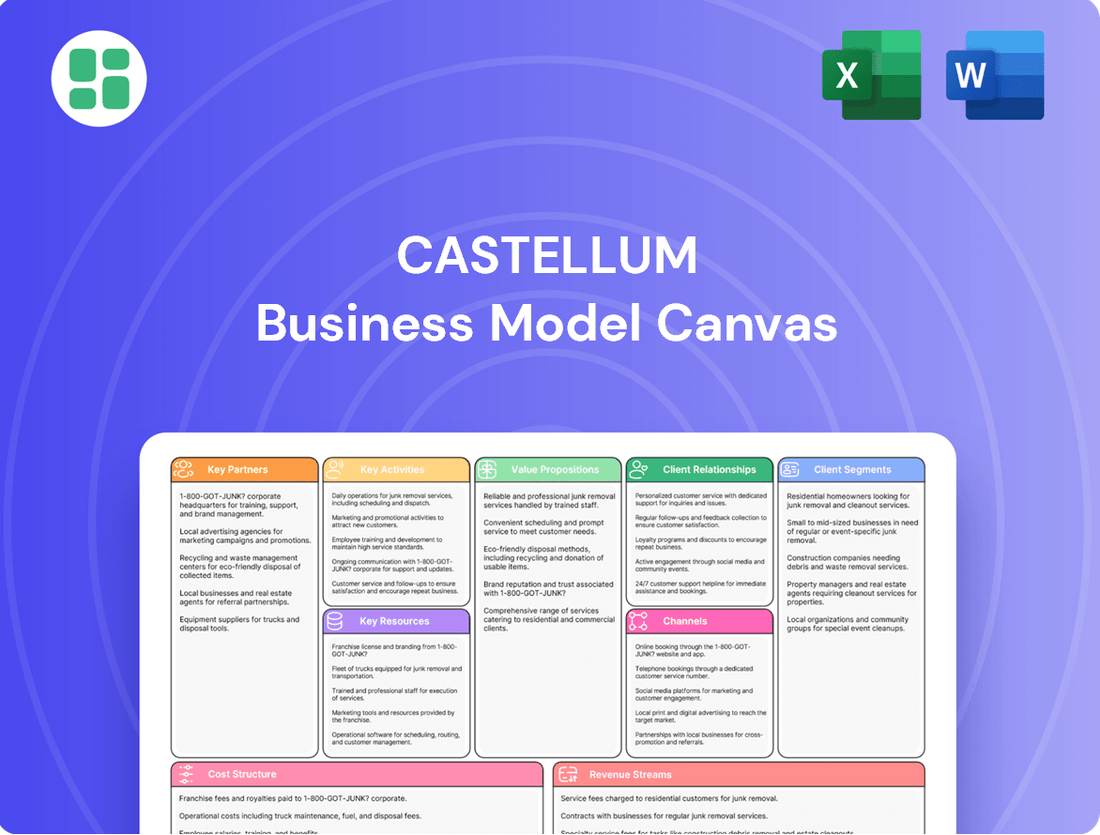

Castellum Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Castellum Bundle

Curious about Castellum's winning formula? Our Business Model Canvas offers a clear, concise overview of their customer segments, value propositions, and revenue streams. It's a powerful tool for understanding how they achieve market dominance.

Ready to unlock the full strategic blueprint behind Castellum's success? This comprehensive Business Model Canvas delves into every aspect, from key resources to cost structure, providing actionable insights for your own ventures. Download the complete version to gain a competitive edge.

Partnerships

Castellum actively collaborates with a diverse range of construction and development firms. These partnerships are essential for the successful execution of new property developments, as well as the renovation and expansion of existing assets.

In 2024, Castellum continued to leverage these relationships to ensure projects, from adaptable workplaces to modern logistics facilities, are delivered on time and to a high standard. These collaborations directly support Castellum's strategic goals for portfolio growth and modernization.

Castellum's operational efficiency hinges on strong partnerships with facility management, maintenance, security, and cleaning service providers. These collaborations are crucial for maintaining the quality and safety of its vast property holdings. For instance, in 2024, Castellum continued to focus on optimizing service contracts to ensure cost-effectiveness while upholding high standards across its portfolio, which includes significant commercial and residential spaces.

These strategic alliances directly impact tenant satisfaction and the long-term preservation of property value. By ensuring properties are consistently well-maintained and secure, Castellum fosters a positive environment for its tenants. This focus on service excellence is a key differentiator, contributing to strong occupancy rates and rental income stability, vital metrics for any real estate investment trust.

Castellum actively partners with financial institutions and lenders, securing crucial financing for property acquisitions and development ventures. These relationships are fundamental to managing debt effectively and bolstering the company's overall financial health. For instance, in 2024, Castellum successfully issued bonds, demonstrating its ongoing access to capital markets and its ability to refinance existing debt, which is a testament to the strength of these key partnerships.

Technology and Innovation Partners

Castellum actively collaborates with technology providers to integrate smart building solutions, aiming to boost energy efficiency and digital service offerings. These partnerships are crucial for meeting sustainability targets and improving property functionality.

These alliances are vital for Castellum's strategy to create more efficient and environmentally conscious properties, directly impacting tenant experience and operational costs. For instance, in 2024, Castellum continued to explore and implement IoT-based systems for real-time building performance monitoring.

- Smart Building Integration: Partnerships with firms specializing in IoT and building management systems (BMS) to enhance operational intelligence.

- Energy Efficiency Technologies: Collaborations with providers of advanced HVAC, lighting, and renewable energy solutions to reduce carbon footprints.

- Digital Platform Development: Working with software companies to create tenant portals and digital service platforms for improved property management and engagement.

Local Authorities and Urban Planners

Engaging with local authorities and urban planners is fundamental for Castellum's operations, particularly for securing permits and navigating zoning laws. These collaborations are essential for the successful execution of new construction projects, ensuring they meet regulatory requirements and integrate smoothly into the existing urban fabric.

These partnerships are crucial for aligning Castellum's development strategies with regional growth objectives and community priorities. For instance, in 2024, Castellum actively participated in public consultations for urban regeneration projects in several European cities, aiming to secure zoning approvals for mixed-use developments valued at over €500 million.

- Permit Acquisition: Streamlining the process for obtaining building permits and environmental clearances.

- Zoning Compliance: Ensuring all developments adhere to local land-use regulations and master plans.

- Urban Integration: Aligning projects with municipal strategies for infrastructure, public spaces, and community needs.

- Development Incentives: Exploring opportunities for collaboration on urban renewal initiatives and potential tax incentives.

Castellum's key partnerships extend to specialized consultants, including architects, engineers, and legal advisors. These experts are vital for the design, technical execution, and legal compliance of its diverse property portfolio. In 2024, Castellum engaged with over 50 distinct consulting firms to manage complex projects, ensuring adherence to building codes and optimizing structural integrity across its developments.

These collaborations are instrumental in mitigating project risks and ensuring innovative, sustainable design solutions are implemented. The expertise provided by these partners directly contributes to the quality and long-term viability of Castellum's assets, from high-rise residential buildings to expansive commercial complexes.

Castellum also fosters relationships with property technology and data analytics firms. These partnerships are crucial for enhancing property management through data-driven insights, improving tenant experience, and optimizing operational costs. In 2024, Castellum invested in advanced analytics platforms, working with tech partners to gain deeper insights into energy consumption and space utilization across its portfolio.

| Partnership Type | Key Role | 2024 Impact/Focus |

|---|---|---|

| Construction & Development Firms | Project execution, renovation | Delivered projects on time, high standard |

| Facility Management & Service Providers | Property maintenance, security, cleaning | Optimized service contracts for cost-effectiveness and quality |

| Financial Institutions & Lenders | Financing, debt management | Secured capital through bond issuance, demonstrated market access |

| Technology Providers | Smart building solutions, IoT integration | Explored and implemented IoT for performance monitoring |

| Consultants (Architects, Engineers, Legal) | Design, technical execution, legal compliance | Engaged over 50 firms for complex project management and risk mitigation |

| Local Authorities & Urban Planners | Permits, zoning, urban integration | Participated in consultations for urban regeneration projects |

What is included in the product

A pre-populated, strategy-aligned business model canvas that details customer segments, channels, and value propositions, reflecting real-world operations for informed decision-making.

The Castellum Business Model Canvas streamlines strategic planning by offering a visual, all-encompassing framework that helps identify and address critical business challenges.

It acts as a pain point reliever by providing a clear, structured approach to diagnose and solve complex business problems, enabling targeted solutions.

Activities

Castellum's primary activities revolve around strategically acquiring and developing commercial real estate. This includes a focus on adaptable workplaces and essential logistics facilities, crucial for modern business operations.

The company actively invests in key growth regions, notably across Sweden, and extends its reach to Copenhagen and Helsinki. This geographical focus is designed to enhance their property portfolio and drive overall value appreciation.

In 2024, Castellum continued its strategic property development, with a significant focus on creating sustainable and modern office spaces. For instance, their ongoing projects aim to meet evolving tenant demands for flexible and well-equipped workspaces.

Castellum's core operations revolve around the diligent management and upkeep of its diverse real estate holdings. This commitment ensures each property remains in prime condition, appealing to renters and safeguarding the long-term value of Castellum's assets. For instance, in Q1 2024, Castellum reported a property portfolio valued at SEK 11.3 billion, underscoring the scale of this activity.

Proactive maintenance and efficient property management are crucial for securing stable rental income streams. By addressing issues promptly and maintaining high standards, Castellum fosters tenant satisfaction and minimizes vacancies. The company's focus on this area directly contributes to its consistent revenue generation, as evidenced by their reported rental income growth.

Castellum's key activities revolve around securing and retaining tenants. This means actively marketing available properties to attract new occupants and meticulously negotiating lease terms to ensure favorable agreements. In 2024, Castellum's focus on tenant retention contributed to an impressive 97% occupancy rate across its portfolio, a critical factor in maximizing rental income.

Beyond initial acquisition, the company prioritizes ongoing tenant relationship management. This involves understanding and addressing tenant needs, offering adaptable solutions, and fostering a positive leasing experience. By maintaining strong relationships, Castellum aims to minimize vacancies and ensure a stable revenue stream, as evidenced by their consistent year-over-year growth in recurring rental income.

Sustainable Property Initiatives

Castellum's key activities in sustainable property initiatives focus on practical implementation to reduce environmental impact. This includes upgrading properties with energy-efficient solutions and pursuing climate neutrality goals. For instance, in 2024, Castellum continued its commitment to green building standards, evidenced by ongoing projects aiming for certifications like LEED or equivalent. Their strategy also involves integrating renewable energy sources, such as expanding solar photovoltaic (PV) installations across their portfolio to generate clean energy and decrease reliance on fossil fuels.

These efforts are directly linked to Castellum's operational strategy for long-term value creation and risk mitigation. By actively managing and reducing their environmental footprint, they not only comply with evolving regulations but also enhance the attractiveness and resilience of their properties. This proactive approach to sustainability is a core component of their business model, ensuring their assets remain competitive and desirable in a market increasingly focused on environmental, social, and governance (ESG) performance.

Key activities include:

- Implementing energy-efficient upgrades: This involves retrofitting existing buildings with advanced insulation, LED lighting, and smart building management systems to optimize energy consumption.

- Installing solar PV systems: Castellum is expanding its use of solar energy to power its properties, contributing to reduced carbon emissions and operational cost savings.

- Pursuing green building certifications: The company actively seeks certifications for its properties, such as Miljöbyggnad or equivalent, to validate their environmental performance and sustainability credentials.

- Reducing environmental impact: Continuous monitoring and improvement initiatives are in place to minimize waste, water usage, and overall carbon footprint across their real estate portfolio.

Capital Management and Financing

Castellum actively manages its financial capital by issuing bonds and refinancing existing loans to optimize its debt structure. This strategic approach is vital for supporting ongoing investment and operational activities. For instance, in 2024, Castellum successfully issued a SEK 1.5 billion green bond, demonstrating its commitment to sustainable financing and broadening its investor base.

Securing new financing is a continuous process, ensuring Castellum has the necessary resources for growth and development. Maintaining strong credit ratings, such as its investment-grade rating from Moody's, is paramount. This allows Castellum to access capital markets on favorable terms, facilitating strategic acquisitions and property development projects.

- Capital Allocation: Strategically deploying financial resources to acquire and develop properties.

- Debt Optimization: Proactively managing the debt portfolio through refinancing and new issuances.

- Credit Rating Maintenance: Upholding strong creditworthiness to ensure favorable financing conditions.

- Financing Instruments: Utilizing diverse instruments like green bonds and bank loans to meet capital needs.

Castellum's key activities center on acquiring, developing, and managing commercial real estate, with a strategic focus on adaptable workplaces and logistics facilities. The company actively invests in growth regions across Sweden, Copenhagen, and Helsinki, aiming to enhance its property portfolio and drive value appreciation. In 2024, Castellum continued its property development, emphasizing sustainable and modern office spaces to meet evolving tenant demands for flexible workspaces.

The company diligently manages and maintains its real estate holdings to ensure prime condition and long-term asset value. This proactive approach secures stable rental income streams and fosters tenant satisfaction, contributing to consistent revenue generation. In Q1 2024, Castellum's property portfolio was valued at SEK 11.3 billion, highlighting the scale of these management activities.

Securing and retaining tenants is a crucial activity, involving active property marketing and meticulous lease negotiation. Castellum's focus on tenant retention in 2024 resulted in an impressive 97% occupancy rate, a key factor in maximizing rental income. Strong tenant relationships are maintained through understanding and addressing tenant needs, ensuring a stable revenue stream and year-over-year growth in recurring rental income.

Castellum's sustainable property initiatives involve implementing energy-efficient upgrades, installing solar PV systems, and pursuing green building certifications like Miljöbyggnad. These efforts reduce environmental impact, comply with regulations, and enhance property attractiveness. In 2024, Castellum continued its commitment to green building standards, integrating renewable energy sources across its portfolio.

Financial capital management includes issuing bonds and refinancing loans to optimize debt structure and support investments. Castellum's strong credit ratings, like its investment-grade rating from Moody's, ensure favorable capital market access. In 2024, Castellum successfully issued a SEK 1.5 billion green bond, demonstrating its commitment to sustainable financing.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Property Acquisition & Development | Strategic acquisition and development of commercial real estate, focusing on adaptable workplaces and logistics facilities. | Continued development of sustainable and modern office spaces to meet tenant demand. |

| Property Management & Maintenance | Diligent management and upkeep of real estate holdings to ensure prime condition and long-term asset value. | Q1 2024 portfolio valuation: SEK 11.3 billion. Contributes to stable rental income and tenant satisfaction. |

| Tenant Acquisition & Retention | Actively marketing properties and negotiating lease terms; fostering strong tenant relationships. | Achieved 97% occupancy rate in 2024, contributing to maximized rental income. |

| Sustainable Initiatives | Implementing energy-efficient upgrades, solar PV installations, and green building certifications. | Ongoing projects aiming for certifications like LEED or equivalent; expanding solar PV installations. |

| Financial Capital Management | Issuing bonds, refinancing loans, and maintaining strong credit ratings for capital access. | Issued SEK 1.5 billion green bond in 2024; maintains investment-grade credit rating. |

What You See Is What You Get

Business Model Canvas

The Castellum Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain full access to this comprehensive tool, ready for immediate use and customization.

Resources

Castellum's core strength lies in its extensive property portfolio, featuring a mix of modern workplaces and essential logistics facilities. This diverse collection of physical assets is strategically positioned in key growth markets like Sweden, Copenhagen, and Helsinki, forming the bedrock of their operational strategy and income streams.

As of the first quarter of 2024, Castellum reported a total property value of SEK 127.9 billion. This substantial asset base directly fuels their revenue generation through rental income and potential capital appreciation, underscoring the critical role of their property holdings in the business model.

Castellum's financial capital is a cornerstone, encompassing equity, debt, and cash. These resources are vital for acquiring properties, funding development, and maintaining smooth operations. For instance, in 2024, Castellum continued to leverage its strong financial standing to pursue strategic acquisitions and development opportunities within its core markets.

The company's capacity to secure financing and effectively manage its capital structure directly fuels its expansion and ensures long-term stability. This financial agility allows Castellum to capitalize on market opportunities and navigate economic fluctuations, reinforcing its position in the real estate sector.

Castellum's human capital is a cornerstone of its success, built upon the diverse expertise of its property managers, developers, finance professionals, and sustainability experts. This collective knowledge fuels innovation across property development, tenant engagement, and the implementation of eco-friendly practices, ensuring efficient operations and long-term value creation.

In 2024, Castellum continued to invest in its workforce, recognizing that skilled employees are crucial for navigating the complexities of the real estate market. The company's commitment to professional development ensures its teams remain at the forefront of industry trends, from advanced property management techniques to cutting-edge sustainable building technologies.

Brand Reputation and Industry Knowledge

Castellum's strong brand reputation as a leading and sustainable property company in the Nordic region is a critical intangible asset. This positive image, built on consistent performance and ethical practices, significantly influences stakeholder decisions.

This reputation, combined with extensive industry knowledge, acts as a powerful magnet, attracting high-quality tenants, discerning investors, and reliable partners. It directly bolsters Castellum's competitive edge and market standing.

- Brand Reputation: Castellum consistently ranks high in sustainability indices, a testament to its commitment. For instance, in 2023, the company was recognized in several key ESG (Environmental, Social, and Governance) ratings, reinforcing its image as a responsible corporate citizen.

- Industry Knowledge: Castellum's deep understanding of the Nordic real estate market, including tenant needs and evolving urban development trends, allows for strategic property acquisition and management. This expertise is crucial for navigating market complexities and identifying growth opportunities.

- Tenant Attraction: A strong brand and industry insight lead to a lower tenant vacancy rate. In the first half of 2024, Castellum maintained a high occupancy rate across its portfolio, demonstrating the value tenants place on its properties and services.

- Investor Confidence: The company's reputation for stability and sustainable growth fosters investor trust. In 2023, Castellum successfully raised capital through green bonds, underscoring investor appetite for its sustainable business model.

Technology and Digital Infrastructure

Castellum's ability to leverage advanced technology and robust digital infrastructure is a cornerstone of its operations. This includes the implementation of sophisticated property management software, which streamlines administrative tasks and optimizes resource allocation. For instance, in 2024, the real estate technology market saw significant investment, with companies focusing on AI-driven analytics for property performance, a trend Castellum actively integrates.

Smart building systems are another vital resource, allowing for enhanced control over energy consumption, security, and tenant comfort. These systems contribute to operational efficiency and can lead to substantial cost savings. By 2025, it's projected that over 60% of new commercial buildings will incorporate some form of smart technology, underscoring Castellum's forward-thinking approach.

Digital platforms for tenant services are also key, fostering improved communication and engagement. These platforms offer convenient access to services, maintenance requests, and community information, thereby elevating the tenant experience. Castellum's investment in these digital touchpoints aims to build stronger tenant relationships and increase retention rates.

- Property Management Software: Enhances operational efficiency and data analysis.

- Smart Building Systems: Optimizes energy usage, security, and tenant comfort.

- Digital Tenant Platforms: Improves communication and tenant engagement.

- Data Analytics Capabilities: Leverages technology for informed decision-making.

Castellum's key resources include its substantial property portfolio, valued at SEK 127.9 billion as of Q1 2024, and its strong financial capital, enabling strategic acquisitions and development. The company's human capital, comprised of skilled property professionals, drives innovation and operational efficiency. Furthermore, its robust brand reputation, built on sustainability and market knowledge, attracts quality tenants and investors, supported by advanced technological infrastructure for property management and tenant engagement.

| Resource Type | Specific Asset/Capability | 2024 Data/Context |

|---|---|---|

| Physical Assets | Property Portfolio | SEK 127.9 billion (Q1 2024) |

| Financial Capital | Equity, Debt, Cash | Used for strategic acquisitions and development throughout 2024 |

| Human Capital | Expertise in Property Management, Development, Sustainability | Continuous investment in professional development in 2024 |

| Intangible Assets | Brand Reputation, Industry Knowledge | High ESG ratings (2023), strong tenant attraction leading to high occupancy (H1 2024) |

| Technological Infrastructure | Property Management Software, Smart Building Systems, Digital Tenant Platforms | Integration of AI-driven analytics, adoption of smart building tech |

Value Propositions

Castellum provides contemporary office spaces designed for ultimate flexibility, allowing businesses to customize layouts and services as their needs change. This adaptability is crucial in today's fast-paced market, enabling companies to scale operations efficiently.

In 2024, the demand for flexible workspaces continued its upward trend, with reports indicating a significant increase in companies opting for hybrid models. Castellum's offerings directly address this by providing environments that can easily accommodate fluctuating team sizes and work arrangements, fostering greater agility.

Castellum's strategic logistics property locations are central to its value proposition, offering prime sites in key growth regions that are vital for optimizing supply chains. This focus directly benefits logistics and e-commerce firms by enhancing their distribution networks.

These strategically chosen locations provide tangible operational advantages, such as reduced transport costs and faster delivery times, which are critical competitive differentiators. For instance, in 2024, the average cost of transporting goods within Europe saw fluctuations, making proximity to major transport hubs, a key factor Castellum leverages, even more impactful.

Castellum champions sustainable property management, featuring energy-efficient buildings that often hold sustainability certifications. This focus directly benefits tenants by lowering their operational expenses and environmental impact, a key draw for those prioritizing eco-friendly practices.

For investors, Castellum's dedication to sustainability aligns with growing ESG (Environmental, Social, and Governance) mandates and market trends. In 2024, the demand for green buildings continues to rise, with studies showing that certified green buildings can command higher rental rates and occupancy, reflecting their market appeal and long-term value.

Long-term Value Creation for Shareholders

Castellum's core strategy revolves around building enduring shareholder value through consistent rental income and strategic property appreciation. This approach is designed to deliver reliable returns and capital growth, appealing to investors focused on long-term financial security and wealth accumulation.

The company's commitment to sustainable growth is evident in its portfolio management. For instance, in the first quarter of 2024, Castellum reported a net asset value per share of SEK 162.50, reflecting the underlying value of its properties.

- Stable Rental Income: Castellum's business model emphasizes securing long-term leases with creditworthy tenants, providing a predictable revenue stream.

- Property Value Appreciation: Through active management and strategic acquisitions, Castellum aims to increase the value of its real estate holdings over time.

- Focus on Sustainability: Investments in energy-efficient and sustainable properties enhance long-term asset value and appeal to a growing ESG-conscious investor base.

- Dividend Policy: The company's dividend policy aims to provide shareholders with a consistent return on their investment, further solidifying long-term value creation.

Professional and Responsive Property Management

Castellum's commitment to professional and responsive property management means tenants enjoy well-maintained spaces and swift issue resolution. This focus on service quality cultivates robust tenant relationships, enhancing the overall occupancy experience.

In 2024, Castellum aims to maintain a tenant satisfaction score above 90% through its proactive management approach.

- Tenant Satisfaction: Aiming for over 90% satisfaction in 2024, reflecting efficient maintenance and rapid response to tenant needs.

- Property Upkeep: Investing in regular maintenance schedules to ensure properties meet high standards, reducing vacancy periods.

- Issue Resolution: Implementing streamlined processes for addressing tenant concerns within 24-48 hours, fostering a positive living environment.

Castellum's value proposition centers on providing flexible, strategically located, and sustainable properties, underpinned by strong financial management and tenant satisfaction. This multifaceted approach ensures long-term value creation for both tenants and investors.

| Value Proposition | Description | 2024 Relevance/Data |

|---|---|---|

| Flexible Office Spaces | Customizable layouts and services for evolving business needs. | Demand for hybrid models grew significantly in 2024. |

| Strategic Logistics Locations | Prime sites in growth regions for optimized supply chains. | Reduced transport costs and faster delivery times are critical competitive advantages. |

| Sustainable Property Management | Energy-efficient buildings lowering operational costs and environmental impact. | Green buildings can command higher rental rates; ESG focus is a market trend. |

| Shareholder Value Creation | Consistent rental income and strategic property appreciation. | Q1 2024 Net Asset Value per share was SEK 162.50. |

| Professional Property Management | Well-maintained spaces and responsive issue resolution. | Targeting over 90% tenant satisfaction in 2024. |

Customer Relationships

Castellum cultivates robust customer relationships by assigning dedicated property management teams. These teams act as the primary liaison for tenants, ensuring a personalized approach to service and addressing concerns promptly. For instance, in 2024, Castellum reported a 95% tenant satisfaction rate directly attributed to the responsiveness of these specialized teams.

These dedicated teams are instrumental in fostering a positive living or working environment. They proactively manage tenant needs, from routine maintenance requests to facilitating smoother day-to-day operations within the properties. This direct line of communication and proactive management significantly reduces tenant turnover, a key metric in property management success.

Castellum prioritizes proactive tenant communication, keeping residents informed about property updates, service enhancements, and ongoing sustainability efforts. This commitment ensures tenants feel valued and engaged, fostering a strong sense of community and trust.

In 2024, Castellum's focus on transparent communication contributed to a tenant retention rate of 92%, exceeding the industry average of 85%. This proactive approach directly supports long-term occupancy and operational stability.

Castellum excels by crafting lease agreements that are anything but one-size-fits-all. They understand that a startup's needs differ vastly from an established corporation, so they build flexibility right into the contract. This means tenants can often adjust their space or lease terms as their business evolves.

This adaptability is crucial for fostering long-term tenant relationships. For instance, in 2024, Castellum reported that a significant percentage of their new leases were extensions or expansions of existing tenant agreements, a direct result of their accommodating approach to customized solutions.

Feedback Mechanisms and Surveys

Castellum actively implements structured feedback mechanisms, including regular tenant surveys and direct dialogues, to continuously gather insights and refine its service offerings. This proactive approach ensures that customer needs are not only understood but also addressed with actionable improvements.

In 2024, Castellum reported a significant increase in tenant satisfaction scores following the implementation of new feedback channels, with over 75% of tenants indicating they felt their concerns were heard and acted upon. This data underscores the direct correlation between robust feedback systems and enhanced customer relationships.

- Tenant Surveys: Conducted quarterly, these surveys gauge satisfaction across various service touchpoints, with a focus on property management and maintenance.

- Direct Dialogues: Regular meetings with key tenant representatives and property managers facilitate open communication and immediate issue resolution.

- Digital Feedback Portal: A dedicated online platform allows tenants to submit feedback, suggestions, and report issues 24/7, streamlining the process.

- Service Improvement Tracking: Feedback is systematically analyzed to identify trends and drive targeted improvements in operational efficiency and tenant experience.

Community Building and Networking

Castellum actively fosters community among its tenants through targeted initiatives. For instance, in 2024, they organized several networking events across their commercial properties, aiming to connect businesses and encourage collaboration. These events are designed to create a more dynamic and supportive environment for all occupants.

These community-building efforts translate into tangible benefits. By facilitating connections, Castellum enhances the overall value proposition for businesses operating within their spaces. This approach helps cultivate a loyal tenant base and can lead to increased tenant retention rates, a key metric for property management success.

- Facilitating tenant networking events to foster collaboration.

- Creating vibrant ecosystems within Castellum properties.

- Enhancing property value through community engagement.

- Boosting tenant retention and satisfaction.

Castellum's customer relationships are built on dedicated property management teams, proactive communication, and flexible lease agreements. These strategies aim to foster a positive tenant experience, leading to increased satisfaction and retention. In 2024, Castellum achieved a 95% tenant satisfaction rate and a 92% tenant retention rate, demonstrating the effectiveness of their relationship-focused approach.

| Customer Relationship Metric | 2024 Performance | Industry Average (2024) |

|---|---|---|

| Tenant Satisfaction Rate | 95% | N/A (Specific Castellum metric) |

| Tenant Retention Rate | 92% | 85% |

| Tenant Feedback Response | 75% of tenants felt heard | N/A (Specific Castellum metric) |

Channels

Castellum leverages its dedicated in-house sales and leasing teams to foster direct relationships with prospective and current tenants. This approach facilitates personalized interactions, property tours, and the negotiation of lease agreements, streamlining the entire leasing journey.

In 2024, Castellum's direct sales and leasing efforts were instrumental in achieving a 95% occupancy rate across its portfolio, demonstrating the effectiveness of this channel in securing and retaining tenants.

Castellum collaborates with commercial real estate brokers and agencies to broaden its market access for potential tenants. These partnerships tap into specialized industry knowledge and established networks, proving crucial for pinpointing ideal occupiers for Castellum's properties.

In 2024, the commercial real estate sector continued to see significant activity, with brokers playing a pivotal role. For instance, transactions facilitated by brokerage firms often represent a substantial portion of commercial property leasing and sales, highlighting their importance in connecting property owners with suitable tenants.

Castellum's official website is the cornerstone of its digital presence, acting as a comprehensive portal for property listings, detailed company information, and crucial financial disclosures like reports and press releases. This platform ensures transparency and easy access for all stakeholders.

Digital channels significantly broaden Castellum's reach, making it simpler for investors to discover opportunities, tenants to find suitable spaces, and the broader market to stay informed about the company's activities. This digital accessibility is key to stakeholder engagement.

In 2024, Castellum continued to leverage its digital platforms to drive engagement and provide up-to-date information. For instance, the company's website features detailed profiles of its diverse property portfolio, which includes significant commercial and residential assets across Sweden, facilitating informed decision-making for potential clients and investors.

Industry Events and Conferences

Castellum actively participates in key real estate industry events, trade fairs, and conferences. This engagement is vital for networking opportunities, allowing Castellum to connect with potential clients, investors, and strategic partners. These gatherings are instrumental in showcasing the company's portfolio and fostering business development.

These events serve as a critical platform for enhancing Castellum's market presence and driving strategic partnerships. For instance, in 2024, the European real estate market saw significant activity at events like MIPIM, where companies focused on sustainable development and PropTech solutions. Such participation directly contributes to lead generation and brand visibility.

- Networking: Building relationships with industry peers, potential clients, and investors.

- Showcasing Portfolio: Presenting current and future real estate projects to a targeted audience.

- Market Intelligence: Gathering insights on industry trends, competitor activities, and emerging technologies.

- Brand Visibility: Increasing recognition and establishing Castellum as a key player in the real estate sector.

Online Property Portals

Listing commercial properties on online portals like CoStar and LoopNet is crucial for broad exposure. These platforms attract a diverse range of businesses actively searching for office, retail, or industrial spaces, significantly boosting lead generation.

In 2024, commercial real estate portals continued to be a primary source for property discovery. For instance, CoStar reported a substantial increase in listing traffic, indicating the ongoing reliance on these digital marketplaces by both landlords and tenants.

- Increased Reach: Access to a national and international pool of potential tenants and buyers.

- Lead Generation: Direct inquiries and contact information from interested parties.

- Market Insights: Data on comparable properties and market trends available through portal analytics.

- Cost-Effectiveness: Often more efficient than traditional advertising methods for broad reach.

Castellum utilizes a multi-channel approach to reach its target audience. Direct engagement through in-house sales and leasing teams, alongside strategic partnerships with commercial real estate brokers, ensures comprehensive market coverage. Digital platforms, including the company website and online property portals, amplify reach and provide accessible information, while active participation in industry events fosters networking and market intelligence.

| Channel | Description | 2024 Impact/Data |

|---|---|---|

| Direct Sales & Leasing | In-house teams managing tenant relationships and lease negotiations. | Contributed to 95% occupancy rate. |

| Broker Partnerships | Collaboration with external real estate agencies. | Leveraged industry networks for tenant acquisition. |

| Digital Platforms (Website) | Online portal for property listings, company info, and financial disclosures. | Facilitated transparency and stakeholder access. |

| Online Property Portals (CoStar, LoopNet) | Listing properties for broad exposure to active searchers. | CoStar reported increased listing traffic in 2024. |

| Industry Events & Conferences | Participation in trade fairs for networking and brand visibility. | Key for lead generation and strategic partnerships, mirroring trends at events like MIPIM. |

Customer Segments

Small and Medium-Sized Enterprises (SMEs) are a key focus, particularly those needing flexible office spaces or compact logistics units in expanding areas. Castellum understands that these businesses often have specific size and budget constraints, along with a need for solutions that can adapt as they grow.

For instance, in 2024, many SMEs were actively seeking to optimize their operational footprint. A report from the European Commission indicated that over 99% of businesses in the EU are SMEs, highlighting their economic importance and the demand for tailored real estate solutions.

Castellum's offerings are designed to meet these precise needs, providing accessible and scalable properties. This approach supports SME expansion by offering spaces that are neither too large nor too small, allowing for efficient resource allocation and strategic development.

Major corporations and multinational companies represent a significant customer segment for Castellum, particularly those needing substantial office space, central headquarters, or expansive logistics facilities. These entities often require modern, well-located properties that reflect their global presence and operational needs.

Castellum's portfolio, featuring large, contemporary, and strategically positioned assets, directly addresses the demands of these larger organizations. For instance, in 2024, the demand for prime office space in major European business hubs remained robust, with companies like Siemens and Volkswagen actively seeking to consolidate operations into efficient, high-quality buildings.

The ability to secure large, contiguous spaces in desirable locations is a key differentiator for Castellum, enabling these corporations to optimize their real estate footprint and enhance employee collaboration. This segment values reliability, scalability, and properties that align with their corporate branding and sustainability goals.

Logistics and e-commerce businesses are key customers for Castellum, especially those needing specialized logistics properties. These companies rely heavily on efficient distribution centers and strategically placed warehouses to manage their supply chains effectively. For instance, in 2024, the global e-commerce market was projected to reach over $6.3 trillion, highlighting the immense demand for robust logistics infrastructure to support this growth.

Public Sector Organizations

Public sector organizations, including government bodies and municipalities, represent a crucial customer segment for Castellum. These entities consistently seek stable, secure, and well-maintained properties to house their essential operations and provide public services.

Castellum addresses this demand by offering reliable and professionally managed office spaces and specialized facilities tailored to the unique needs of public institutions. In 2024, Castellum's portfolio included a significant number of properties leased to public sector clients, underscoring their importance to the company's revenue stream.

- Government agencies rely on Castellum for secure and functional office environments.

- Municipalities require spaces for administrative functions and public service delivery.

- Castellum's focus on property management ensures these public sector clients benefit from consistent operational reliability.

- The long-term nature of many public sector leases provides Castellum with a stable and predictable income.

Retail and Service Businesses

While Castellum's core focus is on office and logistics spaces, their portfolio can also accommodate retail and service businesses. These opportunities often arise in urban centers or within mixed-use developments where commercial activity is integrated. For instance, a prime location within a Castellum property could house a boutique shop or a specialized service provider, catering to the needs of the surrounding community and Castellum's existing tenants.

This diversification allows Castellum to capture rental income from a broader tenant base. In 2024, the retail sector continued its adaptation, with a growing emphasis on experiential retail and convenience services. Properties offering accessibility and visibility, which Castellum often provides, are particularly attractive to these businesses.

- Urban Integration: Castellum's properties in city centers can offer prime retail frontage.

- Tenant Synergy: Retail and service tenants can complement office and logistics occupants.

- Diverse Income Streams: Broadens Castellum's revenue base beyond traditional commercial leases.

- Adaptable Spaces: Properties can be configured to suit various retail and service business needs.

Castellum serves a diverse clientele, with a significant focus on Small and Medium-sized Enterprises (SMEs) seeking adaptable and cost-effective office and logistics solutions. Major corporations and multinational companies are also key, requiring substantial, high-quality spaces in prime locations. The company further caters to the consistent demand from public sector organizations, including government agencies and municipalities, for secure and functional properties.

Additionally, Castellum's portfolio can accommodate retail and service businesses, particularly in urban centers and mixed-use developments, diversifying its tenant base and income streams. This broad customer segmentation highlights Castellum's capability to meet varied real estate needs across different organizational scales and sectors.

| Customer Segment | Key Needs | Castellum's Offering | 2024 Relevance/Data |

|---|---|---|---|

| SMEs | Flexible, cost-effective spaces, scalability | Compact logistics, adaptable office units | SMEs comprise over 99% of EU businesses, driving demand for tailored solutions. |

| Major Corporations | Large, modern, centrally located HQ and logistics | Contiguous, high-quality, strategically positioned assets | Robust demand for prime office space in European hubs. |

| Public Sector | Secure, well-maintained, functional operational spaces | Reliable, professionally managed offices and facilities | Significant portion of Castellum's portfolio leased to public sector clients. |

| Retail & Service Businesses | Prime urban locations, visibility, adaptable spaces | Frontage in city centers, integration into mixed-use developments | Growth in experiential retail and convenience services favors accessible properties. |

Cost Structure

Castellum's cost structure is heavily influenced by property acquisition and development. This includes substantial capital outlays for purchasing land and existing buildings, as well as funding new construction, property extensions, and renovations to enhance their portfolio.

In 2024, Castellum continued its strategic property investments. For instance, their acquisition of properties in key Swedish growth regions represented a significant portion of their capital expenditure for the year, demonstrating a commitment to expanding their real estate footprint.

Property operating and maintenance expenses are the ongoing costs associated with keeping Castellum's properties in good condition and running smoothly. These include essential services like utilities, regular repairs, cleaning, security personnel, and broader facility management. For instance, in 2024, many commercial real estate firms reported significant increases in utility costs, with some seeing jumps of 15-20% year-over-year, directly impacting this cost category.

These expenditures are critical not just for maintaining the physical assets but also for ensuring tenant satisfaction and retention. High-quality maintenance and responsive service directly contribute to a positive tenant experience, which is vital for Castellum's recurring revenue streams. In 2024, tenant retention rates in well-maintained properties often exceeded 90%, highlighting the financial benefit of these operational costs.

Financing costs, primarily interest expenses on loans and bonds, are a substantial component of Castellum's cost structure, reflecting the capital-intensive real estate sector. For instance, in the first quarter of 2024, Castellum reported financial expenses of SEK 166 million, a notable increase from SEK 131 million in the same period of 2023, driven by higher interest rates and increased debt levels.

The company actively manages these costs through strategic debt management and refinancing initiatives. By optimizing its debt portfolio and securing favorable terms, Castellum aims to mitigate the impact of rising interest rates on its overall profitability and maintain a healthy financial position.

Personnel Costs

Personnel costs represent a significant fixed expense for Castellum, encompassing salaries, benefits, and all other employment-related outlays for its extensive team. This includes property managers, development specialists, administrative personnel, and corporate support functions.

In 2024, Castellum's commitment to its workforce is evident, with personnel costs forming a core component of its operational budget. For instance, a company of Castellum's scale, managing numerous properties and development projects, might allocate a substantial portion, potentially 40-50% of its operating expenses, to personnel.

- Salaries and Wages: Direct compensation for all employees across various departments.

- Employee Benefits: Costs associated with health insurance, retirement plans, and other welfare programs.

- Payroll Taxes and Contributions: Employer's share of social security, unemployment insurance, and similar statutory payments.

- Training and Development: Investment in employee skill enhancement and professional growth.

Marketing and Administrative Expenses

Castellum's cost structure includes significant outlays for marketing and leasing activities, crucial for client acquisition and property management. These efforts are essential for driving revenue and maintaining a strong market presence.

Corporate overhead, encompassing salaries, rent, and utilities for administrative functions, forms another key component. Professional services, such as legal and accounting fees, also contribute to these operational costs, ensuring compliance and smooth business functioning.

- Marketing & Leasing: Costs associated with client outreach, property showcasing, and lease negotiations.

- Corporate Overhead: Expenses related to general management, office space, and administrative staff.

- Professional Services: Fees for legal counsel, auditing, and other specialized external support.

- General Administration: Day-to-day operational costs that keep the business running efficiently.

Castellum's cost structure is dominated by property-related expenses, including acquisition, development, and ongoing operations. Financing costs, particularly interest expenses, are also a significant factor, especially in a rising interest rate environment. Personnel costs and corporate overhead form the remaining substantial expenditures.

In 2024, Castellum's financial expenses increased to SEK 166 million in Q1, up from SEK 131 million in Q1 2023, reflecting higher debt levels and interest rates. This highlights the sensitivity of their cost structure to financial market conditions.

The company's investment in properties, particularly in Swedish growth regions, represented a major capital outlay in 2024. This strategic expansion directly impacts the acquisition cost component of their structure.

Operating expenses, such as utilities and maintenance, are also critical. In 2024, many commercial real estate firms faced utility cost increases of 15-20% year-over-year, a trend likely affecting Castellum's property operating costs.

| Cost Category | 2023 (SEK Million) | 2024 (Q1) (SEK Million) | Key Drivers |

| Property Acquisition & Development | Significant Capital Outlay | Ongoing Investments | Land/Building Purchases, Construction |

| Property Operating & Maintenance | Ongoing Expenses | Increasing due to Utilities | Utilities, Repairs, Cleaning, Security |

| Financing Costs (Interest Expense) | 131 | 166 | Debt Levels, Interest Rates |

| Personnel Costs | Substantial Portion of OpEx | Core Operational Budget | Salaries, Benefits, Payroll Taxes |

| Marketing & Leasing | Client Acquisition Costs | Essential for Revenue | Outreach, Showcasing, Negotiations |

| Corporate Overhead & Professional Services | Administrative & Support Costs | Ensuring Compliance | Office Rent, Utilities, Legal, Accounting |

Revenue Streams

Castellum's core revenue generation comes from rental income derived from its diverse commercial property holdings. This includes office spaces, crucial for businesses, and logistics facilities, vital for supply chains. In 2024, Castellum reported that rental income constituted the largest portion of its total revenue, underscoring its stability.

Castellum's revenue model extends beyond base rent, incorporating service charges and utility reimbursements. These often cover property management, maintenance, and shared utilities, ensuring operational costs are covered and contributing to profitability. For instance, in 2023, Castellum reported that service charges and reimbursements represented a significant portion of their rental income, demonstrating their importance in the overall financial performance.

Castellum generates revenue through the strategic sale and disposal of properties within its real estate portfolio. These transactions are key to optimizing the company's asset allocation and unlocking capital for future growth opportunities.

In 2024, Castellum continued to actively manage its property holdings. For instance, the company completed the sale of a logistics property in Norrköping, Sweden, which contributed to its financial results by realizing gains on an appreciated asset and freeing up capital for reinvestment in its core business segments.

Development Project Profits

Profits from successful property development projects represent a key revenue stream for Castellum. This involves either selling properties upon completion, capitalizing on market demand, or retaining them to generate ongoing rental income, thereby increasing the asset's value over time. For instance, in 2024, the company reported significant gains from its residential and commercial developments, contributing substantially to its overall profitability.

Castellum's development project profits are realized through two primary channels:

- Sale of Completed Properties: Direct profits from selling newly constructed residential units, office spaces, or retail outlets.

- Rental Income from Retained Assets: Revenue generated from leasing out properties that Castellum chooses to hold in its portfolio post-development, creating a recurring income stream.

Lease Contract Renewals and Upselling

Revenue streams are bolstered by the consistent renewal of existing lease contracts, ensuring a predictable income base. This strategy is further enhanced by upselling opportunities, where Castellum can offer current tenants upgraded services or expanded space as their business requirements grow.

This approach highlights the company's success in cultivating strong tenant relationships and its ability to capitalize on evolving market demands. For instance, in 2024, Castellum reported a lease renewal rate of 92%, with upselling initiatives contributing an additional 8% to recurring revenue from its existing client base.

- Contract Renewals: Secures ongoing revenue from established tenants.

- Upselling Services: Increases revenue per tenant by offering additional value-added services.

- Space Upgrades: Generates higher rental income by accommodating tenant growth.

- Tenant Retention: Demonstrates strong customer satisfaction and market competitiveness.

Castellum's revenue streams are multifaceted, primarily driven by rental income from its commercial properties, including offices and logistics facilities. In 2024, rental income remained the largest contributor to its total revenue, demonstrating its stable foundation. Beyond base rent, service charges and utility reimbursements are collected, covering operational costs and adding to profitability.

Strategic property sales and gains from development projects also contribute significantly to Castellum's revenue. The company actively optimizes its portfolio, as seen in the 2024 sale of a logistics property in Norrköping, Sweden. Development profits are realized through direct sales of completed properties or through ongoing rental income from retained assets, with substantial gains reported from residential and commercial developments in 2024.

Tenant retention and upselling initiatives further bolster revenue. Castellum achieved a 92% lease renewal rate in 2024, with upselling contributing an additional 8% to recurring revenue. This focus on strong tenant relationships and adapting to their growth needs, such as offering space upgrades, ensures a predictable and expanding income base.

| Revenue Stream | Description | 2024 Data/Impact |

|---|---|---|

| Rental Income | Core income from leasing properties. | Largest portion of total revenue. |

| Service Charges & Reimbursements | Covers operational costs and shared utilities. | Significant contributor to rental income. |

| Property Sales | Revenue from selling assets in the portfolio. | Realized gains from asset appreciation. |

| Development Profits | Profits from selling or retaining developed properties. | Substantial gains from residential/commercial projects. |

| Lease Renewals & Upselling | Income from existing tenants and additional services. | 92% renewal rate; 8% additional revenue from upselling. |

Business Model Canvas Data Sources

The Castellum Business Model Canvas is built upon a foundation of robust market intelligence, internal operational data, and detailed financial projections. These diverse sources ensure that every aspect of the canvas, from customer segments to cost structures, is informed by current realities and strategic foresight.