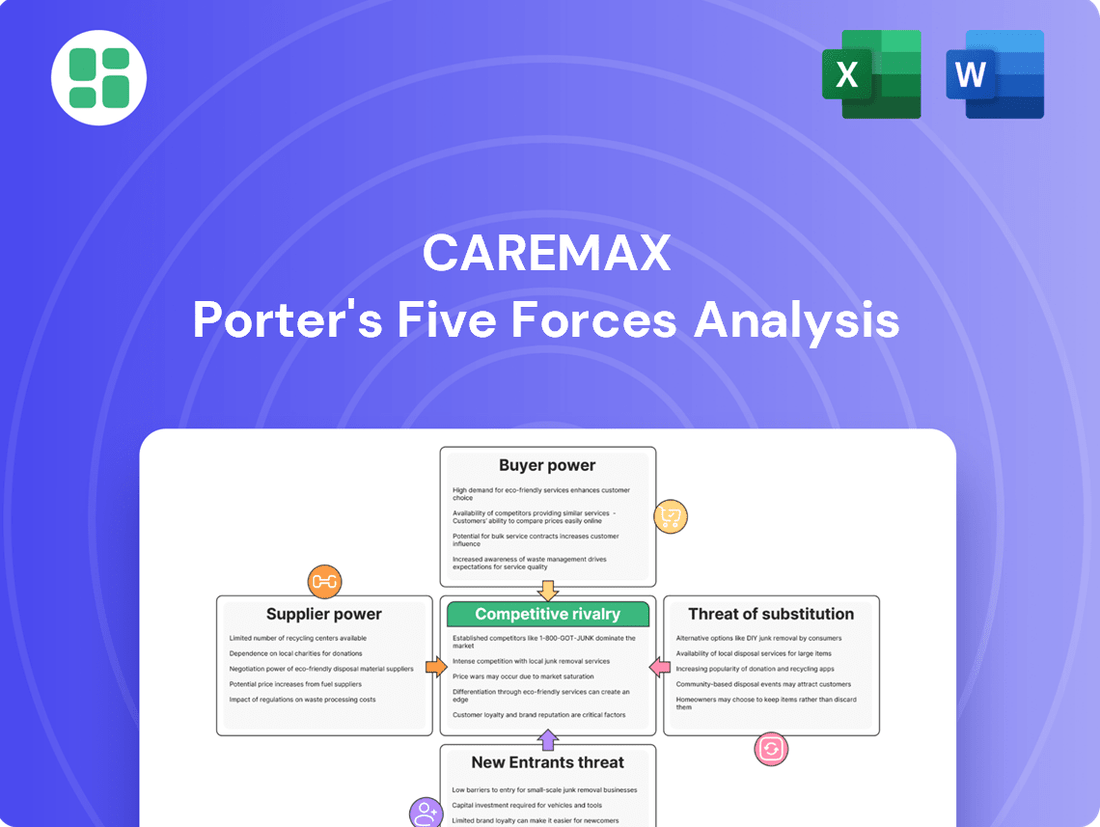

CareMax Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CareMax Bundle

CareMax navigates a healthcare landscape shaped by powerful forces, from intense rivalry among existing players to the ever-present threat of new entrants. Understanding the bargaining power of both buyers and suppliers is crucial for strategic positioning.

This brief overview only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CareMax’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The market for experienced value-based care physicians and specialized healthcare professionals, particularly those skilled in chronic disease management and care coordination, is intensely competitive. This scarcity of talent directly translates into significant bargaining power for these medical professionals, driving up labor costs.

CareMax, like many in the healthcare sector, faces the reality of high labor expenses. For instance, in 2023, the company reported substantial increases in its cost of services, a significant portion of which is attributed to personnel. This financial pressure highlights the leverage skilled medical staff hold.

Suppliers of pharmaceuticals and medical equipment wield significant bargaining power, especially when their products are critical for patient care and few substitutes exist. This essential nature means providers like CareMax often have limited leverage to negotiate prices down, particularly for specialized treatments or patented drugs.

The inflationary environment of 2024 has directly impacted these costs. For instance, the producer price index for medical supplies saw an increase, reflecting higher manufacturing and raw material expenses. This translates to increased input costs for healthcare providers, squeezing margins and impacting their ability to absorb price hikes without passing them on.

CareMax's reliance on its proprietary technology and data analytics platform places significant importance on its technology and data analytics providers. If these providers offer highly specialized solutions or if switching costs are substantial, they could wield considerable bargaining power over CareMax.

The increasing emphasis on AI and data analytics within the value-based care sector, a trend that intensified through 2024, further elevates the strategic importance of these technology partners. Companies like CareMax are investing heavily to leverage these advancements, making the technology providers' offerings critical to their operational success and competitive edge.

Facility Lessors and Real Estate

As a healthcare provider reliant on physical locations, CareMax faces significant bargaining power from facility lessors and real estate owners. These landlords can dictate lease terms, directly impacting operational expenses and the ability to expand. Indeed, unaffordable leases were identified as a key contributor to CareMax's financial distress, underscoring the critical nature of these relationships.

The leverage held by landlords, particularly those with prime real estate, can significantly influence CareMax's cost structure and growth potential. This power dynamic is amplified when suitable alternative locations are scarce or costly to secure. For instance, in 2024, reports indicated that healthcare facility rental costs in key metropolitan areas saw an average increase of 5-7%, a trend that would directly challenge providers with substantial lease obligations.

- Lease Dependency: CareMax's operational model necessitates physical medical centers, making lease agreements a fundamental cost driver.

- Bankruptcy Link: Unmanageable lease expenses were a cited factor in CareMax's bankruptcy filing, highlighting supplier power's impact.

- Location Leverage: Landlords in desirable or strategically important locations possess considerable bargaining power, influencing CareMax's cost base and expansion plans.

Payer Relationships (Indirect Suppliers of Patients/Revenue)

While not direct suppliers of goods, Medicare Advantage plans act as crucial conduits, effectively supplying patients and the necessary revenue streams to CareMax. The bargaining power of these payers is substantial, as they control access to large patient populations and reimbursement terms.

CareMax's experience with Steward Health Care in 2024 starkly illustrates this power. The termination of a significant contract with Steward, a major payer for CareMax, led to a considerable financial setback, underscoring the vulnerability of providers reliant on these large health insurance entities.

These payers possess the ability to significantly influence CareMax's financial health by dictating reimbursement rates, payment terms, and network participation. This leverage means that changes in payer policies or contract negotiations can have a direct and immediate impact on CareMax's revenue and profitability.

- Payer Influence: Medicare Advantage plans supply patients and revenue, giving them significant leverage over providers like CareMax.

- Contractual Dependence: CareMax's financial stability is directly tied to its contracts with these large payers.

- Reimbursement Power: Payers dictate payment rates and terms, directly impacting provider revenue.

- 2024 Impact: The termination of a key contract in 2024 demonstrated the severe financial consequences of payer leverage.

The bargaining power of suppliers is a critical factor for CareMax, influencing its operational costs and overall profitability. This power stems from various sources, including the scarcity of specialized talent, the essential nature of certain medical supplies, the reliance on proprietary technology, and the leverage held by real estate lessors and major payers.

| Supplier Type | Bargaining Power Factors | Impact on CareMax | 2024 Data/Trend |

|---|---|---|---|

| Skilled Healthcare Professionals | Scarcity of experienced value-based care physicians and specialists | Increased labor costs, impacting cost of services | Continued high demand for chronic disease management expertise |

| Pharmaceuticals & Medical Equipment | Criticality of products, limited substitutes, patent protection | Limited negotiation leverage on prices, increased input costs | Producer Price Index for medical supplies saw increases |

| Technology & Data Analytics Providers | Proprietary solutions, high switching costs, strategic importance | Potential for higher costs for specialized platforms | Increased investment in AI and data analytics driving demand for partners |

| Real Estate Lessors | Prime locations, limited alternative sites | High lease expenses impacting operational costs and expansion | Average rental cost increases of 5-7% in key metropolitan areas |

| Medicare Advantage Plans (Payers) | Control over patient populations and reimbursement terms | Significant influence on revenue and profitability | Contract terminations can lead to substantial financial setbacks (e.g., Steward Health Care in 2024) |

What is included in the product

This analysis dissects the competitive forces impacting CareMax, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Instantly identify and address competitive threats with a clear, actionable overview of all five forces.

Customers Bargaining Power

CareMax's primary customers, Medicare Advantage (MA) members, wield significant bargaining power due to the abundance of plan choices available. In 2024, the Centers for Medicare & Medicaid Services (CMS) projected over 3,100 MA plans nationwide, offering beneficiaries a wide array of options. This competitive landscape empowers patients to select plans and providers that best meet their needs, prioritizing factors like accessibility, cost, and quality of care.

The ability for patients to switch MA plans, often during annual enrollment periods, incentivizes providers like CareMax to maintain high levels of customer satisfaction. If patients are dissatisfied with their current provider's service, cost, or convenience, they can readily move to a competitor. This dynamic creates a tangible leverage point for customers, compelling providers to offer attractive benefits and a positive patient experience to retain their business.

Medicare Advantage (MA) plans act as the primary buyers for CareMax's services in a value-based care model, holding considerable sway over providers. These plans, managing large groups of beneficiaries, can negotiate terms and reimbursement rates, effectively setting the standard for care delivery and cost. For instance, in 2024, Medicare Advantage enrollment continued its upward trend, with projections indicating over 30 million beneficiaries, a significant increase from previous years, underscoring the plans' substantial market presence and leverage.

For Medicare Advantage members, the financial hurdles to switching primary care providers within their network, or even changing plans during open enrollment, are generally quite low. This ease of transition directly amplifies the bargaining power of individual patients.

CareMax, therefore, faces a constant imperative to showcase its value proposition to retain its patient base. In 2024, Medicare Advantage enrollment continued its upward trend, with over 33 million Americans choosing these plans, highlighting the competitive landscape where patient retention is paramount.

Information Availability and Patient Engagement

Patients now have unprecedented access to information about healthcare providers, including quality ratings, patient reviews, and detailed explanations of insurance plan benefits. This increased transparency significantly bolsters their bargaining power as they can make more informed choices about where and how they receive care.

CareMax's strategic focus on a patient-centric model directly addresses this shift. By prioritizing improved patient outcomes and an enhanced overall experience, CareMax aims to cultivate loyalty among an increasingly discerning and empowered patient base. This approach is vital for member retention in a market where patients can readily compare options.

- Informed Decision-Making: Patients in 2024 are actively researching healthcare providers online, with platforms like Healthgrades and Vitals seeing millions of user visits monthly, allowing for direct comparisons of quality and patient satisfaction.

- Value-Based Care Emphasis: The growing adoption of value-based care models incentivizes providers to focus on patient outcomes and satisfaction, further empowering patients to seek providers who deliver superior results and experiences.

- Digital Health Literacy: A significant portion of the population, particularly younger demographics, demonstrate high digital health literacy, actively utilizing online resources to manage their health and select providers, thereby increasing their influence.

Regulatory Protections for Beneficiaries

Medicare Advantage beneficiaries benefit from robust federal regulations that mandate specific standards for care, accessibility, and grievance procedures. These protections, enforced by entities like the Centers for Medicare & Medicaid Services (CMS), give patients and their representatives significant leverage in their interactions with healthcare providers like CareMax.

This regulatory framework effectively translates into indirect bargaining power for the patient population. For instance, CMS's oversight ensures that plans meet certain quality metrics and that beneficiaries have recourse if services are denied or inadequate. In 2024, CMS continued to emphasize member protections and quality initiatives within Medicare Advantage, reinforcing the importance of these regulatory safeguards.

- Federal regulations ensure beneficiaries receive defined standards of care and access to services.

- CMS oversight provides beneficiaries with appeal rights, strengthening their position.

- These protections empower patients, influencing CareMax's operational and service delivery requirements.

- The regulatory environment indirectly enhances the bargaining power of the beneficiary population.

CareMax's customers, primarily Medicare Advantage beneficiaries, possess substantial bargaining power due to the vast number of available plan choices and the ease with which they can switch plans. In 2024, the sheer volume of Medicare Advantage plans, exceeding 3,100 nationwide as projected by CMS, allows patients to readily compare and select providers based on cost, quality, and accessibility, directly influencing CareMax's service offerings and patient retention strategies.

The increasing digital health literacy and access to online information empower patients to make more informed decisions, further amplifying their leverage. With millions of monthly visits to healthcare comparison sites in 2024, patients can easily assess provider ratings and patient satisfaction, compelling CareMax to prioritize patient experience and outcomes to remain competitive.

Furthermore, federal regulations overseen by CMS, which mandate specific care standards and grievance procedures, provide beneficiaries with a strong safety net and recourse, indirectly bolstering their bargaining power. These regulatory protections, continually emphasized by CMS in 2024, ensure that providers like CareMax adhere to high service levels, thereby empowering the patient population.

| Factor | Description | Impact on CareMax | 2024 Data/Trend |

|---|---|---|---|

| Plan Choice Abundance | Numerous Medicare Advantage plans offer beneficiaries a wide selection. | Increases patient ability to switch providers. | Over 3,100 MA plans projected nationwide. |

| Ease of Switching | Low financial or logistical barriers for patients to change providers or plans. | Drives provider focus on patient satisfaction and retention. | Annual enrollment periods facilitate frequent transitions. |

| Information Accessibility | Patients have access to online reviews, quality ratings, and plan details. | Empowers informed decision-making and provider comparison. | Millions of monthly visits to healthcare comparison websites. |

| Regulatory Protections | CMS mandates standards for care, accessibility, and grievance procedures. | Provides recourse for patients and influences provider operations. | CMS continued emphasis on member protections in 2024. |

Preview the Actual Deliverable

CareMax Porter's Five Forces Analysis

This preview showcases the complete CareMax Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the healthcare sector. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The value-based primary care arena, especially for Medicare Advantage beneficiaries, is crowded with many players. These include major health systems and focused value-based care organizations, creating a highly competitive environment.

CareMax faces rivals such as SteadyMD, Signallamp Health, and Firefly Health, all vying for patient sign-ups and agreements with insurance providers. This fragmented market intensifies the struggle for market share.

The healthcare landscape is rapidly consolidating, with significant mergers among established health systems. Simultaneously, non-traditional players are entering the primary care arena, exemplified by Amazon, CVS, and Walgreens. This influx of well-funded, innovative companies creates a complex competitive environment for CareMax.

These new entrants often bring disruptive care delivery models, challenging existing norms and increasing competitive intensity. For instance, CVS Health's acquisition of Oak Street Health in 2023 for $10.6 billion highlights the significant investment and strategic focus on primary care by large retail pharmacy chains.

Operating primary care centers inherently carries substantial fixed costs. These include maintaining facilities, investing in essential technology, and supporting a considerable workforce, all of which represent significant ongoing expenses for companies like CareMax.

CareMax’s own financial disclosures underscore these intense operational pressures. The company has publicly cited high labor costs and burdensome lease agreements as key contributors to its financial difficulties, illustrating the sector's demanding cost structure.

These high fixed costs often fuel aggressive competition. To cover overhead and achieve profitability, providers may engage in price wars or focus on maximizing patient volume, intensifying rivalry within the market.

Service Differentiation and Outcomes Focus

CareMax differentiates itself through a technology-driven, patient-centered model designed to enhance health outcomes and lower expenses. This strategy aims to set it apart in a market where rivals also pursue better quality and efficiency. For instance, in 2024, the healthcare sector saw continued investment in telehealth and remote patient monitoring, technologies CareMax leverages to achieve its integrated care goals.

The core of CareMax's competitive strategy hinges on its ability to consistently prove better patient results and cost reductions. This is crucial in the evolving landscape of value-based care, where providers are increasingly reimbursed based on quality of care rather than volume of services. Demonstrating tangible improvements, such as reduced hospital readmission rates or better chronic disease management, becomes a key battleground.

- Technology Integration: CareMax's investment in platforms for data analytics and patient engagement aims to streamline care coordination and personalize treatment plans.

- Outcomes Measurement: The company's focus on tracking key performance indicators like patient satisfaction scores and clinical outcome improvements directly addresses the demands of value-based purchasing.

- Cost Efficiency: By optimizing resource allocation and preventive care strategies, CareMax seeks to deliver care at a lower overall cost compared to traditional models.

Impact of CareMax's Bankruptcy and Asset Sales

CareMax's recent Chapter 11 bankruptcy filing and subsequent asset sales to Revere Medical and ClareMedica Viking, LLC, highlight the intense competitive rivalry in the healthcare sector. This financial distress signals a market where even established companies struggle to maintain profitability, indicating a highly aggressive competitive landscape.

The sale of CareMax's assets suggests that the remaining players will likely face even greater pressure as market share redistributes. This could lead to a more consolidated but also more fiercely contested market among the surviving entities, potentially impacting pricing and service offerings.

- CareMax filed for Chapter 11 bankruptcy in early 2024.

- Key assets were sold to Revere Medical and ClareMedica Viking, LLC, in April 2024.

- This event underscores a highly competitive market environment where established players face significant challenges.

- The asset sales are expected to reshape market dynamics and intensify competition among remaining healthcare providers.

The competitive rivalry within the value-based primary care sector is exceptionally high, driven by numerous established health systems and specialized value-based care organizations. CareMax's market presence is challenged by entities like SteadyMD, Signallamp Health, and Firefly Health, all competing for patient acquisition and payer contracts.

The sector is further intensified by the entry of well-capitalized, non-traditional players such as Amazon, CVS, and Walgreens, who are actively investing in and disrupting primary care delivery models. For example, CVS Health's $10.6 billion acquisition of Oak Street Health in 2023 exemplifies this trend, injecting significant capital and innovative approaches into the market.

High fixed costs associated with operating primary care centers, including facility maintenance, technology investments, and staffing, create pressure for providers to maximize patient volume, often leading to aggressive competition. CareMax itself has cited high labor costs and lease agreements as significant operational burdens, reflecting the sector's demanding cost structure.

CareMax's Chapter 11 bankruptcy filing in early 2024 and the subsequent sale of its assets in April 2024 to Revere Medical and ClareMedica Viking, LLC, starkly illustrate the intense competitive pressures. These events underscore a market where even significant players struggle for profitability, suggesting a highly contested environment that will likely see further consolidation and intensified rivalry among remaining providers.

| Competitor Type | Examples | Impact on Rivalry |

|---|---|---|

| Value-Based Care Specialists | SteadyMD, Signallamp Health, Firefly Health | Direct competition for patients and payer contracts, fragmenting market share. |

| Large Health Systems | Various established hospital networks | Leverage existing infrastructure and patient bases, increasing competitive intensity. |

| Non-Traditional Entrants | Amazon, CVS (via Oak Street Health), Walgreens | Introduce disruptive models and significant capital, raising the bar for innovation and efficiency. |

SSubstitutes Threaten

Patients can still choose traditional fee-for-service primary care providers, operating on a volume-based rather than outcomes-based model. This traditional approach remains a viable substitute, particularly for those who don't prioritize the coordinated care found in value-based models.

Despite the industry's move towards value-based care, a substantial amount of healthcare payments still utilize the fee-for-service structure. In 2023, fee-for-service still accounted for a significant portion of healthcare spending in the US, though precise figures for its dominance over value-based care are dynamic and constantly evolving as the shift progresses.

Urgent care centers and retail clinics present a notable threat of substitution for traditional primary care practices. These facilities offer convenient access for immediate, non-emergent health needs, often at a lower price point than a doctor's office visit. For instance, by mid-2024, the number of retail clinics in the US had surpassed 10,000, providing easily accessible care for common ailments.

This accessibility can draw patients away from established primary care relationships, particularly for acute conditions. The growing footprint of these convenient care options directly impacts the patient volume and revenue streams of traditional primary care providers, highlighting a significant competitive pressure.

The increasing prevalence of telehealth and virtual care platforms presents a significant threat of substitutes for CareMax's traditional in-person primary care model. These digital solutions offer a convenient alternative, especially for routine check-ups and managing ongoing health conditions, making it easier for patients to bypass physical locations. For instance, the U.S. telehealth market was valued at approximately $37.7 billion in 2023 and is projected to grow substantially, indicating a strong patient preference for accessible virtual options.

Specialty Care Without Primary Care Coordination

Patients, particularly those managing chronic or complex conditions, may opt for direct access to specialists, bypassing the primary care coordination that CareMax champions. This trend represents a significant threat, as individuals could directly engage with specialists, effectively substituting CareMax's integrated model with a more fragmented, yet potentially quicker, route to specialized treatment.

This can lead to less efficient resource utilization and potentially poorer health outcomes for patients who don't benefit from coordinated care. For instance, in 2024, the average wait time for a specialist appointment in the US was reported to be around 24 days, a figure that might incentivize patients to seek direct access if they perceive it as faster, even without primary care oversight.

The availability of direct-to-consumer telehealth services for specific conditions also acts as a substitute. These services allow patients to consult specialists remotely, bypassing the need for a primary care physician referral or CareMax's coordination. This direct access, while potentially fragmenting care, fulfills an immediate need for specialized medical advice or treatment.

- Direct Specialist Access: Patients may bypass primary care coordination to see specialists directly.

- Telehealth Substitutes: Remote specialist consultations offer an alternative to integrated care models.

- Fragmented Care Risk: Independent navigation of the healthcare system can lead to disjointed patient journeys.

- Patient Motivation: Perceived efficiency and speed in accessing specialized care can drive patients towards substitutes.

Self-Care and Employer-Sponsored Wellness Programs

The threat of substitutes for CareMax's primary care services is present, particularly from self-care and employer-sponsored wellness programs. For less severe health issues, individuals may opt for over-the-counter medications or utilize health management resources provided by their employers, thereby bypassing traditional primary care visits.

These alternatives, while not direct replacements for comprehensive medical care, can indeed diminish the demand for routine primary care appointments. For instance, the U.S. market for over-the-counter drugs alone was valued at approximately $35 billion in 2024, indicating a significant spend on self-managed health solutions. Similarly, employer-sponsored wellness programs are becoming increasingly sophisticated, offering services that can address minor ailments or promote preventative health, potentially reducing the need for a doctor's visit.

- Self-Care Options: Individuals increasingly turn to readily available over-the-counter medications and home remedies for minor ailments, reducing the need for physician consultations.

- Employer Wellness Programs: Many companies offer health screenings, fitness challenges, and mental health support, acting as a substitute for some primary care functions.

- Digital Health Tools: Mobile health apps and telehealth platforms provide convenient access to health information and basic consultations, potentially diverting patients from traditional clinics.

- Preventative Health Focus: A growing emphasis on lifestyle changes and preventative measures can decrease the reliance on reactive medical interventions for minor issues.

The threat of substitutes for CareMax's model is significant, driven by accessible and often lower-cost alternatives. Traditional fee-for-service primary care still holds a considerable market share, appealing to patients who don't prioritize coordinated care. In 2023, fee-for-service remained a dominant payment structure in U.S. healthcare, though its exact percentage is fluid as value-based care gains traction.

Urgent care centers and retail clinics offer convenient, price-competitive options for immediate needs, with over 10,000 retail clinics operating in the U.S. by mid-2024. Telehealth platforms, valued at approximately $37.7 billion in 2023, provide a growing substitute for routine and chronic condition management, bypassing physical locations entirely.

Patients also increasingly opt for direct specialist access, bypassing primary care coordination, a trend potentially fueled by average specialist wait times of around 24 days in 2024. Furthermore, self-care through over-the-counter medications, a market valued at roughly $35 billion in 2024, and employer wellness programs reduce the demand for routine primary care visits.

| Substitute Type | Description | Market Data/Trend |

|---|---|---|

| Traditional Fee-for-Service | Volume-based primary care | Significant portion of 2023 U.S. healthcare spending |

| Urgent Care & Retail Clinics | Convenient, lower-cost immediate care | Over 10,000 U.S. retail clinics by mid-2024 |

| Telehealth & Virtual Care | Remote consultations and management | U.S. market valued at $37.7 billion in 2023 |

| Direct Specialist Access | Bypassing primary care coordination | Average U.S. specialist wait time ~24 days (2024) |

| Self-Care & Employer Wellness | Over-the-counter meds, employer health programs | U.S. OTC drug market ~$35 billion (2024) |

Entrants Threaten

Establishing a robust network of primary care centers, particularly those leveraging a technology-driven value-based care approach like CareMax, demands considerable initial investment. This capital is allocated across real estate acquisition or leasing, state-of-the-art medical equipment, sophisticated technology infrastructure, and the recruitment of skilled personnel.

The sheer scale of these capital outlays presents a formidable hurdle for prospective competitors seeking to enter the market. For instance, setting up a single, fully equipped primary care facility can easily run into millions of dollars, making it a significant barrier to entry for smaller or less capitalized organizations.

Navigating the intricate web of regulations governing Medicare Advantage (MA) presents a significant hurdle for new entrants. Securing approval and establishing contracts with numerous MA plans is a time-consuming and demanding undertaking. CareMax's own experience highlights this, as a crucial contract termination in 2023 led to substantial financial strain, demonstrating the critical nature of these payer relationships.

The threat of new entrants into the Medicare Advantage primary care space is significantly tempered by the substantial need for established physician networks and strong brand recognition. CareMax, for instance, has spent over a decade, since its founding in 2011, cultivating its network and patient trust. Newcomers must overcome the considerable hurdle of attracting both skilled physicians and a loyal patient base, particularly Medicare Advantage members, in a market where established players already hold significant sway.

Data and Technology Infrastructure Investment

The threat of new entrants in the value-based care sector, specifically concerning data and technology infrastructure, is significantly mitigated by the substantial investment required. Effective value-based care hinges on advanced data analytics and technology platforms for tasks like coordinating care, identifying high-risk patients, and tracking health outcomes. For instance, companies like Optum, a UnitedHealth Group subsidiary, have invested billions in their technology infrastructure and data analytics capabilities, creating a formidable barrier.

Building or acquiring the necessary sophisticated infrastructure demands considerable capital and specialized expertise, making it a high hurdle for newcomers. This includes robust electronic health record (EHR) systems, data warehousing, predictive modeling tools, and secure patient portals. New entrants would need to replicate these complex systems, a process that is both time-consuming and financially demanding, potentially costing hundreds of millions of dollars.

- High Capital Outlay: Developing a comprehensive data and technology infrastructure can easily run into tens or hundreds of millions of dollars, a significant barrier for startups.

- Specialized Expertise Required: New entrants need to recruit and retain talent with expertise in data science, health informatics, cybersecurity, and software development, which is a competitive and costly endeavor.

- Regulatory Compliance Costs: Ensuring that technology infrastructure meets stringent healthcare regulations like HIPAA adds another layer of complexity and expense for new players.

- Integration Challenges: New entrants must also integrate their systems with existing healthcare providers, payers, and pharmacies, a complex and often costly undertaking.

Competitive Response from Incumbents

Existing players, including CareMax and other substantial value-based care organizations, are deeply entrenched and would likely respond with robust competitive strategies to discourage new market entrants. In 2024, the healthcare industry continued to see significant M&A activity, with major players actively consolidating to enhance their market standing.

This trend of consolidation, evident in numerous deals throughout 2024, indicates that established companies are focused on fortifying their positions, thereby increasing the barriers to entry for any new competitors seeking to establish a significant presence.

- Aggressive Pricing Strategies: Incumbents may lower prices or offer enhanced service packages to make it difficult for new entrants to compete on cost.

- Increased Marketing and Brand Building: Existing players will likely invest more in marketing to reinforce brand loyalty and awareness, making it harder for newcomers to attract customers.

- Lobbying and Regulatory Influence: Established companies may leverage their influence to shape regulations in ways that favor existing operators and create hurdles for new entrants.

The threat of new entrants for CareMax is significantly low due to substantial capital requirements, regulatory complexities, and the need for established networks. The high cost of setting up advanced healthcare infrastructure, estimated in the hundreds of millions for robust data and technology, acts as a major deterrent. Furthermore, navigating Medicare Advantage contracts and building patient trust, a process that took CareMax since 2011, presents a considerable challenge for newcomers.

| Barrier | Estimated Cost/Effort | Impact on New Entrants |

|---|---|---|

| Capital Outlay (Infrastructure & Real Estate) | Tens to hundreds of millions of dollars | Very High |

| Medicare Advantage Contracts & Network Building | Years of effort and significant relationship management | Very High |

| Technology & Data Analytics Investment | Hundreds of millions of dollars | Very High |

| Regulatory Compliance & Licensing | Significant ongoing costs and expertise | High |

Porter's Five Forces Analysis Data Sources

Our CareMax Porter's Five Forces analysis is built upon a robust foundation of data, encompassing company annual reports, SEC filings, industry-specific market research, and expert analyst reports.