Castellum Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Castellum Bundle

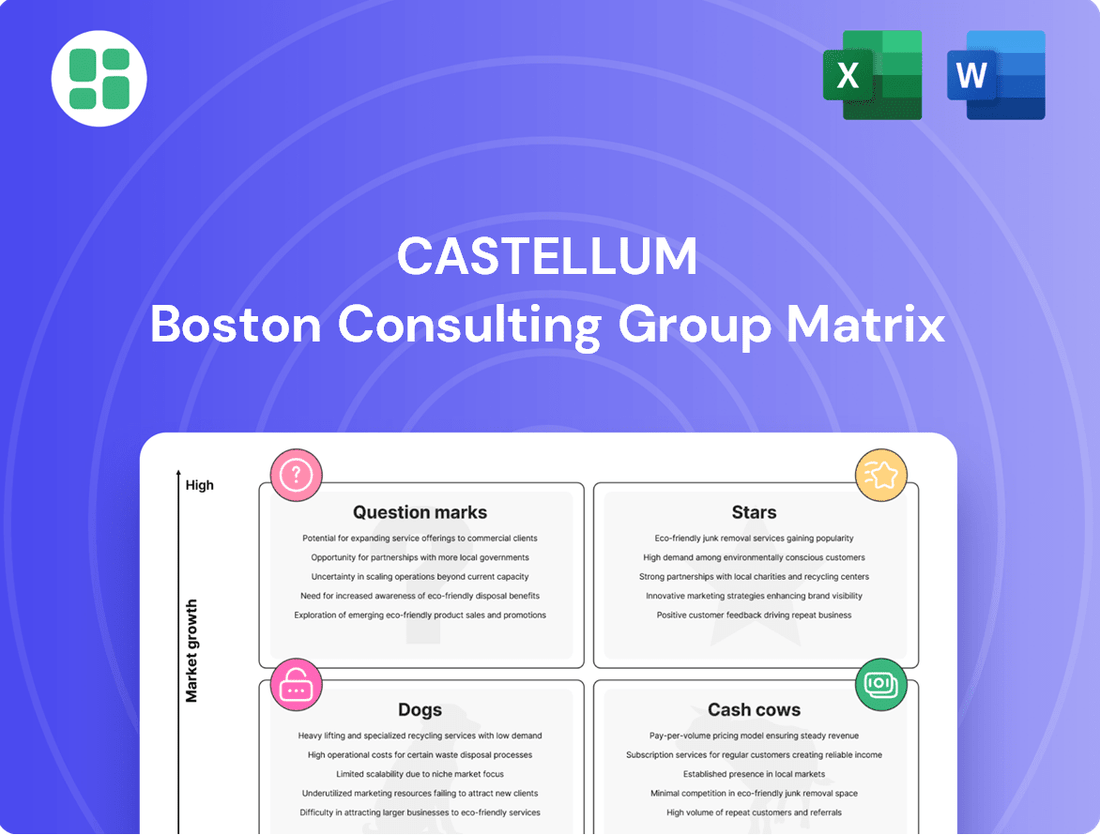

The Castellum BCG Matrix provides a powerful framework to understand a company's product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks based on market growth and share. This initial glimpse highlights the strategic importance of each category. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Castellum's focus on prime logistics developments, like the 22,000 square meter facility in Durv, Malner, places it in a high-growth category. This strategic expansion addresses the escalating need for advanced supply chain infrastructure across the Nordic region.

By investing in these modern logistics properties, Castellum is well-positioned to capitalize on market expansion and secure substantial rental revenue. This segment is crucial for the company's future growth trajectory.

High-Quality Office Projects in Growth Hubs represent Star products within the Castellum BCG Matrix. An excellent example is Castellum's Infinity office project in Hagastaden, Stockholm. This development, with an investment volume of approximately SEK 1.7 billion, is strategically positioned in a rapidly expanding inner-city district.

The Infinity project aims to deliver premium office spaces designed to attract and retain high-value tenants. Such initiatives are vital for companies like Castellum to solidify their market standing in competitive urban environments.

Castellum's strategic acquisitions in expanding regions are a key component of its growth strategy, particularly evident in its recent moves. The company's acquisition of five properties for SEK 1.7 billion in Uppsala, Örebro, and Linköping in June 2025 underscores this focus. These locations are recognized for their strong growth potential, aligning with Castellum's objective to bolster its presence in dynamic markets.

These newly acquired assets are modern and appealing, strategically situated near transportation hubs and existing Castellum portfolios. This proximity facilitates streamlined management operations and enhances the company's ability to penetrate and serve these growing markets more effectively. The integration of these properties is expected to yield significant operational efficiencies and expand market reach.

The primary aim of these acquisitions is to cultivate robust cash flows and elevate the overall quality of Castellum's property portfolio. By investing in high-potential markets like Uppsala, Örebro, and Linköping, Castellum positions itself to capitalize on future appreciation and rental growth, thereby strengthening its financial performance and market standing.

Advanced Sustainable Properties

Advanced Sustainable Properties within Castellum's portfolio are recognized as Stars due to their significant contribution to the company's climate neutrality goal by 2030. These properties boast impressive environmental credentials, with 68% of their value holding sustainability certifications. Furthermore, 23% of their electricity needs are met through self-generation, highlighting a strong commitment to renewable energy sources.

These highly sustainable assets are particularly attractive to tenants and investors who prioritize environmental responsibility. This demand translates into premium rental income and robust long-term value appreciation, especially as the market for green buildings continues to expand. Castellum's focus on these properties positions them favorably in a market increasingly driven by ESG (Environmental, Social, and Governance) factors.

- High Sustainability Certification: 68% of property value is sustainability-certified.

- Renewable Energy Generation: 23% of electricity consumption is self-generated.

- Market Demand: Attracts environmentally conscious tenants and investors.

- Financial Performance: Commands premium rents and strong long-term value.

Increased Stake in Entra ASA

Castellum's strategic move to increase its stake in Entra ASA to 37.0% by mid-2025 solidifies its position in Norway's real estate market. This significant investment in Entra, the nation's largest listed property company, underscores Castellum's focus on high-growth opportunities. The expanded ownership directly translates to greater exposure to Norway's attractive economic development zones, especially within Oslo.

This increased stake is a clear indicator of Castellum's strategy to grow its market share through targeted equity investments in strong, performing companies. By bolstering its holding in Entra, Castellum is not just acquiring more property; it's investing in a platform that offers substantial growth potential in a key Scandinavian market.

- Increased Ownership: Castellum's stake in Entra ASA will reach 37.0% by mid-2025.

- Market Focus: Entra ASA is Norway's largest listed real estate company.

- Strategic Rationale: Amplifies exposure to attractive Norwegian growth areas, particularly Oslo.

- Growth Strategy: Demonstrates commitment to expanding market share via strategic equity investments.

Stars in Castellum's BCG Matrix represent high-growth, high-market-share assets. These are the company's most promising investments, driving future revenue and value. Examples include prime logistics facilities and high-quality office projects in expanding urban centers. Castellum's strategic acquisitions in dynamic markets and its increased stake in Entra ASA also fall into this category, reflecting a strong performance and significant growth potential.

| Asset Type | Example | Market Position | Growth Potential |

|---|---|---|---|

| Prime Logistics | Durv, Malner facility (22,000 sqm) | High | High |

| High-Quality Office | Infinity project, Hagastaden (SEK 1.7bn investment) | High | High |

| Strategic Acquisitions | Uppsala, Örebro, Linköping properties (SEK 1.7bn) | High | High |

| Strategic Equity Investment | Entra ASA stake (37.0% by mid-2025) | High | High |

What is included in the product

The Castellum BCG Matrix offers a strategic framework for analyzing a company's portfolio, guiding investment decisions.

It categorizes business units into Stars, Cash Cows, Question Marks, and Dogs to inform resource allocation.

Eliminates the confusion of where to invest by clearly visualizing each business unit's strategic position.

Cash Cows

Castellum's established office properties in major Nordic cities, such as Stockholm, Gothenburg, and Malmö, represent its core cash cows. These assets are characterized by their prime locations and consistent generation of substantial rental income, often secured by long-term leases with creditworthy tenants, including public sector organizations.

This stability translates into predictable and reliable cash flows for Castellum, with minimal ongoing capital expenditure required for upkeep or operational enhancements. For instance, in the first quarter of 2024, Castellum reported a strong rental income performance from its office segment, underscoring the maturity and profitability of these holdings.

Castellum's mature logistics properties, especially those situated in prime industrial zones across its core operating regions, are firmly established as cash cows. These assets boast consistently high occupancy rates, often exceeding 95% in 2024, and benefit from long-standing tenant relationships, ensuring a predictable and robust stream of rental income.

The operational stability of these mature logistics assets means they demand very little in terms of new capital investment for expansion or significant upgrades. This low capital expenditure requirement allows them to generate substantial free cash flow, which is crucial for Castellum to reinvest in higher-growth areas of its portfolio or to fund other strategic corporate objectives.

Castellum's public sector tenant portfolio, representing 26% of its contract value as of 2024, is a prime example of a Cash Cow within the BCG Matrix. This segment benefits from exceptionally stable and predictable revenue streams due to the nature of its clientele.

Properties leased to public sector entities are characterized by long-term, secure contracts. This inherent stability translates into consistent rental income and robust occupancy rates, solidifying these assets as reliable cash generators for Castellum. For instance, in 2023, the company reported a high occupancy rate across its portfolio, with public sector tenants being a significant contributor to this stability.

Diversified and Stable Asset Base

Castellum's property portfolio, boasting a valuation of approximately SEK 159 billion as of June 30, 2025, exemplifies a diversified and stable asset base. This broad spread of assets across various property types and geographic regions is a key characteristic of its Cash Cow status within the BCG Matrix.

The inherent stability derived from this extensive and varied asset base ensures strong recurring income streams. This consistent cash flow is fundamental to Castellum's financial robustness, allowing for predictable revenue generation.

- Diversified Portfolio: Approximately SEK 159 billion in property value as of June 30, 2025.

- Stable Income: Broad and consistent cash flow from varied asset types and locations.

- Financial Strength: Underpinned by a resilient and extensive asset base.

Properties with High Economic Occupancy

Properties maintaining a high economic occupancy rate, reported at 90.3% for H1 2025 across the portfolio, are strong cash cows.

This high occupancy directly translates into maximized rental income and efficient utilization of assets. It significantly reduces the drag from vacant space, ensuring consistent operational profitability.

- High Economic Occupancy: 90.3% for H1 2025.

- Impact on Income: Maximized rental income due to efficient asset utilization.

- Profitability: Consistent operational profitability by minimizing vacant space.

Castellum's mature office and logistics properties, particularly those in prime Nordic locations, serve as its primary cash cows. These assets benefit from long-term leases with creditworthy tenants, including public sector organizations, ensuring stable and predictable rental income with minimal capital expenditure requirements. The company's strong performance in its office segment during Q1 2024 and high occupancy rates, often exceeding 95% for logistics properties in 2024, highlight their profitability and maturity.

The public sector tenant portfolio, representing 26% of Castellum's contract value in 2024, is a prime example of a cash cow due to exceptionally stable and predictable revenue streams from long-term, secure contracts. Furthermore, properties with high economic occupancy, such as the 90.3% reported for H1 2025, maximize rental income and ensure consistent operational profitability by minimizing vacant space.

| Asset Type | Key Characteristics | Contribution to Cash Flow | Supporting Data (2024/H1 2025) |

|---|---|---|---|

| Mature Office Properties | Prime locations, long-term leases, creditworthy tenants | Consistent, predictable rental income | Strong Q1 2024 rental income performance |

| Mature Logistics Properties | Prime industrial zones, high occupancy, long-standing relationships | Robust and predictable rental income, low capex | Occupancy rates >95% in 2024 |

| Public Sector Tenanted Properties | Long-term, secure contracts, stable clientele | Exceptionally stable and predictable revenue | 26% of contract value (2024) |

| High Occupancy Properties | Efficient asset utilization | Maximized rental income, consistent profitability | 90.3% economic occupancy (H1 2025) |

Full Transparency, Always

Castellum BCG Matrix

The Castellum BCG Matrix you are previewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises—just a comprehensive, analysis-ready strategic tool designed for immediate application in your business planning.

Dogs

Older office properties in less central or declining sub-markets, especially those with persistently high vacancies or needing costly, uneconomical renovations, often fall into the 'dog' category of the BCG Matrix. These assets may find it difficult to attract or keep tenants, resulting in diminished rental income and negative net leasing. For instance, in Q1 2024, the U.S. office vacancy rate reached a record high of 19.6%, with older, less amenitized buildings bearing the brunt of this trend, often seeing effective rents decline by 10-15% year-over-year.

Properties with high vacancy rates, exceeding Castellum's portfolio average of 90.3%, are considered dogs in the BCG matrix. These underperforming assets drain resources, as they incur maintenance and operational expenses without yielding adequate rental income. For instance, if a property in Castellum’s portfolio has a vacancy rate of 35% compared to the market average of 10%, it would likely be categorized as a dog.

Properties situated in micro-locations identified as stagnant or declining by Castellum represent the 'Dogs' quadrant of the BCG Matrix. These assets are characterized by a lack of local economic momentum, hindering their potential for rental income appreciation and capital value growth.

For instance, a property in a region experiencing a 2% annual population decline and a 1.5% decrease in average household income, as observed in certain rural areas in 2024, would likely fall into this category. Such conditions make it difficult to attract and retain tenants, leading to higher vacancy rates and downward pressure on rents.

These 'Dog' assets are typically candidates for divestment. Continued investment in such locations would yield diminishing returns, making a strategic sale a more prudent approach to reallocate capital towards more promising growth regions within Castellum's portfolio.

Properties Requiring Uneconomical Redevelopment

Properties classified as Dogs in the Castellum BCG Matrix are those where the cost to redevelop them to a competitive standard is excessively high, with a significant question mark over whether the investment will ever pay off. Think of a prime office building in a secondary market that needs a complete overhaul of its HVAC system, elevators, and facade to even approach modern standards. The expense of these upgrades might easily run into tens of millions, and even then, the projected rental income might not justify the outlay.

This financial unviability stems from the fact that the capital required for redevelopment could far exceed the potential future rental income or any anticipated increase in the property's market value. For instance, a retail property in a declining shopping district might require a complete reimagining, including demolition and rebuilding, to attract tenants. In 2024, the cost of construction materials and labor has remained elevated, making such extensive projects even more prohibitive.

- High Redevelopment Costs: Properties needing substantial upgrades like structural reinforcement, modernizing utilities, or complete aesthetic overhauls often fall into this category.

- Uncertain Return on Investment: The projected income or sale price after redevelopment may not be sufficient to cover the immense costs, leading to a negative or negligible return.

- Market Obsolescence: These assets are often outdated in terms of design, technology, or location, making it difficult to attract tenants or buyers even after significant investment.

- Example Scenario: A 1970s office tower requiring a full seismic retrofit and energy efficiency upgrades, coupled with a downtown location facing increased competition from newer, more sustainable buildings, could represent a Dog. The projected cost for such a retrofit could easily exceed $50 million, with a payback period of over 20 years, making it a questionable investment.

Specific Properties with Major Tenant Departures

The property in Solna, Stockholm, exemplifies a potential dog in the Castellum BCG Matrix. AFRY's planned departure from 23,000 sq. m. by September 2028 creates a significant vacancy risk.

This substantial space, if not re-leased promptly, could result in considerable revenue loss for Castellum. The holding costs associated with an underutilized asset further exacerbate the situation, demanding swift and effective leasing strategies.

- Property Location: Solna, Stockholm

- Vacating Tenant: AFRY

- Vacating Space: 23,000 sq. m.

- Vacating Date: September 2028

Dogs represent properties with low market share and low growth potential, often requiring significant capital to maintain or reposition. These assets typically generate low returns and may even incur losses, making them candidates for divestment.

For instance, a property with a consistently low occupancy rate, say below 70%, and in a market experiencing negative rental growth, would likely be classified as a dog. In 2024, many older retail spaces in secondary locations faced these challenges, with vacancy rates in some U.S. malls reaching over 25%.

Divesting these underperforming assets allows for the reallocation of capital to more promising investments, thereby improving the overall portfolio's performance and profitability.

Consider the following breakdown of 'Dog' characteristics:

| Characteristic | Description | Example Data (2024) |

|---|---|---|

| Market Growth | Low or declining | Certain secondary city office markets saw negative rental growth of -2% to -5% in 2024. |

| Relative Market Share | Low | Properties in sub-markets with less than 5% market share for their asset class. |

| Profitability | Low or negative | Properties with a net operating income (NOI) yield below 3% or negative cash flow. |

| Investment Need | High for repositioning, low for maintenance | A 1980s office building requiring a $20 million upgrade to compete with newer stock. |

Question Marks

New urban development projects, particularly those in their nascent stages where Castellum is acquiring land or funding initial planning without secured pre-leases, represent classic question marks in the BCG matrix. These ventures are positioned in areas with promising growth potential, but they are inherently risky, demanding significant upfront capital before demonstrating market viability or generating revenue.

Consider a hypothetical scenario where Castellum invests in a new district development in a rapidly expanding European city. By mid-2024, the company might have committed €50 million to land acquisition and initial zoning studies for a project projected to cost €500 million upon completion. The uncertainty lies in securing future tenants and navigating potential regulatory hurdles, making its market share and growth rate highly speculative at this juncture.

Castellum's exploration into less traditional property sub-segments, such as specialized data centers or innovative co-living spaces, would fall under the question mark category. These ventures, while potentially high-growth, carry significant risk due to unproven market demand and the substantial capital required to build infrastructure and establish a foothold. For instance, the European data center market, while booming, demands significant upfront investment in power, cooling, and connectivity, with returns often realized over extended periods.

Properties undergoing major, speculative redevelopment fall into the question mark category of the Castellum BCG Matrix. These are existing buildings being transformed for a new market or tenant, with outcomes far from certain. For instance, a historic office building in downtown Chicago, originally built in the 1920s, might be undergoing a multi-million dollar conversion to luxury residential units. The success hinges on whether the new target demographic embraces the location and the redesigned amenities, a gamble that requires significant upfront investment.

Investments in Emerging Nordic Growth Regions

Castellum's investments in emerging Nordic growth regions, characterized by low current market share but high future potential, align with the question mark category in the BCG matrix. These nascent markets demand substantial upfront capital to establish a foothold and cultivate a competitive edge. For instance, Castellum's strategic focus on developing logistics hubs in underserved areas of Northern Sweden, a region experiencing a surge in industrial investment, exemplifies this approach.

- High Growth Potential: Emerging Nordic regions are poised for significant economic expansion, driven by factors like green industrialization and infrastructure development.

- Low Market Share: Castellum's presence in these nascent markets is typically small initially, reflecting the early stage of development and investment.

- Significant Investment Required: Building infrastructure, acquiring land, and establishing market presence in these new territories necessitate substantial capital outlay.

- Strategic Importance: These question mark investments are crucial for Castellum's long-term diversification and for capturing future market leadership opportunities.

Properties with High Potential but Low Current Occupancy

Castellum's portfolio includes properties in promising locations that are currently underutilized. These assets, while holding significant future value, face the immediate hurdle of attracting tenants and boosting occupancy. For instance, in Q1 2024, Castellum reported a portfolio occupancy rate of 91.6%, but specific newly acquired or developed properties might be below this average.

The strategy for these question mark properties involves intensive leasing campaigns and potentially adapting the space to meet current market demands. Failure to improve occupancy could see these assets transition into the 'dog' category within the BCG matrix. Castellum's 2023 annual report highlighted ongoing development projects in growth regions like Stockholm and Gothenburg, which are prime candidates for this classification.

- New developments and acquisitions in high-growth urban areas.

- Current occupancy rates below the portfolio average, indicating potential for improvement.

- Strategic focus on tenant attraction and space utilization to unlock future value.

- Risk of becoming 'dogs' if leasing challenges are not overcome.

Question marks in Castellum's BCG Matrix represent investments with high growth potential but currently low market share, requiring significant capital. These are often new urban developments or niche property types where market viability is still being established.

For example, Castellum's expansion into specialized logistics hubs in emerging Nordic markets, like Northern Sweden, exemplifies a question mark. These initiatives demand substantial upfront investment to build infrastructure and secure a presence in a region experiencing industrial growth, but their long-term success is not yet guaranteed.

Similarly, properties undergoing speculative redevelopment, such as converting an old office building in Chicago to residential units, also fall into this category. The outcome depends heavily on market acceptance and tenant demand, making it a strategic gamble with considerable capital at risk.

Castellum's strategic focus on underutilized properties in promising locations, aiming to increase occupancy through intensive leasing, also highlights question marks. These assets, while having future value, face the immediate challenge of attracting tenants, with a risk of becoming 'dogs' if leasing efforts falter.

| Investment Type | Growth Potential | Market Share | Capital Requirement | Risk Factor |

|---|---|---|---|---|

| New Urban Developments | High | Low | High | Speculative |

| Niche Property Types (e.g., Data Centers) | High | Low | Very High | Unproven Demand |

| Speculative Redevelopments | Moderate to High | Low | High | Market Acceptance |

| Underutilized Properties | Moderate | Low | Moderate | Leasing Success |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial disclosures, market research reports, and industry growth projections to provide a comprehensive view of business unit performance.