Carrier Global Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carrier Global Bundle

Discover the strategic framework that powers Carrier Global's market dominance with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Unlock the full blueprint to understand how Carrier innovates and thrives in the global HVAC and building solutions sector.

Partnerships

Carrier's strategic acquisitions are a cornerstone of its business model, significantly bolstering its portfolio. A prime example is the 2024 integration of Viessmann Climate Solutions, a move that dramatically broadened Carrier's global reach in intelligent climate and energy solutions.

This acquisition, valued at approximately €12 billion, allows Carrier to present a more robust and distinct range of sustainable technologies and services. It directly supports Carrier's strategic alignment with major global shifts towards electrification and digitalization.

By incorporating Viessmann's expertise and product lines, Carrier is enhancing its competitive edge and market positioning in the rapidly evolving climate solutions sector.

Carrier's global business model heavily relies on a vast network of independent distributors and wholesale partners. This extensive reach allows them to effectively penetrate diverse markets worldwide for their HVAC and refrigeration solutions.

These partnerships are vital for Carrier's market penetration strategy, enabling access to a wide array of customers spanning residential, commercial, and industrial segments. For instance, in 2024, Carrier continued to strengthen these relationships, with distributors playing a key role in their approximately $22 billion in net sales.

This traditional distribution approach remains a fundamental element of how Carrier brings its products to market. It ensures local expertise and customer support, which are critical for customer satisfaction and brand loyalty.

Carrier actively partners with leading technology firms and industry innovators to push the boundaries of climate and building control. These collaborations are crucial for integrating advanced capabilities such as AI into their offerings, aiming to create smarter, more efficient building environments. For instance, their work with tech providers accelerates the development of sophisticated climate solutions that respond dynamically to real-time data, enhancing energy savings and occupant comfort.

Industry Associations and Advocacy Groups

Carrier actively engages with industry associations and advocacy groups to shape industry standards and promote sustainable practices. This engagement is crucial for influencing policy and staying ahead of market trends, particularly in areas like building decarbonization.

For instance, Carrier's collaboration with organizations such as C40 Cities aids in developing effective cooling roadmaps, reinforcing the company's commitment to environmental responsibility. This strategic involvement ensures Carrier remains a leader in climate resilience initiatives.

- Industry Standards: Participation in groups like the Air-Conditioning, Heating, and Refrigeration Institute (AHRI) helps define performance and safety standards.

- Policy Influence: Engaging with bodies such as the U.S. Green Building Council (USGBC) allows Carrier to advocate for policies supporting energy efficiency and sustainable building practices.

- Sustainability Focus: Collaborations with climate-focused organizations underscore Carrier's dedication to reducing environmental impact across its product lifecycle.

- Market Foresight: These partnerships provide valuable insights into emerging regulations and consumer demands for greener solutions, as seen in the growing market for high-efficiency HVAC systems.

Service and Aftermarket Partners

Carrier Global’s strength in service and aftermarket relies on a vast network of service centers and specialized partners worldwide. These alliances are crucial for delivering ongoing maintenance, repair services, and digital solutions, ensuring Carrier's products perform optimally throughout their operational life. For instance, Carrier's commitment to aftermarket support is underscored by its extensive dealer network, which plays a vital role in customer satisfaction and generating consistent revenue. In 2023, Carrier reported significant growth in its aftermarket segments, reflecting the value customers place on reliable support and extended product performance.

These partnerships are not just about fixing things; they are about offering comprehensive support that enhances the customer experience and extends the lifespan of Carrier's equipment. This focus on post-sale service is a key differentiator, fostering customer loyalty and creating predictable, recurring revenue streams. The company's strategic investments in digital service platforms further empower these partners, enabling proactive maintenance and remote diagnostics, which are increasingly important in today's interconnected world.

- Global Service Network: Carrier maintains a broad global presence of authorized service centers and independent dealers, ensuring localized support for its diverse product lines.

- Aftermarket Revenue Contribution: The aftermarket segment, including parts, services, and digital solutions, represents a substantial and growing portion of Carrier's overall revenue, contributing to financial stability and profitability.

- Digital Service Integration: Partnerships are increasingly focused on integrating digital technologies for predictive maintenance, remote monitoring, and enhanced customer service, improving operational efficiency and customer engagement.

Carrier's key partnerships are multifaceted, encompassing strategic acquisitions, extensive distribution networks, technology collaborations, industry engagements, and a robust service ecosystem.

The acquisition of Viessmann Climate Solutions in 2024 for approximately €12 billion significantly expanded Carrier's sustainable technology offerings and global footprint, aligning with electrification trends.

Carrier's vast network of independent distributors and wholesale partners is crucial for market penetration, supporting their net sales which reached approximately $22 billion in 2024, ensuring local expertise and customer access.

Collaborations with technology firms enhance Carrier's product capabilities, integrating AI for smarter building environments, while industry association memberships shape standards and promote sustainability.

A strong global service network of authorized centers and dealers is vital for aftermarket support, contributing significantly to revenue and customer loyalty through digital service integration.

| Partnership Type | Key Examples/Focus | Impact/Benefit | 2024 Relevance |

|---|---|---|---|

| Strategic Acquisitions | Viessmann Climate Solutions | Expanded climate solutions, global reach | €12 billion acquisition |

| Distribution Networks | Independent Distributors, Wholesalers | Market penetration, customer access | Supported ~$22 billion net sales |

| Technology Collaborations | Leading Tech Firms | AI integration, advanced capabilities | Development of smart building solutions |

| Industry Associations | AHRI, USGBC, C40 Cities | Standards setting, policy influence, sustainability | Promoting energy efficiency |

| Service & Aftermarket | Authorized Service Centers, Dealers | Maintenance, repair, digital solutions, recurring revenue | Growth in aftermarket segments |

What is included in the product

This Business Model Canvas outlines Carrier Global's strategy for providing HVAC, refrigeration, and fire & security solutions, detailing customer segments like residential and commercial, and channels through distributors and direct sales.

It emphasizes value propositions such as energy efficiency and safety, supported by key partners and resources to achieve revenue streams from product sales and services.

Carrier's Business Model Canvas offers a structured approach to pinpointing and addressing operational inefficiencies, acting as a pain point reliver by clarifying value propositions and customer segments.

By visualizing key business elements, Carrier's Business Model Canvas effectively diagnoses and resolves pain points by highlighting areas for improved customer relationships and revenue streams.

Activities

Carrier's primary activities revolve around the meticulous design, efficient manufacturing, and extensive global distribution of advanced climate solutions. This encompasses a broad spectrum of heating, ventilation, air conditioning (HVAC), and refrigeration technologies.

Post its significant portfolio transformation in 2024, Carrier has strategically honed its operations to concentrate on these essential climate solutions. This includes catering to the residential, commercial, and transportation sectors with a diverse array of products.

In 2023, Carrier reported net sales of $22.1 billion, underscoring the scale of its operations in delivering these critical climate technologies across various global markets and applications.

Carrier's commitment to sustainable innovation is a cornerstone of its business, driving significant investment in research and development. This focus is geared towards creating advanced solutions in electrification and digital technologies.

By 2030, Carrier plans to invest billions of dollars to pioneer intelligent climate and energy solutions. These investments are designed to significantly reduce environmental impact and boost energy efficiency across their product lines.

Key R&D outputs include next-generation heat pump technologies, cutting-edge cold chain advancements, and sophisticated smart building solutions, all aimed at meeting evolving market demands for sustainability.

Carrier's key activities heavily involve providing robust aftermarket services, encompassing maintenance, repairs, and advanced digital monitoring solutions. These offerings are crucial for ensuring the longevity and optimal performance of their HVAC and refrigeration systems.

A significant part of this strategy is the utilization of BluEdge Command Centers. These centers leverage artificial intelligence to proactively monitor building systems, predict potential equipment failures, and optimize operational efficiency, thereby minimizing downtime for their clients.

This focus on aftermarket growth is a cornerstone of Carrier's business model, directly contributing to a substantial portion of recurring revenue. For instance, in 2023, Carrier reported strong performance in its HVAC segment, with aftermarket services playing a vital role in customer retention and loyalty.

Strategic Portfolio Transformation and Integration

Carrier Global's strategic portfolio transformation is a cornerstone of its business model, actively reshaping its market position. In 2024, this involved divesting its Fire & Security and Commercial Refrigeration segments, a move designed to sharpen its strategic focus. This significant divestiture activity was complemented by a major acquisition, Viessmann Climate Solutions, signaling a clear pivot towards core intelligent climate and energy solutions.

The integration of newly acquired entities, such as Viessmann Climate Solutions, is a critical ongoing activity. This process is essential for unlocking potential synergies, such as cost efficiencies and revenue enhancements, while also broadening Carrier's technological capabilities and market reach in the climate and energy sector. Successful integration is key to realizing the strategic value of these portfolio changes.

- Divestiture of non-core assets: Completed the sale of Fire & Security and Commercial Refrigeration businesses in 2024, streamlining operations.

- Strategic acquisition: Acquired Viessmann Climate Solutions, enhancing its position in the climate and energy solutions market.

- Focus on core competencies: Redirecting resources and strategic efforts towards intelligent climate and energy solutions.

- Synergy realization: Actively working to integrate acquired businesses to achieve operational and financial benefits.

Operational Excellence and Productivity Enhancement

Carrier Global's commitment to operational excellence is a cornerstone of its business model, driving significant productivity gains. Through programs like Carrier Excellence, the company actively pursues efficiency improvements across its vast manufacturing and supply chain networks, aiming to streamline processes and minimize waste.

This relentless focus on enhancing productivity directly translates to cost reductions, contributing to margin expansion. For example, in 2023, Carrier reported a significant improvement in its operating margins, partly attributed to these ongoing efficiency initiatives.

- Manufacturing Efficiency: Implementing lean manufacturing principles and automation to boost output and reduce defects.

- Supply Chain Optimization: Leveraging advanced analytics and strategic sourcing to enhance logistics and inventory management.

- Service Delivery Improvements: Utilizing digital tools and training to increase the speed and effectiveness of customer service operations.

Carrier's key activities are centered on the design, manufacturing, and distribution of climate solutions, bolstered by a strong emphasis on aftermarket services and ongoing strategic portfolio adjustments. The company actively pursues operational excellence through efficiency programs and invests heavily in research and development for sustainable innovations.

| Key Activity | Description | 2023 Data/Impact |

|---|---|---|

| Climate Solutions Design & Manufacturing | Developing and producing HVAC, refrigeration, and heating technologies. | Net sales of $22.1 billion in 2023. |

| Aftermarket Services | Providing maintenance, repairs, and digital monitoring for installed systems. | Strong performance in HVAC segment, driving customer retention. |

| Strategic Portfolio Management | Divesting non-core assets and acquiring businesses to focus on core climate solutions. | Divested Fire & Security and Commercial Refrigeration in 2024; acquired Viessmann Climate Solutions. |

| Innovation & R&D | Investing in electrification, digital technologies, and sustainable solutions. | Billions planned for investment by 2030 in intelligent climate and energy solutions. |

Preview Before You Purchase

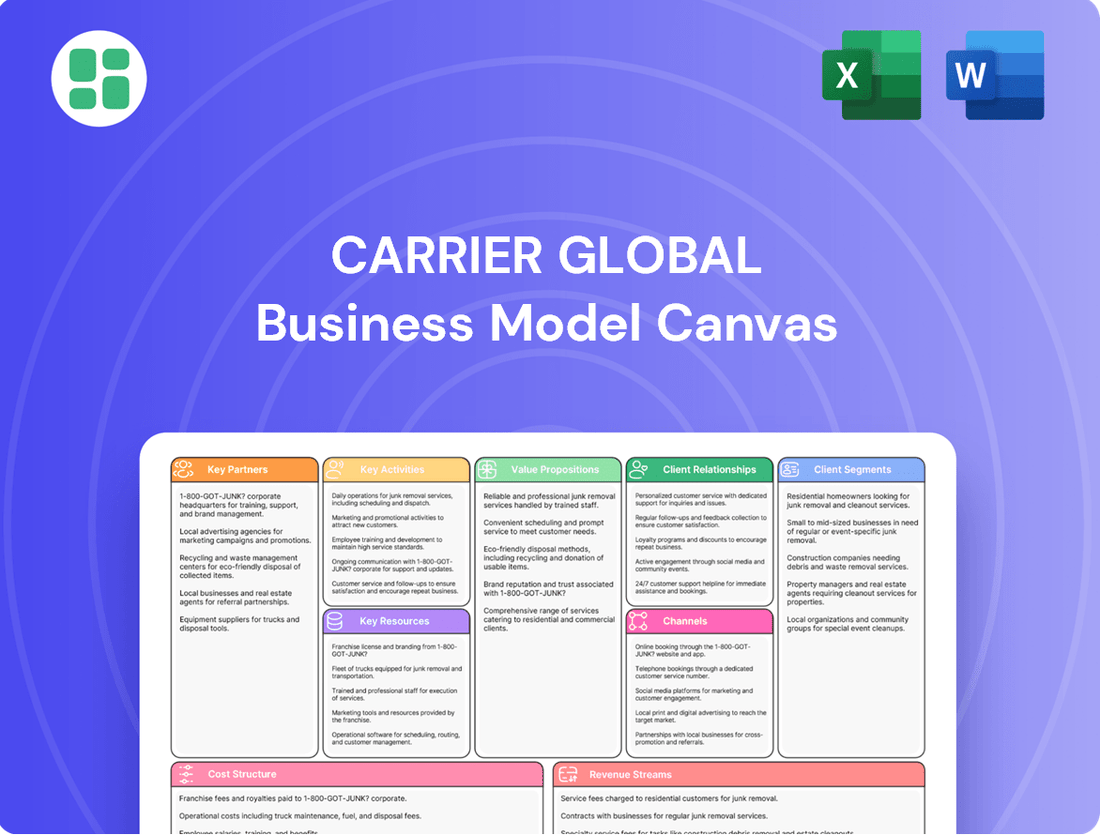

Business Model Canvas

The Carrier Global Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This means you're seeing the complete, professionally structured analysis, not a simplified sample. Once your order is processed, you'll gain full access to this identical file, ready for immediate use and customization.

Resources

Carrier's extensive patent portfolio and proprietary technologies are central to its business model, particularly in HVAC, refrigeration, and building automation. This intellectual property includes cutting-edge designs for energy efficiency and advanced digital solutions, directly contributing to their market-leading position.

In 2023, Carrier continued to invest heavily in research and development, with a significant portion allocated to enhancing their proprietary technologies. This focus allows them to offer differentiated products that command premium pricing and drive customer loyalty, reinforcing their competitive advantage.

Carrier Global operates a vast worldwide network of manufacturing facilities and a robust supply chain. This infrastructure is crucial for designing, producing, and distributing its wide array of products, from HVAC systems to refrigeration units. In 2024, Carrier continued to leverage this global footprint to serve residential, commercial, and industrial markets effectively.

The efficiency of managing this extensive network directly impacts cost control and ensures timely product delivery to customers around the globe. For instance, strategic sourcing and optimized logistics within their supply chain are key drivers for maintaining competitive pricing and meeting demand in diverse geographical regions.

Carrier Global’s business model hinges on its robust brand portfolio, featuring the flagship Carrier brand and recently acquired entities like Viessmann Climate Solutions. This collection of globally recognized names signifies a strong market reputation built on quality, innovation, and reliability.

The significant brand equity translates directly into customer preference and a competitive edge in market share. For instance, Carrier’s HVAC segment consistently demonstrates strong performance, with its brands being a key driver of consumer choice in a competitive landscape.

Skilled Workforce and Global Talent Pool

Carrier's business model hinges on a highly skilled workforce, encompassing engineers, R&D experts, manufacturing staff, sales professionals, and service technicians. This human capital is fundamental to driving innovation, ensuring operational efficiency, and delivering exceptional customer service across its diverse product lines.

Carrier actively invests in its people, recognizing the importance of continuous learning and development. Initiatives like TechVantage are designed to equip service professionals with the latest skills, ensuring they can effectively support Carrier's advanced HVAC and refrigeration solutions. This commitment to workforce development directly translates into superior product performance and customer satisfaction.

- Skilled Workforce: Engineers, R&D specialists, manufacturing personnel, sales teams, and service technicians are core assets.

- Investment in Development: Programs like TechVantage focus on training service professionals for advanced technologies.

- Impact on Business: Human capital fuels innovation, operational efficiency, and customer service excellence.

- Talent Acquisition: Access to a global talent pool allows Carrier to recruit specialized expertise for its diverse operations.

Financial Capital and Strategic Investment Capacity

Carrier Global leverages its substantial financial capital to fuel strategic investments. This includes significant allocations to research and development, crucial for innovation in HVAC and refrigeration technologies. In 2024, Carrier reported robust financial performance, demonstrating its capacity to fund these vital areas and pursue opportunistic acquisitions that enhance its market position.

The company's strong financial footing, projected to continue positively into 2025, underpins its ability to execute growth initiatives. This financial strength is not only for internal development but also enables strategic share repurchases, directly returning value to shareholders and signaling confidence in the company's future prospects.

- Financial Strength: Carrier maintains significant financial capital enabling strategic investments.

- 2024 Performance: Strong financial results in 2024 provided resources for growth.

- 2025 Outlook: Positive projections for 2025 ensure continued funding capacity.

- Shareholder Value: Financial strength supports R&D, acquisitions, and share repurchases.

Carrier's intellectual property, including a vast patent portfolio and proprietary technologies in HVAC, refrigeration, and building automation, is a cornerstone of its competitive advantage. These innovations, focused on energy efficiency and digital solutions, solidify its market leadership. In 2023, Carrier's R&D investments were substantial, directly supporting the development of these differentiated, premium-priced products.

Value Propositions

Carrier provides cutting-edge heating, ventilation, and air conditioning (HVAC) systems designed for maximum energy efficiency and minimal environmental impact. Their innovative solutions, like advanced heat pumps and comprehensive building decarbonization technologies, directly assist customers in lowering their carbon emissions and reducing operational expenses. For instance, in 2023, Carrier reported a significant increase in sales for its sustainable product portfolio, reflecting growing market demand for eco-friendly building solutions.

Carrier Global offers a wide array of products and services catering to residential, commercial, and industrial needs. This includes sophisticated HVAC systems, refrigeration units, and building automation technology.

The company's product line is further enhanced by its strategic acquisition of Viessmann Climate Solutions. This move bolsters Carrier's position by providing integrated climate and energy solutions across the entire value chain.

In 2023, Carrier reported approximately $22.1 billion in net sales, reflecting the breadth and demand for its comprehensive product portfolio. The Viessmann acquisition, completed in early 2024 for €12 billion (approximately $13 billion USD), is expected to significantly expand its European footprint and climate technology offerings.

Carrier offers intelligent, digitally-enhanced systems designed to fine-tune climate control and reduce energy usage in both buildings and throughout the cold chain. These advanced solutions are built to deliver efficiency and sustainability.

Leveraging AI, Carrier's platforms such as BluEdge Command Centers and the Home Energy Management System (HEMS) provide predictive maintenance capabilities and sophisticated energy optimization strategies. For instance, in 2024, buildings equipped with advanced energy management systems have seen an average reduction in energy consumption by up to 15%.

These intelligent management tools translate directly into tangible benefits for customers, including improved operational performance, greater system reliability, and significant cost savings on energy expenditures. This focus on enhanced performance and cost reduction is a core part of Carrier's value proposition.

Enhanced Comfort, Health, and Safety

Carrier's technologies are central to creating indoor environments that prioritize comfort, health, and safety for occupants. This commitment translates into tangible benefits through advanced solutions designed to manage air quality, maintain optimal temperatures, and ensure the integrity of sensitive goods.

The company offers a range of products focused on improving indoor air quality, a critical factor in occupant well-being, especially in light of increasing awareness of airborne pathogens and allergens. For instance, Carrier's advanced filtration systems and ventilation technologies actively remove pollutants and contaminants, contributing to healthier living and working spaces. In 2023, the global air purification market, which includes many of Carrier's offerings, was valued at approximately $15 billion and is projected to grow significantly.

Precise temperature control is another cornerstone of Carrier's value proposition. Their HVAC systems are engineered to provide consistent and reliable climate management, enhancing comfort and energy efficiency. This precision is vital not only for residential and commercial comfort but also for critical applications where temperature stability is paramount. For example, Carrier's refrigeration solutions are essential for the cold chain, ensuring that food remains fresh and medicines maintain their efficacy during transport and storage. The global cold chain market was estimated to be worth over $200 billion in 2023, highlighting the importance of reliable refrigeration technologies.

Carrier's dedication to human well-being and product reliability underpins these offerings. Their solutions are designed for longevity and performance, providing peace of mind to customers who rely on their systems for essential functions. This focus on dependability is a key differentiator, especially in sectors where failure can have significant consequences.

- Improved Indoor Air Quality: Carrier's advanced filtration and ventilation systems actively remove pollutants, contributing to healthier indoor environments.

- Precise Temperature Control: HVAC and refrigeration technologies ensure optimal climate management for comfort and the preservation of sensitive goods.

- Reliable Cold Chain Solutions: Essential for maintaining the freshness of food and the efficacy of medicines through dependable refrigeration.

- Focus on Human Well-being and Product Reliability: Carrier's core commitment to occupant health and the dependable performance of their systems.

Global Aftermarket Support and Lifecycle Value

Carrier's global aftermarket support ensures customers receive continuous value, with a vast network of service technicians and readily available parts. This commitment to the entire product lifecycle, from installation to ongoing maintenance, maximizes operational efficiency and customer satisfaction. In 2024, Carrier continued to invest in digital tools to offer proactive service and predictive maintenance, further enhancing product performance and extending asset life.

Customers benefit from this extensive global service network, which provides expert technicians and a comprehensive supply chain for parts. This focus on lifecycle solutions means Carrier's products maintain optimal performance over their lifespan, leading to increased customer loyalty and reduced total cost of ownership. For instance, their digital service platforms in 2024 enabled remote diagnostics and optimized scheduling, reducing downtime for clients worldwide.

- Global Reach: Access to over 1,200 service locations worldwide.

- Proactive Service: Deployment of advanced digital tools for predictive maintenance.

- Lifecycle Value: Maximizing product performance and customer satisfaction through ongoing support.

- Parts Availability: Ensuring rapid access to genuine Carrier parts to minimize downtime.

Carrier provides advanced, energy-efficient HVAC and refrigeration solutions, including innovative heat pumps and decarbonization technologies. Their focus on sustainability helps customers reduce carbon footprints and operational costs, a trend reflected in their 2023 sales growth for eco-friendly products.

Carrier's value proposition centers on delivering intelligent, digitally-enhanced climate control systems that optimize energy usage for buildings and the cold chain. Leveraging AI, platforms like BluEdge Command Centers offer predictive maintenance and energy optimization, with buildings using these systems seeing up to a 15% reduction in energy consumption in 2024.

The company prioritizes occupant well-being and product reliability, offering solutions that improve indoor air quality and ensure precise temperature control for comfort and the integrity of sensitive goods. This commitment is vital for sectors reliant on stable environments, like the food and pharmaceutical industries.

Carrier's global aftermarket support ensures continuous value through a vast service network and parts availability, maximizing operational efficiency and customer satisfaction. In 2024, investments in digital service platforms facilitated remote diagnostics and optimized scheduling, reducing client downtime.

| Value Proposition | Description | Key Benefit | Supporting Data/Example |

|---|---|---|---|

| Sustainable Climate Solutions | Energy-efficient HVAC and refrigeration, decarbonization tech | Reduced carbon emissions, lower operational costs | 2023 sales growth in sustainable products |

| Intelligent Climate Management | Digitally-enhanced systems, AI-powered optimization | Improved energy efficiency, predictive maintenance | Up to 15% energy reduction in 2024 for equipped buildings |

| Enhanced Well-being & Reliability | Improved indoor air quality, precise temperature control | Healthier environments, product integrity (food/medicine) | Global cold chain market over $200 billion (2023) |

| Comprehensive Aftermarket Support | Global service network, digital maintenance tools | Maximized efficiency, customer satisfaction, reduced downtime | 2024 digital service platforms for remote diagnostics |

Customer Relationships

Carrier Global cultivates strong customer ties through dedicated direct sales and service teams, particularly for its commercial and industrial clientele. This hands-on approach ensures tailored solutions and robust project management, crucial for intricate installations and long-term service agreements.

In 2024, Carrier's commitment to direct engagement likely reinforced its position in markets where specialized support is paramount. For instance, their HVAC solutions for large commercial buildings often require bespoke engineering and continuous maintenance, areas where direct sales and service excel.

Carrier's commitment to customer relationships is strongly evident in its aftermarket service agreements and support. These offerings, like maintenance contracts and technical support, are crucial for ensuring the longevity and optimal performance of their HVAC and refrigeration systems.

The BluEdge Command Centers are a prime example of this dedication. By leveraging AI, these centers proactively monitor equipment, identifying and resolving potential issues before they even affect the customer. This predictive maintenance approach significantly enhances operational reliability and fosters customer trust.

For instance, in 2024, Carrier's focus on digital service solutions and remote monitoring contributed to improved customer uptime and satisfaction. This proactive support model is designed to build lasting relationships by ensuring customers' systems operate smoothly and efficiently over the long term.

Carrier Global Corporation actively nurtures its network of independent distributors and partner retailers. This involves providing comprehensive training programs, robust marketing support, and essential product resources to ensure they are well-equipped to serve customers effectively.

These partnerships are absolutely critical for Carrier's market penetration, particularly within the residential and light commercial segments. For instance, in 2024, the HVAC industry saw continued demand driven by upgrades and new construction, underscoring the importance of a strong distribution network to capture this market share.

By focusing on effective channel management, Carrier ensures a uniform brand experience and consistent customer service across all touchpoints. This strategic approach helps build trust and loyalty, which are paramount for long-term success in a competitive landscape.

Digital Engagement and Customer Portals

Carrier Global increasingly leverages digital platforms, online tools, and customer portals to enhance engagement and streamline interactions. These resources offer detailed product information, energy calculators, and support services, aiming to provide seamless and personalized customer experiences across various touchpoints.

- Digital Platforms: Carrier's investment in digital transformation is evident in its enhanced online presence and customer portals, designed for improved user experience and access to information.

- Customer Portals: These portals serve as a central hub for customers to access product specifications, warranty information, and support resources, simplifying the post-purchase journey.

- Personalized Experiences: The company focuses on delivering tailored content and services through its digital channels, recognizing the growing demand for personalized customer interactions in the HVAC and refrigeration sectors.

- Efficiency Gains: By digitizing customer interactions, Carrier aims to improve operational efficiency and reduce response times, ultimately boosting customer satisfaction and loyalty.

Focus on Customer-Centricity and Value Delivery

Carrier's strategy pivots towards a deeply customer-centric approach, aiming to elevate customer lives and contribute positively to the global environment. This shift moves the company beyond its traditional product-focused model.

The company actively seeks to understand and address evolving customer demands, with a significant emphasis on sustainability and energy efficiency. This understanding drives the development of innovative solutions.

- Customer-Centricity: Carrier's strategy prioritizes understanding and meeting customer needs, shifting from a product-first to a customer-first mindset.

- Value Delivery: The focus is on providing solutions that offer tangible, long-term value and improve the quality of life for customers.

- Sustainability Focus: Carrier is responding to growing customer demand for sustainable and energy-efficient products and services.

- Market Responsiveness: By staying attuned to evolving market trends and customer expectations, Carrier aims to maintain its competitive edge.

Carrier Global fosters strong customer relationships through direct engagement, particularly with commercial and industrial clients, leveraging specialized service teams. This direct approach ensures tailored solutions and robust project management, vital for complex installations and ongoing service agreements, a strategy that continued to be a cornerstone in 2024.

For instance, Carrier's BluEdge Command Centers, utilizing AI for predictive maintenance, significantly enhance equipment reliability and customer trust, demonstrating a commitment to proactive support that builds lasting partnerships by ensuring optimal system performance.

Furthermore, Carrier actively supports its extensive network of independent distributors and retailers through comprehensive training and marketing resources, crucial for market penetration, especially in residential and light commercial sectors, which saw continued demand in 2024.

Digital platforms and customer portals are increasingly central to Carrier's engagement strategy, offering detailed product information and support services to create seamless, personalized customer experiences and improve operational efficiency.

| Customer Relationship Aspect | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales & Service | Tailored solutions and project management for commercial/industrial clients. | Reinforced market position in areas needing specialized support. |

| Aftermarket Service Agreements | Maintenance contracts and technical support for system longevity. | Enhanced operational reliability and customer satisfaction through proactive support. |

| Distribution Network Support | Training and marketing for independent distributors and retailers. | Critical for market penetration in residential/light commercial segments. |

| Digital Engagement | Online tools, portals for information access and streamlined interactions. | Improved user experience and operational efficiency in customer support. |

Channels

Carrier Global leverages its direct sales force to cultivate relationships with major commercial, industrial, and institutional clients. This approach is particularly vital for intricate projects requiring tailored solutions and for negotiating substantial, large-scale contracts directly. In 2024, Carrier's direct sales efforts were instrumental in securing significant deals, contributing to its robust backlog of over $20 billion in HVAC orders.

Carrier Global's independent distributor network is a cornerstone of its market reach, particularly for residential and light commercial HVAC solutions. These distributors act as crucial intermediaries, stocking Carrier's extensive product lines and providing localized sales and technical support. This model allows Carrier to efficiently serve a diverse customer base across numerous geographic regions.

In 2024, Carrier continued to leverage this network, which is vital for maintaining market share and driving sales volume. For instance, the company reported robust performance in its HVAC segment, partly attributable to the extensive reach provided by its independent distribution partners. These partners not only facilitate product sales but also offer essential first-level service and installation, enhancing the overall customer experience and brand loyalty.

Carrier Global partners with a vast network of independent retailers and dealers, a crucial channel for reaching residential customers. These local businesses are the frontline for sales, installation, and initial service of Carrier's HVAC and refrigeration products. In 2024, this channel remained vital, with thousands of HVAC contractors and dealers across North America and globally ensuring consumer accessibility and localized expertise.

Global Service Centers

Carrier's global service centers form a crucial part of its aftermarket support strategy. These centers are strategically located worldwide to offer essential maintenance, repair, and parts distribution, ensuring customers receive timely and expert assistance. This extensive network is fundamental to maintaining product uptime and fostering high levels of customer satisfaction, reinforcing Carrier's dedication to providing comprehensive lifecycle solutions.

The operational efficiency of these centers directly impacts Carrier's revenue streams through service contracts and spare parts sales. For instance, in 2023, Carrier reported that its Services segment generated approximately $7.1 billion in revenue, highlighting the significant contribution of aftermarket support. These centers are equipped to handle a wide range of HVAC and refrigeration equipment, from residential units to complex commercial systems.

- Global Reach: Operates a vast network of service locations to support customers across diverse geographical markets.

- Aftermarket Revenue Driver: Contributes significantly to Carrier's service revenue, which was over $7 billion in 2023.

- Customer Uptime: Essential for minimizing equipment downtime and ensuring operational continuity for clients.

- Lifecycle Solutions: Integral to Carrier's strategy of offering end-to-end product support from installation to eventual decommissioning.

Digital Platforms and E-commerce Presence

Carrier is significantly boosting its digital presence, focusing on its corporate website and online tools. These platforms offer product selectors and enhance customer interaction, streamlining the journey from initial interest to post-purchase support.

While direct e-commerce varies by product line, digital channels are crucial for sales enablement, marketing outreach, and customer service across all of Carrier's business segments. This digital focus improves accessibility to information and support.

- Website & Online Tools: Carrier's corporate website serves as a central hub for product information, technical specifications, and support resources.

- Customer Engagement: Digital platforms facilitate customer interaction through online inquiries, service requests, and access to digital tools.

- Sales Support: Online product selectors and configurators aid customers and sales teams in identifying the right solutions, even for complex HVAC and refrigeration systems.

- Information Accessibility: Digital channels ensure customers can easily access vital data, enhancing their understanding and decision-making process.

Carrier Global utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a direct sales force for large accounts, an extensive independent distributor network for broad market penetration, and a vast network of independent retailers and dealers primarily serving the residential sector. Complementing these physical channels are robust digital platforms, including its corporate website and online tools, which enhance customer engagement and provide crucial sales enablement resources.

| Channel | Primary Focus | Key Role | 2024 Relevance/Data |

|---|---|---|---|

| Direct Sales | Major commercial, industrial, institutional clients | Tailored solutions, large-scale contracts | Secured significant deals contributing to over $20B HVAC backlog. |

| Independent Distributors | Residential & light commercial HVAC | Product stocking, localized sales & support | Vital for market share and sales volume in HVAC segment. |

| Retailers & Dealers | Residential customers | Sales, installation, initial service | Thousands of HVAC contractors globally ensure accessibility. |

| Global Service Centers | Aftermarket support | Maintenance, repair, parts distribution | Services segment revenue was ~$7.1B in 2023. |

| Digital Channels | Customer engagement & sales enablement | Product info, online tools, support | Enhance accessibility and streamline customer journey. |

Customer Segments

Residential customers are homeowners looking for ways to keep their homes comfortable year-round. This includes individuals and families who need reliable heating, cooling, and ventilation systems. Carrier offers a variety of products designed to meet these needs, from traditional central air conditioners and furnaces to more advanced heat pumps.

The focus for these customers is on creating a comfortable living environment while also prioritizing energy efficiency to manage utility costs. Indoor air quality is another significant concern, with homeowners seeking solutions that improve the air they breathe within their homes. For instance, in 2023, the U.S. Department of Energy reported that HVAC systems account for nearly half of a home's energy usage, highlighting the importance of efficient solutions.

Commercial building owners and operators are a core customer segment for Carrier Global. This group includes a wide array of entities, from small business owners managing their own office spaces to large institutions like universities and hospital networks overseeing extensive portfolios. They are keenly interested in solutions that reduce operating expenses, enhance energy efficiency, and ensure a comfortable and productive environment for occupants. For instance, in 2024, the global commercial real estate market continued to grapple with rising energy costs, making energy-efficient HVAC systems a top priority for these decision-makers.

Industrial clients, encompassing manufacturing plants, data centers, and other facilities, represent a crucial segment for Carrier. These customers rely on advanced HVAC, refrigeration, and building automation systems for precise process control, maintaining critical environments, and ensuring efficient equipment cooling. The demand from data centers is a significant growth driver within Carrier's commercial HVAC business.

In 2024, the global data center market experienced substantial expansion, with investments in new construction and upgrades projected to reach hundreds of billions of dollars. This trend directly translates to increased demand for Carrier's high-efficiency cooling solutions and intelligent building management systems designed to handle the immense thermal loads generated by these facilities.

Transportation and Cold Chain Industry

This segment is crucial for Carrier, encompassing businesses that rely on maintaining precise temperatures for goods in transit. Think of the companies moving your groceries, life-saving medicines, or delicate flowers. Carrier’s solutions are vital here, ensuring product integrity from origin to destination.

Carrier’s offerings for this segment are extensive, covering everything from the refrigeration units on semi-trucks and trailers to the specialized cooling systems for shipping containers. They also provide essential equipment for cold storage in warehouses and retail environments, demonstrating a comprehensive approach to the cold chain.

- Market Focus: Companies in the food, pharmaceutical, and logistics sectors that handle temperature-sensitive cargo.

- Carrier Solutions: Transport refrigeration units (e.g., for trucks, trailers, containers), cold chain monitoring systems, and warehouse/retail cooling solutions.

- Industry Impact: Supporting the safe and efficient delivery of perishable goods, reducing spoilage, and ensuring product quality.

- 2024 Data Point: The global cold chain market was projected to reach over $300 billion in 2024, highlighting the significant demand for reliable temperature control solutions.

Customers Focused on Sustainability and Decarbonization

This segment is increasingly vital, with a growing number of businesses and organizations actively pursuing environmental responsibility. They are specifically looking for solutions to achieve building decarbonization and meet net-zero targets. For instance, a significant portion of new building projects in 2024 are incorporating advanced energy efficiency standards, driven by regulatory pressures and corporate sustainability commitments.

These customers are keen on adopting energy-efficient HVAC systems, particularly heat pumps, which offer a lower carbon alternative to traditional heating methods. Carrier's focus on these technologies aligns with a market trend where investments in sustainable building solutions are projected to grow by over 15% annually through 2025.

- Demand for Heat Pumps: Global sales of heat pumps saw a substantial increase in 2023, with projections indicating continued double-digit growth for 2024, driven by decarbonization efforts.

- Net-Zero Commitments: Over 70% of Fortune 500 companies have publicly announced net-zero targets, creating a substantial market for energy-efficient building solutions.

- Smart Energy Management: Adoption of smart building technologies, including integrated energy management systems, is expected to rise by 20% in commercial real estate by the end of 2024.

- Regulatory Influence: Stricter building codes and emissions regulations in key markets are compelling property owners to invest in decarbonization technologies.

Carrier Global serves a diverse customer base, from individual homeowners seeking comfort and energy savings to large commercial entities prioritizing operational efficiency and sustainability. The company also caters to industrial clients requiring precise environmental controls and the critical cold chain logistics sector ensuring product integrity during transport. A growing segment focuses on decarbonization and net-zero goals, driving demand for advanced, eco-friendly solutions.

| Customer Segment | Key Needs | Carrier Solutions | 2024 Market Relevance |

|---|---|---|---|

| Residential | Comfort, Energy Efficiency, Indoor Air Quality | Central HVAC, Heat Pumps, Air Purifiers | HVAC accounts for ~50% of home energy use (DOE) |

| Commercial Buildings | Reduced Operating Costs, Energy Efficiency, Occupant Comfort | Commercial HVAC, Building Automation Systems | Global commercial real estate market focused on energy costs |

| Industrial Facilities | Process Control, Critical Environment Maintenance, Equipment Cooling | Advanced HVAC, Refrigeration, Building Management | Data center market expansion driving demand for cooling solutions |

| Cold Chain Logistics | Product Integrity, Temperature Control during Transit | Transport Refrigeration, Cold Storage Solutions | Global cold chain market projected over $300 billion in 2024 |

| Sustainability Focused | Decarbonization, Net-Zero Targets, Energy Efficiency | Heat Pumps, Smart Energy Management Systems | 15%+ annual growth in sustainable building solutions expected |

Cost Structure

Manufacturing and production expenses represent a substantial part of Carrier's cost structure, encompassing the creation of their HVAC and refrigeration systems. This category includes the price of raw materials, essential components, direct labor wages, factory operating costs like utilities and equipment maintenance, and rigorous quality assurance measures to ensure product reliability.

For 2024, Carrier Global reported significant expenditures in this area. For instance, their cost of sales, which heavily reflects manufacturing and production, stood at approximately $18.4 billion for the fiscal year ending December 31, 2023, indicating the scale of these operational costs. Optimizing these expenses through streamlined manufacturing and robust supply chain partnerships is paramount for maintaining competitive pricing and profitability.

Carrier Global's cost structure heavily features substantial investments in Research and Development (R&D). These expenditures are crucial for driving innovation and ensuring the company maintains its technological edge in the HVAC, refrigeration, and fire and security sectors. For instance, in 2023, Carrier reported R&D expenses of approximately $1.2 billion, reflecting a commitment to developing next-generation products and sustainable solutions.

These R&D outlays are directed towards a broad spectrum of initiatives. This includes the creation of new, more energy-efficient HVAC systems, advanced refrigeration technologies for food safety and sustainability, and the development of sophisticated digital solutions and smart building technologies. Such investments are fundamental to Carrier's long-term growth strategy and its ability to stay competitive in rapidly evolving markets.

Sales, General, and Administrative (SG&A) costs are fundamental to Carrier Global's outreach and operational efficiency. These expenses include everything from compensating the sales team and running impactful marketing campaigns to managing administrative functions and supporting the company's extensive corporate structure. For instance, in 2023, Carrier reported SG&A expenses of approximately $3.3 billion, reflecting significant investment in customer engagement and brand building across its diverse markets.

Effective management of SG&A is crucial for maximizing return on investment. Strategic marketing initiatives and the development of robust sales channels directly influence how efficiently these costs translate into customer acquisition and revenue generation. Carrier's focus on digital transformation and optimizing its distribution networks aims to streamline these processes, ensuring that every dollar spent on SG&A contributes meaningfully to business growth and market presence.

Acquisition and Integration Costs

Carrier's strategic repositioning involves significant acquisition and integration costs, particularly following major moves like the acquisition of Viessmann Climate Solutions. These expenses encompass transaction fees, legal counsel, and the considerable effort required to merge new operations, technologies, and personnel into existing structures. For instance, the Viessmann deal alone, valued at approximately $12 billion, incurred substantial upfront and integration-related expenditures.

These costs are a critical component of Carrier's short-to-medium term financial outlay as they work to realize the strategic benefits of their portfolio transformation. The integration process often includes harmonizing IT systems, rebranding efforts, and aligning supply chains, all of which contribute to the overall cost structure.

- Transaction Fees: Costs associated with deal structuring, due diligence, and advisory services for acquisitions.

- Integration Expenses: Costs for merging IT systems, operational processes, and personnel post-acquisition.

- Divestiture Costs: Expenses related to selling off non-core business units, including legal and administrative fees.

- Strategic Realignment: These costs reflect Carrier's active management of its business portfolio to enhance future growth and profitability.

Supply Chain and Logistics Costs

Carrier Global manages extensive supply chain and logistics costs, encompassing everything from sourcing raw materials to delivering finished HVAC systems worldwide. In 2023, the company reported significant expenditures in this area, reflecting the complexity of its global operations. Optimizing these costs is a continuous effort, directly impacting profitability and customer satisfaction.

Key components of Carrier's supply chain and logistics expenses include:

- Procurement: Costs associated with acquiring components and raw materials from a diverse global supplier base.

- Transportation: Expenses for moving goods via ocean freight, air cargo, and land transport to manufacturing facilities and distribution centers.

- Warehousing: Costs related to storing inventory in strategically located facilities to ensure product availability.

- Distribution: Expenses involved in the final delivery of products to customers, including last-mile logistics.

Carrier's cost structure is significantly influenced by its extensive manufacturing and production operations, including raw materials, labor, and factory overhead. For the fiscal year ending December 31, 2023, Carrier's cost of sales was approximately $18.4 billion, highlighting the scale of these expenses.

Research and Development (R&D) is another major cost driver, with Carrier investing approximately $1.2 billion in 2023 to foster innovation in energy-efficient systems and digital solutions.

Sales, General, and Administrative (SG&A) expenses, totaling about $3.3 billion in 2023, support customer engagement and brand building across its global markets.

Strategic repositioning, such as the acquisition of Viessmann Climate Solutions for approximately $12 billion, also contributes substantial transaction and integration costs to the overall structure.

| Cost Category | 2023 Approximate Cost (USD Billions) | Key Components |

|---|---|---|

| Manufacturing & Production | $18.4 (Cost of Sales) | Raw materials, direct labor, factory overhead, quality assurance |

| Research & Development (R&D) | $1.2 | New product development, energy efficiency, digital solutions |

| Sales, General & Administrative (SG&A) | $3.3 | Sales force compensation, marketing, corporate administration |

| Acquisitions & Integration | Variable (e.g., $12B for Viessmann) | Transaction fees, due diligence, IT system merging, rebranding |

Revenue Streams

Carrier's core revenue generation stems from the direct sale of its extensive HVAC and refrigeration product portfolio. This encompasses everything from residential air conditioning units to large-scale commercial HVAC systems and specialized transportation refrigeration solutions.

Demand for these products is fueled by new building projects, the ongoing need for equipment replacement, and strategic upgrades across residential, commercial, and industrial sectors. For instance, in 2023, Carrier reported net sales of $22.1 billion, with a significant portion attributable to these equipment sales.

Carrier Global generates significant and high-margin revenue from its aftermarket parts and services. This includes sales of replacement parts, maintenance contracts, and repair services for its HVAC and refrigeration equipment.

A key component of this revenue is recurring income from long-term service agreements and advanced predictive maintenance solutions. For instance, their BluEdge Command Centers leverage data analytics to anticipate equipment failures, reducing downtime and enhancing customer satisfaction, which in turn drives service revenue.

In 2023, Carrier emphasized aftermarket as a core growth driver, aiming to expand its installed base and service penetration. This strategic focus is crucial for bolstering profitability and customer loyalty, as aftermarket typically offers higher margins compared to initial equipment sales.

Carrier is seeing a growing portion of its revenue come from advanced digital solutions and software subscriptions. These offerings are designed to boost the performance and efficiency of the systems they install.

Examples like the Abound™ Suite and Home Energy Management Systems (HEMS) highlight this trend. These platforms provide intelligent controls and sophisticated energy optimization capabilities, demonstrating a clear move towards digital, value-added services.

Revenue from Strategic Acquisitions

Carrier Global generates new revenue streams through strategic acquisitions, notably the integration of Viessmann Climate Solutions. This acquisition immediately adds sales from Viessmann's established product lines, including heat pumps, boilers, and solar photovoltaic systems. These moves are crucial for diversifying Carrier's overall revenue and strengthening its position in rapidly expanding markets focused on sustainable technologies.

The acquisition of Viessmann Climate Solutions, valued at approximately $12 billion, significantly bolsters Carrier's presence in the European HVAC market and the broader sustainable solutions sector. This strategic integration is expected to contribute substantially to Carrier's revenue growth, aligning with its long-term strategy to become a leader in healthy, safe, sustainable, and intelligent building and cold chain solutions.

- Acquisition Impact: Viessmann Climate Solutions adds significant sales from heat pumps, boilers, and solar PV products.

- Market Expansion: Diversifies revenue and expands Carrier's footprint in high-growth sustainable technology markets, particularly in Europe.

- Strategic Alignment: Supports Carrier's goal of leadership in sustainable building and cold chain solutions.

- Financial Contribution: The approximately $12 billion acquisition is a key driver for projected revenue increases.

Project-Based and Solutions Revenue

Carrier Global secures revenue through large-scale project installations and system integrations for major commercial and industrial clients. These projects often involve custom-designed energy solutions and building automation systems tailored to specific operational requirements.

This segment’s revenue streams are a blend of upfront product sales and ongoing specialized services, reflecting the comprehensive nature of these client engagements. For instance, in 2024, Carrier continued to secure multi-year contracts for integrated climate control solutions in large infrastructure projects.

- Project Installations: Revenue from the physical installation of HVAC, refrigeration, and fire safety systems in large commercial buildings and industrial facilities.

- System Integration: Income generated from connecting and optimizing various building systems, such as HVAC with building automation and security, for enhanced efficiency.

- Tailored Energy Solutions: Revenue derived from developing and implementing customized energy management strategies and technologies for clients seeking to reduce operational costs and environmental impact.

- Combined Product and Service Revenue: A significant portion of this stream includes the sale of Carrier's advanced equipment alongside the specialized engineering, commissioning, and maintenance services required for these complex projects.

Carrier's revenue streams are diversified, encompassing direct product sales, high-margin aftermarket services, and increasingly, digital solutions. Strategic acquisitions, like Viessmann Climate Solutions, are also a significant growth driver, expanding market reach and product offerings in sustainable technologies.

The company's 2023 financial performance highlights this breadth, with net sales reaching $22.1 billion. This figure is bolstered by recurring revenue from service agreements and the growing contribution of digital platforms designed to enhance system efficiency and customer experience.

Furthermore, Carrier's focus on large-scale project installations for commercial and industrial clients, integrating advanced climate control and building automation, represents another substantial revenue segment, often involving multi-year contracts for both product and specialized services.

| Revenue Stream | Description | 2023 Performance Indicator |

|---|---|---|

| Product Sales | Direct sale of HVAC and refrigeration equipment. | Core driver of $22.1 billion net sales. |

| Aftermarket Services | Parts, maintenance contracts, and repair services. | Key growth driver with high-margin potential. |

| Digital Solutions | Software subscriptions and performance-enhancing platforms. | Increasingly important for efficiency and customer loyalty. |

| Acquisitions | Integration of acquired companies like Viessmann Climate Solutions. | Adds significant sales from sustainable technology products, valued around $12 billion. |

| Project Installations | Large-scale system integrations for commercial/industrial clients. | Includes upfront sales and ongoing specialized services. |

Business Model Canvas Data Sources

The Carrier Global Business Model Canvas is built using a blend of financial reports, market research, and operational data. These diverse sources ensure a comprehensive and accurate representation of Carrier's strategic framework.