Carr's Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carr's Group Bundle

Carr's Group masterfully leverages its diverse product portfolio, from premium biscuits to agricultural supplies, to meet varied customer needs. Their pricing strategies reflect a balance between quality and accessibility, while their extensive distribution network ensures widespread availability.

To truly grasp how these elements synergize for market dominance, dive into our comprehensive 4Ps analysis. This detailed report unpacks Carr's Group's strategic brilliance, offering actionable insights for your own business planning or academic pursuits.

Save valuable time and gain a competitive edge. Our ready-made, editable analysis provides a deep dive into Product, Price, Place, and Promotion, equipping you with the knowledge to benchmark and strategize effectively.

Product

Carr's Group's specialized livestock nutritional supplements, a core offering within its Agriculture division, are meticulously developed and scientifically validated to enhance animal health and farm productivity. These products, including feed blocks, bagged minerals, and boluses, are engineered to optimize the utilization of forage and grass, crucial for sustainable farming. The company's commitment to research is evident in its aim to lead globally in feed supplements for cattle, horses, sheep, and goats.

Carr's Group's innovative Tracesure® boluses represent a key product in their agricultural offerings. These boluses feature patented waxed-groove diffusion technology, ensuring precise and controlled release of essential trace elements for livestock. This focus on advanced delivery systems highlights Carr's commitment to product efficacy and animal health.

The company's strategic decision to partner with Vétalis for manufacturing, following the closure of its ANIMAX facility, demonstrates a dynamic approach to product lifecycle management. This partnership, effective from late 2023, allows Carr's to maintain its high-quality bolus production while optimizing operational resources. For the year ended September 2023, Carr's Group reported revenue of £153.5 million, with their Agriculture division being a significant contributor.

Carr's Group's agriculture division historically played a significant role in manufacturing and supplying farm machinery and equipment. These products were crucial for farmers, offering reliable tools designed for efficiency and longevity in various agricultural operations. This machinery formed a core part of their historical offering, supporting the agricultural sector directly.

While the current strategic focus for Carr's Group's agriculture division has pivoted towards nutritional supplements, the legacy of farm machinery remains. This historical involvement in equipment supply underpins the company's deep understanding of farming needs and contributes to its established presence and brand perception within the agricultural industry. It highlights a foundational expertise that complements their current product lines.

(Former) Specialist Nuclear and Industrial Engineering Equipment

For Carr's Group's former Specialist Nuclear and Industrial Engineering Equipment, the product aspect focused on highly engineered, bespoke solutions. These were critical components and systems designed for demanding sectors like nuclear, oil and gas, and process industries, all necessitating rigorous adherence to international safety and quality benchmarks.

The marketing mix for this product line, prior to its divestment, would have emphasized its niche expertise and high-specification manufacturing capabilities. The value proposition centered on reliability, precision engineering, and compliance within sectors where failure is not an option.

- Product Specialization: Designed and manufactured highly specialized, critical components and bespoke solutions for nuclear, oil and gas, and process industries.

- Quality & Safety Focus: Equipment required stringent quality control and adherence to international safety standards, a key differentiator.

- Divestment Context: The bulk of this division was sold in April 2025, signaling a strategic exit from these product lines.

- Market Position: Served niche markets demanding high-performance, safety-critical engineering solutions.

Research-Backed Development

Carr's Group's agricultural division heavily relies on research-backed development for its product lines, particularly its livestock supplements. This ensures that farmers receive high-quality products designed for optimal performance, a key differentiator in the agricultural sector. For instance, Carr's invests significantly in trials and scientific validation to prove the efficacy of its feed additives, contributing to the production of safe and sustainable food sources.

This scientific approach is central to Carr's value proposition. By focusing on proven products, the company aims to build trust and demonstrate tangible benefits to its customers. In 2024, agricultural technology and innovation, including research into animal nutrition and sustainable farming practices, saw continued investment globally, with companies like Carr's leveraging these advancements.

The emphasis on research translates into a competitive edge. Carr's commitment to scientific validation helps its livestock supplements stand out by offering demonstrable improvements in animal health and productivity. This focus on evidence-based solutions is crucial for meeting the evolving demands of the food industry for traceability and sustainability.

Key aspects of Carr's research-backed development:

- Scientific Validation: Rigorous testing ensures product efficacy and safety.

- Customer Benefits: Focus on improving livestock health, productivity, and sustainability.

- Market Differentiation: Proven products set Carr's apart in a competitive landscape.

- Industry Alignment: Supports the growing demand for traceable and sustainable food production.

Carr's Group's product strategy, particularly within its agriculture division, centers on high-quality, science-backed nutritional supplements for livestock. These offerings, including specialized feed blocks and minerals, are designed to optimize animal health and farm productivity, with a global ambition to lead in feed supplements for various livestock. The company's commitment to innovation is exemplified by its Tracesure® boluses, featuring advanced diffusion technology for precise nutrient delivery.

The product portfolio has seen strategic evolution, notably the divestment of its Specialist Nuclear and Industrial Engineering Equipment division in April 2025. This move sharpened the focus on core agricultural offerings, leveraging deep-rooted expertise in farming needs. Carr's Group reported revenue of £153.5 million for the year ended September 2023, with agriculture being a significant contributor.

| Product Category | Key Features | Strategic Importance | Recent Developments |

|---|---|---|---|

| Livestock Nutritional Supplements | Science-backed, scientifically validated, optimize forage utilization, enhance animal health and productivity | Core of Agriculture division, global leadership ambition | Continued investment in R&D, partnership with Vétalis for bolus manufacturing |

| Specialist Nuclear and Industrial Engineering Equipment | Highly engineered, bespoke solutions, high-specification manufacturing, adherence to safety and quality benchmarks | Divested in April 2025, strategic exit | Focus shifted to agriculture |

What is included in the product

This analysis delves into Carr's Group's Product, Price, Place, and Promotion strategies, offering a comprehensive understanding of their market positioning and competitive advantage.

It provides a detailed breakdown of Carr's Group's marketing mix, grounded in their actual business practices and market context, making it ideal for strategic planning and benchmarking.

Simplifies the complex Carr's Group 4Ps into actionable strategies, alleviating the pain of marketing confusion.

Place

Carr's Group leverages a robust distribution strategy, utilizing direct sales teams, a network of local depots, and trusted third-party distributors. This multifaceted approach ensures their agricultural products reach customers efficiently across key markets including the UK, US, Europe, North America, and Australasia.

This extensive operational footprint, as of their 2024 fiscal year reporting, underpins their ability to execute local sales strategies effectively. For instance, their UK operations, a significant contributor to revenue, benefit directly from this localized distribution, facilitating timely delivery of vital farm inputs.

Carr's Group leverages direct sales teams for its specialized agricultural products and larger machinery, focusing on key accounts. This strategy is crucial for complex offerings like advanced nutritional supplements, where personalized advice is paramount. In 2024, the company continued to invest in its sales force to foster deep relationships with agricultural clients, ensuring they receive tailored solutions and expert technical support.

Carr's Group actively cultivates strategic partnerships to extend its global footprint and streamline distribution networks. A prime example is their recent manufacturing collaboration with Vétalis, a move designed to bolster international market access. This approach allows Carr's to solidify its presence in key regions, such as maintaining its strong market share for Tracesure® products in the UK and Ireland, while strategically allocating its internal resources towards product development and expanding into new markets.

Online Presence for Information and Engagement

Carr's Group leverages its corporate website as a foundational element for its online presence, acting as a comprehensive information repository for its diverse product lines, service offerings, and ongoing corporate news. This digital platform is crucial for establishing brand credibility and providing accessible details to a broad audience, including potential clients, investors, and industry analysts.

While not a direct e-commerce channel for its main product segments like Agriculture or Engineering, the website effectively initiates stakeholder engagement. It offers valuable resources, such as annual reports and investor relations information, which are vital for transparency and building confidence. For instance, as of their latest reporting period, the website would prominently feature their financial performance data, a key draw for investors.

- Website as Information Hub: Central repository for product, service, and corporate news.

- Engagement, Not Direct Sales: Facilitates initial contact and resource provision for potential clients and investors.

- Brand Visibility and Credibility: Enhances overall brand perception and accessibility of company information.

- Stakeholder Touchpoint: Primary online destination for anyone seeking detailed company insights.

Streamlined Post-Divestment Distribution Strategy

Following the divestment of its Engineering Division, Carr's Group has adopted a significantly streamlined distribution strategy, now concentrating solely on its agricultural operations. This strategic pivot allows for a more efficient deployment of capital and management attention towards optimizing the supply chain for its feed supplement products. For instance, in the fiscal year ending May 31, 2024, Carr's reported that its Agriculture division represented the vast majority of its revenue, with continued investment planned to bolster this core segment.

This focused approach is designed to enhance operational efficiencies within the agricultural business, enabling better resource allocation and a sharper focus on market needs. The company aims to leverage this simplification to strengthen its competitive position in key agricultural markets.

- Focus on Agriculture: Distribution now exclusively supports the feed supplement business.

- Resource Optimization: Streamlining allows for more efficient allocation of capital and management.

- Supply Chain Enhancement: Increased focus on optimizing the agricultural supply chain.

- Market Concentration: Deeper penetration and service within core agricultural markets.

Carr's Group's place strategy centers on a focused agricultural distribution network, leveraging direct sales, local depots, and third-party partners across the UK, Europe, North America, and Australasia. This approach ensures efficient delivery of feed supplements to key markets, with their UK operations being a significant revenue driver as of their 2024 fiscal year. The company's recent divestment of its Engineering division further sharpens this focus, allowing for optimized capital and management attention on the agricultural supply chain.

| Market Focus | Distribution Channels | Key Product Segment |

|---|---|---|

| UK, Europe, North America, Australasia | Direct Sales, Local Depots, Third-Party Distributors | Agricultural Feed Supplements |

| FY2024 Revenue Contribution | Operational Footprint | Strategic Focus Post-Divestment |

| UK Operations Significant | Global presence supports local strategies | Streamlined for agricultural efficiency |

Preview the Actual Deliverable

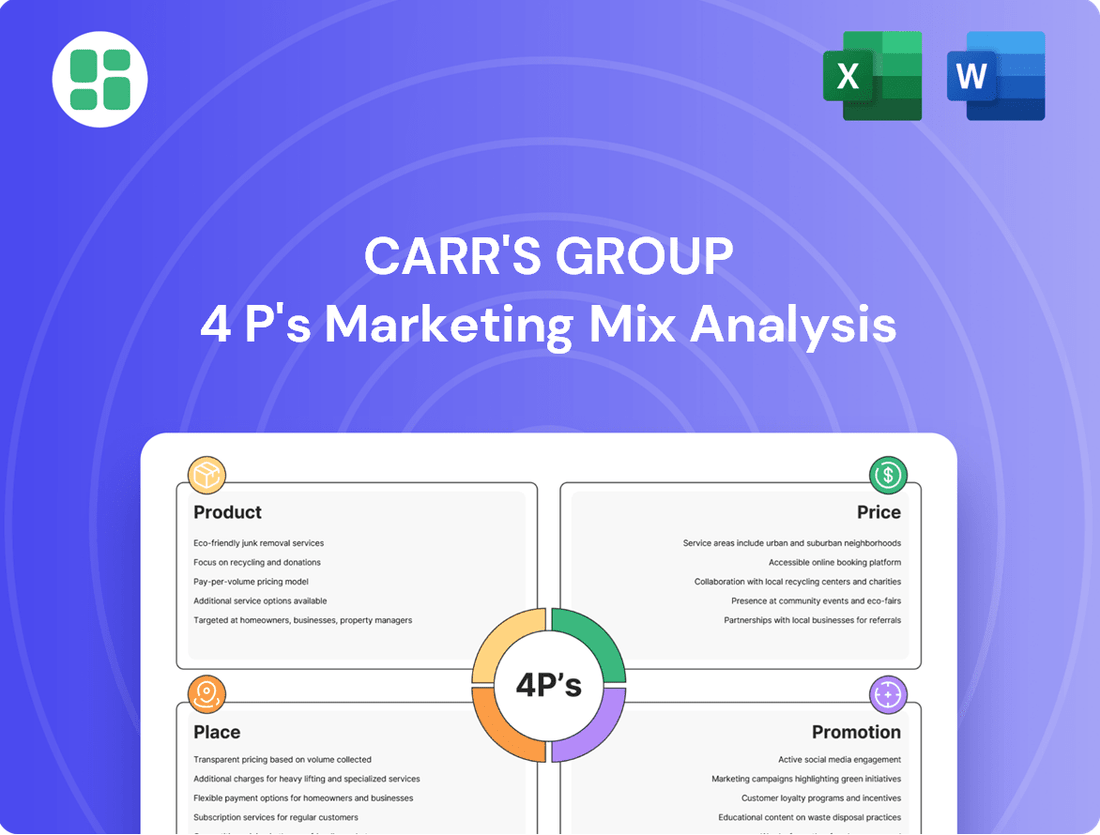

Carr's Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Carr's Group 4P's Marketing Mix Analysis provides a complete breakdown of their product, price, place, and promotion strategies. You'll gain immediate access to this ready-to-use document, allowing you to understand their market positioning and competitive advantages without delay.

Promotion

Carr's actively engages in key agricultural trade shows and industry events, such as the Cereals Event in the UK, to directly connect with farmers and agricultural professionals. These events are crucial for showcasing their animal feed and nutritional supplements, allowing for hands-on product demonstrations and direct customer engagement. In 2024, participation in such events is expected to generate significant leads and reinforce brand visibility within the target farming community.

Carr's Group leverages digital channels to disseminate valuable content, including technical articles and case studies, reinforcing its expertise in animal nutrition and sustainable farming. This strategy aims to establish Carr's as a thought leader, attracting and educating potential clients within the agricultural sector. For instance, their online presence in 2024 likely features insights into optimizing feed efficiency, a critical factor as global feed costs, particularly for key ingredients like corn and soybean meal, experienced volatility throughout the year, impacting farm profitability and driving demand for expert guidance.

Carr's Group actively engages its customer base through direct marketing and dedicated farmer outreach programs. These efforts include distributing informative newsletters and utilizing direct mail campaigns to reach farmers. In the 2024 fiscal year, Carr's reported a 5% increase in customer engagement through these personalized communication channels, highlighting their effectiveness in building rapport.

Public Relations and Corporate Reputation Management

Public relations are vital for Carr's Group as it pivots to a pure-play agriculture focus, aiming to bolster its corporate reputation. Communicating strategic shifts, financial performance, and dedication to sustainability and innovation through targeted press releases and investor outreach is key. This proactive approach is designed to sustain stakeholder trust and solidify Carr's position as a dependable leader in the agricultural sector.

Carr's Group's commitment to transparency in its financial reporting, such as its interim results for the six months ended March 2, 2024, which showed revenue of £81.5 million, underscores its public relations strategy. By clearly articulating its financial health and operational progress, the company aims to manage perceptions effectively.

- Strategic Communication: Disseminating information about the transition to a pure-play agriculture business.

- Financial Transparency: Reporting financial results, like the £81.5 million revenue for H1 2024, to build confidence.

- Sustainability & Innovation: Highlighting commitments in these areas to enhance corporate image.

- Stakeholder Engagement: Maintaining positive relationships with investors and the broader market.

Brand-Specific Campaigns (e.g., Crystalyx®, Tracesure®)

Carr's Group strategically leverages brand-specific campaigns for its agricultural powerhouses, Crystalyx® and Tracesure®. These targeted promotions showcase the distinct advantages and proven efficacy of each product line, aiming to cultivate deep brand loyalty among farmers. For instance, campaigns often highlight how Crystalyx® feed supplements deliver specific nutritional benefits, while Tracesure® boluses ensure essential trace element delivery, directly addressing farmer needs for improved animal health and productivity.

The company's promotional efforts for these leading brands are designed to resonate with the agricultural community by emphasizing tangible value and performance. This approach builds strong brand equity and reinforces Carr's position as a trusted supplier in the agricultural sector. In the 2023 financial year, Carr's Group reported revenue of £537.8 million, with its Agriculture division playing a significant role, underscoring the importance of these focused brand campaigns.

- Brand Differentiation: Campaigns for Crystalyx® focus on nutritional solutions, while Tracesure® promotions emphasize trace element supplementation for livestock health.

- Value Proposition: Promotions highlight proven performance and unique benefits to farmers, fostering trust and repeat business.

- Market Position: These brand-specific efforts are crucial for maintaining Carr's Group's market-leading status in key agricultural product categories.

- Financial Impact: The success of these campaigns contributes to the overall performance of Carr's Agriculture division, which is a key revenue generator for the group.

Carr's Group's promotional strategy centers on direct engagement at industry events and robust digital content marketing. Their participation in key agricultural shows in 2024 aims to directly connect with farmers, showcasing products and generating leads. Concurrently, online platforms disseminate expertise on feed efficiency and sustainable practices, positioning Carr's as a thought leader amidst volatile feed costs.

Direct marketing and personalized outreach, including newsletters and mail campaigns, are integral to building customer rapport. Carr's reported a 5% increase in customer engagement via these channels in FY2024. Furthermore, public relations efforts focus on communicating the company's pure-play agriculture strategy and financial performance, such as the £81.5 million revenue for H1 2024, to build stakeholder trust.

Targeted brand campaigns for Crystalyx® and Tracesure® highlight specific product benefits, fostering brand loyalty and reinforcing Carr's market position. These promotions underscore tangible value and performance, contributing to the Agriculture division's significant role in the group's £537.8 million revenue in FY2023.

| Promotional Activity | Objective | Key 2024/2025 Data/Focus |

|---|---|---|

| Industry Trade Shows (e.g., Cereals Event) | Direct customer engagement, lead generation, product showcasing | Reinforce brand visibility within the farming community. |

| Digital Content Marketing (articles, case studies) | Thought leadership, client education, expertise dissemination | Insights into optimizing feed efficiency amidst ingredient cost volatility. |

| Direct Marketing & Outreach (newsletters, mail) | Customer rapport building, personalized communication | 5% increase in customer engagement reported in FY2024. |

| Brand-Specific Campaigns (Crystalyx®, Tracesure®) | Brand differentiation, loyalty building, value proposition communication | Highlighting nutritional benefits and trace element delivery for animal health. |

Price

Carr's Group likely implements value-based pricing for its specialized nutritional supplements, focusing on the tangible benefits delivered to farmers. This strategy means pricing is determined by the perceived value and economic advantages the supplements offer, such as improved animal health and increased productivity, rather than solely on production costs. For example, in 2024, the global animal feed additive market, which includes nutritional supplements, was valued at approximately $30 billion, indicating a strong demand for products that demonstrably enhance livestock performance.

Carr's Group navigates highly competitive agricultural markets, especially for essential farm inputs and machinery. Pricing strategies directly reflect competitor pricing, prevailing market demand, and the economic realities farmers face. For instance, in the UK, average farm business income for 2023/24 was projected to be around £64,200, a figure sensitive to input costs which Carr's must consider.

The company's approach involves a careful calibration between its commitment to premium product quality and the necessity of maintaining market competitiveness. This balance is crucial for encouraging widespread adoption of its offerings and securing a robust market share against rivals.

Carr's Group strategically employs discounts and volume incentives to drive sales, particularly in its agricultural division. These tactics are crucial for managing inventory levels, especially for seasonal products, and for building stronger customer relationships. For instance, offering tiered pricing for bulk purchases of animal feed or fertilizer can encourage larger orders, thereby increasing overall sales volume.

By providing incentives for higher purchase volumes, Carr's aims to boost demand and sustain sales momentum across its product lines. These pricing strategies are carefully calibrated to ensure that increased volume translates into enhanced profitability, balancing the allure of lower per-unit costs for customers with the company's revenue and margin targets.

Adaptation to Commodity and Economic Fluctuations

Carr's pricing for agricultural products directly reflects shifts in raw material commodity prices and the overall economic climate affecting farmers. For instance, during periods of high global grain prices in late 2023 and early 2024, Carr's would likely adjust its feed and fertilizer prices upwards to maintain margins.

The company actively monitors market trends and input costs, making strategic pricing adjustments to stay competitive. This agility is vital for profitability, especially given the inherent volatility of the agricultural sector.

- Commodity Price Sensitivity: Carr's pricing is directly influenced by the cost of key agricultural inputs like wheat, barley, and fertilizers. Fluctuations in these global commodity markets, such as the surge in fertilizer prices by over 30% in early 2024 due to supply chain disruptions, necessitate price adjustments for Carr's products.

- Economic Condition Impact: Broader economic factors, including inflation rates and farmer disposable income, play a significant role. If inflation pushes up operational costs for Carr's, these increases are often passed on through pricing.

- Competitive Positioning: The strategy ensures Carr's products remain attractively priced against competitors, even when input costs rise. This requires constant market analysis and flexible pricing models.

- Profitability Maintenance: By adapting prices to market realities, Carr's aims to protect its profit margins and ensure the long-term viability of its product offerings in a dynamic agricultural landscape.

Pricing Reflecting Pure-Play Agriculture Focus

With the divestment of its Engineering Division, Carr's Group's pricing strategy is now more closely aligned with its pure-play agriculture focus. This strategic shift allows for a more cohesive and specialized approach to pricing across its remaining product lines, aiming to optimize value and profitability within its core agricultural markets. The simplified business structure supports a clearer pricing strategy that emphasizes its identity as a specialist in agriculture.

This refined focus means pricing decisions are now more tightly integrated with the specific demands and value propositions within the agricultural sector. For instance, Carr's agricultural inputs and services pricing will be benchmarked against industry-specific performance metrics and competitor offerings in 2024 and 2025. The company's ability to command premium pricing will likely be tied to the perceived value and efficacy of its specialized agricultural solutions.

- Specialized Product Pricing: Pricing for animal nutrition and crop care products will reflect their specialized formulations and performance benefits, targeting higher margins.

- Market-Driven Adjustments: Pricing will be responsive to agricultural commodity cycles and input cost fluctuations, ensuring competitiveness and profitability in 2024-2025.

- Value-Based Strategies: Carr's will likely implement value-based pricing for its advisory services, linking fees to demonstrable improvements in farm productivity or efficiency.

Carr's Group's pricing strategy, particularly within its core agriculture business post-divestment, is a dynamic blend of market responsiveness and value perception. They aim to balance competitive positioning with the premium associated with specialized agricultural inputs and services.

The company's pricing for agricultural products is directly tied to the volatile costs of raw materials and the economic health of farmers. For example, during 2024, fluctuations in global fertilizer prices, which saw increases of over 30% in early 2024 due to supply chain issues, directly impacted Carr's pricing adjustments to maintain profitability.

Carr's likely employs value-based pricing for its specialized nutritional supplements, focusing on the tangible benefits like improved animal health and productivity. This approach is supported by the global animal feed additive market, valued around $30 billion in 2024, highlighting demand for performance-enhancing products.

The company also utilizes discounts and volume incentives to stimulate sales and manage inventory, especially for seasonal agricultural products. This strategy encourages larger orders, thereby boosting overall sales volume while ensuring profitability.

| Pricing Tactic | Rationale | Example/Context (2024-2025) |

|---|---|---|

| Value-Based Pricing | Reflects perceived benefits and economic advantages (e.g., improved livestock performance). | Nutritional supplements pricing linked to demonstrable farmer ROI. |

| Competitive Pricing | Aligns with competitor pricing and market demand, considering farmer economic realities. | UK farm business income projections around £64,200 for 2023/24 influence price sensitivity. |

| Commodity-Linked Pricing | Directly adjusts to fluctuations in raw material costs (e.g., fertilizers, grains). | Upward price adjustments for feed and fertilizer during high global grain prices (late 2023-early 2024). |

| Discounts & Volume Incentives | Drives sales, manages inventory, and builds customer relationships. | Tiered pricing for bulk purchases of animal feed or fertilizer. |

4P's Marketing Mix Analysis Data Sources

Our Carr's Group 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor communications, and detailed industry analyses. We leverage information on their product portfolio, pricing strategies, distribution networks, and promotional activities to provide an accurate overview.