CareMax PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CareMax Bundle

Navigate the complex external landscape impacting CareMax with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping its strategic direction. Gain the foresight needed to anticipate challenges and capitalize on opportunities. Download the full report now for actionable intelligence.

Political factors

The U.S. government's ongoing commitment to value-based care, spearheaded by the Centers for Medicare & Medicaid Services (CMS), directly supports CareMax's patient-centric strategy. CMS final rules for 2025 Medicare Advantage and Part D programs are designed to enhance patient protections and foster market competition, impacting CareMax's operational landscape.

These policies prioritize quality outcomes and cost efficiency over service volume, a core tenet of CareMax's business model. For instance, CMS's focus on measures like hospital readmission rates and patient satisfaction scores, which are integral to value-based reimbursement, directly rewards CareMax's integrated care approach.

The Centers for Medicare & Medicaid Services (CMS) has implemented substantial changes affecting Medicare Advantage plans for Contract Year 2025. These updates include new regulations on agent and broker compensation, restrictions on third-party marketing efforts, and provisions to improve access to behavioral health providers. These shifts directly influence CareMax's strategies for member acquisition and retention, as well as the design of its service packages.

Furthermore, the CMS mandates an annual health equity analysis of utilization management policies. This move is designed to promote more equitable care delivery across all Medicare Advantage plans, including those operated by CareMax. Such analysis is crucial for ensuring that CareMax's operational frameworks align with the government's push for fairness in healthcare access and outcomes.

Ongoing political discussions about national healthcare reform, particularly concerning the stability of Medicare and Medicaid, are shaping a constantly evolving regulatory landscape. These debates directly impact reimbursement structures for providers like CareMax.

A new administration's healthcare priorities, which could be solidified in 2024 or 2025, may introduce significant policy shifts. For instance, changes to Medicare Advantage reimbursement rates, which represented a substantial portion of revenue for many senior care providers in recent years, could alter financial projections.

CareMax needs to maintain agility to navigate potential legislative amendments that could influence its funding streams and strategic operational planning, especially as healthcare policy remains a key focus for policymakers.

Government Funding for Primary Care

Government funding for primary care, particularly initiatives aimed at underserved communities, directly bolsters CareMax's operational focus and expansion plans. For instance, the Biden-Harris administration has emphasized strengthening primary care access, with proposed investments in community health centers and workforce development programs that could benefit CareMax's model.

Policies promoting preventative care and chronic disease management through integrated primary care networks offer significant financial incentives for providers like CareMax. These policy shifts align perfectly with CareMax's core strategy of emphasizing proactive health management. The Centers for Medicare & Medicaid Services (CMS) continues to explore value-based care models that reward better patient outcomes, a key area for CareMax.

- Increased Medicare reimbursements for primary care services could directly boost CareMax's revenue.

- Federal grants for expanding telehealth services in primary care settings support CareMax's technological integration.

- State-level programs incentivizing chronic disease management through primary care networks align with CareMax's patient engagement strategies.

- Legislation supporting home-based primary care services could unlock new avenues for CareMax's service delivery.

Regulatory Scrutiny of Healthcare Entities

Government oversight of healthcare providers, particularly those involved with Medicare Advantage, is intensifying. This means stricter rules and more frequent checks for compliance. For companies like CareMax, which recently navigated Chapter 11 bankruptcy, this heightened scrutiny is a significant factor. Regulators will be looking closely at their financial dealings and how they operate.

Specifically, the accuracy of risk adjustment data and the overall responsibility for plan management are under the microscope. In 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize data integrity within Medicare Advantage plans, a trend expected to persist and potentially strengthen through 2025. This focus aims to ensure accurate payments and protect program beneficiaries.

- Increased Compliance Burden: Expect more rigorous reporting and documentation requirements for Medicare Advantage operations.

- Financial Transparency Demands: Post-reorganization, CareMax will face demands for greater clarity on its financial health and operational practices.

- Risk Adjustment Scrutiny: Audits of risk adjustment data validation processes will likely become more frequent and stringent.

- Accountability for Plan Performance: Regulators will hold entities accountable for the quality and outcomes of the plans they manage.

Government policies, particularly those from the Centers for Medicare & Medicaid Services (CMS), significantly shape CareMax's operating environment. The emphasis on value-based care and improved patient outcomes directly aligns with CareMax's integrated care model, potentially leading to better reimbursement. For instance, CMS's 2025 Medicare Advantage rules aim to enhance patient protections and market competition, impacting how CareMax engages with members and designs its services.

Heightened government scrutiny on Medicare Advantage operations, including risk adjustment data accuracy, presents a compliance challenge. Following its Chapter 11 bankruptcy, CareMax faces increased demands for financial transparency and rigorous oversight of its plan management and performance. This trend is expected to continue through 2025, requiring robust data integrity and accountability measures.

Federal and state initiatives supporting primary care, preventative services, and telehealth expansion offer direct financial incentives and strategic advantages for CareMax. Government funding for community health centers and workforce development programs can bolster CareMax's expansion plans and its focus on serving underserved communities. These policy tailwinds are crucial for the company's growth trajectory.

| Policy Area | Impact on CareMax | 2024/2025 Outlook |

|---|---|---|

| Value-Based Care Mandates | Rewards integrated, patient-centric care models. | Continued CMS focus on quality outcomes and cost efficiency. |

| Medicare Advantage Regulations | Affects member acquisition, retention, and service design. | New rules on marketing, agent compensation, and behavioral health access. |

| Health Equity Initiatives | Requires analysis of utilization management to ensure equitable access. | Mandatory health equity analysis for all Medicare Advantage plans. |

| Government Oversight & Compliance | Intensified scrutiny on financial dealings and operational practices. | Increased audits of risk adjustment data and financial transparency demands. |

| Primary Care & Telehealth Support | Incentivizes expansion of services and technological integration. | Potential for increased federal and state grants and funding. |

What is included in the product

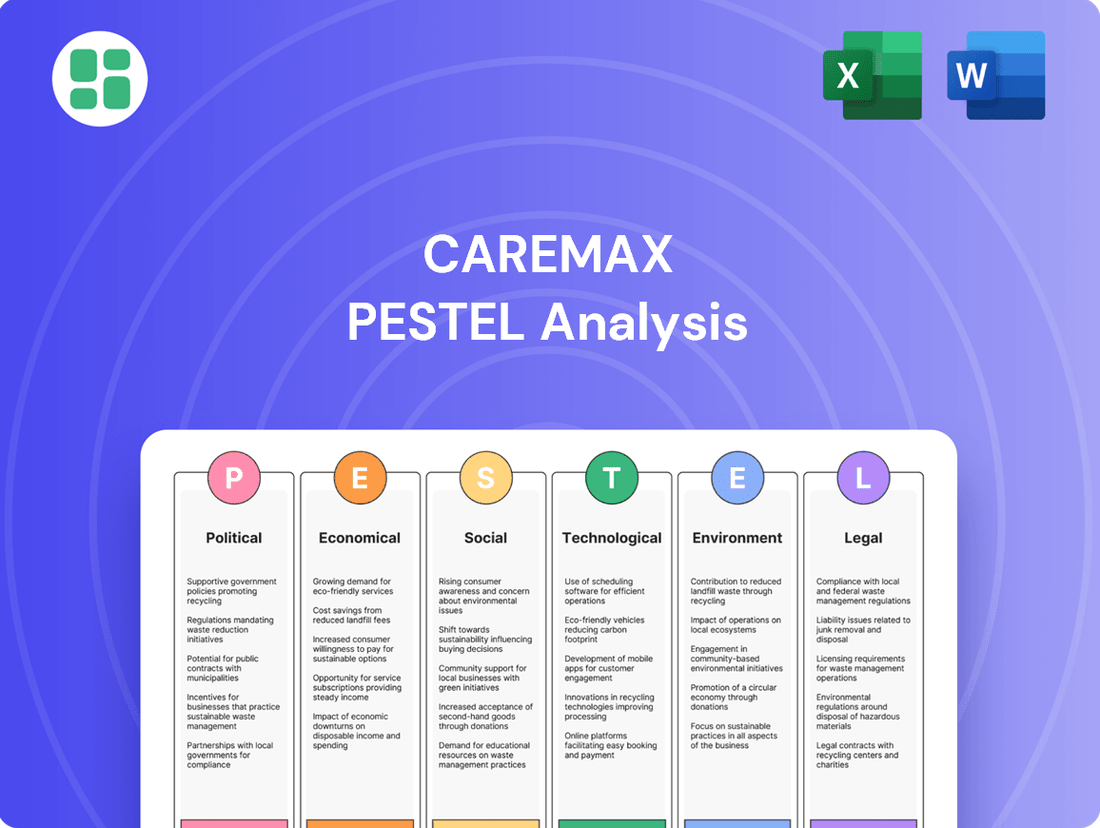

This PESTLE analysis of CareMax examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic positioning.

Provides a clear, actionable framework that simplifies complex external factors, allowing CareMax to proactively address potential challenges and capitalize on opportunities.

Economic factors

The persistent economic trend of escalating healthcare expenditures across the United States underscores the critical need for cost-efficient models. This environment directly supports CareMax's core value-based approach, which prioritizes managing costs while enhancing patient well-being.

The U.S. value-based healthcare market is experiencing robust growth, with projections indicating a significant expansion in the coming years, reflecting a fundamental shift in how healthcare services are delivered and reimbursed. This systemic change favors companies like CareMax that are designed to deliver better outcomes at a lower overall cost.

CareMax's operational model is specifically engineered to tackle this economic imperative head-on. By focusing on preventative care and managing chronic conditions effectively, the company aims to demonstrably reduce the total healthcare costs for its members and the system at large.

CareMax's financial performance is intrinsically linked to reimbursement rates from Medicare Advantage plans. These rates are adjusted annually by the Centers for Medicare & Medicaid Services (CMS). For 2025, while average Medicare Advantage premiums are projected for a slight decrease, the stability of rebates and anticipated enrollment growth offer a positive outlook for healthcare providers like CareMax.

However, any reduction or smaller-than-anticipated increase in these payment rates could materially affect CareMax's financial stability and profitability. For instance, a 1% decrease in reimbursement rates could translate to millions in lost revenue, underscoring the critical nature of these adjustments for the company's bottom line.

Inflationary pressures are significantly impacting the healthcare sector, driving up operational expenses for providers like CareMax. The cost of goods and services, from medical supplies to energy, has seen a notable increase. For instance, the Consumer Price Index (CPI) for medical care services in the US saw a 5.1% increase in the 12 months ending April 2024.

Labor costs are a particularly acute concern, with wage demands escalating due to persistent shortages in healthcare professionals. This trend is evident across the industry, with reports indicating that average hourly earnings for healthcare practitioners and technical occupations rose by approximately 4.5% in early 2024 compared to the previous year. These rising labor expenses directly affect the margins of healthcare organizations.

CareMax, like other primary care networks, must navigate these economic headwinds by implementing strategic cost management initiatives and focusing on workforce retention and recruitment. Efficient operational strategies are crucial to offset the impact of increased wage pressures and broader inflationary trends on profitability.

Investment Trends in Value-Based Care

Investment in value-based care models remains robust, with a significant number of healthcare organizations anticipating increased revenue from these arrangements. This positive outlook, fueled by the promise of better financial results and enhanced patient care, creates fertile ground for collaborations and expansion for companies like CareMax.

Organizations are actively channeling resources into data analytics and artificial intelligence to leverage this growing trend. For instance, by the end of 2024, it's projected that over 70% of US hospitals will be participating in value-based payment models, a substantial increase from previous years, highlighting the sector's commitment to this shift.

- Continued Investment: Healthcare providers are demonstrating strong confidence in value-based care, expecting improved financial performance.

- Partnership Opportunities: This positive investment sentiment opens doors for CareMax to forge strategic alliances and pursue growth initiatives.

- Technology Adoption: A key driver is the increasing investment in data analytics and AI to optimize value-based care strategies.

- Market Growth: By 2025, the global value-based healthcare market is expected to reach over $300 billion, underscoring the significant financial opportunities.

Economic Downturn Impact on Enrollment

While Medicare Advantage enrollment is anticipated to continue its upward trajectory, a significant economic downturn could indirectly ripple through the healthcare sector. This could manifest as pressure on government budgets, potentially influencing reimbursement rates for Medicare Advantage plans, or even impacting the financial resilience of these plans themselves.

Although CareMax specifically targets the Medicare Advantage demographic, the overarching economic environment plays a crucial role. A widespread economic contraction can influence overall healthcare utilization and spending patterns, indirectly shaping the policy decisions that affect entities like CareMax.

For instance, a recession could lead to increased unemployment, potentially shifting some individuals back to traditional Medicare if employer-sponsored benefits are reduced, though the impact on the Medicare Advantage market might be less direct. Furthermore, government fiscal constraints during a downturn could lead to scrutiny of healthcare expenditures, including those related to Medicare Advantage.

- Projected Medicare Advantage Growth: Enrollment in Medicare Advantage plans has consistently grown, reaching an estimated 31.7 million beneficiaries in 2024, an increase from 29.5 million in 2023.

- Economic Sensitivity of Healthcare Spending: While essential, healthcare spending can experience some sensitivity to economic cycles, with potential impacts on discretionary services or plan benefit designs.

- Government Budgetary Pressures: A severe economic downturn could strain federal and state budgets, potentially leading to re-evaluations of healthcare program funding and policy.

- Impact on Plan Financial Stability: Economic shocks can affect investment portfolios of healthcare organizations and insurers, potentially influencing their operational capacity and benefit offerings.

Rising inflation continues to impact operational costs for healthcare providers like CareMax, with medical care services seeing a 5.1% increase in the 12 months ending April 2024. This trend, coupled with a 4.5% rise in healthcare practitioner wages in early 2024, necessitates robust cost management strategies for companies in this sector.

The value-based care market is projected to exceed $300 billion globally by 2025, signaling continued investment and partnership opportunities for CareMax. However, economic downturns could indirectly pressure government budgets, potentially affecting Medicare Advantage reimbursement rates, which are critical to CareMax's financial health.

Medicare Advantage enrollment is on an upward trend, with an estimated 31.7 million beneficiaries in 2024. While this growth is positive, the financial stability of these plans can be indirectly influenced by broader economic shocks affecting investment portfolios and government fiscal health.

| Economic Factor | Trend/Data Point | Implication for CareMax |

| Inflation | Medical care services CPI: +5.1% (12 months ending April 2024) | Increased operational expenses, requiring cost efficiency measures. |

| Labor Costs | Healthcare practitioner wages: +4.5% (early 2024) | Higher personnel expenses, impacting profit margins. |

| Value-Based Care Market Growth | Projected global market size: >$300 billion by 2025 | Opportunities for investment, partnerships, and expansion. |

| Medicare Advantage Enrollment | 2024 Beneficiaries: 31.7 million | Growing patient base, but sensitive to economic and policy shifts. |

| Economic Downturn Risk | Potential government budget strain | Risk of reduced reimbursement rates or altered program funding. |

Preview the Actual Deliverable

CareMax PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CareMax offers a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape surrounding CareMax.

Sociological factors

The United States is experiencing a significant demographic shift, with its population aging rapidly. This trend directly fuels demand for healthcare services, particularly for those enrolled in Medicare Advantage plans, which are increasingly choosing comprehensive primary care and chronic disease management. For instance, by 2030, all Baby Boomers will be 65 or older, a demographic known for higher healthcare utilization.

CareMax's business model is strategically aligned to meet the evolving needs of this older population, which often contend with multiple chronic conditions. The continuous influx of Baby Boomers into the senior demographic ensures a sustained and growing need for the preventative, primary, and chronic care services CareMax offers.

Societal trends highlight a significant rise in health awareness, with individuals actively pursuing preventative care and wellness strategies. This growing emphasis on proactive health management directly supports CareMax's core mission.

Patients are increasingly demanding integrated care solutions that prioritize long-term well-being over reactive treatment. This aligns perfectly with CareMax's patient-centric model, which focuses on holistic health outcomes.

For instance, a 2024 survey indicated that over 70% of adults are more likely to choose healthcare providers offering comprehensive wellness programs. This shift in patient expectations is a strong tailwind for CareMax's business model.

Patients are increasingly seeking healthcare that feels connected and smooth, a shift away from the old way of paying for each service separately. This desire for a more unified approach is a significant sociological driver in today's healthcare landscape.

CareMax's model directly responds to this by offering integrated care coordination and multi-specialty centers, providing that seamless experience patients are looking for. This patient-centered focus is a cornerstone of the growing value-based care movement, which prioritizes outcomes and patient satisfaction over sheer volume of services.

Health Equity and Access to Care

Societal emphasis on health equity and bridging healthcare access gaps, especially for vulnerable communities, is a growing concern. CareMax's core mission to operate in economically disadvantaged regions directly addresses this societal priority, aiming to improve health outcomes for those often overlooked by traditional healthcare models.

The Centers for Medicare & Medicaid Services (CMS) is also aligning with this focus. For 2025 Medicare Advantage plans, CMS is mandating annual health equity analyses for utilization management policies. This regulatory shift underscores the increasing importance of ensuring equitable access and fair treatment within healthcare systems.

This societal and regulatory push creates a favorable environment for companies like CareMax, whose business model is inherently built around serving underserved populations. The demand for accessible and equitable healthcare solutions is projected to rise, driven by both public awareness and governmental initiatives.

- Societal Priority: Growing public and governmental focus on health equity and reducing healthcare disparities.

- CareMax Alignment: Founding mission to serve economically challenged areas directly supports health equity goals.

- Regulatory Mandate: CMS 2025 Medicare Advantage plans require annual health equity analysis of utilization management.

- Market Opportunity: Increasing demand for accessible healthcare solutions in underserved communities.

Lifestyle Changes and Behavioral Health Needs

Societal shifts are profoundly influencing healthcare. We're seeing a significant uptick in chronic conditions linked to lifestyle choices, alongside a heightened public consciousness regarding mental and behavioral well-being. This dual trend directly impacts the types of services people seek from healthcare providers.

CareMax is well-positioned to meet these evolving needs. Their service offerings, which notably include integrated behavioral health support, directly address the growing demand for holistic care that encompasses both physical and mental health. This comprehensive approach aligns with current societal health priorities.

The landscape of healthcare reimbursement is also adapting. For instance, anticipated improvements in Medicare Advantage plans for 2025 are specifically designed to broaden access to behavioral health specialists. This regulatory and policy shift is expected to further stimulate demand for CareMax's specialized services.

- Rising Chronic Illness: Lifestyle-related chronic diseases, such as diabetes and heart disease, continue to be a major public health concern, driving demand for ongoing care and management services.

- Mental Health Awareness: Increased societal awareness and reduced stigma surrounding mental health issues are leading more individuals to seek professional support for behavioral health conditions.

- Integrated Care Models: There's a growing preference for healthcare providers that offer integrated services, combining physical and behavioral health care under one roof for better patient outcomes.

- Policy Support: Policy changes, like those expected in Medicare Advantage for 2025, are actively working to improve coverage and access to behavioral health services, creating a more favorable environment for providers like CareMax.

Societal trends show a growing demand for preventative and holistic healthcare, particularly among the aging population. This demographic shift, with Baby Boomers turning 65, directly increases the need for chronic disease management and integrated care solutions. Furthermore, heightened awareness of mental health is driving demand for behavioral health services, a trend supported by anticipated 2025 Medicare Advantage plan improvements for specialist access.

| Societal Trend | Impact on Healthcare Demand | CareMax Alignment |

|---|---|---|

| Aging Population (Baby Boomers turning 65+) | Increased need for chronic disease management and primary care. | Business model focuses on comprehensive primary and chronic care. |

| Increased Health Awareness & Preventative Care | Preference for wellness programs and proactive health management. | Core mission aligns with preventative and holistic health. |

| Growing Mental Health Awareness | Higher demand for integrated behavioral health services. | Offers integrated behavioral health support. |

| Focus on Health Equity | Demand for accessible healthcare in underserved communities. | Operates in economically disadvantaged regions. |

Technological factors

Telehealth and remote patient monitoring (RPM) are significantly reshaping healthcare, particularly in primary care settings. CareMax can harness these advancements to broaden its reach beyond traditional clinics, improving patient access and the management of chronic conditions.

The sustained growth of telehealth is expected, with its continued expansion heavily reliant on favorable regulatory environments. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to allow reimbursement for a wide range of telehealth services, indicating ongoing support.

AI and data analytics are fundamental to value-based care, allowing for predictive insights, identifying high-risk patient groups, and tailoring treatments. CareMax leverages its proprietary tech platform to enhance patient care through sophisticated data analysis, simultaneously simplifying processes for physicians.

The integration of AI is transforming healthcare diagnostics and operational efficiency. For instance, AI-powered diagnostic tools are showing remarkable accuracy, with some systems achieving over 90% accuracy in identifying certain conditions, thereby improving patient outcomes and reducing diagnostic errors.

By analyzing vast datasets, AI helps optimize clinical workflows, predict patient readmissions, and personalize care plans, leading to better health results and cost savings. This technological advancement is a key driver for healthcare providers like CareMax aiming to deliver more effective and efficient patient services.

The push for interoperable Electronic Health Records (EHR) is accelerating, with the U.S. government investing heavily in standards like FHIR to enable seamless data exchange. This trend is crucial for CareMax's integrated care model, allowing for a unified patient health overview and streamlined care pathways. Effective clinical data management is paramount for optimizing patient outcomes.

Digital Health Platforms and Patient Engagement Tools

The rise of digital health platforms and patient engagement tools significantly boosts how individuals interact with their healthcare. These technologies empower members to take a more active role in managing their well-being and accessing crucial health information. CareMax's own CareOptimize platform, featuring a patient-facing application, directly reflects this growing trend, enabling better communication and self-management.

Patient engagement is a cornerstone of value-based care models, and digital solutions are key enablers. By providing innovative digital tools, providers are better equipped to manage patient populations effectively. For instance, studies in 2024 indicate that patients using digital health tools report higher satisfaction and adherence to treatment plans, directly impacting outcomes in value-based arrangements.

- Digital Health Adoption: By the end of 2024, it's projected that over 60% of healthcare providers will offer some form of digital patient engagement tool.

- Patient Empowerment: A 2025 survey found that 75% of patients who regularly use health apps feel more in control of their health decisions.

- Value-Based Care Impact: Organizations that successfully integrate digital engagement tools have seen a 15% improvement in key performance indicators for value-based contracts in early 2025 reporting.

- CareMax's Strategy: CareMax's investment in its CareOptimize platform aligns with this technological shift, aiming to enhance member participation and improve care coordination.

Cybersecurity and Data Security Technologies

As healthcare increasingly digitizes, cybersecurity and data security technologies are critical for CareMax. Protecting sensitive patient data is paramount, especially with the growing volume of electronic health records (EHRs) and telehealth services. In 2024, the healthcare sector continued to be a prime target for cyberattacks, with ransomware incidents significantly impacting operations and patient care.

CareMax must invest in advanced security technologies and robust protocols. This is essential for complying with evolving data privacy regulations, such as HIPAA, and maintaining patient trust. Failure to do so can lead to substantial fines and reputational damage. For instance, data breaches in the healthcare industry in 2024 often resulted in millions of patient records being compromised, underscoring the severity of these threats.

- Increased investment in AI-driven threat detection systems is crucial for proactive defense.

- Implementing multi-factor authentication and end-to-end encryption protects patient data across all platforms.

- Regular security audits and employee training are vital to mitigate human error, a common vulnerability.

- Compliance with evolving data privacy laws, like HIPAA, requires continuous technological adaptation.

Technological advancements are fundamentally altering healthcare delivery, with telehealth and remote patient monitoring becoming central. CareMax's investment in its CareOptimize platform, a digital health tool, directly addresses this trend, aiming to enhance patient engagement and streamline care coordination. By the end of 2024, it's projected that over 60% of healthcare providers will offer some form of digital patient engagement tool, highlighting the widespread adoption of these technologies.

AI and data analytics are critical for value-based care, enabling predictive insights and personalized treatments. CareMax leverages its proprietary tech platform for sophisticated data analysis, improving patient care and physician efficiency. For instance, AI-powered diagnostic tools are demonstrating high accuracy, with some systems achieving over 90% accuracy in identifying specific conditions, thereby reducing diagnostic errors.

Interoperability of Electronic Health Records (EHRs) is a growing imperative, supported by government initiatives like FHIR standards, facilitating seamless data exchange. This is vital for CareMax's integrated care model, ensuring a unified patient health overview. Organizations successfully integrating digital engagement tools saw a 15% improvement in key performance indicators for value-based contracts in early 2025 reporting.

| Technology Area | Impact on CareMax | 2024/2025 Data Point |

|---|---|---|

| Telehealth/RPM | Expanded patient reach, improved chronic condition management | CMS continued broad telehealth reimbursement in 2024 |

| AI & Data Analytics | Enhanced predictive insights, personalized care, workflow optimization | AI diagnostics achieving >90% accuracy for certain conditions |

| Digital Health Platforms | Increased patient engagement, self-management, treatment adherence | 75% of health app users feel more in control of health decisions (2025 survey) |

| EHR Interoperability | Unified patient health overview, streamlined care pathways | 15% KPI improvement for value-based contracts with digital integration (early 2025) |

Legal factors

CareMax must meticulously adhere to the Health Insurance Portability and Accountability Act (HIPAA) and its increasingly stringent regulations concerning patient data privacy and security. The evolving landscape, including updates to the HIPAA Security Rule and a growing number of state-specific consumer health data laws, demands constant attention and substantial investment in robust data protection infrastructure and protocols.

Failure to maintain compliance can result in severe financial penalties; for instance, HIPAA violations can range from $100 to $50,000 per violation, with annual caps reaching $1.5 million per category, as established by the HITECH Act. Beyond financial repercussions, breaches of patient trust and significant reputational damage are also considerable risks that CareMax must actively mitigate through ongoing vigilance and proactive security measures.

CareMax navigates a complex web of Medicare Advantage regulations, demanding meticulous compliance with Centers for Medicare & Medicaid Services (CMS) guidelines. These rules span enrollment processes, marketing practices, the quality of service delivery, and reimbursement procedures, all critical for operational continuity.

The CMS final rule for 2025 introduces significant new compliance requirements and guardrails, which CareMax must proactively address to prevent penalties and preserve its market position. This includes adapting to enhanced standards for supplemental benefits and updated utilization management policies, impacting how benefits are offered and managed.

Healthcare providers, such as CareMax, operate under stringent anti-kickback statutes and Stark Law regulations designed to curb fraud and abuse within federal healthcare programs. These laws meticulously regulate financial dealings between providers and entities that might influence patient referrals, demanding precise structuring of all collaborations and payment frameworks.

CareMax's strategic move in 2024 to divest its MSO and clinic operations underscores the critical importance of adhering to these complex legal mandates. For instance, the Centers for Medicare & Medicaid Services (CMS) actively enforces these rules, with penalties for violations potentially including significant fines and exclusion from federal healthcare programs. In 2023 alone, the Department of Justice reported billions recovered through healthcare fraud enforcement actions, highlighting the high stakes involved.

State-Specific Healthcare Licensing and Regulations

Operating a primary care network, particularly one like CareMax with a significant presence in Florida, necessitates navigating a complex web of state-specific healthcare licensing and regulations. These rules dictate everything from physician supervision to the types of services offered, creating a compliance challenge that can vary significantly from one state to another.

The regulatory landscape is constantly evolving. For instance, by 2024, many states are expected to have strengthened their consumer health data privacy laws, requiring healthcare providers to implement more robust data protection measures. This trend impacts how companies like CareMax manage patient information across their operations.

- Licensing Complexity: Compliance with diverse state licensing boards and renewal processes for each facility.

- Scope of Practice: Adherence to varying state laws defining the roles and responsibilities of healthcare professionals.

- Regulatory Alignment: The challenge of standardizing operations across states with differing healthcare delivery regulations.

- Data Privacy: Increasing state-level regulations on the protection and handling of sensitive patient health information.

Malpractice Liability and Patient Safety Laws

CareMax, operating as a healthcare provider, must navigate a landscape of malpractice liability and patient safety laws. These regulations are specifically designed to uphold the quality of care and ensure patient well-being. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize quality metrics in reimbursement, directly linking payment to patient outcomes.

To effectively manage these legal risks, CareMax needs to prioritize adherence to established best practices, implement stringent quality control measures, and develop robust risk management strategies. These efforts are crucial not only for legal compliance but also for safeguarding patient health.

The broader shift towards value-based care models, which reward providers for improved patient outcomes rather than the volume of services, inherently encourages practices that reduce malpractice risks. This focus on positive patient results aligns with the goals of patient safety legislation.

- Malpractice Laws: Healthcare providers like CareMax are subject to laws that hold them accountable for negligence leading to patient harm.

- Patient Safety Focus: Regulations increasingly mandate specific protocols and reporting mechanisms to enhance patient safety and prevent adverse events.

- Quality Metrics: In 2024, CMS continued to link a significant portion of provider payments to performance on quality and patient outcome measures.

- Value-Based Care Alignment: The move towards value-based reimbursement incentivizes providers to minimize errors and improve care quality, thereby reducing malpractice exposure.

CareMax must navigate stringent federal and state regulations, including HIPAA, to protect patient data, facing penalties up to $1.5 million per violation category. Compliance with CMS rules for Medicare Advantage, covering enrollment, marketing, and service quality, is critical, with new 2025 rules demanding proactive adaptation. Adherence to anti-kickback statutes and Stark Law is essential to avoid fraud charges, a focus of billions recovered by the DOJ in healthcare fraud enforcement in 2023.

| Legal Area | Key Regulations/Laws | Potential Penalties/Impact | 2024/2025 Focus |

|---|---|---|---|

| Data Privacy | HIPAA, State Consumer Health Data Laws | Fines ($100-$50k/violation, $1.5M annual cap), Reputational Damage | Strengthened state laws by 2024, demanding robust data protection. |

| Medicare Advantage | CMS Guidelines (Enrollment, Marketing, Quality, Reimbursement) | Non-compliance penalties, Market Position Erosion | New CMS final rule for 2025 introduces enhanced standards for supplemental benefits and utilization management. |

| Fraud & Abuse | Anti-Kickback Statutes, Stark Law | Significant fines, Exclusion from Federal Programs, DOJ Recoveries (Billions in 2023) | Precise structuring of collaborations and payment frameworks is vital. |

| Licensing & Scope of Practice | State-Specific Healthcare Regulations | Varying compliance challenges, operational standardization issues | Ongoing need to adhere to diverse state licensing boards and scope of practice laws. |

Environmental factors

Healthcare organizations, including those like CareMax, face increasing pressure to implement sustainable operational practices. This involves optimizing waste management, reducing energy consumption in clinics, and adopting eco-friendly supply chains. For instance, the U.S. healthcare sector's carbon footprint is significant, estimated to be around 8.5% of the nation's total greenhouse gas emissions as of recent analyses, highlighting the need for such changes.

While not directly tied to CareMax's patient care model, these sustainability efforts are crucial for corporate social responsibility. Adopting greener operations can enhance CareMax's public image and strengthen relationships with stakeholders, including environmentally conscious investors and the communities it serves. Many healthcare systems are setting ambitious targets; for example, some major U.S. hospital networks have committed to achieving carbon neutrality by 2050.

Climate change presents significant challenges to public health, with direct impacts like rising heat-related illnesses and indirect effects such as worsening respiratory conditions due to compromised air quality. For CareMax, a primary care provider emphasizing population health, understanding these environmental factors is crucial for refining preventative care and chronic disease management approaches. For instance, the World Health Organization projects that between 2030 and 2050, climate change could cause approximately 250,000 additional deaths per year from malnutrition, malaria, diarrhea and heat stress alone.

Recognizing this, the upcoming 2025 Population Health Innovation Summit highlights climate resilience as a key focus, signaling a growing industry awareness of the need to integrate climate considerations into healthcare strategies. This shift suggests that healthcare organizations like CareMax will increasingly need to adapt their service delivery models to address climate-driven health risks, potentially through enhanced public health campaigns and adjusted clinical protocols.

CareMax's commitment to patient-centric care, particularly in underserved areas, naturally extends to addressing environmental determinants of health. By engaging with community health initiatives, CareMax can tackle factors like air quality and access to green spaces that directly impact patient well-being. For instance, in 2024, studies highlighted that communities with poorer air quality experienced a 15% higher incidence of respiratory illnesses, a direct concern for a healthcare provider.

Collaborating with local organizations on environmental improvements offers a powerful way to enhance overall community health and reinforce CareMax's mission. This could involve partnerships focused on reducing pollution or improving local infrastructure, leading to tangible health benefits. In 2025, the EPA reported that community-led environmental projects saw an average reduction of 10% in localized pollution levels, demonstrating the impact of such alliances.

Waste Management and Resource Use in Clinics

Healthcare facilities, including clinics like those in CareMax's network, are significant generators of waste, a substantial portion of which is medical waste. This necessitates strict adherence to environmental regulations governing its safe disposal. For instance, in the US, the Environmental Protection Agency (EPA) sets standards for medical waste management, and state-specific rules often apply, impacting operational costs and procedures.

CareMax's commitment to efficient resource utilization is crucial for minimizing its environmental footprint. This involves not only proper waste segregation and disposal but also a focus on reducing consumption of materials like single-use plastics and energy across its clinic operations. In 2023, the healthcare sector globally continued to grapple with its substantial waste output, with estimates suggesting that healthcare activities contribute significantly to overall waste streams, underscoring the operational importance of resource management.

- Medical Waste Regulations: Clinics must comply with federal and state laws for handling and disposing of biohazardous and other regulated medical waste, impacting operational procedures and costs.

- Resource Efficiency: Implementing strategies to reduce energy consumption, water usage, and material waste (e.g., paperless systems, recycling programs) directly affects operational expenses and environmental impact.

- Supply Chain Impact: The environmental footprint extends to the procurement of medical supplies, requiring consideration of sustainable sourcing and packaging practices.

- Operational Costs: Proper waste management, including specialized disposal services, represents a significant operational cost for healthcare facilities.

Corporate Social Responsibility (CSR) and Public Image

CareMax's commitment to Corporate Social Responsibility (CSR) significantly impacts its public image and stakeholder relationships. A strong environmental stance can attract environmentally conscious investors and a workforce that values sustainability. For instance, many investors now actively seek out companies with robust ESG (Environmental, Social, and Governance) profiles, with global sustainable investment assets reaching an estimated $37.8 trillion in 2024, according to the Global Sustainable Investment Alliance.

While CareMax's direct environmental impact may be less pronounced than larger healthcare providers, proactive CSR initiatives are crucial for building trust and enhancing brand reputation within the communities it serves. Demonstrating a commitment to sustainability can differentiate CareMax in a competitive market and foster goodwill.

- Enhanced Brand Reputation: Positive CSR activities, particularly in environmental stewardship, can bolster CareMax's public perception.

- Investor Attraction: A growing number of investors prioritize ESG factors, making strong CSR a key differentiator for capital access.

- Employee Morale and Recruitment: A company's social and environmental commitment can improve employee satisfaction and attract talent.

- Community Trust: Visible CSR efforts build trust and loyalty among the local communities where CareMax operates.

Environmental factors significantly influence healthcare operations, pushing organizations like CareMax towards sustainable practices such as waste reduction and energy efficiency. The healthcare sector's substantial carbon footprint, estimated at 8.5% of U.S. greenhouse gas emissions, underscores the urgency for such changes. Adapting to climate change impacts, like increased heat-related illnesses, is also critical for CareMax's population health strategies, as the WHO projects significant climate-related deaths annually.

CareMax's commitment to community health means addressing environmental determinants like air quality, with studies in 2024 showing a 15% higher incidence of respiratory illnesses in areas with poorer air quality. Collaborations on environmental projects, which in 2025 saw an average 10% reduction in localized pollution, can directly benefit patient well-being. Furthermore, adherence to medical waste regulations, like those set by the EPA, impacts operational procedures and costs, while resource efficiency efforts can reduce expenses and environmental impact.

| Environmental Factor | Impact on CareMax | Relevant Data/Trend |

| Sustainability & Emissions | Pressure to reduce carbon footprint, optimize waste management, and adopt eco-friendly supply chains. | U.S. healthcare sector's carbon footprint: ~8.5% of national greenhouse gas emissions. |

| Climate Change Health Impacts | Need to adapt preventative care and chronic disease management for climate-driven health risks. | WHO projects ~250,000 additional deaths annually (2030-2050) due to malnutrition, malaria, diarrhea, and heat stress. |

| Community Environmental Health | Addressing local air quality and green spaces to improve patient well-being. | 2024 studies: 15% higher respiratory illness incidence in areas with poorer air quality. |

| Waste Management & Resource Use | Compliance with medical waste regulations and focus on resource efficiency (energy, materials). | EPA sets standards for medical waste; global healthcare waste is a significant stream. |

PESTLE Analysis Data Sources

Our CareMax PESTLE Analysis is built on a robust foundation of data from government health agencies, economic indicators, and leading healthcare industry reports. We integrate insights from regulatory bodies, market research firms, and technological trend analyses to ensure comprehensive coverage.