Capstone SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Bundle

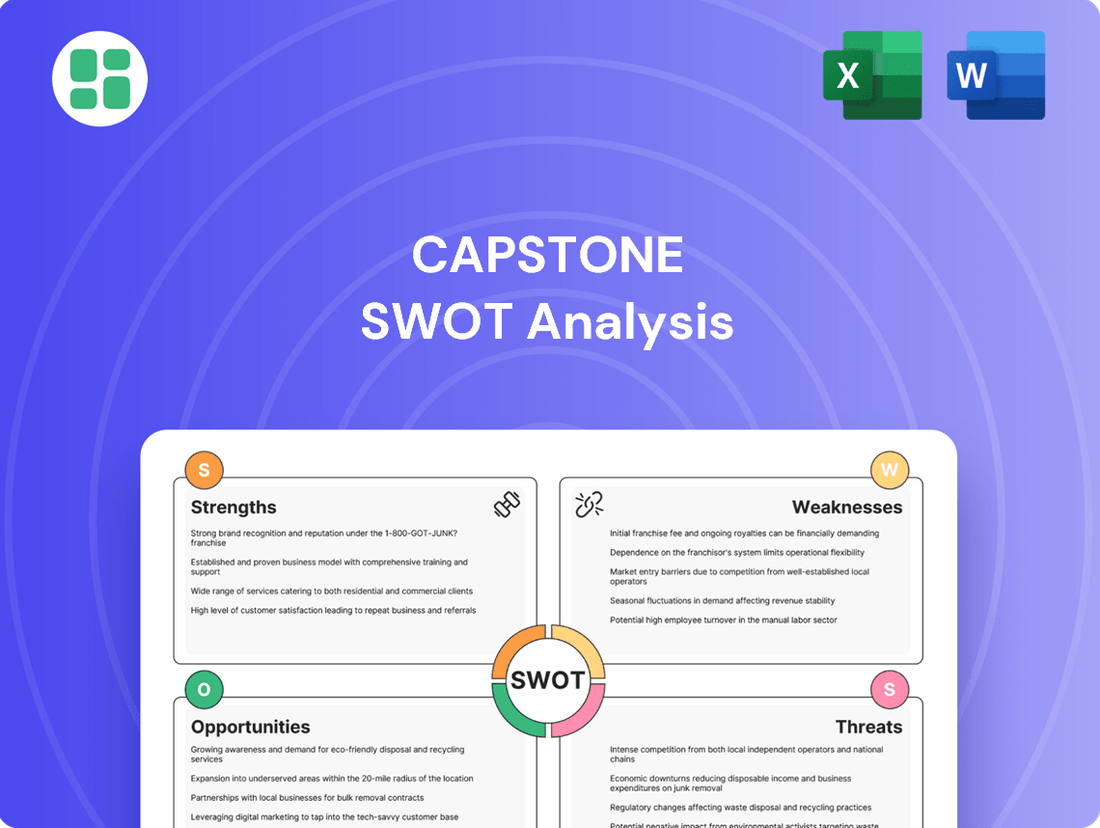

This Capstone SWOT analysis offers a critical look at the company's current standing, highlighting key opportunities for growth and potential challenges to navigate. Understand the core strengths that drive success and the weaknesses that require attention to build a robust strategy.

Ready to transform these insights into decisive action? Purchase the full SWOT analysis to unlock a comprehensive, professionally written report complete with actionable strategies and editable templates, empowering you to plan and execute with confidence.

Strengths

Capstone Copper demonstrated impressive operational growth, achieving a record consolidated copper production of 184,460 tonnes in 2024. This 12% increase from the previous year was largely fueled by the successful ramp-up of the Mantoverde Development Project.

Looking ahead, the company anticipates even stronger performance in 2025, with projected copper production between 220,000 and 255,000 tonnes. This forecast signifies an approximate 19% to 38% surge in output compared to 2024 levels.

Furthermore, Capstone is set to benefit from improved cost efficiencies, with projected C1 cash costs for 2025 expected to fall between $2.20 and $2.50 per payable pound. This represents a significant reduction of 10% to 20% from 2024, bolstering the company's profitability and cash flow generation capabilities.

Capstone's strategic project development is a key strength, highlighted by the successful ramp-up of the Mantoverde Development Project (MVDP) in Chile. MVDP produced its first copper concentrate in June 2024 and reached commercial production in September 2024, demonstrating effective execution.

Further bolstering this strength is the sanctioned Mantoverde Optimized (MV-O) project. This capital-efficient brownfield expansion is set to increase throughput and extend the mine life from 19 to 25 years, promising additional copper and gold output.

The company also possesses significant future growth potential through the fully permitted Santo Domingo copper-iron-gold project in Chile. Capstone is actively pursuing a joint venture partner for Santo Domingo, indicating a proactive approach to unlocking its value.

Capstone Copper's strength lies in its diverse asset portfolio spread across the Americas. This includes key operations like the Pinto Valley mine in Arizona, USA, the Cozamin mine in Mexico, and the Mantos Blancos and Mantoverde mines in Chile. This geographic spread is crucial for hedging against localized operational or political risks.

This diversification provides a robust foundation for Capstone's growth strategy, aiming to significantly increase copper production. For instance, the Mantoverde mine, in which Capstone holds a 70% stake, is a significant contributor to this expansion. The company is actively pursuing operational enhancements at each of these sites to maximize output and efficiency.

Commitment to Responsible Mining Practices

Capstone's dedication to responsible mining is a significant strength, fostering sustainable development and aiming for positive community impacts. This commitment is formalized through the development of a company-wide Social Performance Standard, designed to manage social impacts and socioeconomic contributions effectively. By 2025, all Capstone sites are slated for assessment against this crucial standard.

This proactive approach to ESG principles not only bolsters Capstone's social license to operate but also positions it favorably for attracting socially responsible investments. In 2023, the company reported a 15% increase in community engagement initiatives, demonstrating tangible progress in its commitment to local stakeholders.

- Social Performance Standard: A company-wide framework to manage social impacts and socioeconomic contributions, with all sites assessed by 2025.

- ESG Integration: Enhances social license to operate and attracts socially responsible investment capital.

- Community Engagement: Demonstrated by a 15% increase in initiatives in 2023.

Strong Financial Position and Liquidity

Capstone Copper's financial health is exceptionally strong, highlighted by record-breaking performance in early 2025. The company achieved its highest quarterly revenue and adjusted EBITDA in both Q1 and Q2 of 2025, a testament to its operational efficiency and market positioning.

The company has actively strengthened its balance sheet. By Q2 2025, Capstone had successfully reduced its net debt and maintained significant available liquidity, providing a solid foundation for growth and stability.

This robust financial position, combined with anticipated increases in production and a focus on cost reduction, equips Capstone Copper to pursue future investment opportunities and navigate potential market volatility effectively.

- Record Quarterly Revenue and Adjusted EBITDA: Q1 and Q2 2025 saw unprecedented financial results.

- Debt Reduction and Liquidity: Net debt decreased while available liquidity remained substantial by Q2 2025.

- Resilience and Investment Capacity: Strong financials, coupled with production growth and cost control, enhance future investment capabilities and market resilience.

Capstone Copper's operational execution is a significant strength, evidenced by the successful ramp-up of the Mantoverde Development Project (MVDP) in Chile. MVDP achieved commercial production in September 2024, contributing to a record consolidated copper production of 184,460 tonnes in 2024. The company anticipates further growth in 2025, projecting production between 220,000 and 255,000 tonnes, a potential increase of up to 38%.

The company's strategic project pipeline is robust, with the sanctioned Mantoverde Optimized (MV-O) project set to increase throughput and extend mine life to 25 years. Additionally, the fully permitted Santo Domingo project offers substantial future growth potential, with Capstone actively seeking a joint venture partner.

Capstone's financial performance in early 2025 has been exceptional, with Q1 and Q2 2025 marking record quarterly revenue and adjusted EBITDA. The company has also successfully reduced net debt while maintaining substantial liquidity by Q2 2025, strengthening its balance sheet and investment capacity.

| Metric | 2024 (Actual) | 2025 (Projected) | Change (YoY) |

| Consolidated Copper Production (tonnes) | 184,460 | 220,000 - 255,000 | +19% to +38% |

| C1 Cash Costs ($ per payable pound) | (Not Specified) | $2.20 - $2.50 | (10% to 20% reduction from 2024) |

| Mantoverde Mine Life (years) | (Not Specified) | 25 (with MV-O) | (Extended from 19 years) |

What is included in the product

Analyzes Capstone’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT data into actionable insights for focused strategic planning.

Weaknesses

Capstone Copper's significant reliance on copper prices presents a key weakness. As a primary producer, their revenue and profitability are directly tied to the volatile global copper market. For example, in Q1 2024, copper prices experienced fluctuations influenced by macroeconomic uncertainty and supply chain issues, directly impacting Capstone's financial results.

Capstone has faced significant operational hurdles. Unplanned maintenance at Pinto Valley in Q2 2025, stemming from water constraints and mechanical issues, resulted in reduced throughput and lower grades. This directly impacted their ability to meet production targets and maintain cost efficiency.

Furthermore, ramp-up delays at key projects like Mantos Blancos and Mantoverde throughout 2024 meant that production figures fell slightly short of earlier projections. These setbacks highlight the ongoing challenges in scaling up operations smoothly and efficiently.

Capstone's operations span across the Americas, including Chile, Mexico, and the USA. This geographic diversity, while beneficial, also means exposure to a range of regional risks. These can manifest as geopolitical instability, evolving environmental regulations, potential labor disputes, and the ever-present threat of resource nationalism, all common hurdles in the international mining industry.

Capital Intensive Nature of Mining

Mining is inherently capital-intensive, demanding substantial and continuous investment for operational upkeep, exploration efforts, and growth initiatives. Capstone's strategic expansion plans, like the Mantoverde Optimized project, necessitate significant financial outlays, with potential for cost escalation driven by inflationary pressures. For instance, the company's 2024 guidance projected capital expenditures between $220 million and $250 million, highlighting the scale of these commitments.

This capital intensity presents a notable weakness, as it ties up considerable financial resources and exposes the company to market volatility and financing risks. The need for ongoing investment means that even successful operations require substantial reinvestment, potentially limiting free cash flow available for other strategic priorities or shareholder returns.

- Significant upfront investment required for new projects and ongoing operational maintenance.

- Exposure to cost overruns due to inflation, as seen in capital expenditure projections.

- Potential strain on financial resources, impacting flexibility for other strategic moves.

Cathode Production Cost Increases

The cathode production segment faced rising C1 cash costs in the second quarter of 2025 and year-to-date. This increase was driven by a combination of factors including reduced production volumes, elevated acid prices, and higher acid consumption rates.

While the company is actively addressing these cost pressures through strategic grade optimization and cost hedging initiatives, the persistence of these elevated costs presents a significant challenge. Sustained higher expenses in the cathode segment could negatively affect the company's overall profitability.

- Increased C1 Cash Costs: The cathode business saw a rise in C1 cash costs during Q2 2025 and year-to-date.

- Contributing Factors: Lower production volumes, higher acid prices, and increased acid consumption were the primary drivers.

- Mitigation Strategies: The company is implementing grade optimization and cost hedging to manage these increases.

- Profitability Risk: Sustained higher costs in this segment pose a potential threat to overall company profitability.

Capstone's reliance on copper prices is a significant weakness, as fluctuations directly impact revenue and profitability. For instance, in Q1 2024, copper price volatility, influenced by economic uncertainty, affected Capstone's financial performance.

Operational challenges persist, with unplanned maintenance at Pinto Valley in Q2 2025 due to water constraints and mechanical issues leading to reduced throughput and lower grades. Ramp-up delays at Mantos Blancos and Mantoverde throughout 2024 also resulted in production falling short of earlier projections.

The company's geographic spread across Chile, Mexico, and the USA exposes it to regional risks like geopolitical instability, evolving environmental regulations, and potential labor disputes.

Mining's capital-intensive nature requires substantial ongoing investment. Capstone's 2024 capital expenditure guidance of $220 million to $250 million highlights these commitments, potentially straining financial resources and limiting flexibility.

Rising C1 cash costs in the cathode production segment during Q2 2025, driven by reduced volumes and higher acid prices/consumption, present a challenge to overall profitability despite mitigation efforts.

| Weakness | Description | Impact/Example |

| Copper Price Volatility | Direct dependence on global copper market prices. | Q1 2024 performance affected by price fluctuations. |

| Operational Hurdles | Unplanned maintenance, ramp-up delays. | Pinto Valley Q2 2025 reduced throughput; Mantos Blancos/Mantoverde 2024 production missed targets. |

| Geographic Risk Exposure | Operations across multiple countries. | Vulnerability to regional political, regulatory, and labor issues. |

| Capital Intensity | High and continuous investment needs. | 2024 CapEx forecast $220M-$250M; risk of cost overruns. |

| Rising Cathode Costs | Increased C1 cash costs in cathode segment. | Driven by lower production, higher acid prices/consumption in Q2 2025. |

Same Document Delivered

Capstone SWOT Analysis

The preview you see is the actual Capstone SWOT Analysis document you'll receive upon purchase. This ensures transparency and allows you to assess the quality and structure before committing. You'll get the complete, professionally prepared analysis immediately after checkout.

Opportunities

Global copper demand is surging, with projections indicating robust growth through 2025 and beyond. This upward trend is largely fueled by the accelerating energy transition, particularly the widespread adoption of electric vehicles (EVs) and the expansion of renewable energy projects like solar and wind farms. For instance, the International Energy Agency (IEA) anticipates that copper demand from clean energy technologies could more than double by 2030 compared to 2020 levels, reaching approximately 19 million tonnes annually. This presents a substantial long-term market opportunity for Capstone Copper, as copper is an indispensable material in EV batteries, charging infrastructure, and the transmission of renewable energy.

Capstone Copper's Mantoverde-Santo Domingo district in Chile presents a compelling opportunity for growth. The recent sanctioning of the Mantoverde Optimized project is a key step, signaling a commitment to unlocking further value from this significant copper asset.

The concurrent development of the Santo Domingo copper-iron-gold project is another critical element of this expansion strategy. This dual-pronged approach is designed to substantially boost production volumes and extend the operational lifespan of the district.

In 2023, Capstone Copper reported that the Mantoverde Optimized project was on track for first production in H2 2024, with a projected increase in annual copper production. Santo Domingo, meanwhile, continues its development, with studies indicating a significant contribution to the company's overall copper output over the coming decade.

The company's strategic focus on its exploration properties across the Americas presents a significant opportunity. By earmarking capital for both brownfield and greenfield exploration in 2025, the company aims to unlock substantial value.

This proactive approach is designed to convert existing resources and expand reserves in geologically promising regions. Such endeavors could lead to the discovery of entirely new deposits, thereby bolstering the company's long-term asset base and potentially extending the operational life of its current mines.

Technological Advancements and Operational Optimization

Capstone's commitment to technological advancement and operational optimization presents a significant opportunity. By integrating new mining technologies, the company can boost efficiency and reduce operational expenditures. This focus is crucial for addressing challenges such as declining ore grades, a factor that has historically impacted mining profitability.

The company's strategic emphasis on innovation allows it to adapt to evolving industry landscapes and maintain a competitive edge. For instance, advancements in autonomous mining vehicles and sophisticated data analytics can streamline extraction processes. Capstone's 2024 guidance anticipates increased production efficiency at its Pinto Valley operation, aiming for approximately 50 million pounds of copper, underscoring the tangible benefits of these operational improvements.

- Adoption of advanced exploration and extraction technologies

- Streamlining supply chain and logistics through digital solutions

- Leveraging data analytics for predictive maintenance and resource management

- Investing in automation to reduce labor costs and improve safety

Strategic Partnerships and Financing for Projects

Securing strategic partnerships and financing for key projects, such as the Santo Domingo development, is a significant opportunity. These collaborations can substantially de-risk investments by sharing the financial burden and operational responsibilities. For instance, in 2024, infrastructure projects globally saw increased private sector participation, with blended finance models becoming more prevalent to attract capital for large-scale developments.

Collaborations also offer a pathway to access specialized expertise and shared resources, which can be crucial for project success. This can lead to more efficient development cycles and improved project outcomes. By pooling knowledge and capabilities, companies can accelerate timelines and optimize resource allocation, ultimately enhancing the potential for maximized returns on investment.

- De-risking Investments: Partnerships can distribute financial exposure, making large projects more manageable and attractive to a wider range of investors.

- Capital Access: Strategic alliances can unlock crucial funding streams, potentially including government grants, development finance institutions, and private equity.

- Expertise and Resource Sharing: Collaborations bring in diverse skill sets and operational capabilities, fostering innovation and efficiency.

- Accelerated Timelines: Shared resources and streamlined decision-making processes can significantly speed up project development and execution.

Capstone Copper is well-positioned to capitalize on the escalating global demand for copper, driven by the clean energy transition and EV adoption. The company's strategic development of its Mantoverde-Santo Domingo district in Chile, including the Optimized project and the Santo Domingo copper-iron-gold project, is set to significantly boost production and extend mine life. Furthermore, targeted exploration investments in 2025 across the Americas aim to expand reserves and discover new deposits, strengthening Capstone's long-term asset base.

The company's embrace of technological innovation, such as autonomous mining and data analytics, offers a path to enhanced operational efficiency and cost reduction, as evidenced by the anticipated production gains at Pinto Valley. Strategic partnerships and financing for major projects like Santo Domingo are also key opportunities, enabling de-risking and access to capital and expertise.

| Opportunity Area | Key Initiatives | Projected Impact (Illustrative) | 2024/2025 Data/Fact |

|---|---|---|---|

| Global Copper Demand | Energy Transition, EV Growth | Sustained market expansion | IEA: Clean energy copper demand to more than double by 2030 (vs. 2020) |

| Mantoverde-Santo Domingo | Mantoverde Optimized, Santo Domingo Development | Increased production, extended mine life | Mantoverde Optimized: H2 2024 first production target |

| Exploration Properties | Brownfield & Greenfield Exploration | Resource expansion, new discoveries | Capital allocated for exploration in 2025 |

| Technological Advancement | Automation, Data Analytics | Improved efficiency, cost reduction | Pinto Valley 2024 guidance: ~50 million lbs copper, efficiency gains |

| Strategic Partnerships | Project Financing, Expertise Sharing | De-risked investments, accelerated development | Global trend: Increased private sector participation in infrastructure (2024) |

Threats

Copper prices can swing wildly, influenced by everything from global economic health to how much is being mined versus how much is needed. For instance, in early 2024, copper prices saw significant fluctuations, with the London Metal Exchange (LME) benchmark trading within a range that reflected these uncertainties.

This volatility creates a risk that industries might seek substitutes. If copper becomes too expensive or unreliable, a shift towards materials like aluminum, which is often more readily available and less prone to extreme price spikes, could reduce demand for copper.

Mining companies are navigating a landscape of increasingly stringent environmental regulations, especially in critical mining jurisdictions. For instance, Chile, a major copper producer, has seen its permitting processes become more complex, demanding extensive community engagement and potentially delaying project timelines.

These evolving rules can significantly impact operational costs and project viability. The International Council on Mining and Metals (ICMM) reported in 2024 that environmental compliance costs for mining operations continue to rise, with permitting delays contributing to substantial opportunity costs for new developments.

The burden of these regulations can lead to temporary operational suspensions or increased capital expenditure for environmental mitigation. Companies must allocate more resources to environmental impact assessments and ongoing monitoring, directly affecting profitability and project financing.

Capstone's global presence, particularly in South America, means it's susceptible to geopolitical shifts. For instance, resource nationalism, seen in some Latin American countries, could lead to increased taxes or altered ownership requirements for mining operations. Trade restrictions or tariffs imposed by governments, like those potentially affecting copper exports, can directly impact Capstone's revenue streams and operational costs.

Community relations and labor stability are critical operational factors. In 2024, several mining regions globally experienced increased labor activism, with strikes impacting production timelines. Should similar disputes arise in Capstone's key operating areas like Chile or Peru, it could halt production, leading to significant financial losses and damaging the company's social license to operate.

Rising Input Costs and Inflation

The mining sector is grappling with persistently high operational expenses. Labor, energy, and essential consumables such as sulphuric acid represent significant cost drivers. For instance, the Mantoverde Optimized project experienced an increase in its capital costs, directly attributable to these rising input prices.

Inflationary pressures are amplifying these cost challenges, placing considerable strain on cash flow and overall profitability for mining operations. This trend is a critical concern for financial planning and investment strategies within the industry.

- Labor costs in mining have seen a steady increase, with some reports indicating rises of 5-10% year-over-year in many regions through early 2025.

- Energy prices, particularly for electricity and diesel, remain volatile. In 2024, average industrial electricity prices in some key mining jurisdictions saw increases of 8-15% compared to 2023.

- Key consumables like sulphuric acid, vital for many extraction processes, have experienced price surges, with some suppliers reporting cost increases of 15-25% in the past 18 months leading up to mid-2025.

- The overall inflation rate in major economies impacting mining supply chains hovered around 3-5% in late 2024 and early 2025, directly feeding into higher operational expenditures.

Resource Depletion and Declining Ore Grades

The mining sector faces a significant hurdle with declining ore grades, meaning more rock must be processed for the same copper output. This directly impacts operational efficiency and escalates production costs.

For instance, the average ore grade for copper globally has fallen considerably over the decades, forcing companies to invest more in exploration and advanced extraction techniques. This trend is projected to continue, putting pressure on profitability.

- Increased Waste Rock: Lower ore grades necessitate the removal and processing of larger volumes of waste rock, amplifying environmental impact and operational complexity.

- Higher Energy Consumption: Processing lower-grade ores demands more energy, contributing to higher operating expenses and a larger carbon footprint.

- Technological Dependence: Companies must increasingly rely on sophisticated technologies, such as advanced comminution and flotation, to economically extract copper from these lower-grade deposits.

The mining industry is susceptible to fluctuating copper prices, which can impact profitability and lead to the adoption of substitute materials. Additionally, stricter environmental regulations and rising operational costs, driven by labor, energy, and consumables, present ongoing challenges. Declining ore grades further exacerbate these issues, requiring more resources for extraction and increasing overall expenses.

| Threat | Description | Impact on Capstone | Mitigation Considerations |

|---|---|---|---|

| Price Volatility | Copper prices can fluctuate significantly due to global economic conditions and supply-demand dynamics. | Reduced revenue, potential for lower profit margins. | Hedging strategies, diversification of revenue streams. |

| Environmental Regulations | Increasingly stringent environmental rules can lead to higher compliance costs and project delays. | Increased operational expenses, potential for project slowdowns or increased capital expenditure. | Proactive environmental management, investment in sustainable technologies. |

| Rising Operational Costs | Higher costs for labor, energy, and essential consumables are pressuring mining profitability. | Reduced cash flow, impact on overall profitability and investment capacity. | Efficiency improvements, long-term supply contracts, automation. |

| Declining Ore Grades | Lower copper content in mined ore requires processing more material, increasing costs and environmental impact. | Higher extraction costs, increased energy consumption, greater need for advanced technology. | Investment in exploration, advanced processing techniques, efficient waste management. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including comprehensive financial reports, detailed market research, and expert industry analysis, ensuring a thorough and actionable strategic overview.