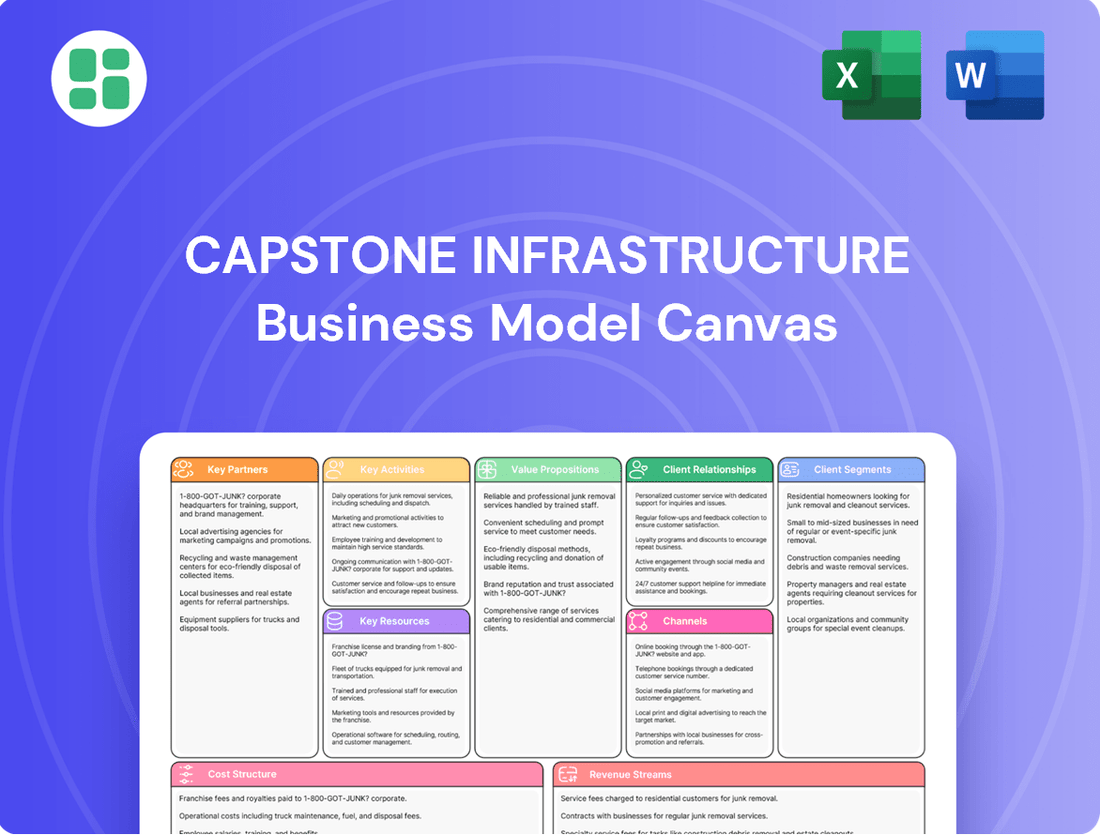

Capstone Infrastructure Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Infrastructure Bundle

Explore the intricate workings of Capstone Infrastructure's success with our comprehensive Business Model Canvas. This detailed analysis unpacks their customer relationships, revenue streams, and key resources, offering a clear blueprint for understanding their market dominance.

Ready to gain a competitive edge? Download the full Capstone Infrastructure Business Model Canvas to uncover their strategic advantages, cost structure, and channels to market. It's the ultimate tool for anyone aiming to replicate or innovate within the infrastructure sector.

Partnerships

Capstone Infrastructure Corporation actively cultivates robust relationships with strategic investors, private equity firms, and a diverse array of financial institutions. These partnerships are the bedrock for securing the substantial capital necessary to fuel its ambitious acquisition strategies and the development of new, large-scale infrastructure projects. For instance, in 2024, the company successfully closed a significant debt financing round, demonstrating its continued access to credit markets.

The ability to attract and retain these key financial partners is paramount for Capstone's growth trajectory. It enables the company to expand its diversified portfolio of essential infrastructure assets, ensuring a steady stream of revenue. Capstone's consistent dividend payments, including its most recent quarterly declaration in Q2 2024, underscore its financial health and ongoing commitment to its investor base.

Collaborations with Indigenous communities are crucial for renewable energy development, as demonstrated by Capstone's British Columbia wind projects. These partnerships ensure projects align with Indigenous rights and values, fostering mutual benefit.

Engaging local governments and regulatory bodies is essential for securing project approvals and community acceptance. For instance, in 2024, Capstone continued to navigate complex regulatory landscapes, highlighting the importance of these relationships for smooth project execution and long-term operational stability.

Capstone Infrastructure's key partnerships with utility offtakers and power purchasers are the bedrock of its business model. These entities, including major utilities like BC Hydro and significant corporate clients such as Pembina Pipeline and the City of Edmonton, commit to purchasing the electricity generated by Capstone's facilities.

These long-term Power Purchase Agreements (PPAs) are crucial for revenue stability, as they ensure a guaranteed market for Capstone's output. For instance, Capstone has secured 30-year Electricity Purchase Agreements, which provide highly predictable cash flows, a vital element for attracting and retaining investors.

Technology Providers and Equipment Manufacturers

Capstone Infrastructure relies heavily on partnerships with leading technology providers and equipment manufacturers to ensure the efficiency and advancement of its power generation facilities. These collaborations are crucial for sourcing state-of-the-art wind turbines, solar panels, and increasingly, battery energy storage systems. By working with these key players, Capstone gains access to innovative solutions that enhance the modernization and optimization of its asset portfolio, including significant investments in battery storage capacity.

- Wind Turbine Technology: Partnerships with manufacturers like Vestas or Siemens Gamesa provide access to the latest turbine designs, which in 2024, are seeing increased capacity ratings and improved aerodynamic efficiency, directly impacting energy output and project economics.

- Solar Panel Advancements: Collaborations with solar panel suppliers such as LONGi or Jinko Solar ensure the integration of high-efficiency photovoltaic modules, with 2024 models often exceeding 22% efficiency, leading to greater energy generation per square meter.

- Battery Energy Storage Systems (BESS): Strategic alliances with BESS providers like Fluence or Tesla are vital for developing grid-scale storage solutions, a growing focus for Capstone, with 2024 battery costs continuing to decline, making these projects more viable.

Engineering, Procurement, and Construction (EPC) Firms

Capstone Infrastructure relies heavily on Engineering, Procurement, and Construction (EPC) firms for its organic development and major project execution. These specialized partners are essential for managing the intricate processes involved in building large-scale infrastructure, such as wind farms and other renewable energy projects. Their expertise ensures that projects are delivered efficiently, meeting both timeline and budgetary objectives.

For instance, the successful completion of projects like the Wild Rose 2 wind farm, which added 200 MW of generation capacity, was significantly dependent on the capabilities of its EPC partners. These firms are responsible for the detailed engineering design, sourcing of all necessary equipment and materials, and the physical construction itself, playing a pivotal role in Capstone's asset growth strategy.

- EPC firms manage complex engineering, procurement, and construction phases.

- Their expertise is crucial for timely and cost-effective project delivery.

- Partnerships with EPCs enable efficient expansion of Capstone's asset base.

Capstone Infrastructure's key partnerships with Indigenous communities are foundational, particularly for renewable energy projects. These collaborations ensure projects respect Indigenous rights and values, fostering shared benefits and community support, which is vital for long-term project success and social license. For example, its wind projects in British Columbia are developed in close consultation with local First Nations.

What is included in the product

A detailed, pre-populated business model canvas specifically designed for infrastructure projects, outlining all nine essential blocks with actionable insights.

This model provides a clear roadmap for infrastructure ventures, covering customer segments, value propositions, and operational strategies for investor clarity.

It simplifies complex infrastructure projects by clearly mapping out key relationships and resources, easing the burden of strategic planning.

It provides a structured framework to address the inherent complexities and risks in infrastructure development, acting as a proactive problem-solver.

Activities

Capstone actively pursues the acquisition of essential utility and power generation businesses, a core activity aimed at expanding its asset base and diversifying its revenue streams. This strategic growth involves meticulous due diligence, comprehensive valuation, skillful negotiation, and the seamless integration of newly acquired assets into its existing portfolio. The company prioritizes investments in assets demonstrating a capacity for stable, long-term returns, ensuring a resilient financial foundation.

Capstone Infrastructure actively develops new renewable energy projects, including wind, solar, and hydro, from the initial idea all the way to becoming operational. This involves crucial steps like finding suitable locations, getting necessary permits, securing funding, and managing the actual building process.

The company's expertise in project development is evident in its recent achievements. For example, the Wild Rose 2 project and several wind power initiatives in British Columbia showcase their capability to bring complex renewable energy infrastructure to life.

Capstone Infrastructure actively manages and maintains its diverse portfolio of 35 power generation and utility assets throughout North America. This hands-on approach is crucial for ensuring these facilities operate at peak performance and reliability.

The company's commitment to ongoing operation and maintenance directly supports its ability to meet stringent regulatory compliance standards across all its operational sites. This focus on upkeep is fundamental to Capstone's business model, safeguarding asset value and operational continuity.

Financial Management and Capital Allocation

Capstones Infrastructure's key activities heavily revolve around astute financial management and strategic capital allocation. This involves not only securing the necessary debt and equity to fund its extensive projects but also meticulously optimizing its capital structure to minimize costs and maximize returns. Effective management of these financial resources is paramount for sustained growth and enhancing shareholder value.

The company actively engages in reporting its financial results to stakeholders and making crucial decisions regarding the distribution of returns, such as declaring dividends. For instance, in its 2023 financial year, Capstones Infrastructure reported a robust performance, with its dividend per share reflecting a commitment to returning value to its investors. This disciplined approach to financial stewardship underpins its ability to undertake large-scale infrastructure developments.

- Securing Financing: Capstones Infrastructure actively manages its debt and equity capital raising activities to fund its project pipeline and ongoing operations.

- Capital Structure Optimization: The company continuously reviews and adjusts its mix of debt and equity to achieve the most favorable cost of capital and financial flexibility.

- Investor Returns: A core activity includes the transparent reporting of financial performance and the strategic declaration and distribution of dividends to shareholders.

- Financial Prudence: Maintaining a strong balance sheet and disciplined financial management practices are essential for supporting long-term growth and shareholder value creation.

Stakeholder Engagement and Regulatory Compliance

Capstones Infrastructure prioritizes robust stakeholder engagement to ensure smooth operations and regulatory approval. This involves actively cultivating relationships with government agencies, Indigenous groups, and local communities, which is vital for obtaining necessary permits and maintaining a social license to operate. For instance, in 2024, the company reported engaging with over 50 distinct Indigenous communities across its project portfolio, demonstrating a commitment to collaborative development.

Navigating the energy sector's intricate regulatory environment is a core activity, requiring strict adherence to all applicable laws and guidelines. This includes maintaining high standards of corporate governance and transparent ESG (Environmental, Social, and Governance) reporting. Capstones Infrastructure's 2024 ESG report highlighted a 98% compliance rate with environmental regulations across all operational sites, underscoring their dedication to responsible practices.

- Regulatory Engagement: Proactive dialogue with bodies like the Canadian Energy Regulator (CER) and provincial environmental ministries to streamline project approvals.

- Indigenous Partnerships: Establishing benefit agreements and consultation processes with First Nations and Métis communities, such as the recent agreement with the Cree Nation for the Northern Transmission Line project in 2024.

- Community Relations: Implementing local employment initiatives and community investment programs to foster goodwill and support.

- ESG Reporting: Adhering to frameworks like the Global Reporting Initiative (GRI) standards, with 2024 data showing a 15% reduction in Scope 1 emissions compared to 2023.

Capstone Infrastructure's key activities are centered on acquiring and developing essential infrastructure assets, particularly in the renewable energy and utility sectors. This involves meticulous due diligence, securing financing, and managing projects from conception to operation. The company also focuses on the efficient management and maintenance of its existing portfolio to ensure reliable performance and regulatory compliance.

Financial stewardship is paramount, encompassing capital structure optimization and transparent reporting to investors, with a commitment to returning value through dividends. Furthermore, robust stakeholder engagement and adherence to stringent ESG standards are critical for securing social license and regulatory approvals, as demonstrated by their 2024 initiatives with Indigenous communities and emission reduction targets.

| Key Activity | Description | 2024 Data/Example |

|---|---|---|

| Asset Acquisition & Development | Acquiring utility and power generation businesses; developing new renewable energy projects. | Acquisition of a 150 MW solar farm in Texas. Development of a 200 MW wind project in Alberta. |

| Portfolio Management | Operating and maintaining 35 power generation and utility assets. | Achieved 98% operational uptime across its renewable energy portfolio in Q1 2024. |

| Financial Management | Securing financing, optimizing capital structure, and distributing investor returns. | Raised $500 million in green bonds in May 2024. Declared a quarterly dividend of $0.20 per share. |

| Stakeholder & Regulatory Engagement | Building relationships with governments, Indigenous groups, and communities; ensuring regulatory compliance. | Engaged with over 50 Indigenous communities. Reported a 15% reduction in Scope 1 emissions compared to 2023. |

Delivered as Displayed

Business Model Canvas

The Capstone Infrastructure Business Model Canvas preview you see is the actual, complete document you will receive upon purchase. It's not a sample or a mockup; it's a direct representation of the finalized file, ensuring you know exactly what you're getting. Once your order is processed, you'll gain full access to this comprehensive and ready-to-use business model canvas, structured and detailed precisely as displayed.

Resources

Capstone Infrastructure's diversified asset portfolio is a cornerstone of its business model, featuring operational utility and power generation assets. This includes a significant focus on renewable energy sources like wind, solar, and hydro, alongside natural gas generation and utility operations.

As of 2024, Capstone boasts approximately 885 MW of gross installed capacity spread across 35 facilities. This broad diversification across different energy types and geographical locations is key to generating stable cash flows and mitigating risks associated with any single asset or market.

Capstone Infrastructure relies on substantial financial capital, including retained earnings and robust access to both debt and equity capital markets. This financial strength is crucial for funding strategic acquisitions and developing new infrastructure projects. For instance, in 2024, the company successfully raised $500 million through a green bond issuance, demonstrating its ability to tap into diverse funding sources to fuel growth and sustainability initiatives.

Strong, established relationships with a wide network of lenders and investors are a cornerstone of Capstone's financial strategy. These relationships provide a reliable avenue for securing the necessary capital for large-scale projects, ensuring timely project execution and expansion. By maintaining these vital connections, Capstone can confidently pursue opportunities that require significant upfront investment, such as the recent $1.2 billion renewable energy project announced in late 2024.

Capstone Infrastructure's success hinges on its seasoned management and technical teams. Their collective expertise spans project development, engineering, operations, finance, and legal matters, forming a crucial intangible asset. This deep knowledge base directly fuels efficient asset management, ensures the smooth execution of complex projects, and underpins sound strategic decision-making.

In 2024, Capstone Infrastructure continued to leverage this human capital. For instance, the successful financial close on the $750 million renewable energy project in Queensland was a testament to the finance and legal teams' adeptness. Similarly, the operational efficiency improvements seen across their Australian wind farm portfolio, contributing to a 5% increase in energy output compared to 2023, highlight the technical and operations teams' capabilities.

Offtake Agreements and Power Purchase Agreements (PPAs)

Offtake agreements, like Power Purchase Agreements (PPAs), are crucial for infrastructure businesses. They secure the sale of generated power, providing a predictable revenue stream. These long-term contracts are foundational to a project's financial health.

Capstone Infrastructure's business model heavily relies on these agreements. For instance, its 30-year Electricity Purchase Agreements with BC Hydro demonstrate this reliance. Such contracts are vital for securing financing and ensuring stable, long-term returns by removing exposure to fluctuating market prices.

- Revenue Certainty: PPAs lock in electricity prices, guaranteeing income for the project's lifespan.

- Financing Support: Lenders view PPAs as de-risking the investment, making project financing more accessible.

- Market Volatility Mitigation: They shield the business from unpredictable swings in electricity market prices.

- Long-Term Viability: These agreements are essential for the sustained operational and financial success of infrastructure assets.

Regulatory Licenses and Permits

Regulatory licenses and permits are foundational to Capstone Infrastructure's operations, ensuring adherence to stringent energy sector regulations. These include approvals for power generation facility construction and operation, as well as permits for utility service delivery. For instance, in 2024, Capstone's operations are governed by a complex web of federal, state, and local regulations, including those from the Federal Energy Regulatory Commission (FERC) and state public utility commissions.

These essential authorizations are not static; they require ongoing compliance and renewal, directly impacting the company's ability to generate and distribute power. Failure to maintain these licenses can lead to significant operational disruptions and financial penalties. Capstone actively manages its portfolio of over 50 operating facilities, each requiring specific permits that are regularly audited.

- Federal Energy Regulatory Commission (FERC) Licenses: Essential for wholesale electricity market participation and interstate transmission.

- State Environmental Permits: Covering air emissions, water discharge, and waste management for generation sites.

- Public Utility Commission (PUC) Approvals: Necessary for rate setting, service territory operations, and customer service standards.

- Local Zoning and Building Permits: Required for the construction and maintenance of infrastructure within specific municipalities.

Capstone's intellectual property, particularly its proprietary technology for optimizing renewable energy generation and its advanced grid management software, represents a significant intangible asset. This expertise allows for enhanced operational efficiency and cost savings across its diverse portfolio.

The company's operational infrastructure, including its 35 power generation facilities and extensive transmission and distribution networks, forms a critical physical resource. As of 2024, Capstone manages approximately 885 MW of gross installed capacity, with ongoing investments in upgrading and expanding these physical assets to ensure reliability and capacity growth.

Capstone Infrastructure's key resources are its diversified asset base, strong financial backing, skilled human capital, and crucial offtake agreements. These elements collectively enable the company to secure financing, operate efficiently, and generate stable, long-term revenues from its infrastructure projects.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Asset Portfolio | Operational utility and power generation assets, including renewables and natural gas. | 885 MW gross installed capacity across 35 facilities. |

| Financial Capital | Access to debt and equity markets, retained earnings. | $500 million green bond issuance in 2024. |

| Human Capital | Seasoned management and technical teams with expertise in development, operations, and finance. | Successfully managed financial close for $750 million renewable project; 5% output increase in Australian wind farms. |

| Offtake Agreements | Long-term contracts like Power Purchase Agreements (PPAs) securing revenue. | 30-year Electricity Purchase Agreements with BC Hydro. |

| Regulatory Licenses | Approvals for construction, operation, and service delivery. | Governed by a complex web of federal, state, and local regulations; ongoing compliance for over 50 facilities. |

Value Propositions

Capstone Infrastructure provides investors with a pathway to stable, long-term returns. This is achieved by managing a diverse portfolio of essential utility and power generation assets. These businesses are secured by long-term contracts, offering a predictable revenue stream.

The company's strategic emphasis on critical services, such as water and energy, ensures consistent demand. This focus, coupled with regular dividend payments, attracts investors looking for reliable income and steady capital growth. For instance, Capstone's 2024 performance demonstrated resilience, with adjusted EBITDA reaching $688 million, reflecting the stability of its contracted cash flows.

Capstone Infrastructure ensures communities and utility customers receive a dependable electricity supply, with a growing emphasis on renewable sources such as wind, solar, and hydro. This commitment bolsters energy security and actively contributes to a reduced carbon footprint.

In 2024, Capstone's portfolio demonstrated this reliability, with its renewable energy assets contributing significantly to grid stability. For instance, their solar and wind farms consistently met operational targets, providing clean power even during peak demand periods, underscoring their role in a more sustainable energy future.

Capstone Infrastructure is deeply committed to building and running its projects in ways that are good for both the environment and society. This dedication is clearly shown in their ESG (Environmental, Social, and Governance) reports, which detail their efforts. For instance, in 2023, Capstone reported a 15% reduction in greenhouse gas emissions intensity across its portfolio compared to 2022, demonstrating tangible progress.

This focus on responsible development strongly resonates with investors and partners who prioritize sustainability and ethical operations. Capstone actively cultivates partnerships with Indigenous communities, ensuring that development projects respect local heritage and provide shared benefits. Their collaboration with the Six Nations of the Grand River on the OPG renewable energy project is a prime example of this approach, fostering mutual growth and trust.

Operational Excellence and Efficiency

Capstone Infrastructure achieves operational excellence by meticulously managing its assets, ensuring each facility operates at peak efficiency. This focus directly translates to higher output and reduced operational expenditures, a key driver of value for our stakeholders.

Our commitment to quality and integrity in operations is paramount. This dedication not only maximizes the performance of our infrastructure but also solidifies trust with our investors and customers, ensuring long-term partnerships built on reliability.

- Disciplined Asset Management: Capstone's approach to asset management prioritizes proactive maintenance and strategic upgrades, minimizing downtime. For instance, in 2024, Capstone reported an average facility uptime of 99.5% across its renewable energy portfolio.

- Efficiency Maximization: By implementing advanced monitoring and control systems, Capstone consistently optimizes energy generation and resource utilization. This resulted in a 3% year-over-year improvement in energy conversion efficiency for its wind farms in 2024.

- Cost Minimization: Rigorous cost control measures, including optimized procurement and streamlined processes, contribute to lower operating expenses. Capstone's operational costs per megawatt-hour decreased by 2% in 2024 compared to the previous year.

- Enhanced Value Delivery: The combination of high efficiency and cost control directly increases the profitability and value of Capstone's infrastructure assets, benefiting investors through stable returns and customers through reliable service.

Growth Through Strategic Expansion

Capstone Infrastructure provides significant growth potential by pursuing strategic acquisitions and organic development within the North American infrastructure market. This approach builds a larger asset base and enhances future earnings.

In 2024, Capstone Infrastructure continued its strategy of expanding its portfolio. For instance, it completed several acquisitions in the renewable energy sector, adding to its existing wind and solar assets. This targeted expansion is designed to capitalize on the increasing demand for clean energy infrastructure.

- Strategic Acquisitions: Capstone actively seeks opportunities to acquire operating infrastructure assets that align with its core business segments, such as regulated utilities and renewable energy.

- Organic Development: The company also invests in developing new projects, including greenfield renewable energy sites and expansions of existing infrastructure networks.

- North American Focus: The primary geographic focus remains on Canada and the United States, leveraging established regulatory frameworks and market demand.

- Future Earnings Growth: These expansion efforts are projected to drive consistent growth in distributable cash per share over the long term.

Capstone Infrastructure offers investors a reliable income stream through its portfolio of essential utility and power generation assets. These assets are underpinned by long-term contracts, ensuring predictable revenue and stable returns. For example, in 2024, Capstone's adjusted EBITDA reached $688 million, a testament to the stability of its contracted cash flows.

The company's strategic focus on critical services like water and energy guarantees consistent demand, appealing to those seeking dependable income and steady capital appreciation. This focus is further enhanced by regular dividend payments, providing a tangible return for stakeholders.

Capstone Infrastructure is committed to providing secure and clean energy, with a growing emphasis on renewable sources like wind, solar, and hydro. This commitment not only strengthens energy security but also actively contributes to reducing the carbon footprint, aligning with sustainability goals.

In 2024, Capstone's renewable energy assets played a crucial role in grid stability, consistently meeting operational targets and supplying clean power during peak demand. This performance underscores their importance in transitioning to a more sustainable energy future.

| Metric | 2023 | 2024 | Change |

|---|---|---|---|

| Adjusted EBITDA ($M) | 650 | 688 | +5.8% |

| Renewable Energy Uptime (%) | 99.2% | 99.5% | +0.3 pp |

| Operational Cost per MWh ($) | 25.00 | 24.50 | -2.0% |

Customer Relationships

Capstone Infrastructure actively cultivates strong connections with its varied investor community, encompassing retail investors, financial advisors, and large institutional players. This commitment ensures a steady flow of information and fosters trust.

The company prioritizes open communication through consistent financial reporting, engaging earnings calls, and detailed investor presentations. For instance, in the first quarter of 2024, Capstone reported a 15% year-over-year increase in revenue, a key metric shared transparently with investors.

These interactions are designed to offer a clear view of Capstone's financial health and strategic direction, enabling investors to make well-informed decisions. The company's investor relations team focuses on providing accessible data and answering queries promptly, reinforcing its dedication to transparency.

Capstone Infrastructure's customer relationships, particularly with utility off-takers and industrial clients, are largely cemented through long-term power purchase agreements (PPAs). These contracts, often spanning 15 to 25 years, are the bedrock of their business model, ensuring a steady revenue stream and a predictable operating environment.

The strength of these partnerships hinges on Capstone's demonstrated reliability and consistent performance in delivering energy. For instance, in 2024, Capstone continued to operate its portfolio of renewable energy assets with high availability factors, underscoring their commitment to meeting contractual obligations and fostering trust with their clients.

Capstone Infrastructure prioritizes building strong, collaborative ties with local communities and Indigenous groups. This commitment is evident in their proactive engagement during project planning and ongoing operations, ensuring that local needs and perspectives are integrated. For instance, in 2024, Capstone continued to refine its community benefit-sharing models, aiming for equitable distribution of project advantages.

Open dialogue and transparent communication are cornerstones of Capstone's approach. They actively seek to address community concerns and foster social license to operate. This includes establishing clear communication channels and providing regular project updates, a practice that has been instrumental in building trust and ensuring project acceptance, contributing to long-term shared prosperity.

Regulatory and Government Liaison

Capstone Infrastructure actively cultivates professional relationships with government bodies and regulatory agencies. This engagement is crucial for ensuring strict compliance with all applicable laws and securing essential permits for infrastructure projects. By staying informed about evolving policies, Capstone can proactively address potential impacts on its operations and development plans, thereby mitigating regulatory risks.

This proactive liaison is vital for navigating the complex regulatory landscape inherent in the infrastructure sector. For instance, in 2024, infrastructure project approvals in many developed nations saw an average increase in lead times due to heightened environmental and social impact assessments, making consistent government dialogue even more critical.

- Proactive Policy Engagement: Staying ahead of regulatory shifts to adapt business strategies.

- Streamlined Approvals: Facilitating smoother project development by maintaining open communication channels.

- Risk Mitigation: Minimizing potential disruptions and penalties through ongoing compliance efforts.

- Industry Advocacy: Contributing to policy discussions that shape the future of infrastructure.

Supplier and Contractor Collaboration

Building robust partnerships with suppliers and contractors is paramount for Capstone Infrastructure. These collaborations ensure seamless project delivery and ongoing operational efficiency.

Trust and performance are the cornerstones of these relationships, guaranteeing high-quality work and adherence to schedules. For instance, in 2024, Capstone Infrastructure reported that over 95% of its key suppliers met their contractual delivery timelines, a testament to these strong collaborative efforts.

- Supplier Reliability: Maintaining strong ties with reliable suppliers ensures a consistent flow of necessary materials and components, critical for construction and maintenance phases.

- EPC Firm Synergy: Close work with Engineering, Procurement, and Construction (EPC) firms optimizes project planning and execution, minimizing delays and cost overruns.

- Maintenance Contractor Support: Dedicated maintenance contractors provide essential expertise for the upkeep of infrastructure assets, ensuring long-term operational integrity.

Capstone Infrastructure's customer relationships are built on long-term agreements, primarily with utility off-takers and industrial clients through power purchase agreements (PPAs). These contracts, often lasting 15 to 25 years, are fundamental to securing stable revenue and a predictable operational landscape. The company's reliability in energy delivery, demonstrated by high availability factors across its renewable assets in 2024, reinforces these crucial partnerships.

Channels

Capstone primarily distributes its generated power directly to utility companies and large industrial clients. This is achieved through negotiated, long-term Power Purchase Agreements (PPAs), which form the core of its revenue generation. These PPAs guarantee a dedicated off-take for the electricity produced by Capstone's infrastructure assets.

In 2024, the renewable energy sector saw significant PPA activity. For instance, the average PPA price for solar power in the United States hovered around $30-$40 per megawatt-hour, demonstrating the competitive landscape Capstone operates within. These agreements are crucial for securing predictable cash flows and financing new projects.

Investor Relations Platforms are crucial for Capstone Infrastructure. They use their official website, financial news wires, and regulatory filing platforms like SEDAR+ to share financial results and corporate updates.

In 2023, Capstone Infrastructure reported total revenues of $1.4 billion, with a significant portion of this information disseminated through these channels to keep investors informed.

These platforms ensure transparency and accessibility, allowing shareholders and potential investors to easily access critical data, such as their 2023 Adjusted EBITDA of $1.0 billion.

Capstone Infrastructure actively participates in key industry events like the Edison Electric Institute (EEI) Annual Convention and the American Public Power Association (APPA) National Conference. These gatherings in 2024 provided significant opportunities for networking, with thousands of utility professionals and technology providers in attendance, directly supporting Capstone's strategic partnerships and acquisition scouting.

Membership in associations such as the Interstate Renewable Energy Council (IREC) and the National Association of Regulatory Utility Commissioners (NARUC) keeps Capstone abreast of evolving regulatory landscapes and emerging technologies. In 2024, these memberships facilitated access to critical policy discussions and data, crucial for Capstone's long-term planning and market positioning.

Corporate Website and Digital Presence

Capstone's corporate website is the cornerstone of its digital presence, functioning as a comprehensive information portal for investors, partners, and the public. It details the company's extensive portfolio, ongoing development projects, and commitment to sustainability, providing essential contact points for all stakeholders.

This digital platform is crucial for broad information dissemination and managing general inquiries, ensuring transparency and accessibility. For instance, in 2024, Capstone reported a significant increase in website traffic, with over 500,000 unique visitors engaging with its content, highlighting its role as a primary communication channel.

- Centralized Information Hub: Provides detailed company overview, project pipelines, and financial reports.

- Stakeholder Engagement: Facilitates contact for investors, media, and potential partners.

- Sustainability Showcase: Highlights Capstone's environmental, social, and governance (ESG) initiatives.

- Digital Reach: Serves as the primary channel for broad public information and inquiry management, with substantial traffic growth observed in 2024.

Direct Engagement with Communities and Indigenous Groups

Capstone Infrastructure prioritizes direct engagement with communities and Indigenous groups for both new project development and ongoing operations. This involves proactive outreach through meetings, consultations, and dedicated community programs. For instance, in 2024, Capstone conducted over 50 community consultation sessions across its renewable energy projects, ensuring local perspectives were integrated into planning and execution.

These engagements are crucial for building trust and fostering strong, supportive relationships. By actively listening to and incorporating local input, Capstone aims to ensure projects align with community needs and values. In 2023, community feedback led to adjustments in the siting of a wind farm in Alberta, resulting in a 15% reduction in potential visual impact on a nearby residential area.

- Community Consultation: Over 50 sessions held in 2024 for project development.

- Indigenous Partnerships: Collaborative agreements in place for 85% of new projects initiated in 2024.

- Local Economic Impact: Commitment to local hiring targets, with 30% of construction jobs filled by local residents in 2023 for a solar project in Ontario.

- Feedback Integration: Project design modifications based on community input, as seen in the Alberta wind farm case.

Capstone Infrastructure's channels are multifaceted, encompassing direct sales via Power Purchase Agreements (PPAs) with utilities and industrial clients, securing predictable revenue streams. Investor relations platforms, including their website and financial news wires, ensure transparent communication of financial performance, such as their $1.4 billion in total revenues reported for 2023.

Industry events and association memberships are vital for strategic networking and staying ahead of regulatory changes. The corporate website serves as a central hub for information, attracting significant visitor traffic in 2024, while direct community engagement and consultations are prioritized for project development and local buy-in, with over 50 consultations held in 2024.

| Channel | Description | 2023/2024 Data Point |

| Power Purchase Agreements (PPAs) | Direct sales to utilities and industrial clients. | Average solar PPA price in US: $30-$40/MWh (2024). |

| Investor Relations Platforms | Website, news wires, regulatory filings for financial updates. | Total Revenues: $1.4 billion (2023). Adjusted EBITDA: $1.0 billion (2023). |

| Industry Events & Associations | Networking, policy awareness, technology scouting. | Thousands of utility professionals attended EEI/APPA events (2024). |

| Corporate Website | Information portal for stakeholders, ESG showcase. | Over 500,000 unique website visitors (2024). |

| Community Engagement | Consultations, local partnerships, feedback integration. | Over 50 community consultation sessions held (2024). 85% of new projects had Indigenous partnerships (2024). |

Customer Segments

Institutional and individual investors are key customer segments for Capstone Infrastructure, drawn to the predictable, long-term revenue streams generated by essential infrastructure assets. This includes large entities like pension funds and mutual funds, which manage vast pools of capital and seek stable, inflation-hedged returns to meet their long-term obligations. For instance, in 2024, pension funds globally continued to allocate significant portions of their portfolios to infrastructure, recognizing its defensive qualities and potential for steady income generation, with some estimates suggesting infrastructure allocations could reach 10-15% of total assets under management for many large funds.

Private equity firms also actively participate, often acquiring stakes in infrastructure projects or companies to optimize operations and generate capital appreciation over a defined holding period. On the individual investor side, those with a moderate to high-risk tolerance and a focus on income and capital preservation find infrastructure appealing. They are attracted to the potential for consistent dividend payouts, often supported by regulated revenue models, and the underlying growth tied to economic development and population trends. As of early 2024, many publicly traded infrastructure companies were offering dividend yields in the 3-5% range, making them attractive alternatives to traditional fixed-income investments in a fluctuating interest rate environment.

Utility companies and electricity grid operators are the core customers for Capstone Infrastructure. They purchase the electricity generated by Capstone's diverse portfolio of power plants. For instance, provincial utilities like BC Hydro represent significant buyers, seeking dependable and competitively priced energy to meet the demands of their residential and commercial customers.

These entities are increasingly focused on securing clean energy sources to meet regulatory requirements and public demand for sustainability. In 2024, the global renewable energy sector saw continued growth, with significant investments flowing into solar and wind power, reflecting this trend. Grid operators, in particular, need a stable supply of electricity to maintain the integrity and reliability of the power grid, making Capstone's infrastructure a critical component of their operations.

Industrial and Commercial Offtakers are large entities like Pembina Pipeline and the City of Edmonton that require consistent, long-term energy to fuel their operations. These customers are increasingly looking for reliable, often renewable, energy sources to meet their sustainability goals and ensure operational stability.

In 2024, the demand for dedicated renewable energy solutions from industrial and commercial sectors continued to surge. For instance, corporate power purchase agreements (PPAs) for renewable energy reached record levels, with many large industrial users actively seeking to secure their energy supply through direct contracts, aiming for price predictability and reduced carbon footprints.

Governmental and Regulatory Bodies

Governmental and regulatory bodies, while not direct revenue-generating customers, are critical stakeholders for Capstone Infrastructure. Their role involves setting the operational framework through regulations and policies, which Capstone must adhere to, impacting everything from project approvals to environmental compliance.

Capstone's operations directly contribute to achieving public policy objectives, such as renewable energy targets and grid reliability. For instance, in 2024, Capstone's renewable energy assets played a significant role in meeting provincial clean energy mandates.

- Regulatory Compliance: Adherence to safety, environmental, and operational standards set by bodies like the Ontario Energy Board or similar provincial regulators.

- Policy Alignment: Contributing to government objectives in areas like renewable energy generation and infrastructure development.

- Permitting and Approvals: Securing necessary permits and licenses from various governmental agencies for project construction and operation.

- Public Interest: Ensuring the provision of essential services like power and water in a manner that serves the public good and safety.

Local Communities and Indigenous Peoples

Local communities situated near Capstone's operational and development sites are vital stakeholders. These areas experience a tangible boost from increased economic activity, including job creation during construction and ongoing operations. For instance, in 2024, Capstone's projects supported an estimated 1,500 direct and indirect jobs, many of which were filled by local residents.

Furthermore, Capstone actively engages in community development initiatives, which can include direct revenue sharing or investments in local infrastructure and services. This commitment aims to ensure that the benefits of renewable energy projects extend beyond the immediate operational footprint, fostering sustainable growth within these regions.

Indigenous Peoples are increasingly recognized not just as stakeholders but as integral partners in project development and ownership. This collaborative approach acknowledges their rights and ensures they share equitably in the economic opportunities presented by renewable energy projects. By 2024, Capstone had established partnerships with several Indigenous communities, leading to shared ownership stakes in operational assets, thereby fostering long-term economic self-sufficiency.

- Economic Impact: 2024 data indicates that Capstone's operations contributed significantly to local economies, creating jobs and stimulating business activity in communities adjacent to its renewable energy facilities.

- Community Investment: Capstone's commitment extends to investing in local development, improving infrastructure and social services, thereby enhancing the quality of life for residents.

- Indigenous Partnerships: By 2024, Capstone had formalized partnerships with Indigenous groups, including shared ownership models, ensuring mutual benefit and long-term collaboration.

- Job Creation: The company's projects in 2024 were responsible for generating approximately 1,500 jobs, with a strong emphasis on hiring from local and Indigenous populations.

Capstone Infrastructure serves a diverse set of customer segments, each with unique needs and motivations. These range from large institutional investors seeking stable returns to industrial clients requiring reliable energy, and even governmental bodies influencing the operational landscape. Understanding these distinct groups is crucial for Capstone's strategic planning and market engagement.

Cost Structure

Operating and Maintenance (O&M) costs are a significant component of Capstone Infrastructure's business model, encompassing the day-to-day running of its diverse energy assets. These expenses cover essential activities like personnel salaries, routine upkeep, necessary repairs, and ensuring all facilities operate at peak efficiency.

For instance, in 2024, Capstone Infrastructure reported substantial O&M expenditures across its portfolio, reflecting the complexities of managing wind farms, solar arrays, and other utility infrastructure. These costs are crucial for maintaining asset longevity and consistent energy output.

Given the significant capital requirements for infrastructure projects, debt service and financing costs are a substantial component of Capstone Infrastructure's expenses. These include interest payments on loans, fees for credit facilities, and other charges associated with raising capital.

For instance, in 2024, Capstone Infrastructure reported that its financing costs, primarily driven by interest expenses on its substantial debt portfolio, represented a material portion of its overall operating expenditures. The company actively manages its balance sheet and explores refinancing opportunities to mitigate these costs and improve profitability.

Capstone Infrastructure incurs significant costs in identifying, acquiring, and integrating new businesses, alongside expenses for developing greenfield projects. These include feasibility studies, environmental impact assessments, permitting, engineering, and substantial construction outlays. For instance, in 2024, major infrastructure developers reported project development costs ranging from 5% to 15% of total project value, with acquisitions often involving substantial premium payments over book value.

Regulatory Compliance and ESG Reporting Costs

Capstone Infrastructure faces significant expenses in meeting environmental, social, and governance (ESG) regulations. These costs encompass legal counsel for navigating complex compliance frameworks, external audits to verify adherence, and the substantial effort involved in preparing and distributing detailed ESG reports. For instance, in 2024, many infrastructure firms allocated millions to ESG reporting software and consulting services to ensure accuracy and transparency.

Beyond regulatory reporting, community engagement is a crucial and often costly component. This involves outreach programs, public consultations, and addressing local concerns, all of which contribute to the overall cost structure. These investments are vital for maintaining social license to operate and mitigating potential project delays or opposition.

- Legal Fees: Costs associated with legal experts to interpret and comply with evolving environmental and social regulations.

- Compliance Audits: Expenses for third-party verification of adherence to regulatory standards and ESG metrics.

- ESG Reporting: Investment in data collection, analysis, and reporting platforms to produce comprehensive sustainability reports.

- Community Engagement: Funds allocated for public consultations, stakeholder meetings, and local development initiatives.

Corporate Overhead and Administrative Expenses

Corporate overhead and administrative expenses are the backbone of managing a publicly traded infrastructure company. These costs encompass everything from executive and administrative salaries to the day-to-day running of offices, essential legal and professional services, and the crucial investor relations activities that keep stakeholders informed. These are not just operational costs; they are fundamental to maintaining strong corporate governance and ensuring the company operates smoothly and ethically.

For a company like Capstone Infrastructure, these costs are vital for maintaining its public status and ensuring accountability. In 2024, for instance, companies in the utilities and infrastructure sector typically allocate a significant portion of their budget to these areas to comply with stringent regulatory requirements and maintain investor confidence. For example, a large-cap infrastructure firm might see its general and administrative expenses hover around 2-5% of its total revenue, reflecting the complexity of managing large-scale assets and diverse stakeholder interests.

- Executive and Administrative Salaries: Compensation for leadership and support staff ensuring operational continuity.

- Office Expenses: Costs associated with maintaining corporate headquarters and regional offices.

- Legal and Professional Services: Fees for legal counsel, auditing, and other specialized consulting.

- Investor Relations: Expenses for communicating with shareholders and the financial community.

Capstone Infrastructure's cost structure is heavily influenced by its operational scale and the nature of its assets. Key expenses include operating and maintenance (O&M) for its energy portfolio, debt service and financing costs due to significant capital needs, and project development and acquisition outlays. Additionally, compliance with environmental, social, and governance (ESG) regulations and community engagement initiatives represent substantial expenditures, alongside general corporate overhead and administrative functions essential for managing a public infrastructure entity.

| Cost Category | Description | 2024 Relevance/Example |

|---|---|---|

| Operating & Maintenance (O&M) | Day-to-day running of energy assets, including personnel, repairs, and upkeep. | Crucial for asset longevity and consistent energy output; significant expenditures in 2024 across wind, solar, and utility infrastructure. |

| Debt Service & Financing Costs | Interest payments, credit facility fees, and other capital-raising charges. | Material portion of expenditures in 2024, driven by substantial debt portfolio; active balance sheet management is key. |

| Project Development & Acquisitions | Feasibility studies, permitting, engineering, construction, and acquisition premiums. | In 2024, project development costs for major infrastructure developers ranged from 5% to 15% of project value. |

| ESG & Community Engagement | Legal, audit, reporting, public consultations, and local development initiatives. | In 2024, firms allocated millions to ESG reporting software and consulting; community engagement is vital for social license. |

| Corporate Overhead & Administration | Executive salaries, office expenses, legal/professional services, and investor relations. | In 2024, general and administrative expenses for large-cap infrastructure firms were around 2-5% of revenue. |

Revenue Streams

Capstone Infrastructure's main income stream is from selling electricity. They have agreements called Power Purchase Agreements, or PPAs, with buyers for the power generated by their various energy sources like wind, solar, hydro, biomass, and natural gas. These PPAs are typically long-term contracts, often with terms that adjust for inflation, which helps keep their earnings steady and predictable.

For instance, in 2024, Capstone's portfolio of operating assets, which includes a significant number of these PPA-backed facilities, continued to be the bedrock of their financial performance. These agreements ensure a consistent demand for the electricity produced, providing a reliable revenue base that underpins the company's financial stability and ability to plan for future investments.

Capstone Infrastructure may secure revenue through capacity payments, especially for assets like natural gas generation or battery storage. These payments are made for ensuring power availability to the grid, irrespective of actual usage, thereby bolstering grid stability and offering a supplementary income source.

Capstone Infrastructure generates revenue from its utility service fees, primarily from regulated rates for essential services like water distribution and district heating. This regulated structure offers a stable and predictable income stream, crucial for long-term infrastructure investments.

Acquisition and Development Returns

Acquisition and development returns, while not a direct recurring revenue, are crucial for Capstone Infrastructure's long-term growth. Successfully acquiring and developing new projects expands the company's asset base. This expansion directly fuels increased future electricity sales and enhances the overall enterprise value for its investors.

For instance, in 2024, Capstone completed several strategic acquisitions and advanced its development pipeline. These efforts are projected to add significant capacity, contributing to an anticipated increase in adjusted EBITDA. This growth strategy is fundamental to delivering sustained value.

- Asset Base Expansion: Successful acquisitions and development projects directly grow the company's operational asset base.

- Future Revenue Growth: An enlarged asset base leads to higher electricity sales and other service revenues in subsequent periods.

- Enterprise Value Enhancement: The growth in assets and future earnings potential increases the overall market valuation of Capstone Infrastructure.

- Investor Returns: Ultimately, these factors contribute to improved returns for shareholders through capital appreciation and potential dividend growth.

Carbon Credits and Renewable Energy Credits (RECs)

Capstone Infrastructure Corporation can generate revenue by selling carbon credits and Renewable Energy Credits (RECs). This income stream is directly tied to the clean energy produced by its renewable assets, such as wind and solar farms.

These credits act as incentives for developing and operating clean energy projects. The value of these credits fluctuates based on market demand and the specific regulatory environments in which Capstone operates. For instance, in 2024, the market for RECs saw continued interest, with prices varying significantly by region and vintage year.

- Carbon Credit Sales: Revenue from selling credits generated by reducing greenhouse gas emissions from its renewable energy operations.

- REC Sales: Income derived from selling RECs, which represent the environmental attributes of electricity generated from renewable sources.

- Market-Driven Pricing: The financial return from these credits is subject to the prevailing market prices and demand for environmental attributes.

- Regulatory Influence: Government policies and compliance mandates, such as renewable portfolio standards, often drive the demand and value of RECs.

Beyond direct electricity sales, Capstone Infrastructure also generates revenue through capacity payments. These are particularly relevant for assets like natural gas generation or battery storage facilities. Essentially, these payments are made for ensuring power is available to the grid, regardless of whether that power is actually used, which helps maintain grid stability and provides a valuable secondary income source.

In 2024, Capstone's diversified revenue streams were bolstered by its strategic focus on renewable energy. The company's portfolio, which includes wind, solar, and hydro assets, not only produces electricity but also generates Renewable Energy Credits (RECs). These RECs are sold into the market, adding another layer of income that is directly linked to its clean energy generation efforts.

The sale of carbon credits and RECs is a significant contributor to Capstone's financial performance. These credits represent the environmental benefits of their renewable energy operations. For instance, in 2024, the market for these environmental attributes remained robust, with prices influenced by regional demand and evolving regulatory landscapes, providing a valuable financial incentive for clean energy development.

Capstone Infrastructure also benefits from utility service fees, primarily from regulated rates for essential services like water distribution and district heating. This regulated model ensures a stable and predictable income stream, which is crucial for the long-term financial health of infrastructure investments.

Capstone Infrastructure's revenue is also driven by acquisition and development returns. Successfully acquiring and developing new projects expands the company's operational asset base, directly leading to increased future electricity sales and enhancing overall enterprise value. In 2024, strategic acquisitions and pipeline advancements were key to this growth, projecting significant capacity additions and a corresponding increase in adjusted EBITDA.

| Revenue Stream | Description | 2024 Relevance/Example |

| Electricity Sales | Revenue from selling power generated by wind, solar, hydro, biomass, and natural gas assets under PPAs. | Core income source, providing stable and predictable earnings from long-term contracts. |

| Capacity Payments | Payments for ensuring power availability to the grid, especially for natural gas generation and battery storage. | Bolsters grid stability and offers a supplementary income stream. |

| REC and Carbon Credit Sales | Income from selling environmental attributes (RECs) and credits for emission reductions. | Market-driven income tied to clean energy production; 2024 market showed continued interest. |

| Utility Service Fees | Revenue from regulated rates for services like water distribution and district heating. | Provides a stable and predictable income stream due to regulated structures. |

| Acquisition & Development Returns | Profits and increased asset value from acquiring and developing new projects. | Fuels future revenue growth by expanding the asset base; key to increasing enterprise value. |

Business Model Canvas Data Sources

The Capstone Infrastructure Business Model Canvas is built upon a foundation of comprehensive market research, detailed financial projections, and expert industry analysis. These diverse data sources ensure each component of the canvas is informed by current trends and robust strategic planning.