Carrier Global SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carrier Global Bundle

Carrier Global, a leader in HVAC and refrigeration, boasts significant strengths in its brand recognition and global reach, but faces challenges from intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for navigating its market.

Want the full story behind Carrier's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Carrier Global Corporation stands as a dominant force in intelligent climate and energy solutions, underscored by its extensive worldwide reach. Its broad global presence in 2024 allows it to tap into diverse economic cycles and consumer demands across continents.

The company boasts a comprehensive product suite encompassing HVAC, refrigeration, fire, security, and building automation systems, catering to residential, commercial, and industrial markets. This diversification, a key strength, mitigates risks associated with over-reliance on any single sector, as evidenced by its balanced revenue streams in recent fiscal reports.

Carrier's established global footprint translates into significant market penetration and strong brand recognition, facilitating easier adoption of new technologies and products. This worldwide brand equity is a powerful asset in a competitive landscape, enabling them to command premium pricing and customer loyalty.

Carrier's dedication to sustainable innovation is a significant strength, directly addressing the escalating global demand for energy-efficient and environmentally responsible building solutions. This commitment is underscored by substantial investments in research and development, aimed at creating products that actively contribute to decarbonization efforts.

The company's focus on developing high-efficiency HVAC and refrigeration systems, for instance, directly helps customers lower their greenhouse gas emissions. This proactive approach not only ensures compliance with increasingly stringent environmental regulations but also resonates strongly with a growing segment of environmentally conscious consumers and businesses, solidifying Carrier's position as a frontrunner in the climate solutions sector.

Carrier Global has showcased impressive financial results, with strong sales and adjusted earnings per share reported in recent quarters, signaling a positive trajectory for future expansion.

The company's strategic acquisition of Viessmann Climate Solutions in 2024 significantly bolstered its climate solutions segment, marking a pivotal step in its portfolio transformation.

This strategic realignment, coupled with solid operational execution, has led to healthy operating margins and favorable cash flow forecasts, underpinning its financial strength.

Strategic Acquisitions and Portfolio Optimization

Carrier has strategically bolstered its portfolio through significant acquisitions, notably the €12 billion ($13.1 billion USD) acquisition of Viessmann Climate Solutions in early 2024. This move substantially enhanced Carrier's presence in the European sustainable heating and cooling market. Concurrently, Carrier has divested non-core assets, such as its Commercial Refrigeration business for $1.2 billion USD in 2023, to concentrate on its more profitable climate and energy solutions segments.

These actions demonstrate a clear strategy to optimize its business structure and capitalize on high-growth areas.

- Acquisition of Viessmann Climate Solutions: Completed in early 2024 for €12 billion, significantly expanding Carrier's sustainable technology offerings.

- Divestiture of Commercial Refrigeration: Sold for $1.2 billion USD in 2023, allowing for greater focus on core climate solutions.

- Portfolio Streamlining: Enhances market competitiveness by concentrating on high-margin, sustainable climate and energy products.

- Long-Term Growth Potential: Strategic optimization positions Carrier for sustained growth in evolving global markets.

Advanced Digitalization and Service Capabilities

Carrier is significantly bolstering its advanced digitalization and service capabilities. The company is actively investing in smart technologies, particularly integrating Internet of Things (IoT) and Artificial Intelligence (AI) into its HVAC systems. This focus allows for enhanced remote monitoring and predictive maintenance, directly improving product offerings and operational efficiency.

These digital advancements are not just about better products; they are also about creating new revenue streams and deepening customer relationships. By expanding aftermarket services, Carrier is leveraging its technological investments to optimize system performance and enhance customer convenience. For instance, in 2024, Carrier reported a notable increase in its service revenue, driven by these digital solutions.

- IoT and AI Integration: Carrier is embedding IoT and AI into HVAC systems for proactive maintenance and remote diagnostics.

- Service Revenue Growth: Digitalization efforts are contributing to a growing portion of Carrier's overall revenue through expanded aftermarket services.

- Customer Value Proposition: Enhanced monitoring and predictive capabilities offer customers greater system reliability and reduced downtime.

- Operational Efficiency: Digital tools streamline operations, leading to cost savings and improved service delivery.

Carrier's diverse product portfolio, spanning HVAC, refrigeration, fire, and security systems, provides resilience against sector-specific downturns. This broad market coverage allows the company to capitalize on opportunities across residential, commercial, and industrial segments, a strategy that has consistently supported stable revenue streams. The company's strong brand recognition globally further enhances its market position, enabling premium pricing and customer loyalty.

What is included in the product

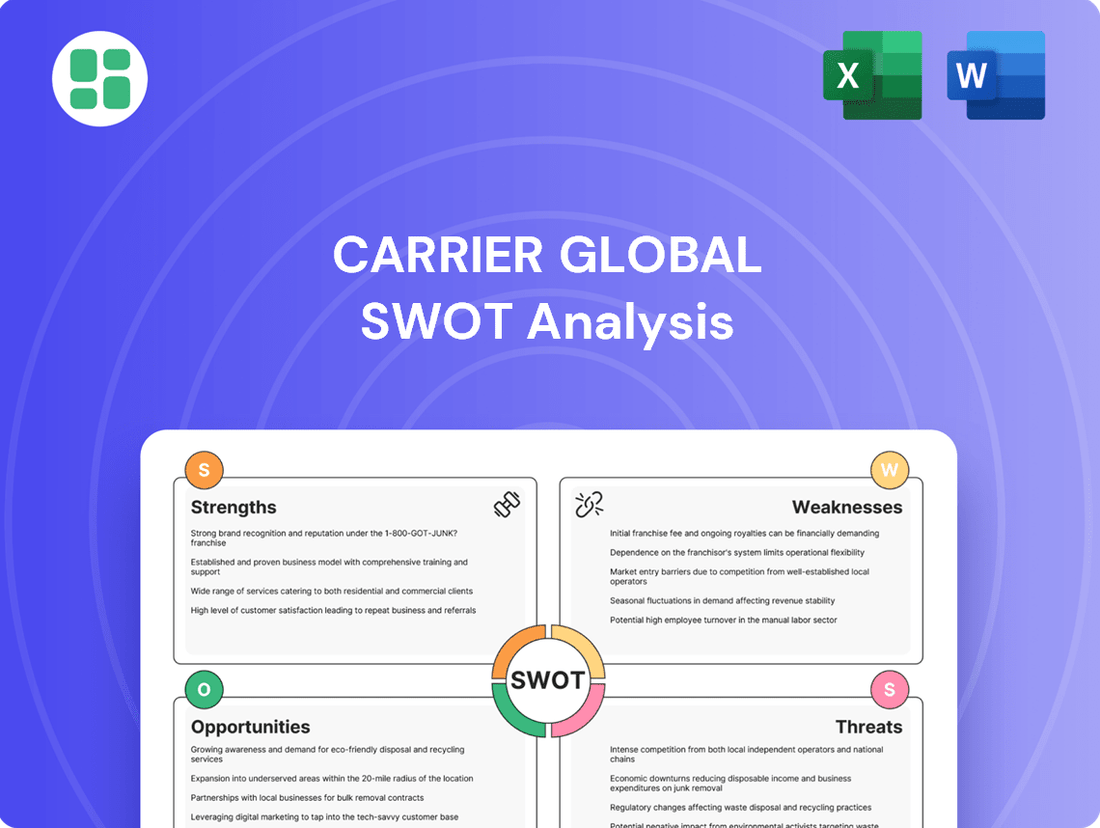

Carrier Global's SWOT analysis highlights its strong brand reputation and innovation in HVAC and refrigeration as key strengths, while potential supply chain disruptions and integration challenges post-spin-off represent weaknesses. The company is well-positioned to capitalize on growing demand for energy-efficient solutions and smart building technology, but faces intense competition and evolving regulatory landscapes as significant threats.

Provides a concise SWOT matrix for fast, visual strategy alignment, helping Carrier Global quickly identify and address competitive vulnerabilities.

Weaknesses

Carrier's reliance on the construction industry makes it susceptible to market downturns. For instance, a slowdown in new residential builds or commercial projects directly translates to lower demand for their HVAC and building automation systems. This cyclicality can lead to unpredictable revenue streams.

The company's financial performance is thus tied to the health of the construction sector, which experienced a notable slowdown in certain regions during late 2023 and early 2024 due to rising interest rates and inflation, impacting new project starts and renovation budgets.

Carrier operates in exceptionally crowded markets for HVAC, refrigeration, and building technologies. This means they're up against many global and local companies all trying to capture the same customers. This intense rivalry naturally puts pressure on prices, which can squeeze Carrier's profitability. To stay ahead, they must constantly innovate and find ways to make their products stand out from the competition, a challenge that requires ongoing strategic focus and investment.

Carrier's global operations rely on complex supply chains, making them vulnerable to disruptions. Geopolitical tensions, trade disputes, and natural disasters can significantly impact their ability to source components and deliver products, leading to increased costs and production delays. For instance, the ongoing semiconductor shortage, which began in 2020 and continued through 2023, affected many manufacturing sectors, including HVAC and refrigeration, potentially impacting Carrier's output and delivery schedules.

High Research and Development Investment Needs

Carrier Global faces significant financial pressure due to the substantial and ongoing investment required in research and development to stay ahead in the competitive climate and energy solutions market. This continuous need for R&D funding is a critical weakness, as it directly impacts profitability and cash flow.

The company must allocate considerable resources to develop and integrate cutting-edge technologies such as advanced smart building systems, artificial intelligence for energy management, and next-generation sustainable refrigerants. For instance, in 2023, Carrier reported R&D expenses of approximately $1.1 billion, a figure expected to remain robust in 2024 and 2025 to support innovation pipelines.

Failure to adequately fund R&D could result in technological obsolescence, diminishing Carrier's market position and relevance. The pace of innovation in areas like IoT integration and energy efficiency demands consistent, high-level investment to maintain a competitive edge.

- High R&D Expenditure: Continued investment in areas like smart building tech and AI is crucial, impacting financial flexibility.

- Technological Obsolescence Risk: Insufficient R&D spending could lead to outdated products and a loss of market share.

- Competitive Pressure: Rivals are also investing heavily, creating an imperative for Carrier to match or exceed R&D efforts.

Challenges in Specific Regional Markets

Carrier Global has faced headwinds in specific geographical areas, notably a downturn in residential and light commercial HVAC sales within China and Europe. This trend, evident in recent financial reports, indicates localized market saturation or intensified competition, impacting overall revenue streams.

Furthermore, the company observed a reduction in its North American truck and trailer refrigeration segment sales. These regional weaknesses, while not negating global strengths, necessitate tailored approaches to navigate distinct market conditions and competitive landscapes, potentially requiring strategic adjustments in product offerings or pricing.

- China and Europe HVAC Decline: Residential and light commercial HVAC sales in China and Europe have shown a downward trend.

- North America Refrigeration Dip: Truck and trailer refrigeration sales in North America experienced a decrease.

- Impact on Overall Performance: These localized challenges can temper growth achieved in other segments.

- Need for Targeted Strategies: Addressing specific market dynamics and competitive pressures in these regions is crucial.

Carrier's significant investment in research and development, approximately $1.1 billion in 2023, while necessary for innovation, strains its financial flexibility and impacts profitability. Failure to maintain this pace risks technological obsolescence, potentially diminishing its market share against competitors who are also investing heavily in areas like smart building technologies and AI-driven energy management.

Localized market weaknesses, such as declining residential and light commercial HVAC sales in China and Europe, alongside a dip in North American truck and trailer refrigeration sales, present challenges. These regional downturns, noted in recent financial reports, require tailored strategies to counteract intensified competition or market saturation, potentially tempering overall growth.

| Weakness | Impact | Supporting Data/Context |

|---|---|---|

| High R&D Expenditure | Financial strain, reduced profitability | R&D spend ~ $1.1 billion in 2023; continued high investment expected for 2024-2025 |

| Technological Obsolescence Risk | Loss of market share | Pace of innovation in IoT and energy efficiency demands consistent, high-level investment |

| Localized Market Declines | Tempered overall growth | Downturns in China/Europe HVAC and North America refrigeration segments |

Full Version Awaits

Carrier Global SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality, offering a comprehensive breakdown of Carrier Global's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get, providing a clear glimpse into the strategic insights contained within. Purchase unlocks the entire in-depth version, ready for your strategic planning.

Opportunities

The intensifying global concern over climate change, coupled with more stringent environmental mandates and escalating energy expenses, is fueling a surge in demand for sustainable and energy-efficient building systems. Carrier's proactive investments in eco-friendly technologies, including advanced heat pumps and refrigerants with lower global warming potential, strategically align it to capitalize on this expanding market. This presents a significant avenue for sustained revenue growth across its product lines.

Carrier is well-positioned to capitalize on the surging demand for smart building technologies. The global smart building market, projected to reach $100 billion by 2025, offers substantial growth avenues. By integrating IoT, AI, and automation into its core offerings, Carrier can deliver enhanced energy efficiency and predictive maintenance, key drivers for building owners seeking operational cost reductions.

This technological integration allows Carrier to move beyond traditional equipment sales to offering comprehensive, digitally-enabled solutions. These advanced systems not only improve indoor air quality and occupant comfort but also create recurring revenue streams through service contracts and data analytics. For instance, Carrier’s Healthy Buildings solutions are designed to leverage these technologies, providing tangible benefits for building performance and occupant well-being.

Carrier Global is strategically enhancing its aftermarket services, which include maintenance, parts, and retrofits. This segment offers a high-margin, recurring revenue stream, contributing significantly to the company's financial stability. For instance, in the first quarter of 2024, Carrier reported a 7% increase in total revenue, with aftermarket sales showing robust growth, underpinning the importance of this segment.

The company is also investing heavily in digital solutions, such as its Home Energy Management System and advanced predictive analytics. These offerings not only improve customer experience and retention but also create new avenues for profitability. This digital push is designed to leverage Carrier's vast installed base, turning existing customer relationships into ongoing revenue opportunities.

Emerging Market Expansion and Urbanization Trends

Emerging markets are experiencing significant growth, with rapid urbanization fueling demand for advanced building technologies. Carrier is well-positioned to leverage this by expanding its reach in regions like Southeast Asia and India, where infrastructure development is a key priority. For instance, in 2024, the global smart buildings market, which heavily relies on HVAC and building management systems, was projected to reach over $100 billion.

Carrier's strategy involves tailoring its offerings to local requirements, a crucial step for success in diverse economies. This approach allows for new avenues of organic growth and helps diversify the company's revenue streams away from more mature markets.

- Urbanization Drive: Over 60% of the world's population is expected to live in urban areas by 2030, creating substantial demand for new construction and retrofitting projects requiring sophisticated HVAC solutions.

- Economic Development: Emerging economies are seeing rising disposable incomes, leading to increased investment in comfortable and energy-efficient buildings.

- Market Diversification: Expansion into these regions reduces reliance on traditional markets, offering a more resilient growth profile for Carrier.

- Tailored Solutions: Adapting products to specific climate conditions and building codes in emerging markets is key to capturing market share.

Strategic Partnerships and Collaborations

Carrier's strategic partnerships are a key avenue for growth. By teaming up with tech giants and energy sector leaders, Carrier can tap into new markets and accelerate innovation. For example, collaborations like the one with Google Cloud for AI-driven energy management solutions are crucial for developing cutting-edge products and increasing market penetration. These alliances bolster Carrier's technical prowess and broaden its solution offerings.

These collaborations are not just about new products; they are about building a stronger ecosystem. In 2024, Carrier continued to emphasize these types of alliances, focusing on areas like smart building technology and sustainable energy solutions. These efforts are designed to leverage external expertise and resources, allowing Carrier to respond more effectively to evolving market demands and technological advancements.

- Technology Integration: Partnerships with companies like Google Cloud enable the integration of advanced AI and cloud capabilities into Carrier's HVAC and building management systems.

- Market Expansion: Collaborations with energy providers and other industry players can open doors to new geographic regions and customer segments.

- Innovation Acceleration: Joint development projects with partners can speed up the creation and deployment of next-generation climate control and energy efficiency solutions.

Carrier's commitment to innovation in sustainable technologies, such as advanced heat pumps and refrigerants, positions it to benefit from increasing global demand for energy-efficient building solutions. The company's expansion into smart building technologies, leveraging IoT and AI, taps into a market projected to exceed $100 billion by 2025, offering significant growth potential through enhanced operational efficiency for clients.

Threats

Economic downturns can severely curb spending on new buildings and renovations, directly impacting Carrier's sales. For instance, a global recession in late 2023 and early 2024 saw reduced construction activity in many regions, which translates to fewer opportunities for HVAC and refrigeration system installations.

Lower consumer and business confidence during such periods often leads to delayed or canceled projects. This reduced demand can pressure Carrier's revenue streams and profitability, as seen in sectors sensitive to economic cycles.

Furthermore, market volatility, characterized by fluctuating inflation and interest rates, poses a significant threat. Higher interest rates, for example, can increase the cost of financing for construction projects, while inflation can drive up raw material and labor costs for Carrier, impacting margins.

The HVAC and building solutions market is fiercely competitive, often leading to aggressive price wars, especially for more common products. This intense rivalry pressures companies like Carrier to constantly find ways to reduce costs or stand out through new technologies and extra services.

For instance, in 2023, the HVAC industry saw significant price adjustments as manufacturers navigated supply chain costs and demand fluctuations. Carrier's gross profit margin for the fiscal year ending December 31, 2023, was 32.99%, a slight decrease from 33.17% in 2022, indicating the persistent challenge of margin erosion amidst competitive pressures.

Sustained price battles can directly harm Carrier’s financial results, making it crucial for the company to innovate and offer superior value to maintain profitability.

The relentless pace of technological advancement, especially in fields like artificial intelligence and the Internet of Things (IoT), presents a significant challenge. This rapid innovation could quickly make current Carrier offerings less competitive.

New market entrants leveraging cutting-edge technologies might emerge, potentially disrupting Carrier's established product lines and market position. For instance, advancements in smart building technology could challenge traditional HVAC systems.

To counter this, Carrier faces the imperative of substantial and ongoing investment in research and development. Staying ahead requires a proactive approach to innovation, with R&D spending in the HVAC industry generally seeing significant allocations to maintain competitiveness.

Strict Regulatory Changes and Compliance Costs

Carrier Global faces increasing pressure from evolving environmental regulations, especially those targeting refrigerants and energy efficiency. For instance, the U.S. Environmental Protection Agency's AIM Act, which began phasing down hydrofluorocarbons (HFCs) in 2022, continues to impact the HVAC industry by mandating lower global warming potential (GWP) refrigerants. This shift necessitates significant investment in research, development, and manufacturing to adapt product lines and ensure compliance.

These regulatory shifts translate directly into substantial compliance costs for Carrier. Adapting existing products and redesigning new ones to meet stricter mandates, such as those for SEER2 (Seasonal Energy Efficiency Ratio 2) in the United States, requires considerable capital expenditure. For example, the transition to new refrigerants and more efficient components can add to production costs, potentially affecting profit margins if these costs cannot be fully passed on to consumers.

Failure to navigate these regulatory changes effectively poses a serious threat. Non-compliance can lead to hefty penalties, as seen with past environmental violations in the manufacturing sector, and could even result in the exclusion of products from key markets. Carrier must proactively manage these risks by investing in sustainable technologies and maintaining a robust compliance framework to safeguard its market position.

Key considerations include:

- Refrigerant Transition: The ongoing phase-down of high-GWP refrigerants, like HFCs, requires significant R&D and manufacturing adjustments, impacting product development timelines and costs.

- Energy Efficiency Standards: Increasingly stringent energy efficiency mandates, such as updated SEER2 standards in the US, necessitate redesigns and potentially higher component costs for HVAC systems.

- Global Regulatory Divergence: Navigating varying environmental regulations across different international markets adds complexity and cost to product compliance and market access strategies.

Supply Chain Vulnerabilities and Geopolitical Risks

Carrier's extensive global supply chain is a significant area of vulnerability, susceptible to disruptions stemming from geopolitical tensions and trade disputes. For instance, in 2023, ongoing trade friction between major economies continued to pose challenges for companies with international manufacturing footprints, impacting component sourcing and logistics costs. This reliance on global networks exposes Carrier to risks related to political instability and evolving trade policies, which can directly affect production schedules and profitability.

The availability and cost of critical raw materials and electronic components are particularly sensitive to these external shocks. A shortage or price surge in essential materials, such as specialized alloys or semiconductors used in their HVAC and refrigeration units, can significantly hinder manufacturing output and squeeze profit margins. For example, semiconductor shortages experienced in late 2021 and into 2022 continued to have ripple effects across various industries, including HVAC manufacturing, by mid-2024, underscoring the persistent nature of these supply chain risks.

- Supply Chain Dependencies: Carrier's reliance on a complex web of international suppliers for key components like compressors and refrigerants presents a significant risk.

- Geopolitical Impact: Evolving trade tariffs and sanctions between nations where Carrier operates or sources materials can lead to increased costs and operational hurdles.

- Logistical Disruptions: Port congestion and shipping delays, which remained a concern in various global trade routes through 2023 and into early 2024, can impede the timely delivery of finished goods and raw materials.

- Raw Material Volatility: Fluctuations in the prices of metals such as copper and aluminum, essential for manufacturing HVAC and refrigeration systems, directly impact Carrier's cost of goods sold.

Intense competition within the HVAC and building solutions sector can lead to price wars, potentially eroding Carrier's profit margins. For instance, Carrier's gross profit margin saw a slight dip from 33.17% in 2022 to 32.99% in 2023, reflecting ongoing pricing pressures.

Rapid technological advancements, particularly in smart building and IoT integration, pose a threat of obsolescence for existing product lines, demanding continuous R&D investment to remain competitive.

Stricter environmental regulations, such as the phase-down of high-GWP refrigerants and evolving energy efficiency standards like SEER2, necessitate costly product redesigns and compliance efforts.

Carrier's reliance on a global supply chain makes it vulnerable to disruptions from geopolitical tensions, trade disputes, and raw material price volatility, impacting production and costs.

SWOT Analysis Data Sources

This Carrier Global SWOT analysis is built upon a foundation of credible data, including their latest financial filings, comprehensive market research reports, and expert commentary from industry analysts to ensure a robust and insightful assessment.