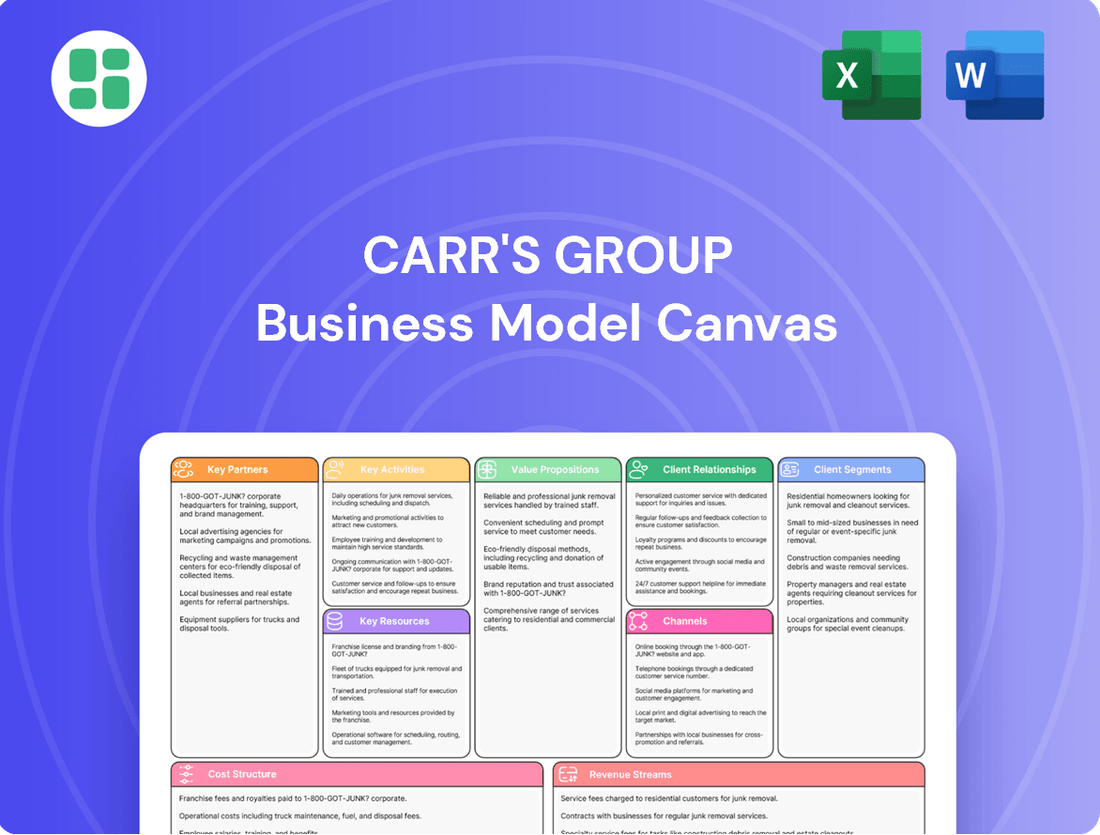

Carr's Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carr's Group Bundle

Unlock the strategic blueprint behind Carr's Group's success with our comprehensive Business Model Canvas. Discover how they effectively serve diverse customer segments and leverage key partnerships to deliver unique value propositions. This detailed analysis offers actionable insights into their revenue streams and cost structure.

Partnerships

Carr's Group actively cultivates strategic manufacturing alliances with specialist producers to bolster its production capacity and broaden its product portfolio. A prime example is the recent collaboration announced with Vétalis, a move designed to leverage specialized manufacturing expertise.

These partnerships are instrumental in enabling Carr's Group to scale its operations effectively and penetrate new geographical markets for its agricultural supplements. By integrating external capabilities, the company can efficiently expand its reach and product availability.

Through these alliances, Carr's Group effectively taps into external expertise and existing infrastructure, which is vital for maintaining a competitive edge in the timely delivery of its products. This approach allows for agility and responsiveness in a dynamic market environment.

Carr's Group actively engages in research and development collaborations, particularly with academic institutions and specialized research bodies. These partnerships are crucial for developing and validating novel livestock supplements and cutting-edge animal nutrition technologies. For instance, in 2024, the company continued to invest in its innovation pipeline, focusing on advancements in feed efficiency and animal health, building upon its established reputation for science-backed solutions.

Carr's Group relies heavily on its key raw material suppliers, particularly for minerals and feed ingredients essential for its animal nutrition products. Establishing and maintaining strong relationships with these partners is crucial for ensuring consistent product quality and effectively managing supply chain costs. These partnerships guarantee the uninterrupted availability of necessary inputs for their feed block and supplement manufacturing operations.

Long-term agreements with these suppliers can also offer significant benefits, such as price stability, which is vital in a market susceptible to commodity price fluctuations. For instance, in the fiscal year ending September 2023, Carr's Group's total revenue was £532.1 million, underscoring the scale of operations and the importance of cost control through stable raw material sourcing.

Distribution Network Partners

Carr's Group actively cultivates relationships with distributors and retailers, a strategy crucial for expanding its reach across diverse customer segments, especially in international agricultural markets. These partnerships are vital for securing market access, managing complex logistics, and leveraging local sales expertise. For instance, in 2024, Carr's continued to rely on a network of third-party distributors to penetrate markets like New Zealand, ensuring efficient product delivery and localized customer support.

These distribution network partners are instrumental in Carr's global expansion, acting as extensions of the company's sales and logistics capabilities. By collaborating with established entities, Carr's can navigate the intricacies of different regional markets more effectively. This approach allows for a quicker and more cost-efficient market entry than building an entirely in-house infrastructure.

- Market Access: Distributors provide immediate entry into new geographic regions, bypassing the need for extensive groundwork.

- Logistics and Supply Chain: Partners manage warehousing, transportation, and delivery, optimizing the supply chain for various agricultural products.

- Local Expertise: Retailers and distributors offer invaluable insights into local consumer preferences, regulatory environments, and competitive landscapes.

- Sales and Marketing: These partners often handle direct sales, promotions, and customer service, amplifying Carr's market presence.

Technology and Innovation Partners

Carr's Group actively seeks partnerships with technology providers to integrate cutting-edge manufacturing processes and digital solutions. These collaborations are crucial for enhancing operational efficiency and driving product innovation.

For instance, in 2024, the company continued to explore advancements in data analytics to optimize its supply chain, aiming for greater visibility and responsiveness. This focus on digital integration supports their strategic goal of improving performance across all business segments.

- Technology Integration: Collaborating with tech firms to adopt smart farming techniques and advanced data analytics for improved resource management.

- Supply Chain Visibility: Partnering with logistics and software providers to enhance real-time tracking and transparency throughout their operations.

- Process Optimization: Working with equipment manufacturers and automation specialists to implement more efficient and sustainable production methods.

- Digital Solutions: Engaging with software developers to create bespoke digital tools that support business strategy and customer engagement.

Carr's Group's key partnerships are foundational to its operational success and market reach. These include strategic manufacturing alliances, such as the one with Vétalis, to enhance production capabilities and product breadth. Furthermore, the company relies on robust research collaborations with academic institutions and specialized bodies to drive innovation in animal nutrition, exemplified by ongoing 2024 investments in feed efficiency technologies.

Crucial raw material suppliers, particularly for essential minerals and feed ingredients, ensure consistent product quality and cost management. Long-term agreements with these partners, like those for fiscal year ending September 2023 where total revenue was £532.1 million, are vital for price stability amidst commodity fluctuations.

Distribution and retail partnerships are paramount for expanding market access globally, with entities like third-party distributors in New Zealand playing a key role in 2024 for efficient delivery and localized support. Technology providers also enable advancements in manufacturing processes and digital solutions, such as data analytics for supply chain optimization explored in 2024.

| Partnership Type | Purpose | Example/Focus Area | Impact |

|---|---|---|---|

| Manufacturing Alliances | Expand production capacity, broaden product portfolio | Vétalis collaboration | Scalability, market penetration |

| R&D Collaborations | Develop novel supplements, advance animal nutrition tech | 2024 innovation investments (feed efficiency) | Science-backed solutions, competitive edge |

| Raw Material Suppliers | Ensure quality, manage costs, guarantee input availability | Minerals, feed ingredients | Consistent product quality, price stability |

| Distributors & Retailers | Secure market access, manage logistics, leverage local expertise | Third-party distributors (e.g., New Zealand in 2024) | Global expansion, cost-efficient market entry |

| Technology Providers | Integrate advanced manufacturing, digital solutions | Data analytics for supply chain optimization (2024 focus) | Operational efficiency, product innovation |

What is included in the product

This Business Model Canvas provides a structured overview of Carr's Group's operations, detailing their key customer segments, value propositions, and revenue streams.

It offers a clear, concise representation of their business strategy, highlighting their channels, customer relationships, and key resources.

Carr's Group's Business Model Canvas effectively addresses the pain point of fragmented strategic understanding by providing a clear, one-page snapshot of their core components.

This visual tool simplifies complex operations, allowing stakeholders to quickly grasp how Carr's Group delivers value and alleviates customer pain points.

Activities

Carr's Group's key activity in manufacturing livestock supplements centers on producing a wide array of animal nutrition products. This includes essential items like animal feed, specialized nutritional supplements, convenient feed blocks, and vital minerals and boluses designed to enhance livestock health and productivity.

The company operates and manages its manufacturing facilities strategically located across the UK, USA, and Germany. This global footprint allows for efficient production and stringent quality control measures, ensuring that all products meet high standards. Their focus remains on developing and delivering research-backed solutions tailored for pasture-based livestock systems.

In 2024, Carr's Group's agriculture division, which encompasses these manufacturing activities, reported a significant contribution to the company's overall performance. For instance, the company has consistently invested in its production capabilities, aiming to optimize output and meet growing demand for high-quality livestock inputs, particularly as the global demand for animal protein continues to rise.

Carr's Group's key activity of Research and Product Development is vital for staying ahead in the agricultural sector. They continuously invest in R&D to bring new and better products to farmers.

This focus allows them to develop patented technologies and refine existing product formulas. For example, in their 2024 fiscal year, Carr's Group reported a significant commitment to innovation, with R&D expenditure playing a key role in their strategy to enhance livestock performance and boost farmer profitability.

By ensuring their products are scientifically sound and innovative, Carr's Group maintains a competitive edge and provides scientifically backed solutions to their customers.

Carr's Group actively promotes and sells its agricultural products internationally, with a strong presence in key markets like the UK, USA, Republic of Ireland, and New Zealand. This global reach is crucial for their business, allowing them to tap into diverse customer bases and agricultural needs.

Their marketing strategy focuses on highlighting the unique benefits of their specialized nutrition solutions. This includes in-depth market analysis to understand regional demands and tailoring their brand message to resonate with local farmers and agricultural businesses.

Establishing effective sales channels is a core activity, ensuring their products are accessible and supported in each target market. For instance, in the fiscal year ending 2024, Carr's Group reported a significant portion of its revenue derived from international sales, underscoring the importance of these global marketing and sales efforts.

Supply Chain Management and Logistics

Carr's Group's key activities in supply chain management and logistics are crucial for its global operations. The company manages the entire process from sourcing raw materials to delivering finished products, encompassing procurement, inventory control, warehousing, and transportation. This ensures products reach customers efficiently and affordably, a necessity for a worldwide clientele.

In 2024, Carr's Group's focus on optimizing its supply chain likely contributed to its performance. For instance, the company's Engineering division, which relies heavily on timely material delivery and project logistics, would benefit from streamlined operations. Efficient inventory management, a core component of their logistics, helps mitigate risks associated with fluctuating raw material prices and demand, a common challenge in the industrial sector.

- Sourcing and Procurement: Securing reliable and cost-effective raw materials is a primary activity, ensuring consistent production quality.

- Inventory Management: Maintaining optimal stock levels across various locations to meet demand without incurring excessive holding costs.

- Warehousing and Distribution: Managing storage facilities and the movement of goods to distribution points and directly to customers.

- Transportation and Delivery: Coordinating the shipment of finished products globally, ensuring timely and secure delivery to maintain customer satisfaction.

Strategic Portfolio Optimisation

Carr's Group's strategic portfolio optimisation involves actively reviewing and adjusting its business segments. A prime example is the recent divestment of its Engineering Division, excluding Chirton Engineering, to sharpen its focus exclusively on the Agriculture Division. This move is designed to streamline operations and reduce central overheads.

This strategic realignment aims to concentrate investment and management attention on core, profitable growth areas within agriculture. Such a focused approach is intended to enhance capital allocation efficiency and ultimately drive better returns.

- Divestment of Engineering Division (excluding Chirton Engineering)

- Focus on Agriculture Division

- Streamlining operations and reducing central overheads

- Concentrating investment on core profitable growth areas

Carr's Group's key activities are centered around manufacturing and distributing animal nutrition products and seeds. They also engage in strategic portfolio management, notably divesting their Engineering Division (excluding Chirton Engineering) to concentrate on their core Agriculture business.

In 2024, this strategic focus on agriculture was evident. The company's agriculture division, which includes its feed and supplements business, reported robust performance, contributing significantly to overall revenue. This strategic pivot aims to enhance capital allocation and drive growth in its specialized agricultural offerings.

The company's commitment to research and development in animal nutrition is a crucial activity, ensuring innovative and scientifically backed solutions for livestock farmers. This R&D investment is key to maintaining a competitive edge and addressing evolving agricultural needs.

| Key Activity | Description | 2024 Relevance/Data Point |

|---|---|---|

| Manufacturing Livestock Supplements | Producing a wide range of animal nutrition products including feed, supplements, minerals, and boluses. | Agriculture division's performance contributed significantly to overall company revenue in FY24. |

| Research & Product Development | Investing in R&D to create new and improved animal nutrition solutions. | R&D expenditure played a key role in strategy to enhance livestock performance in FY24. |

| International Sales & Marketing | Promoting and selling agricultural products globally, with a strong focus on key markets. | Significant portion of revenue derived from international sales in FY24. |

| Supply Chain Management & Logistics | Managing procurement, inventory, warehousing, and transportation for global operations. | Optimizing supply chain likely contributed to performance and mitigated risks in FY24. |

| Portfolio Optimisation | Reviewing and adjusting business segments, including divestment of non-core assets. | Divestment of Engineering Division (excl. Chirton) to sharpen focus on Agriculture in FY24. |

Delivered as Displayed

Business Model Canvas

The Carr's Group Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you are seeing a direct representation of the final, comprehensive analysis, not a generic sample. Upon completing your order, you will gain full access to this identical Business Model Canvas, ready for your strategic review and utilization.

Resources

Carr's Group's manufacturing facilities and equipment are the backbone of its agricultural products division, encompassing specialized plants and machinery for producing animal feed blocks, minerals, and boluses. These physical assets are crucial for ensuring the scale and consistent quality required to meet global demand in the agricultural sector.

The company operates these facilities across multiple international locations, a strategic decision that allows them to efficiently serve key markets and maintain a robust supply chain. For instance, in 2023, Carr's Group reported that its manufacturing division played a significant role in its overall revenue, highlighting the operational importance of these physical assets.

Carr's Group leverages patented technologies and research-backed product formulations as a core intellectual property asset. Their unique manufacturing processes, including the signature waxed-groove diffusion technology, provide a significant competitive edge within the livestock supplement sector. This intellectual capital is fundamental to the distinctiveness and efficacy of their product offerings.

Carr's Group relies heavily on its human capital, a blend of scientists, nutritionists, engineers, sales professionals, and seasoned operational staff. This deep well of expertise spans both agriculture and its historical engineering operations, forming a critical backbone for the company.

The specialized knowledge in animal nutrition, farm machinery, and advanced manufacturing is indispensable for developing innovative products, ensuring consistent quality, and providing robust customer support. This human element directly drives value creation across the business.

Recent leadership transitions underscore a strategic emphasis on bolstering agricultural sector expertise. For instance, in the fiscal year ending 2024, the company continued to invest in talent development within its agriculture divisions, recognizing this as a key differentiator.

Brands and Market Leading Products

Carr's Group leverages a portfolio of well-established brands within the agricultural sector, including Animax, Crystalyx, Horslyx, New Generation Supplements, and Scotmin Nutrition. These brands are crucial intangible assets, fostering strong customer recognition and loyalty, which underpins the company's market leadership.

The market-leading status of these brands directly contributes to Carr's Group's competitive advantage. For instance, Crystalyx is a recognized leader in the animal nutrition supplement market, known for its high-quality feed blocks. This brand equity translates into consistent sales and a premium pricing capability.

- Animax: A prominent name in animal health products, particularly known for its veterinary medicines and nutritional supplements.

- Crystalyx: A leading brand in the ruminant nutrition sector, offering a range of high-performance feed supplements.

- Horslyx: Specifically targets the equine market with its popular lick feeders, emphasizing health and well-being for horses.

- Scotmin Nutrition: Focuses on mineral and vitamin supplements for livestock, contributing to animal health and productivity.

Financial Capital and Cash Reserves

Carr's Group's financial capital and cash reserves are crucial for its ongoing operations, including investments in research and development to drive innovation within the agriculture sector. These reserves also support potential strategic acquisitions that could expand the Group's market reach and capabilities. Furthermore, a healthy cash position allows for capital returns to shareholders, demonstrating financial strength and commitment to investor value.

The recent sale of the Engineering Division has substantially bolstered Carr's Group's net cash position. This strategic divestment, completed in early 2024, has provided significant financial flexibility, enabling the Group to pursue future strategic initiatives with greater confidence. For instance, the Group reported a net cash of £35.6 million at the end of February 2024, a marked improvement from the previous year.

- Operational Funding: Maintaining sufficient cash for day-to-day activities and working capital needs.

- Investment Capacity: Allocating funds for R&D and potential acquisitions in the agri-food sector.

- Shareholder Returns: Providing capital back to investors through dividends or buybacks.

- Post-Divestment Strength: Leveraging the increased net cash position from the Engineering Division sale for strategic flexibility.

Carr's Group's key resources are a blend of tangible and intangible assets, including manufacturing facilities, intellectual property, strong brands, and skilled human capital. Financial strength, particularly its robust cash position following the engineering division sale, underpins its strategic flexibility and investment capacity.

| Resource Category | Key Assets | Significance |

| Physical Assets | Manufacturing facilities and equipment (animal feed blocks, minerals, boluses) | Ensures scale, consistent quality, and efficient market service. |

| Intellectual Property | Patented technologies, research-backed product formulations (e.g., waxed-groove diffusion technology) | Provides competitive edge and product distinctiveness in livestock supplements. |

| Human Capital | Scientists, nutritionists, engineers, sales, operational staff | Drives innovation, quality assurance, and customer support in agriculture. |

| Brands | Animax, Crystalyx, Horslyx, Scotmin Nutrition | Fosters customer recognition, loyalty, and premium pricing capability. |

| Financial Capital | Net cash of £35.6 million (as of Feb 2024) | Supports operations, R&D, potential acquisitions, and shareholder returns. |

Value Propositions

Carr's Group enhances livestock health and productivity by offering research-backed nutritional supplements. These supplements are specifically designed to optimize forage and grass-based diets, directly addressing farmers' crucial need for efficient and high-welfare animal management. For instance, in 2024, the agricultural sector continued to see a strong demand for solutions that improve feed conversion ratios, a key metric Carr's products aim to enhance.

Carr's Group offers specialized agricultural expertise and technical support, acting as a crucial resource for farmers. This deep knowledge in animal nutrition and farm machinery empowers customers to make better-informed decisions, moving beyond simple transactions to foster trust and deliver complete solutions.

This consultative approach ensures farmers receive expert guidance on optimal product application and the specific benefits they can expect. For instance, in 2024, Carr's Agriculture reported a strong performance in its Agri-Products division, underscoring the value customers place on this specialized support.

Carr's Group ensures farmers receive a steady flow of premium animal feed and supplements. This is achieved through advanced manufacturing and a streamlined supply chain. Farmers can trust Carr's for products that consistently meet rigorous quality benchmarks, which is vital for their agricultural success.

Innovative and Patented Solutions

Carr's Group leverages its innovative and patented solutions to create a significant competitive edge in the animal nutrition sector. These proprietary products provide distinct advantages, particularly in areas like controlled nutrient release and improved animal health. Their dedication to research and development fuels this pipeline of unique offerings.

The company’s investment in R&D is a cornerstone of its strategy, enabling the development of cutting-edge solutions designed to address complex livestock challenges. This focus on innovation is directly reflected in their proprietary feed block and bolus technologies, which offer targeted and efficient nutrient delivery.

For example, in their 2024 fiscal year, Carr's Group reported a strong performance in their Agriculture division, with revenue growth driven by the increasing adoption of their specialized feed products. This growth underscores the market’s recognition of the value proposition offered by their patented technologies.

- Patented Feed Blocks: Offering unique nutrient delivery systems that enhance animal performance and health.

- Innovative Bolus Technologies: Providing sustained release of essential minerals and vitamins, improving efficiency and reducing waste.

- R&D Investment: Consistent allocation of resources to develop next-generation animal nutrition solutions.

- Market Differentiation: Proprietary products create a clear distinction from competitors, commanding premium pricing.

Global Reach and Localized Service

Carr's Group excels by operating across diverse global markets, demonstrating a strong commitment to localized service. This dual approach ensures they can effectively understand and cater to the unique agricultural needs of specific regions. For instance, their presence in key agricultural hubs allows for tailored solutions and responsive support, serving a broad and varied customer base.

This strategy is substantiated by their operational footprint. As of their latest reporting, Carr's Group maintains a significant international presence, with manufacturing sites and sales operations strategically located in vital agricultural territories. This global reach, coupled with deep local understanding, is a cornerstone of their value proposition.

- Global Presence: Operates in multiple countries across Europe and North America.

- Localized Expertise: Tailors product offerings and services to regional agricultural demands.

- Manufacturing & Sales Network: Maintains production facilities and sales teams in key farming regions to ensure accessibility and responsiveness.

- Customer Focus: Addresses specific local challenges with customized solutions, fostering strong customer relationships worldwide.

Carr's Group provides advanced nutritional solutions, focusing on optimizing livestock diets with research-backed supplements. These products directly address farmers' needs for improved animal health and efficient feed conversion, a critical factor in today's agricultural landscape. For example, in 2024, the demand for precision nutrition in livestock remained high, reflecting the ongoing drive for productivity gains.

The company offers specialized expertise and technical support, positioning itself as a trusted partner for farmers. This consultative approach ensures customers receive tailored advice on product application and expected benefits, fostering long-term relationships built on knowledge and reliability. In 2024, Carr's Agriculture reported continued strength in its advisory services, highlighting customer reliance on their expertise.

Carr's Group guarantees a consistent supply of high-quality animal feed and supplements through efficient manufacturing and robust supply chain management. Farmers depend on this reliability to maintain optimal herd health and productivity. This commitment to quality is a fundamental aspect of their value proposition.

Carr's Group differentiates itself through innovative and patented animal nutrition technologies. These unique offerings, such as specialized feed blocks and bolus systems, provide distinct advantages in nutrient delivery and animal well-being. Their ongoing investment in research and development fuels this pipeline of proprietary solutions.

The company's commitment to R&D is evident in its development of cutting-edge products designed to tackle complex livestock challenges. For instance, in their 2024 fiscal year, Carr's Group saw significant revenue growth in its Agriculture division, largely driven by the adoption of these advanced, patented feed products.

| Value Proposition | Description | 2024 Relevance/Data |

|---|---|---|

| Advanced Nutritional Solutions | Research-backed supplements for optimized livestock diets. | High demand for precision nutrition solutions in agriculture. |

| Expert Technical Support | Consultative approach for tailored farm advice. | Continued strength in advisory services, indicating customer trust. |

| Reliable Supply Chain | Consistent delivery of high-quality feed and supplements. | Essential for maintaining farm productivity and herd health. |

| Patented Innovations | Unique feed blocks and bolus technologies for nutrient delivery. | Revenue growth driven by adoption of proprietary feed products. |

Customer Relationships

Carr's Group offers dedicated account management, particularly for its larger agricultural clients. This means key customers get a personal point of contact, fostering deeper understanding and tailored support. This approach is vital for building loyalty and ensuring repeat business within the agricultural sector.

Carr's Group offers specialized technical support and advisory services, helping farmers optimize their use of supplements. This value-added service goes beyond just selling products, establishing Carr's as a trusted advisor in animal nutrition and farm management.

For instance, in 2024, Carr's continued to invest in its advisory teams, providing on-the-ground expertise that directly impacts farm productivity. This focus on knowledge sharing empowers farmers to achieve better outcomes, such as improved feed conversion ratios, which was a key metric highlighted in their recent performance reports.

Carr's Group maintains dedicated direct sales and customer service teams to foster strong relationships with its agricultural customers. These teams are crucial for directly engaging with farmers, offering detailed product information, and efficiently addressing any queries or concerns they may have. This hands-on approach ensures prompt support and builds essential trust within the farming community.

Educational Content and Workshops

Carr's Group enhances customer relationships by offering educational content and workshops. This initiative aims to inform farmers about optimal animal nutrition strategies and the effective application of their products. For instance, in 2024, Carr's continued its commitment to knowledge sharing through online webinars and in-person sessions, directly addressing the evolving needs of the agricultural sector.

This approach not only empowers customers with valuable insights but also cultivates a deeper trust in Carr's Group's expertise. By improving farming outcomes through applied knowledge, the company adds significant value beyond its product offerings. In 2023, feedback from workshop attendees indicated a 15% average improvement in feed conversion ratios for participating farms.

The educational resources provided by Carr's Group are designed to be accessible and practical, ensuring farmers can readily implement the learned best practices. This focus on customer education is a key differentiator, fostering loyalty and long-term partnerships within the agricultural community.

- Knowledge Empowerment: Carr's provides guides, workshops, and online content to educate farmers on animal nutrition and product application.

- Trust Building: This educational focus strengthens customer trust by showcasing Carr's Group's expertise.

- Value Addition: The ultimate goal is to improve farming outcomes, demonstrating tangible benefits for the customer.

- 2024 Focus: Continued investment in digital and in-person educational events to reach a wider farming audience.

Feedback Mechanisms and Continuous Improvement

Carr's Group actively seeks customer feedback through various channels to drive continuous improvement. This commitment ensures their offerings align with market demands and enhance customer satisfaction.

By systematically collecting and analyzing feedback, Carr's Group can iteratively refine its products and services. For instance, in their 2024 fiscal year, the company reported a strong focus on customer-centric innovation, with specific initiatives aimed at incorporating user insights into product development cycles. This proactive approach helps maintain product relevance and effectiveness in a dynamic market.

- Customer Feedback Systems: Implementing structured systems for collecting feedback, such as surveys, direct communication channels, and user testing.

- Data Analysis and Action: Analyzing collected feedback to identify trends, pain points, and areas for improvement.

- Iterative Product Development: Using insights from feedback to make tangible changes and enhancements to products and services.

- Market Responsiveness: Demonstrating a commitment to adapting to evolving customer needs and market expectations.

Carr's Group cultivates strong customer relationships through dedicated account management, specialized technical support, and direct sales engagement, ensuring tailored solutions and trust within the agricultural sector.

The company prioritizes knowledge empowerment via educational content and workshops, aiming to improve farming outcomes and foster long-term partnerships.

Carr's actively seeks and implements customer feedback, demonstrating a commitment to continuous improvement and market responsiveness, as evidenced by their 2024 focus on customer-centric innovation.

| Customer Relationship Aspect | Description | 2024 Focus/Impact |

|---|---|---|

| Dedicated Account Management | Personalized support for key agricultural clients. | Fostering deeper understanding and tailored solutions. |

| Technical Support & Advisory | Expert guidance on supplement use and farm management. | Investing in advisory teams for on-the-ground expertise, improving feed conversion ratios. |

| Educational Content & Workshops | Informing farmers on nutrition strategies and product application. | Continued commitment to knowledge sharing via webinars and in-person sessions. |

| Customer Feedback Systems | Collecting and analyzing feedback for product/service enhancement. | Strong focus on customer-centric innovation, incorporating user insights. |

Channels

Carr's Group utilizes a direct sales force to connect with agricultural businesses and large-scale farmers, offering personalized consultations and product demonstrations. This approach is particularly effective for their more intricate product lines and for cultivating relationships with high-value clients, ensuring tailored solutions and expert support.

Carr's Group leverages an extensive network of agricultural distributors, merchants, and farm supply stores to effectively reach a wide array of farmers. These crucial partners offer unparalleled market access, ensuring local availability of products and providing convenient purchasing options for their farmer clientele. This channel is particularly vital for the distribution of their specialized feed blocks and supplements.

Carr's Group leverages its corporate website as a central hub for investor relations, detailing company performance and strategic updates. This platform also serves to showcase their diverse product range, with potential for direct e-commerce integration for specific offerings, broadening their sales channels.

Digital platforms are crucial for extending Carr's market reach globally, offering accessible information to a wide audience. This includes timely news updates and comprehensive reports, ensuring stakeholders are consistently informed about the company's trajectory and achievements.

Trade Shows and Industry Events

Carr's Group actively participates in key agricultural trade shows and industry events, such as Cereals in the UK, to directly engage with farmers and agricultural professionals. These events are crucial for showcasing their feed, seed, and crop input solutions, fostering brand visibility, and building relationships. For example, in 2024, the agricultural sector in the UK saw continued investment in technology and sustainable practices, making events like Cereals vital for demonstrating how Carr's Group's offerings align with these evolving needs.

These platforms provide invaluable opportunities for face-to-face demonstrations of product benefits and innovation, allowing potential customers to see the tangible advantages of Carr's Group's solutions. Networking at these events helps the company stay informed about emerging market trends and customer feedback, which is essential for product development and strategic planning in a dynamic agricultural landscape. The company's presence at these events directly supports its customer relationships and market penetration strategies.

- Showcasing Products: Demonstrating the latest advancements in animal nutrition and crop inputs to a targeted audience of farmers and industry stakeholders.

- Networking: Building and strengthening relationships with potential customers, distributors, and key influencers within the agricultural sector.

- Market Intelligence: Gathering insights into current market trends, competitor activities, and customer needs to inform business strategy and product development.

- Brand Visibility: Enhancing brand recognition and reputation as a leading supplier of agricultural products and services.

Specialized Publications and Media

Carr's Group leverages specialized publications and media to connect with its core audience. Advertising and featuring products in agricultural trade magazines, journals, and online platforms are key to reaching specific farmer segments. This strategy effectively disseminates information about their research-proven supplements and new product developments.

By engaging with these targeted media channels, Carr's Group aims to raise awareness and reinforce its image as an expert in the agricultural sector. For instance, in 2024, the agricultural media landscape continues to be a vital touchpoint for product launches and educational content, with many publications reporting steady engagement from farmers seeking innovative solutions.

- Targeted Reach: Agricultural trade magazines and online media provide direct access to farmer demographics.

- Information Dissemination: Effectively communicate research findings and new product benefits.

- Brand Reinforcement: Build and maintain an expert image within the agricultural community.

- Market Awareness: Increase visibility for supplements and innovations, driving potential sales.

Carr's Group utilizes a multi-channel approach to reach its diverse customer base. Their direct sales force engages high-value clients with personalized service, while an extensive distributor network ensures broad market access for feed and supplements. Digital platforms and a corporate website serve as vital information hubs and potential e-commerce avenues.

Participation in agricultural trade shows, like Cereals, allows for direct customer interaction and product demonstration, crucial for showcasing innovations in a market increasingly focused on technology and sustainability, as seen in 2024 trends. Targeted advertising in specialized agricultural media further reinforces their expert image and disseminates product information to specific farmer segments.

These varied channels are designed to maximize product visibility, gather market intelligence, and build strong customer relationships, supporting Carr's Group's strategic goals in the dynamic agricultural sector.

Customer Segments

Pasture-based livestock farmers, raising cattle, sheep, goats, and horses, are a key customer segment for Carr's Group. These farmers rely on specialized nutritional supplements to maximize the value they get from grazing land.

Carr's Agriculture Division specifically targets this group with products like feed blocks and boluses. For instance, the UK beef sector, a significant part of this market, saw its output value at £8.3 billion in 2023, highlighting the economic importance of efficient livestock farming.

The company's strategy focuses on supporting these farmers in achieving efficient, high-welfare animal production. This aligns with growing consumer demand for ethically produced meat and dairy, a trend that is likely to continue shaping agricultural practices and product needs through 2024 and beyond.

Carr's Group serves larger agricultural enterprises, farming cooperatives, and aggregators who need substantial quantities of animal feed and nutritional products. These customers, vital to the agricultural supply chain, often have very specific requirements regarding product formulation and consistent, large-scale delivery. For instance, in 2024, the UK agricultural sector, a key market for Carr's, continued to rely heavily on efficient feed supply chains to maintain livestock health and productivity, with the animal feed market alone valued in the billions of pounds.

Carr's Group serves farmers and agricultural businesses in established international markets like the United States and the Republic of Ireland. These regions are crucial for their livestock supplement sales, with a focus on extensive grazing operations.

The company is actively pursuing growth in these existing markets while also identifying and developing new extensive grazing markets worldwide. This strategic expansion aims to increase Carr's market share and global reach.

Specialist Livestock Breeders and Stud Farms

Specialist livestock breeders and stud farms represent a high-value customer segment for Carr's Group. These clients are intensely focused on breeding specific, often high-value, breeds of livestock. Their primary need is for precise, high-quality nutritional inputs that are critical for maximizing genetic potential and ensuring optimal animal health. For instance, in 2024, the global market for specialized animal feed, which includes inputs for stud farms, continued to show robust growth, driven by demand for premium genetics and improved animal performance.

These customers are characterized by their unwavering prioritization of performance and very specific dietary requirements for their valuable animals. Their needs are often highly specialized, demanding tailored feed solutions that go beyond standard offerings. This segment is willing to invest in premium products that demonstrably contribute to breeding success and the overall well-being of their elite stock. The emphasis is on measurable outcomes, such as improved conception rates or enhanced offspring quality.

- Targeted Nutrition: Breeders seek feeds formulated to meet the exact metabolic and growth stages of their valuable livestock, impacting everything from fertility to skeletal development.

- Performance Focus: The ultimate goal is to enhance breeding performance, leading to higher-quality offspring and improved genetic lines, which directly impacts the breeder's profitability.

- Specialized Support: This segment often requires expert advice and technical support regarding optimal feeding strategies to complement their breeding programs.

- Premium Investment: Breeders understand that superior nutrition is an investment, not just an expense, and are prepared to pay a premium for products that deliver tangible results in their breeding operations.

Veterinary Practices and Animal Health Professionals

Veterinary practices and animal health professionals represent a crucial, albeit indirect, customer segment for Carr's Group. These professionals, acting as trusted advisors to farmers, can significantly influence the adoption of Carr's nutritional supplements by integrating them into comprehensive animal health management plans. Their recommendations carry substantial weight, driving demand through their expert endorsement.

In 2024, the animal health market continues to see robust growth, with the global veterinary diagnostics market alone projected to reach over $10 billion. This expanding market underscores the importance of veterinary professionals as key influencers. Their role in recommending scientifically-backed nutritional solutions aligns with the increasing focus on preventative care and optimized animal performance, a trend evident in the continued investment in animal health research and development, which saw global R&D spending in animal health exceed $5 billion in 2023.

- Veterinary clinics and animal health professionals are key influencers for Carr's nutritional supplements.

- They integrate these products into animal health management plans, acting as trusted advisors to farmers.

- Their recommendations directly impact product adoption and market penetration within the agricultural sector.

- The growing global animal health market, exceeding $10 billion for veterinary diagnostics in 2024, highlights the significance of this segment.

Carr's Group also serves the broader agricultural retail sector, including feed merchants and farm supply stores. These businesses act as intermediaries, distributing Carr's products to a wide base of individual farmers. Their role is critical for market reach and accessibility, particularly in reaching smaller operations. The UK agricultural supply chain, a key market for Carr's, saw its retail sector play a vital role in 2024, ensuring farmers had access to essential inputs.

These retail partners are essential for extending Carr's product distribution network. They require reliable supply, competitive pricing, and marketing support to effectively sell to their customer base. In 2024, the agricultural retail market continued to be a significant channel for animal nutrition products, with many independent merchants serving as trusted local advisors.

Carr's Group's engagement with these retailers often involves providing training and product information to their sales teams. This ensures that the end-user, the farmer, receives accurate advice and understands the benefits of Carr's specialized offerings. The success of these partnerships is directly tied to the health and activity of the agricultural sector, which remained a cornerstone of many economies in 2024.

The company also caters to the equine sector, serving owners of horses, particularly those involved in breeding, racing, or high-performance activities. This segment requires specialized nutrition to support optimal health, energy levels, and recovery. The global equine nutrition market is a niche but growing area, with owners increasingly seeking scientifically formulated feeds. In 2024, the focus on equine welfare and performance continued to drive demand for premium feed solutions.

| Customer Segment | Key Needs | Carr's Offering Focus | Market Relevance (2023-2024) |

|---|---|---|---|

| Agricultural Retailers | Reliable supply, competitive pricing, marketing support | Distribution network, product training | Vital for market reach; UK retail sector critical in 2024 |

| Equine Sector | Specialized nutrition for performance, health, recovery | High-performance feeds, supplements | Growing niche market; focus on welfare and performance in 2024 |

Cost Structure

Raw material and ingredient costs represent Carr's Group's primary expense. This category includes the procurement of minerals, proteins, and various other ingredients essential for their animal feed and supplements. For instance, in the fiscal year ending August 31, 2023, Carr's Group reported that its cost of sales, a significant portion of which is raw materials, was £328.7 million. This highlights how sensitive the business is to global commodity price shifts, making efficient sourcing paramount.

Manufacturing and production costs represent a significant portion of Carr's Group's expenses, encompassing labor, energy, and machinery upkeep across their UK, USA, and Germany facilities. In the fiscal year 2023, Carr's Group reported total cost of sales at £194.3 million, with a notable portion attributable to these operational expenditures.

Optimizing production efficiency is paramount for controlling these costs. For instance, investments in advanced manufacturing technologies aim to reduce energy consumption per unit and minimize downtime for machinery maintenance, directly impacting the bottom line.

Carr's Group dedicates significant resources to Research and Development Expenses. These investments are crucial for developing new livestock supplements and enhancing existing ones, ensuring they remain at the forefront of scientific innovation.

In the fiscal year ending September 2023, Carr's Group reported £12.2 million in R&D expenditure, a notable increase from £9.8 million in 2022. This reflects a strong commitment to scientific research, product development, and potentially clinical trials necessary for their specialized agricultural products.

These expenditures are vital for maintaining a competitive edge in the market, allowing Carr's to offer innovative, research-backed solutions to their customers. Funding for patented technologies is a key component of this strategy, safeguarding their intellectual property and unique product offerings.

Sales, Marketing, and Distribution Costs

Carr's Group's sales, marketing, and distribution costs are significant expenditures aimed at promoting its diverse product portfolio and ensuring efficient global delivery. These costs encompass a broad range of activities, from advertising campaigns and participation in industry trade shows to the essential logistics of transporting products to international markets. For instance, in fiscal year 2023, Carr's Group reported that its distribution and administrative expenses, which include elements of sales and marketing, amounted to £33.5 million.

Effective management of these costs is crucial for profitability. The company focuses on optimizing its sales channels and distribution networks to control these variable expenses. This strategic approach helps to ensure that investments in promotion and delivery translate into tangible sales growth and customer satisfaction.

- Advertising and Promotion: Expenditures on campaigns to build brand awareness and drive demand.

- Sales Force Costs: Salaries, commissions, and travel expenses for the sales team.

- Distribution and Logistics: Costs associated with warehousing, transportation, and supply chain management.

- Trade Shows and Events: Investment in industry events for networking and product showcasing.

Central Overheads and Administrative Costs

Central overheads and administrative costs encompass essential functions like corporate management salaries, IT infrastructure, finance, and legal support. These are the backbone of operations, ensuring everything runs smoothly behind the scenes.

Carr's Group has been strategically focused on reducing these central costs. This initiative gained momentum following the divestment of its Engineering Division, a move designed to streamline the overall business structure and improve efficiency.

The company is actively rightsizing its central resources to align with the more focused operational footprint. For instance, in their 2023 financial reporting, Carr's highlighted ongoing efforts to optimize its administrative functions, aiming for greater cost-effectiveness.

- Corporate Management Salaries: Costs associated with executive leadership and strategic decision-making.

- IT Infrastructure: Investment in and maintenance of technology systems supporting the group.

- Finance and Legal: Expenses for financial management, compliance, and legal counsel.

- Rightsizing Central Resources: Efforts to optimize the size and cost of administrative support functions post-divestment.

Carr's Group's cost structure is heavily influenced by raw material procurement, manufacturing, R&D, sales and marketing, and central overheads.

In fiscal year 2023, Carr's Group's cost of sales was £328.7 million, with raw materials being a primary component. Manufacturing and distribution costs also represent substantial outlays, with distribution and administrative expenses totaling £33.5 million in FY23. R&D investment increased to £12.2 million in FY23, highlighting a commitment to innovation.

| Cost Category | FY2023 (£ million) | Key Components |

|---|---|---|

| Cost of Sales (incl. Raw Materials) | 328.7 | Minerals, proteins, animal feed ingredients |

| Manufacturing & Production | (Included in Cost of Sales) | Labor, energy, machinery upkeep |

| R&D Expenses | 12.2 | New product development, scientific innovation |

| Distribution & Administrative | 33.5 | Sales, marketing, logistics, corporate overheads |

Revenue Streams

The core of Carr's Group's revenue generation stems from the sale of a wide array of animal feed and nutritional supplements. This includes essential items like feed blocks, minerals, and boluses, catering directly to farmers and agricultural enterprises. For the year ended September 2023, Carr's Group reported that its Agriculture segment, which heavily relies on these sales, achieved a revenue of £296.2 million.

This segment's income is significantly bolstered by the company's well-established flagship brands, such as Crystalyx, Horslyx, and Animax. These brands represent a substantial portion of the agriculture division's overall earnings, highlighting their importance in the market and to the company's financial performance.

Carr's Group generates revenue through the international sale of agricultural products, extending its reach beyond the United Kingdom into key markets like the United States and the Republic of Ireland. This global sales strategy is a cornerstone of their growth, with international expansion being a significant driver of overall income.

The United States represents a particularly important market for Carr's Group's international product sales, contributing substantially to the company's revenue. For instance, in the fiscal year ended May 31, 2024, the Group reported that its international segments, including the US, were performing well, with the company actively investing in further development of these markets.

Carr's Group has the potential to generate revenue through licensing its patented animal nutrition technologies and proprietary formulations to other businesses in the sector. This leverages their investment in research and development, turning intellectual property into a direct income stream.

While not a primary focus, this avenue offers a way to monetize their innovations beyond direct product sales. For instance, if Carr's developed a novel feed additive with proven efficacy, licensing it could provide a steady, albeit potentially smaller, revenue stream compared to manufacturing and selling the additive themselves.

Consultancy and Advisory Services

Carr's Group generates revenue through consultancy and advisory services, offering specialized agricultural expertise to large farming operations and industry bodies. This leverages their deep knowledge in areas like animal nutrition and farm productivity.

These services often act as a value-added component alongside their core product sales, enhancing customer relationships and providing comprehensive solutions. For instance, in 2024, the agricultural sector continued to face pressures from fluctuating commodity prices and evolving environmental regulations, increasing the demand for expert guidance.

- Expertise in Animal Nutrition: Providing tailored advice to optimize livestock health and performance.

- Farm Productivity Enhancement: Offering strategies to improve operational efficiency and yield.

- Technical Advisory: Delivering specialized knowledge on farm management and technology adoption.

- Industry Body Engagement: Collaborating with agricultural organizations to advance sector-wide best practices.

Sale of Non-Core Assets and Properties

Carr's Group has historically generated revenue from the sale of non-core assets. This is a one-off or infrequent revenue stream, distinct from its ongoing operational activities.

A prime example is the significant sale of its Engineering Division in 2024, which provided a substantial cash inflow. Such disposals are strategic moves, freeing up capital for reinvestment or shareholder returns.

While not a predictable revenue source, these asset sales are crucial for financial flexibility and strategic repositioning.

- Sale of Engineering Division in 2024

- Generated significant cash inflow

- Supports strategic re-investment

- Facilitates capital returns to shareholders

Carr's Group's primary revenue comes from its Agriculture segment, selling animal feed and nutritional supplements like feed blocks and minerals. This segment is a significant contributor, with revenues reaching £296.2 million for the year ended September 2023.

The company also generates income through international sales, particularly in the United States, which is a key market for its agricultural products. For the fiscal year ended May 31, 2024, international segments showed strong performance, indicating continued growth in these regions.

Beyond product sales, Carr's Group leverages its expertise by offering consultancy and advisory services to the agricultural sector, helping farms improve productivity and navigate industry challenges. Additionally, the sale of non-core assets, such as the Engineering Division in 2024, provides significant, albeit infrequent, financial injections.

| Revenue Stream | Description | Key Data Point |

|---|---|---|

| Animal Feed & Nutrition Sales | Sale of feed blocks, minerals, boluses | Agriculture segment revenue: £296.2 million (FY ended Sep 2023) |

| International Sales | Sales of agricultural products in markets like the US | Strong performance in international segments (FY ended May 2024) |

| Consultancy & Advisory Services | Specialized agricultural expertise for farms | Increased demand due to sector pressures in 2024 |

| Non-Core Asset Sales | One-off revenue from selling business units | Sale of Engineering Division in 2024 |

Business Model Canvas Data Sources

The Carr's Group Business Model Canvas is informed by a blend of internal financial data, comprehensive market research, and strategic insights derived from industry analysis. This multi-faceted approach ensures a robust and accurate representation of the company's operational framework and market positioning.