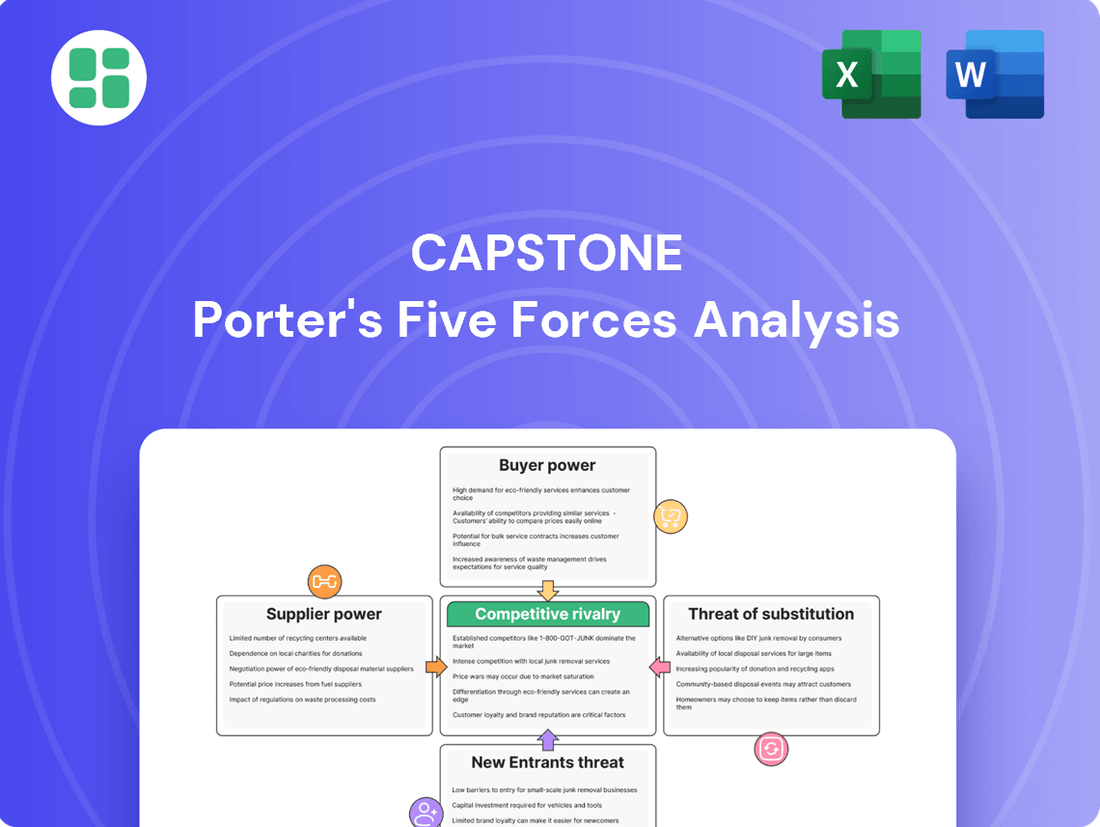

Capstone Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Bundle

This brief snapshot only scratches the surface of the competitive landscape surrounding Capstone. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for navigating its market.

Unlock the full Porter's Five Forces Analysis to explore Capstone’s competitive dynamics, market pressures, and strategic advantages in detail, revealing the true forces shaping its industry.

Suppliers Bargaining Power

Capstone Copper's reliance on specialized suppliers for essential inputs like heavy mining equipment, processing chemicals, and digital technologies highlights a significant bargaining power. For instance, the global market for large-scale mining excavators is dominated by a few major manufacturers, meaning Capstone has limited options when sourcing these critical assets.

These niche suppliers often operate in concentrated markets, facing few direct competitors. This scarcity of alternatives grants them substantial leverage, allowing them to dictate terms, pricing, and delivery schedules, directly impacting Capstone's operational costs and efficiency.

The mining industry relies heavily on highly skilled labor, such as geologists, mining engineers, and specialized equipment operators. The availability of these professionals is often limited, especially in the remote locations where many mining operations are situated. This scarcity significantly enhances the bargaining power of these specialized workers and the service providers who supply them.

For instance, in 2024, the global shortage of experienced mining engineers was a persistent concern, leading to increased recruitment costs and higher salary expectations. Companies often face bidding wars for top talent, directly impacting operational expenses and potentially delaying project timelines. This situation underscores the substantial bargaining power suppliers of specialized labor wield in the mining sector.

Energy, especially electricity and fuel for heavy equipment, represents a significant expense for mining operations. In areas with constrained energy availability or elevated prices, energy providers can wield substantial influence. For instance, in 2024, the average industrial electricity price in the European Union was approximately €150 per megawatt-hour, a figure that can dramatically impact a mine's profitability.

Water is equally critical for mineral processing, and its scarcity, particularly in arid mining regions like parts of Australia, can empower water suppliers. When water is a limited commodity controlled by a few entities, mining companies may face increased costs or operational limitations, as seen in the challenges faced by some South American mines dealing with water rights and availability.

Environmental and Regulatory Compliance Services

The bargaining power of suppliers in environmental and regulatory compliance services is growing significantly. As global environmental standards tighten, the need for specialized expertise in areas like emissions monitoring, waste management, and permitting becomes critical for businesses across all sectors. This increased demand, coupled with the specialized knowledge required, allows these service providers to command premium pricing.

For instance, the global environmental consulting market was valued at approximately $38.4 billion in 2023 and is projected to reach $65.5 billion by 2030, growing at a compound annual growth rate of 7.9%. This robust growth indicates a strong market position for suppliers.

- Increased Demand: Stricter regulations worldwide, including those related to carbon emissions and plastic waste, directly boost the need for compliance services.

- Specialized Expertise: Suppliers possess unique, often legally mandated, knowledge that is difficult for companies to replicate internally.

- Critical Importance: Failure to comply can lead to severe penalties, operational shutdowns, and reputational damage, making these services indispensable.

- Limited Substitutes: For complex regulatory environments, few viable alternatives exist to specialized consulting firms.

Logistics and Transportation Providers

The bargaining power of logistics and transportation providers in the copper industry is significant, particularly where infrastructure is underdeveloped. Efficiently moving copper concentrate and finished cathodes from mines to ports or refineries, as well as handling inbound supplies, is critical for operations. In 2024, global shipping costs, a key component of logistics, saw fluctuations. For instance, the Baltic Dry Index, a benchmark for dry bulk shipping rates, experienced volatility throughout the year, reflecting supply and demand dynamics in freight markets.

When the number of reliable logistics partners is limited, especially in regions with challenging terrain or underdeveloped road and rail networks, these providers can command higher prices and dictate service terms. This situation was particularly relevant in several African copper-producing nations in 2024, where infrastructure limitations increased reliance on a smaller pool of transportation companies. The ability to secure timely and cost-effective transport directly impacts a copper producer's profitability and operational efficiency.

- Limited Provider Options: In many copper-producing regions, especially those with developing infrastructure, the number of qualified and reliable logistics providers for bulk materials like copper concentrate can be scarce.

- Infrastructure Dependence: The efficiency and cost of transporting copper are heavily reliant on the quality of roads, railways, and port facilities, which can be a bottleneck in certain countries.

- Cost Sensitivity: Transportation costs can represent a substantial portion of the overall cost of bringing copper to market, giving powerful logistics firms leverage over producers.

- Service Reliability: Disruptions in logistics can halt production or delay shipments, making reliable service a critical factor that strengthens the bargaining position of dependable providers.

Suppliers in the copper industry, particularly those providing specialized equipment, critical chemicals, and skilled labor, hold significant bargaining power. This leverage stems from market concentration, the unique nature of their offerings, and the essential role they play in mining operations. For instance, the limited number of manufacturers for large-scale mining machinery means Capstone Copper faces fewer choices and potentially higher costs for these vital assets.

The scarcity of specialized talent, such as experienced mining engineers, further amplifies supplier power. In 2024, the global shortage of these professionals drove up recruitment expenses and salary demands, compelling companies to compete for top talent. This dynamic directly impacts operational budgets and project timelines, illustrating the substantial influence of labor suppliers.

Energy and water, crucial inputs for copper extraction and processing, also present opportunities for supplier leverage. In 2024, industrial electricity prices in the EU averaged around €150 per megawatt-hour, a cost that significantly affects mine profitability. Similarly, water scarcity in arid regions empowers local water suppliers, potentially increasing costs and imposing operational constraints on mining firms.

| Supplier Category | Reason for Bargaining Power | 2024 Impact/Data Point |

|---|---|---|

| Heavy Mining Equipment Manufacturers | Market concentration, few alternatives | Limited supplier options for specialized excavators |

| Specialized Labor (e.g., Mining Engineers) | Global shortage, high demand | Increased recruitment costs and salary expectations |

| Energy Providers | Essential input, price volatility | EU industrial electricity prices averaged €150/MWh |

| Water Suppliers | Scarcity in arid regions, critical for processing | Potential for increased costs and operational limitations |

What is included in the product

This analysis dissects the competitive forces impacting Capstone, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Quickly identify and address competitive threats with a visual representation of all five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

The commodity nature of copper concentrate and cathode significantly empowers customers. Because these products are largely undifferentiated, buyers can switch between suppliers with minimal friction and cost. This interchangeability means Capstone's offerings are directly comparable to those of competitors, giving large industrial purchasers substantial leverage in price negotiations.

Capstone Copper's main customers are major industrial companies like smelters, refiners, and manufacturers in industries such as electronics, construction, and automotive. These buyers often purchase large quantities of copper, which gives them significant influence to negotiate better prices and terms.

In 2024, the global copper market saw continued demand from these sectors, with prices fluctuating based on supply and macroeconomic factors. For instance, the automotive industry's push towards electric vehicles, a significant copper consumer, continued to drive demand, though supply chain issues and geopolitical events in 2024 impacted the availability and cost of raw materials, potentially strengthening buyer leverage.

Copper's critical role in burgeoning sectors like electric vehicles (EVs) and renewable energy, where demand is projected to surge, highlights buyer dependence. For instance, the global EV market was valued at approximately $380 billion in 2023 and is expected to grow significantly, driving substantial copper consumption. This reliance means buyers are keenly aware of copper prices.

However, this dependence doesn't inherently diminish buyer power. Many of these customers, particularly in manufacturing, face pressure to keep their own product prices competitive. Their capacity to absorb or pass on increased copper costs to their end consumers directly impacts their negotiation leverage with copper suppliers. If they can't easily pass on costs, they will push harder for stable or lower copper prices.

Availability of Alternative Suppliers

The bargaining power of customers is significantly influenced by the availability of alternative suppliers. For companies like Capstone Copper, this means buyers often have choices among numerous global copper producers.

Customers typically have access to multiple global copper producers, including major players like Freeport-McMoRan, BHP Group, and Codelco. This broad array of alternative suppliers means that if Capstone Copper's pricing or terms are not competitive, buyers can easily shift their purchases to other producers, limiting Capstone's pricing power.

- Global Copper Market: The copper market is characterized by a significant number of producers, making it easier for buyers to find alternatives.

- Price Sensitivity: Buyers can leverage competition among suppliers to negotiate more favorable prices.

- Switching Costs: For many buyers, the cost of switching between copper suppliers is relatively low, further empowering them.

- Market Dynamics: In 2024, global copper prices have seen volatility, increasing the importance for buyers to secure competitive deals from multiple sources.

Buyers' Cost Structure and Profitability

The bargaining power of customers is significantly shaped by their own cost structures. When copper constitutes a substantial part of a buyer's total production expenses, they are naturally inclined to push harder for lower prices, directly impacting their profitability. For example, in 2024, the automotive sector, a major consumer of copper, faced fluctuating raw material costs, making copper price a key negotiation point for vehicle manufacturers.

However, the market dynamics of 2024 also revealed a counterbalancing force. The surging demand for copper, fueled by the global push for electrification and renewable energy infrastructure, meant that some buyers prioritized securing reliable supply chains over aggressive price reductions. This was particularly evident in the electric vehicle battery manufacturing segment, where consistent access to copper was paramount for meeting production targets.

- Copper's share in a buyer's cost structure directly correlates with their price negotiation leverage.

- In 2024, automotive manufacturers, with significant copper input costs, actively sought favorable pricing.

- Conversely, strong demand from green energy sectors in 2024 allowed some buyers to prioritize supply security over price.

- The interplay between cost impact and market demand dictates the ultimate bargaining power of customers.

The bargaining power of customers in the copper market is substantial due to the commodity nature of the product and the availability of numerous global suppliers. Buyers, often large industrial firms, can switch suppliers with minimal cost, giving them significant leverage in price negotiations. This is particularly true when copper represents a large portion of their production expenses, as seen in the automotive sector in 2024.

| Customer Segment | 2024 Market Influence Factors | Impact on Bargaining Power |

|---|---|---|

| Smelters & Refiners | High volume purchases, price sensitivity due to processing costs | Strong; can negotiate based on processing margins and competitor pricing. |

| Electronics Manufacturers | Demand driven by consumer electronics cycles, focus on component costs | Moderate to Strong; price fluctuations directly affect product competitiveness. |

| Automotive Industry (EV focus) | Increasing copper intensity per vehicle, but also supply chain pressures | Strong; critical demand but also pressure to control EV costs. In 2024, securing supply was as key as price. |

| Construction Industry | Demand tied to infrastructure and housing starts, price sensitivity | Moderate; less concentrated purchasing power than other sectors but still price-aware. |

What You See Is What You Get

Capstone Porter's Five Forces Analysis

This preview showcases the complete Capstone Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within your chosen industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden surprises. You'll gain instant access to this professionally formatted and ready-to-use analysis, empowering you with critical strategic insights.

Rivalry Among Competitors

The global copper production landscape, while featuring significant players, remains notably fragmented. This means no single entity or small group of companies holds overwhelming market power, fostering a highly competitive environment. Capstone Copper, therefore, navigates a market populated by many mid-tier and large-scale mining operations, all competing intensely for a share of the global copper demand.

In 2023, for instance, the top 10 copper-producing companies accounted for roughly 30% of global output, indicating a broad distribution of production. This contrasts sharply with more consolidated industries, highlighting the inherent rivalry. In such a commodity-driven sector, where the product itself is largely undifferentiated, competition often centers on cost efficiency, operational excellence, and securing access to high-quality reserves.

The copper mining industry is defined by incredibly high fixed costs. Think about the money needed for exploration, building mines, and keeping them running – it's a massive upfront investment. For example, developing a new copper mine can easily cost billions of dollars.

These substantial investments act as significant exit barriers. Once a company has sunk so much capital into a mine, it's very difficult and costly to just walk away, even if copper prices are low. This forces companies to keep producing to try and recoup their fixed costs, which can flood the market and intensify competition among producers.

The copper market's robust demand, driven by the energy transition, is projected to grow at a 2.6% CAGR through 2034. This expansion somewhat softens direct price competition by increasing the overall market pie.

However, intense rivalry persists for securing new copper reserves and funding production expansions. Companies are actively competing for exploration rights and developing new mining operations to meet this surging demand.

Operational Efficiency and Cost Leadership

The copper industry is characterized by intense rivalry, especially when it comes to operational efficiency and cost leadership. Because copper is largely a commodity, companies must excel at producing it at the lowest possible cost to gain a competitive edge. Capstone Copper's strategic investments, such as the Mantoverde Development Project (MVDP) and its subsequent optimization (MV-O), are directly aimed at boosting production volumes and driving down per-unit costs. This focus is crucial for Capstone to effectively compete with larger, more established players in the market.

Capstone’s efforts to improve operational efficiency are evident in its project development plans. For instance, the MVDP is projected to significantly increase Capstone's copper production. By streamlining operations and leveraging economies of scale, Capstone aims to achieve a lower cost per pound of copper produced. This strategy is vital for maintaining profitability and market share in a sector where price fluctuations are common and cost control is paramount.

- Cost Reduction Focus: Capstone Copper's strategy centers on achieving lower production costs through projects like MVDP and MV-O.

- Production Scale: The goal is to increase output, which in turn helps to reduce the cost per unit of copper produced.

- Competitive Imperative: In the commodity copper market, cost leadership is a primary driver of competitive advantage.

- 2024 Outlook: Capstone Copper anticipates significant production increases from its Chilean operations in 2024, aiming to solidify its position as a low-cost producer.

Geographical Concentration and Regulatory Environment

Capstone Copper's operations are heavily concentrated in regions like Chile and Peru, which are also major global copper producers. This geographical overlap means Capstone often faces rivals operating under very similar regulatory frameworks and labor conditions. For instance, in 2023, Chile accounted for approximately 26% of global copper mine production, with Peru contributing another 10%.

This shared environment intensifies competition, as companies must navigate comparable environmental regulations, tax structures, and community engagement expectations. Success often hinges on how effectively each company can manage these localized factors, including securing social license to operate and mitigating risks of operational disruptions stemming from policy changes or labor disputes.

- Geographical Concentration: Capstone Copper's primary operational areas in Chile and Peru are also hubs for other major copper producers, leading to direct competition in resource-rich zones.

- Regulatory Parity: Companies operating in these concentrated regions often face similar environmental, tax, and labor laws, creating a level playing field that amplifies rivalry.

- Social License and Labor: Competition extends to securing and maintaining positive community relations and stable labor agreements, as disruptions in one company can highlight vulnerabilities for others.

- Operational Risks: Similar regulatory and social pressures mean that companies are susceptible to comparable operational risks, such as potential strikes or policy shifts impacting production.

The competitive rivalry in the copper market is fierce, driven by a fragmented production landscape where no single player dominates. This means companies like Capstone Copper must constantly focus on cost efficiency and operational excellence to stand out. With significant exit barriers due to high fixed costs, producers are incentivized to maintain output, potentially leading to market oversupply and heightened competition.

The global copper market is characterized by intense competition, particularly concerning cost leadership and operational efficiency. As a commodity, copper's value is largely undifferentiated, making the lowest cost producer the most competitive. Capstone Copper's strategic focus on projects like the Mantoverde Development Project (MVDP) and its optimization (MV-O) directly addresses this by aiming to boost production volumes and reduce per-unit costs, essential for competing against larger, established players.

Capstone Copper's strategic positioning in Chile and Peru places it directly alongside other major copper producers, intensifying rivalry within these resource-rich regions. Companies operating in these areas face similar regulatory, tax, and labor conditions, creating a competitive environment where success hinges on effectively managing local factors and securing a social license to operate.

| Metric | 2023 (Approx.) | 2024 Projection | Key Competitor Activity |

| Global Copper Mine Production | 22.4 million tonnes | 22.7 million tonnes | Continued expansion by major producers like Codelco, BHP, and Anglo American. |

| Capstone Copper Production (Chile) | N/A (Pre-full ramp-up) | Significant increase expected from Mantoverde | Focus on cost optimization and operational efficiency to gain market share. |

| Copper Price (LME) | Average ~$8,800/tonne | Projected to remain strong, driven by demand | Price volatility remains a key competitive factor. |

SSubstitutes Threaten

Aluminum stands as copper's most significant substitute, especially in electrical applications like wiring and power transmission. Its lighter weight and considerably lower price point make it a compelling choice for many manufacturers and utility companies. For instance, aluminum conductors are commonly used in overhead power lines where weight is a major consideration.

While aluminum's electrical conductivity is roughly 60% that of copper, this difference is often manageable. In many scenarios, larger aluminum conductors can be used to achieve similar current-carrying capacities to smaller copper ones, often at a lower overall system cost. This cost-effectiveness is a primary driver for its adoption, particularly in large-scale infrastructure projects where budget constraints are significant.

The price differential between copper and aluminum can fluctuate, but aluminum typically remains the more economical option. As of early 2024, the price of copper was around $8,000-$9,000 per metric ton, while aluminum hovered around $2,000-$2,500 per metric ton, demonstrating a substantial cost advantage for aluminum in many bulk applications.

In telecommunications, fiber optics present a substantial threat of substitution to traditional copper cables. The superior bandwidth and enhanced security of fiber optics have driven widespread adoption for high-speed data transmission, significantly diminishing copper's role in core networks.

While fiber optics offer speeds up to 10 Gbps and beyond, copper's capacity is often limited to much lower speeds, making it less suitable for modern data-intensive applications. This technological advantage means that as fiber infrastructure expands, the demand for copper for new, high-performance telecommunication links continues to wane.

Emerging advanced materials like graphene and carbon nanotubes pose a potential long-term threat as substitutes for traditional materials such as copper. These novel substances offer exceptional conductivity, strength, and a significantly lighter profile. For instance, research into graphene's electrical conductivity has shown it to be hundreds of times better than copper.

While these materials are currently in early development or niche applications and often come with a higher price tag, continuous innovation and advancements in manufacturing scalability could significantly reduce costs. By 2024, the global market for advanced materials was valued in the hundreds of billions of dollars, with significant investment flowing into R&D for next-generation conductors.

Substitution Driven by Price and Supply Concerns

When copper prices surge, or supply becomes uncertain, industries often look for alternatives. For instance, during periods of high copper prices, aluminum, a common substitute, might become more attractive. In 2023, copper prices fluctuated significantly, at times exceeding $9,000 per metric ton, making cost-sensitive industries re-evaluate their material choices.

This push for alternatives isn't just about immediate cost savings; it's also a strategic move to manage long-term risks. Companies invest in research and development to find new materials that can perform as well as copper but offer greater price stability and supply chain security. The electrical vehicle sector, a major copper consumer, is a prime example, with ongoing efforts to optimize the use of copper or explore alternatives in battery components and wiring.

- Copper Price Volatility: Copper prices in 2023 saw significant swings, impacting industries reliant on the metal.

- Aluminum as an Alternative: Aluminum's lower price point makes it a compelling substitute in various applications, especially when copper costs rise.

- R&D Investment: Industries are actively investing in developing new conductive materials to reduce reliance on copper and mitigate supply chain risks.

- EV Sector Focus: The electric vehicle industry is a key area where the search for copper alternatives is intensifying due to high demand and material costs.

Limited Direct Substitutability in Key Applications

Copper's unique properties, such as exceptional electrical and thermal conductivity, ductility, and resistance to corrosion, make direct substitution challenging in many essential applications. This is particularly true for sectors driving the global energy transition, including electric vehicle (EV) motors and renewable energy infrastructure like wind turbines and solar farms. In 2024, the demand for copper in EVs alone was projected to reach over 1.5 million metric tons, highlighting its critical role.

While aluminum and other materials can replace copper in some areas, they often fall short in performance, especially where high conductivity and reliability are paramount. For instance, aluminum's conductivity is about 60% of copper's, requiring larger and heavier conductors for equivalent performance. This performance gap significantly limits the immediate threat of substitution in high-demand, high-performance markets.

- Critical Role in Energy Transition: Copper's indispensability in EV motors and renewable energy infrastructure, with EV demand reaching over 1.5 million metric tons in 2024, underscores its limited substitutability.

- Performance Deficiencies of Alternatives: Materials like aluminum, while cheaper, offer only about 60% of copper's conductivity, necessitating larger, heavier components for comparable electrical performance.

- Application-Specific Necessity: In applications demanding superior thermal management, electrical efficiency, and long-term durability, copper remains the preferred material, thereby reducing the overall threat of substitutes.

The threat of substitutes for copper is moderate, largely due to its unique combination of high electrical and thermal conductivity, ductility, and corrosion resistance. While aluminum offers a cost advantage and lighter weight, its lower conductivity (around 60% of copper's) necessitates larger conductors, impacting space and weight constraints in many applications. Fiber optics have largely replaced copper in high-speed telecommunications, representing a significant substitution in that sector.

Emerging advanced materials like graphene and carbon nanotubes show promise for superior conductivity but are currently in early development and face cost barriers. The electric vehicle (EV) sector, a major copper consumer, is actively exploring material optimization and alternatives, but copper's performance remains critical for EV motors and battery components. In 2024, the demand for copper in EVs was projected to exceed 1.5 million metric tons, highlighting its ongoing importance.

| Substitute Material | Key Advantages | Key Disadvantages vs. Copper | Primary Application Areas of Substitution | 2024 Market Context/Outlook |

|---|---|---|---|---|

| Aluminum | Lower price, lighter weight | Lower conductivity (approx. 60%), requires larger conductors | Overhead power lines, some wiring | Significant adoption in infrastructure; price sensitivity drives choice. |

| Fiber Optics | Higher bandwidth, faster speeds, less interference | Higher initial installation cost, less flexible than copper cable | Telecommunications, data transmission | Dominant in new high-speed networks; diminishing copper role in core infrastructure. |

| Advanced Materials (Graphene, Carbon Nanotubes) | Potentially superior conductivity, strength, lighter weight | High current cost, limited scalability, early development stage | Future electronics, specialized conductors | Significant R&D investment; potential long-term threat, not immediate. |

Entrants Threaten

The copper mining sector is characterized by extremely high capital intensity. Developing a new mine, from initial exploration to full-scale production, demands hundreds of millions, if not billions, of dollars. This substantial financial hurdle acts as a significant deterrent to new companies looking to enter the market.

For instance, Capstone Copper's Mantoverde Development Project, a significant undertaking, involved capital expenditures in the hundreds of millions of dollars. Such large-scale investments are necessary for acquiring land, conducting geological surveys, building infrastructure, and purchasing heavy machinery, creating a formidable barrier to entry for smaller or less capitalized firms.

The threat of new entrants in the copper mining sector is significantly dampened by the extraordinarily lengthy and intricate permitting processes. New ventures can expect timelines of 15 to 17 years from the initial discovery of a copper deposit to the commencement of actual production.

These protracted regulatory pathways, which encompass rigorous environmental impact assessments and extensive community consultations, act as a substantial barrier. They not only delay market entry but also escalate the inherent risks associated with developing new mining operations, thereby deterring potential new players.

The scarcity of high-quality copper reserves presents a significant barrier to entry for new companies. Discovering new, economically viable, and high-grade copper deposits is increasingly rare. For instance, in 2023, global copper exploration budgets continued to focus on brownfield sites rather than greenfield discoveries, reflecting this challenge.

Most easily accessible deposits have already been exploited, meaning new entrants would likely face substantially higher exploration costs and potentially lower ore grades. This makes it considerably harder for them to achieve competitive production costs compared to established players with access to more favorable reserves.

Established Infrastructure and Supply Chains

Established players like Capstone Copper leverage extensive existing infrastructure and deeply entrenched supply chain relationships. This provides a significant advantage, as new entrants would face the daunting task of replicating these networks, a process that is both time-consuming and capital-intensive. For instance, building out the necessary logistics and securing reliable raw material suppliers can add years and millions to a new project's timeline.

Newcomers would also need to overcome the hurdle of securing favorable terms from suppliers and logistics providers, which are often more readily available to established companies with proven track records and higher volumes. In 2024, the global mining industry saw significant investment in supply chain resilience, highlighting the importance of these existing networks.

- Established Infrastructure: Capstone Copper benefits from existing operational assets and transportation networks, reducing upfront capital requirements for new entrants.

- Supply Chain Dominance: Long-standing relationships with key suppliers and logistics partners give incumbents leverage in securing materials and transport at competitive rates.

- Operational Expertise: Decades of experience in mining operations translate into efficiency and cost savings that are difficult for new entrants to match quickly.

- Economies of Scale: Existing players often operate at a scale that allows for lower per-unit production costs, a barrier for smaller, newer operations.

Geopolitical and Regulatory Risks

The threat of new entrants in the copper mining sector is significantly amplified by geopolitical and regulatory risks. Copper mining operations are frequently situated in regions like Chile and Peru, where political stability and regulatory environments can be fluid. For instance, in 2023, Peru experienced significant political unrest, impacting mining operations and investor confidence. New players must meticulously assess and manage these volatile landscapes.

Navigating complex local community relations is paramount, as demonstrated by ongoing dialogues and potential disputes in various South American mining jurisdictions. Furthermore, the specter of resource nationalism, where governments assert greater control over natural resources, presents a substantial barrier. This can manifest as changes in royalty structures or even outright nationalization, as has been a concern in some African mining nations in recent years. For example, Zambia has periodically reviewed its mining tax regime, creating uncertainty for both existing and potential new investors.

- Geopolitical Instability: Regions like the Democratic Republic of Congo, a major copper producer, have faced challenges related to governance and security, increasing operational risks for new entrants.

- Regulatory Uncertainty: Chile, a global copper powerhouse, continually revises its mining laws and environmental regulations, demanding constant adaptation from companies. In 2024, discussions around water usage rights and environmental impact assessments remain critical.

- Resource Nationalism: The potential for governments to increase taxes and royalties on mining profits, as seen in discussions in countries like Zambia, can deter new investments by reducing expected returns.

- Community Relations: Successful new entrants must build strong relationships with local communities, addressing concerns about land use, environmental impact, and benefit sharing, which can be a lengthy and resource-intensive process.

The threat of new entrants in the copper mining sector is generally low due to immense capital requirements, with new mine development costing hundreds of millions to billions of dollars. The lengthy permitting process, often taking 15-17 years from discovery to production, also acts as a significant deterrent.

Furthermore, the scarcity of high-grade copper reserves means new players face higher exploration costs and potentially lower ore grades compared to established firms. Existing infrastructure, supply chain dominance, and operational expertise held by companies like Capstone Copper create substantial barriers that are difficult for newcomers to overcome.

Geopolitical and regulatory risks, coupled with the need for strong community relations, further complicate market entry. For instance, in 2023, Peru’s political instability highlighted the volatile operating environments many copper mines inhabit.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and government economic indicators to provide a comprehensive understanding of the competitive landscape.