or other less volatile investments.

- Geopolitical Instability Impact: Increased global tensions can lead to broader market volatility, affecting investor sentiment and capital availability.

- Nordic Region Vulnerability: Despite regional stability, external shocks like energy crises or trade wars can impact financing costs and economic stability in Sweden.

- Foreign Investment Shifts: Investors may reallocate capital away from markets like Nordic real estate towards perceived safer havens during periods of global uncertainty.

Castellum faces threats from economic headwinds, including a projected gradual recovery in Sweden, which could limit rental income growth. Rising vacancy rates in specific segments, like Stockholm offices, and the trend towards shorter leases also pose risks to stable revenue streams. Intensified competition for prime Nordic assets is likely to increase acquisition costs, potentially impacting portfolio expansion and profitability.

| Threat Category | Specific Risk | Impact on Castellum | Data Point/Outlook |

|---|---|---|---|

| Economic Uncertainty | Slower-than-expected economic recovery | Dampened rental demand, property value stagnation | Swedish GDP growth projected to be gradual in 2025. |

| Market Dynamics | Increased vacancy in specific office markets | Reduced rental income, lower property valuations | Stockholm office vacancy rates have seen an uptick. |

| Tenant Behavior | Shift towards shorter lease agreements | Less predictable rental income, increased leasing costs | Growing demand for flexible office solutions. |

| Competition | Heightened competition for prime Nordic assets | Increased acquisition costs, squeezed profit margins | Investor optimism rising in Nordic real estate recovery. |

SWOT Analysis Data Sources

This Castellum SWOT analysis is built upon a foundation of robust data, including official company financial filings, comprehensive market research reports, and insights from industry experts. These diverse sources ensure a well-rounded and accurate assessment of Castellum's strategic position.