Carrier Global Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carrier Global Bundle

Unlock the strategic potential of Carrier Global by understanding its position within the BCG Matrix. This powerful framework illuminates which of their offerings are market leaders, which are generating consistent cash flow, and which require careful consideration for future investment.

Don't miss out on the critical insights that can shape your own business strategy. Purchase the full BCG Matrix report for Carrier Global to gain a comprehensive, data-driven analysis and actionable recommendations for optimizing your product portfolio and maximizing profitability.

Stars

Carrier's commercial HVAC business is a star performer, especially in the booming data center market. The increasing need for reliable cooling in these facilities is a major growth driver for the company. This segment is poised for continued expansion as digitalization accelerates globally.

Carrier's strategic move to acquire Viessmann Climate Solutions in 2024 has dramatically enhanced its standing in the European heat pump sector. This acquisition taps into a market driven by strong energy security mandates and ambitious decarbonization targets.

The European heat pump market is a prime example of a burgeoning industry, with significant growth potential. For instance, Germany alone saw a remarkable surge in heat pump unit sales, exceeding 50% growth in 2024, underscoring the rapid market adoption and Carrier's strategic advantage through Viessmann's established brand and distribution network.

Carrier's aftermarket services, a key component of its growth strategy, are positioned as a Star in the BCG Matrix. These services, including maintenance, parts, and retrofits, have consistently delivered double-digit organic growth and strong profitability.

Leveraging a substantial installed base, these offerings generate a predictable, high-margin revenue stream that exhibits resilience against economic downturns. Carrier is targeting continued double-digit aftermarket growth through 2025, underscoring its strategic significance.

High-Efficiency Commercial Chillers and VRF Systems

Carrier's high-efficiency commercial chillers and Variable Refrigerant Flow (VRF) systems are strong contenders in the BCG matrix, likely positioned as Stars. The market for these advanced HVAC solutions is experiencing robust growth, fueled by increasing demand for energy-efficient and sustainable building technologies. For instance, the global commercial HVAC market was projected to reach over $150 billion by 2024, with a significant portion driven by the adoption of high-efficiency systems and VRF technology.

These products directly address critical market needs for reduced operational costs and environmental impact, aligning with global decarbonization efforts and the rise of smart building management. Carrier's commitment to innovation in this sector, including new rooftop units and advanced chiller designs, solidifies its competitive edge. The company's focus on performance and sustainability ensures it captures a substantial share of this expanding market segment.

- Market Growth: The commercial HVAC sector, particularly for high-efficiency and VRF systems, is expanding significantly, driven by energy efficiency mandates and sustainability goals.

- Product Innovation: Carrier's continuous development of advanced chillers, VRF systems, and rooftop units enhances performance and lowers operating expenses for customers.

- Sustainability Focus: These solutions are central to global decarbonization trends and the development of greener, smarter buildings.

- Competitive Positioning: Carrier's strong product portfolio and market presence in this growing segment suggest a leading position as Stars in the BCG matrix.

Sustainable Building Solutions Portfolio

Carrier's Sustainable Building Solutions portfolio is a key component of its growth strategy, fitting squarely into the Stars category of the BCG Matrix. This segment focuses on innovative offerings designed to meet the escalating demand for environmentally responsible building operations.

The company's commitment to sustainability is evident in its product development, which includes advanced systems that utilize low-Global Warming Potential (GWP) refrigerants and sophisticated integrated digital controls. These technologies are crucial for optimizing energy consumption in commercial and residential buildings.

The market trend towards building decarbonization and enhanced energy efficiency is a significant tailwind for this business. Carrier is well-positioned to capitalize on this, aligning with its overarching vision to lead in intelligent climate and energy solutions.

- Market Growth: The global green building market was valued at approximately $1.07 trillion in 2023 and is projected to reach $3.17 trillion by 2030, growing at a CAGR of 16.7%.

- Carrier's Focus: Carrier's investments in low-GWP refrigerant technology and digital building management systems directly address key market demands.

- Strategic Alignment: This portfolio supports Carrier's goal of providing intelligent climate and energy solutions, capturing a larger share of the environmentally conscious market.

Carrier's commercial HVAC business, particularly its high-efficiency chillers and VRF systems, are strong Stars. These products are in high-growth markets driven by energy efficiency and sustainability demands.

The company's aftermarket services are also Stars, consistently delivering double-digit organic growth and strong profitability, leveraging a large installed base for predictable, high-margin revenue.

Carrier's acquisition of Viessmann Climate Solutions in 2024 significantly boosted its position in the European heat pump market, a Star segment driven by energy security and decarbonization efforts, with Germany alone seeing over 50% growth in heat pump sales in 2024.

The Sustainable Building Solutions portfolio, focusing on low-GWP refrigerants and digital controls, is another Star. This segment aligns with the growing green building market, which was valued at approximately $1.07 trillion in 2023 and is projected to reach $3.17 trillion by 2030.

| Business Segment | BCG Matrix Position | Key Growth Drivers | Relevant 2024 Data/Trends |

|---|---|---|---|

| Commercial HVAC (High-Efficiency Chillers & VRF) | Star | Energy efficiency mandates, sustainability goals, smart building adoption | Global commercial HVAC market projected over $150 billion in 2024; strong demand for advanced, energy-saving systems. |

| Aftermarket Services | Star | Large installed base, recurring revenue, product longevity | Targeting continued double-digit aftermarket growth through 2025; high profitability and resilience. |

| European Heat Pumps (via Viessmann acquisition) | Star | Energy security, decarbonization targets, government incentives | Germany heat pump unit sales grew over 50% in 2024; strong market adoption driven by policy. |

| Sustainable Building Solutions | Star | Green building market growth, low-GWP refrigerants, digital controls | Global green building market valued at ~$1.07 trillion in 2023, projected $3.17 trillion by 2030 (16.7% CAGR). |

What is included in the product

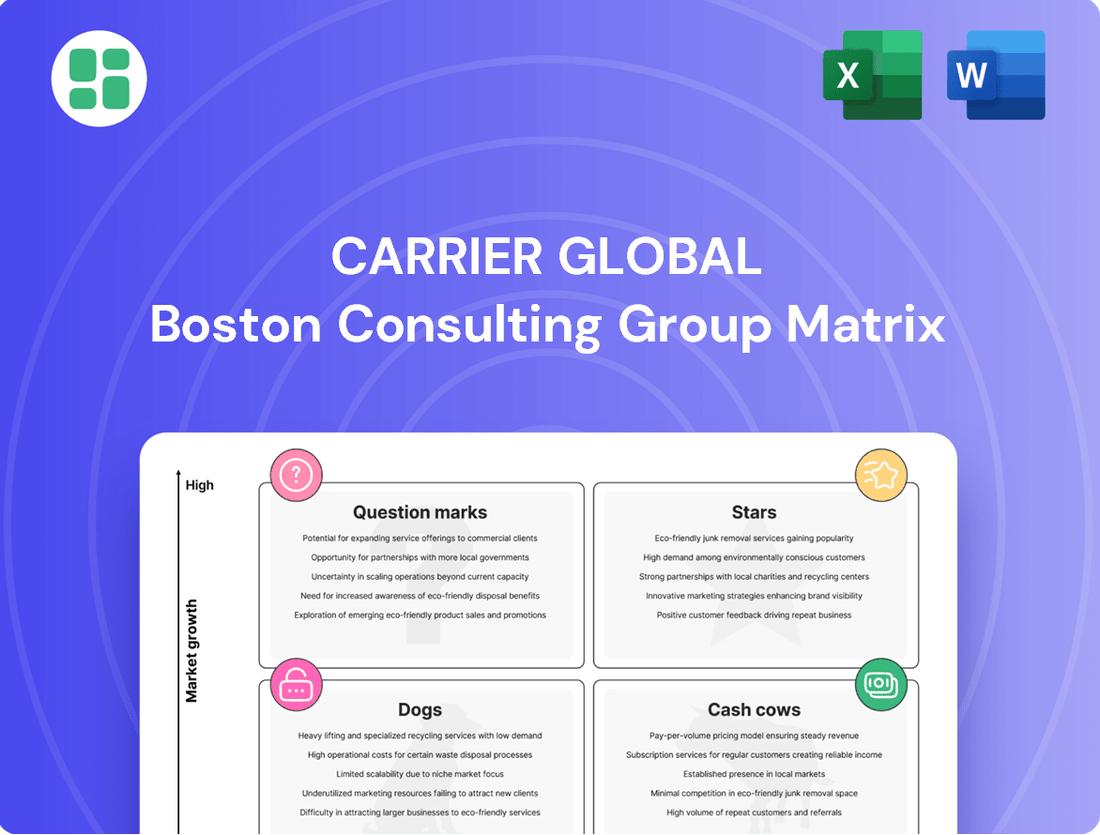

This BCG Matrix analysis highlights Carrier Global's product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

A clear BCG Matrix visual for Carrier Global's business units alleviates the pain of strategic indecision.

Cash Cows

Carrier's North American residential HVAC business is a classic cash cow. This mature market segment boasts a high market share for Carrier, driven by strong brand recognition and an extensive distribution network.

Despite moderate growth fueled by energy efficiency trends, this segment consistently generates substantial cash flow and profitability. For instance, in 2024, Carrier reported robust performance in its HVAC segment, with its residential offerings being a significant contributor to overall revenue and operating profit, underscoring its role as a stable financial anchor.

Established Commercial HVAC Systems (Non-Data Center) represent a significant cash cow for Carrier Global. This mature segment, serving traditional office buildings, retail, and industrial sectors, benefits from Carrier's long-standing reputation for reliability and deep customer ties. For instance, in 2023, Carrier reported that its HVAC segment, which includes these established systems, generated approximately $11.7 billion in revenue, demonstrating its consistent contribution to the company's financial health.

Carrier Transicold's container refrigeration systems are a classic Cash Cow within Carrier Global's portfolio. They dominate the stable global cold chain market, a sector that relies heavily on these units for transporting temperature-sensitive items like food and pharmaceuticals. This consistent demand translates into predictable and substantial cash flow.

In 2024, the global cold chain market was valued at approximately $290 billion, with refrigeration equipment being a significant component. Carrier Transicold's established market leadership and the essential nature of its products ensure a strong and steady revenue stream, allowing Carrier Global to fund investments in its growth areas.

Traditional Building Automation Systems

Carrier's traditional building automation systems, the bedrock of their offerings, are firmly established in numerous commercial and institutional structures. These systems, designed for essential building management and energy conservation, are mature product lines that consistently deliver steady income through ongoing maintenance, system upgrades, and servicing existing installations.

These foundational technologies are considered Cash Cows within Carrier's portfolio. Their extensive market penetration ensures a substantial and reliable market share, translating into predictable and consistent cash flows that can be reinvested into other growth areas of the business. For instance, Carrier's HVAC solutions, which often integrate these automation systems, saw significant demand in 2024 as businesses prioritized energy efficiency and operational cost reduction.

- Market Position: Dominant in established building stock.

- Revenue Stream: Stable, recurring revenue from maintenance and service contracts.

- Growth Potential: Limited organic growth, focus on upgrades and retrofits.

- Strategic Role: Generates consistent cash to fund innovation and new ventures.

North America Light Commercial HVAC

The North American light commercial HVAC sector, catering to smaller commercial spaces, represents a mature market. Carrier Global holds a substantial position here, boasting a robust product portfolio. This segment is a consistent generator of revenue and cash flow, supported by ongoing replacement demands and stable market needs, despite a more moderate growth trajectory compared to other segments.

Carrier's North America Light Commercial HVAC business is a significant contributor to the company's overall financial stability. In 2023, Carrier's HVAC segment, which includes light commercial, saw substantial revenue. For instance, Carrier's total revenue in 2023 was approximately $22.1 billion, with the HVAC segment being a primary driver.

- Mature Market Dynamics: The North American light commercial HVAC market is characterized by steady demand driven by replacement cycles rather than rapid expansion.

- Carrier's Strong Position: Carrier Global benefits from a well-established brand and distribution network in this segment, ensuring consistent market share.

- Cash Flow Generation: This segment acts as a reliable cash cow, providing stable earnings that can fund investments in higher-growth areas of the business.

- 2023 Performance Indicators: While specific light commercial breakdowns are proprietary, the broader HVAC segment's revenue in 2023 underscores its importance, contributing significantly to Carrier's overall financial health.

Carrier's established residential and commercial HVAC systems, along with its Transicold refrigeration units, function as significant cash cows. These mature business lines benefit from strong market positions and consistent demand, generating substantial and predictable cash flows. The company leverages this financial stability to invest in emerging technologies and growth markets, ensuring a balanced portfolio strategy.

| Business Segment | Market Position | Growth Rate | Cash Flow Generation |

|---|---|---|---|

| North American Residential HVAC | High Market Share | Moderate | High |

| Established Commercial HVAC (Non-Data Center) | Strong Brand Reputation | Low to Moderate | High |

| Carrier Transicold (Container Refrigeration) | Dominant in Cold Chain | Stable | High |

| Traditional Building Automation Systems | Extensive Penetration | Low | High |

| North American Light Commercial HVAC | Substantial Position | Moderate | High |

What You See Is What You Get

Carrier Global BCG Matrix

The Carrier Global BCG Matrix you are previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report. It's meticulously crafted to provide actionable insights into Carrier Global's product portfolio, allowing for immediate integration into your business planning and decision-making processes.

Dogs

Carrier's North America Truck and Trailer Refrigeration business saw organic sales drop by 6% in 2024. This decline points to a market facing subdued demand, potentially indicating a mature or contracting sector for these products.

This performance suggests that this segment might be a cash consumer with limited growth prospects, a characteristic often associated with 'Dogs' in the BCG matrix. Continued underperformance could warrant a strategic review, possibly leading to divestment if market conditions don't improve.

The residential and light commercial HVAC sector in China presented a significant challenge for Carrier in 2024. Sales experienced a notable decline, dropping 11% in the second quarter of 2025, signaling a tough market environment with limited growth potential for the company's products in this specific area.

This downturn suggests that Carrier's market share in China's residential and light commercial HVAC segment is likely low, potentially classifying it as a 'dog' within the BCG matrix. Factors such as aggressive local competition or adverse economic conditions could be contributing to this underperformance, impacting Carrier's overall market standing.

Carrier Global divested its Fire & Security businesses, including Global Access Solutions and its fire divisions, in 2024. This strategic move aligns with Carrier's focus on its core HVAC and refrigeration segments, signaling these divested units were considered less central to its future growth strategy. The divestitures are a clear example of shedding "Dogs" in the BCG matrix, assets with low growth and market share that can tie up resources.

Legacy Commercial Refrigeration Cabinets

Carrier Global divested its commercial refrigeration cabinet business in 2024. This move was part of a broader strategy to streamline operations and concentrate on its core climate and energy solutions. The sale of this segment, alongside the Fire & Security division, signaled a shift towards becoming a more specialized company.

The divestiture of the commercial refrigeration cabinet business strongly suggests it occupied a 'Dog' position within Carrier's BCG Matrix. This classification implies the segment likely exhibited low market growth and held a low market share, making it a less strategic asset for the company's future growth trajectory.

- Divestiture Year: 2024

- Reason for Divestiture: Strategic focus on 'pure-play' climate and energy solutions.

- BCG Matrix Classification Implication: Likely a 'Dog' due to low growth and market share.

- Impact: Streamlined Carrier's portfolio, exiting a non-core business.

Outdated or Less Energy-Efficient HVAC Product Lines

Carrier Global, a leader in HVAC solutions, faces the challenge of managing older product lines that may not meet evolving energy efficiency standards. As regulatory bodies like the U.S. Department of Energy mandate higher SEER2 and HSPF2 ratings, older technologies risk becoming liabilities.

These less efficient products could see declining sales and market share as consumers and businesses increasingly prioritize sustainability and lower operating costs. For instance, while Carrier's 2023 sustainability report highlights significant progress in reducing its operational footprint, managing the transition of its entire product portfolio to meet future efficiency benchmarks is a continuous undertaking.

- Declining Market Share: Products failing to meet new efficiency standards may lose ground to more advanced competitors.

- Regulatory Risk: Non-compliance with updated energy regulations can lead to penalties or market exclusion.

- Investment Needs: Significant R&D and manufacturing adjustments are required to update or phase out legacy product lines.

- Customer Demand Shift: Growing consumer preference for eco-friendly and cost-saving solutions accelerates the obsolescence of older HVAC models.

Carrier's North America Truck and Trailer Refrigeration business experienced a 6% organic sales decline in 2024, suggesting a mature or contracting market segment. This underperformance, coupled with a low market share in China's residential and light commercial HVAC sector, where sales dropped 11% in Q2 2025, points to potential 'Dog' classifications within the BCG matrix.

The divestiture of Carrier's Fire & Security businesses and its commercial refrigeration cabinet business in 2024 further supports this interpretation. These strategic exits indicate Carrier's move to shed assets with low growth and market share, aligning with the 'Dog' profile to focus on core climate and energy solutions.

Legacy HVAC products failing to meet new energy efficiency standards, such as higher SEER2 and HSPF2 ratings mandated by the U.S. Department of Energy, also risk becoming 'Dogs'. These products may face declining sales and market share as customer demand shifts towards more sustainable and cost-effective solutions.

| Business Segment | 2024 Performance Indicator | BCG Matrix Implication |

| North America Truck & Trailer Refrigeration | -6% organic sales decline | Potential 'Dog' |

| China Residential & Light Commercial HVAC | -11% sales decline (Q2 2025) | Likely 'Dog' |

| Fire & Security Businesses (Divested 2024) | Divested | Classified as 'Dog' |

| Commercial Refrigeration Cabinets (Divested 2024) | Divested | Classified as 'Dog' |

Question Marks

Carrier Energy, launched in 2024, is an organic startup focused on sustainable system-level offerings like Home Energy Management Systems (HEMS) and battery assemblies. This positions them within the high-growth, emerging market of home energy optimization and grid flexibility.

While the market for HEMS and battery solutions is expanding rapidly, with the global residential energy storage market projected to reach $36.3 billion by 2030, Carrier Energy is still in its nascent stages of market penetration. Significant investment is required to capture market share and potentially ascend to a Star position within the BCG Matrix.

Carrier Global is strategically investing in AI-driven predictive maintenance and smart building analytics through platforms like Abound and Lynx. These advanced digital solutions enable remote monitoring and diagnostics, aiming to optimize building performance and reduce downtime.

While the broader HVAC aftermarket is a strong performer for Carrier, these specific AI-powered services are positioned in a high-growth, albeit nascent, market segment. Carrier's market share in these cutting-edge digital offerings is still in its formative stages, reflecting the rapid evolution and competitive landscape of smart building technology.

Carrier's acquisition of AddVolt in May 2025 signals a strategic push into the burgeoning electric transport refrigeration sector. This move targets a high-growth area within the cold chain, offering plug-and-play electrical systems for refrigerated trucks.

While this segment is still developing, Carrier's investment aims to capture market share. Given its nascent stage and the company's ongoing efforts to establish a foothold, electric transport refrigeration solutions like AddVolt are positioned as Question Marks, representing significant future potential within Carrier's portfolio.

Advanced Grid-Interactive HVAC Technologies

Carrier Global is investing in advanced grid-interactive HVAC technologies, positioning itself within the intelligent climate and energy solutions sector. These systems are designed to optimize building energy consumption and communicate with the power grid, aligning with the growing demand for smart grid integration and renewable energy sources.

This segment represents a high-growth opportunity, fueled by global smart grid initiatives and the increasing adoption of renewables. For instance, the global smart grid market was valued at approximately $37.5 billion in 2023 and is projected to reach over $100 billion by 2030, indicating significant expansion potential for grid-interactive technologies.

- Market Growth: The smart grid sector, a key driver for grid-interactive HVAC, is experiencing rapid expansion, with projections indicating substantial market growth in the coming years.

- Carrier's Position: Carrier is actively building its leadership and market share in this developing market, moving from a relatively early stage of market penetration.

- Technological Advancement: Development focuses on HVAC systems that can dynamically respond to grid signals, enhancing energy efficiency and supporting grid stability.

- Strategic Importance: These technologies are crucial for Carrier's strategy to offer integrated solutions that manage both climate control and energy resources effectively.

New Geographic Market Expansions for Specific Sustainable Tech

Carrier Global is strategically targeting new geographic markets with its sustainable technology offerings, particularly in HVAC solutions. India, Japan, and the Middle East represent key expansion areas where Carrier sees significant potential for its high-growth, eco-friendly products. This focus acknowledges that while some of these regions might have established HVAC markets overall, Carrier's specific sustainable tech solutions are entering with a lower initial market share, presenting a classic "question mark" scenario in the BCG matrix due to their high growth potential and the need for substantial investment to capture market share.

- India's HVAC market is projected to grow at a CAGR of over 10% through 2027, driven by increasing disposable incomes and government initiatives for energy efficiency.

- Japan's commitment to carbon neutrality by 2050 fuels demand for advanced, sustainable HVAC systems, a segment where Carrier aims to increase its footprint.

- The Middle East is experiencing rapid urbanization and infrastructure development, creating a fertile ground for the adoption of new, energy-efficient cooling technologies.

- Carrier's investment in these markets for sustainable tech aligns with their strategy to build market share in high-potential, yet currently less penetrated, segments.

Carrier's expansion into new geographic markets, particularly with its sustainable HVAC technologies in India, Japan, and the Middle East, exemplifies a classic Question Mark scenario. These regions offer substantial growth potential, yet Carrier's current market share in these specific sustainable segments is relatively low, necessitating strategic investment to build traction.

The company is focusing on high-growth, eco-friendly products in these areas, recognizing that while the overall HVAC markets may be established, their advanced sustainable solutions are entering with a nascent market penetration. This presents a clear "question mark" in the BCG Matrix, characterized by high growth prospects and the need for significant capital to achieve a dominant market position.

Carrier's strategic approach in these developing markets involves substantial investment to capture market share in sustainable HVAC solutions. For instance, India's HVAC market is projected to grow at a CAGR exceeding 10% through 2027, driven by energy efficiency initiatives, a key factor supporting Carrier's Question Mark positioning in this region.

The company's efforts in Japan, driven by carbon neutrality goals, and the Middle East, fueled by infrastructure development, further highlight the high-growth, lower-penetration characteristic of these ventures. These initiatives underscore Carrier's commitment to developing its footprint in these promising, yet currently less established, segments of the sustainable technology market.

| Market | Growth Potential | Carrier's Current Position | BCG Matrix Classification | Strategic Focus |

|---|---|---|---|---|

| India (Sustainable HVAC) | High (CAGR >10% through 2027) | Low Penetration | Question Mark | Building Market Share |

| Japan (Sustainable HVAC) | High (Carbon Neutrality Driven) | Emerging | Question Mark | Increasing Footprint |

| Middle East (Sustainable HVAC) | High (Urbanization Driven) | Developing | Question Mark | Market Penetration |

BCG Matrix Data Sources

Our Carrier Global BCG Matrix draws from comprehensive financial disclosures, industry growth forecasts, and detailed market share analysis to provide a robust strategic overview.