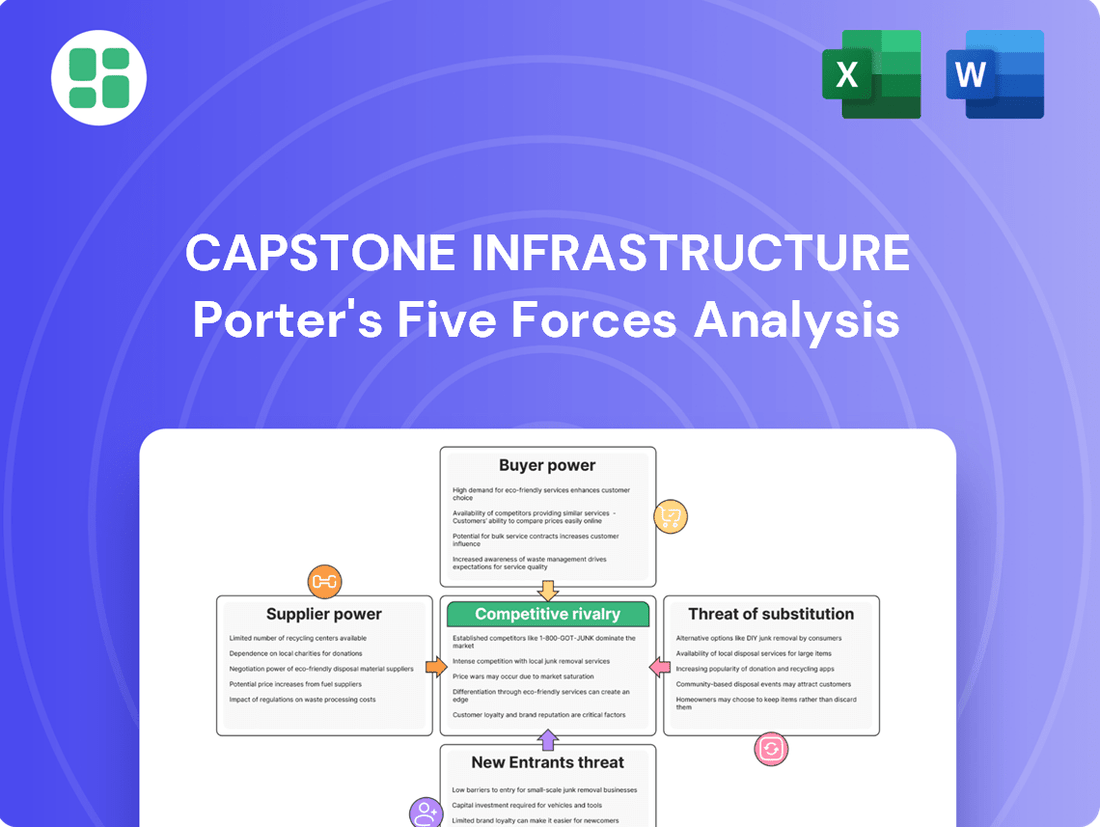

Capstone Infrastructure Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Infrastructure Bundle

Capstone Infrastructure operates within a dynamic energy sector, where the bargaining power of buyers and the intensity of rivalry significantly shape its strategic landscape. Understanding these forces is crucial for navigating market challenges and identifying opportunities.

The complete report reveals the real forces shaping Capstone Infrastructure’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The market for essential renewable energy equipment, like wind turbines and solar panels, is often dominated by a small number of global manufacturers. This concentration can grant them considerable leverage over infrastructure companies such as Capstone Infrastructure, influencing pricing and supply terms.

For instance, in 2023, Vestas, a leading wind turbine manufacturer, held a significant share of the global market, highlighting the concentrated nature of this sector. Similarly, major solar panel producers often control a substantial portion of production capacity, giving them pricing power.

When supply chain disruptions occur, or demand for components surges, these key equipment manufacturers can command higher prices and extend delivery timelines for critical infrastructure components. This directly impacts Capstone's project costs and development schedules.

Suppliers of key materials such as steel, copper, and specialized components for renewable energy projects, like those developed by Capstone Infrastructure, are subject to significant price fluctuations. In 2024, the global price of copper, a vital element in power transmission, saw considerable swings, impacting the cost of essential infrastructure components.

This volatility directly affects equipment manufacturers, who often pass on these increased input costs to developers. For Capstone, this translates to higher project development expenses, potentially squeezing profit margins on new wind and solar farms. For instance, a 10% increase in steel prices could add millions to the cost of a large-scale solar project.

The renewable energy and infrastructure sectors rely heavily on specialized labor for everything from building solar farms to maintaining wind turbines. This demand for expertise means that the availability of skilled engineers, project managers, and construction crews directly impacts project execution.

A significant factor in this is the capacity of Engineering, Procurement, and Construction (EPC) firms. In 2024, the global EPC market for renewable energy projects faced challenges with talent shortages, leading to increased competition for skilled workers. This scarcity allows specialized labor and EPC providers to negotiate higher rates, potentially inflating project costs and extending delivery schedules for companies like Capstone Infrastructure.

Technology and Innovation Dependence

Capstone Infrastructure's reliance on technology providers for advanced power generation and storage solutions significantly impacts supplier bargaining power. Suppliers possessing proprietary technology or leading innovation in critical areas, such as battery energy storage systems (BESS) – a key growth area for Capstone – can wield considerable influence. For instance, in 2024, the global BESS market was valued at approximately $15 billion, with specialized technology providers commanding premium pricing due to their unique offerings.

This dependence creates a scenario where a few key suppliers might control essential components or intellectual property. Capstone's strategic investments in BESS projects, aiming to capitalize on the growing demand for grid stability and renewable energy integration, highlight this vulnerability. Companies that develop and patent next-generation battery chemistries or advanced grid management software can dictate terms, especially if Capstone's project timelines are dependent on their specific technological advancements.

- Technological Differentiation: Suppliers with unique, patented technologies in areas like advanced turbine efficiency or novel energy storage solutions possess higher bargaining power.

- Innovation Leadership: Companies at the forefront of BESS development, offering superior energy density or faster charging capabilities, can command higher prices and favorable contract terms.

- Critical Component Control: Suppliers who are sole providers of essential, high-performance components for Capstone's renewable energy infrastructure projects can exert significant leverage.

Logistics and Transportation Costs

The intricate logistics of moving massive infrastructure components, often to challenging, remote locations, significantly amplify the leverage of specialized transportation providers. For example, in 2024, the cost of shipping heavy machinery can represent a substantial portion of a project's budget, giving these suppliers considerable sway.

Escalating fuel prices and persistent infrastructure congestion are key drivers behind this increased supplier bargaining power. These factors directly translate into higher operational costs for logistics firms, which they then pass on to infrastructure developers, impacting project timelines and overall expenses.

- Logistics Complexity: Moving large, heavy components to remote sites is inherently difficult and costly.

- Fuel Price Impact: Rising fuel costs directly increase transportation expenses, strengthening supplier leverage.

- Infrastructure Bottlenecks: Congested transportation networks lead to delays and higher operational costs for logistics providers.

- Increased Project Costs: These factors contribute to a larger share of project budgets being allocated to transportation and logistics.

The bargaining power of suppliers for Capstone Infrastructure is significant, particularly in the renewable energy sector where specialized components and skilled labor are crucial. Concentrated markets for wind turbines and solar panels, dominated by a few global players, give these manufacturers considerable pricing and delivery leverage. For instance, Vestas's substantial market share in 2023 exemplifies this supplier concentration.

Material price volatility, such as the swings in copper prices observed in 2024, directly impacts Capstone's project costs as these increases are often passed on by equipment manufacturers. Furthermore, the scarcity of skilled labor in the EPC market in 2024 means specialized firms can negotiate higher rates, potentially inflating project expenses and extending delivery schedules for Capstone.

Technology providers offering proprietary solutions, especially in areas like battery energy storage systems (BESS), also hold significant sway. With the BESS market valued at around $15 billion in 2024, companies with leading innovations can command premium pricing, impacting Capstone's strategic investments in grid stability solutions.

Complex logistics for transporting large components to remote sites, exacerbated by rising fuel prices and infrastructure congestion in 2024, further empower specialized transportation providers, adding to Capstone's project costs and timelines.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Capstone Infrastructure | Relevant 2024 Data/Trends |

|---|---|---|---|

| Renewable Energy Equipment Manufacturers | Market concentration, proprietary technology | Pricing power, delivery schedule control | Vestas's significant global market share (2023 data) |

| Raw Material Suppliers | Price volatility of key commodities | Increased project development expenses | Significant fluctuations in global copper prices (2024) |

| Specialized Labor & EPC Firms | Talent shortages, demand for expertise | Higher labor rates, extended project timelines | Global EPC market talent shortages (2024) |

| Technology Providers (e.g., BESS) | Technological differentiation, innovation leadership | Premium pricing for advanced solutions | Global BESS market valued at ~$15 billion (2024) |

| Logistics and Transportation Providers | Logistics complexity, fuel prices, infrastructure congestion | Higher transportation costs, potential delays | Escalating fuel costs and transportation bottlenecks (2024) |

What is included in the product

This analysis unpacks the competitive forces impacting Capstone Infrastructure, detailing industry rivalry, buyer and supplier power, new entrant threats, and substitute products to inform strategic decision-making.

Instantly identify and mitigate competitive threats with a visual breakdown of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Capstone Infrastructure's reliance on long-term Power Purchase Agreements (PPAs) significantly reduces customer bargaining power. These contracts, often spanning 15-25 years, lock in electricity rates with entities like utilities or large industrial users. For instance, in 2024, a substantial portion of Capstone's revenue was secured through such agreements, insulating them from immediate price renegotiations and ensuring predictable cash flows.

Capstone Infrastructure's customers, encompassing both residential and industrial users, rely on essential utility and power generation services. This indispensable nature of electricity and water supply means that for the core provision of these services, customers have very few, if any, readily available alternatives. In 2024, the demand for reliable energy remained consistently high across all sectors, underscoring this essentiality.

In regulated utility sectors, customer bargaining power is significantly curtailed because rates are typically determined by regulatory bodies, not direct negotiation. For Capstone Infrastructure, this means customers cannot easily influence pricing for its essential services like electricity or water distribution.

For instance, in 2024, many utility rate reviews, such as those impacting Capstone's regulated assets in Canada, involved extensive public consultations and regulatory approvals, underscoring the limited direct influence customers have on final pricing structures.

Customer Concentration and Offtake Agreements

While electricity end-users are numerous, Capstone Infrastructure's direct clientele often comprises large, concentrated entities such as provincial utilities like BC Hydro or significant industrial partners. These major customers possess considerable leverage when negotiating substantial offtake agreements, influencing pricing and contract terms.

The bargaining power of these concentrated customers is a key factor for Capstone. For instance, in 2024, major utility contracts often involve long-term commitments that, while providing revenue stability, also lock in specific price points. This can limit Capstone's ability to adjust pricing based on market fluctuations.

- Customer Concentration: Capstone's reliance on a few large provincial utilities or industrial clients means these entities can exert significant influence.

- Offtake Agreement Negotiations: The terms of these long-term contracts are often heavily negotiated, giving powerful customers considerable sway.

- Pricing Influence: Large offtake agreements can set price ceilings, limiting Capstone's pricing flexibility and potentially impacting profit margins.

- Market Dynamics in 2024: In the current energy market, the demand for stable power sources continues, but the financial health and regulatory environments of these large utility customers also play a role in their negotiating power.

Distributed Energy Resources (DERs) Adoption

The growing adoption of distributed energy resources (DERs) by consumers and businesses presents a potential shift in bargaining power. As more customers generate their own power through rooftop solar or store energy with batteries, they become less reliant on traditional grid-supplied electricity. This increased self-sufficiency could lead to greater leverage when negotiating terms or pricing with utility providers.

Capstone Infrastructure, recognizing this trend, is actively exploring opportunities in battery storage development. This strategic move positions the company to potentially benefit from, rather than be solely challenged by, the rise of DERs. For instance, by 2024, the U.S. saw significant growth in residential solar installations, with projections indicating continued expansion, underscoring the evolving energy landscape.

- Increased Customer Choice: DERs offer consumers alternatives to solely purchasing power from the grid, potentially driving down demand for traditional utility services.

- Price Sensitivity: As customers invest in their own energy generation and storage, they may become more sensitive to the pricing and reliability of grid electricity.

- Capstone's Strategic Response: Capstone's investment in battery storage development aims to align with and capitalize on the DER trend, potentially offering new services to customers.

- Long-Term Impact: While the immediate impact may be gradual, the long-term trend towards distributed generation suggests a potential increase in customer bargaining power within the energy sector.

Capstone Infrastructure's bargaining power with customers is generally low, particularly with large, concentrated clients like provincial utilities. While many end-users have limited alternatives for essential services, major offtake agreements negotiated in 2024 often lock in prices, restricting Capstone's flexibility.

The rise of distributed energy resources (DERs) in 2024, such as residential solar, also signals a potential increase in customer leverage. As customers gain more control over their energy supply, their reliance on traditional providers may decrease, potentially leading to greater price sensitivity and negotiation power.

| Customer Type | Bargaining Power Factor | Impact on Capstone (2024 Context) |

|---|---|---|

| Large Utilities (e.g., BC Hydro) | Concentration, long-term PPAs | Significant influence on pricing and terms, limiting Capstone's flexibility. |

| Industrial Users | Volume of offtake, contract negotiation | Can negotiate for favorable rates, especially for large, consistent demand. |

| Residential/Small Commercial (Indirect) | Limited direct negotiation, but influenced by DER adoption | Growing self-sufficiency through DERs in 2024 could indirectly increase future leverage. |

What You See Is What You Get

Capstone Infrastructure Porter's Five Forces Analysis

This preview showcases the complete Capstone Infrastructure Porter's Five Forces Analysis, meaning the document you see is precisely what you will receive immediately after purchase. You can be confident that no placeholders or modified sections will be present; this is the final, professionally formatted report ready for your strategic planning. Gain immediate access to this in-depth analysis, empowering your decision-making without any delay or unexpected changes.

Rivalry Among Competitors

The infrastructure and renewable energy markets in Canada and North America are quite competitive, featuring a wide array of participants from major institutional investors to smaller, specialized developers. This diverse landscape means companies are constantly vying for market share and project opportunities.

Despite the fragmentation, there's a clear trend towards consolidation. We're seeing significant merger and acquisition (M&A) activity, particularly targeting platform assets. For instance, in 2024, Brookfield Asset Management continued its strategy of acquiring and integrating renewable energy platforms, aiming to scale its operations efficiently.

This drive for consolidation highlights the intense competition for attractive growth avenues and stable, long-term assets. Companies are actively seeking to expand their portfolios and gain economies of scale, making it challenging for smaller, less capitalized players to compete effectively for prime projects.

The power generation and utility industries demand enormous initial investments for building and maintaining infrastructure. For instance, the average cost to build a new utility-scale solar farm in the U.S. can range from $1 million to $2 million per megawatt, and this doesn't even include land acquisition or transmission line costs. These substantial fixed costs push companies to operate their assets at peak capacity, driving them to aggressively bid on new projects to spread these costs over a larger revenue base, thus heightening competition among existing players.

Demand for electricity is experiencing a significant upswing, driven by factors like the burgeoning data center industry and the broader trend of electrification. This surge is further amplified by robust government incentives aimed at promoting clean energy development. For instance, in 2024, many provinces have been actively outlining investment opportunities in renewable energy, signaling a positive environment for growth.

However, this attractive market dynamic also intensifies competitive rivalry. Securing new projects and long-term contracts is becoming increasingly challenging as more players enter the arena, all vying for these opportunities. The clear signals from provincial governments about renewable energy investments are attracting a greater number of participants, making it harder for any single entity to dominate.

Differentiation Challenges in Commodity Power

Competitive rivalry in the power sector is intense because electricity itself is largely a commodity. This makes it challenging for individual power producers, like Capstone Infrastructure, to stand out based purely on the electricity they generate. Differentiation efforts often focus on other aspects of their operations.

The battle for market share frequently hinges on factors beyond the kilowatt-hour. Companies compete on the strength of their project economics, which includes cost of generation and financing. Reliability, ensuring a consistent power supply, is also a major differentiator. Furthermore, a growing emphasis on sustainability and the ability to secure stable, long-term power purchase agreements (PPAs) are key competitive advantages.

- Project Economics: Lower operating costs and efficient capital structures can lead to more competitive pricing.

- Reliability: Consistent uptime and minimal disruptions are crucial for customer retention and attracting new contracts.

- Sustainability: Investments in renewable energy sources and environmentally friendly practices are increasingly valued by investors and consumers.

- Contractual Security: Long-term PPAs provide revenue certainty, a significant advantage in a volatile market.

Geographic and Segment Focus

Capstone Infrastructure's strategy to diversify across wind, solar, hydro, natural gas, and utility operations in North America offers some insulation. However, intense competition persists within each specific asset category and regional market. Many other developers are also actively pursuing renewable energy projects and battery storage solutions, intensifying the rivalry.

The North American renewable energy sector, a key focus for Capstone, saw significant investment in 2024. For instance, the U.S. added an estimated 16 GW of solar capacity and 8 GW of wind capacity by the end of 2024, according to preliminary industry reports. This growth attracts numerous players, including major utilities, independent power producers, and private equity firms, all vying for prime development sites and favorable power purchase agreements.

- Intense Competition in Renewables: The push for decarbonization fuels fierce competition among developers for wind and solar projects, particularly in regions with strong policy support like the U.S. Midwest and Texas.

- Utility-Scale Battery Storage Race: As grid reliability becomes paramount, companies are aggressively competing to develop and operate utility-scale battery storage projects, often co-located with renewable assets.

- Geographic Overlap: Capstone's presence in key North American markets means direct competition with other infrastructure companies that have similar geographic and segment focuses.

- Acquisition and Consolidation Pressures: The desire for scale and diversification means companies are also competing to acquire existing assets or portfolios, driving up valuations and deal activity.

The infrastructure sector, particularly renewables, sees intense rivalry as many companies vie for projects and market share. This competition is fueled by growing demand for electricity, driven by electrification and data centers, alongside government incentives promoting clean energy. In 2024, the U.S. alone saw an estimated 16 GW of solar and 8 GW of wind capacity added, attracting a multitude of players including utilities, independent power producers, and private equity firms.

Electricity's commodity nature means differentiation often comes through project economics, reliability, sustainability initiatives, and securing long-term power purchase agreements. The race for utility-scale battery storage is also a significant competitive battleground, with companies seeking to enhance grid reliability.

This crowded market means Capstone Infrastructure faces direct competition from other firms with similar geographic and asset focuses, as well as competing to acquire existing portfolios, which has driven up valuations.

| Competitive Factor | Description | 2024 Data/Trend |

|---|---|---|

| Project Economics | Lower operating costs and efficient capital structures enable competitive pricing. | Focus on cost reduction and optimized financing for new bids. |

| Reliability | Consistent uptime and minimal disruptions are key for contracts. | Increased investment in asset maintenance and grid integration technology. |

| Sustainability | Environmentally friendly practices and renewable energy sources are valued. | Growing demand for green energy projects, attracting significant capital. |

| Contractual Security | Long-term Power Purchase Agreements (PPAs) offer revenue certainty. | Intensified competition for securing stable, long-term PPAs. |

| Market Share Pursuit | Companies aim to scale operations and gain economies of scale. | Continued merger and acquisition (M&A) activity targeting platform assets. |

SSubstitutes Threaten

Improvements in energy efficiency technologies and the increasing adoption of demand-side management programs are significantly reducing overall electricity consumption. For instance, in 2024, many utilities reported record low peak demand growth, partly attributed to these initiatives, directly impacting the need for new power generation capacity. This trend poses a substantial threat to infrastructure companies like Capstone, as it effectively substitutes for the demand they aim to meet with new projects, potentially limiting their growth avenues.

The rise of distributed generation, like rooftop solar and microgrids, presents a significant threat of substitutes for traditional utility providers. Consumers can increasingly generate their own power, reducing demand for grid electricity. In 2024, the global distributed solar PV market continued its strong growth, with installations projected to add substantial capacity, further empowering consumers to become prosumers and lessen their dependence on centralized power sources.

Advancements in energy storage technologies pose a significant threat to Capstone Infrastructure. While Capstone is actively investing in battery storage, further cost reductions and efficiency gains in these technologies could empower consumers and businesses with greater energy independence. This shift could diminish the reliance on traditional, centralized power generation, impacting Capstone's baseload power revenue streams.

Alternative Energy Sources and Technologies

The threat of substitutes for Capstone Infrastructure's energy assets is a significant consideration, particularly with the rapid advancements in alternative energy sources and technologies. Longer-term, the development of disruptive energy sources or conversion technologies could pose a substantial challenge. Emerging nuclear technologies, for instance, or other novel clean energy solutions might offer greater efficiency or cost-effectiveness compared to Capstone's existing portfolio. In 2023, global investment in clean energy reached an estimated $1.7 trillion, signaling a strong market shift towards alternatives.

These evolving technologies represent potential substitutes that could impact the demand for Capstone's current energy offerings.

- Emerging Nuclear Technologies: Advances in small modular reactors (SMRs) and fusion energy research could offer new, potentially more efficient baseload power generation.

- Advanced Renewable Technologies: Innovations in solar panel efficiency, offshore wind turbine capacity, and energy storage solutions like advanced battery technology could make these alternatives more competitive.

- Green Hydrogen: The increasing focus on green hydrogen production, powered by renewable energy, presents a substitute for fossil fuels in various industrial and transportation sectors.

Shifts in Industrial Processes and Fuel Switching

Major industrial consumers are increasingly exploring alternatives to traditional electricity consumption. For instance, the global hydrogen market is projected to grow significantly, with some estimates suggesting it could reach over $700 billion by 2030, indicating a strong trend towards clean fuel adoption.

This shift towards alternative energy inputs, such as direct hydrogen use or other clean fuels, presents a direct substitution threat to Capstone Infrastructure's core power generation services. Such fuel switching by industrial clients could reduce their reliance on grid-supplied electricity.

The potential for widespread fuel switching means that Capstone's existing customer base might decrease their demand for its electricity generation. This dynamic directly impacts revenue streams and market share within the industrial sector.

- Fuel Switching Potential: Industrial sectors like manufacturing and heavy industry are prime candidates for adopting hydrogen or other clean fuels, directly impacting electricity demand.

- Market Growth of Alternatives: The burgeoning clean energy market, with hydrogen leading, signals a tangible shift away from conventional power sources for industrial processes.

- Impact on Capstone: Reduced industrial demand for electricity due to fuel switching poses a direct threat to Capstone Infrastructure's revenue and market position.

The threat of substitutes for Capstone Infrastructure is substantial, driven by advancements in energy efficiency and distributed generation. Innovations like rooftop solar and battery storage empower consumers to reduce reliance on traditional grid power. For example, the global distributed solar market saw significant expansion in 2024, with installations projected to add considerable capacity, directly impacting demand for utility-scale power generation.

Furthermore, the development of alternative energy sources and technologies poses a long-term challenge. Emerging nuclear technologies, alongside more efficient renewable solutions and advanced battery storage, offer competitive alternatives. Global investment in clean energy reached approximately $1.7 trillion in 2023, underscoring a market pivot towards these substitutes.

Industrial consumers are also increasingly exploring fuel switching, with green hydrogen showing significant growth potential. Projections suggest the global hydrogen market could exceed $700 billion by 2030, indicating a substantial shift away from traditional electricity consumption for industrial processes. This trend directly threatens Capstone's revenue streams by reducing industrial demand for its power generation services.

| Substitute Category | Key Technologies/Trends | Impact on Capstone | Relevant Data Point (2023-2024) |

|---|---|---|---|

| Energy Efficiency & Demand Management | Smart grids, advanced insulation, LED lighting | Reduced overall electricity consumption | Utilities reported record low peak demand growth in 2024. |

| Distributed Generation | Rooftop solar, microgrids, community solar | Decreased reliance on centralized power | Strong growth in global distributed solar PV installations. |

| Energy Storage | Advanced battery technologies (e.g., solid-state) | Increased energy independence for consumers | Continued cost reductions and efficiency gains in storage solutions. |

| Alternative Energy Sources | Small Modular Reactors (SMRs), fusion energy, advanced renewables | Potential for more efficient/cost-effective baseload power | Global clean energy investment reached $1.7 trillion in 2023. |

| Fuel Switching (Industrial) | Green hydrogen, synthetic fuels | Reduced industrial demand for grid electricity | Global hydrogen market projected to reach over $700 billion by 2030. |

Entrants Threaten

Entering the infrastructure and power generation sector, like that of Capstone Infrastructure, requires immense upfront capital. Developing a new power plant or major infrastructure project can easily run into billions of dollars. For instance, a typical large-scale solar farm might cost several hundred million dollars, while a new conventional power plant could exceed a billion dollars in construction costs, creating a formidable barrier for potential new competitors.

The energy and utility sectors are notoriously complex due to stringent regulations and extensive permitting requirements. New entrants must navigate a labyrinth of provincial and federal policies, including detailed environmental assessments, which can significantly prolong project timelines and increase upfront costs. For instance, in 2024, the average time for obtaining major energy project approvals in Canada remained substantial, often extending over several years, creating a formidable hurdle for smaller or less experienced companies.

New power generation projects face significant hurdles in connecting to existing transmission grids. This process is often expensive, takes a considerable amount of time, and can be slowed down by various bottlenecks. For instance, in 2023, the average wait time for interconnection studies in the US reached over three years for some renewable energy projects, highlighting the severity of these delays.

Limited transmission capacity and the sheer volume of projects in interconnection queues act as substantial barriers to entry. As of early 2024, the US Federal Energy Regulatory Commission (FERC) reported over 2,000 GW of proposed generation and storage capacity waiting for interconnection studies, a number that far exceeds current transmission capabilities and effectively restricts new entrants.

Need for Specialized Expertise and Experience

Developing, operating, and managing a diversified portfolio of utility and power generation assets demands a high degree of specialized technical, operational, and financial acumen. Newcomers often find it challenging to build the necessary skilled workforce and establish a credible track record required for effective competition.

For instance, securing the necessary permits and regulatory approvals for infrastructure projects can be a lengthy and complex process, often requiring deep understanding of local and national legislation. In 2024, the average time for obtaining major infrastructure permits in developed economies remained above 18 months, a significant barrier for new entrants without established relationships and expertise.

- Technical Proficiency: Expertise in areas like grid management, renewable energy integration, and asset maintenance is critical.

- Operational Experience: Proven ability to manage complex, large-scale operations efficiently and safely is paramount.

- Financial Acumen: Access to capital and sophisticated financial structuring capabilities are essential for project viability.

- Regulatory Navigation: Deep understanding of environmental, safety, and market regulations is non-negotiable.

Established Relationships and Long-Term Contracts

Established players like Capstone Infrastructure have cultivated deep-seated relationships with critical stakeholders, including government agencies, Indigenous communities, and major power consumers. These existing ties create significant barriers for newcomers seeking to enter the market.

The infrastructure sector is heavily reliant on long-term contracts, such as Power Purchase Agreements (PPAs). For instance, by the end of 2023, Capstone had secured a substantial portfolio of contracted cash flows, with approximately 94% of its EBITDA from contracted sources, underscoring the importance of these agreements in providing revenue stability.

- Incumbent Advantage: Existing relationships with regulators and local communities streamline permitting and operational processes, which new entrants must painstakingly build.

- Contractual Locks: Long-term PPAs, often spanning 15-30 years, lock in revenue for incumbents and make it difficult for new projects to secure comparable off-take agreements at competitive rates.

- Capital Intensity: The high upfront capital required for infrastructure projects, coupled with the need for guaranteed revenue streams via contracts, deters many potential new entrants.

- Regulatory Hurdles: Navigating complex regulatory frameworks and obtaining necessary approvals can be a lengthy and costly process, favoring established entities with experience and existing licenses.

The threat of new entrants in the infrastructure sector, particularly for companies like Capstone Infrastructure, is significantly mitigated by the sector's immense capital requirements. Building new power plants or major infrastructure projects often involves billions of dollars in upfront investment. For example, constructing a new conventional power plant can cost well over a billion dollars, presenting a substantial financial barrier for potential competitors.

Navigating the complex web of regulations and lengthy permitting processes is another major deterrent for new players. In 2024, obtaining major energy project approvals in Canada continued to be a multi-year endeavor, demanding significant resources and expertise that many new entrants may lack.

Existing players also benefit from established relationships with government bodies, communities, and customers, which are crucial for securing long-term contracts like Power Purchase Agreements (PPAs). Capstone Infrastructure, for instance, had approximately 94% of its EBITDA from contracted sources by the end of 2023, highlighting the stability and advantage these agreements provide over new, uncontracted projects.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point (2023-2024) |

|---|---|---|---|

| Capital Requirements | Extremely high upfront investment for project development. | Deters new entrants due to financial scale. | New conventional power plant costs can exceed $1 billion. |

| Regulatory & Permitting Complexity | Intricate legal and environmental approval processes. | Increases time and cost, favoring experienced firms. | Major energy project approvals can take several years. |

| Access to Transmission Grids | Difficulties and costs associated with connecting to existing infrastructure. | Creates delays and additional expenses for new projects. | Over 2,000 GW of proposed capacity awaiting interconnection studies in the US (early 2024). |

| Established Relationships & Contracts | Deep ties with stakeholders and long-term PPAs. | Secures revenue streams and market access for incumbents. | ~94% of Capstone's EBITDA contracted by end of 2023. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating annual reports, investor presentations, and industry-specific market research from reputable firms like Gartner and IDC to provide a comprehensive view of the competitive landscape.