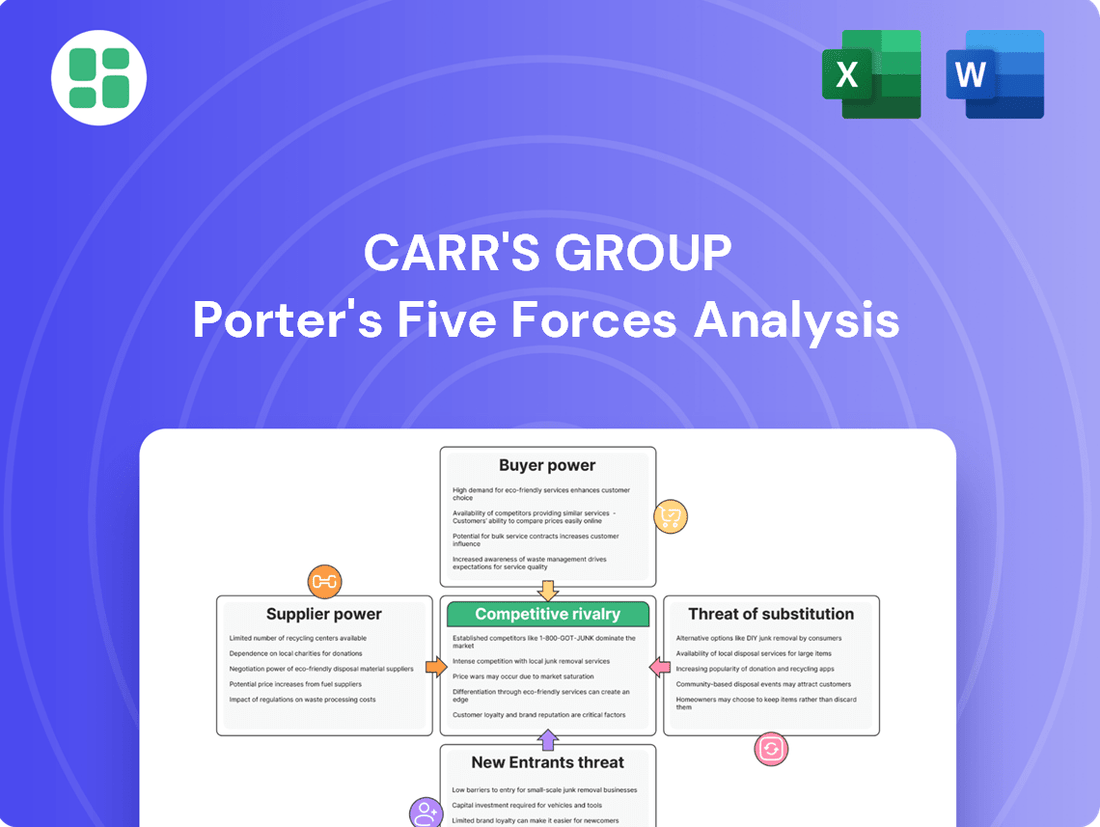

Carr's Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carr's Group Bundle

Carr's Group navigates a landscape shaped by moderate buyer power and the ever-present threat of substitutes in its core markets. Understanding the intensity of these forces is crucial for any strategic outlook.

The complete report reveals the real forces shaping Carr's Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Carr's Group is significantly shaped by how concentrated and specialized the supplier base is across its operational segments. In the agriculture sector, a broad and diverse range of grain suppliers generally limits individual supplier leverage. However, when it comes to specialized feed ingredients or unique processing machinery, suppliers with niche expertise can command greater influence, potentially increasing costs for Carr's Group.

For Carr's Group's engineering division, which underwent a significant disposal in April 2025, the situation was different. This division often relied on highly specialized components, particularly for demanding sectors like nuclear and oil & gas. The limited number of suppliers possessing the requisite technical skills and certifications for these critical parts meant these suppliers held substantial bargaining power.

The uniqueness of inputs and the associated switching costs significantly influence the bargaining power of suppliers for Carr's Group. If the company relies on proprietary or highly specialized components, especially those relevant to its former engineering operations, changing suppliers could incur substantial costs related to re-tooling, re-certification, or the potential loss of intellectual property.

In the agriculture division, while many feed ingredients are commoditized, the presence of patented nutritional supplements or specialized farm machinery parts could introduce higher switching costs. This means suppliers of these unique inputs can command better terms, increasing their bargaining power.

Suppliers' capacity to integrate forward, meaning they start producing the final products themselves, significantly boosts their leverage over Carr's Group. If a key supplier of animal feed ingredients were to establish its own feed production facilities, it could directly compete with Carr's existing operations, thereby increasing its bargaining power.

In the engineering division, a manufacturer of highly specialized components might possess the capability to develop and market finished engineering products. However, this move typically demands substantial investment in manufacturing, distribution, and market penetration, which can be a considerable barrier to entry for many suppliers.

Importance of Carr's to Supplier's Business

The significance of Carr's Group's business to its suppliers' overall revenue is a key determinant of supplier bargaining power. If Carr's represents a substantial portion of a supplier's sales, that supplier may be less inclined to push for unfavorable terms, thus reducing their leverage.

Conversely, if Carr's is a minor client to a large, diversified supplier, the supplier would likely possess greater bargaining power due to their ability to absorb the loss of Carr's business more easily.

- Supplier Dependence: A supplier heavily reliant on Carr's for a significant percentage of their income will have less power to dictate terms.

- Carr's Market Share: The proportion of Carr's business relative to a supplier's total client base influences the supplier's willingness to be demanding.

- Supplier Diversification: Suppliers with a broad customer base are less vulnerable to losing any single client, increasing their potential bargaining power.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for Carr's Group. If Carr's can easily switch to alternative raw materials for its animal feed or different components for its engineering machinery without substantial cost or operational disruption, the power of existing suppliers is naturally reduced. This is because suppliers would be less able to dictate terms if Carr's has viable alternatives readily accessible in the market.

However, the situation changes when Carr's relies on highly specialized or patented inputs. In such cases, the limited availability of substitutes can significantly bolster the bargaining power of those specific suppliers. For instance, if a particular ingredient for a specialized animal feed blend is only produced by a handful of companies or is protected by patents, Carr's would have fewer options, giving those suppliers more leverage in price negotiations and contract terms.

- Limited Substitutes for Key Ingredients: In 2024, Carr's Group's reliance on specific nutrient blends or additives for its premium animal feed ranges could present a challenge if these components have few readily available alternatives.

- Specialized Engineering Components: For its engineering division, the availability of custom-machined parts or specific hydraulic systems might be limited, potentially increasing supplier power for those critical inputs.

- Impact on Cost Structure: A lack of substitutes for essential inputs can directly inflate Carr's cost of goods sold, impacting profitability.

The bargaining power of suppliers for Carr's Group is influenced by the concentration and specialization of its supplier base. For its agriculture division, a broad base of grain suppliers generally limits individual leverage, but specialized feed ingredients or machinery suppliers with niche expertise can exert more influence. The engineering division, prior to its disposal in April 2025, faced a situation where suppliers of highly specialized components for sectors like nuclear and oil & gas held significant power due to a limited number of qualified providers.

The uniqueness of inputs and switching costs also play a crucial role. Proprietary or specialized components, particularly those formerly used in the engineering division, can lead to substantial costs if Carr's needs to change suppliers, such as for re-tooling or re-certification. While many agricultural feed ingredients are commoditized, patented nutritional supplements or specialized farm machinery parts can increase switching costs, thereby enhancing supplier bargaining power.

Suppliers' ability to integrate forward and Carr's significance to a supplier's revenue are key factors. If a key supplier of animal feed ingredients were to start its own feed production, it would directly compete with Carr's, increasing its leverage. Conversely, if Carr's represents a large portion of a supplier's sales, that supplier is likely to be less demanding, reducing their bargaining power. In 2024, the availability of substitutes for essential inputs directly impacted Carr's cost of goods sold; for instance, limited alternatives for specific nutrient blends in premium animal feed or custom-machined parts for the engineering division could inflate costs.

| Factor | Impact on Carr's Group | 2024 Relevance |

| Supplier Concentration | High concentration increases supplier power. | Limited number of specialized component suppliers for former engineering division. |

| Uniqueness of Inputs | Proprietary or patented inputs grant suppliers leverage. | Patented nutritional supplements for animal feed; custom parts for engineering. |

| Availability of Substitutes | Abundant substitutes reduce supplier power. | Commoditized grain supply vs. limited alternatives for specialized feed ingredients. |

| Supplier Dependence on Carr's | Low dependence strengthens supplier power. | Suppliers with diversified client bases are less affected by Carr's business. |

What is included in the product

This analysis dissects the competitive landscape for Carr's Group, evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis tailored for Carr's Group.

Customers Bargaining Power

The bargaining power of customers within Carr's Agriculture division is significantly influenced by client concentration and their purchase volumes. Large agricultural cooperatives or major distributors, by virtue of their substantial buying power, can indeed exert considerable pressure on pricing and payment terms. This is a key consideration as Carr's continues to strategically emphasize its agriculture segment.

Customer switching costs, which reflect how easily customers can move to a different supplier, significantly impact their bargaining power. For Carr's Group's animal feed and nutritional supplements, these costs can be moderate. Switching might involve adjustments to feeding routines, potential impacts on livestock performance during the transition, and the effort of building new supplier relationships.

In contrast, the historical engineering division faced higher switching costs for its customers. Moving away from established specialist equipment suppliers would have entailed substantial expenses due to the need for integrating critical components and navigating complex regulatory approval processes, thereby reducing customer power.

Customer price sensitivity is a significant factor for Carr's Group, particularly within its agriculture division. Farmers, operating with often thin profit margins, are highly attuned to the cost of essential inputs like animal feed and supplements. For instance, in 2024, fluctuating commodity prices for grains, a key component of animal feed, directly influenced farmer purchasing decisions and their willingness to absorb price increases from suppliers.

This heightened sensitivity means that any rise in Carr's Group's input costs or operational expenses can quickly translate into pressure on their pricing. Economic downturns or adverse climatic conditions, which can impact crop yields and livestock health, further amplify this price-consciousness among agricultural customers. They will actively seek out the most economical options to maintain their own profitability.

Threat of Backward Integration by Customers

The threat of customers integrating backward, meaning they start producing their own feed or supplements, can significantly boost their bargaining power. This is particularly relevant for basic feed components, where large agricultural operations might consider self-production to reduce costs.

While less likely for highly specialized nutritional products, the potential for large enterprises to internalize production of simpler feed ingredients poses a risk. For instance, a major farming cooperative with substantial resources could explore manufacturing basic feed mixes, thereby reducing their reliance on external suppliers like Carr's Group.

- Customer Backward Integration: Large agricultural entities might produce their own feed or supplements.

- Impact on Power: This action directly increases customer bargaining power.

- Feasibility for Basic Components: Self-production is more viable for standard feed ingredients than specialized nutritional products.

- Example: A large farming cooperative could potentially manufacture basic feed mixes.

Customer Information Availability

The increasing availability of information to customers significantly bolsters their bargaining power. With readily accessible data on product alternatives and pricing, consumers are empowered to make more informed purchasing decisions.

In 2024, the digital landscape has further amplified this trend. Customers can effortlessly compare offerings from various agricultural product and service providers, driving down prices and demanding better value. This transparency forces companies to be more competitive.

- Informed Consumers: Customers now have unprecedented access to competitor pricing and product specifications.

- Price Sensitivity: Increased information leads to greater price sensitivity among buyers.

- Negotiation Leverage: Well-informed customers can negotiate more effectively for better terms and prices.

Customers in Carr's Group's agriculture segment possess significant bargaining power, driven by their price sensitivity and the increasing availability of information. In 2024, fluctuating grain prices directly impacted farmers' purchasing decisions, making them highly receptive to competitive pricing from suppliers like Carr's. This environment necessitates efficient operations to manage input costs and maintain favorable pricing strategies.

Full Version Awaits

Carr's Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Carr's Group, detailing the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the industry. The document you see here is exactly what you’ll be able to download after payment, offering a comprehensive and ready-to-use strategic assessment.

Rivalry Among Competitors

Carr's Group's competitive rivalry is significantly influenced by the number and diversity of players in its core Agriculture division. This sector encompasses animal feed, nutritional supplements, and farm machinery, featuring a broad spectrum of competitors ranging from large, established international corporations to nimble, localized specialists.

For instance, in the UK animal feed market, which Carr's operates within, there are numerous independent and co-operative feed manufacturers. While specific market share data for 2024 is still emerging, historical trends show a fragmented landscape. Major players like AB Agri and ForFarmers compete alongside many smaller, regional mills, each vying for market share through price, product quality, and service offerings.

The farm machinery sector, while less of a primary focus for Carr's post-divestments, also presents a diverse competitive environment. Global manufacturers such as John Deere and CNH Industrial dominate, but they face competition from a multitude of smaller, specialized equipment providers and local dealers who offer tailored solutions and support.

The growth rate within the agriculture sector, especially for livestock supplements, directly impacts how fiercely companies compete. When the market is expanding rapidly, there's often room for everyone to grow, reducing the pressure to steal customers from competitors. For example, the global animal feed additives market, a key area for livestock supplements, was projected to reach approximately USD 38.5 billion in 2024, with a compound annual growth rate (CAGR) of around 5.2% expected through 2030. This robust growth suggests that companies like Carr's Group can pursue expansion strategies without necessarily engaging in cutthroat battles for existing market share.

Carr's Group focuses on differentiating its agricultural offerings by leveraging patented technology and research-backed solutions, exemplified by their specialized feed blocks and boluses designed for livestock. This product innovation aims to create unique value for farmers, moving beyond simple commodity pricing. In 2024, the agricultural sector continued to see a demand for specialized inputs that enhance animal health and productivity, a trend Carr's is positioned to capitalize on through its R&D efforts.

The company cultivates strong brand loyalty by consistently delivering effective products and building trust within the farming community. This loyalty acts as a significant barrier against intense price competition, as farmers may be willing to pay a premium for reliable and proven solutions. For instance, positive farmer testimonials and repeat purchase rates are key indicators of this loyalty, helping to secure Carr's market share even when faced with lower-cost alternatives.

Exit Barriers in the Industry

High exit barriers can indeed fuel competitive rivalry. When it's difficult or costly for companies to leave an industry, even those that are struggling may persist, leading to intensified competition. This can manifest as price wars or aggressive market share battles.

For Carr's Group, while they have exited their engineering division, the remaining agriculture operations likely involve significant fixed assets. Think about specialized manufacturing plants for feed supplements or large-scale distribution networks. These represent substantial investments that aren't easily liquidated, creating a form of exit barrier.

The persistence of these assets, even if not fully utilized or profitable, can trap capital and management attention, forcing continued engagement in a potentially challenging market. This can keep the rivalry alive, as these companies are less likely to simply shut down operations.

- Specialized Assets: Manufacturing facilities for animal feed, for example, are not easily repurposed, locking in capital.

- Long-Term Contracts: Existing supply agreements or distribution contracts can obligate companies to continue operations.

- Divestment Challenges: Finding a buyer for specialized agricultural assets might be difficult, increasing the cost of exiting.

- Brand Reputation: A long-standing presence in the agricultural sector can also be a factor, as companies may be reluctant to abandon established market positions.

Fixed Costs and Capacity Utilization

Carr's Group operates in sectors like animal feed manufacturing, which inherently carry significant fixed costs. When demand falters and capacity utilization dips, the pressure to cover these overheads intensifies. This often translates into aggressive pricing strategies as companies try to boost sales volume, creating a challenging competitive landscape. For instance, in the UK feed sector, margins can be tight, and any underutilization of expensive production facilities can quickly impact profitability.

Carr's strategic emphasis on operational efficiency and rigorous cost management is therefore crucial for navigating this environment. By optimizing production processes and controlling expenses, the company can better absorb the impact of fluctuating demand and maintain competitiveness even when capacity utilization is not at its peak. This focus allows them to compete more effectively against rivals who may be less adept at cost control.

- High Fixed Costs: Industries like animal feed production require substantial investment in plant and machinery, leading to high fixed operational expenses.

- Capacity Utilization Impact: Low capacity utilization forces companies to spread fixed costs over fewer units, increasing per-unit costs and incentivizing price competition to drive volume.

- Carr's Strategy: Carr's Group's focus on operational efficiency and cost reduction is vital for mitigating the pressures of intense rivalry driven by fixed costs and utilization rates.

Carr's Group faces a competitive agricultural market with numerous players, from large global entities to smaller regional specialists, particularly in its core animal feed and nutritional supplements segments. The farm machinery sector, though less central, also features intense competition from major manufacturers and niche providers.

The growth rate of the agriculture sector, especially for livestock supplements, influences rivalry intensity. For example, the global animal feed additives market was projected to reach approximately USD 38.5 billion in 2024, with a projected CAGR of around 5.2% through 2030, indicating that expansion opportunities may temper direct competition for market share.

Carr's strategy of product differentiation through research-backed solutions and building brand loyalty helps mitigate direct price-based rivalry. This focus on unique value, evident in their specialized feed blocks and boluses, aims to secure market position by fostering farmer trust and repeat business, even against lower-cost alternatives.

SSubstitutes Threaten

The threat of substitutes for Carr's agriculture products hinges on how effectively alternative solutions can match or surpass the price-performance of their offerings in livestock nutrition and farm machinery. If farmers find cheaper ways to achieve comparable animal health and productivity, this threat escalates.

For instance, if new, lower-cost feed additives emerge that boost animal growth as effectively as Carr's existing products, or if advancements in autonomous farming equipment reduce the need for traditional machinery maintenance and parts, Carr's market position could be challenged.

In 2023, the global animal feed additives market was valued at approximately $20 billion and is projected to grow, indicating a dynamic landscape where innovative and cost-effective substitutes could emerge. Similarly, the agricultural machinery sector sees continuous innovation, with some segments experiencing price pressures that could make alternatives more appealing.

The threat of substitutes for Carr's Group's animal feed products is moderate. Farmers, the primary buyers, often stick to familiar feeding regimes due to tradition and a perceived risk associated with trying new products. For instance, in 2024, the UK agricultural sector, a key market for Carr's, continued to emphasize established practices, although there's a growing awareness of efficiency gains.

Switching to alternative feed sources or different nutritional formulations requires clear, demonstrable benefits. A significant shift would likely be driven by substantial cost savings or proven improvements in animal health and productivity, which might not always be immediately apparent to the end-user.

The availability of alternative technologies, particularly in agriculture, presents a significant threat to Carr's Group. For instance, precision farming techniques that optimize nutrient delivery or new genetic approaches reducing reliance on external supplements can diminish the demand for traditional products.

Carr's Group actively counters this by emphasizing its commitment to research-backed products. This focus aims to ensure its offerings remain relevant and competitive against these evolving agricultural technologies, a strategy crucial for maintaining market share in a dynamic sector.

Changes in Farming Practices

Shifts in farming practices represent a significant threat of substitutes for Carr's Group. For instance, a move towards more extensive grazing or different livestock management systems could decrease the demand for specific feed supplements or machinery that Carr's currently provides. This is particularly relevant as many farmers are exploring alternative methods to reduce costs and environmental impact.

Carr's Group's strategy acknowledges this by focusing on pasture-based livestock supplements, aligning with evolving market trends. However, if these alternative practices gain substantial traction, they could bypass the need for traditional inputs, thereby diminishing the market for Carr's core offerings. For example, the increasing popularity of regenerative agriculture techniques might lead to a reduced reliance on manufactured feed additives.

- Reduced Demand for Specific Feed Supplements: As farming practices evolve, the need for certain types of feed supplements could decline, impacting Carr's sales volume.

- Shift to Alternative Livestock Management: Changes like increased reliance on natural grazing or different animal husbandry methods can lessen dependence on machinery and processed feed.

- Alignment with Market Trends: Carr's focus on pasture-based supplements is a strategic response, but the pace of change in farming practices can outstrip adaptation.

- Potential for Disintermediation: New farming models might directly source or produce their own supplements, bypassing traditional suppliers like Carr's.

Indirect Substitutes for Productivity

Farmers can achieve greater productivity and profitability through avenues other than traditional inputs like feed or fertilizer. For instance, advanced data analytics platforms are increasingly being used for precise herd management, optimizing breeding, health, and feeding strategies. This can lead to significant improvements in output without necessarily increasing the volume of purchased feed. In 2024, the global agricultural analytics market was valued at approximately $2.5 billion and is projected to grow substantially, indicating a strong adoption of these indirect substitutes.

Similarly, innovations in crop genetics and cultivation techniques are yielding higher crop outputs from the same or even less land. Improved crop yields directly reduce a farmer's reliance on purchasing supplementary feed for livestock, thereby acting as a substitute for traditional input providers. For example, advancements in drought-resistant corn varieties can buffer against yield losses, lessening the need for costly feed purchases during challenging seasons. The global seed market, a key enabler of these yield improvements, was estimated to be over $60 billion in 2024.

These indirect substitutes, by offering alternative pathways to enhanced farm profitability, can siphon demand away from traditional agricultural input suppliers. Farmers might reallocate capital from purchasing feed or fertilizers to investing in technology or higher-yielding seeds. This shift in investment priorities poses a threat as it diminishes the market share and revenue potential for companies focused solely on conventional inputs.

Key indirect substitutes impacting farm productivity include:

- Precision Livestock Farming: Utilizing sensors and data analytics to optimize animal health, nutrition, and reproduction, reducing reliance on bulk feed purchases.

- Advanced Crop Genetics: Developing seeds with higher yields, disease resistance, and improved nutrient uptake, minimizing the need for fertilizers and potentially reducing feed requirements for livestock.

- Farm Management Software: Platforms that integrate data from various farm operations to improve decision-making, resource allocation, and overall efficiency, indirectly boosting productivity.

- Vertical Farming and Controlled Environment Agriculture: While a different farming model, these can offer highly efficient, localized production, potentially reducing the overall demand for traditional agricultural inputs on a larger scale.

The threat of substitutes for Carr's Group's feed products is moderate, as farmers often prefer established feeding practices. However, advancements in precision farming and genetics offer alternative routes to farm productivity. For instance, in 2024, the agricultural analytics market reached approximately $2.5 billion, highlighting a significant shift towards data-driven solutions that can optimize livestock management and reduce reliance on traditional feed inputs.

Similarly, innovations in crop genetics, with the global seed market valued over $60 billion in 2024, allow farmers to achieve higher yields, potentially decreasing their need for supplementary feed for livestock. This diversion of capital towards technology and improved genetics can diminish the market for conventional input suppliers like Carr's.

| Substitute Category | Example | Impact on Carr's Group | Market Size/Growth (2024 Data) |

| Data Analytics & Precision Farming | Herd management software, sensor technology | Reduces reliance on bulk feed purchases by optimizing nutrition and health. | Agri-analytics market: ~$2.5 billion, growing. |

| Advanced Crop Genetics | High-yield, disease-resistant seeds | Increases farm output, potentially lowering demand for livestock feed. | Global Seed Market: >$60 billion. |

| Alternative Livestock Management | Regenerative agriculture, extensive grazing | Decreases demand for specific feed supplements and machinery. | Growing adoption, specific market size varies. |

| New Feed Additives/Formulations | Cost-effective, high-efficacy alternatives | Directly competes with Carr's feed products on price and performance. | Global animal feed additives market: ~$20 billion (2023), growing. |

Entrants Threaten

The agriculture sector, particularly animal nutrition where Carr's Group concentrates its efforts, demands significant upfront capital. Establishing modern manufacturing facilities, investing in ongoing research and development for product innovation, and building robust distribution channels all require substantial financial outlay, effectively deterring potential new competitors.

Furthermore, cultivating a trusted and recognized brand in the animal nutrition market is not merely about product quality; it necessitates considerable investment in marketing, sales, and customer support. This brand building, crucial for market penetration and customer loyalty, adds another layer of financial barrier for newcomers aiming to compete with established players like Carr's Group.

Strict regulatory hurdles and the need for certifications in animal feed and veterinary supplements, covering aspects like feed safety and health standards, present a significant barrier to new entrants. Navigating these complex approval processes and adhering to stringent quality controls, especially across the diverse international markets where Carr's Group operates, requires substantial investment and expertise.

Existing players in the agriculture sector, such as Carr's Group, leverage significant economies of scale. This translates to lower per-unit costs in production, bulk purchasing power for raw materials, and more efficient distribution networks. For instance, in 2024, major agricultural input suppliers often operate at volumes that allow them to negotiate substantial discounts from their own suppliers, a benefit new entrants would find difficult to replicate quickly.

Furthermore, the experience curve plays a crucial role. Over years of operation, companies like Carr's develop deep expertise in product formulation, understanding customer needs, and navigating complex regulatory landscapes. This accumulated knowledge allows for optimized processes and more effective market penetration, creating a barrier for newcomers who lack this historical data and practical know-how.

Access to Distribution Channels and Relationships

New companies entering the animal feed sector face significant hurdles in securing access to established distribution networks. Carr's Group benefits from long-standing relationships with farmers and agricultural distributors, built over years of reliable service and brand development. This existing infrastructure makes it difficult for newcomers to penetrate the market and gain the trust necessary to move their products effectively.

The established presence of Carr's in the agricultural supply chain acts as a substantial barrier. For instance, in 2024, Carr's Group reported that its UK Agri-food segment, which includes animal feed, continued to be a core contributor to its performance. New entrants would need to invest heavily in replicating this extensive network, a costly and time-consuming endeavor.

- Established Distribution Networks: Carr's possesses a deeply entrenched network of relationships with farmers and agricultural distributors, a key asset.

- Brand Recognition and Trust: Years of operation have fostered significant brand recognition and trust, which are difficult for new entrants to replicate quickly.

- Market Penetration Costs: The cost and time required for new companies to build comparable distribution channels and customer relationships are substantial deterrents.

- Farmer Loyalty: Existing relationships often translate to farmer loyalty, making it challenging for new feed suppliers to gain initial orders and build momentum.

Brand Identity and Customer Loyalty

Carr's Group benefits significantly from its market-leading brands and patented livestock supplements. This strong brand identity cultivates deep customer loyalty among farmers, making it difficult for new entrants to gain traction.

New competitors would face substantial hurdles in replicating Carr's established reputation and product trust. They would need to undertake considerable investment in marketing and product innovation to persuade farmers to switch from their current, reliable suppliers.

- Brand Loyalty: Carr's established brands create a barrier, as farmers are often hesitant to change from trusted suppliers.

- Patented Products: Proprietary livestock supplements offer a unique selling proposition that new entrants must match or exceed.

- Marketing Investment: New entrants require significant capital for marketing to build awareness and overcome existing customer loyalty.

- Switching Costs: Farmers may perceive switching costs, including potential performance differences or supplier relationship disruption, as too high.

The threat of new entrants for Carr's Group in its core animal nutrition market is generally low. Significant capital investment is required for modern manufacturing, R&D, and distribution, acting as a primary deterrent. For example, establishing a new feed mill with advanced technology and compliance standards could easily cost tens of millions of pounds.

Building brand recognition and trust in this sector is a lengthy and expensive process, demanding substantial marketing and sales efforts. Furthermore, stringent regulatory requirements for feed safety and health certifications across various international markets add complexity and cost, necessitating expertise that new players may lack.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront costs for facilities, R&D, and distribution. | Significant financial hurdle. |

| Brand Loyalty & Trust | Established reputation and customer relationships. | Difficult to penetrate existing farmer loyalty. |

| Regulatory Hurdles | Complex certifications and safety standards. | Requires specialized knowledge and investment. |

| Economies of Scale | Lower per-unit costs for established players. | New entrants face higher initial operating costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Carr's Group leverages data from company annual reports, investor presentations, and industry-specific trade publications. We also incorporate insights from market research reports and financial databases to provide a comprehensive view of the competitive landscape.