CareMax SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CareMax Bundle

CareMax's market position is defined by its unique strengths in value-based care and its potential for expansion, but also faces challenges in competitive pressures and regulatory shifts. Understanding these dynamics is crucial for any stakeholder looking to navigate the healthcare landscape effectively.

Want the full story behind CareMax's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CareMax's deep-rooted expertise in value-based primary care is a significant strength, honed through years of focusing on patient outcomes and cost management. This foundational competency in a patient-centric model continues to be a core asset, even amidst recent strategic shifts.

The company's commitment to providing comprehensive services, such as preventative care and robust chronic disease management, directly addresses the growing demand for proactive healthcare solutions. This aligns perfectly with current and future healthcare industry priorities.

CareMax's centers previously achieved a 5-Star quality rating for three consecutive years, a testament to their dedication to high-quality patient care. This consistent recognition speaks volumes about the efficacy of their clinical approaches and patient management systems.

This strong track record of quality ratings, achieved prior to its financial restructuring and asset sales in late 2023 and early 2024, could serve as a valuable residual asset for any entities that have acquired or may acquire its former operational centers.

CareMax developed a proprietary, technology-enabled platform focused on enhancing patient care and streamlining physician workflows using data analytics. This infrastructure was designed to boost patient engagement and enable customized care plans.

The company's strategic vision for technology integration, particularly through this platform, represented a forward-thinking approach to healthcare delivery. While specific post-bankruptcy details for the platform are not public, the emphasis on technology remains a key consideration for any successor entity.

Experience with Medicare Advantage Population

CareMax's deep experience with the Medicare Advantage population is a significant strength, allowing them to understand the unique healthcare needs and navigate the intricacies of this specific patient demographic and program. This specialization enables highly tailored care coordination and service delivery, a crucial advantage in the evolving healthcare landscape.

By focusing on Medicare Advantage, CareMax has cultivated an inherent knowledge base that translates into more effective patient engagement and outcomes. This expertise is particularly valuable as Medicare Advantage enrollment continues to grow, with projections indicating sustained expansion through 2025 and beyond.

- Specialized Knowledge: Deep understanding of Medicare Advantage patient needs and program complexities.

- Tailored Care: Ability to deliver customized services and care coordination for this demographic.

- Market Focus: Expertise directly applicable to a growing and significant segment of the healthcare market.

Successful Chapter 11 Emergence

CareMax's successful emergence from Chapter 11 bankruptcy in February 2025, just three months after its November 2024 filing, demonstrates a swift resolution to its immediate financial distress. This expedited process suggests a well-defined restructuring plan and efficient asset sales were executed. The company's ability to navigate bankruptcy and emerge, even with significant divestitures, points to a structured approach in addressing its financial challenges.

Key aspects of this emergence include:

- Swift Restructuring: Completed Chapter 11 proceedings in approximately three months, indicating decisive action.

- Asset Divestitures: Successfully finalized asset sales as part of the restructuring, a common but critical step in such processes.

- Avoidance of Liquidation: The emergence signifies a move away from complete dissolution, allowing for a controlled wind-down or highly specialized operations.

CareMax's core strength lies in its specialized focus on the Medicare Advantage population, a demographic experiencing consistent growth. This deep understanding allows for tailored care coordination and service delivery, crucial for navigating the program's complexities. Their expertise is directly applicable to a significant and expanding segment of the healthcare market, positioning them advantageously for future engagement.

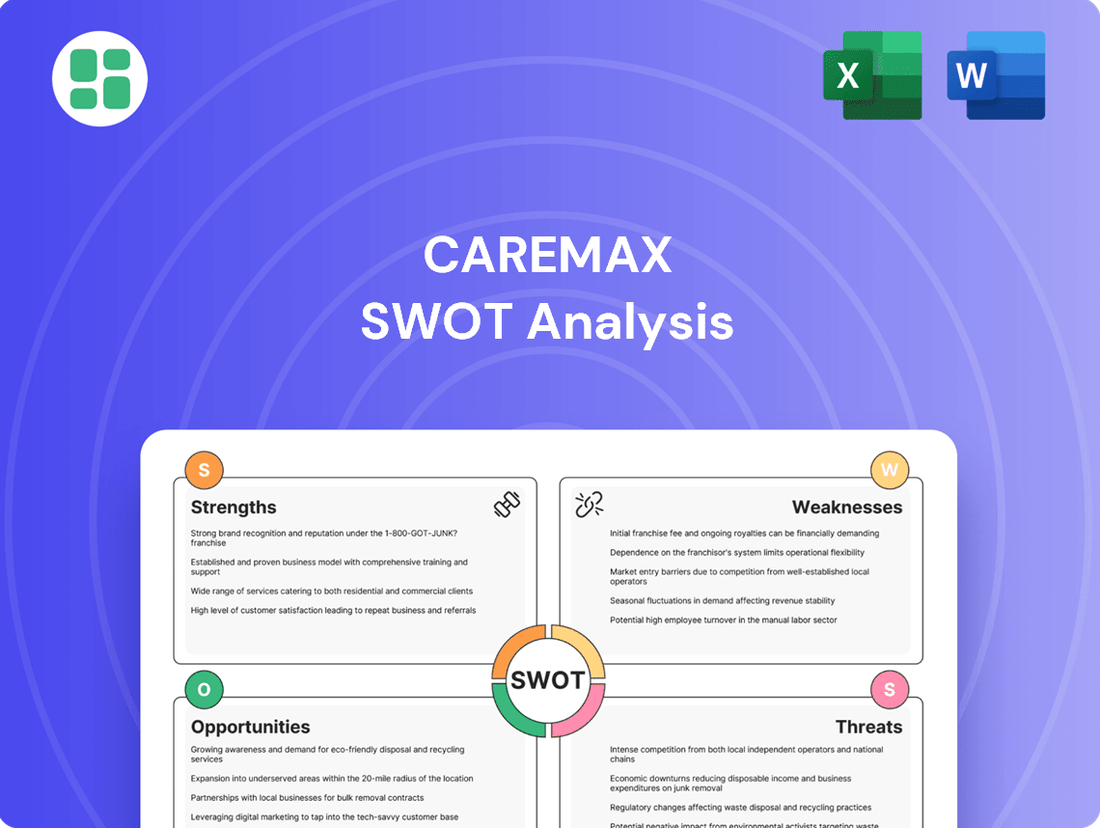

What is included in the product

Delivers a strategic overview of CareMax’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing CareMax's strategic challenges and opportunities.

Weaknesses

CareMax's recent Chapter 11 bankruptcy filing in November 2024, from which it emerged in February 2025, is a stark indicator of significant financial instability. This period of restructuring involved substantial asset divestitures and operational overhauls, fundamentally reshaping the company's structure and strategic direction.

The necessity of bankruptcy protection highlights a critical failure in managing prior financial commitments and navigating complex business challenges. This event directly impacts investor confidence and signals a heightened risk profile for the company moving forward.

CareMax's significant asset divestiture, a core part of its bankruptcy proceedings, drastically reshaped its operational landscape. The company sold off its Managed Services Organization (MSO) and a substantial portion of its operating clinics, a move that significantly reduced its scale and membership base.

These strategic sales, aimed at restructuring debt, left CareMax with a considerably smaller operational footprint. The divestiture of these key revenue-generating assets severely limits its capacity to generate income from its former primary business activities, impacting its future revenue streams.

CareMax has faced significant financial headwinds, reporting substantial net losses and negative Adjusted EBITDA leading up to and during its bankruptcy proceedings. For instance, in the first quarter of 2024, the company reported a net loss of $18.6 million, a stark contrast to the $3.1 million profit in the same period of 2023, signaling a worsening financial position.

The company also grappled with a high Medical Expense Ratio, which exceeded 100% in certain periods prior to its restructuring. This metric, indicating that the cost of medical claims surpassed revenue generated from premiums, points to fundamental issues in pricing, utilization management, or provider contracting within its prior operational framework.

These persistent financial struggles, characterized by ongoing losses and an elevated Medical Expense Ratio, underscore inherent weaknesses in CareMax's previous business model. They suggest potential operational inefficiencies, aggressive or unsustainable growth strategies, and a difficulty in effectively managing healthcare costs in a competitive market.

Loss of Shareholder Value

CareMax's confirmed Chapter 11 plan resulted in the complete discharge and extinguishment of all pre-existing equity interests, including outstanding shares. This means existing shareholders received zero distributions, effectively wiping out their investment. This severe loss of shareholder value significantly erodes investor confidence in the CareMax entity moving forward.

The company's intention to deregister its securities further underscores this loss, signaling a probable end to public trading and the availability of its shares on exchanges. This action makes it virtually impossible for former shareholders to recover any residual value from their holdings.

- Shareholder Equity Eliminated: All existing CareMax shares were extinguished under the Chapter 11 plan, resulting in a 100% loss for shareholders.

- Investor Confidence Impact: The complete write-off of equity interests severely damages investor confidence in the CareMax brand and its future prospects.

- Public Trading Cessation: Plans to deregister securities indicate a likely end to public trading, removing any potential for future recovery through market mechanisms.

Reduced Operational Scale

Following its bankruptcy proceedings, CareMax's operational scale has been substantially curtailed. The sale of its clinics and Management Services Organization (MSO) significantly reduced its direct patient care delivery capabilities. This diminished footprint directly impacts its market presence and future growth prospects within its historical service areas.

The company's ability to serve a broad patient population is now limited by its reduced network. For instance, prior to its restructuring, CareMax operated a substantial number of centers across Florida. Post-restructuring, the exact number of directly operated centers is significantly lower, impacting its reach.

- Reduced Clinic Network: Following the sale of many of its facilities, CareMax's physical presence is a fraction of its former size.

- Limited MSO Services: The divestiture of its MSO means a reduced capacity to manage and support healthcare operations for a wider network.

- Impact on Market Share: This contraction directly affects its ability to compete in markets where it previously held a larger share.

- Constrained Growth Trajectory: The smaller operational base presents challenges for aggressive expansion or regaining lost market momentum.

CareMax's prior financial performance was characterized by significant operational weaknesses, including substantial net losses and a persistently high Medical Expense Ratio exceeding 100% in certain periods before its restructuring. These issues pointed to fundamental problems in cost management and revenue generation within its former business model.

The company's Chapter 11 bankruptcy filing in November 2024, from which it emerged in February 2025, led to the complete extinguishment of all existing equity interests. This resulted in a total loss for shareholders, with zero distributions made, severely undermining investor confidence and eliminating any possibility of recovery through existing shareholdings.

Furthermore, CareMax's strategic decision to deregister its securities signals an end to public trading, making it nearly impossible for former shareholders to recoup any investment value. This move, coupled with the sale of its MSO and a significant portion of its clinics, has drastically reduced its operational scale and market presence.

The company's diminished clinic network and reduced MSO services directly impact its ability to serve a broad patient population and compete effectively in its former service areas, creating a constrained growth trajectory.

Full Version Awaits

CareMax SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of CareMax's internal strengths and weaknesses, alongside external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, allowing you to tailor the analysis to your specific needs.

Opportunities

The Medicare Advantage market is a significant growth area, with enrollment projected to reach over 35 million beneficiaries in 2025, a substantial increase from previous years. This expansion is fueled by the continuing aging of the U.S. population and the attractiveness of Medicare Advantage plans offering benefits beyond traditional Medicare.

While CareMax's direct operational involvement has changed following its Chapter 11 filing in 2023 and subsequent asset sales, the robust growth of the Medicare Advantage sector itself remains a powerful market trend. This sustained demand for senior healthcare services within managed care frameworks could still offer avenues for new, specialized healthcare providers or for businesses that have acquired CareMax's former operational assets.

The healthcare landscape is increasingly prioritizing value-based care, a model that rewards providers for patient outcomes rather than the volume of services. The Centers for Medicare & Medicaid Services (CMS) has set a target for 100% of Medicare beneficiaries to be in value-based care arrangements by 2030, signaling a strong industry-wide commitment.

This fundamental shift creates fertile ground for companies like CareMax, whose model is designed to thrive within these outcome-focused reimbursement structures. While CareMax has navigated its own operational hurdles, the underlying industry trend towards rewarding quality and efficiency remains a substantial opportunity for the entire healthcare sector.

The growing embrace of telehealth, amplified by innovations in AI and data analytics, presents a significant opportunity to broaden healthcare access and boost efficiency. This technological wave can foster deeper patient connections and optimize operational workflows, benefiting companies adept at integrating these tools.

For CareMax, this could translate into leveraging any remaining technological infrastructure or former assets to carve out a specialized niche in the evolving digital health landscape. The telehealth market, projected to reach $396.9 billion by 2027 according to some estimates, underscores the substantial growth potential.

Aging Population Demographic

The aging population in the U.S. is a significant tailwind, driving increased demand for healthcare services, especially for managing chronic conditions and promoting preventative health. This demographic shift creates a substantial market opportunity for senior care specialists like CareMax.

By 2030, all baby boomers will be 65 or older, meaning 1 in 5 Americans will be retirement age. This growing segment represents a fundamental market opportunity for providers specializing in senior care, irrespective of CareMax's specific restructuring.

- Growing Demand: The number of Americans aged 65 and over is projected to reach 73 million by 2030.

- Chronic Disease Prevalence: Approximately 6 in 10 adults in the U.S. have a chronic disease, with this rate increasing with age.

- Healthcare Expenditure: Older adults account for a disproportionately large share of healthcare spending, with Medicare spending expected to grow.

Potential for New, Focused Ventures

Following its restructuring and asset sales, CareMax is positioned to explore highly focused ventures, potentially leveraging its remaining intellectual property and core expertise. A leaner operational structure, free from prior debt burdens, could provide the agility needed to pursue new business models or strategic partnerships within the dynamic healthcare sector. For instance, if CareMax were to retain certain specialized care delivery capabilities, it could target niche markets or specific patient populations that are underserved by larger, more generalized providers.

The company's stated intention to deregister its securities in 2024 signifies a significant shift, potentially allowing management to concentrate resources on operational improvements and strategic reorientation without the immediate pressures of public market reporting and shareholder demands. This move could unlock capital or operational flexibility previously allocated to compliance and investor relations, enabling a more direct pursuit of focused growth opportunities. For example, if CareMax had valuable data analytics capabilities related to value-based care, it could explore licensing these or developing targeted software solutions for other healthcare entities.

- Focus on specialized patient care: CareMax could concentrate on high-demand areas like chronic disease management or post-acute care, where its expertise might be most valuable.

- Leverage technology for efficiency: Investing in telehealth or remote patient monitoring could create new revenue streams and improve patient access, especially in underserved regions.

- Strategic partnerships: Collaborating with accountable care organizations (ACOs) or health insurance providers could offer a pathway to more stable, value-driven revenue.

- Intellectual property monetization: If CareMax developed proprietary care models or patient engagement tools, these could be licensed to other healthcare organizations.

The ongoing expansion of the Medicare Advantage market, projected to serve over 35 million beneficiaries by 2025, presents a substantial opportunity for specialized healthcare providers. This growth, coupled with the government's push towards value-based care—aiming for 100% of Medicare beneficiaries in such arrangements by 2030—creates a favorable environment for outcome-focused healthcare models.

The increasing adoption of telehealth and digital health solutions, with the telehealth market expected to reach nearly $400 billion by 2027, offers avenues for enhanced patient engagement and operational efficiency. Furthermore, the demographic trend of an aging population, with all baby boomers turning 65 by 2030, ensures sustained demand for senior-focused healthcare services.

| Opportunity Area | Key Driver | Potential Impact |

|---|---|---|

| Medicare Advantage Growth | Aging population, enhanced benefits | Increased patient volume for specialized care |

| Value-Based Care Transition | CMS initiatives, focus on outcomes | Alignment with efficient, quality-driven models |

| Digital Health Adoption | Telehealth, AI, data analytics | Improved access, operational efficiency, new revenue streams |

| Senior Demographics | Baby Boomer generation reaching retirement age | Sustained high demand for senior healthcare services |

Threats

The healthcare arena, particularly in Medicare Advantage and value-based care, is a battlefield. CareMax faces a crowded market dominated by established national insurers and a multitude of niche providers, all vying for patient attention and market share.

This fierce competition directly impacts CareMax by potentially squeezing profit margins and hindering growth. Companies must invest heavily in attracting new patients and staying ahead with innovative services, a significant hurdle in this dynamic sector.

Considering CareMax's past competitive environment, which included major industry players, any strategic move or re-entry into the market will undoubtedly be met with significant challenges from these formidable rivals.

Unfavorable regulatory shifts present a significant hurdle for healthcare providers like CareMax. Changes in healthcare regulations, reimbursement rates, and government policies can directly impact revenue streams and operational strategies. For example, the Centers for Medicare & Medicaid Services (CMS) decision to end the Medicare Advantage Value-Based Insurance Design (VBID) model after 2025, citing concerns over excessive costs, underscores the unpredictable nature of regulatory support for value-based care programs.

Economic volatility, marked by inflationary pressures and potential downturns, poses a significant threat. Rising operating costs, particularly for labor and interest rates, directly impact healthcare providers like CareMax. In fact, CareMax itself pointed to these escalating costs and inflation as key contributors to its bankruptcy filing in 2024.

Challenges in Risk Management

Successfully managing patient risk and accurately predicting healthcare needs is a major hurdle for CareMax, especially within value-based care arrangements. This complexity directly impacts the company's financial health.

Higher-than-anticipated medical utilization can significantly inflate medical expense ratios, potentially leading to substantial financial losses for CareMax. For instance, unexpected surges in chronic condition management or acute care needs can quickly erode profit margins.

The fundamental challenge of reliably forecasting and managing the health outcomes for a large patient population represents a persistent operational and financial risk. This difficulty is amplified in the dynamic healthcare landscape of 2024 and 2025, where evolving patient demographics and treatment advancements add layers of uncertainty.

- Difficulty in predicting patient health needs

- Risk of increased medical utilization impacting expense ratios

- Operational and financial vulnerability due to forecasting challenges

Damaged Brand and Investor Confidence

CareMax's Chapter 11 bankruptcy filing in early 2024, coupled with subsequent asset sales, has significantly eroded its brand image and investor trust. This financial distress, which led to the extinguishment of all prior equity interests, presents a formidable hurdle for attracting new investment or partnerships. The lingering negative perception from this period of financial instability is likely to impact the company's ability to rebuild and secure future funding.

The implications of this damaged reputation are far-reaching. For instance, as of the second quarter of 2024, CareMax's market capitalization plummeted to a fraction of its previous value, reflecting the deep skepticism among investors. This makes securing essential capital for growth or even operational stability exceedingly difficult. Furthermore, the company may struggle to attract and retain top talent, as potential employees often view financially unstable organizations as risky career choices.

- Chapter 11 Filing Impact: CareMax filed for Chapter 11 bankruptcy protection in February 2024, a move that immediately signaled severe financial distress.

- Equity Extinguishment: All existing equity interests were rendered worthless as part of the bankruptcy proceedings, a stark indicator of the company's financial collapse.

- Investor Confidence Erosion: Post-filing, investor confidence has been severely undermined, making capital raising a significant challenge.

- Talent Acquisition Difficulty: The negative brand perception makes it harder to attract and retain skilled employees, hindering any rebuilding efforts.

The healthcare landscape is intensely competitive, with established national insurers and specialized providers vying for market share, potentially squeezing CareMax's profit margins and hindering growth. Unfavorable regulatory shifts, such as the end of the Medicare Advantage VBID model after 2025, introduce significant uncertainty to revenue streams and strategic planning.

Economic volatility, including inflation and rising interest rates, directly impacts operating costs, as evidenced by CareMax citing these factors in its 2024 bankruptcy filing. Accurately predicting and managing patient health needs and utilization remains a core challenge, with higher-than-anticipated medical expenses posing a direct threat to financial stability.

CareMax's Chapter 11 bankruptcy filing in February 2024 and the subsequent extinguishment of all prior equity interests have severely damaged its brand image and investor confidence. This financial distress makes capital raising and attracting talent exceedingly difficult, as reflected in its drastically reduced market capitalization in Q2 2024.

| Threat Category | Specific Threat | Impact on CareMax | Example/Data Point |

|---|---|---|---|

| Market Competition | Intense competition from national insurers and niche providers | Pressure on profit margins, hindered growth | Crowded Medicare Advantage market |

| Regulatory Environment | Unpredictable shifts in healthcare policy and reimbursement | Impact on revenue streams, operational strategy changes | CMS ending VBID model after 2025 |

| Economic Factors | Inflationary pressures and rising interest rates | Increased operating costs (labor, interest) | Cited as a contributor to 2024 bankruptcy filing |

| Operational Risk | Difficulty in predicting patient health needs and utilization | Risk of increased medical expense ratios, financial losses | Forecasting challenges amplified in dynamic 2024-2025 landscape |

| Reputational Damage | Erosion of brand image and investor trust due to bankruptcy | Difficulty in attracting investment and talent | Market capitalization significantly reduced post-filing (Q2 2024) |

SWOT Analysis Data Sources

This CareMax SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and actionable assessment.