Castellum Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Castellum Bundle

Castellum's competitive landscape is shaped by powerful forces, influencing everything from pricing to innovation. Understanding these dynamics is crucial for any stakeholder. This brief overview highlights the key pressures, but doesn't reveal the full picture.

The complete report reveals the real forces shaping Castellum’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Castellum's strategic focus on growth regions like Sweden, Copenhagen, and Helsinki inherently limits the availability of prime land for new projects. This scarcity directly translates into increased bargaining power for landowners, who can command higher prices for their properties. For instance, in 2024, property prices in prime urban areas across these regions saw continued upward pressure due to consistent demand and limited supply.

The market for large-scale commercial and logistics property development often sees a limited number of highly specialized construction firms. For instance, in 2024, the global construction market, valued at approximately $13.3 trillion, is characterized by a significant portion of large, complex projects requiring specialized skills and certifications. If these specialized companies are in high demand or possess unique, hard-to-replicate expertise, their bargaining power naturally increases.

This increased power can translate into higher construction costs and potentially longer project timelines for developers like Castellum. While Castellum's substantial scale might offer some leverage in negotiations, a reliance on a small pool of these key specialized players presents a notable risk to project execution and budget management.

Suppliers of critical building materials like steel, concrete, and timber can wield significant power. This is amplified by ongoing global supply chain disruptions and the inherent volatility of commodity prices. For instance, the average price of lumber saw significant swings in 2023 and early 2024, directly impacting construction budgets.

These price fluctuations, coupled with increased demand for construction projects, can directly squeeze Castellum's development costs and, consequently, its profit margins. A surge in demand for materials, as seen in the post-pandemic construction boom, often translates to higher supplier leverage.

Furthermore, Castellum's strategic focus on sustainable property management may introduce an additional layer of supplier power. Sourcing specialized, eco-friendly materials, while aligned with their mission, can be more expensive and may involve fewer suppliers, giving them greater bargaining influence.

Access to competitive financing

Castellum's ability to secure competitive financing is a key factor influencing the bargaining power of its suppliers, particularly financial institutions. While Castellum maintains a robust financial standing and access to capital markets, the prevailing interest rates and lending conditions dictated by banks and bondholders can significantly impact its cost of capital. For instance, if credit markets tighten or interest rates rise, Castellum's borrowing costs would increase, thereby enhancing the leverage of its lenders.

Castellum's proactive approach to refinancing and maintaining a strong balance sheet are crucial strategies to mitigate the impact of fluctuating financial market conditions. These actions help to manage the bargaining power of financial suppliers by ensuring favorable terms and reducing reliance on potentially costly external capital. For example, as of the first quarter of 2024, Castellum reported a solid equity ratio, which typically allows for more favorable financing terms.

- Interest Rate Sensitivity: Castellum's cost of capital is directly influenced by benchmark interest rates, such as those set by central banks.

- Credit Market Conditions: The availability and cost of debt financing can change based on broader economic sentiment and lender risk appetite.

- Balance Sheet Strength: A strong balance sheet, characterized by healthy liquidity and manageable debt levels, typically reduces the bargaining power of financial suppliers.

- Refinancing Strategy: Proactive refinancing efforts can lock in lower rates and extend debt maturities, thereby insulating Castellum from immediate rate hikes.

Dependency on utility and infrastructure providers

Castellum's operations, whether for new projects or ongoing management of existing properties, are fundamentally reliant on utility and infrastructure providers. This includes essential services like electricity, water, and internet connectivity, as well as broader infrastructure development crucial for property accessibility and tenant satisfaction.

In markets where these providers operate as monopolies or have very limited competition, their bargaining power significantly increases. This can lead to dictated terms and pricing, directly impacting Castellum's operating expenses. For instance, in 2024, average commercial electricity prices in Sweden, Castellum's primary market, saw fluctuations, with some regions experiencing higher costs due to grid investment needs, potentially increasing Castellum's utility bills if not mitigated.

- Dependency on essential services: Castellum requires reliable electricity, water, and internet for all its properties.

- Monopoly power of providers: In many areas, utility and infrastructure services are provided by single entities, giving them leverage.

- Impact on operating costs: Unfavorable terms from these providers can inflate Castellum's expenses and affect property profitability.

- Mitigation strategies: Castellum can reduce this dependency through long-term contracts and investments in on-site renewable energy solutions, such as solar installations which are becoming increasingly cost-effective.

The bargaining power of suppliers significantly impacts Castellum's profitability and operational efficiency. This power is amplified when suppliers are concentrated, offer specialized inputs, or face high demand, as seen with specialized construction firms and critical material providers. For instance, in 2024, the construction sector continued to grapple with material cost volatility, with lumber prices experiencing notable fluctuations, directly affecting project budgets.

What is included in the product

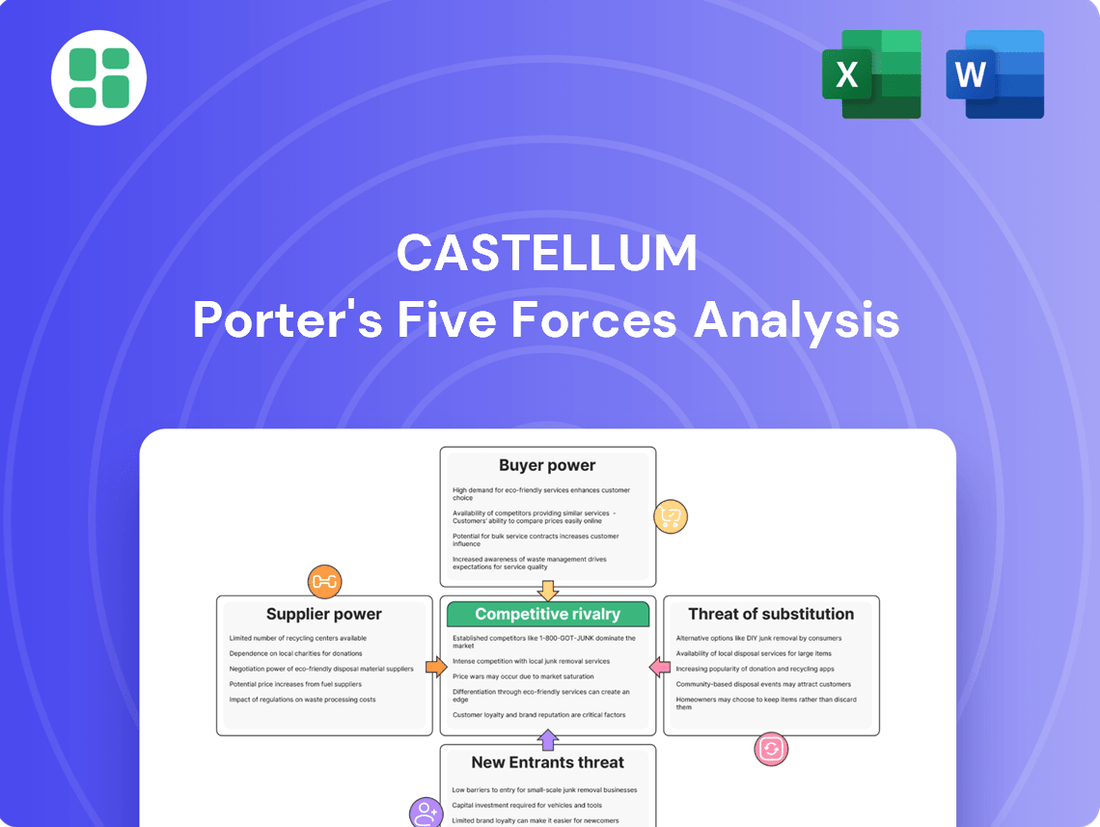

This Castellum Porter's Five Forces analysis dissects the competitive landscape, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Quickly identify and neutralize competitive threats by visualizing the intensity of each Porter's Five Force.

Customers Bargaining Power

The demand for flexible and adaptable spaces is a significant factor influencing the bargaining power of Castellum's customers, particularly its tenants. Corporate clients are increasingly seeking lease terms that offer agility, allowing them to scale their operations up or down without being locked into rigid, long-term commitments. This trend is amplified in certain office market segments experiencing rising vacancy rates, which naturally shifts negotiation leverage towards the tenant. For instance, in the first quarter of 2024, office vacancy rates in major European cities like Berlin and Amsterdam saw slight increases, providing tenants with more options and thus greater power to negotiate favorable lease conditions, potentially impacting Castellum's rental income growth.

In growing markets, Castellum's tenants have a wide array of choices, not just from competitors but also from private landlords offering commercial properties. This abundance of options directly strengthens their bargaining position.

The availability of numerous alternative properties significantly increases the bargaining power of customers. For instance, a high vacancy rate in specific areas, like the Stockholm office market, empowers tenants. They can readily secure suitable spaces elsewhere, which in turn pressures Castellum on rental rates and occupancy levels.

While tenants certainly have options for office space, the practicalities of moving can be a major hurdle. For instance, a business might face expenses related to physically relocating, reconfiguring their IT systems, and the inevitable downtime that disrupts operations. These switching costs can significantly dampen a tenant's immediate power to negotiate, particularly for smaller businesses.

These substantial switching costs directly benefit Castellum by bolstering the stability of its rental income. For example, in 2024, the average commercial lease term in many major European cities hovers around 3-5 years, and the cost of breaking a lease or relocating can easily amount to several months' rent, plus significant operational disruption, making tenants hesitant to move.

Large corporate and public sector tenants

Castellum's tenant base includes significant corporate and public sector entities. Their substantial size and long-term lease agreements grant them considerable leverage. This means they can negotiate for better rental rates or demand significant investment in property upgrades and customizations, directly influencing Castellum's financial performance.

The bargaining power of these large tenants is a critical factor. For instance, a single large corporate tenant might represent a significant portion of a property's rental income. If such a tenant seeks concessions, Castellum must carefully weigh the potential loss of revenue against the cost of retaining the tenant. In 2024, the office vacancy rate in major European cities, where Castellum operates, remained a concern, potentially increasing tenant leverage.

- Tenant Size: Large corporate and public sector tenants command significant market share, giving them negotiating strength.

- Lease Commitments: Long-term leases provide tenants with stability and the ability to negotiate favorable terms over extended periods.

- Negotiating Power: Tenants can leverage their position to secure rent reductions or substantial fit-out allowances, impacting Castellum's profitability.

- Public Sector Stability: While powerful, public sector tenants also offer a high degree of rental income stability due to their often long-term and secure funding.

Impact of economic conditions on tenant solvency

Economic downturns significantly impact tenant solvency, directly affecting Castellum's revenue streams. During periods of economic uncertainty, tenants, especially those in retail and hospitality sectors, face reduced consumer spending and tighter credit conditions. This financial strain can lead to tenants requesting rent deferrals or renegotiating lease terms, thereby increasing their bargaining power.

In 2024, for instance, many European economies, including Sweden, experienced inflationary pressures and rising interest rates, which squeezed household budgets and corporate margins. This environment made tenants more sensitive to rent increases and more likely to seek concessions. Castellum's ability to maintain strong occupancy and rental income is therefore closely tied to the prevailing economic climate.

Signs of economic recovery in Sweden during 2025, such as projected GDP growth and decreasing inflation, could potentially alleviate some of this pressure. A stronger economy generally translates to healthier businesses and consumers, reducing the likelihood of tenant defaults and softening tenant demands for concessions. This would, in turn, strengthen Castellum's position against its customers.

- Tenant Financial Health: Economic conditions directly influence the ability of Castellum's tenants to meet their rental obligations.

- Rent Concessions: Weak economic periods often force property owners to offer rent reductions or deferrals, increasing tenant leverage.

- Occupancy Rates: Tenant solvency issues can lead to vacancies, diminishing Castellum's pricing power and occupancy levels.

- Economic Outlook for 2025: Positive economic indicators in Sweden could improve tenant financial stability and reduce their bargaining power.

The bargaining power of Castellum's customers is influenced by the availability of substitutes and the cost for tenants to switch providers. When tenants have numerous alternative properties to choose from, especially in markets with high vacancy rates like Stockholm in early 2024, their ability to negotiate favorable lease terms increases significantly.

However, the substantial costs associated with relocating, such as IT reconfiguration and operational downtime, act as a deterrent for tenants seeking immediate changes. For example, in 2024, average commercial lease terms in major European cities often range from 3-5 years, and breaking these leases can incur costs equivalent to several months' rent, plus disruption, thereby reducing a tenant's immediate leverage.

Large corporate and public sector tenants, due to their size and long-term commitments, possess considerable negotiating strength. They can effectively bargain for reduced rental rates or demand significant property upgrades, directly impacting Castellum's profitability. For instance, a major tenant's departure could represent a substantial portion of a property's income, forcing Castellum to carefully consider any concessions offered.

| Factor | Impact on Castellum | 2024/2025 Data Point |

| Availability of Substitutes | Increases tenant bargaining power | Office vacancy rates in Stockholm saw a slight increase in Q1 2024. |

| Switching Costs | Decreases tenant bargaining power | Relocation costs can amount to several months' rent and operational downtime. |

| Tenant Size & Commitments | Increases tenant bargaining power | Large tenants can negotiate for rent reductions or fit-out allowances. |

| Economic Conditions | Increases tenant bargaining power during downturns | Inflationary pressures in Sweden during 2024 made tenants more sensitive to rent increases. |

Full Version Awaits

Castellum Porter's Five Forces Analysis

This preview displays the complete Castellum Porter's Five Forces Analysis you will receive upon purchase. It offers a thorough examination of competitive forces within a chosen industry, providing actionable insights for strategic decision-making. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file.

Rivalry Among Competitors

The Nordic commercial property market, particularly in Sweden, is characterized by a significant number of publicly traded property companies. These entities, including Castellum's direct competitors, actively vie for prime property acquisitions, promising development projects, and desirable tenant agreements.

This intense competition directly impacts market dynamics, as these companies frequently engage in bidding wars for assets and development rights. The investment landscape in 2024 and early 2025 reflected this heightened rivalry, with increased transaction volumes and a competitive environment for securing new business.

The competition for prime assets and desirable tenants is intense, especially in sought-after growth areas for commercial and logistics properties. This rivalry means that companies like Castellum are constantly vying for the same high-quality buildings and the businesses that occupy them.

This fierce competition can lead to inflated property prices and can cap the potential for rental income growth. For instance, in the prime office sector, a noticeable trend of tenants seeking superior quality spaces means landlords are competing harder to attract and retain these high-value occupants, impacting profitability.

Many competitors in the real estate sector, much like Castellum, maintain diversified portfolios that include office, logistics, and various other commercial property segments. This widespread diversification means that companies can readily shift their strategic focus or capitalize on strengths in different areas, thereby intensifying competition across a broader range of property types.

For instance, in 2024, major real estate investment trusts (REITs) often hold substantial assets in both office and logistics, creating direct competition for Castellum’s core focus on adaptable workplaces and logistics. This overlap means rivals can leverage existing infrastructure and market presence in one segment to gain an advantage in another, making the competitive landscape particularly dynamic.

Focus on sustainability and ESG factors

Sustainability and ESG factors are increasingly shaping competition within the Nordic property sector. Companies like Castellum are differentiating themselves by highlighting their environmental, social, and governance (ESG) performance, including green building certifications and ambitious climate-neutral targets.

This focus intensifies rivalry, pushing firms to invest heavily in sustainable practices and innovations. For instance, in 2024, the Nordic real estate market saw a significant uptick in green bond issuances, with several major players, including those in direct competition with Castellum, raising substantial capital specifically for eco-friendly projects. This trend underscores the financial commitment required to stay competitive in this evolving landscape.

- ESG as a Competitive Differentiator: Companies are actively using their sustainability credentials to attract investors and tenants.

- Investment in Green Initiatives: Achieving climate-neutral goals and obtaining green certifications necessitates significant capital expenditure.

- Innovation Driver: The pressure to excel in ESG performance spurs innovation in building design, energy efficiency, and resource management.

- Increased Rivalry: The emphasis on sustainability creates a new battleground, where companies compete not just on price and location, but also on their environmental impact.

Impact of market sentiment and financing conditions

Competitive rivalry within industries is significantly shaped by prevailing market sentiment and the ease of obtaining financing. When investor confidence is high and capital is readily available, as observed in 2024 and continuing into 2025, transaction volumes tend to surge.

This heightened activity translates directly into more intense competition, particularly for attractive acquisition targets and development opportunities. For instance, the global M&A market saw a notable uptick in deal value in early 2024, with some sectors experiencing double-digit percentage increases in activity compared to the previous year, fueled by favorable financing conditions.

- Improved Financing Conditions: Lower interest rates and increased availability of credit in 2024 made it cheaper and easier for companies to borrow money for acquisitions or expansion.

- Increased Investor Appetite: A more optimistic outlook among investors led to greater demand for equities and a willingness to fund new ventures and takeovers.

- Higher Transaction Volumes: The combination of better financing and investor enthusiasm resulted in more deals being announced and completed across various sectors.

- Heightened Competition: As more players actively seek opportunities, the competition to acquire desirable assets or secure funding for projects intensifies.

The competitive rivalry in the Nordic commercial property market, particularly for companies like Castellum, is fierce due to a substantial number of publicly traded entities actively pursuing prime assets and development projects. This competition intensified in 2024, marked by increased transaction volumes and a drive to secure desirable tenants and acquisitions.

Many competitors, including major REITs, hold diversified portfolios spanning office and logistics, creating direct competition with Castellum's focus areas. This overlap allows rivals to leverage existing strengths, making the landscape dynamic. For example, in 2024, the demand for high-quality office spaces meant landlords were in a stronger position to attract and retain tenants, intensifying the competition for prime locations and premium rents.

Sustainability and ESG performance are increasingly becoming key differentiators, pushing companies to invest in green initiatives. The Nordic real estate market saw a notable rise in green bond issuances in 2024, with competitors raising significant capital for eco-friendly projects, highlighting the financial commitment necessary to remain competitive.

Favorable financing conditions and high investor confidence in 2024 fueled increased transaction volumes and, consequently, heightened competition for attractive assets. Global M&A activity saw a significant uptick, with some sectors experiencing double-digit percentage increases, driven by easier access to capital.

| Competitor Type | Key Focus Areas | 2024 Competitive Action Example | Impact on Rivalry |

|---|---|---|---|

| Publicly Traded Property Companies | Prime acquisitions, development projects, tenant agreements | Engaged in bidding wars for prime office buildings in Stockholm | Inflated property prices, pressure on rental income |

| Major REITs | Office, Logistics, Diversified portfolios | Increased investment in logistics hubs to capture e-commerce growth | Intensified competition across multiple property segments |

| ESG-Focused Firms | Sustainable building certifications, climate-neutral targets | Raised substantial capital via green bonds for eco-friendly developments | Drives innovation and investment in sustainability |

SSubstitutes Threaten

The rise of remote and hybrid work models presents a substantial threat of substitution for traditional office spaces, directly impacting Castellum's portfolio. Companies are increasingly opting for flexible work arrangements, reducing their reliance on large physical footprints. This shift can lead to lower demand for office leases, potentially increasing vacancy rates and exerting downward pressure on rental income for Castellum.

In 2024, the ongoing evolution of work arrangements continues to reshape the commercial real estate landscape. While many companies have called employees back to the office, hybrid models remain prevalent, with many organizations maintaining a significant portion of their workforce operating remotely at least part-time. This sustained trend directly challenges the necessity of traditional, centrally located office buildings, a core component of Castellum's business.

The burgeoning co-working and flexible office sector presents a significant threat of substitution for traditional office real estate providers like Castellum. These alternatives offer businesses greater agility and lower upfront costs compared to long-term leases, directly challenging Castellum's core business model.

In 2024, the flexible office market continued its expansion, with major providers reporting high occupancy rates. For instance, WeWork, a prominent player, aimed to achieve profitability by optimizing its portfolio and securing longer-term commitments from enterprise clients, indicating a maturing but still competitive landscape.

For Castellum, this trend means a potential loss of market share as companies increasingly opt for the flexibility and cost-effectiveness of co-working spaces, especially for smaller teams or project-based work. This forces Castellum to consider adapting its offerings or risk losing tenants to these more adaptable competitors.

The threat of substitutes is significantly amplified by technological advancements, particularly in communication and virtual office solutions. These innovations are increasingly making a physical presence less critical for many businesses, especially smaller ones and startups. For instance, the widespread adoption of robust video conferencing platforms and cloud-based collaboration tools allows teams to operate effectively regardless of location, directly impacting the demand for traditional office spaces.

In 2024, the commercial real estate sector, particularly for office spaces, has continued to feel the pressure from these evolving work models. Companies are re-evaluating their space needs, often opting for smaller footprints or flexible co-working arrangements. This trend is a direct substitute for traditional, long-term office leases, reducing the inherent demand for large commercial properties and potentially leading to higher vacancy rates in some markets.

Companies opting for property ownership

Companies increasingly opting for property ownership instead of leasing presents a significant threat of substitutes for Castellum's rental income model. This trend is particularly noticeable among larger corporations with substantial capital and long-term strategic visions. Such a shift directly bypasses the need for commercial property leasing services.

Several factors drive this move towards ownership. Favorable market conditions, including potentially lower interest rates for commercial mortgages, can make purchasing more attractive than renting over an extended period. For instance, in early 2024, commercial property yields in many European markets remained competitive, encouraging investment in owned assets.

- Property ownership as an alternative to leasing: Businesses can directly acquire and manage their commercial spaces, eliminating rental payments.

- Impact of interest rates: Lower borrowing costs can make property acquisition a more financially viable option than long-term leases.

- Strategic long-term goals: Companies may view property ownership as a way to build equity and gain greater control over their operational environment.

- Market conditions in 2024: The commercial real estate market in 2024 saw varied performance, with some regions offering attractive opportunities for direct investment.

Shifts in investment towards alternative asset classes

From an investor's viewpoint, alternative asset classes can act as substitutes for direct investment in commercial property companies like Castellum. If other sectors, such as private equity or venture capital, are perceived to offer better returns or lower risk profiles, capital could easily shift away from real estate. This reallocation of funds can directly impact Castellum's market valuation and its ability to secure necessary capital for growth or operations.

For instance, in 2024, the global alternative investments market continued its upward trajectory, with assets under management (AUM) projected to reach approximately $23 trillion by the end of the year, according to various industry reports. This growth indicates a strong investor appetite for diversification beyond traditional stocks and bonds, which includes real estate, but also a broader range of options that could siphon investment away from specific property companies.

The increasing accessibility and marketing of these alternative investments present a significant competitive force. Investors are no longer limited to publicly traded securities or direct property ownership. This broader investment universe means that companies like Castellum must continually demonstrate compelling value propositions to retain and attract capital.

Consider these factors impacting Castellum:

- Increased Competition for Capital: AUM in global hedge funds alone were estimated to be around $4.1 trillion in early 2024, showcasing a substantial pool of capital seeking diverse opportunities.

- Yield Sensitivity: If interest rates remain elevated or rise further in 2024, the yield on less volatile fixed-income instruments might become more attractive compared to the risk-adjusted returns of commercial real estate.

- Diversification Strategies: Investors actively seeking to diversify portfolios might allocate funds to areas like infrastructure, digital assets, or impact investing, which are gaining traction as viable alternatives to traditional real estate investments.

- Performance Benchmarks: The performance of alternative asset classes, when benchmarked against real estate returns, can directly influence investor allocation decisions, potentially drawing capital away from Castellum if these alternatives consistently outperform.

The threat of substitutes for Castellum's traditional office spaces is multifaceted, driven by evolving work models and alternative investment opportunities. Companies are increasingly embracing remote and hybrid work, reducing their need for large physical footprints and opting for flexible co-working solutions. This directly impacts Castellum's leasing revenue by creating more agile and cost-effective alternatives for tenants.

Furthermore, the broader investment landscape offers substitutes for capital that might otherwise flow into commercial real estate. Alternative asset classes are attracting significant investor interest, potentially diverting funds away from property companies like Castellum if they offer more attractive risk-reward profiles.

In 2024, the commercial real estate market continued to grapple with these substitution threats. For instance, the global alternative investments market was projected to reach around $23 trillion, indicating a robust demand for options beyond traditional real estate, which could impact Castellum's ability to attract and retain investment.

Companies are also increasingly choosing property ownership over leasing, especially when favorable financing conditions make acquisition more appealing than long-term rental agreements. This trend directly bypasses Castellum's core rental income model.

| Substitute Type | Impact on Castellum | 2024 Market Trend/Data |

|---|---|---|

| Flexible Office/Co-working | Reduced demand for traditional leases, potential loss of market share | High occupancy rates reported by major providers; WeWork focused on profitability |

| Property Ownership | Bypasses rental income model, reduces demand for leased spaces | Competitive commercial property yields in many European markets |

| Alternative Asset Classes | Diversion of investor capital away from real estate | Global alternative investments AUM projected to reach $23 trillion |

| Remote/Hybrid Work | Lower demand for office space, increased vacancy risk | Sustained prevalence of hybrid models impacting traditional office footprints |

Entrants Threaten

Entering the commercial property market, particularly at the scale Castellum operates, demands immense capital. Think billions for land, construction, and ongoing management. This high capital intensity is a formidable barrier, significantly limiting the number of new players who can realistically compete.

The real estate development sector in Sweden, Copenhagen, and Helsinki faces significant barriers to entry due to stringent and lengthy regulatory approvals, zoning laws, and environmental permit requirements. These complex legal and bureaucratic processes demand considerable time, expertise, and financial resources, making it difficult for new companies to establish themselves.

For instance, obtaining planning permission in major Swedish cities can often extend beyond a year, involving multiple stages of review and public consultation. Similarly, Copenhagen's urban development projects are subject to rigorous environmental impact assessments and building regulations, adding layers of complexity. In Helsinki, the process for securing necessary permits for large-scale developments can also be protracted, requiring adherence to detailed land-use plans and sustainability standards.

The property development sector demands highly specialized expertise, encompassing construction, urban planning, and intricate legal frameworks. Newcomers must navigate these complex areas, often requiring significant investment in talent acquisition and training to build the necessary proficiency.

Local market knowledge is equally crucial, involving understanding regional demand, zoning regulations, and community needs. For instance, in 2024, the average time to obtain building permits in major US cities often exceeded six months, highlighting the complexity of local regulatory environments that new entrants must master.

Difficulty in acquiring prime locations

Castellum operates in highly desirable growth regions where prime commercial and logistics locations are already scarce and fiercely competed for. This scarcity presents a significant barrier to entry for new companies looking to establish a presence.

Established players, including Castellum itself, possess extensive portfolios and well-developed networks. These existing relationships and land banks give them a distinct advantage in securing the best sites, often at more favorable terms than newcomers can achieve.

For instance, in many of Castellum's key markets, land acquisition costs have seen substantial increases. In the Nordics, prime industrial land prices in sought-after logistics hubs have reportedly risen by 10-15% year-over-year through early 2024, making it increasingly expensive for new entrants to compete.

- Limited Availability of Prime Sites: High demand in growth regions restricts the supply of ideal locations.

- Established Player Advantage: Existing portfolios and networks give incumbents a competitive edge in site acquisition.

- Rising Land Costs: Increased acquisition expenses in key markets create a financial hurdle for new entrants.

- Competition for Resources: Newcomers face intense competition from established entities for limited development opportunities.

Established tenant relationships and brand reputation

Castellum’s established tenant relationships and strong brand reputation act as a significant barrier to new entrants. The company has cultivated long-standing partnerships with a diverse range of tenants, including major corporations and public sector organizations. This loyalty is built on Castellum's consistent delivery of sustainable and high-quality properties, fostering trust and reliability in the market.

New companies entering the real estate sector would face considerable challenges in replicating this established tenant base and brand equity. Building comparable trust and securing large-scale clients requires substantial time, investment, and a proven track record, which new entrants lack. For instance, Castellum’s focus on ESG (Environmental, Social, and Governance) principles, a key differentiator in 2024, further solidifies its appeal to tenants prioritizing sustainability, a trend expected to intensify.

- Long-term tenant partnerships: Castellum’s existing relationships are difficult for newcomers to displace.

- Brand reputation for quality and sustainability: This appeals to a growing segment of the market, making it harder for new entrants to compete.

- High switching costs for tenants: Moving to a new provider can be disruptive and costly for large organizations.

- Demonstrated track record: Castellum’s history of successful property management and development provides a competitive advantage.

The threat of new entrants for Castellum is relatively low due to several significant barriers. The sheer capital required to enter the commercial property market, especially at Castellum's scale, is immense, often running into billions for land acquisition and development. Furthermore, navigating the complex web of stringent regulations, zoning laws, and lengthy approval processes in key markets like Sweden, Copenhagen, and Helsinki demands substantial expertise and time. For example, in 2024, obtaining building permits in major Nordic cities could easily take over a year, a considerable hurdle for any new player.

| Barrier Type | Description | Impact on New Entrants | Example Data (Early 2024) |

|---|---|---|---|

| Capital Intensity | High cost of land, construction, and management. | Significant financial barrier. | Prime Nordic industrial land prices up 10-15% YoY. |

| Regulatory Hurdles | Complex approval processes, zoning, environmental permits. | Time-consuming and resource-intensive. | Building permits in major cities > 6 months (US benchmark). |

| Specialized Expertise | Need for skills in construction, planning, legal. | Requires investment in talent. | N/A (Qualitative barrier) |

| Market Knowledge | Understanding local demand, regulations, community needs. | Difficult for newcomers to acquire. | N/A (Qualitative barrier) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built on a robust foundation of data, including company annual reports, financial statements, and market research reports from reputable firms. We also leverage industry-specific publications and government economic data to provide a comprehensive view of competitive dynamics.