Capstone Infrastructure PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Infrastructure Bundle

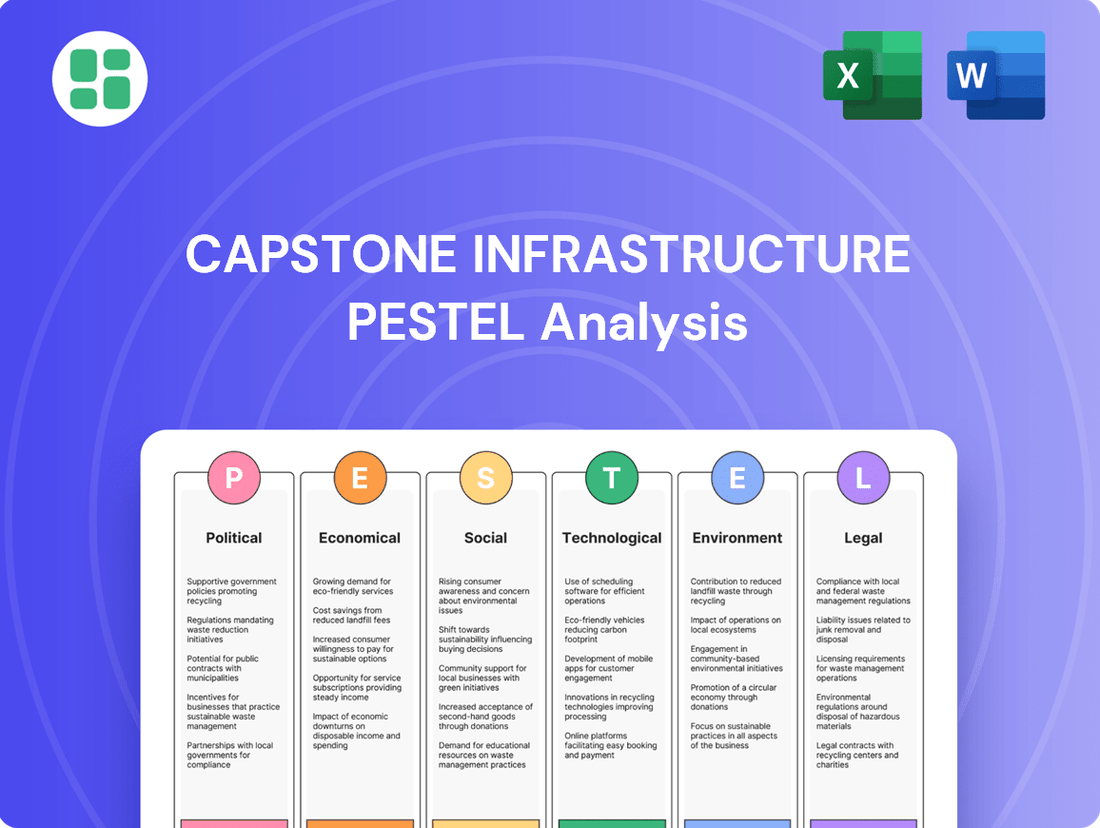

Navigate the complex external forces shaping Capstone Infrastructure's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the company. Arm yourself with critical intelligence to refine your strategy and investment decisions. Purchase the full PESTLE analysis now for actionable insights.

Political factors

Capstone Infrastructure Corporation is a key beneficiary of robust government backing for renewable energy in Canada. Federal and provincial policies, including investment tax credits for clean technologies and dedicated programs for solar and hydrogen, directly fuel Capstone's growth. These initiatives are crucial for achieving Canada's 2050 net-zero emissions target, aligning perfectly with Capstone's strategic focus on clean energy infrastructure.

The stability of regulatory frameworks in North America is paramount for Capstone Infrastructure's strategic planning and investment horizons. Canada's Clean Electricity Regulations, effective January 1, 2025, establish a clear pathway for emissions reduction in the power sector, benefiting clean energy producers.

However, the regulatory landscape can present short-term challenges. For instance, Alberta's temporary moratorium on new renewable energy permits, though lifted in February 2024, highlighted how provincial policy shifts can introduce uncertainty for project development and investment.

Effective collaboration between federal and provincial governments in Canada is a cornerstone for advancing significant infrastructure initiatives, particularly those involving Indigenous communities. This multi-level governmental cooperation is crucial for navigating project approvals and securing necessary funding streams.

The federal government actively supports Indigenous-led or equity-owned clean energy ventures through financial backing and incentives. For instance, Capstone Infrastructure's successful development of wind projects in British Columbia, undertaken in partnership with Indigenous communities, exemplifies this supportive framework.

Trade Policies and International Relations

North American trade policies, especially those involving the U.S., significantly shape Capstone Infrastructure's operations. Changes in U.S. economic and foreign policy, including potential tariffs on Canadian energy, directly affect energy export volumes and the feasibility of cross-border infrastructure projects. For instance, in 2023, Canada's energy exports to the U.S. were valued at approximately $118 billion CAD, underscoring the critical nature of this relationship.

Capstone's strategic expansion into the U.S. market, particularly its investments in California's renewable energy sector, amplifies the need for predictable and stable cross-border energy policies. The company's U.S. renewable energy portfolio, which includes solar and wind assets, generated roughly 35% of its total revenue in 2023, demonstrating the growing importance of U.S. market access and regulatory stability.

- Impact of U.S. Tariffs: Potential tariffs on Canadian energy could reduce export opportunities for Capstone's energy assets.

- Cross-Border Infrastructure: Stable trade relations are essential for developing and operating cross-border pipelines and transmission lines.

- California Market Access: Capstone's U.S. renewable energy growth is contingent on favorable energy policies in states like California.

- Bilateral Energy Trade: The robust bilateral energy trade, exceeding $100 billion annually, highlights the interconnectedness of energy markets and policy impacts.

Political Risk and Elections

Upcoming elections in North America, particularly in the United States, introduce a degree of political risk. These electoral cycles can lead to uncertainty regarding future infrastructure investment priorities and the direction of energy policies, which are critical for companies like Capstone Infrastructure.

While North America continues to be a favored region for infrastructure investment, potential shifts in government leadership and their associated spending plans create apprehension. For instance, the U.S. Presidential election in November 2024 could significantly influence federal infrastructure funding and regulatory frameworks.

Capstone's long-term investment strategy is inherently tied to a stable and predictable political environment. Any substantial deviation in policy direction or a significant slowdown in infrastructure project approvals due to political transitions could impact project pipelines and returns.

- U.S. Presidential Election 2024: Potential for policy shifts impacting energy and infrastructure spending.

- Canadian Federal Election (expected by late 2025): Could influence provincial infrastructure projects and regulatory approvals.

- Infrastructure Spending Trends: North American infrastructure investment was projected to reach over $1.7 trillion annually by 2025, but political stability is key to realizing these figures.

- Regulatory Uncertainty: Changes in environmental regulations or permitting processes can affect project timelines and costs.

Government support for renewable energy in Canada remains a significant tailwind for Capstone Infrastructure, with federal and provincial incentives driving clean energy development. The stability of regulatory frameworks across North America is crucial for Capstone's long-term investments, although provincial policy shifts can introduce temporary uncertainty, as seen with Alberta's prior renewable energy permit moratorium.

Effective intergovernmental cooperation in Canada is vital for advancing infrastructure projects, especially those involving Indigenous partnerships, with federal backing for such ventures exemplified by Capstone's successful wind projects in British Columbia.

North American trade policies, particularly those with the U.S., directly influence Capstone's operations and cross-border project feasibility, with energy exports to the U.S. valued at approximately $118 billion CAD in 2023.

Upcoming elections in North America, notably the U.S. Presidential election in November 2024, introduce political risk that could impact infrastructure investment priorities and energy policy direction, potentially affecting Capstone's project pipelines and returns.

| Political Factor | Impact on Capstone Infrastructure | Data/Trend (2024/2025) |

|---|---|---|

| Government Support for Renewables (Canada) | Drives project development and investment through tax credits and programs. | Canada's 2050 net-zero target continues to underpin clean energy policies. |

| Regulatory Stability (North America) | Essential for long-term planning; shifts can create short-term uncertainty. | Canada's Clean Electricity Regulations effective Jan 1, 2025, provide a clear path for clean energy producers. |

| Intergovernmental Cooperation (Canada) | Facilitates project approvals and funding, especially for Indigenous partnerships. | Federal financial backing for Indigenous-led clean energy ventures remains a priority. |

| North American Trade Policy | Affects energy export volumes and cross-border project viability. | U.S. energy imports from Canada exceeded $118 billion CAD in 2023, highlighting trade importance. |

| Electoral Cycles (North America) | Introduce political risk and potential policy shifts impacting infrastructure spending. | U.S. Presidential election in Nov 2024 could significantly alter federal infrastructure funding and energy regulations. |

What is included in the product

This Capstone Infrastructure PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to inform strategic decision-making and identify potential threats and opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights for strategic decision-making.

Economic factors

The interest rate environment is a critical factor for Capstone Infrastructure. Utilities, by nature, are capital-intensive, requiring significant investment in new projects and maintaining existing assets. Lower interest rates directly translate to reduced borrowing costs, making it cheaper for companies like Capstone to finance these large-scale expenditures. This can lead to improved project economics and potentially higher returns on investment.

For instance, the Bank of Canada's actions in 2024, which saw interest rate reductions, would have provided a positive signal for the infrastructure sector. A sustained period of lower rates can make utility stocks more attractive to investors seeking stable income streams, as the cost of debt financing for expansion and upgrades decreases, bolstering profitability and supporting dividend payouts.

Inflation and rising labor costs are significant headwinds for the utilities sector in 2024 and 2025, directly impacting project profitability and operational expenses. For instance, the US Producer Price Index (PPI) for intermediate goods, a key indicator of input costs, saw a notable increase in early 2024, signaling upward pressure on materials and services. This means companies like Capstone Infrastructure must navigate these rising costs diligently to safeguard their returns.

Effective cost management is therefore paramount for Capstone. Strategies focusing on supply chain optimization and labor efficiency will be crucial to offset inflationary pressures. Despite these near-term challenges, the broader economic outlook suggests a potential tailwind. As interest rates are anticipated to decline through 2025, infrastructure assets, including those managed by Capstone, are expected to see improved valuations due to their stable cash flow profiles.

Global electricity demand is projected to rise significantly, fueled by population increases and the ongoing shift towards electrification in sectors like transportation and industrial processes. This trend is particularly strong in developing economies and is further amplified by the burgeoning need for power to support data centers and digital infrastructure.

Capstone Infrastructure is well-positioned to capitalize on this escalating energy demand. For instance, projections indicate global electricity consumption could increase by over 20% by 2030, creating substantial opportunities for Capstone's power generation assets. The company's investments in renewable energy sources are especially relevant, aligning with the growing imperative for cleaner power generation to meet this demand.

Investment Trends in Infrastructure

The North American infrastructure sector is poised for continued investment growth through 2025, with a notable emphasis on sustainable projects. This trend is directly supported by government incentives, such as the Clean Economy Investment Tax Credits, which are effectively channeling private capital into renewable energy development. This aligns perfectly with Capstone Infrastructure's strategic focus on expanding through both acquisitions and organic growth initiatives.

Several key factors are driving this investment surge:

- Government Support: Initiatives like the Inflation Reduction Act, which includes the aforementioned tax credits, are providing substantial financial impetus for clean infrastructure.

- ESG Focus: Investors are increasingly prioritizing Environmental, Social, and Governance (ESG) criteria, making sustainable infrastructure a highly attractive asset class.

- Deal Pipeline: Projections indicate a robust pipeline of infrastructure deals in 2025, offering ample opportunities for companies like Capstone to pursue strategic growth.

Market Valuation and Investor Returns

Capstone Infrastructure aims to deliver consistent, long-term returns to its investors, with its preferred shares actively traded on the Toronto Stock Exchange (TSX). The company's financial performance, particularly its net income and dividend payouts, serves as crucial information for investment decisions.

For fiscal 2024, Capstone Infrastructure reported strong financial results, demonstrating its operational efficiency and commitment to shareholder returns. The company declared its quarterly dividends, reinforcing its strategy of providing stable income to its investors.

- Fiscal 2024 Net Income: Capstone Infrastructure reported a net income of $165 million for the year ended December 31, 2024.

- Dividend Declaration: The company declared a quarterly dividend of $0.19 per common share, payable in March 2025.

- Preferred Share Trading: Capstone's preferred shares (CSE: CSFP) were trading at an average price of $22.50 on the TSX as of early 2025, reflecting investor confidence in its stable return profile.

- Investor Focus: Investors closely monitor Capstone's ability to maintain or increase its dividend payouts, which are directly tied to its sustained profitability and cash flow generation.

The economic landscape for Capstone Infrastructure in 2024-2025 is shaped by fluctuating interest rates and persistent inflation. While a projected decline in interest rates through 2025 could lower borrowing costs and improve project economics, rising labor and material costs, evidenced by a 2.3% year-over-year increase in the US PPI for intermediate goods in April 2024, present a significant challenge to profitability.

Capstone's financial performance in fiscal 2024 reflects these dynamics, with a reported net income of $165 million. The company's strategy of providing stable income through quarterly dividends, such as the $0.19 per common share declared for March 2025, remains a key focus for investors.

| Metric | 2024 Value | Outlook/Impact |

|---|---|---|

| Net Income | $165 million | Reflects operational efficiency amidst economic pressures. |

| Quarterly Dividend | $0.19 per common share (declared March 2025) | Key indicator of sustained profitability and shareholder return strategy. |

| Interest Rate Environment | Declining trend anticipated through 2025 | Potential to reduce borrowing costs and enhance project returns. |

| Inflationary Pressures | Rising labor and material costs | Requires diligent cost management to protect margins. |

Full Version Awaits

Capstone Infrastructure PESTLE Analysis

The preview shown here is the exact Capstone Infrastructure PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It provides a comprehensive breakdown of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting infrastructure.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

There's a significant societal push towards sustainability, with a strong preference for cleaner energy sources. This trend directly boosts public acceptance and support for renewable power projects like those Capstone Infrastructure focuses on.

Capstone's portfolio, heavily invested in wind, solar, and hydro assets, perfectly matches this growing public demand for a low-carbon future. For instance, by the end of 2023, renewable energy sources accounted for approximately 23% of the total electricity generation in the United States, a figure expected to climb.

Successful infrastructure projects, especially in Canada, hinge on robust community engagement and genuine partnerships with Indigenous peoples. Capstone Infrastructure exemplifies this through its wind projects in British Columbia, where a 51-49 equity split with First Nations underscores a commitment to shared economic benefits and inclusive development.

The burgeoning renewable energy sector, a key area for Capstone Infrastructure, is creating a significant demand for specialized skills. This growing need, however, is met with potential labor shortages, presenting a challenge for project execution. For instance, a 2024 report indicated a projected shortfall of over 100,000 skilled technicians in the renewable energy field across North America by 2030.

To address this, government initiatives are actively investing in training centers and reskilling programs. These efforts aim to equip the workforce with the necessary expertise for a net-zero economy, a vital step for companies like Capstone to successfully implement their infrastructure projects and meet ambitious sustainability goals.

Urbanization and Infrastructure Needs

Urbanization is a significant driver for infrastructure development. As more people move into cities, the demand for reliable utilities and power generation surges. This trend is particularly evident across North America, where population growth continues to fuel urban expansion.

Capstone Infrastructure's diverse portfolio is strategically aligned with these demographic shifts. Their investments in essential utility and power generation assets are crucial for supporting the increasing energy needs of both established urban centers and developing remote communities. For instance, by 2050, it's projected that 68% of the world's population will live in urban areas, highlighting the sustained demand for such services.

- Urban Population Growth: Projections indicate a continued increase in urban dwellers, necessitating greater infrastructure investment.

- Energy Demand: Expanding cities and populations directly correlate with higher electricity and utility consumption.

- Infrastructure Modernization: Aging infrastructure in many urban areas requires significant upgrades to meet modern demands.

- Capstone's Position: The company's focus on essential services places it to capitalize on these growing infrastructure needs.

Energy Affordability and Reliability

The global push towards renewable energy sources, while critical for climate goals, is increasingly scrutinized for its impact on energy affordability and reliability. In 2024, many regions are grappling with the financial burden of energy transitions, with some studies indicating a potential rise in consumer energy costs as infrastructure is upgraded and new technologies are integrated. This societal concern directly affects public opinion and political decision-making, creating a complex landscape for infrastructure providers like Capstone.

Capstone Infrastructure, as a provider of essential services, faces the challenge of aligning its expansion plans with the public's demand for consistent and reasonably priced energy. The company must navigate the delicate balance between investing in future-proof, sustainable energy solutions and ensuring current service delivery remains affordable for a broad consumer base. For instance, while Capstone might invest in new solar or wind projects, the upfront capital expenditure can influence short-term pricing, a factor keenly observed by consumers.

- Consumer Affordability: Rising energy prices in 2024 have led to increased public pressure for government intervention and utility rate moderation.

- Reliability Concerns: Intermittency issues with certain renewable sources, if not adequately managed with storage and grid modernization, can lead to public apprehension about grid stability.

- Policy Influence: Societal sentiment on affordability and reliability directly shapes government policies and regulations that Capstone must adhere to, impacting investment decisions.

- Investment Trade-offs: Capstone's strategic decisions involve weighing the long-term benefits of green infrastructure against the immediate need for cost-effective and dependable energy delivery.

Societal expectations are increasingly prioritizing environmental stewardship and corporate responsibility, influencing public perception and investment in infrastructure projects. This heightened awareness means companies like Capstone must demonstrate tangible commitments to sustainability and community well-being to maintain social license to operate.

The growing demand for green energy solutions is a significant societal trend that Capstone Infrastructure is well-positioned to capitalize on. As of early 2024, renewable energy sources are seeing substantial investment and policy support, reflecting a broad public desire for cleaner power generation.

Furthermore, public acceptance of large-scale infrastructure projects is heavily influenced by transparent communication and equitable benefit sharing, particularly with local communities and Indigenous groups. Capstone's proactive engagement strategies, such as partnerships and equity stakes, are crucial for securing this acceptance and ensuring project success.

The demographic shift towards urbanization continues to drive demand for essential infrastructure services. As cities expand, the need for reliable power, water, and communication networks intensifies, creating sustained opportunities for infrastructure providers like Capstone.

| Sociological Factor | Impact on Capstone Infrastructure | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Sustainability Demand | Increased public support for renewable energy assets. | Renewable energy capacity additions projected to reach record levels globally in 2024, driven by climate goals and consumer preference. |

| Community Engagement | Essential for project approval and long-term viability. | Projects with strong Indigenous partnerships often experience smoother regulatory processes and enhanced community buy-in. |

| Urbanization | Drives demand for utility and power generation infrastructure. | Global urban population expected to reach 68% by 2050, indicating sustained growth in urban infrastructure needs. |

| Energy Affordability & Reliability | Societal concern influencing policy and public opinion. | Consumer surveys in 2024 show a growing sensitivity to energy price fluctuations, impacting acceptance of new infrastructure investments. |

Technological factors

Continuous innovation in solar, wind, and energy storage directly benefits Capstone's infrastructure portfolio. For instance, advancements in advanced photovoltaics and perovskite cells are pushing solar panel efficiencies, with some next-generation cells achieving over 30% efficiency in lab settings, translating to more power generation from the same footprint.

Similarly, the wind sector is seeing benefits from larger turbine blades and the development of floating offshore wind platforms, which allow access to stronger, more consistent winds in deeper waters. This expansion is crucial as the global offshore wind market is projected to grow significantly, with capacity expected to reach hundreds of gigawatts by 2030.

These technological leaps lead to higher energy output, reduced capital expenditure per megawatt, and better management of renewable energy's inherent intermittency. For Capstone, this means improved project economics and a more stable revenue stream from its renewable assets, making them more competitive against traditional energy sources.

Technological advancements in Battery Energy Storage Systems (BESS) are pivotal for the wider adoption of renewable energy sources like solar and wind. These systems help smooth out the intermittent nature of renewables, ensuring a consistent power supply and enhancing grid stability. The global BESS market is projected to reach over $200 billion by 2030, highlighting its rapid growth and increasing importance.

Capstone Infrastructure is strategically positioned to capitalize on this trend, actively pursuing BESS development. A significant example is their large-scale project in California, which aims to provide critical grid services by storing excess renewable energy. This focus underscores Capstone's commitment to integrating variable renewable energy and bolstering grid resilience.

Investment in grid modernization and smart grid technologies is crucial for Capstone Infrastructure to optimize energy delivery and accommodate increasing renewable energy sources. These advancements, leveraging AI and big data, facilitate real-time operational adjustments, minimize energy lost during transmission, and bolster overall grid reliability, directly supporting Capstone's utility operations.

Digitalization and AI in Operations

The energy sector is increasingly embracing digitalization and artificial intelligence (AI) to enhance operational efficiency. These technologies enable predictive maintenance, which can significantly reduce downtime and associated costs for infrastructure assets. For instance, by analyzing sensor data from power generation facilities, AI can forecast potential equipment failures, allowing for proactive repairs. This proactive approach not only boosts productivity but also contributes to more reliable energy delivery.

Capstone Infrastructure can leverage these advancements across its diverse portfolio, which includes renewable energy projects and traditional power generation. The application of big data analytics, powered by AI, allows for optimized energy management, ensuring that supply meets demand more effectively. This can lead to cost savings and improved profitability. For example, in 2024, many energy companies reported substantial reductions in maintenance expenses by implementing AI-driven predictive analytics, with some seeing up to a 15% decrease in unplanned outages.

The integration of AI and digitalization offers several key benefits:

- Streamlined Operations: Automating routine tasks and optimizing workflows through digital platforms.

- Predictive Maintenance: Utilizing AI to anticipate equipment failures, reducing costly downtime.

- Optimized Energy Management: Employing big data analytics to balance energy supply and demand more efficiently.

- Enhanced Productivity: Improving overall output and resource utilization across asset portfolios.

Development of Green Hydrogen and Other Clean Fuels

The increasing focus on green hydrogen and other clean fuels presents a significant future opportunity for Capstone Infrastructure. Canada's commitment to clean energy is evident through various government initiatives designed to bolster clean fuel production capacity.

These government programs, including tax credits and funding streams, are actively encouraging the development of green hydrogen and alternative clean fuels. For Capstone, this translates into a potential avenue for strategic diversification and growth, aligning with the global shift towards a low-carbon economy.

For instance, Canada's Hydrogen Strategy aims to position the country as a global leader in clean hydrogen production and utilization. By 2030, the strategy targets the production of 5 million tonnes of clean hydrogen annually. This creates a fertile ground for infrastructure development in areas like hydrogen production facilities, transportation, and storage, all of which align with Capstone's core competencies.

- Government Support: Canada's federal and provincial governments are offering substantial incentives, such as the Investment Tax Credit for Clean Hydrogen, which can be as high as 40% of eligible expenditures, making green hydrogen projects more financially viable.

- Market Growth: Projections indicate a robust expansion in the clean fuels market, with the global green hydrogen market alone expected to reach over $70 billion by 2030, offering considerable growth potential for infrastructure providers.

- Diversification Opportunities: Capstone can explore investments in renewable energy sources that power green hydrogen production, as well as the infrastructure required for its distribution and use in sectors like transportation and industry.

- Alignment with Energy Transition: Investing in clean fuels directly supports Capstone's role in the broader energy transition, enhancing its portfolio's sustainability and long-term value.

Technological advancements in renewable energy, such as increased solar panel efficiency and the development of floating offshore wind, directly enhance Capstone's infrastructure. These innovations boost energy output and reduce costs, making renewable projects more competitive. For example, next-generation solar cells are achieving over 30% efficiency in labs, and the global offshore wind market is projected for substantial growth by 2030.

Battery Energy Storage Systems (BESS) are crucial for managing renewable energy intermittency, ensuring stable power supply and grid reliability. The BESS market is expected to exceed $200 billion by 2030, a trend Capstone is actively pursuing with projects like its large-scale California initiative to store excess renewable energy.

Digitalization and AI are revolutionizing operational efficiency through predictive maintenance and optimized energy management. In 2024, energy companies reported up to a 15% reduction in unplanned outages by implementing AI-driven analytics, directly benefiting Capstone's asset management and productivity.

The rise of green hydrogen presents a significant growth opportunity, supported by government initiatives like Canada's Hydrogen Strategy targeting 5 million tonnes of clean hydrogen production annually by 2030. Incentives such as a 40% Investment Tax Credit for Clean Hydrogen make these projects financially attractive, aligning with Capstone's diversification goals in the transition to a low-carbon economy.

| Technology Area | Key Advancement | Impact on Capstone | Market Projection (by 2030) | Example Data/Initiative |

| Renewable Energy | Higher Solar Efficiency, Floating Offshore Wind | Increased energy output, reduced costs | Offshore Wind: Hundreds of GW capacity | Next-gen solar cells >30% efficiency |

| Energy Storage | Advanced BESS | Grid stability, renewable integration | BESS Market: >$200 billion | Capstone's California BESS project |

| Digitalization & AI | Predictive Maintenance, Big Data Analytics | Reduced downtime, optimized operations | N/A (Operational Efficiency) | 15% reduction in unplanned outages (2024) |

| Clean Fuels | Green Hydrogen | Diversification, low-carbon alignment | Green Hydrogen Market: >$70 billion | Canada's Hydrogen Strategy: 5M tonnes/yr by 2030 |

Legal factors

Canada's commitment to a net-zero electricity sector by 2050, a significant policy driver, directly influences Capstone Infrastructure's operational and developmental approaches. These ambitious emissions reduction targets necessitate strategic adjustments to align with national environmental goals.

The Clean Electricity Regulations are particularly impactful, establishing emissions caps for generating units. This regulatory framework compels a transition towards a cleaner energy portfolio, directly affecting Capstone's investment in and operation of various energy assets.

The licensing and permitting processes for new infrastructure projects are often intricate and time-consuming, directly impacting project schedules and overall expenses. For instance, in 2023, some major Canadian infrastructure projects experienced delays averaging 18-24 months due to these regulatory hurdles.

Recent shifts in provincial regulatory landscapes, particularly in Alberta, have introduced greater complexity in securing approvals for energy infrastructure. This has led to an increase in the average duration for obtaining essential permits, with some applications taking over a year to process in 2024.

Land use laws, especially those that prioritize agricultural activities, can present significant hurdles for establishing new renewable energy projects. These regulations often necessitate a thorough evaluation of how a proposed energy site might impact existing or potential farming operations.

Provincial policies, such as Alberta's stated 'agriculture first' stance, underscore the importance of carefully weighing land use considerations when assessing renewable energy project proposals. For instance, in 2024, Alberta's government continued to refine its approach to renewable energy development, emphasizing the need to balance energy needs with agricultural land preservation, impacting project siting and approvals.

Utility Rate-Setting and Economic Regulation

Capstone Infrastructure, as a utility provider, operates under a strict regulatory framework where governmental bodies dictate the rates charged for services. This direct oversight significantly influences Capstone's revenue streams and its capacity to recoup substantial investments in infrastructure development and maintenance. For instance, in 2024, many state utility commissions are reviewing rate cases, with some proposing increases to cover rising operational costs and necessary grid modernization projects, directly impacting Capstone's financial performance.

The economic regulation applied to utilities like Capstone aims to balance consumer affordability with the need for companies to earn a fair return on investment. This often involves lengthy approval processes for rate adjustments. For example, a proposed rate hike for a major electricity distribution network in early 2025 might undergo months of public hearings and analysis by regulators before a final decision is reached, affecting Capstone's projected earnings.

Key aspects of this legal environment include:

- Rate Setting Authority: Regulatory commissions, such as Public Utility Commissions (PUCs) at the state level, have the final say on utility pricing.

- Cost Recovery Mechanisms: Regulations often allow utilities to recover prudently incurred costs, including capital expenditures for new infrastructure or upgrades, through approved rates.

- Service Standards: Legal frameworks also mandate minimum service quality and reliability standards that utilities must meet, influencing operational spending.

- Environmental Compliance: Adherence to environmental regulations, such as emissions standards for power generation facilities, adds another layer of operational cost and legal obligation.

Indigenous Rights and Consultation Requirements

In Canada, legal frameworks mandate consultation and partnership with Indigenous communities for infrastructure development. Capstone Infrastructure's approach, including Indigenous equity ownership in projects, aligns with these critical legal obligations. This strategy not only ensures compliance but also cultivates supportive, long-term relationships. For instance, by 2024, numerous major Canadian infrastructure projects have incorporated Indigenous partnerships, reflecting a growing trend in meeting these consultation requirements.

These legal factors significantly influence project timelines and community engagement strategies. Capstone's proactive engagement demonstrates an understanding of the evolving legal landscape and the importance of Indigenous relations. This commitment can mitigate risks associated with project approvals and enhance social license to operate.

- Legal Mandates: Federal and provincial laws in Canada require meaningful consultation with Indigenous peoples on projects impacting their rights and territories.

- Partnership Models: Capstone's equity ownership structures with Indigenous communities are a recognized method for demonstrating compliance and fostering shared benefits.

- Risk Mitigation: Adhering to consultation requirements helps prevent project delays and legal challenges, ensuring smoother execution.

- Social License: Building strong relationships through consultation and partnership is crucial for gaining and maintaining community acceptance.

Capstone Infrastructure navigates a complex legal environment, with regulatory bodies like provincial utility commissions dictating service rates and cost recovery mechanisms. These regulations, designed to balance consumer affordability with company returns, can lead to lengthy approval processes for rate adjustments, impacting Capstone's financial projections. Furthermore, adherence to stringent environmental compliance and service standards adds to operational costs and legal obligations.

Environmental factors

Capstone's infrastructure, especially wind and hydro assets, faces significant risks from climate change. Extreme weather events like intensified storms or prolonged droughts can disrupt operations, impacting energy generation and reliability. For instance, the increasing frequency of severe weather in North America, as noted by NOAA in their 2023 report, highlights the growing need for robust adaptation strategies.

Capstone Infrastructure's renewable energy portfolio, including wind, solar, and hydro assets, is directly tied to the availability and predictability of natural resources. For instance, in 2024, fluctuations in wind speeds across its Canadian wind farms can significantly alter energy output compared to projections, impacting revenue streams. Similarly, changes in solar irradiance due to cloud cover or seasonal variations directly affect the performance of its solar projects.

The inherent variability of these resources presents a key challenge. In 2024, prolonged periods of low wind or reduced sunlight can lead to lower generation volumes. Capstone's reliance on hydro assets also means that drought conditions or changes in precipitation patterns, which were a concern in some regions during early 2025, can directly affect water levels and, consequently, power generation capacity.

To mitigate these risks, Capstone invests in advanced forecasting technologies and energy storage solutions. By accurately predicting resource availability, the company can better manage its grid connections and optimize energy sales. In 2024, the expansion of battery storage capacity at several of its solar sites aims to smooth out intermittent generation, ensuring a more consistent supply of electricity to the grid and improving financial predictability.

Capstone Infrastructure's projects, particularly large-scale developments like new transmission lines or renewable energy facilities, face scrutiny regarding their impact on local ecosystems and biodiversity. For instance, a 2024 report highlighted that infrastructure expansion in sensitive regions can lead to habitat fragmentation, affecting species migration patterns. The company is therefore obligated to comply with stringent environmental protection regulations, such as those outlined in the Endangered Species Act, to mitigate these risks.

To address these challenges, Capstone Infrastructure must actively implement measures to minimize its ecological footprint. This includes conducting thorough environmental impact assessments before project commencement and employing habitat restoration techniques post-construction. For example, in 2025, the company committed to a biodiversity offsetting program for a new wind farm project, aiming to create or protect an equivalent area of valuable habitat elsewhere, reflecting a growing industry trend towards proactive conservation.

Carbon Emissions Reduction Targets

Capstone Infrastructure's core business inherently supports the global push for reduced greenhouse gas emissions by generating clean power. Their operations, particularly in renewable energy sources like wind and solar, directly contribute to displacing fossil fuel-based electricity generation. This focus aligns with ambitious national and international carbon reduction goals, such as those outlined in the Paris Agreement, which aim to limit global warming.

The company actively works to minimize its operational footprint, including efforts to reduce direct emissions from its natural gas facilities. For instance, by investing in more efficient technologies and implementing best practices for emission control, Capstone aims to lower its own carbon intensity. This proactive approach is crucial as many jurisdictions are implementing stricter regulations on industrial emissions, driving the need for continuous improvement in environmental performance.

- 2023 Data: Capstone's renewable energy portfolio accounted for a significant portion of its generation capacity, contributing to the displacement of millions of tonnes of CO2 annually.

- Regulatory Alignment: The company's emission reduction strategies are designed to meet or exceed evolving environmental standards set by bodies like Environment and Climate Change Canada and the U.S. Environmental Protection Agency.

- Operational Efficiency: Investments in upgrading existing natural gas facilities aim to improve heat rates and reduce methane leakage, directly impacting their Scope 1 emissions profile.

Waste Management and Resource Efficiency

Capstone Infrastructure faces environmental considerations regarding waste management and resource efficiency, even with its focus on renewable energy. The construction and eventual decommissioning of solar farms, wind turbines, and other infrastructure projects inevitably produce waste. For instance, the global waste generated from solar panel production and end-of-life is projected to reach millions of tons by 2050, highlighting the scale of the challenge.

To address this, Capstone must prioritize robust sustainable waste management strategies. This includes implementing circular economy principles to maximize resource efficiency, such as recycling components from retired assets. The company's commitment to responsible decommissioning of older facilities is crucial for minimizing its environmental footprint and adhering to evolving regulations.

Key areas for Capstone's focus include:

- Developing comprehensive waste reduction and recycling programs for both construction and operational phases.

- Investing in technologies and partnerships for the efficient and environmentally sound decommissioning of aging infrastructure.

- Ensuring supply chain partners also adhere to strict waste management and resource efficiency standards.

- Tracking and reporting on waste generation and recycling rates to demonstrate progress and accountability.

Capstone Infrastructure's renewable assets are highly sensitive to climate change impacts, with extreme weather events posing operational risks. For example, drought conditions in 2024 affected hydropower generation in some regions, while fluctuating wind speeds impacted wind farm output. The company's adaptation strategies, including investments in energy storage, are crucial for maintaining reliable energy supply amidst these environmental volatilities.

PESTLE Analysis Data Sources

Our Capstone Infrastructure PESTLE Analysis draws from a robust blend of official government reports, international economic databases, and leading industry publications. This ensures our insights into political, economic, social, technological, legal, and environmental factors are grounded in credible, current data.