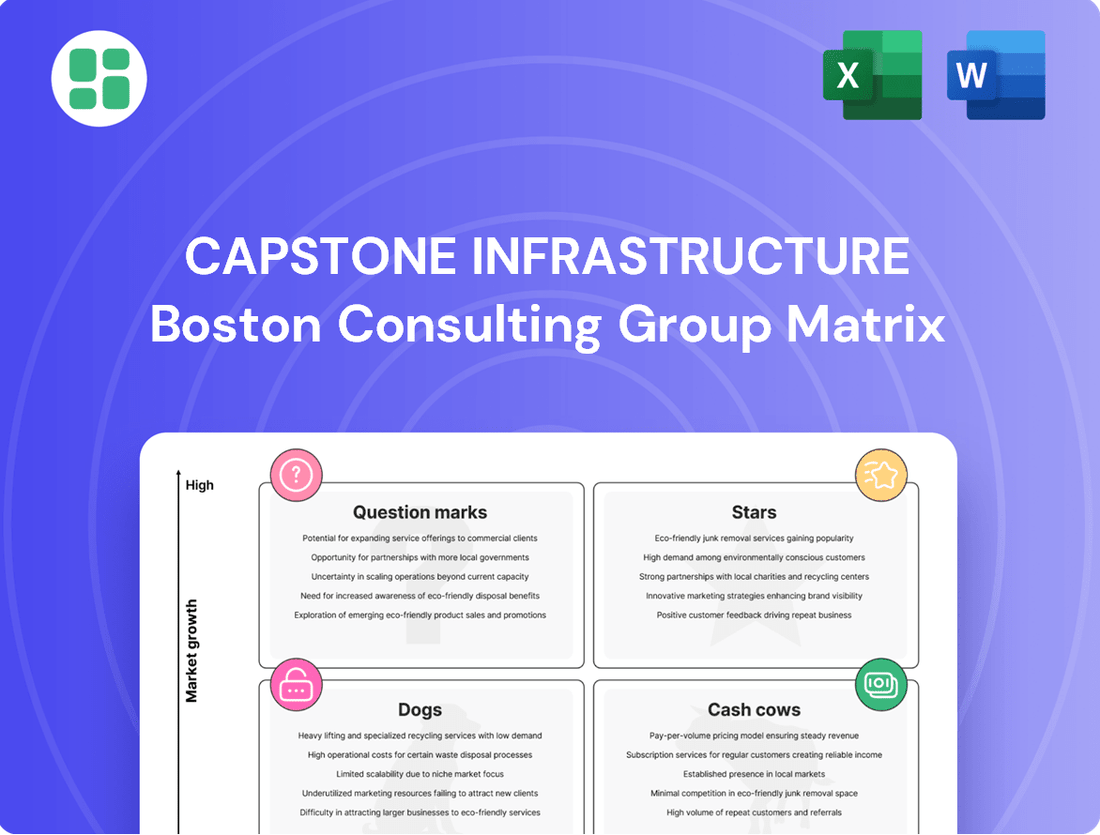

Capstone Infrastructure Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Infrastructure Bundle

Uncover the strategic positioning of Capstone Infrastructure's portfolio with our insightful BCG Matrix analysis. See which assets are driving growth (Stars), generating stable returns (Cash Cows), lagging behind (Dogs), or requiring careful consideration (Question Marks).

This preview offers a glimpse into the critical insights that can shape your investment decisions and optimize resource allocation.

Purchase the full BCG Matrix report to gain a comprehensive understanding of Capstone Infrastructure's market performance and unlock actionable strategies for future success.

Stars

Capstone Infrastructure is making significant strides in British Columbia's burgeoning renewable energy sector. The company has secured three large-scale wind projects, collectively boasting 537 megawatts (MW) of capacity. This expansion into a high-growth market, particularly with Indigenous partners, highlights their strategic positioning for substantial market share in new developments.

These projects are underpinned by long-term, 30-year power purchase agreements (PPAs) with BC Hydro. This ensures predictable and stable revenue streams for Capstone as these wind farms become operational, a crucial factor for long-term financial planning and investor confidence.

The 192 MW Wild Rose 2 wind project in Alberta, Capstone's largest under construction, is slated for completion in 2025. This substantial investment highlights Capstone's commitment to the burgeoning renewable energy sector, solidifying its position as a key player in Canada's wind energy expansion. The project's development signifies strong growth prospects and strategic market penetration.

Capstone Infrastructure is strategically developing a robust pipeline of battery energy storage projects, with a significant emphasis on California. This includes the potential for North America's largest battery storage system, a testament to their ambitious scale.

The battery storage market is booming, with global investment projected to reach hundreds of billions of dollars by 2030. Capstone's early and substantial entry into this rapidly expanding sector, particularly in a key market like California which aims for 100% clean energy by 2045, positions them to capture significant market share.

This development directly supports the accelerating energy transition and addresses the increasing need for grid stability and reliability as renewable energy sources become more prevalent. In 2024, California alone is expected to have over 10 GW of installed battery storage capacity, highlighting the immense market opportunity.

North American Renewable Energy Expansion

Capstone Infrastructure is actively expanding its renewable energy operations into the United States, capitalizing on the robust growth within the North American clean energy sector. This strategic move allows the company to tap into burgeoning demand for sustainable power sources and broaden its market presence. By entering these dynamic U.S. markets, Capstone aims to significantly increase its overall market share within the competitive renewable infrastructure landscape.

The U.S. renewable energy market is experiencing substantial growth, driven by supportive government policies and increasing corporate commitments to sustainability. For instance, in 2023, renewable energy sources accounted for approximately 21% of total U.S. electricity generation, a figure projected to climb higher in the coming years. Capstone's expansion aligns with this trend, positioning it to benefit from continued investment and development in solar, wind, and other clean energy technologies.

- Diversification into U.S. Markets: Capstone is broadening its renewable energy footprint beyond Canada, targeting the high-growth U.S. market.

- Meeting Clean Energy Demand: The expansion is driven by the escalating need for clean energy solutions across North America.

- Market Share Growth: By entering dynamic U.S. regions, Capstone seeks to enhance its overall market share in the renewable infrastructure sector.

- 2023 U.S. Renewable Generation: Renewable sources contributed roughly 21% to U.S. electricity generation in 2023, indicating significant market opportunity.

Acquisition-Led Growth in High-Demand Sectors

Capstone Infrastructure's strategy emphasizes acquisition-led growth, particularly in sectors like renewable energy where demand is robust. This means they actively seek to buy companies or assets that fit into their utility and power generation portfolio, especially those focused on sustainable energy sources. By doing so, Capstone aims to accelerate its expansion and solidify its market position.

This aggressive acquisition strategy allows Capstone to quickly scale up its operations and capture market share in high-growth areas. For instance, in 2024, the renewable energy sector saw significant investment, with global renewable energy capacity additions reaching an estimated 510 GW, a 7% increase from 2023 according to the International Energy Agency (IEA). Capstone's focus on this area positions them to benefit directly from this trend.

By integrating newly acquired, high-potential assets, Capstone can enhance its overall portfolio and capitalize on emerging market opportunities. This approach is crucial for maintaining competitiveness and driving value in the dynamic infrastructure landscape. The company's ability to identify and execute these strategic acquisitions is a key driver of its growth trajectory.

- Acquisition Strategy: Focus on acquiring assets in high-demand sectors like renewable energy within the utility and power generation businesses.

- Market Capitalization: This approach allows for rapid expansion of operational capacity and market share in growing markets.

- Growth Driver: Enables quick capitalization on market opportunities by integrating new, high-potential assets.

- Industry Trend: Aligns with the significant global growth in renewable energy capacity, which saw an estimated 510 GW added in 2024.

Stars in the BCG Matrix represent high-growth, high-market-share businesses. For Capstone Infrastructure, their expansion into the U.S. renewable energy market and their significant battery storage projects in California align with this classification.

The company's substantial investments in wind projects, like the 192 MW Wild Rose 2 in Alberta, and their strategic acquisition-led growth in the booming renewable sector, where global capacity additions reached an estimated 510 GW in 2024, position these ventures as potential Stars.

Their focus on high-growth areas, coupled with securing long-term PPAs, suggests a strong potential for future market leadership and significant revenue generation.

Capstone's ambitious battery storage pipeline, aiming for potentially North America's largest system, further solidifies its position in a rapidly expanding market, driven by the global push for clean energy solutions.

What is included in the product

This BCG Matrix overview analyzes product portfolio positioning, guiding investment and divestment decisions.

The Capstone Infrastructure BCG Matrix provides a clear, one-page overview, relieving the pain of scattered business unit data.

Cash Cows

Capstone's mature Canadian hydroelectric facilities are classic cash cows. These established assets, operating in stable, regulated markets, generate consistent, predictable cash flows with minimal need for new investment beyond routine maintenance. For example, in 2024, Capstone's hydroelectric segment continued to be a bedrock of its financial performance, contributing a substantial portion of its operating income.

Capstone's established wind and solar farms, particularly those with Power Purchase Agreements (PPAs), are prime examples of cash cows. These facilities are in their mature operational stages, meaning they are reliably producing energy and generating consistent revenue. In 2024, for instance, such assets contribute significantly to Capstone's stable cash flow, often boasting high profit margins because the electricity is already sold under long-term contracts.

Capstone's approximately 885 MW portfolio, spread across 35 operating facilities, primarily wind and solar, forms its stable cash cow. This diversification across multiple Canadian provinces underpins a resilient revenue stream.

Utility Businesses

Capstone Infrastructure's utility businesses, such as its water and electricity distribution networks, are classic examples of Cash Cows within the BCG Matrix. These operations benefit from regulated environments that ensure stable, predictable revenue streams and often hold dominant market share within their service territories. While operating in mature, low-growth markets, the essential nature of their services guarantees consistent demand and reliable profitability, making them a bedrock for the company's financial stability.

These utility assets are crucial for generating consistent cash flow, which can then be reinvested into other areas of Capstone's portfolio, like Stars or Question Marks. For instance, in 2024, Capstone's regulated utilities continued to demonstrate resilience. Their performance is often tied to regulatory frameworks that allow for cost recovery and a reasonable rate of return, contributing significantly to the company's overall earnings stability.

- Stable Revenue: Regulated utilities provide predictable income streams essential for covering operational costs and debt obligations.

- High Market Share: Dominant positions in service areas limit competitive pressures and ensure consistent customer bases.

- Low Growth, High Profitability: Mature markets mean slower expansion but established infrastructure allows for efficient, profitable operations.

- Cash Generation: These businesses are the primary source of reliable cash to fund other strategic initiatives or shareholder returns.

Consistent Dividend Payouts

Capstone Infrastructure's consistent declaration of quarterly dividends, including those for preferred shares with rate resets, highlights the robust and dependable cash generation from its mature assets. This stability in shareholder returns is a direct reflection of healthy cash flow from its established operations.

These consistent payouts are a hallmark of businesses with strong cash cow segments, demonstrating a mature and reliable income stream. For instance, in the first quarter of 2024, Capstone Infrastructure reported distributable cash flow of $155.5 million, a significant increase from $134.9 million in the same period of 2023, directly supporting its dividend commitments.

- Consistent Dividend History: Capstone Infrastructure has a track record of regular quarterly dividend payments.

- Preferred Share Payouts: Dividends are also paid on preferred shares, which feature rate resets, indicating structured and predictable outflows.

- Mature Asset Strength: The ability to maintain these payouts points to the strong cash-generating capacity of the company's established infrastructure assets.

- Financial Performance Support: In Q1 2024, distributable cash flow reached $155.5 million, underscoring the financial health supporting these consistent returns.

Capstone Infrastructure's mature hydroelectric and renewable energy assets, particularly those with long-term power purchase agreements, function as its cash cows. These established operations in stable, regulated markets generate reliable, predictable cash flows with minimal capital expenditure beyond maintenance. In 2024, these segments continued to be significant contributors to the company's operating income, demonstrating their role as dependable income generators.

The company's utility businesses, including water and electricity distribution, are also prime examples of cash cows. Operating within regulated frameworks, these essential services ensure consistent demand and profitability, solidifying their position as foundational elements of Capstone's financial stability. Their consistent cash generation allows for reinvestment into growth areas of the portfolio.

Capstone's commitment to consistent dividend payouts, including for preferred shares, directly reflects the robust cash generation from these mature, cash cow assets. The company's Q1 2024 distributable cash flow of $155.5 million, up from $134.9 million in Q1 2023, underscores the financial strength supporting these returns.

| Asset Type | BCG Category | Key Characteristics | 2024 Contribution Indication |

| Hydroelectric Facilities | Cash Cow | Mature, stable regulated markets, predictable cash flows | Substantial operating income contributor |

| Wind & Solar Farms (with PPAs) | Cash Cow | Mature operations, reliable revenue, high profit margins | Significant stable cash flow |

| Utility Businesses (Water, Electricity Distribution) | Cash Cow | Regulated environments, dominant market share, essential services | Bedrock of financial stability |

Preview = Final Product

Capstone Infrastructure BCG Matrix

The Capstone Infrastructure BCG Matrix preview you are viewing is the identical, fully-formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just the complete, analysis-ready BCG Matrix ready for your strategic planning needs.

Dogs

Within Capstone Infrastructure's portfolio, certain older or smaller assets might be classified as dogs. These could be facilities with higher operating expenses or those in mature, slow-growth markets where competition is intensifying. For example, an aging, smaller renewable energy asset with declining efficiency might struggle to compete with newer, more advanced technologies, impacting its profitability.

These dog assets often demand significant maintenance relative to the revenue they generate. Consider a legacy power generation facility that, while still operational, requires substantial capital for upkeep to meet environmental standards or maintain reliability, thereby consuming resources that could be better allocated elsewhere. In 2024, the average age of power generation infrastructure in many developed countries is increasing, leading to higher maintenance costs.

The 156 MW Cardinal Power natural gas facility, while operational, presents a challenge for Capstone Infrastructure's low-carbon future. As the company's largest pollution source, it may be classified as a 'dog' within the BCG matrix due to its environmental impact and the company's strategic shift.

In 2024, the energy sector is increasingly prioritizing decarbonization, which likely limits the long-term growth prospects for natural gas generation. This could mean Cardinal Power ties up capital that might be more effectively invested in renewable energy projects, a key area for future growth and sustainability.

Power generation assets with expiring Power Purchase Agreements (PPAs) or those facing renegotiation under less favorable terms are prime candidates for the dog quadrant in the Capstone Infrastructure BCG Matrix. For instance, a solar farm whose PPA, signed a decade ago at a premium rate, is set to expire in 2025 and is unlikely to be renewed at a comparable price, might see its profitability significantly decline.

Without securing new, attractive contracts, these assets could struggle to maintain their market position, especially in increasingly competitive energy markets where wholesale prices may not cover operational costs. This scenario directly impacts their ability to generate substantial returns, pushing them towards the dog classification due to declining revenue streams and uncertain future cash flows.

Underperforming Smaller Hydro Assets

Underperforming smaller hydro assets, particularly those facing localized environmental issues or aging infrastructure, can land in the dog quadrant of the BCG matrix. These assets, often geographically isolated, might struggle with higher maintenance costs compared to their revenue generation. For instance, in 2024, some smaller hydro facilities in regions experiencing prolonged drought conditions saw output reductions of up to 15%, impacting their profitability.

Their limited scale means they may not contribute significantly to overall growth or profit, especially when factoring in operational complexities. In 2023, the average operating cost per megawatt-hour for smaller hydro plants (under 50 MW) was approximately 10% higher than for larger facilities, reflecting economies of scale challenges.

- Limited Scale: Smaller hydro assets often lack the economies of scale seen in larger power generation facilities.

- Environmental Challenges: Localized environmental regulations or changing weather patterns can disproportionately affect smaller, isolated hydro operations.

- Aging Infrastructure: Older facilities may require substantial capital investment for upgrades, increasing operational expenses.

- Lower Revenue Potential: Reduced water flow or lower electricity prices can significantly impact the revenue streams of these smaller assets.

Non-Core or Divested Businesses

Capstone Infrastructure's non-core or divested businesses are categorized as Dogs in the BCG Matrix. Historically, these have been assets with a low market share and low growth potential, or those that no longer align with the company's core strategic direction. For instance, if Capstone divested a renewable energy project in a region with declining demand, that segment would represent a Dog.

These divested assets often represent units that Capstone has decided to exit to reallocate capital towards more promising ventures. By shedding these underperforming or non-strategic units, the company can improve its overall portfolio efficiency. For example, in 2024, Capstone may have completed the sale of a legacy infrastructure asset that was becoming increasingly costly to maintain and offered limited future growth prospects.

The primary rationale for divesting these Dog businesses is to unlock capital that can be reinvested in Star or Question Mark segments, thereby driving future growth and profitability. This strategic pruning is crucial for maintaining a lean and focused operational structure.

- Divested Assets: Historically, non-core businesses with low market share and low growth.

- Strategic Alignment: Units no longer fitting Capstone's core strategic focus.

- Capital Reallocation: Divestment frees up capital for investment in growth areas.

- Portfolio Efficiency: Shedding underperforming units improves overall company performance.

Assets classified as Dogs within Capstone Infrastructure's portfolio are those with low market share and low growth prospects, often requiring significant investment without commensurate returns. These can include older, less efficient infrastructure or businesses that no longer align with the company's strategic focus on decarbonization and growth. For instance, a legacy power plant with high operational costs and facing stricter environmental regulations might fall into this category.

In 2024, the trend towards renewable energy means that assets heavily reliant on fossil fuels, particularly those with aging infrastructure and limited upgrade potential, are increasingly likely to be categorized as Dogs. These assets may consume disproportionate capital for maintenance and compliance, diverting resources from more promising investments. The average age of critical infrastructure globally is rising, exacerbating these challenges.

Divesting these Dog assets is a key strategy for Capstone to unlock capital and improve portfolio efficiency. By selling off underperforming or non-strategic units, the company can reinvest in its Star and Question Mark segments, which are poised for future growth. This pruning process is vital for maintaining a competitive edge and focusing on sustainable, high-return opportunities.

For example, a smaller, older hydroelectric facility facing reduced water availability due to climate change and high maintenance costs could be a Dog. In 2023, some smaller hydro plants experienced output reductions of up to 15% due to drought, impacting their profitability and making them candidates for divestment or restructuring.

Question Marks

Capstone's early-stage battery storage projects in the U.S., particularly in California, are a classic question mark on the BCG matrix. These large-scale systems are in the development phase, meaning they require significant capital infusion before they can even begin to generate revenue. For instance, the U.S. energy storage market saw over $6 billion invested in 2023, highlighting the substantial upfront costs involved.

While the U.S. battery storage market is projected for rapid expansion, with forecasts suggesting it could reach over $100 billion by 2030, Capstone's projects are still navigating the complexities of permitting, grid interconnection, and securing offtake agreements. This development stage means they haven't yet demonstrated consistent market share or proven their long-term profitability, making their future trajectory uncertain.

These nascent projects are essentially bets on future market dominance. They need to successfully transition from development to operational status, proving their economic viability and competitive edge to climb the BCG matrix towards becoming Stars. The success hinges on Capstone's ability to manage development risks and capitalize on the growing demand for grid-scale energy storage solutions.

Capstone Infrastructure's ventures into new technology integration, such as pilot projects for advanced battery storage or emerging offshore wind technologies, fall into the question mark category of the BCG matrix. These represent investments in high-growth potential areas but currently hold a low market share. For instance, the global energy storage market, including batteries, was projected to reach over $100 billion by 2025, indicating a significant growth trajectory that Capstone aims to tap into.

These initiatives demand substantial capital expenditure for research, development, and initial deployment. While the market for innovative grid solutions and renewable integration is expanding rapidly, Capstone's current position within these nascent segments is small. Success hinges on scaling these technologies effectively and achieving cost efficiencies to compete, much like how solar power has evolved from a question mark to a star in recent years.

Capstone Infrastructure's development pipeline boasts over 2,000 MW across wind, solar, and battery storage. Projects in this pipeline that haven't yet received formal approval or secured long-term power purchase agreements are categorized as question marks. These assets represent opportunities for significant future growth but also come with considerable development risks and necessitate substantial capital investment to progress.

Initial Forays into New Geographic Markets

Capstone Infrastructure's expansion into new U.S. geographic sub-markets, even within its broader North American focus, represents a classic question mark scenario in the BCG matrix. These ventures demand substantial initial capital to build brand recognition and operational infrastructure, with the potential for high future growth but currently low market share. For instance, entering a state where Capstone has minimal existing operations requires significant investment in new facilities and marketing, similar to how renewable energy projects often face high upfront costs before generating consistent returns.

The uncertainty surrounding immediate market share acquisition is a key characteristic. Capstone must invest heavily in marketing and sales to penetrate these new territories, facing established competitors. For example, in 2024, infrastructure development in emerging markets often sees companies spending upwards of 15-20% of projected revenue on market entry and brand building activities to gain initial traction.

These question mark investments are crucial for long-term diversification and growth, but they carry inherent risks. Capstone needs to carefully monitor key performance indicators in these nascent markets, such as customer acquisition cost and early adoption rates. A successful transition from question mark to star depends on Capstone's ability to effectively execute its market entry strategy and adapt to local conditions.

- High Upfront Investment: Entering new U.S. sub-markets requires significant capital for infrastructure and market presence.

- Low Initial Market Share: Capstone faces the challenge of gaining traction against established competitors in these new territories.

- Uncertainty of Success: The potential for high future growth is present, but immediate market share and profitability are not guaranteed.

- Strategic Importance: These question marks are vital for Capstone's long-term diversification and overall portfolio growth.

Partnerships for Future Growth

Partnerships for future growth, particularly those focused on developing new renewable energy projects, are categorized as question marks within the Capstone Infrastructure BCG Matrix. These ventures, like the collaboration with Eurowind Energy targeting over 1GW of projects in California, represent a strategic push into high-growth areas.

The success of these partnerships hinges on their early-stage execution and ability to convert potential into tangible market share and robust financial returns.

- Joint Ventures for Renewable Expansion: Partnerships with entities like Eurowind Energy are designed to tap into the burgeoning renewable energy sector, aiming for significant capacity additions.

- Early-Stage Investment: These collaborations are in their nascent phases, requiring substantial investment and strategic oversight to navigate market entry and project development.

- High Growth Potential: The objective is to capitalize on the demand for clean energy, positioning Capstone Infrastructure for substantial future growth in new geographical or technological markets.

- Execution Risk: The ultimate success and transition from question mark to a star or cash cow depend critically on the effective management and completion of these ambitious projects.

Capstone Infrastructure's early-stage battery storage projects in the U.S. are prime examples of question marks on the BCG matrix. These projects demand significant capital for development, with the U.S. energy storage market attracting over $6 billion in investment in 2023 alone. While the market is poised for substantial growth, reaching projected figures over $100 billion by 2030, these nascent projects face hurdles like permitting and grid interconnection, making their future market share and profitability uncertain.

These ventures represent bets on future market dominance, requiring successful navigation from development to operational status to prove economic viability. The success of these question marks hinges on Capstone's ability to manage development risks and capitalize on the increasing demand for grid-scale energy storage.

Capstone's pilot projects for advanced battery storage or offshore wind technologies also fall into the question mark category. These initiatives require substantial capital for R&D and initial deployment, aiming to tap into a global energy storage market projected to exceed $100 billion by 2025. The challenge lies in scaling these technologies and achieving cost efficiencies to compete effectively.

Capstone's development pipeline, including over 2,000 MW across wind, solar, and battery storage, contains question marks for projects awaiting formal approval or power purchase agreements. These assets offer significant future growth potential but carry considerable development risks and necessitate substantial capital investment to advance.

Capstone's expansion into new U.S. sub-markets represents a classic question mark scenario, demanding significant initial capital for infrastructure and market presence. While these ventures offer high future growth potential, they currently have low market share, with companies in emerging markets often allocating 15-20% of projected revenue to market entry in 2024.

Partnerships for new renewable energy projects, such as the collaboration with Eurowind Energy for over 1GW in California, are also question marks. These early-stage collaborations require substantial investment and strategic oversight to convert potential into tangible market share and financial returns in the burgeoning clean energy sector.

| Category | Description | Capital Requirement | Market Share | Growth Potential | Key Challenge |

|---|---|---|---|---|---|

| Question Mark | Early-stage battery storage projects, new technology pilots, unapproved pipeline projects, new geographic sub-markets, strategic partnerships. | High Upfront Investment | Low Initial | High Future | Uncertainty of Success, Execution Risk |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.