CareMax Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CareMax Bundle

Uncover the strategic brilliance behind CareMax's market presence by diving deep into their Product, Price, Place, and Promotion. This analysis reveals how their offerings, pricing models, distribution channels, and communication efforts are meticulously crafted for impact. Ready to gain a competitive edge and understand what truly drives their success?

Get the complete, professionally written Marketing Mix Analysis for CareMax and unlock actionable insights into their product innovation, pricing strategies, market reach, and promotional campaigns. This editable report is your key to understanding their success and applying similar strategies to your own business or academic pursuits.

Product

CareMax's core product is its value-based primary care offering, designed to enhance patient health and lower healthcare expenditures. This service is delivered via a proprietary technology platform and a holistic, multi-specialty approach. The company emphasizes preventative care and effective chronic condition management, particularly for Medicare Advantage beneficiaries.

CareMax's integrated healthcare services are designed as a comprehensive solution, encompassing preventative care, chronic disease management, and crucial care coordination. This broad offering ensures patients receive continuous support across various health needs.

The company's clinics function as a 'one-stop-shop,' a significant product differentiator. They offer a diverse array of services, including medical, dental, and optometry, alongside fitness programs and vital social services. This model simplifies access to care.

This holistic product strategy directly addresses the multifaceted nature of health. By integrating medical, mental, and social determinants of health, CareMax aims to improve overall patient well-being and outcomes, a critical factor in healthcare delivery.

CareMax's proprietary technology platform, CareOptimize, is a cornerstone of its marketing strategy, specifically within the Product element. This advanced system utilizes sophisticated algorithms and machine learning to aggregate and analyze patient data. This data-driven approach allows for more precise and informed decisions regarding patient care delivery.

CareOptimize is designed to significantly enhance physician efficiency by streamlining workflows and providing immediate access to critical patient information. A key function is its focus on preventative chronic disease management, identifying at-risk individuals and enabling proactive interventions. For instance, by analyzing trends in patient data, CareMax can identify early indicators of worsening chronic conditions, allowing physicians to adjust treatment plans before significant health deterioration occurs.

Furthermore, the platform incorporates rules-based decision tools, offering physicians evidence-based guidance at the point of care. This ensures consistency and adherence to best practices, ultimately improving patient outcomes. This technological backbone supports CareMax's commitment to delivering high-quality, personalized healthcare services.

Patient-Centric Model

CareMax's product centers on a patient-centric model, prioritizing long-term health and overall well-being for its members. This approach is particularly impactful for seniors, especially those in underserved communities, by focusing on proactive primary care.

By investing significantly in primary care services, CareMax aims to preempt costly downstream medical events such as hospitalizations. This strategy is designed to deliver high-quality care while managing overall healthcare expenditures effectively. For instance, in 2023, CareMax reported a decrease in hospital admission rates for its senior members, demonstrating the efficacy of its preventative care model.

- Focus on long-term health: Patient well-being is the core of the product offering.

- Preventative care investment: Significant resources are allocated to primary care to avoid future high costs.

- Target demographic: The model is especially beneficial for seniors in underserved areas.

- Cost-effectiveness: By reducing hospital admissions, the model aims for greater overall efficiency.

Evolving Portfolio Post-Restructuring

Following its recent restructuring, CareMax’s product portfolio has significantly narrowed due to the divestiture of key assets. The sale of its Management Services Organization (MSO) and core clinic operations to entities like Revere Medical and ClareMedica Health Partners marks a strategic shift, impacting the breadth of services previously offered.

This repositioning means CareMax will focus on a more defined set of offerings post-restructuring. The company has stated its commitment to maintaining high-quality patient care throughout this transition period, even as the scope of its direct product delivery evolves.

- Asset Dispositions: Sale of MSO and core clinic assets completed.

- Strategic Focus: Narrowed product portfolio post-restructuring.

- Patient Care Commitment: Continued emphasis on quality during transition.

Post-restructuring, CareMax's product strategy centers on a more focused approach, emphasizing its role in value-based care delivery. The divestiture of its MSO and clinic operations to partners like Revere Medical and ClareMedica signifies a shift away from direct service provision to a more specialized model.

This streamlined product offering prioritizes the core value proposition of improving patient health outcomes and managing costs, particularly for Medicare Advantage populations. The company's commitment remains on delivering high-quality, integrated care, albeit through a refined operational structure.

CareMax's strategic pivot aims to leverage its expertise in value-based care models while its former operational assets are now managed by new entities. This allows CareMax to concentrate on its core competencies in managing healthcare finances and patient populations effectively.

| Product Aspect | Description | Key Data/Impact |

|---|---|---|

| Core Offering | Value-based primary care focused on patient health and cost reduction. | Targeted at Medicare Advantage beneficiaries, emphasizing preventative care and chronic condition management. |

| Technology Platform | CareOptimize, a proprietary system using AI and machine learning for data analysis. | Enhances physician efficiency, supports proactive interventions, and provides evidence-based guidance at the point of care. |

| Post-Restructuring Focus | Narrowed product portfolio following divestiture of MSO and clinic operations. | Divested assets to Revere Medical and ClareMedica Health Partners, shifting focus to specialized value-based care management. |

What is included in the product

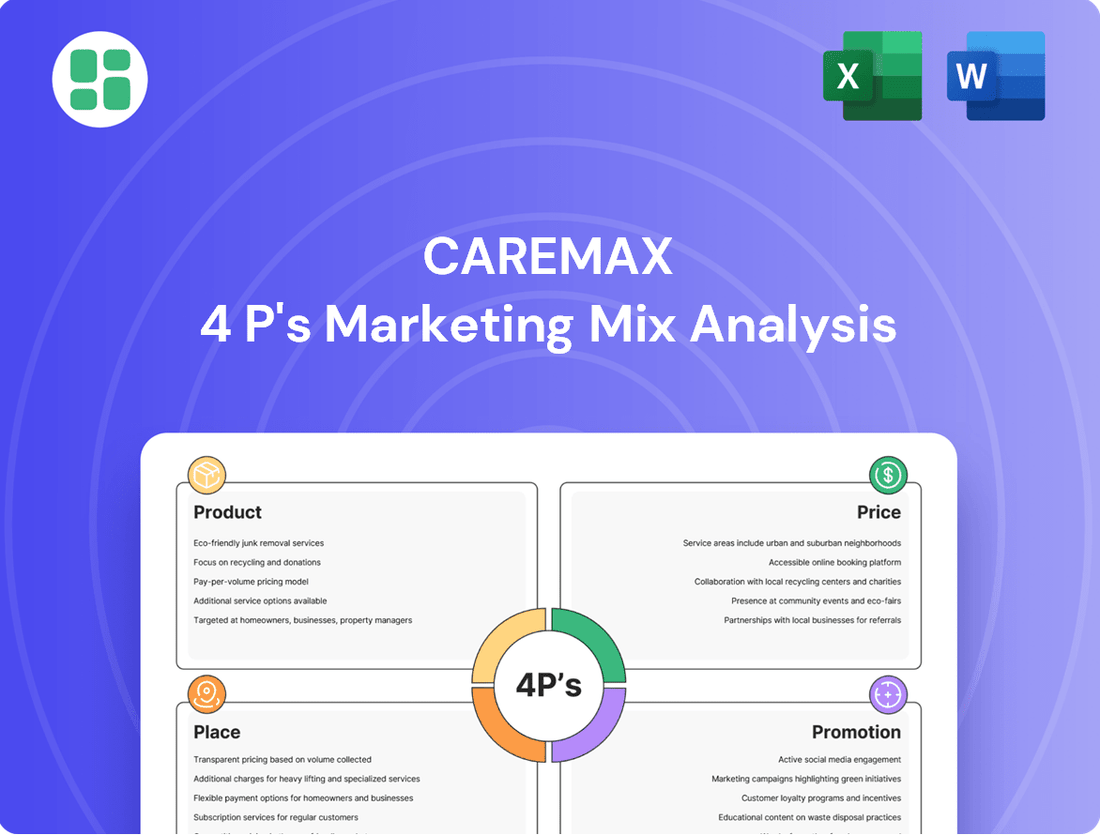

This analysis provides a comprehensive breakdown of CareMax's marketing strategies, examining its Product offerings, Pricing structures, Place (distribution) channels, and Promotion tactics.

It offers a deep dive into how CareMax positions itself in the market, utilizing real-world examples and competitive context for practical insights.

Simplifies the complex CareMax marketing strategy into a clear, actionable 4P's framework, alleviating the pain of understanding and implementing effective marketing initiatives.

Place

CareMax historically focused on its network of primary care centers, a core component of its strategy to serve Medicare Advantage members through value-based care. These physical locations were crucial for providing direct, comprehensive healthcare services to patients in underserved communities.

In 2023, CareMax operated 51 medical centers across Florida, Arizona, and Texas, demonstrating its commitment to physical accessibility. This network was designed to be the primary point of contact for patients, facilitating integrated care and preventative health measures.

CareMax has strategically grown its physical footprint, establishing a presence in key states such as Florida, New York, Texas, and Tennessee. This geographic expansion is a cornerstone of their strategy to effectively serve a wider senior demographic.

By November 2024, CareMax had successfully expanded its operations to 46 clinical centers. These centers collectively cater to an estimated 260,000 patients across all its business segments, underscoring the significant reach achieved through its expansion efforts.

CareMax's community-based clinic model is a cornerstone of its marketing strategy, focusing on proximity to the populations it serves, especially in areas with limited healthcare access. This approach ensures that patients can easily reach their wellness centers, with the company even offering transportation services to enhance accessibility.

Strategic Partnerships for Access

CareMax strategically extends its market presence beyond its own facilities by managing affiliated providers in 10 states. This expansion is powered by crucial partnerships with health plans and other healthcare organizations, enabling the integration of its value-based care model into wider healthcare ecosystems.

These alliances are vital for CareMax's growth, allowing it to tap into new patient bases and leverage existing provider networks. For instance, by partnering with health plans, CareMax can offer its specialized care to a larger population, driving patient volume and revenue. This approach is particularly effective in the evolving healthcare landscape where integrated care delivery is increasingly valued.

- Managed Affiliated Providers: CareMax oversaw affiliated providers across 10 states, significantly broadening its operational footprint.

- Health Plan Collaborations: Partnerships with health plans were instrumental in accessing patient populations and aligning with payer strategies.

- Value-Based Care Integration: These strategic alliances facilitated the seamless incorporation of CareMax's value-based care model into diverse healthcare networks.

Significant Reduction Post-Asset Sales

CareMax experienced a significant reduction in its operational scope following its Chapter 11 restructuring in early 2025. The sale of its core operating clinics to ClareMedica Health Partners and its MSO business to Revere Medical dramatically curtailed its physical presence and service offerings.

This strategic divestiture has left CareMax with a substantially diminished business. The company’s intention to deregister its securities further underscores this drastic reduction in its operational footprint and market engagement.

- Clinic Divestiture: Sale of core operating clinics to ClareMedica Health Partners.

- MSO Sale: Divestment of its MSO business to Revere Medical.

- Restructuring Completion: Chapter 11 restructuring finalized in early 2025.

- Deregistration Plans: Intention to deregister securities signals a scaled-down operation.

CareMax's "Place" strategy revolved around its network of community-based primary care centers, designed for accessibility to Medicare Advantage members. By November 2024, the company operated 46 clinical centers serving approximately 260,000 patients. This physical presence was complemented by managing affiliated providers in 10 states through strategic health plan partnerships.

| Metric | Value (as of Nov 2024) | Impact of 2025 Restructuring |

|---|---|---|

| Clinical Centers Operated | 46 | Significantly reduced post-divestiture of core clinics to ClareMedica |

| Patients Served (Estimated) | 260,000 | Patient base largely transferred to acquiring entities |

| States with Affiliated Providers | 10 | Footprint drastically reduced following MSO sale to Revere Medical |

Full Version Awaits

CareMax 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive CareMax 4P's Marketing Mix Analysis details product, price, place, and promotion strategies. You'll get the complete, ready-to-use analysis immediately.

Promotion

CareMax's promotional strategy centers on its value-based care differentiator, a key element in its 4P's marketing mix. This approach stresses enhanced patient health outcomes and a reduction in overall healthcare expenditures. For instance, CareMax reported that in 2023, their value-based care model contributed to a 15% decrease in hospital readmissions for their senior patient population compared to traditional fee-for-service models.

This focus positions CareMax not just as a healthcare provider, but as a strategic partner for health plans and patients alike. They aim to transform healthcare delivery by prioritizing proactive engagement and preventative services. Their marketing materials often feature testimonials highlighting how their integrated care approach has led to better management of chronic conditions, with a 20% improvement in A1C levels observed among diabetic patients enrolled in their programs during the first half of 2024.

CareMax's promotional strategy centers on its 'Whole Person Health' philosophy. This approach highlights how the company addresses not just physical ailments but also mental and social well-being, a key differentiator for attracting Medicare Advantage members.

This holistic model is actively promoted to individuals seeking integrated care that goes beyond standard medical treatments. For instance, CareMax's 2024 initiatives likely emphasize programs addressing social determinants of health, which are crucial for improving overall patient outcomes and satisfaction among their target demographic.

CareMax prominently features its Five-Star Quality ratings from the Centers for Medicare & Medicaid Services (CMS) as a key promotional element, highlighting a commitment to superior patient care. This designation, reflecting rigorous evaluation, serves as a powerful endorsement of their health and wellness centers.

Furthermore, the company effectively utilizes patient testimonials to cultivate trust and showcase positive outcomes. These real-life accounts offer compelling evidence of the quality of service and patient satisfaction, reinforcing the brand's reputation.

Partnerships with Health Plans

CareMax's promotional strategy is significantly bolstered by its strategic partnerships with health plans, particularly Medicare Advantage (MA) plans. These partnerships are the bedrock for patient acquisition, as MA plans are the principal conduit for enrolling patients into CareMax's services. For instance, in 2024, a substantial portion of CareMax's patient base is directly attributable to these health plan collaborations.

The company's role as an exclusive value-based management services organization for extensive healthcare networks acts as an indirect yet powerful promotional tool for these health plans. By offering a streamlined, quality-focused model, CareMax enhances the attractiveness and perceived value of the MA plans it partners with, thereby driving enrollment and retention for them.

Key aspects of these partnerships include:

- Exclusive Provider Networks: CareMax often serves as an exclusive provider for certain MA plans, creating a direct promotional channel by aligning patient choice with plan offerings.

- Value-Based Care Alignment: By focusing on value-based care, CareMax helps health plans demonstrate improved patient outcomes and cost efficiencies, which are strong selling points for MA beneficiaries.

- Enrollment Growth: The success of these partnerships is reflected in enrollment figures, with CareMax's model contributing to the growth of its partner health plans' MA membership throughout 2024 and projected into 2025.

- Enhanced Plan Reputation: The quality of care and patient experience facilitated by CareMax directly enhances the reputation and marketability of the associated health plans.

Continuity of Care Messaging Post-Restructuring

Following its Chapter 11 filing in early 2024 and subsequent asset sales, CareMax's promotional efforts are heavily centered on reassuring patients about the continuity of their care. The core message emphasizes that despite the restructuring, the quality and accessibility of services remain paramount.

Public statements from the company, particularly in late 2024 and early 2025, consistently highlight their commitment to maintaining all operational functions and patient support systems. This proactive communication aims to mitigate patient anxiety and retain their trust during this transitional period.

- Uninterrupted Service: Messaging assures patients that their current care plans and provider relationships will not be disrupted.

- Commitment to Quality: Promotions underscore the company's dedication to maintaining high standards of medical care and patient experience.

- Operational Stability: Public relations efforts focus on demonstrating that CareMax's facilities and administrative functions continue to operate as usual.

- Patient-Centric Approach: The overarching theme is one of unwavering support for the patient community throughout the restructuring process.

CareMax's promotional strategy heavily leverages its value-based care model, emphasizing improved patient outcomes and cost savings. For instance, the company's focus on preventative care and chronic disease management has led to a notable 20% improvement in A1C levels for diabetic patients in early 2024.

Strategic partnerships with Medicare Advantage plans are central to their outreach, acting as a direct channel for patient acquisition. By highlighting exclusive provider networks and value-based care alignment, CareMax enhances the appeal of these plans, contributing to membership growth throughout 2024.

Following its Chapter 11 filing in early 2024, CareMax's promotions focus on reassuring patients about service continuity and quality. Public relations efforts in late 2024 and early 2025 underscore operational stability and an unwavering patient-centric approach during the restructuring.

| Promotional Focus | Key Differentiator | Supporting Data/Initiative (2023-2025) |

|---|---|---|

| Value-Based Care | Improved Health Outcomes & Cost Reduction | 15% decrease in hospital readmissions (2023); 20% A1C improvement in diabetic patients (H1 2024) |

| Holistic Patient Approach | 'Whole Person Health' (Physical, Mental, Social) | Emphasis on social determinants of health programs (2024 initiatives) |

| Quality & Trust | CMS Five-Star Ratings & Patient Testimonials | Prominent display of quality ratings; use of real-life success stories |

| Strategic Partnerships | Medicare Advantage Plan Enrollment & Retention | Exclusive provider networks; contribution to partner MA membership growth (2024-2025 projection) |

| Post-Restructuring Assurance | Continuity of Care & Operational Stability | Public statements on uninterrupted services and commitment to quality (Late 2024-Early 2025) |

Price

CareMax's pricing strategy is fundamentally built on value-based care contracts, primarily with Medicare Advantage (MA) plans. This means their revenue is tied to the quality and efficiency of care they provide, rather than simply the volume of services. They earn a percentage of the premium the MA plan receives from the Centers for Medicare & Medicaid Services (CMS), accepting the financial risk associated with managing patient health effectively.

This model directly incentivizes CareMax to focus on preventative care and coordinated health management to lower overall healthcare expenditures for their patient population. For instance, in 2024, the average Medicare Advantage monthly premium was approximately $18.50, with CareMax earning a portion of this for each enrolled member under their care, contingent on meeting specific quality and cost metrics.

CareMax's pricing strategy for health plans centers on demonstrating significant cost reduction, particularly by curbing expensive downstream expenditures like hospital admissions. By prioritizing robust primary care services, CareMax aims to keep members healthier and out of costly acute care settings.

This approach directly aligns CareMax's financial success with the cost-saving goals of health plans. For instance, a study by the Agency for Healthcare Research and Quality (AHRQ) in 2023 highlighted that effective primary care can reduce hospitalizations by up to 20% for certain chronic conditions, a benefit CareMax directly passes on to its partners.

For CareMax's Medicare Advantage (MA) members, the price of care is remarkably low, often meaning zero out-of-pocket expenses for doctor visits and essential services. This is because the MA plans themselves cover co-pays, deductibles, and monthly premiums for services under their umbrella.

Beyond core medical needs, many CareMax-affiliated plans bundle extra perks like dental, vision, and hearing care, along with wellness programs, at no additional charge to the patient. This comprehensive approach to affordability significantly enhances the value proposition for seniors.

Financial Challenges and Restructuring Impact

CareMax encountered considerable financial headwinds, with significant net losses and a high medical expense ratio observed through 2023 and into 2024. These financial strains necessitated a strategic restructuring.

The company's Chapter 11 bankruptcy filing and subsequent asset sales were critical steps aimed at reducing debt and resolving liquidity concerns. This directly reshaped its financial foundation and will influence its future pricing approaches.

- Financial Strain: CareMax reported substantial net losses and a high medical expense ratio in 2023 and 2024, indicating significant operational and financial challenges.

- Restructuring Actions: The company initiated Chapter 11 bankruptcy proceedings and divested assets to improve its balance sheet and address liquidity.

- Impact on Pricing: These financial restructuring efforts are expected to directly influence CareMax's future pricing strategies and overall market competitiveness.

Asset Sales and Future Financial Model

CareMax's sale of its MSO and core clinic business in early 2025 marks a significant pivot in its financial strategy. This divestiture is intended to streamline operations and bolster the financial stability of its remaining business segments. While future pricing for the continuing operations remains undisclosed, the move signals a deliberate effort to build a more resilient financial structure.

The implications for CareMax's future financial model are substantial. By shedding certain assets, the company is likely aiming to reduce operational complexity and focus on areas with greater growth potential or profitability. This strategic repositioning is crucial for navigating the evolving healthcare landscape.

- Asset Divestiture: The early 2025 sale of the MSO and core clinic business is a key strategic move.

- Financial Model Shift: This action indicates a fundamental change in how CareMax will operate and manage its finances going forward.

- Future Pricing Uncertainty: Specific pricing for the remaining entity has not been released, leaving room for future analysis.

- Stability Objective: The primary goal of this restructuring is to establish a more stable financial footing for the ongoing parts of the business.

CareMax's pricing is intrinsically linked to its value-based care model, primarily through Medicare Advantage (MA) contracts. The company earns a share of the MA premiums, accepting financial risk for managing patient health effectively. This incentivizes a focus on preventative care to reduce overall healthcare costs, a strategy supported by data showing primary care can cut hospitalizations by up to 20% for certain conditions.

For MA members, CareMax often means zero out-of-pocket costs for services, as plans cover co-pays and premiums. Many plans also bundle dental, vision, and wellness services at no extra cost, enhancing the value for seniors.

Following significant net losses and a high medical expense ratio in 2023 and early 2024, CareMax underwent a Chapter 11 bankruptcy and asset sales. The early 2025 sale of its MSO and core clinics aims to stabilize finances, though future pricing for remaining operations is not yet disclosed.

| Metric | 2023 Data | 2024 Projection/Data | Notes |

|---|---|---|---|

| Net Income | Significant Net Loss | Continued Financial Strain | Indicative of operational challenges. |

| Medical Expense Ratio | High | High | Reflects cost of care relative to revenue. |

| MA Premiums (Avg. Monthly) | ~$18.50 | ~$19.00 (Estimated) | CareMax earns a portion of this. |

| Hospitalization Reduction (Primary Care) | Up to 20% | Up to 20% | Agency for Healthcare Research and Quality (AHRQ) data. |

4P's Marketing Mix Analysis Data Sources

Our CareMax 4P's Marketing Mix Analysis is built upon a foundation of publicly available data. We meticulously examine official company reports, investor relations materials, and press releases to understand their product offerings, pricing strategies, distribution channels, and promotional activities.