Carr's Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carr's Group Bundle

Carr's Group possesses strong brand recognition and a diverse product portfolio, yet faces challenges from evolving consumer tastes and intense competition. Understanding these dynamics is crucial for any strategic investor or business leader.

Want the full story behind Carr's Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Carr's Group has strategically repositioned itself as a focused, pure-play agriculture business following the divestment of most of its Engineering Division. This move allows the company to channel all its resources and expertise into its high-growth agriculture segment, streamlining operations and aiming for improved long-term earnings quality.

Carr's Group's agriculture division is a significant strength, showcasing robust financial performance. In the first half of fiscal year 2025, this segment saw revenues climb by 7.0%, with adjusted operating profit surging by an impressive 33.4%.

This growth is driven by strong market demand, evidenced by a substantial 13% rise in UK low moisture block tonnage and a 3% increase in US volumes. Such consistent profitability in its core operations provides a solid foundation for the company's financial stability and future expansion.

Carr's Agriculture boasts market-leading brands in its livestock supplements, offering research-proven feed blocks, minerals, and boluses. These specialized products are designed to enhance pasture and grass-based nutrition for optimal animal health and efficiency. For example, in the fiscal year ending August 31, 2023, Carr's Group reported that its Agriculture segment revenue was £174.1 million, demonstrating the significant market presence of these offerings.

Enhanced Financial Flexibility and Shareholder Returns

Carr's Group's sale of its Engineering Division for £75 million has markedly improved its financial standing, resulting in a net cash position. This strategic move bolsters the company's ability to pursue future opportunities. The company is returning up to £70 million to shareholders through a tender offer, a clear signal of its dedication to enhancing shareholder returns.

This capital allocation strategy underscores a commitment to rewarding investors. The remaining funds offer significant financial flexibility, enabling Carr's Group to invest in and accelerate growth within its core agriculture division. This dual approach of shareholder returns and strategic reinvestment positions the company for sustained development.

- Strengthened Balance Sheet: The £75 million sale of the Engineering Division resulted in a net cash position for Carr's Group.

- Shareholder Returns: Up to £70 million is being returned to shareholders via a tender offer, prioritizing shareholder value.

- Strategic Flexibility: Retained capital provides financial resources to support growth initiatives in the agriculture sector.

Global Presence and Streamlined Leadership

Carr's Group's agriculture division boasts a significant global footprint, with manufacturing facilities strategically located in the UK, US, and Germany. This allows the company to serve a diverse customer base, exporting its products to over 20 countries worldwide. This broad market access is a key strength, mitigating risks associated with reliance on a single region and opening avenues for sustained growth.

The recent organizational overhaul, consolidating operations into a unified global specialist business, is a major strategic advantage. This streamlined structure, bolstered by an integrated leadership team and the appointment of a new CEO in June 2025, is designed to foster more agile and consistent decision-making. This unified approach enhances the group's ability to leverage its international presence effectively.

- Global Manufacturing Footprint: Operations in UK, US, and Germany.

- Extensive Market Reach: Sales across more than 20 countries.

- Strategic Reorganization: Unified global specialist business structure enhancing leadership and decision-making.

- Leadership Enhancement: New CEO appointed June 2025 to drive international strategy.

Carr's Group's agriculture division demonstrates robust financial health, with a 7.0% revenue increase and a 33.4% surge in adjusted operating profit in H1 FY25. This performance is underpinned by strong demand, with UK low moisture block tonnage up 13% and US volumes up 3%.

The company's market-leading livestock supplements, backed by research, contribute significantly to its revenue, which reached £174.1 million for the Agriculture segment in FY23. This focus on specialized, high-performance products solidifies its competitive edge.

The strategic divestment of the Engineering Division for £75 million has created a net cash position, enhancing financial flexibility. This allows for a significant return of capital to shareholders, with up to £70 million being distributed via a tender offer, while retaining resources for agricultural growth.

Carr's Group benefits from a global manufacturing presence in the UK, US, and Germany, serving over 20 countries. This international reach, combined with a newly unified global specialist business structure and a CEO appointed in June 2025, enhances operational agility and strategic execution.

| Metric | FY23 | H1 FY25 | YoY Growth (H1 FY25) |

| Agriculture Revenue | £174.1m | N/A | 7.0% |

| Agriculture Adj. Operating Profit | N/A | N/A | 33.4% |

| UK Low Moisture Block Tonnage | N/A | N/A | 13% |

| US Volumes | N/A | N/A | 3% |

| Engineering Division Sale Proceeds | N/A | £75m | N/A |

| Shareholder Return (Tender Offer) | N/A | Up to £70m | N/A |

What is included in the product

Provides a comprehensive SWOT analysis of Carr's Group, detailing its internal strengths and weaknesses alongside external opportunities and threats to inform strategic decision-making.

Highlights key Carr's Group strengths and weaknesses for targeted risk mitigation.

Weaknesses

Following the divestment of its Engineering Division, Carr's Group's financial results are now more closely tied to the agricultural sector, especially in the northern hemisphere. This shift amplifies the impact of seasonal fluctuations on the company's trading patterns.

The company's performance is increasingly susceptible to the agricultural calendar, with the second half of its fiscal year historically showing weaker trading volumes. This pronounced seasonality could potentially temper the company's overall annual financial performance.

Carr's Group's status as a pure-play agriculture business means it's more susceptible to the ups and downs of agricultural markets. This includes swings in commodity prices, which can directly affect the cost of raw materials for their feed manufacturing operations. For example, a significant increase in global grain prices, a common occurrence influenced by weather patterns and geopolitical events, could squeeze Carr's profit margins if they cannot pass these costs onto customers.

Changes in farmer profitability also pose a direct risk. If farmers face reduced incomes due to lower crop yields or falling livestock prices, their spending on essential inputs like animal feed, a core product for Carr's, is likely to decrease. This concentrated exposure to the agricultural sector's economic health can lead to less predictable revenue streams and profit stability for the company.

Trading conditions in the United States, particularly in the southern regions, remain subdued due to persistent climatic factors impacting agricultural operations. This ongoing environmental challenge directly affects demand for Carr's Group's products.

The expected recovery in US cattle herd sizes, a key driver for livestock supplement sales, is now projected to occur later than initially anticipated, potentially impacting Carr's Group's performance into fiscal year 2026. This delay creates a prolonged period of potentially lower demand.

Operational Restructuring and Integration Risks

Carr's Group's strategic divestment of its Engineering Division and the closure of underperforming agricultural segments, such as Afgritech and its New Zealand operations, while intended to sharpen focus, introduce significant operational restructuring and integration risks. These moves, designed to streamline the business, can lead to temporary disruptions. For instance, the integration of new leadership or the reallocation of resources following these changes might not go as smoothly as planned.

The company must navigate potential challenges in maintaining operational continuity during these transitions. Unforeseen costs associated with the restructuring process itself could also impact financial performance in the short term.

- Operational Disruption: The process of divesting divisions and closing operations inherently carries a risk of impacting ongoing business activities and customer relationships.

- Integration Challenges: Successfully integrating new management or reallocating staff and resources post-restructuring can present hurdles, potentially affecting efficiency.

- Unforeseen Costs: Restructuring initiatives often involve unexpected expenses related to severance packages, asset write-downs, or legal and advisory fees.

Niche Market Concentration

Carr's Group's specialization in livestock supplements, while offering a focused approach, inherently concentrates risk within a specific agricultural segment. This niche market exposure means that any significant downturn in the pasture-based livestock sector, or the introduction of highly disruptive alternative feed products, could disproportionately impact the company's performance. For instance, a severe drought impacting grazing land in key markets, or a rapid shift towards lab-grown or insect-based protein sources, could present substantial challenges.

The company's reliance on this particular niche market makes it more vulnerable to sector-specific regulatory changes or shifts in consumer demand for traditional livestock products. As of the latest available data, the global animal feed market, while growing, exhibits regional variations and is subject to factors like animal disease outbreaks and feed ingredient price volatility, all of which can amplify the impact on a specialized player like Carr's Group.

- Niche Focus: Specialization in livestock supplements creates a concentrated risk profile.

- Sector Vulnerability: Susceptible to downturns or disruptions within the pasture-based livestock segment.

- Disruptive Threats: Emergence of alternative feed products poses a significant risk.

Carr's Group's concentrated focus on the agricultural sector, particularly livestock supplements, leaves it exposed to significant sector-specific risks. A downturn in the pasture-based livestock market, or the emergence of disruptive alternative feed products, could disproportionately affect the company. For example, the global animal feed market, while projected to grow, faces volatility from disease outbreaks and ingredient price fluctuations, which are amplified for specialized producers.

The company's reliance on a niche market makes it vulnerable to shifts in consumer demand for traditional livestock products and sector-specific regulatory changes. This specialization, while allowing for focused expertise, also concentrates potential negative impacts, making the business less resilient to broad agricultural market shocks.

Preview the Actual Deliverable

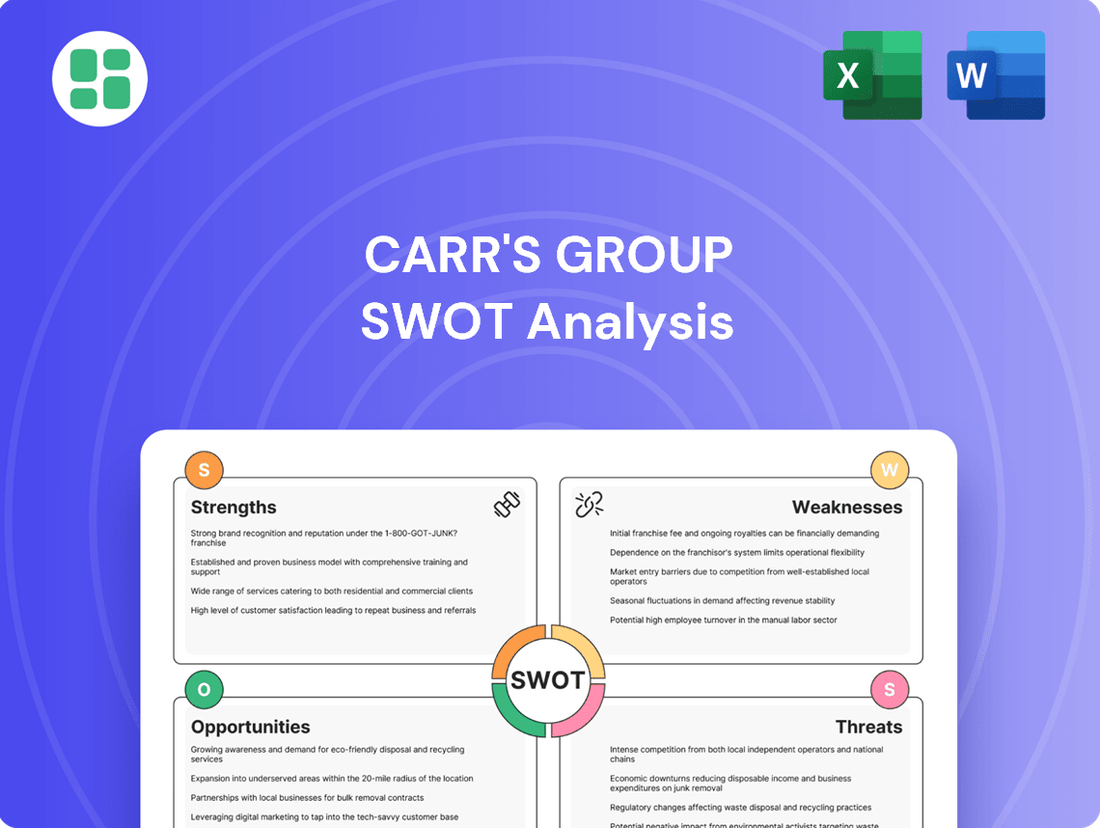

Carr's Group SWOT Analysis

The preview you see is the actual Carr's Group SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you get the complete, professional report you expect, with no hidden surprises.

This is a real excerpt from the complete Carr's Group SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to leverage every insight for strategic planning.

Opportunities

Global demand for protein is on the rise, with projections from the OECD and FAO suggesting a significant increase in beef consumption and overall protein availability through 2030. This presents a substantial opportunity for Carr's Group, whose expertise in livestock nutrition directly addresses the need for enhanced efficiency and productivity in meat production.

For instance, the global meat market was valued at approximately $1.1 trillion in 2023 and is expected to grow. Carr's Group's specialized feed supplements and animal health products are crucial for farmers aiming to meet this escalating demand, positioning the company to benefit from this sustained growth trend.

Carr's Group is strategically evaluating the potential to enter new geographic markets, with a specific focus on grazing-based regions in the southern hemisphere. This move aims to counter the seasonality inherent in its existing northern hemisphere operations.

By diversifying geographically, Carr's can tap into counter-seasonal demand, potentially smoothing out revenue streams. For instance, expanding into markets like Australia or New Zealand during their respective growing seasons could significantly boost sales of their animal nutrition products.

This expansion offers a dual benefit: reducing reliance on a single hemisphere's agricultural cycles and opening up substantial new revenue streams. The company's proactive approach to identifying these growth geographies underscores a commitment to long-term market share expansion and resilience.

Carr's Group's focus on 'research proven' products and its Global New Product Development program are significant opportunities. This commitment fosters continuous innovation in livestock nutrition, allowing the company to develop advanced supplements. For instance, in the fiscal year ending September 2023, Carr's Group invested £10.6 million in R&D, a key driver for these advancements.

Leveraging patented technology presents another avenue for growth. This can solidify Carr's Group's position as a market leader and unlock new revenue streams. The company's strong track record in developing specialized animal feeds and nutritional solutions, supported by ongoing research, positions it well to capitalize on emerging trends in sustainable and efficient livestock farming.

Leveraging Streamlined Structure for Efficiency and Growth

Carr's Group's streamlined structure, following the sale of its Engineering Division, presents a significant opportunity to sharpen its focus on the Agriculture Division. This simplification allows for more strategic allocation of capital and resources, directly fueling growth within its core business. For instance, with the Engineering Division divested, Carr's can now channel its financial capacity into expanding its animal nutrition and crop care offerings, areas where it holds strong market positions.

The enhanced focus on agriculture is expected to translate into improved operational efficiency and profitability. By concentrating on its core competencies, Carr's can optimize its supply chains, streamline production processes, and invest in innovation within the agricultural sector. This strategic alignment is crucial for capitalizing on market trends and driving higher operating margins, potentially building on the reported revenue growth in its Agriculture segment.

- Optimized Capital Deployment: Resources previously tied to the Engineering Division can now be directed towards high-growth agricultural initiatives.

- Enhanced Focus on Core Business: Simplification allows for greater investment in and attention to the Agriculture Division's market-leading products and services.

- Improved Operating Margins: Streamlined operations and a clearer strategic direction are expected to boost profitability within the Agriculture segment.

- Capitalizing on Market Leadership: The company can leverage its strengthened position to further expand its market share in animal nutrition and crop care.

Strengthening Sustainability and ESG Contributions

Carr's Group's commitment to enhancing livestock health and productivity directly supports a reduced agricultural carbon footprint by boosting efficiency. For instance, by improving feed conversion ratios, farmers can achieve the same output with fewer resources, thereby lowering greenhouse gas emissions per unit of product. This focus aligns with growing global demands for sustainable food production.

Further investment in Environmental, Social, and Governance (ESG) initiatives, particularly the measurement and management of Scope 3 emissions, presents a significant opportunity. By transparently reporting on these indirect emissions, Carr's Group can bolster its brand reputation and attract environmentally conscious investors and consumers. This proactive approach is becoming increasingly crucial for market competitiveness.

The company can leverage its sustainability efforts to gain a competitive edge. For example, a 2024 report by McKinsey indicated that companies with strong ESG performance often exhibit higher profitability and lower cost of capital. Carr's Group's continued focus on these areas, including potential partnerships for circular economy initiatives within the agricultural supply chain, could unlock new market segments and strengthen stakeholder relationships.

- Enhanced Brand Reputation: Demonstrating a clear commitment to ESG principles, including Scope 3 emissions, can significantly improve Carr's Group's standing with investors and consumers.

- Market Access and Growth: A strong sustainability profile can open doors to new markets and partnerships that prioritize environmentally responsible suppliers.

- Operational Efficiency: Initiatives aimed at improving livestock health and productivity inherently lead to more efficient resource utilization, reducing waste and environmental impact.

- Investor Appeal: Growing investor interest in sustainable investments means that robust ESG performance can attract capital and potentially lower the cost of financing.

The increasing global demand for protein, particularly in meat production, presents a significant opportunity for Carr's Group. Their expertise in livestock nutrition, evidenced by a £10.6 million R&D investment in FY23, allows them to develop advanced solutions to meet this growing need. The company's strategic move into southern hemisphere markets aims to capitalize on counter-seasonal demand, potentially smoothing revenue and expanding market share.

Carr's Group's focus on innovation, backed by patented technology, positions them to lead in efficient and sustainable livestock farming. The divestment of their Engineering Division allows for optimized capital deployment, sharpening their focus on the Agriculture segment and potentially improving operating margins. Furthermore, their commitment to ESG initiatives, including Scope 3 emissions management, enhances brand reputation and attracts environmentally conscious investors.

Threats

Carr's Group faces significant challenges from volatile input costs. For instance, global grain prices, a key component for their animal feed business, saw considerable swings in 2024. The price of wheat, a primary ingredient, experienced a notable increase of over 15% in the first half of 2024 due to adverse weather conditions in major producing regions, directly impacting Carr's procurement expenses.

Energy costs, another critical factor for manufacturing and transportation, also remain a persistent threat. As of late 2024, oil prices continued to exhibit unpredictability, with Brent crude fluctuating between $75 and $90 per barrel. These fluctuations directly squeeze Carr's profit margins, creating uncertainty in financial planning and potentially affecting their ability to maintain competitive pricing.

Extreme weather events, such as prolonged droughts or intense rainfall, directly threaten Carr's Group's agricultural inputs business. These conditions can degrade pasture quality and impact livestock health, reducing the demand for their animal nutrition supplements. For instance, the ongoing drought conditions in the southern United States in 2024 have already strained agricultural producers, potentially dampening sales for companies like Carr's.

Outbreaks of animal diseases like avian flu or swine fever represent a significant threat to Carr's Group. These events can drastically reduce livestock populations, leading to severe trade restrictions and a dampened demand for animal feed and supplements. For instance, the global impact of African Swine Fever, which has affected millions of pigs since its emergence, highlights the potential for widespread disruption in the agricultural supply chain, directly impacting companies like Carr's that supply essential inputs to the livestock sector.

Intense Competition and Market Saturation

Carr's Group faces a highly competitive landscape in the animal feed and supplement sector, challenged by established global corporations and agile regional producers. This intense rivalry can exert downward pressure on pricing, potentially shrinking market share and necessitating higher marketing investments, which could impact profitability.

For instance, the global animal feed market, valued at approximately $450 billion in 2023, is projected to grow at a CAGR of around 3.5% through 2030. Within this, the UK feed market, a key operational area for Carr's, experienced a slight contraction in volume in recent years due to economic factors, intensifying competition for available sales.

- Market Saturation: The animal feed market, particularly in developed regions, shows signs of saturation, limiting organic growth opportunities.

- Price Sensitivity: Customers, especially in the agricultural sector, are often price-sensitive, forcing suppliers to compete on cost.

- Innovation Costs: Staying ahead requires continuous investment in research and development for new formulations and sustainable practices, adding to operational expenses in a competitive environment.

Evolving Agricultural Regulations and Trade Policies

Changes in agricultural regulations, such as stricter animal welfare or feed safety standards, could increase Carr's Group's compliance costs. For instance, new environmental protection mandates in key markets might necessitate investments in updated production processes.

Evolving international trade policies present a significant threat. Tariffs or quotas imposed on key imported ingredients or exported finished goods could disrupt supply chains and reduce market access, impacting profitability. In 2024, for example, ongoing trade tensions between major agricultural blocs continue to create uncertainty for global food ingredient suppliers.

- Increased Compliance Costs: New regulations on feed safety or environmental impact could necessitate capital expenditure for Carr's Group.

- Trade Barriers: Tariffs or import restrictions on ingredients or finished products can negatively affect margins and market reach.

- Supply Chain Disruptions: Sudden policy shifts can interrupt the flow of essential raw materials or finished goods.

Carr's Group operates in a highly competitive environment, facing pressure from both large global players and smaller, agile regional competitors. This intense rivalry can lead to price wars, eroding profit margins and requiring increased marketing spend to maintain market share. For example, the UK animal feed market saw a slight volume contraction in recent years, intensifying competition among suppliers.

Regulatory changes, particularly concerning feed safety and environmental impact, pose a significant threat. Increased compliance costs associated with new mandates could necessitate capital expenditure, impacting profitability. Furthermore, evolving international trade policies, including potential tariffs and quotas on key ingredients or finished goods, risk disrupting supply chains and limiting market access.

| Threat Category | Specific Threat | Impact on Carr's Group | Example/Data (2024/2025) |

|---|---|---|---|

| Competition | Market Saturation & Price Pressure | Reduced margins, potential market share loss | UK feed market volume contraction, intense rivalry |

| Regulatory & Trade | Stricter Regulations (e.g., feed safety) | Increased compliance costs, capital expenditure | Potential new environmental protection mandates |

| Regulatory & Trade | Trade Barriers (tariffs, quotas) | Supply chain disruption, reduced market access | Ongoing trade tensions impacting global food ingredient suppliers |

SWOT Analysis Data Sources

This Carr's Group SWOT analysis is built upon a foundation of comprehensive data, including their latest financial reports, detailed market research, and expert industry commentary to provide a robust strategic overview.