Castellum PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Castellum Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Castellum's trajectory. This meticulously researched PESTLE analysis provides the actionable intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain a decisive advantage.

Political factors

Changes in urban planning and zoning laws are a critical political factor for Castellum. For instance, in 2024, many cities are reviewing or implementing updated zoning ordinances to encourage mixed-use development and address housing shortages. These shifts can either open new avenues for Castellum's portfolio expansion, as seen with the rezoning of industrial areas for residential use in several major metropolitan areas, or pose challenges if new regulations restrict density or introduce costly compliance measures.

Favorable government policies that incentivize development, such as tax abatements for affordable housing projects or expedited permitting processes for sustainable construction, directly boost Castellum's value creation strategies. Conversely, restrictive policies, like increased green space mandates or height restrictions in prime locations, can significantly slow down or even halt planned projects. The stability of these policies is paramount; for example, a sudden reversal of a development incentive program in late 2024 could impact Castellum's projected returns on a multi-year project by millions of dollars.

Central bank interest rate policies, while economic in nature, carry significant political weight. Governments often exert influence on central banks, particularly concerning mandates for financial stability and inflation control. For Castellum, a real estate investment company, these policy shifts directly impact its operational costs and investment strategies.

In 2024 and 2025, major central banks like the US Federal Reserve and the European Central Bank have been navigating a complex economic landscape. For instance, the Federal Reserve maintained its benchmark interest rate in the range of 5.25%-5.50% through much of 2024, a stance influenced by persistent inflation data. This elevated rate environment directly increases Castellum's cost of capital for new acquisitions and development projects, potentially compressing the yields on its property portfolio and dampening investor enthusiasm for real estate assets.

Government fiscal policies, including property taxes, capital gains taxes, and corporate taxation, directly impact Castellum's profitability and investment returns. For instance, in 2024, many jurisdictions are reviewing property tax rates to balance municipal budgets, which could increase Castellum's operating expenses.

Changes in these tax regimes, such as increased property taxes or new levies on real estate transactions, can reduce net rental income and overall property valuations. For example, a proposed increase in capital gains tax on property sales in a key market could dampen investor appetite for Castellum's assets.

Conversely, tax incentives for sustainable building or specific types of development could influence investment decisions. In 2025, we anticipate potential government initiatives offering tax credits for energy-efficient retrofits, which could boost Castellum's strategies for portfolio enhancement.

Regulatory Environment and Building Standards

The political will to enforce stricter building codes, safety regulations, and accessibility standards directly impacts Castellum's operational costs. For instance, in 2024, the EU's updated Energy Performance of Buildings Directive (EPBD) mandates significant energy efficiency upgrades for existing buildings, potentially increasing renovation expenses for properties Castellum manages or develops. This requires substantial investment in compliance, which can affect project budgets and timelines.

Political shifts can significantly alter Castellum's operating environment. A move towards deregulation might ease some compliance burdens, while increased oversight, such as stricter fire safety regulations following incidents in 2023, could necessitate further investment and procedural changes. Castellum must remain agile to adapt to evolving political landscapes and their direct financial implications.

Key regulatory considerations for Castellum include:

- Compliance Costs: Adhering to updated building codes and safety standards can add 5-15% to development and renovation budgets in 2024-2025.

- Accessibility Mandates: Implementing universal design principles and accessibility features, often driven by political advocacy, requires specific financial allocations.

- Environmental Regulations: Stricter energy efficiency and sustainability requirements, like those being phased in across major European markets, necessitate capital expenditure for compliance.

International Trade Relations and Geopolitical Stability

Castellum's operations across Sweden, Copenhagen, and Helsinki are significantly shaped by international trade relations and geopolitical stability within the Nordic and broader European regions. For instance, the ongoing geopolitical shifts, including the re-evaluation of supply chains post-2022, have led to increased focus on regional resilience. This can indirectly bolster investor confidence in stable, well-connected markets like those Castellum operates in, potentially driving demand for commercial real estate.

Shifts in trade agreements or the emergence of political tensions can directly impact economic growth forecasts, which in turn influence tenant demand and the overall investment climate. For example, the European Union's continued commitment to single market principles, despite external pressures, generally supports cross-border investment and economic activity. However, any significant disruption to trade flows or an increase in regional instability could dampen investor sentiment and affect Castellum's ability to attract international capital and maintain strong tenant occupancy.

- Nordic Economic Growth: The Nordic countries, including Sweden and Denmark, have generally maintained stable economic growth, with GDP growth projections for Sweden around 1.5% and Denmark around 1.8% for 2024, according to recent IMF outlooks.

- EU Trade Framework: Castellum benefits from the EU's extensive network of trade agreements, which facilitate cross-border business and investment within the bloc.

- Geopolitical Risk Premium: Increased geopolitical uncertainty globally can lead to a higher risk premium demanded by investors, potentially impacting property valuations and financing costs for companies like Castellum.

- Energy Security: Political discussions and actions related to energy security in Europe can influence operating costs for businesses and, consequently, their real estate needs and ability to pay rent.

Government stability and policy continuity are crucial for Castellum's long-term investment strategy. Unforeseen political changes, such as shifts in government or major policy reversals, can create uncertainty and impact property valuations and development pipelines. For instance, a change in government in Sweden in late 2024 could lead to a reassessment of existing real estate development incentives.

The regulatory environment, including zoning laws and building codes, directly influences Castellum's ability to develop and manage properties. In 2024, many cities are updating these regulations to promote sustainability and address housing needs, which could create new opportunities or impose additional compliance costs. For example, stricter energy efficiency standards being implemented across the EU in 2025 will require significant capital expenditure for Castellum's portfolio.

Fiscal policies, such as property taxes and capital gains taxes, directly affect Castellum's profitability. Changes in these tax regimes, like potential increases in property taxes in Denmark or Sweden in 2025, could impact operating expenses and investment returns. Conversely, government incentives for green building or urban regeneration can offer significant financial advantages.

International trade relations and geopolitical stability within the Nordic and European regions are also key political factors. Stable trade agreements and a predictable geopolitical landscape, as generally seen in the Nordic countries with projected GDP growth of around 1.5% for Sweden and 1.8% for Denmark in 2024, foster investor confidence and support real estate demand. However, increased geopolitical risks could lead to higher financing costs and affect investment appetite.

What is included in the product

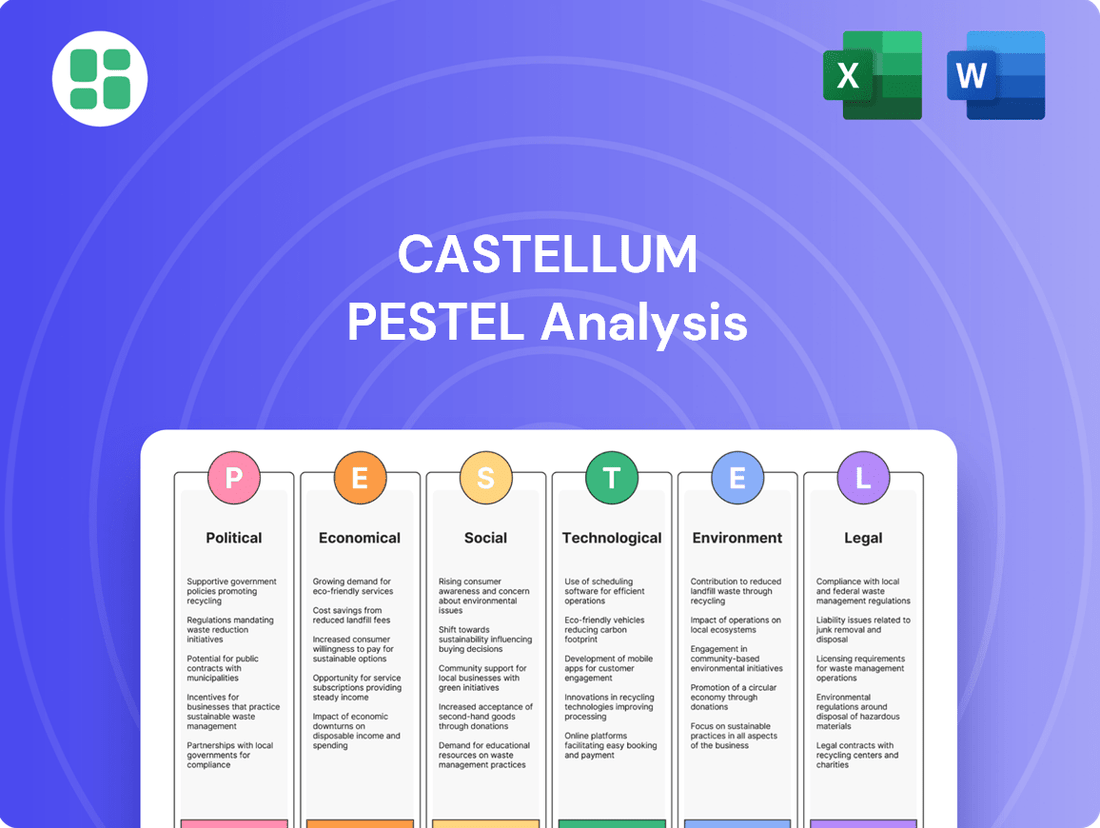

This Castellum PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, offering a comprehensive view of the external landscape.

Castellum's PESTLE analysis provides a structured framework, simplifying complex external factors into actionable insights that alleviate the pain of strategic uncertainty.

Economic factors

The prevailing interest rate environment significantly impacts Castellum's financing costs for property acquisitions and development. For instance, the European Central Bank's key interest rates, which influence borrowing costs across the Eurozone, have seen a notable shift. After a period of historically low rates, the ECB began a tightening cycle in mid-2022, with its main refinancing operations rate increasing from 0.00% in July 2022 to 4.50% by September 2023, impacting Castellum's debt servicing expenses and potentially affecting property valuations due to higher discount rates.

Rising interest rates directly translate to higher debt servicing expenses for Castellum, potentially squeezing profit margins on new projects and existing leveraged assets. This increased cost of capital can also lead to a downward pressure on property valuations as investors demand higher yields to compensate for the greater financing risk. For example, a property valued at €100 million with a 50% loan-to-value ratio would see its annual interest payments increase substantially with rate hikes, impacting its net operating income and overall return on investment.

Conversely, a more favorable interest rate environment, characterized by lower borrowing costs, can act as a catalyst for Castellum's investment activities. Lower rates reduce the financial burden of property acquisitions and development, making more projects viable and potentially enhancing property yields by lowering the cost of capital. This scenario can stimulate greater investor appetite for real estate assets, as the spread between property yields and financing costs widens, leading to more attractive investment opportunities for Castellum.

Inflation directly impacts Castellum's financial health by influencing both its expenses and revenue streams. While rising inflation can increase operating costs for maintenance, utilities, and staffing, many of Castellum's commercial leases are structured with indexation clauses. These clauses allow for rental income adjustments, typically tied to inflation metrics like the Consumer Price Index (CPI), helping to preserve the real value of its rental income.

For instance, in early 2024, inflation rates in key European markets where Castellum operates remained a significant consideration. While specific lease structures vary, a general trend observed across the real estate sector is that leases with built-in annual escalations, often linked to inflation, can see rent increases of 2-4% or more depending on the prevailing economic conditions. This mechanism is crucial for Castellum to mitigate the erosive effect of inflation on its rental income, ensuring that its revenue keeps pace with rising costs.

The economic health of Sweden, Denmark, and Finland significantly influences tenant demand for Castellum's commercial real estate. In 2024, Sweden's GDP growth is projected around 1.5%, Denmark's around 1.8%, and Finland's around 1.2%, according to recent forecasts. A growing economy generally translates to more jobs and business expansion, directly boosting the need for office and logistics spaces, which benefits Castellum through increased occupancy and rental income.

Conversely, an economic slowdown can dampen this demand. For instance, if these economies experience a contraction, businesses may scale back operations or delay expansion plans, leading to fewer new leases and potentially higher vacancy rates for Castellum. This was evident in some European markets during periods of economic uncertainty in 2023, where rental growth slowed.

Property Valuations and Investment Climate

Economic cycles are a major driver of property valuations, which is crucial for Castellum's strategy of enhancing property value. For instance, during economic upswings, demand for real estate typically increases, pushing prices higher. Conversely, downturns can lead to decreased valuations and slower market activity.

Investor confidence and the availability of capital directly impact the real estate market's attractiveness. When confidence is high and capital is readily accessible, real estate often outperforms other asset classes, leading to increased investment and higher valuations. For example, in late 2024, global real estate investment saw a notable uptick in certain regions due to easing inflation and anticipated interest rate cuts, boosting investor sentiment.

A robust investment climate, characterized by favorable economic conditions and supportive policies, is essential for Castellum's growth. This environment facilitates higher property valuations and improves access to financing for acquisitions and development projects.

- Economic Cycles: Property valuations are highly sensitive to economic cycles, impacting Castellum's core business of value appreciation.

- Investor Confidence: High investor confidence, often seen in periods of economic stability, drives capital towards real estate, increasing valuations.

- Capital Availability: Easier access to capital in a strong economy allows Castellum to pursue growth opportunities and leverage investments more effectively.

- Real Estate Attractiveness: When alternative investments offer lower returns, real estate becomes a more appealing asset class, further supporting property valuations.

Employment Rates and Business Confidence

High employment rates and robust business confidence are fundamental to the health of the commercial property market, directly benefiting companies like Castellum. When unemployment is low, and businesses feel optimistic about the future, they tend to grow. This growth often means needing more office space or expanding logistics operations.

For instance, as of early 2024, many developed economies, including those where Castellum operates, have maintained relatively low unemployment figures. This stability encourages businesses to commit to longer-term leases and invest in their physical infrastructure. Strong business confidence, often measured by surveys, indicates a willingness to undertake capital expenditures, which includes leasing or purchasing commercial real estate.

- Low unemployment fuels consumer spending and business investment.

- Business confidence surveys in late 2023 and early 2024 generally showed resilience, despite some global economic headwinds.

- Increased hiring directly translates to demand for office and industrial spaces.

- Castellum's portfolio benefits from this demand as businesses seek flexible and modern workplaces.

The prevailing interest rate environment significantly impacts Castellum's financing costs for property acquisitions and development. For instance, the European Central Bank's key interest rates, which influence borrowing costs across the Eurozone, have seen a notable shift. After a period of historically low rates, the ECB began a tightening cycle in mid-2022, with its main refinancing operations rate increasing from 0.00% in July 2022 to 4.50% by September 2023, impacting Castellum's debt servicing expenses and potentially affecting property valuations due to higher discount rates.

Rising interest rates directly translate to higher debt servicing expenses for Castellum, potentially squeezing profit margins on new projects and existing leveraged assets. This increased cost of capital can also lead to a downward pressure on property valuations as investors demand higher yields to compensate for the greater financing risk. For example, a property valued at €100 million with a 50% loan-to-value ratio would see its annual interest payments increase substantially with rate hikes, impacting its net operating income and overall return on investment.

Conversely, a more favorable interest rate environment, characterized by lower borrowing costs, can act as a catalyst for Castellum's investment activities. Lower rates reduce the financial burden of property acquisitions and development, making more projects viable and potentially enhancing property yields by lowering the cost of capital. This scenario can stimulate greater investor appetite for real estate assets, as the spread between property yields and financing costs widens, leading to more attractive investment opportunities for Castellum.

Inflation directly impacts Castellum's financial health by influencing both its expenses and revenue streams. While rising inflation can increase operating costs for maintenance, utilities, and staffing, many of Castellum's commercial leases are structured with indexation clauses. These clauses allow for rental income adjustments, typically tied to inflation metrics like the Consumer Price Index (CPI), helping to preserve the real value of its rental income.

For instance, in early 2024, inflation rates in key European markets where Castellum operates remained a significant consideration. While specific lease structures vary, a general trend observed across the real estate sector is that leases with built-in annual escalations, often linked to inflation, can see rent increases of 2-4% or more depending on the prevailing economic conditions. This mechanism is crucial for Castellum to mitigate the erosive effect of inflation on its rental income, ensuring that its revenue keeps pace with rising costs.

The economic health of Sweden, Denmark, and Finland significantly influences tenant demand for Castellum's commercial real estate. In 2024, Sweden's GDP growth is projected around 1.5%, Denmark's around 1.8%, and Finland's around 1.2%, according to recent forecasts. A growing economy generally translates to more jobs and business expansion, directly boosting the need for office and logistics spaces, which benefits Castellum through increased occupancy and rental income.

Conversely, an economic slowdown can dampen this demand. For instance, if these economies experience a contraction, businesses may scale back operations or delay expansion plans, leading to fewer new leases and potentially higher vacancy rates for Castellum. This was evident in some European markets during periods of economic uncertainty in 2023, where rental growth slowed.

Economic cycles are a major driver of property valuations, which is crucial for Castellum's strategy of enhancing property value. For instance, during economic upswings, demand for real estate typically increases, pushing prices higher. Conversely, downturns can lead to decreased valuations and slower market activity.

Investor confidence and the availability of capital directly impact the real estate market's attractiveness. When confidence is high and capital is readily accessible, real estate often outperforms other asset classes, leading to increased investment and higher valuations. For example, in late 2024, global real estate investment saw a notable uptick in certain regions due to easing inflation and anticipated interest rate cuts, boosting investor sentiment.

A robust investment climate, characterized by favorable economic conditions and supportive policies, is essential for Castellum's growth. This environment facilitates higher property valuations and improves access to financing for acquisitions and development projects.

- Economic Cycles: Property valuations are highly sensitive to economic cycles, impacting Castellum's core business of value appreciation.

- Investor Confidence: High investor confidence, often seen in periods of economic stability, drives capital towards real estate, increasing valuations.

- Capital Availability: Easier access to capital in a strong economy allows Castellum to pursue growth opportunities and leverage investments more effectively.

- Real Estate Attractiveness: When alternative investments offer lower returns, real estate becomes a more appealing asset class, further supporting property valuations.

High employment rates and robust business confidence are fundamental to the health of the commercial property market, directly benefiting companies like Castellum. When unemployment is low, and businesses feel optimistic about the future, they tend to grow. This growth often means needing more office space or expanding logistics operations.

For instance, as of early 2024, many developed economies, including those where Castellum operates, have maintained relatively low unemployment figures. This stability encourages businesses to commit to longer-term leases and invest in their physical infrastructure. Strong business confidence, often measured by surveys, indicates a willingness to undertake capital expenditures, which includes leasing or purchasing commercial real estate.

- Low unemployment fuels consumer spending and business investment.

- Business confidence surveys in late 2023 and early 2024 generally showed resilience, despite some global economic headwinds.

- Increased hiring directly translates to demand for office and industrial spaces.

- Castellum's portfolio benefits from this demand as businesses seek flexible and modern workplaces.

Economic growth projections for key Nordic countries in 2024 indicate varied performance, influencing Castellum's market dynamics. Sweden's projected GDP growth of around 1.5%, Denmark's 1.8%, and Finland's 1.2% suggest moderate expansion. These figures are crucial as they correlate with business activity and, consequently, demand for commercial real estate. A stronger economy typically leads to increased leasing activity and potential rental growth for Castellum.

Inflationary pressures, while moderating in some regions by early 2024, continue to affect operational costs and rental income adjustments. For example, if inflation remains above central bank targets, it could necessitate further interest rate hikes, impacting financing costs. However, Castellum's lease structures, often incorporating inflation-linked rent reviews, provide a degree of protection, ensuring that rental income can keep pace with rising expenses.

Investor sentiment and capital availability are closely tied to the overall economic outlook. Positive economic forecasts and stable interest rate expectations, such as those anticipated for late 2024 with potential rate cuts, tend to boost investor confidence in real estate. This can lead to increased transaction volumes and upward pressure on property valuations, benefiting Castellum's portfolio performance.

| Economic Factor | 2024 Projection/Status | Impact on Castellum | Data Source/Example |

|---|---|---|---|

| GDP Growth (Sweden) | ~1.5% | Supports business expansion and demand for commercial space. | IMF World Economic Outlook (April 2024) |

| GDP Growth (Denmark) | ~1.8% | Drives increased leasing activity and rental income potential. | European Commission Economic Forecast (Spring 2024) |

| GDP Growth (Finland) | ~1.2% | Indicates moderate economic activity, influencing tenant demand. | Bank of Finland Forecast (March 2024) |

| Inflation Rate (Eurozone Average) | Moderating, but remains a key consideration. | Affects operating costs; lease indexation mitigates rental income erosion. | Eurostat (early 2024 data) |

| Interest Rates (ECB Main Refinancing Rate) | 4.50% (as of Sept 2023) | Increases financing costs; higher discount rates impact valuations. | European Central Bank |

| Unemployment Rate (Key Nordic Markets) | Generally low and stable. | Boosts consumer spending and business confidence, increasing demand for real estate. | National statistical offices (early 2024 data) |

| Investor Confidence | Improving due to easing inflation and anticipated rate cuts. | Facilitates capital inflow and higher property valuations. | Market sentiment surveys (late 2024 outlook) |

Full Version Awaits

Castellum PESTLE Analysis

The preview you see here is the exact Castellum PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of the Castellum's external environment.

The content and structure shown in the preview is the same Castellum PESTLE Analysis document you’ll download after payment, offering actionable insights.

Sociological factors

Castellum's core markets, including Stockholm, Gothenburg, Malmö, Copenhagen, and Helsinki, are experiencing significant population increases and a sustained shift towards urban living. For instance, Stockholm's population is projected to reach approximately 2.5 million by 2030, a substantial rise from its current figures, directly fueling demand for commercial and logistics spaces.

This ongoing urbanization translates into a greater need for offices, retail outlets, and crucially, modern logistics facilities to support the increased economic activity and consumer needs within these concentrated urban centers. The concentration of people and businesses in these growth regions is a fundamental driver for Castellum's strategic focus.

Societal shifts are profoundly reshaping how and where people work, with a significant move towards hybrid and remote models. This trend directly impacts the demand for traditional office spaces, as employees increasingly prioritize work-life balance. For companies like Castellum, this means adapting their offerings to meet these evolving tenant needs.

Castellum's strategy must therefore focus on providing adaptable workplaces that cater to flexible layouts, collaborative zones, and amenities supporting diverse working styles. This continuous adaptation is crucial for remaining competitive in the 2024-2025 market, where tenant flexibility is paramount.

Demographic shifts, like the aging population in many developed nations and the increasing presence of Gen Z in the workforce, significantly influence commercial property needs. For instance, by 2025, Gen Z is projected to make up a substantial portion of the global workforce, often prioritizing flexible work arrangements and sustainable building features. This necessitates that Castellum adapt its property designs to accommodate these evolving preferences, potentially including more co-working spaces and enhanced environmental certifications.

Different age demographics often have distinct priorities for workplace environments. Younger generations may seek collaborative spaces and advanced technology integration, while older workers might value accessibility and established amenities. Castellum’s ability to cater to this spectrum, perhaps through varied floor plans or adaptable building services, is crucial for attracting a diverse tenant base and ensuring high occupancy rates in 2024 and beyond.

Consumer Preferences for Sustainability and Well-being

Societal shifts are increasingly prioritizing sustainability and occupant well-being, directly impacting real estate demand. This growing awareness means tenants, employees, and investors are actively seeking properties that demonstrate strong environmental credentials, foster healthy living and working conditions, and contribute positively to the surrounding community. For instance, a 2024 report indicated that over 70% of commercial real estate investors consider ESG (Environmental, Social, and Governance) factors crucial in their decision-making process, highlighting a clear market preference for sustainable assets.

Castellum's strategic focus on sustainable property management directly addresses this evolving consumer preference. By investing in energy-efficient upgrades, promoting green spaces, and ensuring healthy indoor environments, Castellum enhances the desirability and long-term value proposition of its portfolio. This approach is not just about compliance; it’s about aligning with market demands, as properties with high sustainability ratings often command higher rents and experience lower vacancy rates. For example, buildings with LEED Platinum certification have shown rental premiums of up to 10% compared to non-certified properties in similar locations.

- Growing Demand for Green Buildings: A significant portion of the market now prioritizes environmentally certified properties.

- Tenant and Employee Well-being: Occupants are increasingly looking for spaces that support health, productivity, and a positive work experience.

- Investor Focus on ESG: Environmental, Social, and Governance factors are becoming critical drivers for real estate investment decisions.

- Castellum's Alignment: The company's sustainable practices directly cater to these market trends, boosting property appeal and value.

Social Equity and Community Integration

There's a growing demand for companies to actively support social fairness and weave themselves into the fabric of local communities. For property firms like Castellum, this translates to a responsibility to assess the social consequences of their building projects. It also means actively involving neighborhood residents and ensuring their properties foster lively and welcoming urban spaces.

This focus on social equity directly impacts how the public views a company and can significantly influence the ease of obtaining project approvals. For instance, in 2024, a significant portion of consumers, upwards of 60%, indicated that a company's commitment to social responsibility influences their purchasing decisions. This sentiment is likely to grow.

Consider these key areas:

- Community Engagement: Proactive dialogue with local stakeholders, including residents and community groups, is crucial for understanding and addressing local needs.

- Inclusive Development: Designing properties that cater to diverse demographic needs and promote accessibility can foster greater community integration.

- Social Impact Assessment: Evaluating the potential positive and negative social effects of new developments allows for mitigation strategies and enhanced community benefit.

- Local Economic Contribution: Prioritizing local employment and sourcing from local businesses during development and operation phases strengthens community ties.

Societal trends are increasingly emphasizing tenant well-being and flexible work environments. By 2025, studies indicate a growing preference for hybrid models, impacting office space design and amenity offerings. Castellum’s adaptation to these shifts, focusing on adaptable layouts and health-conscious features, is key to meeting evolving tenant demands.

Technological factors

The integration of smart building technologies, like IoT sensors and advanced building management systems, is revolutionizing property operations. These systems, including predictive maintenance tools, are becoming standard for efficient building management.

Castellum can harness these advancements to significantly reduce energy usage and boost tenant comfort. By optimizing operations and gaining data-driven insights, the company can achieve substantial cost savings and elevate tenant satisfaction, a key driver in today's competitive real estate market.

The global smart building market was valued at approximately $80 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, indicating strong market momentum and adoption of these technologies.

PropTech, or property technology, is revolutionizing real estate with innovations like virtual tours, digital leasing, and sophisticated portfolio analytics. These advancements are key to modernizing property management.

For Castellum, adopting PropTech can significantly streamline operations, leading to a better tenant experience via digital services and more informed decisions driven by robust data analysis. This boosts efficiency and market standing.

The global PropTech market was valued at approximately $23.7 billion in 2023 and is projected to reach over $100 billion by 2030, highlighting the rapid adoption and potential for Castellum to leverage these technologies for growth and competitive advantage.

Castellum can leverage advanced data analytics and AI to sharpen its property portfolio management. For instance, AI algorithms can sift through vast datasets to predict shifting tenant demand in specific urban areas, a capability that became increasingly crucial in the post-pandemic rental market of 2024.

By analyzing historical rental data and economic indicators, AI can pinpoint optimal rental pricing strategies, ensuring Castellum maximizes revenue. In 2024, the average rental yield across major European cities saw fluctuations; AI's predictive power can help mitigate risks associated with incorrect pricing, a key factor in maintaining profitability.

This data-driven approach allows for more informed investment decisions and efficient asset allocation, a critical advantage. As of early 2025, real estate investment trusts (REITs) are increasingly adopting AI for risk assessment, with some reporting a 10-15% improvement in portfolio performance due to better predictive modeling.

Cybersecurity and Data Privacy Concerns

Castellum's increasing reliance on digital platforms and smart building systems, coupled with the collection of tenant data, elevates cybersecurity to a critical technological concern. Protecting sensitive information and operational infrastructure from cyber threats is vital for maintaining stakeholder trust and ensuring uninterrupted business operations.

Compliance with stringent data privacy regulations, such as the General Data Protection Regulation (GDPR), necessitates robust cybersecurity measures. Failure to protect data can lead to significant financial penalties and reputational damage. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report.

- Cyber threats targeting smart building systems pose a risk to operational continuity.

- Tenant data privacy is a key concern, requiring adherence to regulations like GDPR.

- The average cost of a data breach globally was $4.45 million in 2024.

- Strong cybersecurity is essential for Castellum's reputation and operational integrity.

Sustainable Building Technologies and Materials

Technological advancements are reshaping the construction and property management landscape, directly impacting Castellum's sustainability efforts. Innovations in materials science are leading to the development of eco-friendly alternatives, such as recycled concrete and low-carbon insulation, which can significantly reduce a building's embodied carbon. For example, the global green building materials market was valued at over $250 billion in 2023 and is projected to grow substantially, indicating a strong demand and availability of these advanced solutions.

Energy efficiency is another critical technological frontier. Castellum can leverage sophisticated energy management systems, including smart HVAC controls and integrated solar photovoltaic (PV) solutions. By 2024, the cost of solar energy has fallen dramatically, making it increasingly competitive. Many commercial buildings are now aiming for net-zero energy status, a goal facilitated by these technologies, which also lowers operational costs and enhances tenant appeal.

Furthermore, advancements in construction waste management technologies are crucial. Digital platforms for material tracking and recycling, alongside innovative deconstruction techniques, allow Castellum to minimize landfill waste. The construction and demolition waste sector generated over 1.5 billion tons of waste globally in 2023, highlighting the significant environmental impact and the opportunity for companies like Castellum to implement circular economy principles through technology.

These technological integrations are not just about environmental responsibility; they translate into tangible business benefits. Castellum can achieve higher sustainability ratings, such as LEED Platinum, which are increasingly becoming a prerequisite for institutional investors and high-value tenants. By adopting these cutting-edge sustainable building technologies, Castellum is positioning itself to meet evolving market demands and create long-term value through reduced operational expenses and enhanced property desirability.

Technological factors are profoundly reshaping the real estate sector, influencing everything from building operations to investment strategies. Castellum's strategic adoption of smart building technologies, like IoT sensors and advanced building management systems, is crucial for optimizing energy consumption and enhancing tenant comfort. The global smart building market's projected growth to exceed $200 billion by 2030 underscores this trend.

PropTech innovations, including virtual tours and digital leasing, are streamlining property management, with the global PropTech market expected to surpass $100 billion by 2030. Castellum can leverage AI and advanced data analytics for predictive maintenance and optimized rental pricing, a capability that saw increased importance in the dynamic rental markets of 2024 and early 2025. As of early 2025, REITs adopting AI have reported performance improvements of 10-15% through better predictive modeling.

However, the increasing reliance on digital platforms and tenant data collection elevates cybersecurity to a critical concern, with the global average cost of a data breach reaching $4.45 million in 2024. Castellum must prioritize robust cybersecurity measures to protect sensitive information and maintain stakeholder trust, especially given stringent data privacy regulations like GDPR.

Legal factors

Castellum navigates a web of real estate and property laws across Sweden, Denmark, and Finland, dictating everything from ownership rights to land use and development. These regulations are crucial for ensuring the legitimacy of their property transactions and development ventures. For instance, in 2024, Sweden's Planning and Building Act continues to shape urban development, impacting Castellum's project timelines and compliance requirements.

Landlord-tenant laws are a critical legal factor for Castellum. These laws, varying by jurisdiction, dictate everything from lease terms and rent control to eviction processes and tenant protections. For instance, in 2024, some regions saw proposals or enactments of stricter rent stabilization measures, which could directly affect Castellum's revenue forecasts if implemented in their operating areas. Compliance is paramount to avoid costly litigation and maintain positive tenant relationships, ensuring operational continuity.

Environmental and building permit regulations are crucial for Castellum's operations, impacting property development timelines and costs. For instance, in 2024, the European Union's updated Energy Performance of Buildings Directive (EPBD) mandates stricter energy efficiency standards for new and existing buildings, potentially requiring significant retrofitting investments for properties Castellum manages or develops.

Compliance with these regulations, such as conducting environmental impact assessments and adhering to waste management protocols, is non-negotiable for legal project viability. Failure to meet these standards, like those for emissions or waste disposal, can lead to substantial fines and project delays, as seen in several high-profile construction projects across Europe in 2023 that faced permit challenges due to environmental concerns.

Taxation Laws and Corporate Compliance

Castellum operates within diverse tax landscapes, necessitating careful management of corporate income taxes, property transfer taxes, and Value Added Tax (VAT) on rental income. For instance, in the UK, corporate tax rates have seen adjustments, with the main rate set at 25% from April 2023, impacting net profits. Changes in tax legislation or their enforcement directly influence Castellum's financial performance and strategic planning.

Maintaining rigorous compliance with all applicable tax laws is paramount for Castellum. Failure to adhere to these regulations can result in substantial penalties, legal repercussions, and damage to the company's reputation. For example, in 2023, tax authorities globally collected trillions in revenue, highlighting the strict enforcement environment. Ensuring accurate tax filings and payments is crucial for financial stability and operational continuity.

- Corporate Income Tax: Navigating varying corporate tax rates across jurisdictions, such as the 21% federal rate in the United States, impacts profitability.

- Property Transfer Taxes: These taxes, which can range from 0% to over 10% depending on the location and property value, affect acquisition costs.

- VAT on Rentals: Compliance with VAT regulations on commercial property rentals, where applicable, requires careful accounting and reporting.

- Regulatory Changes: Anticipating and adapting to shifts in tax policy, like potential changes to capital gains tax or property-related levies, is vital for financial forecasting.

Data Protection and Privacy Regulations (e.g., GDPR)

Castellum's operations, which involve collecting and processing tenant, employee, and smart building data, are heavily influenced by data protection and privacy regulations like the GDPR in the EU. Adhering to these rules is paramount for responsible data handling and safeguarding privacy. Failure to comply can result in significant financial penalties, impacting Castellum's reputation and stakeholder trust.

The GDPR, for instance, imposes strict requirements on consent, data minimization, and breach notification. For Castellum, this means ensuring transparent data collection practices and robust security measures to protect sensitive information. As of 2024, data privacy remains a top concern for consumers and regulators alike, underscoring the importance of Castellum’s compliance efforts.

- GDPR Fines: Non-compliance can lead to fines of up to €20 million or 4% of annual global turnover.

- Data Breach Impact: A significant data breach could cost Castellum millions in remediation and legal fees, alongside reputational damage.

- Tenant Trust: Demonstrating strong data protection practices is crucial for maintaining tenant confidence and securing new business.

Castellum's legal landscape is shaped by a variety of statutes, including those governing real estate transactions, landlord-tenant relationships, and environmental standards across Sweden, Denmark, and Finland. For example, Sweden's Planning and Building Act in 2024 continues to influence project timelines and compliance for urban development. Furthermore, evolving landlord-tenant laws, with potential rent stabilization measures in some regions during 2024, directly impact revenue forecasts and necessitate strict adherence to avoid litigation.

Environmental factors

Climate change presents significant physical risks to Castellum's property holdings. We are seeing an uptick in extreme weather events, such as intense rainfall leading to flooding and more powerful storms, which can directly damage our properties. For instance, in 2024, global insured losses from natural catastrophes were estimated to be around $120 billion, a figure that highlights the growing financial exposure.

These events translate into tangible costs for Castellum. Property damage necessitates expensive repairs, and the increased frequency of claims often leads to higher insurance premiums, impacting our operational expenses. Furthermore, severe weather can disrupt business operations, affecting tenants and supply chains, which can indirectly impact rental income and property valuations.

To counter these threats, Castellum is prioritizing resilience in its property management and development strategies. This includes investing in climate-resilient design features and carefully considering the location of new assets to avoid areas with a high risk of future climate-related impacts. By 2025, we aim to have 75% of our new developments incorporate enhanced flood defenses and energy-efficient cooling systems.

Environmental regulations are tightening across Scandinavia, with Sweden, Denmark, and Finland setting ambitious decarbonization goals. These policies directly affect property owners like Castellum, pushing for significant reductions in energy consumption and carbon emissions.

Castellum is actively responding by investing in energy-efficient building technologies, integrating renewable energy sources such as solar power, and undertaking extensive retrofits. For instance, in 2023, Castellum reported a 10% reduction in energy consumption per square meter across its portfolio, a direct result of these strategic investments aimed at meeting evolving environmental standards and contributing to climate action.

Growing concerns over the depletion of natural resources are pushing industries, including construction and property, towards embracing circular economy principles. This shift emphasizes waste reduction, the extensive reuse and recycling of building materials, and designing structures with future deconstruction in mind. For instance, the Ellen MacArthur Foundation reports that the construction sector accounts for approximately 60% of global resource extraction, highlighting the urgency of this transition.

Castellum's commitment to sustainability is evident in its integration of these principles into its development and renovation projects. By prioritizing resource efficiency and minimizing environmental impact, the company aims to create more resilient and responsible building practices. This approach is increasingly vital as global demand for raw materials continues to rise, with projections suggesting that by 2050, annual global material consumption could reach 184 billion tonnes, according to the UN Environment Programme.

Biodiversity and Land Use Impacts

Property development and management inherently alter land use, directly affecting local biodiversity and ecosystems. For instance, the expansion of urban areas often leads to habitat fragmentation, a significant driver of species decline globally.

There's a pronounced and increasing focus on safeguarding and actively improving biodiversity within urban settings and on development project sites. This trend is driven by both public awareness and evolving regulatory frameworks.

Castellum must meticulously assess and mitigate its ecological footprints. This involves integrating green infrastructure, such as green roofs and permeable paving, and potentially undertaking habitat restoration initiatives. For example, in 2024, many European cities saw increased investment in urban greening projects, with some aiming to increase tree canopy cover by 20% by 2030 to support biodiversity and climate resilience.

- Habitat Fragmentation: Urban sprawl reduces the contiguous natural areas available for wildlife, leading to isolated populations and decreased genetic diversity.

- Green Infrastructure Investment: Cities like Paris and Berlin have allocated substantial funds in 2024 towards expanding green spaces and implementing nature-based solutions, recognizing their biodiversity benefits.

- Regulatory Compliance: Stricter environmental impact assessments are becoming standard, requiring developers to demonstrate how they will protect or enhance biodiversity on their sites, with penalties for non-compliance.

- Ecosystem Services: The enhancement of biodiversity contributes to vital ecosystem services, including pollination, water purification, and carbon sequestration, which have tangible economic value.

Tenant and Investor Demand for Green Buildings

Tenant and investor demand for green buildings is a significant environmental driver. Properties achieving high sustainability certifications, such as LEED Platinum or BREEAM Outstanding, are increasingly sought after. For instance, in 2024, office buildings with green certifications often saw rental premiums ranging from 5% to 15% compared to non-certified counterparts, with vacancy rates typically lower by a similar margin.

This trend directly impacts asset valuation and investment strategies. Environmentally conscious investors are actively allocating capital towards portfolios demonstrating strong ESG (Environmental, Social, and Governance) performance. Castellum's proactive approach to sustainable property management, including investments in energy efficiency and renewable energy sources, aligns with this market preference, thereby bolstering its portfolio's attractiveness and long-term value.

The market is responding with tangible financial benefits for sustainable properties:

- Higher Rental Income: Certified green buildings can achieve rental premiums, boosting revenue.

- Lower Vacancy Rates: Demand from tenants seeking sustainable spaces leads to quicker leasing.

- Investor Appeal: ESG-focused investors favor properties with strong environmental credentials.

- Operational Cost Savings: Energy-efficient buildings typically have lower utility expenses.

Castellum faces increasing costs due to climate change, with global insured losses from natural catastrophes reaching approximately $120 billion in 2024. This necessitates investments in resilient design and strategic site selection to mitigate physical risks and operational disruptions, impacting rental income and property values.

Stricter environmental regulations across Scandinavia are driving Castellum to invest in energy efficiency and renewables, leading to a 10% reduction in energy consumption per square meter in 2023. This proactive approach aligns with market demand for green buildings, which command rental premiums and attract ESG-focused investors.

The company is also embracing circular economy principles to reduce waste and reuse materials, addressing the construction sector's significant resource extraction. Castellum's commitment to sustainability enhances its portfolio's attractiveness and long-term value amid rising global material consumption.

Protecting biodiversity is crucial, with a focus on integrating green infrastructure and restoring habitats. Castellum's efforts to mitigate ecological footprints are supported by urban greening initiatives and stricter environmental impact assessments, reflecting a growing trend towards nature-based solutions.

| Environmental Factor | Impact on Castellum | Castellum's Response/Data |

|---|---|---|

| Climate Change & Extreme Weather | Physical damage to properties, increased insurance costs, operational disruptions | 2024 global insured losses from natural catastrophes: ~$120 billion. Castellum investing in resilient design; aiming for 75% of new developments to incorporate enhanced flood defenses by 2025. |

| Environmental Regulations & Decarbonization | Mandates for reduced energy consumption and carbon emissions | 2023: 10% reduction in energy consumption per square meter. Investing in energy efficiency and renewables. |

| Resource Depletion & Circular Economy | Need for waste reduction, material reuse, and sustainable sourcing | Construction sector accounts for ~60% of global resource extraction. Castellum prioritizing resource efficiency in development and renovation. |

| Biodiversity & Land Use Change | Habitat fragmentation, ecological impact of development | Focus on green infrastructure and habitat restoration. Urban greening investments increasing; some cities target 20% tree canopy increase by 2030. |

| Tenant & Investor Demand for Green Buildings | Preference for sustainable certifications, ESG performance | Green-certified office buildings saw 5-15% rental premiums in 2024. Lower vacancy rates in certified properties. |

PESTLE Analysis Data Sources

Our Castellum PESTLE Analysis is meticulously crafted using a blend of official government publications, reputable financial institutions, and leading market research firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in credible, current data.