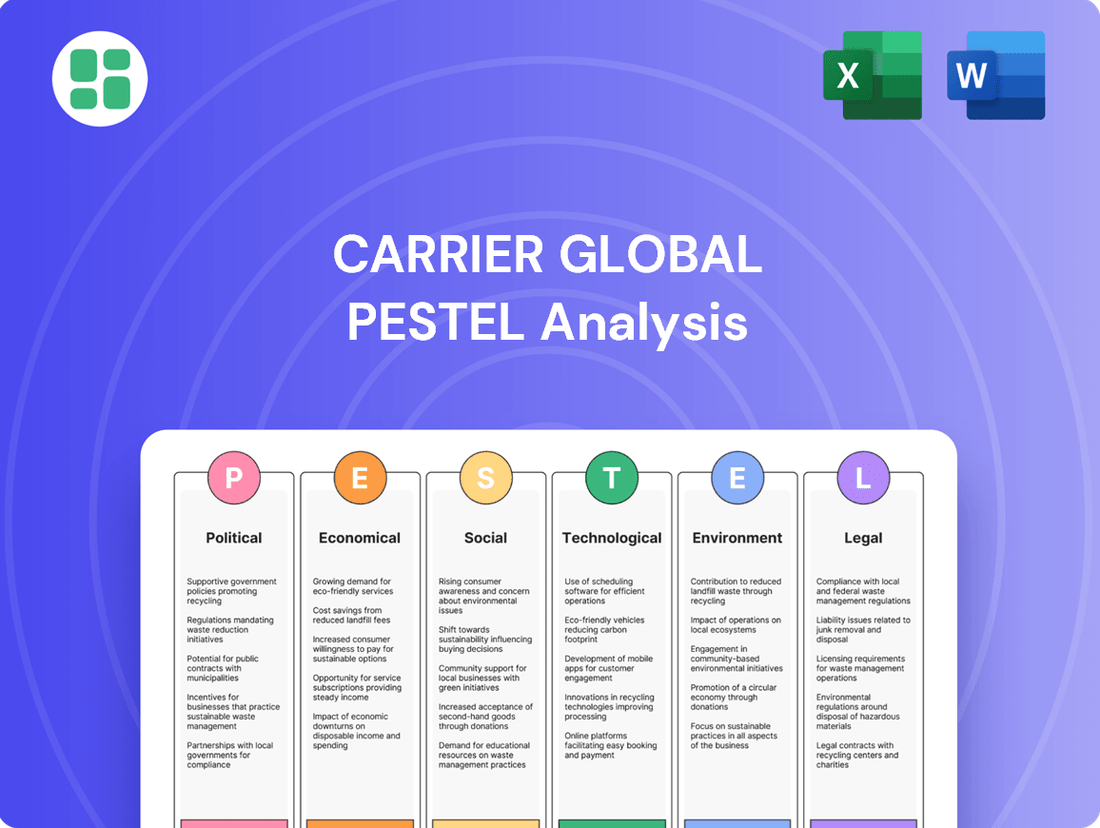

Carrier Global PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carrier Global Bundle

Discover the critical political, economic, social, technological, legal, and environmental factors shaping Carrier Global's trajectory. Our PESTLE analysis provides a comprehensive overview, highlighting opportunities and challenges that could impact your investment or business strategy. Unlock actionable insights and gain a competitive edge by downloading the full report today!

Political factors

New Environmental Protection Agency (EPA) regulations, effective January 1, 2025, are compelling a significant shift in the HVAC industry towards refrigerants with lower Global Warming Potential (GWP). This mandates the adoption of alternatives like R-454B and R-32, phasing out older, high-GWP refrigerants such as R-410A.

This regulatory change directly influences Carrier Global's operations, requiring adjustments to manufacturing processes and product design to accommodate these new refrigerants. While these transitions aim for environmental sustainability, they may initially lead to increased costs for new HVAC systems, impacting consumer purchasing decisions and the company's pricing strategies.

As a global leader, Carrier must navigate these evolving regulations across its extensive product lines and complex supply chains to ensure full compliance and maintain its competitive edge in a market increasingly focused on environmental responsibility.

Governments globally are tightening energy efficiency standards for HVAC systems, a key driver for Carrier Global. For instance, the European Union's Ecodesign directive continues to push for higher efficiency ratings, impacting product design and market entry. These regulations, coupled with incentives like the U.S. Inflation Reduction Act's tax credits for high-efficiency equipment, directly boost demand for Carrier's advanced, sustainable offerings.

Global trade policies and tariffs significantly influence Carrier's operational costs and market reach. For example, the imposition of tariffs on components like advanced control modules can directly increase manufacturing expenses for their smart building solutions. In 2024, ongoing trade negotiations and potential shifts in import duties across key markets like the US and China necessitate constant vigilance to mitigate supply chain disruptions and maintain competitive pricing.

Building Codes and Construction Standards

Evolving building codes and construction standards, increasingly focused on sustainability and safety, directly impact the design and functionality of HVAC, fire, security, and building automation systems. For instance, California's Title 24 energy efficiency standards, with updates expected for 2025, are pushing for more demand-responsive controls in new non-residential buildings. Carrier must consistently innovate its product offerings to align with or surpass these stringent requirements, which in turn shapes product development cycles and market adoption rates.

These regulatory shifts necessitate significant investment in research and development. For example, the push for higher energy efficiency ratings in HVAC systems, often mandated by building codes, requires Carrier to develop more advanced compressors, heat exchangers, and smart control algorithms. The company's ability to adapt to and anticipate these changes is crucial for maintaining its competitive edge and ensuring market relevance in the coming years.

- Sustainability Mandates: Codes increasingly require features like enhanced insulation, renewable energy integration, and reduced carbon emissions in building materials and systems.

- Safety Regulations: Stricter fire safety codes, for example, drive demand for advanced fire detection and suppression technologies, impacting Carrier's product portfolio.

- Energy Efficiency Targets: Government-imposed energy efficiency standards, such as those in California's Title 24, directly influence the performance specifications of HVAC equipment.

- Smart Building Integration: Building automation standards are evolving to promote interoperability and data-driven building management, requiring sophisticated control systems.

Political Stability and Geopolitical Risks

Carrier Global's operations are significantly influenced by political stability in its key markets, such as North America and Europe. Geopolitical risks, including ongoing conflicts and international tensions, can disrupt supply chains and impact demand for HVAC and refrigeration solutions. For instance, the protracted conflict in Eastern Europe has led to increased energy price volatility, indirectly affecting construction and industrial spending, which are crucial for Carrier's commercial and industrial segments.

Shifts in government policies and priorities also pose a risk. For example, changes in infrastructure spending or building efficiency regulations, driven by political agendas, can either boost or hinder Carrier's growth. The company's strategy to maintain diverse manufacturing and distribution networks across different regions, including approximately 30 manufacturing sites globally as of 2024, helps to mitigate the impact of localized political instability or sanctions.

- Geopolitical Impact: Ongoing geopolitical tensions can lead to supply chain disruptions and increased operational costs for Carrier.

- Policy Sensitivity: Carrier's commercial and industrial segments are sensitive to government infrastructure investment and regulatory changes.

- Diversification Strategy: A global footprint with numerous manufacturing facilities mitigates risks associated with political instability in any single region.

- Market Demand Fluctuations: Political unrest or economic sanctions in key markets can cause unpredictable shifts in demand for Carrier's products.

Governmental support for green technologies, such as the U.S. Inflation Reduction Act of 2024, directly benefits Carrier Global by incentivizing the adoption of high-efficiency HVAC systems. Conversely, trade policies and tariffs, like those impacting components imported into the U.S. from China in 2024, can increase manufacturing costs and affect pricing strategies for smart building solutions.

Carrier's global operations are inherently tied to political stability and government spending priorities in key markets. For instance, geopolitical tensions in Eastern Europe in 2024 contributed to energy price volatility, indirectly influencing construction demand, a critical sector for Carrier's commercial and industrial segments.

The company's diversified manufacturing and distribution network, comprising approximately 30 sites globally as of 2024, serves as a strategic buffer against localized political instability or sanctions, ensuring resilience in its supply chain and market access.

What is included in the product

Carrier Global's PESTLE analysis examines how political, economic, social, technological, environmental, and legal factors influence its operations and strategy.

This comprehensive evaluation identifies critical external forces shaping Carrier Global's industry, offering actionable insights for strategic decision-making.

A concise PESTLE analysis of Carrier Global's external environment, highlighting key political, economic, social, technological, environmental, and legal factors, serves as a pain point reliever by providing clarity and focus for strategic decision-making.

This analysis offers a summarized view of Carrier Global's operating landscape, enabling teams to quickly identify potential threats and opportunities, thereby alleviating the pain of navigating complex external forces without a clear roadmap.

Economic factors

Global economic growth is a key driver for Carrier Global. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a steady rate that supports demand for construction and HVAC systems. This economic stability, especially in developed markets, directly translates to increased activity in residential, commercial, and industrial construction projects, which are crucial for Carrier's sales.

The construction sector's health is paramount. For instance, the U.S. Census Bureau reported a 1.5% increase in new residential construction starts in April 2024 compared to the previous year, indicating a positive trend. Similarly, commercial construction, a significant market for Carrier's advanced building automation systems, showed resilience. This sustained construction activity underpins the demand for Carrier's energy-efficient HVAC solutions and building management technologies.

Carrier's own performance reflects these economic trends. The company reported strong results in 2024, partly fueled by a growing backlog in commercial HVAC projects. Looking ahead to 2025, the outlook remains optimistic, with continued investment in infrastructure and commercial real estate expected to bolster sales volumes. This positive trajectory is directly linked to the anticipated continuation of global economic expansion and robust construction pipelines.

Inflationary pressures in 2024 and early 2025 continue to significantly impact the cost of raw materials, components, and labor for manufacturers like Carrier. This directly affects their operational expenses and can squeeze profit margins, especially if price adjustments to customers lag behind rising input costs.

The ongoing transition to new, more environmentally friendly refrigerant standards, such as those mandated by the AIM Act in the United States, is a prime example. Industry estimates suggest that these new systems could see cost increases of up to 30% for consumers and businesses purchasing new HVAC equipment, reflecting the higher expense of compliant components and manufacturing processes.

Changes in interest rates significantly influence the construction and renovation sectors, key markets for Carrier Global. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25% to 5.50% through 2024 and potentially into 2025, as indicated by market expectations, higher borrowing costs could indeed dampen demand for new HVAC systems and building projects.

Carrier's ability to invest in research and development for energy-efficient technologies and pursue strategic acquisitions hinges on the availability of affordable capital. Similarly, Carrier's customers, ranging from large commercial developers to individual homeowners, rely on accessible financing for major equipment purchases and building upgrades. The cost of capital directly impacts the economic viability of these investments.

Carrier's financial strategy in 2024 and projected into 2025 demonstrates a commitment to shareholder returns. For example, the company announced a quarterly dividend of $0.20 per share in early 2024, alongside ongoing share repurchase programs, indicating a focus on capital allocation that balances reinvestment with returning value to investors.

Disposable Income and Consumer Spending

Disposable income is a key driver for Carrier's residential HVAC and smart home solutions. When consumers have more money left after essential expenses, they are more likely to invest in upgrades or new, energy-efficient systems. This trend is supported by recent economic data; for instance, the U.S. personal saving rate, a proxy for disposable income, remained elevated in early 2024, indicating continued consumer capacity for discretionary spending.

Consumer confidence also plays a crucial role. A positive outlook on the economy encourages spending on larger purchases like HVAC systems. In the first quarter of 2024, consumer confidence indices generally showed resilience, suggesting a willingness to make significant household investments. Despite potential higher upfront costs associated with new, regulation-compliant systems, consumers are increasingly prioritizing long-term energy savings and environmental benefits, making these investments more attractive.

- Disposable Income Trends: U.S. disposable income saw a notable increase in late 2023 and early 2024, providing a stronger base for consumer spending on durable goods.

- Consumer Confidence: Consumer sentiment surveys in early 2024 indicated a generally positive or stable outlook, supporting demand for home improvement products.

- Energy Efficiency Investment: A growing segment of consumers are willing to pay a premium for HVAC systems that offer enhanced energy efficiency, driven by both cost savings and environmental awareness.

- Regulatory Impact: New regulations, such as those concerning refrigerant types, may increase initial system costs but are expected to drive adoption of more advanced, efficient technologies.

Market Competition and Pricing Pressures

Carrier Global navigates a fiercely competitive global landscape, where intense rivalry from both seasoned industry giants and agile newcomers consistently exerts downward pressure on pricing. This environment necessitates a delicate balancing act: offering attractive prices while simultaneously funding crucial investments in sustainable technologies and advanced solutions. For instance, in 2023, the HVAC market, a core segment for Carrier, saw continued price competition, particularly in the residential sector, as manufacturers sought market share amidst fluctuating demand.

To maintain its competitive standing, Carrier strategically employs acquisitions and emphasizes its development of differentiated, digitally enhanced lifecycle solutions. These initiatives aim to provide greater value beyond the initial product sale, fostering customer loyalty and creating new revenue streams. The company's focus on connected systems and service offerings, highlighted by its increasing digital service revenue, is a key strategy to combat commoditization and pricing erosion.

- Competitive Landscape: Carrier faces intense competition from global players like Daikin, Johnson Controls, and Trane Technologies, as well as regional and emerging manufacturers.

- Pricing Pressures: The market frequently experiences price sensitivity, especially in high-volume segments, forcing companies to optimize costs and offer value-added services.

- Innovation Investment: Balancing competitive pricing with R&D for energy-efficient and smart building technologies is critical for long-term market position.

- Strategic Differentiation: Carrier's growth strategy includes acquiring companies and expanding its portfolio of integrated, digital solutions to command premium pricing and customer stickiness.

Global economic growth directly impacts Carrier Global's performance, with a projected 3.2% global growth in 2024 by the IMF supporting construction demand. This stability fuels residential, commercial, and industrial projects, crucial for Carrier's sales, as evidenced by a 1.5% rise in U.S. new residential construction starts in April 2024.

Inflationary pressures in 2024 and early 2025 are increasing raw material, component, and labor costs for Carrier, potentially squeezing profit margins if price increases lag. For example, new, environmentally friendly refrigerant standards could raise HVAC equipment costs by up to 30% for consumers.

Interest rates significantly influence Carrier's key markets. If the Federal Reserve maintains its rate between 5.25% and 5.50% through 2025, higher borrowing costs may curb demand for new HVAC systems and construction projects.

Disposable income and consumer confidence are vital for Carrier's residential offerings. In early 2024, elevated U.S. personal savings rates indicated strong consumer capacity for discretionary spending, while consumer confidence indices showed resilience, encouraging significant household investments despite potential higher upfront costs for energy-efficient systems.

| Economic Factor | Carrier Global Impact | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Drives demand for construction and HVAC systems. | IMF projected 3.2% global growth in 2024; steady growth expected into 2025. |

| Inflation | Increases operational costs for raw materials, components, and labor. | Persistent inflationary pressures impacting input costs in 2024-2025. |

| Interest Rates | Affects financing costs for construction projects and consumer purchases. | Federal Reserve rate expected to remain in the 5.25%-5.50% range through 2025, potentially dampening demand. |

| Disposable Income & Consumer Confidence | Influences spending on residential HVAC and smart home solutions. | Elevated personal savings in early 2024 and resilient consumer confidence support discretionary spending. |

Preview Before You Purchase

Carrier Global PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Carrier Global delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain actionable insights into market dynamics and strategic opportunities.

Sociological factors

Societal awareness regarding the importance of healthy indoor environments and sustainable building practices is rapidly increasing. This growing demand directly influences consumer and corporate choices, pushing for buildings that prioritize occupant well-being and minimize environmental impact.

This trend translates into a significant market opportunity for advanced HVAC systems that enhance indoor air quality, boost energy efficiency, and contribute to overall occupant health and comfort. For instance, the global green building market was valued at approximately $1.06 trillion in 2023 and is projected to reach $2.43 trillion by 2028, demonstrating the scale of this shift.

Carrier's strategic focus on sustainable solutions and healthy buildings positions it favorably to capitalize on this evolving societal preference. Their investments in technologies that improve air quality and reduce energy consumption align perfectly with the growing expectation for environmentally responsible and health-conscious building designs.

The global trend of rapid urbanization, with a significant portion of the world's population now living in cities, fuels demand for advanced building solutions. This shift, coupled with the growing emphasis on smart city development, directly benefits companies like Carrier. For instance, the smart building market was valued at approximately $80 billion in 2023 and is projected to reach over $200 billion by 2030, demonstrating substantial growth potential.

Smart city initiatives specifically drive the need for integrated systems that enhance energy efficiency, security, and overall urban functionality. Carrier's expertise in building automation and smart climate control positions it to capitalize on this demand, offering solutions that optimize resource management and improve the quality of urban living. The building automation system market alone is anticipated to grow at a compound annual growth rate (CAGR) of over 12% through 2028.

Aging infrastructure in developed nations, particularly in North America and Europe, drives significant demand for HVAC, refrigeration, and security system upgrades. This trend directly benefits Carrier Global, as it translates into a consistent need for their aftermarket services, replacement parts, and energy-efficient retrofit solutions. For instance, the U.S. infrastructure bill, with substantial allocations towards modernization projects, is expected to further stimulate this demand throughout 2024 and into 2025.

Workforce Demographics and Labor Shortages

The HVAC sector, including major players like Carrier, is grappling with a significant demographic shift. An aging workforce, coupled with a persistent shortage of skilled technicians, presents a tangible challenge. This directly affects the industry's ability to service existing installations and meet the growing demand for new ones, potentially hindering operational efficiency and growth. For instance, a 2023 report indicated that nearly 40% of HVAC technicians are over 45 years old, highlighting the impending retirement wave.

To counter these labor market dynamics, companies like Carrier are intensifying their focus on workforce development. This involves substantial investments in training programs, apprenticeships, and partnerships with vocational schools. The aim is to cultivate a new generation of skilled professionals, ensuring a robust pipeline of talent to support future operations and innovation. Carrier's 2024 initiatives include expanding their technician training programs by 25%.

- Aging Workforce: A substantial portion of the current HVAC technician base is approaching retirement age.

- Skilled Labor Shortage: There's a critical deficit in the number of qualified technicians available to meet industry demand.

- Impact on Operations: These demographic trends can lead to delays in service, reduced installation capacity, and increased operational costs.

- Industry Response: Companies are actively investing in training and development to build a sustainable talent pipeline.

Consumer Preferences for Smart Home Technology

Consumer preferences are increasingly leaning towards smart home technology, directly impacting the HVAC industry. This shift means homeowners expect more than just basic climate control; they want seamless integration and intelligent features. For instance, the global smart home market was valued at approximately USD 104.2 billion in 2023 and is projected to grow significantly, with smart thermostats being a key driver.

Consumers are actively seeking convenience, the ability to manage their homes remotely, and robust energy management capabilities. This demand is pushing manufacturers like Carrier to embed Internet of Things (IoT) and Artificial Intelligence (AI) into their residential HVAC systems. By 2025, it's estimated that over 50% of households in developed nations will have at least one smart home device.

- Growing Smart Home Adoption: Consumers are increasingly integrating smart devices into their homes, driving demand for connected HVAC solutions.

- Demand for Convenience and Control: Remote access and simplified operation are becoming standard expectations for residential comfort systems.

- Energy Efficiency Focus: Consumers are prioritizing energy management features to reduce utility bills and environmental impact.

- Integration Expectations: Homeowners anticipate HVAC systems that can communicate and work harmoniously with other smart home technologies.

Societal shifts towards health and sustainability are a major driver for Carrier Global. Consumers and businesses increasingly demand indoor environments that promote well-being and minimize ecological footprints, directly boosting the market for advanced HVAC solutions. For example, the global green building market was valued at approximately $1.06 trillion in 2023 and is projected to reach $2.43 trillion by 2028.

Urbanization and the rise of smart cities also create significant opportunities. As more people live in cities, the need for integrated, energy-efficient building systems grows. The smart building market, valued at around $80 billion in 2023, is expected to exceed $200 billion by 2030, highlighting the demand for Carrier's expertise in building automation.

However, the industry faces challenges from an aging workforce and a shortage of skilled technicians, with nearly 40% of HVAC technicians over 45 in 2023. This necessitates substantial investment in training programs, like Carrier's planned 25% expansion of its technician training in 2024, to ensure future operational capacity.

Consumer demand for smart home technology is also reshaping the HVAC landscape. Homeowners expect integrated, remotely controllable, and energy-efficient systems. By 2025, over 50% of households in developed nations are anticipated to own at least one smart home device, pushing manufacturers like Carrier to innovate in this space.

Technological factors

The integration of Artificial Intelligence and the Internet of Things is transforming building management. AI-powered systems can now fine-tune HVAC based on who's in the building and when, predict when equipment needs servicing, and significantly boost energy savings. IoT sensors are crucial for this, feeding real-time data to enable smarter, more responsive building operations.

Carrier is actively incorporating these technological leaps into its product offerings. For instance, Carrier's Abound platform leverages AI and IoT to provide predictive maintenance and energy optimization for commercial buildings, aiming to reduce operational costs and improve occupant comfort.

Technological innovation in refrigerants is a major driver for the HVAC industry, especially with increasing environmental regulations. Carrier Global is actively investing in and deploying new HVAC systems that utilize refrigerants with lower Global Warming Potential (GWP), such as R-454B and R-32. This focus also extends to advancing heat pump technology, making these systems more efficient and environmentally friendly.

These advancements are not just about compliance; they are essential for addressing global climate change concerns. For instance, the European Union's F-Gas Regulation continues to phase down HFCs, pushing for alternatives with significantly lower GWP. Carrier's commitment to developing these next-generation refrigerants and heat pumps positions them to meet these evolving standards and capture market share in a transition towards more sustainable cooling and heating solutions.

Digital twins, essentially virtual replicas of physical assets like HVAC systems, are becoming a game-changer in smart building technology. This allows for incredibly detailed, real-time monitoring and analysis of equipment performance.

Coupled with predictive maintenance, this technology enables Carrier to anticipate potential failures before they happen, streamlining service operations and significantly reducing unexpected downtime for their customers. This proactive approach is crucial for maintaining operational efficiency in the increasingly connected building environment.

Cybersecurity in Connected Systems

As HVAC, security, and building automation systems become increasingly connected, cybersecurity emerges as a paramount technological challenge. Protecting these integrated platforms from cyber threats is vital for maintaining operational continuity, safeguarding sensitive data, and ensuring the safety of building occupants. For instance, the global cybersecurity market for IoT devices, which includes many building automation components, was projected to reach over $20 billion in 2024, highlighting the scale of this concern.

Carrier's smart solutions, which often involve cloud connectivity and data exchange, are directly exposed to these evolving threats. A breach could compromise not only system functionality but also sensitive building management data and tenant privacy. In 2023, the average cost of a data breach in the United States was estimated at $9.48 million, a figure that underscores the financial risks associated with inadequate cybersecurity.

- Increased Connectivity Risks: The integration of HVAC, security, and building automation systems creates a larger attack surface for cyber threats.

- Operational Integrity and Safety: Protecting these connected systems is crucial for preventing disruptions and ensuring occupant well-being.

- Data Privacy Concerns: Connected building systems often handle sensitive operational and personal data, making robust protection essential.

- Investment in Security: Carrier must prioritize significant investment in advanced cybersecurity measures for its smart building technologies to mitigate risks and maintain customer trust.

Electrification and Energy Storage Solutions

The global shift towards electrification, especially in the HVAC sector, is a significant technological driver creating new avenues for Carrier. This trend is fueled by a growing demand for sustainable and efficient heating and cooling systems. For instance, by 2023, the global electric heating market was valued at approximately $120 billion, with projections indicating continued growth driven by electrification initiatives.

Advancements in energy storage solutions are also pivotal, enabling HVAC systems to become more than just energy consumers. Innovations like Home Energy Management Systems (HEMS) are transforming residential HVAC units into intelligent energy assets. These systems can store energy, manage consumption during peak hours, and shift usage to off-peak periods, thereby optimizing energy costs and grid stability. By 2025, the smart home energy management market is expected to reach over $20 billion globally.

- Electrification Trend: Growing adoption of electric heating and cooling systems, driven by environmental concerns and government incentives.

- Energy Storage Integration: HVAC systems are increasingly incorporating battery storage and smart grid connectivity.

- HEMS Development: Home Energy Management Systems allow for dynamic load shifting and demand response capabilities, turning homes into active grid participants.

- Market Growth: The global smart home energy management market is projected for substantial expansion, indicating strong consumer interest in energy-efficient and controllable solutions.

Technological advancements are fundamentally reshaping the HVAC industry, with AI and IoT integration driving smarter building management and predictive maintenance. Carrier's Abound platform exemplifies this, utilizing these technologies to optimize building operations and reduce costs.

The push for lower Global Warming Potential (GWP) refrigerants, such as R-454B and R-32, is a key technological factor, directly influenced by regulations like the EU's F-Gas Regulation. Carrier is investing heavily in these next-generation refrigerants and more efficient heat pump technology to meet environmental standards and market demand.

Digital twins are revolutionizing asset management by providing virtual replicas for detailed performance analysis and proactive maintenance, minimizing downtime. Furthermore, the increasing connectivity of building systems highlights cybersecurity as a critical technological challenge, with significant investments required to protect against data breaches and operational disruptions, a market projected to exceed $20 billion for IoT devices in 2024.

Electrification and energy storage are also major technological drivers, with the global electric heating market valued around $120 billion by 2023. Innovations in Home Energy Management Systems (HEMS) are transforming HVAC units into intelligent energy assets, with the smart home energy management market expected to surpass $20 billion globally by 2025.

| Technological Factor | Description | Impact on Carrier | Market Data (2024/2025 Projections) |

| AI & IoT Integration | Smarter building management, predictive maintenance, energy optimization. | Enhances product offerings (e.g., Abound platform), improves operational efficiency. | AI in building automation market growing significantly. |

| Refrigerant Technology | Shift to lower GWP refrigerants (R-454B, R-32), enhanced heat pumps. | Drives R&D, ensures regulatory compliance, creates competitive advantage. | EU F-Gas Regulation phasing down HFCs. |

| Digital Twins & Predictive Maintenance | Virtual asset replicas for advanced monitoring and proactive servicing. | Reduces customer downtime, improves service revenue. | Key for smart building operational efficiency. |

| Cybersecurity | Protecting connected building systems from threats. | Requires significant investment, crucial for customer trust and data protection. | Global IoT cybersecurity market projected over $20 billion in 2024. |

| Electrification & Energy Storage | Increased adoption of electric HVAC, integration with HEMS. | Opens new market segments, positions Carrier for sustainable solutions. | Global electric heating market ~$120 billion (2023); Smart home energy management market >$20 billion (2025). |

Legal factors

The Environmental Protection Agency's (EPA) upcoming regulations, especially those effective January 1, 2025, concerning refrigerants with high Global Warming Potential (GWP) are a significant factor for Carrier Global. These rules necessitate a proactive approach to product redesign and manufacturing processes, pushing for the adoption of lower GWP alternatives. For instance, the AIM Act phasedown aims to reduce HFC consumption by 85% by 2036, directly influencing the types of refrigerants Carrier must incorporate into its HVAC and refrigeration systems.

These EPA mandates also emphasize enhanced energy efficiency standards and more stringent leak detection requirements for cooling equipment. Failure to adhere to these evolving environmental regulations could result in substantial financial penalties for non-compliance, impacting Carrier's operational costs and market standing. The EPA projected that compliance with these new standards would drive innovation in the HVAC industry, potentially leading to more sustainable and efficient product offerings.

International environmental accords, like the Kigali Amendment to the Montreal Protocol, are reshaping the global refrigerant market by mandating a phase-down of hydrofluorocarbons (HFCs). This creates a regulatory framework that directly impacts Carrier's product development and market entry strategies across its diverse international operations, necessitating adaptation to varying national implementation timelines and standards.

Carrier Global must adhere to a complex web of national and local building and safety codes, impacting everything from product design to installation. These regulations, covering fire safety and security, are non-negotiable for ensuring public well-being and structural integrity.

For instance, evolving energy efficiency standards, like California's Title 24, which saw significant updates in 2025, require Carrier to continually innovate its HVAC and refrigeration systems to meet stringent performance benchmarks.

Intellectual Property Laws

Intellectual property laws are foundational to protecting Carrier's technological edge. Safeguarding patents, trademarks, and trade secrets for its HVAC, refrigeration, and building automation innovations is vital for sustained competitive advantage. For instance, in 2023, the global intellectual property market saw significant activity, with patent filings continuing to rise across technology sectors, underscoring the importance of robust IP strategies.

Navigating the diverse international landscape of IP protection presents a complex challenge. Carrier must maintain a comprehensive global strategy to ensure its innovations are adequately shielded across different legal jurisdictions, which can vary significantly in enforcement and scope.

- Patent Protection: Securing patents for new cooling technologies and energy-efficient systems is critical.

- Trademark Enforcement: Protecting brand names and logos associated with Carrier's quality and reliability is paramount.

- Trade Secret Management: Implementing stringent internal controls to safeguard proprietary manufacturing processes and design data is essential.

- Global Compliance: Adhering to varying IP regulations in key markets like China, the EU, and the US ensures broad protection.

Data Privacy and Security Regulations

Carrier Global must navigate a complex web of data privacy and security regulations, especially as its smart building solutions generate and process significant amounts of data. Laws like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States impose strict requirements on how companies collect, use, and store personal information. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher. This necessitates robust data protection measures to safeguard customer and operational data, thereby mitigating legal risks and preserving customer confidence in Carrier's connected technologies.

The increasing interconnectedness of building systems, often referred to as the Internet of Things (IoT), amplifies these legal obligations. Carrier's commitment to data security is therefore not just a technical challenge but a critical legal and reputational imperative. In 2023, data breaches cost organizations an average of $4.45 million globally, highlighting the financial implications of inadequate security. Ensuring compliance means implementing strong encryption, access controls, and transparent data handling policies across all its smart building offerings.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- CCPA Requirements: Mandates consumer rights regarding data access, deletion, and opt-out of sale.

- Average Breach Cost: Global average cost of a data breach was $4.45 million in 2023.

- IoT Security Focus: Growing regulatory scrutiny on data security for connected devices in buildings.

Carrier Global faces significant legal challenges related to environmental regulations, particularly the phasedown of hydrofluorocarbons (HFCs) mandated by international agreements like the Kigali Amendment and domestic laws such as the AIM Act. These regulations, with key deadlines approaching in 2025, require substantial investment in R&D for alternative refrigerants and product redesign to meet evolving efficiency standards and leak detection requirements.

The company must also navigate a complex landscape of building codes and safety standards, which are continually updated. For example, California's Title 24 energy efficiency standards, updated in 2025, directly impact HVAC system design and performance requirements for Carrier's products sold in the state.

Intellectual property law is crucial for protecting Carrier's innovations in HVAC and building automation. The rising volume of patent filings globally, as seen in 2023, underscores the need for robust IP strategies and enforcement across various jurisdictions to maintain a competitive edge.

Data privacy regulations, such as GDPR and CCPA, present ongoing compliance demands for Carrier's smart building solutions. The significant financial penalties for non-compliance, with GDPR fines potentially reaching 4% of global annual turnover, highlight the critical need for stringent data security measures and transparent data handling practices.

Environmental factors

Climate change is a significant driver for Carrier Global, as it intensifies the demand for advanced HVAC solutions. More frequent and severe heatwaves and cold snaps globally necessitate more robust and energy-efficient cooling and heating systems. For instance, in 2024, many regions experienced record-breaking temperatures, directly increasing the need for reliable air conditioning.

This escalating climate impact fuels the market for Carrier's climate control technologies, from residential units to large-scale commercial applications. The push for sustainability also means a greater focus on systems that reduce energy consumption, a key area where Carrier is investing. The company's commitment to innovation in efficiency is crucial as global energy demand for climate control continues its upward trend, projected to rise significantly by 2030.

The environmental impact of refrigerants, especially their high Global Warming Potential (GWP), is a critical concern. Carrier is navigating the complex phase-down of these substances, a process mandated by regulations like the U.S. Environmental Protection Agency's (EPA) AIM Act, which targets a 70% reduction in HFC production and consumption by 2025 compared to 2012 baseline levels.

This transition to lower-GWP alternatives, such as hydrofluoroolefins (HFOs), presents both significant operational challenges and opportunities for innovation. Carrier's investment in developing and implementing these next-generation refrigerants is crucial for compliance and market leadership in a rapidly evolving regulatory landscape.

Buildings are major energy guzzlers, accounting for roughly 40% of global energy consumption and a significant portion of greenhouse gas emissions. This reality is driving substantial pressure from regulatory bodies, eco-conscious consumers, and ESG-focused investors to slash the carbon footprint associated with built environments.

The demand for energy-efficient heating, ventilation, and air conditioning (HVAC) systems and advanced building automation is soaring. For instance, the global smart building market was valued at approximately $76 billion in 2023 and is projected to reach over $200 billion by 2030, highlighting this trend.

Carrier Global's strategic emphasis on electrification and sustainable innovation directly aligns with these market demands. Their investments in technologies like heat pumps and smart controls position them to capitalize on the growing need for decarbonizing the building sector.

Resource Scarcity and Sustainable Materials

Carrier Global is increasingly focused on resource scarcity and sustainable materials, a trend amplified by global supply chain challenges and a growing emphasis on the circular economy. This means the company actively seeks to incorporate more recycled, recyclable, and environmentally sound materials into its HVAC and refrigeration products. For instance, Carrier is investing in R&D to improve heat recovery technologies, which reduce energy consumption and reliance on primary resources.

The drive for sustainability is not just about compliance but also about operational efficiency and market positioning. By 2024, the demand for green building materials and energy-efficient appliances is expected to continue its upward trajectory, influencing Carrier's material sourcing and product design. The company's commitment extends to designing products with a longer lifespan and easier disassembly for recycling at the end of their service life.

- Material Innovation: Carrier is exploring the use of recycled aluminum and plastics in its manufacturing, aiming to reduce reliance on virgin resources.

- Circular Economy Focus: Product design is evolving to facilitate easier repair, refurbishment, and eventual recycling of components.

- Energy Efficiency: Enhanced heat recovery systems are being integrated into HVAC units to minimize energy waste, thereby reducing the demand for fuel resources.

- Supply Chain Resilience: Diversifying material sources and investing in sustainable alternatives helps mitigate risks associated with the scarcity of specific raw materials.

Waste Management and Product End-of-Life

Carrier Global faces increasing scrutiny regarding waste management throughout its product lifecycle. This includes minimizing waste generated during manufacturing processes and ensuring responsible disposal or recycling of products at their end-of-life. The company's commitment to environmental stewardship is directly tied to how effectively it addresses these challenges.

For 2024, a key focus for Carrier will be enhancing its waste diversion rates from landfills. For instance, by the end of 2023, Carrier reported achieving a 79% waste diversion rate across its global operations, a figure it aims to improve upon. This involves implementing more robust recycling programs and exploring innovative methods for repurposing manufacturing byproducts.

Furthermore, product design is evolving to incorporate principles of circular economy. Carrier is investing in research and development to create products that are easier to disassemble and recycle, thereby reducing the environmental impact of discarded equipment. This proactive approach is crucial as regulatory pressures and consumer expectations for sustainable practices continue to mount.

- Waste Diversion Goals: Carrier aims to increase its global waste diversion rate beyond the 79% achieved by year-end 2023.

- Circular Economy Design: Focus on designing HVAC and refrigeration units for enhanced recyclability and reduced end-of-life environmental impact.

- Regulatory Compliance: Adherence to evolving global regulations concerning electronic waste and product lifecycle management.

- Operational Efficiency: Implementing advanced waste reduction techniques within manufacturing facilities to minimize landfill contributions.

Climate change is a primary driver for Carrier Global, increasing demand for efficient HVAC systems due to extreme weather events. For example, 2024 saw record-breaking temperatures, boosting the need for reliable cooling solutions. The company's focus on energy-efficient technologies aligns with the projected rise in global energy demand for climate control.

The environmental impact of refrigerants, particularly their high Global Warming Potential (GWP), necessitates a transition to alternatives like HFOs, driven by regulations such as the EPA's AIM Act. This shift presents both challenges and opportunities for Carrier's innovation in compliance and market leadership.

Buildings contribute significantly to global energy consumption and emissions, driving demand for energy-efficient HVAC and smart building solutions. The global smart building market, valued at approximately $76 billion in 2023, is expected to exceed $200 billion by 2030, underscoring this trend.

Carrier Global is prioritizing resource scarcity and sustainable materials, incorporating recycled content and enhancing heat recovery technologies. By 2024, demand for green building materials continues to grow, influencing Carrier's material sourcing and product design for longevity and recyclability.

PESTLE Analysis Data Sources

Our Carrier Global PESTLE analysis is constructed using a diverse range of data sources, including reports from international organizations like the World Bank and IMF, government publications detailing regulatory changes, and reputable industry analysis firms. This ensures a comprehensive understanding of political, economic, social, technological, environmental, and legal factors impacting the company.