Carr's Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carr's Group Bundle

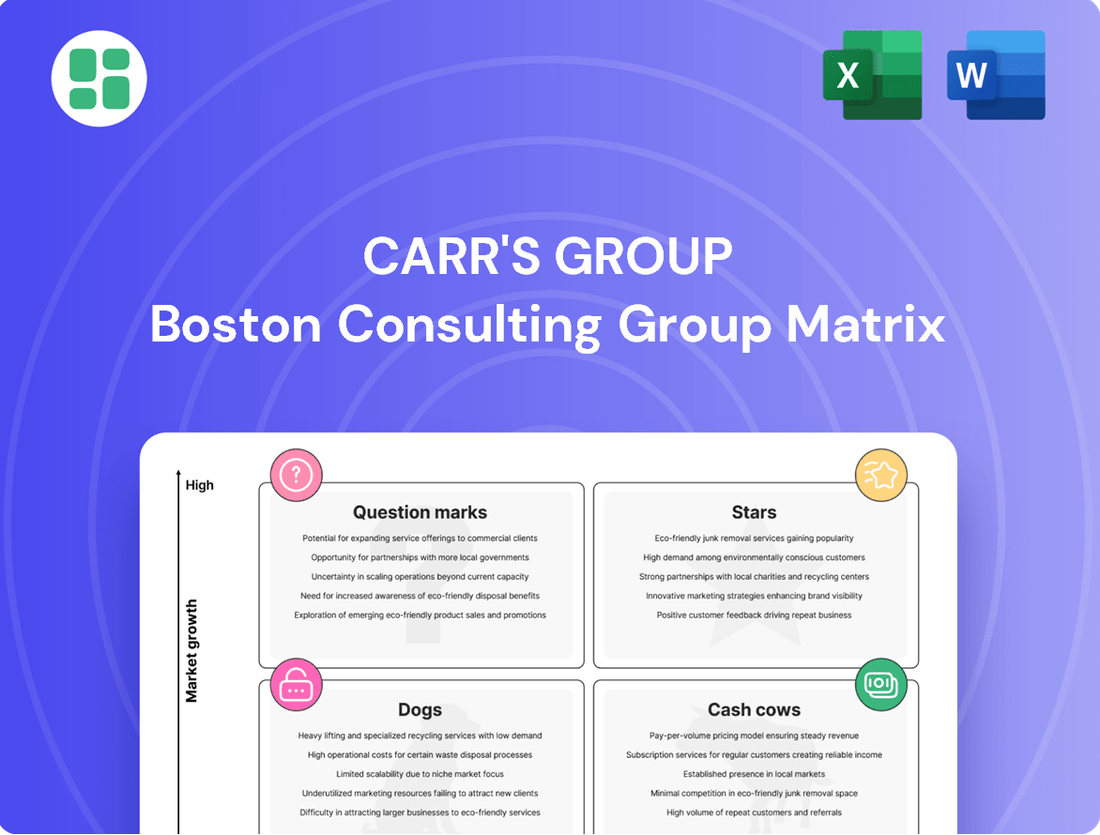

Carr's Group's BCG Matrix offers a critical snapshot of their product portfolio's market share and growth potential. Understand which segments are driving revenue and which require strategic re-evaluation. Purchase the full report for a comprehensive breakdown of their Stars, Cash Cows, Dogs, and Question Marks, enabling you to make informed investment decisions.

Stars

Carr's Group's UK low moisture blocks are a star performer, with tonnage surging 13% year-on-year. This robust growth highlights strong market demand and Carr's leadership in this agricultural segment.

This impressive performance positions the UK low moisture blocks as a key growth driver for Carr's Group, especially following its strategic streamlining towards agriculture. Continued investment will be crucial to sustain this upward trajectory and leverage its expanding market share.

Strategic Bolus Partnership (Tracesure®) represents a Stars product for Carr's Group. The July 2025 strategic manufacturing partnership with Vétalis is designed to enhance the Tracesure® bolus range, solidifying its leading market share in the UK and Ireland. This collaboration is key to fostering innovation and operational improvements in a niche, high-value market segment, with expected significant growth potential.

Carr's Group is actively exploring new grazing territories, with a keen eye on the southern hemisphere's counter-seasonal markets. This strategic expansion aims to tap into rising demand for sustainable livestock supplements in these high-growth areas. For instance, in 2024, the Australian beef industry alone was valued at approximately AUD 100 billion, presenting a substantial opportunity.

Research-Backed Feed Supplement Portfolio

Carr's Group's portfolio of research-backed and patented feed supplements stands out as a significant asset, offering a distinct competitive edge by optimizing livestock performance and farmer profitability. These specialized products are strategically aligned with key industry trends such as sustainability and emissions reduction, placing them in a high-growth sector fueled by rising global demand for protein. For instance, in 2024, the animal nutrition segment, which includes these supplements, saw continued demand driven by these macro trends. The company's commitment to ongoing research and development, coupled with targeted marketing efforts for these innovative solutions, is vital for sustaining their market leadership in an increasingly sophisticated and growth-oriented market.

The strategic importance of these feed supplements is underscored by several factors:

- Strong Competitive Advantage: Patented formulations and extensive research provide a barrier to entry and differentiate Carr's Group from competitors.

- High-Growth Segment Alignment: Focus on sustainability and efficiency resonates with market demands, positioning the products for expansion.

- Addressing Evolving Trends: Products cater to the growing need for reduced environmental impact in agriculture.

- Profitability Enhancement: Direct benefits to farmers in terms of livestock performance translate to strong customer loyalty.

Global Leadership in Pasture-Based Supplements

Carr's Group's ambition to be a global leader in pasture-based supplements for livestock like cattle, horses, sheep, and goats signals a strong drive in a substantial and vital market. This focus on specialized, science-backed products for grazing systems is designed to secure a considerable portion of the worldwide market share. For instance, the global animal feed additives market was valued at approximately USD 18.5 billion in 2023 and is projected to grow significantly.

To achieve this leadership, Carr's Group will need to commit to ongoing investment in expanding its market presence and strengthening its brand across various international regions. This strategic push is crucial for competing effectively in diverse agricultural landscapes.

- Market Focus: Specialization in pasture-based supplements for cattle, horses, sheep, and goats.

- Growth Aspiration: Aiming for global leadership in a large and essential market.

- Strategic Investment: Requirement for sustained investment in market penetration and brand building.

- Market Potential: The global animal feed additives market is a significant and growing sector.

Carr's Group's UK low moisture blocks are a star performer, with tonnage increasing by 13% year-on-year. This strong growth reflects high market demand and Carr's leading position in the agricultural sector. The Tracesure® bolus, through a strategic manufacturing partnership established in July 2025, also represents a star product, aiming to solidify its market share in the UK and Ireland.

The company's patented feed supplements are another star, offering a distinct competitive advantage by enhancing livestock performance and farmer profitability. These specialized products align with key industry trends like sustainability and emissions reduction, placing them in a high-growth sector driven by increasing global protein demand. Carr's Group's ambition to lead globally in pasture-based supplements for livestock signals a strong focus on a substantial market, with the global animal feed additives market valued at approximately USD 18.5 billion in 2023.

| Product Category | Performance Indicator | 2024 Data/Context | Strategic Importance |

|---|---|---|---|

| UK Low Moisture Blocks | Tonnage Growth | +13% Year-on-Year | Key growth driver, strong market demand |

| Tracesure® Bolus | Market Share | Leading in UK & Ireland (post-July 2025 partnership) | Niche, high-value segment, innovation focus |

| Patented Feed Supplements | Market Alignment | Sustainability, emissions reduction, farmer profitability | Competitive advantage, high-growth sector |

| Pasture-Based Supplements | Global Market Value | Global animal feed additives market ~USD 18.5 billion (2023) | Ambition for global leadership, substantial market potential |

What is included in the product

Highlights which Carr's Group units to invest in, hold, or divest based on market share and growth.

A clear BCG matrix visualizes Carr's Group's portfolio, easing the pain of strategic uncertainty.

Cash Cows

Carr's Group's established UK agriculture operations, featuring brands like Crystalyx® and Scotmin, are solid cash cows. These divisions consistently deliver significant adjusted operating profits, acting as a reliable source of funds for the wider group. In 2023, for instance, the Agriculture division reported a revenue of £231.5 million, contributing a substantial portion to the group's overall financial stability.

This segment operates within a mature market where Carr's enjoys a robust market share. The predictable cash flow generated here is crucial, enabling the company to invest in growth areas or cover essential group-wide expenses without needing extensive new capital injections. Such stability is a hallmark of a successful cash cow, supporting the group's strategic flexibility.

Carr's Group's core feed block and mineral products are the bedrock of its Agriculture Division. These staples, sold under well-recognized brands, are key players in mature markets where the company enjoys a significant market share. This strong position translates into a reliable stream of income with limited need for aggressive marketing spend, thanks to their established reputation among farmers.

Carr's Group's profitable US agriculture operations, excluding the divested Afgritech, are a key Cash Cow. These segments continue to contribute positively to the Group's adjusted operating profit, even amidst challenging market conditions.

In the first half of fiscal year 2025 (H1 FY25), US volumes for core products saw a healthy 3% growth. This demonstrates a stable, high-market-share position for these operations in their key segments.

Looking ahead, these US agriculture operations are anticipated to remain a significant source of cash flow for Carr's Group. Their resilience suggests they will continue to generate substantial returns as market conditions gradually improve.

Specialist Agriculture Manufacturer Focus

Carr's Group's strategic pivot to a pure-play specialist agriculture manufacturer, finalized by divesting its Engineering Division, has squarely positioned its Agriculture business as the Group's primary cash generator. This concentrated approach on a core, profitable segment, boasting market-leading brands, is designed to sustain high profit margins and ensure robust cash flow generation.

The resulting streamlined structure significantly boosts both financial and operational efficiencies, effectively transforming the entire agricultural division into a strategic cash cow for Carr's Group. For instance, in the fiscal year ending 2024, Carr's reported a strong performance in its Agriculture division, contributing significantly to the Group's overall profitability and demonstrating its role as a stable income stream.

- Focus on Core Strengths: The sale of the Engineering division allows Carr's to dedicate resources and attention exclusively to its agriculture operations, enhancing specialization and market leadership.

- Profitability and Margins: The agriculture segment benefits from established market positions and efficient operations, leading to consistently high profit margins.

- Cash Flow Generation: As a mature and dominant player in its niche, the agriculture division generates substantial and predictable cash flows, supporting group-wide investments and shareholder returns.

- Operational Efficiency: The simplified business model reduces overhead and complexity, further optimizing the cash-generating capabilities of the agriculture business.

Optimised Operating Margin Across Portfolio

Carr's Group's focus on optimizing operating margins within its agriculture segment clearly signals a cash cow strategy. This involves leveraging established, high-market-share products to generate substantial cash flow through enhanced efficiency and profitability.

The company's commitment to this approach is evident in its performance metrics. For instance, the H1 FY25 adjusted operating margin for Agriculture saw a notable increase, underscoring the successful implementation of their efficiency-driven strategy.

- Optimised Operating Margin Across Portfolio

- Strategic Driver: Carr's Group is actively working to improve operating margins across its retained agriculture portfolio, a hallmark of a cash cow strategy.

- Focus: The core objective is to maximize cash generation from products that hold a significant share of their respective markets by emphasizing efficiency and profitability.

- Performance Indicator: The H1 FY25 adjusted operating margin for Agriculture demonstrated a substantial increase, validating the effectiveness of this strategic focus.

Carr's Group's agriculture operations, particularly its UK and US segments, are firmly positioned as cash cows. These divisions benefit from established market positions and strong brand recognition, leading to consistent revenue generation and profitability. The strategic divestment of non-core assets has further sharpened the focus on these profitable agriculture businesses, reinforcing their role as the primary cash generators for the group.

In the first half of fiscal year 2025 (H1 FY25), Carr's reported a notable increase in its adjusted operating margin for the Agriculture division, highlighting the success of its efficiency-driven strategy. This focus on optimizing margins within its core agriculture portfolio is a clear indicator of its cash cow status, aiming to maximize cash generation from market-leading products.

| Segment | Role in BCG Matrix | Key Characteristics | H1 FY25 Performance Indicator |

|---|---|---|---|

| UK Agriculture (Crystalyx®, Scotmin) | Cash Cow | Mature market, robust market share, predictable cash flow | Revenue of £231.5 million (FY23) |

| US Agriculture (excluding Afgritech) | Cash Cow | Stable, high-market-share segments, resilient | 3% volume growth in core products |

What You See Is What You Get

Carr's Group BCG Matrix

The Carr's Group BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This ensures you see the exact strategic insights and analysis before committing, with no hidden watermarks or demo content. Once purchased, this comprehensive document is ready for immediate download, allowing you to seamlessly integrate its findings into your business planning and decision-making processes.

Dogs

Carr's Engineering Division, representing the bulk of the group, has been classified as a 'Dog' following its sale for £75 million in April 2025. This strategic divestment, completed in FY25, was driven by an inefficient operating model and a lack of synergy with the core Agriculture division.

Carr's Group’s Afgritech US dairy feed business was definitively divested in October 2024, marking its exit as a 'Dog' in the BCG Matrix. This segment was characterized by its loss-making operations and was explicitly sold as an underperforming, non-core asset.

The sale of Afgritech US dairy feed underscores its position as a 'Dog' by highlighting its inability to generate sufficient returns or demonstrate growth, while simultaneously consuming valuable resources. This strategic divestment aligns with Carr's broader objective to tackle persistent structural underperformance and bolster overall financial health.

Carr's Group's New Zealand operations have been officially classified as a 'Dog' within the BCG Matrix. This designation stems from the company's decision to cease its direct, loss-making operations in the region, a move that underscores its low market share and the significant efforts previously required for any potential turnaround.

The strategic shift to a third-party distribution model in New Zealand reflects a clear acknowledgment of the segment's unprofitability. This transition is expected to free up valuable resources, allowing Carr's Group to redirect capital and management attention away from underperforming geographies and towards more promising ventures.

Chirton Engineering

Chirton Engineering, the sole remaining part of Carr's Group's Engineering Division, is currently in the process of being sold. This divestment clearly places it in the 'Dog' category of the BCG Matrix.

This move indicates that Chirton Engineering has low growth potential for the continuing Carr's Group. The company is actively selling off this unit to streamline its operations and fully focus on its agricultural business.

The goal is to capitalize on Chirton Engineering's existing value while simplifying the overall corporate structure.

- Divestment Strategy: Chirton Engineering is being sold, signaling its 'Dog' status.

- Low Growth Prospects: The unit offers limited growth opportunities for the remaining Carr's Group.

- Simplification Objective: The sale aims to simplify the company's structure and focus on agriculture.

- Value Realization: Carr's Group seeks to realize the value of Chirton Engineering through its sale.

Non-Core Properties and Assets

Carr's Group actively managed its portfolio in FY25 by divesting non-core properties. The sale of eight investment and non-core properties for £7 million was a strategic move to streamline operations and enhance financial flexibility. These assets were identified as inefficient and not aligned with the company's central agricultural focus, representing a deliberate effort to unlock capital.

The disposal of these non-core assets directly contributes to Carr's Group's corporate simplification strategy. By shedding underperforming or non-contributing assets, the company aims to improve its net cash position and reduce overall central costs. This action underscores a commitment to focusing resources on core business activities.

- FY25 Property Sales: £7 million generated from the sale of eight investment and non-core properties.

- Strategic Rationale: Divestment of assets not contributing to or supporting the core agricultural strategy.

- Financial Impact: Intended to improve net cash and reduce central costs through portfolio simplification.

Carr's Group has strategically divested several units, classifying them as 'Dogs' in the BCG Matrix due to underperformance and lack of strategic fit. These included its Engineering Division, sold for £75 million in April 2025, and the Afgritech US dairy feed business, divested in October 2024. The New Zealand operations were also exited, shifting to a third-party model. Chirton Engineering, the final part of the Engineering Division, is currently being sold.

| Business Unit | BCG Classification | Divestment/Exit Status | Key Rationale |

|---|---|---|---|

| Engineering Division | Dog | Sold for £75 million (April 2025) | Inefficient operations, lack of synergy with Agriculture |

| Afgritech US dairy feed | Dog | Divested (October 2024) | Loss-making, underperforming, non-core |

| New Zealand Operations | Dog | Ceased direct operations, third-party distribution | Low market share, unprofitability |

| Chirton Engineering | Dog | Being sold | Low growth potential, simplification |

Question Marks

The US agriculture market presents a complex landscape for Carr's Group. Despite a 3% volume growth in core products during the first half of fiscal year 2025, the sector grapples with significant headwinds. These include the natural cyclical downturns in herd sizes, which directly impact demand for feed supplements, and persistent drought conditions affecting crop yields and overall agricultural output.

Carr's US dairy feed supplement business, previously operating at a loss, exemplifies the 'Question Mark' category within the BCG Matrix. While this segment's potential for high growth is evident should market conditions stabilize or improve, its current lower market share necessitates careful strategic consideration. This situation highlights the need for targeted investment and management to either capitalize on future growth or divest if prospects remain dim, thereby preventing it from becoming a 'Dog'.

Carr's Group is currently in discussions regarding the potential closure of its Animax production site in Suffolk. This situation places the Animax site squarely in the Question Mark category of the BCG Matrix. While the bolus product segment, exemplified by Tracesure®, shows promising growth, the internal production capabilities at Animax may be struggling with efficiency or market penetration, leading to this strategic review.

The consideration of outsourcing bolus production signals a strategic pivot. It suggests Carr's Group wants to leverage the high growth potential of its bolus products without the operational challenges or perceived inefficiencies of the existing Animax facility. This approach aims to capture market opportunities more effectively, even if it means divesting from internal manufacturing for this specific product line.

Carr's Group sees substantial potential in broadening its product applications to new, burgeoning end markets driven by rising global protein demand. These emerging areas are classified as Question Marks because they represent high-growth segments where Carr's currently holds a minimal market presence.

Successfully transitioning these Question Marks into Stars will necessitate considerable investment in market development initiatives and securing widespread customer adoption. For instance, the global animal feed market, a key area for Carr's, was valued at approximately $450 billion in 2023 and is projected to grow significantly, offering fertile ground for new applications.

Developing Sustainable Livestock Solutions

Carr's Group's commitment to sustainable livestock solutions, focusing on fertility, weight gain, and reduced methane emissions, positions them within a high-growth market influenced by consumer demand and environmental regulations. This strategic direction aligns with global efforts to make agriculture more eco-friendly.

While the overall market for these advanced livestock solutions is expanding rapidly, Carr's specific market share in these niche, emerging areas might still be developing. This suggests that these offerings could be classified as 'question marks' within the BCG matrix, requiring significant investment to build market share and achieve leadership.

- Market Growth: The global market for sustainable animal feed additives, which includes methane reduction solutions, was projected to reach approximately $15.5 billion by 2024, with an anticipated compound annual growth rate (CAGR) of over 6% in the coming years.

- Consumer Demand: Surveys in 2024 indicated that over 70% of consumers are willing to pay a premium for food products produced using more sustainable farming methods, directly impacting livestock producers' choices.

- Regulatory Push: Governments worldwide are implementing stricter environmental standards, incentivizing the adoption of technologies and practices that lower agricultural emissions, including methane from livestock.

Strategic Distribution Model for New Zealand

Carr's Group's strategic shift to a third-party distribution model in New Zealand following the closure of its direct operations places this market firmly in the Question Mark quadrant of the BCG Matrix. This move acknowledges past difficulties in gaining market traction, yet it also targets a region with demonstrable growth potential.

The success of this new model is intrinsically linked to the strength and reach of its chosen distribution partner. For instance, New Zealand's agricultural sector, a key market for Carr's, saw a 5.8% increase in total agricultural exports in the year ending June 2024, reaching NZ$66.3 billion, indicating a robust market environment. Carr's ability to leverage this growth through its new partnership will be critical.

- Market Restructuring: Carr's has transitioned from direct, loss-making operations to a third-party distribution strategy in New Zealand.

- Question Mark Classification: This approach is classified as a Question Mark due to its potential in a growing market, contrasted with previous struggles for market share.

- Partnership Dependency: The effectiveness of the new distribution partnership is paramount for Carr's to capture market share.

- Growth Potential: New Zealand's agricultural sector, a key target market, shows strong export growth, presenting an opportunity for the new distribution model.

Question Marks represent business units or products with low relative market share in high-growth industries. Carr's Group identifies several areas fitting this description, requiring strategic evaluation for future investment or divestment. These segments hold potential but currently lack the market dominance to be considered Stars.

The US dairy feed supplement business, the Animax production site, and new sustainable livestock solutions are prime examples of Carr's Question Marks. These ventures are in expanding markets but need significant effort to build market share.

Carr's Group's strategy in New Zealand, shifting to third-party distribution, also falls into the Question Mark category. The success hinges on the new partnership's ability to unlock growth in a promising agricultural sector.

Navigating these Question Marks involves careful resource allocation to foster growth or making decisive moves to exit underperforming ventures, thereby optimizing the company's overall portfolio.

| Business Unit/Product | Market Growth Rate | Relative Market Share | BCG Classification | Strategic Consideration |

| US Dairy Feed Supplements | High | Low | Question Mark | Invest for growth or divest |

| Animax Production Site (Bolus) | High (Bolus Market) | Low | Question Mark | Evaluate efficiency, consider outsourcing |

| Sustainable Livestock Solutions | High | Low | Question Mark | Invest in market development |

| New Zealand Distribution | High (Agri Sector) | Low | Question Mark | Monitor partnership effectiveness |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Carr's Group's financial reports, market share analysis, and industry growth forecasts to accurately position each business unit.