Capstone Infrastructure SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Infrastructure Bundle

Capstone Infrastructure's market position is shaped by its robust project pipeline and experienced management team, but also faces challenges from regulatory hurdles and competitive pressures. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Capstone Infrastructure's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Capstone Infrastructure Corporation's strength lies in its significantly diversified asset portfolio. It operates across various essential utility and power generation segments, encompassing renewable sources like wind, solar, and hydro, as well as natural gas facilities. This spread across different energy technologies and infrastructure types naturally reduces the risk tied to any single market or technology, fostering more consistent revenue streams.

The company's strategic diversification is further evidenced by its substantial operational footprint. As of recent reports, Capstone Infrastructure boasts approximately 885 MW of gross installed capacity, spread across 35 distinct facilities. This broad base of operations across multiple energy sources and geographical locations provides a robust foundation for stability and resilience in its financial performance.

Capstone Infrastructure's strategic emphasis on essential utilities and power generation is a key strength, targeting stable, long-term returns for its investors. This focus on infrastructure assets, often supported by long-term contracts and regulated revenue streams, generates predictable cash flows. For instance, in 2024, Capstone's diversified portfolio, including wind and solar farms, consistently contributed to a reliable income stream, underscoring its appeal for steady investment growth.

Capstone Infrastructure is strongly positioned to capitalize on the accelerating global shift towards renewable energy. The company is actively expanding its portfolio of wind, solar, and hydro assets, demonstrating a clear commitment to the energy transition. This strategic focus aligns with increasing demand for sustainable, low-carbon power sources.

The company's dedication to clean energy is evidenced by recent developments, such as securing significant wind projects in British Columbia. Furthermore, Capstone is advancing a substantial pipeline of battery storage projects, a crucial component for grid stability and the integration of intermittent renewable sources. This forward-looking approach is expected to drive future growth and benefit from supportive regulatory frameworks.

Strategic Acquisitions and Organic Development

Capstone Infrastructure's strategy hinges on a dual approach of strategic acquisitions and organic development to expand its asset base within the infrastructure sector. This allows for rapid market consolidation and the creation of new, high-value assets. The company actively assesses acquisition targets and has secured financing to support its mergers and acquisitions strategy.

This approach is reflected in its recent activities. For instance, in 2023, Capstone completed several acquisitions, significantly increasing its renewable energy portfolio. The company also advanced several greenfield projects, including a major wind farm development expected to be operational by late 2024, contributing to its organic growth objectives.

- Strategic Acquisitions: Capstone consistently evaluates opportunities to acquire established infrastructure assets, aiming to enhance scale and diversify its portfolio.

- Organic Development: The company invests in building new infrastructure projects, such as renewable energy facilities and transmission lines, to create long-term value.

- Financing Support: Secured credit facilities and capital raises provide the necessary financial backing for both acquisition and development initiatives.

- Market Consolidation: The dual strategy enables Capstone to capitalize on market consolidation trends while also pursuing de novo growth opportunities.

Strong North American Market Presence

Capstone Infrastructure's strong North American market presence is a significant strength. Operating across multiple Canadian provinces and expanding into the U.S., particularly California for battery storage, allows it to tap into established regulatory frameworks and robust energy demand. This geographic diversification mitigates risk and capitalizes on regional market stability and growth opportunities.

The company's established footprint in North America provides a solid foundation for its operations and future growth. For instance, as of Q1 2024, Capstone's portfolio included a significant number of operating assets across Canada and the United States, contributing to a stable revenue stream. This extensive network allows for efficient operations and the ability to respond effectively to market needs.

- Established Presence: Operations spanning key regions in Canada and the U.S.

- Regulatory Advantage: Benefits from well-defined infrastructure investment environments.

- Market Demand: Leverages consistent and growing energy demand in North America.

- Strategic Expansion: Targeted growth in areas like U.S. battery storage, exemplified by its California projects.

Capstone Infrastructure's diversified asset base, spanning renewable energy like wind and solar, alongside natural gas facilities, provides significant operational stability. This broad mix reduces reliance on any single energy source or market, ensuring more consistent revenue generation. The company's substantial installed capacity, approximately 885 MW across 35 facilities as of recent data, further solidifies this strength, offering resilience through geographic and technological spread.

The company's strategic focus on essential utilities and power generation, often backed by long-term contracts, generates predictable cash flows. This approach is particularly valuable in the current market, as demonstrated by the consistent income streams from its diverse portfolio, including wind and solar farms, throughout 2024. This inherent stability makes Capstone an attractive investment for steady growth.

Capstone is well-positioned to benefit from the global shift towards renewable energy, actively expanding its wind, solar, and hydro assets. This commitment is underscored by recent project wins, such as significant wind projects in British Columbia, and a growing pipeline of battery storage projects crucial for grid integration. This forward-looking strategy aligns with increasing demand for sustainable power.

Capstone Infrastructure excels through a dual strategy of strategic acquisitions and organic development to expand its infrastructure portfolio. This approach allows for rapid market consolidation and the creation of new, high-value assets. For example, in 2023, the company completed several acquisitions and advanced greenfield projects, including a major wind farm development slated for late 2024 operation, highlighting its growth momentum.

Capstone's strong North American market presence, with operations across Canada and expanding into the U.S., particularly California for battery storage, is a key advantage. This geographic diversification allows it to leverage established regulatory frameworks and robust energy demand, mitigating risk and capitalizing on regional market stability and growth opportunities. As of Q1 2024, its extensive network of operating assets across both countries contributed to a stable revenue stream.

| Metric | Value (as of recent reporting) | Significance |

|---|---|---|

| Gross Installed Capacity | Approx. 885 MW | Demonstrates scale and operational breadth across diverse energy sources. |

| Number of Facilities | 35 | Highlights diversification across multiple locations and technologies. |

| Key Renewable Segments | Wind, Solar, Hydro | Aligns with growing demand for sustainable energy and reduces reliance on fossil fuels. |

| Geographic Footprint | Canada & U.S. (e.g., British Columbia, California) | Leverages stable regulatory environments and strong energy demand in established markets. |

What is included in the product

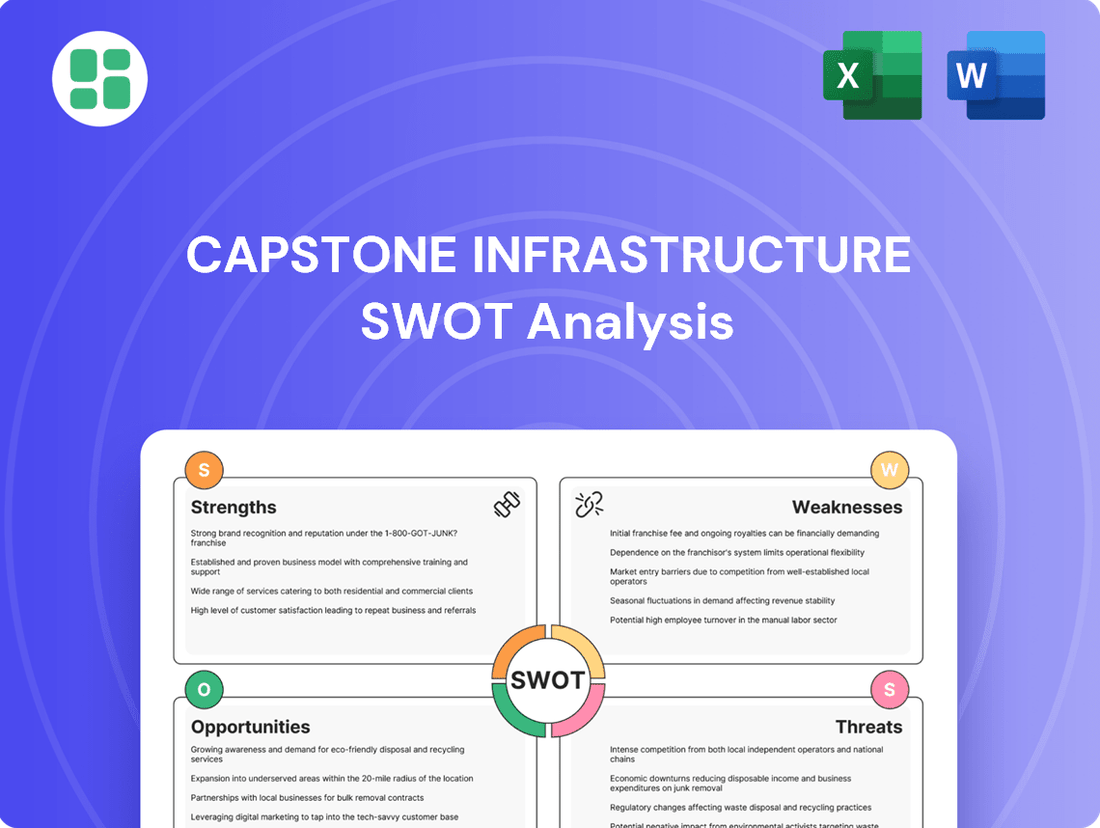

Analyzes Capstone Infrastructure’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Identifies critical infrastructure vulnerabilities and opportunities for proactive mitigation, relieving the pain of unexpected operational disruptions.

Weaknesses

Capstone Infrastructure's operations are inherently capital intensive, demanding substantial upfront investment for developing, acquiring, and managing large-scale assets like power generation facilities. This high capital expenditure can constrain financial flexibility, often requiring significant debt financing or equity issuances. For instance, the company's capital expenditure guidance for 2025 has seen an increase, underscoring the ongoing need for substantial investment.

Capstone Infrastructure's reliance on government regulations and energy policies presents a significant weakness. As a player in utilities and power generation, the company's profitability and future projects are directly tied to evolving rules. For instance, changes in renewable energy subsidies or carbon pricing mechanisms, as detailed in their annual information forms, could substantially alter financial outcomes.

Capstone Infrastructure's reliance on natural gas generation assets, despite its robust renewable portfolio, creates a vulnerability to the volatile pricing of natural gas. For instance, a significant downturn in natural gas prices during 2024 or early 2025 could directly affect the revenue streams from these specific facilities.

While the company's diversified asset base, including solar and wind, offers a degree of insulation, substantial swings in natural gas costs can still impact the profitability of its fossil fuel-dependent operations. This exposure remains a key consideration for investors monitoring the company's financial performance.

The strategic decision by Capstone to halt further development of fossil fuel-powered projects signals a clear intent to reduce this commodity price risk over the long term, aligning with broader industry trends towards decarbonization.

Integration Risks from Acquisitions

Capstone Infrastructure's reliance on strategic acquisitions for growth introduces significant integration risks. Successfully merging new businesses involves navigating complex operational, cultural, and financial challenges. Failure to effectively integrate can result in unexpected expenses, project delays, and a failure to achieve the projected benefits from these investments, as seen in the potential for post-acquisition integration costs to erode initial investment value.

For instance, a poorly managed integration could lead to:

- Disruption of existing operations: Merging systems and processes can temporarily halt or slow down service delivery.

- Cultural clashes: Differing corporate cultures can hinder collaboration and employee morale, impacting productivity.

- Failure to realize synergies: Expected cost savings or revenue enhancements may not materialize if integration is not executed efficiently.

In 2024, the infrastructure sector saw a notable increase in M&A activity, with integration challenges frequently cited as a primary reason for underperformance in acquired assets, underscoring the critical need for robust integration planning and execution by companies like Capstone.

Operational and Environmental Risks

Capstone Infrastructure's diverse portfolio, spanning wind, solar, hydro, and natural gas, inherently carries operational and environmental risks. Equipment failures at any of these facilities, such as a turbine malfunction or a solar panel degradation, can lead to significant unplanned downtime and increased maintenance expenses. For instance, severe weather events, like prolonged droughts impacting hydro output or extreme temperatures affecting solar efficiency, can directly reduce revenue generation.

Environmental incidents, though less frequent, pose a substantial threat to Capstone's operations and reputation. These could range from minor spills to more significant ecological impacts, necessitating costly remediation efforts and potentially leading to regulatory fines. The company's acknowledgment of these risks is evident in its first ESG report, signaling a proactive approach to managing its environmental footprint and mitigating potential liabilities.

The company's reliance on various energy sources means it's susceptible to a broad spectrum of operational challenges. For example, in 2023, the renewable energy sector globally faced headwinds due to supply chain disruptions and rising component costs, impacting project development and operational efficiency. Capstone's ability to navigate these complexities, including maintaining uptime across its varied asset base, is crucial for consistent financial performance.

- Equipment Malfunctions: Risk of breakdowns in wind turbines, solar inverters, or hydro generators impacting energy production.

- Adverse Weather: Droughts reducing hydro output, low wind speeds impacting turbine generation, or excessive cloud cover affecting solar farms.

- Environmental Incidents: Potential for spills, habitat disruption, or non-compliance with environmental regulations leading to fines and reputational damage.

- Supply Chain Issues: Disruptions in obtaining spare parts or new equipment for maintenance and upgrades, as seen in the broader renewable sector in 2023.

Capstone Infrastructure's extensive capital requirements create a significant financial strain. The company's projected capital expenditures for 2025 reflect this ongoing need for substantial investment in its diverse asset base, potentially limiting financial flexibility and necessitating considerable debt or equity financing.

Regulatory dependence is a key vulnerability for Capstone, as shifts in energy policies and subsidies directly impact profitability. Changes in renewable energy incentives or carbon pricing, as outlined in their disclosures, could materially affect financial results.

The company's exposure to natural gas price volatility, despite its renewable assets, remains a weakness. Fluctuations in natural gas costs during 2024 and early 2025 could negatively impact revenue from its fossil fuel generation segments.

Integration risks associated with strategic acquisitions pose a considerable challenge. Inefficiently integrating new businesses can lead to unexpected costs and unrealized synergies, as observed across the infrastructure sector in 2024 where integration issues often hampered acquired asset performance.

What You See Is What You Get

Capstone Infrastructure SWOT Analysis

The preview you see is the actual Capstone Infrastructure SWOT Analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting – a professionally structured and comprehensive report.

This is a real excerpt from the complete Capstone Infrastructure SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs.

You’re viewing a live preview of the actual Capstone Infrastructure SWOT analysis file. The complete version, packed with detailed insights, becomes available immediately after checkout.

Opportunities

The global push for decarbonization, amplified by climate change concerns, is creating a robust and enduring demand for renewable energy. This presents a significant opportunity for Capstone Infrastructure to expand its portfolio through the development and acquisition of wind, solar, and hydro projects. Capstone's strategic focus on renewables directly benefits from this trend, allowing it to leverage its established expertise.

Capstone is actively progressing a substantial pipeline of renewable energy projects, positioning it to capitalize on this growing market. For instance, as of early 2024, the company reported a significant number of renewable projects in various stages of development, aiming to add substantial generating capacity to its portfolio in the coming years.

Government infrastructure spending initiatives, particularly in North America, offer substantial opportunities for Capstone Infrastructure. Programs focused on clean energy and grid modernization, like those seen in the 2024/2025 budget cycles, can provide crucial financing and grants. These initiatives de-risk new projects, potentially accelerating Capstone's development pipeline by offering favorable terms and long-term power purchase agreements.

Technological advancements in energy storage, particularly in battery technology, present a significant opportunity for Capstone Infrastructure. These innovations allow for enhanced grid stability and the more effective integration of intermittent renewable energy sources like solar and wind. This not only strengthens Capstone's existing renewable portfolio but also opens avenues for new revenue generation through grid services and storage solutions.

Capstone is strategically positioning itself to capitalize on these trends by actively developing large-scale battery storage projects. For instance, the company has targeted battery storage for its 2025 growth initiatives, aiming to bolster the value and reliability of its renewable energy assets. As of early 2024, the global energy storage market is experiencing robust growth, with projections indicating continued expansion driven by renewable energy adoption and grid modernization efforts.

Expansion into New Infrastructure Sub-sectors

Capstone Infrastructure has a significant opportunity to broaden its reach beyond its current focus on utilities and power generation. Exploring adjacent infrastructure sub-sectors like water management, transportation networks, and digital infrastructure presents a clear path for growth. This diversification not only taps into new markets but also strengthens the company's overall portfolio resilience, drawing on its proven expertise in managing vital assets.

The company's strategic pursuit of new acquisition targets is a key enabler for this expansion. For instance, in 2024, Capstone actively evaluated several potential acquisitions in the renewable energy and digital infrastructure spaces, aiming to bolster its existing capabilities and enter new service areas. This proactive approach to M&A is designed to accelerate its entry into these promising sub-sectors.

- Diversification into Water Infrastructure: Potential to acquire or develop water treatment and distribution assets, a sector projected to see significant investment driven by aging infrastructure and population growth.

- Transportation Sector Opportunities: Exploring investments in toll roads, ports, or airports, which benefit from increased economic activity and trade volumes, particularly in emerging markets where Capstone has a presence.

- Digital Infrastructure Growth: Expanding into areas like fiber optic networks or data centers, capitalizing on the escalating demand for connectivity and data storage solutions.

- Leveraging Existing Expertise: Applying its established project management and operational excellence from power generation to these new infrastructure domains, ensuring efficient integration and management.

Partnerships and Joint Ventures

Collaborating with Indigenous communities, local governments, and other industry players through strategic partnerships and joint ventures presents a significant opportunity for Capstone Infrastructure. These alliances can streamline project development, share substantial capital requirements, and crucially, foster greater community acceptance and support. This approach is vital for navigating complex regulatory landscapes and ensuring long-term project viability.

Capstone has already seen tangible success with Indigenous partnerships, notably in securing new wind projects. For instance, in 2023, their partnership with the WFN Development Corporation for the WFN Solar project in British Columbia exemplifies this strategy, highlighting a proven model for future growth and renewable energy development.

- Facilitate Project Development: Partnerships can expedite permitting and land access.

- Reduce Capital Requirements: Sharing investment burdens lowers financial risk.

- Enhance Community Acceptance: Joint ventures with Indigenous groups build trust and local buy-in.

- Expand Market Reach: Collaborating with other industry players opens new project pipelines.

The global energy transition is a major tailwind, with renewable energy demand surging. Capstone is well-positioned to benefit from this, expanding its renewable portfolio. Government stimulus packages, particularly in North America, are also providing significant financial support and de-risking new clean energy projects, accelerating development timelines.

Technological advancements in energy storage, such as improved battery technology, offer a chance to enhance grid stability and integrate renewables more effectively. This opens new revenue streams for Capstone through grid services. Furthermore, exploring diversification into water, transportation, and digital infrastructure presents a pathway to broader growth and portfolio resilience.

| Opportunity Area | 2024/2025 Focus | Key Benefit |

|---|---|---|

| Renewable Energy Expansion | Pipeline development and acquisitions | Capitalize on decarbonization demand |

| Government Infrastructure Spending | Clean energy and grid modernization programs | Access to financing, grants, and favorable PPAs |

| Energy Storage Integration | Battery storage project development | Enhance renewable asset value and grid services |

| Infrastructure Diversification | Water, transportation, digital infrastructure exploration | Portfolio resilience and new market access |

Threats

Rising interest rates present a considerable challenge for Capstone Infrastructure. As a company that frequently finances its projects and acquisitions through debt, higher borrowing costs directly impact its financial health. For instance, the Bank of Canada's policy interest rate saw increases throughout 2022 and 2023, reaching 5.00% by July 2023, a significant jump from the 0.25% seen in early 2022. This environment makes it more expensive to secure the capital needed for new developments, potentially making previously viable projects less attractive due to reduced profitability and a higher overall cost of capital.

The infrastructure and renewable energy sectors are seeing a surge in investment, attracting a growing number of players. This means Capstone Infrastructure faces tougher competition from other independent power producers, established utilities, and large financial investors looking to enter the market. For instance, global investment in energy transition infrastructure reached an estimated $1.3 trillion in 2024, a figure projected to climb further.

This increased competition can directly impact Capstone's profitability. It often leads to higher prices for acquiring new projects and can squeeze profit margins on the projects themselves. Furthermore, securing the most attractive contracts, whether for power purchase agreements or infrastructure development, becomes more challenging in a crowded marketplace.

Sudden or unfavorable shifts in energy policy, environmental regulations, or incentive programs across North America pose a significant threat to Capstone Infrastructure. For instance, changes to feed-in tariffs or carbon pricing mechanisms could directly impact the profitability of their renewable energy assets. In 2024, the ongoing debate around renewable energy subsidies in various Canadian provinces highlights the potential for such policy shifts to alter project economics.

Climate Change Impacts and Extreme Weather

While Capstone Infrastructure is heavily invested in renewable energy, a significant threat lies in the physical impacts of climate change on its operational assets. More frequent and intense extreme weather events, such as hurricanes, floods, and wildfires, pose a direct risk to wind farms, solar plants, and hydroelectric facilities.

These events can lead to substantial operational disruptions, causing downtime and lost revenue. Furthermore, physical damage to infrastructure necessitates costly repairs and increased maintenance expenditures. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, highlighting the escalating frequency and severity of such events impacting infrastructure nationwide.

- Increased risk of physical damage to renewable energy infrastructure from extreme weather.

- Potential for operational disruptions and revenue loss due to climate-related events.

- Escalating maintenance and repair costs associated with weather-induced damage.

Cybersecurity Risks to Operational Technology

Capstone's utility and power generation sectors face escalating cybersecurity risks targeting their Operational Technology (OT) systems. These critical infrastructure components, responsible for managing physical processes like power distribution, are prime targets for malicious actors. A successful breach could lead to widespread power outages, impacting millions and causing significant economic disruption.

The financial and reputational fallout from such an attack could be substantial. For instance, the Colonial Pipeline ransomware attack in 2021, which disrupted fuel supply, resulted in an estimated $90 million in direct costs and significant business interruption. Capstone's exposure to similar threats necessitates robust defenses for its OT environments.

- Increased Attack Surface: The growing interconnectedness of OT systems with IT networks expands the potential entry points for cyber threats.

- Sophistication of Attacks: Nation-state actors and organized cybercrime groups are developing increasingly sophisticated methods to target industrial control systems.

- Potential for Physical Disruption: Unlike IT breaches, OT attacks can directly impact physical operations, leading to service interruptions and safety concerns.

- Regulatory Scrutiny: Government agencies are intensifying oversight of critical infrastructure cybersecurity, with potential penalties for non-compliance.

Capstone Infrastructure faces significant threats from rising interest rates, making debt financing more costly and potentially impacting project profitability. The increasing competition in the renewable energy sector also pressures margins and contract acquisition. Furthermore, policy shifts in energy and environmental regulations, along with the physical impacts of climate change on operational assets, present substantial risks. Escalating cybersecurity threats to operational technology systems pose a severe danger of disruption and financial loss.

| Threat Category | Specific Threat | Impact on Capstone | Supporting Data/Example |

|---|---|---|---|

| Financial | Rising Interest Rates | Increased cost of debt, reduced project profitability. | Bank of Canada policy rate reached 5.00% in July 2023. |

| Market | Increased Competition | Pressure on project acquisition costs and profit margins. | Global energy transition investment reached $1.3 trillion in 2024. |

| Regulatory | Policy & Regulatory Shifts | Unfavorable changes to incentives or regulations impacting asset economics. | Ongoing debates on renewable energy subsidies in Canadian provinces (2024). |

| Operational | Climate Change Impacts | Physical damage to assets, operational disruptions, increased maintenance costs. | 28 U.S. billion-dollar weather disasters in 2023 (NOAA). |

| Cybersecurity | OT System Breaches | Widespread power outages, economic disruption, reputational damage. | Colonial Pipeline attack (2021) cost an estimated $90 million. |

SWOT Analysis Data Sources

This Capstone Infrastructure SWOT analysis is built upon a robust foundation of data, drawing from official government reports, extensive industry surveys, and expert consultations to provide a comprehensive and actionable assessment.