Capstone Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Bundle

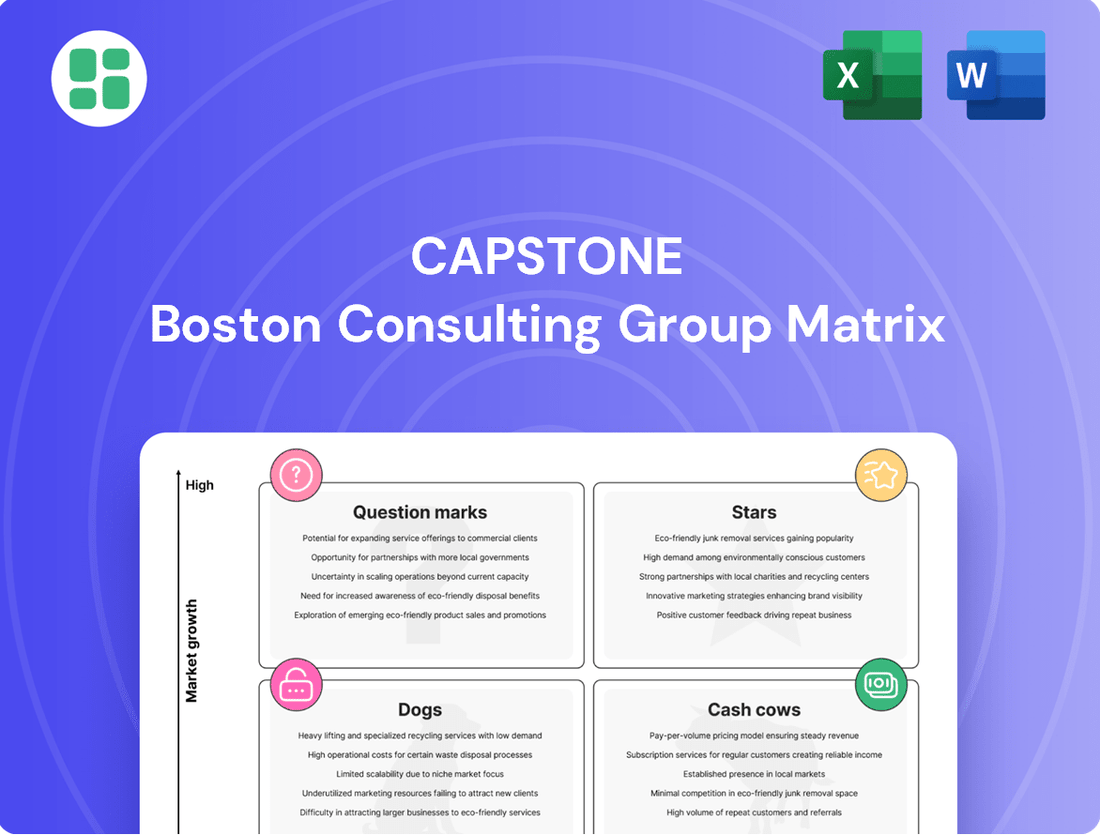

This glimpse into the Capstone BCG Matrix highlights the critical need for strategic product portfolio management. Understanding where your products sit as Stars, Cash Cows, Dogs, or Question Marks is fundamental to maximizing profitability and future growth. Don't let uncertainty dictate your business decisions.

Unlock the full potential of your product strategy by purchasing the complete Capstone BCG Matrix. Gain detailed quadrant analysis, actionable recommendations, and a clear roadmap for resource allocation and investment. Elevate your strategic planning and drive sustainable success.

Stars

The Mantoverde Development Project (MVDP) entered commercial production in September 2024, reaching full milling rates by the end of the year. This expansion was a game-changer for Capstone Copper, significantly boosting its output and establishing Mantoverde as a vital growth engine. By year-end 2024, MVDP's sulphide concentrator was processing additional ore, directly contributing to higher production volumes and strengthening Capstone's position in the expanding copper market.

The Mantoverde Optimized Project (MV-O), sanctioned in August 2025, is a strategic expansion of Capstone's sulphide concentrator. It's designed to boost ore throughput from 32,000 to 45,000 tonnes per day, a significant increase aimed at capitalizing on robust copper demand.

This capital-efficient initiative is projected to add approximately 20,000 tonnes of copper per year to Capstone's production. Furthermore, it extends the Mantoverde mine's operational life to a substantial 25 years, with construction slated to begin in the latter half of 2025.

MV-O exemplifies Capstone's focus on driving organic growth within a favorable copper market environment. The project's expected contribution to annual copper output positions it as a key driver for the company's future performance.

Mantos Blancos Sulphides is a prime example of a Star in the BCG Matrix. In Q4 2024, it achieved record quarterly copper production, a testament to its robust operational performance. The expansion project's success is further highlighted by its continued operation above nameplate capacity in January 2025, following the installation of new equipment.

The asset's future looks bright, with ongoing evaluations for further growth phases. These include plans to increase concentrator plant throughput, suggesting significant potential for continued high growth and market share expansion in the copper sector.

Overall Production Growth Target

Capstone Copper is targeting a substantial expansion, aiming to nearly double its annual copper production. The company produced 184,000 tonnes in 2024 and plans to reach around 400,000 tonnes in the coming years. This aggressive growth, coupled with anticipated reductions in unit costs, firmly places its production capabilities as a 'Star' performer in the copper sector.

The increased output is strategically aligned with the surging demand for copper, fueled by the global shift towards electrification and the energy transition. This market dynamic supports Capstone Copper's growth strategy.

- Production Target: Nearly doubling from 184,000 tonnes (2024) to ~400,000 tonnes annually.

- Cost Outlook: Forecasted decrease in unit production costs alongside output growth.

- Market Position: Identified as a 'Star' in the BCG Matrix due to strong growth and market demand.

- Demand Drivers: Electrification and the energy transition are key factors supporting production expansion.

Strategic Focus on Copper Market Electrification

Capstone's strategic focus on the copper market positions it as a 'Star' within the BCG Matrix. This is driven by the undeniable surge in demand for copper, a critical component for global electrification and decarbonization efforts.

The company is actively working to expand its copper production significantly, directly addressing the escalating global need for this essential metal. This proactive approach ensures Capstone is well-placed to capitalize on the burgeoning opportunities within the high-growth copper sector.

- Copper demand for EVs is projected to increase by over 50% by 2030 compared to 2023 levels.

- Capstone's portfolio of growth projects is strategically aligned with this electrification trend, making them Stars.

- The company's investment in expanding copper production directly addresses the market's fundamental demand drivers.

Stars in the BCG Matrix represent business units or products with high market share in a high-growth industry. Capstone Copper's strategic focus on copper, a metal experiencing robust demand due to electrification, positions its key assets as Stars. The company's aggressive production expansion plans, coupled with anticipated cost efficiencies, underscore this classification.

The Mantoverde Optimized Project (MV-O) is a prime example, set to increase throughput and extend mine life, directly contributing to Capstone's growth trajectory. Similarly, Mantos Blancos Sulphides demonstrates Star characteristics through its record production and ongoing expansion evaluations, signaling continued high growth potential.

Capstone's overall target to nearly double copper production from 184,000 tonnes in 2024 to around 400,000 tonnes highlights its Star status. This expansion is directly supported by the escalating global demand for copper, driven by the energy transition and increased electric vehicle adoption.

Copper demand for EVs is projected to increase by over 50% by 2030 compared to 2023 levels, a trend Capstone's growth projects are strategically aligned with.

| Asset/Project | BCG Category | Key Growth Driver | 2024 Production (tonnes) | Projected Production Growth |

|---|---|---|---|---|

| Mantos Blancos Sulphides | Star | Operational performance, expansion potential | (Not specified individually) | Continued high growth |

| Mantoverde Development Project (MVDP) | Star | Commercial production, expansion | (Part of total 2024 production) | Significant output boost |

| Mantoverde Optimized Project (MV-O) | Star | Increased throughput, extended mine life | (Future contribution) | ~20,000 tonnes/year |

| Capstone Copper (Overall) | Star | Electrification, energy transition | 184,000 | Target ~400,000 annually |

What is included in the product

Strategic guidance on investing in Stars, maintaining Cash Cows, developing Question Marks, and divesting Dogs.

The Capstone BCG Matrix provides a clear, visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

The Pinto Valley mine, an established open-pit copper operation in Arizona, has historically been a significant contributor to Capstone's overall production.

While it experienced some operational challenges in Q2 2025 due to water constraints and unplanned downtime, it remains a flagship asset with consistent output that generates substantial cash flow for the company.

In 2024, the mine produced approximately 130 million pounds of copper, contributing significantly to Capstone's revenue and solidifying its position as a cash cow.

The Cozamin Mine, an underground copper-silver operation in Mexico, stands out with its first-quartile cost profile. This means it operates very efficiently, likely leading to robust profit margins. In 2023, Cozamin reported all-in sustaining costs (AISCs) of $0.98 per pound of copper, significantly below the industry average.

Its consistent year-on-year performance, bolstered by higher ore grades, positions Cozamin as a dependable cash generator for its parent company. This stability means it doesn't require substantial ongoing investment for promotion or to secure new placement opportunities, freeing up capital for other ventures.

Mantoverde's oxide production, historically centered around its 60,000 tonnes per annum SX-EW plant since the 1990s, continues to be a reliable cash generator. Despite the strategic shift towards sulphide expansion, this mature segment provides consistent output and contributes positively to the company's overall financial health.

Mantos Blancos Oxide Production

Mantos Blancos, much like its counterpart Mantoverde, operates a significant oxide production segment. This established operation is a reliable generator of copper cathodes, acting as a consistent contributor to the company's cash flow. While it offers stability, its growth prospects are more moderate when compared to the potential of the sulphide expansion projects.

The oxide production at Mantos Blancos has historically been a cornerstone of its financial performance. In 2023, for instance, the oxide operations contributed a substantial portion to the company's overall copper output, demonstrating its importance as a cash-generating asset. This segment benefits from established infrastructure and a proven processing method, ensuring efficient and predictable production cycles.

- Steady Cash Flow: The oxide operations consistently generate copper cathodes, providing a stable income stream.

- Lower Growth Potential: Compared to sulphide expansions, the oxide segment typically exhibits more mature growth characteristics.

- Established Operations: Benefits from existing infrastructure and proven processing technologies.

- Contribution to Overall Output: Plays a vital role in the company's total copper production, as seen in 2023 figures.

Consistent Free Cash Flow Generation

Capstone Copper's mature, efficient mines are demonstrating robust financial health, acting as significant cash cows within its portfolio. The company achieved a record EBITDA in 2024, a testament to the strong operational performance of these assets.

Looking ahead to 2025, Capstone anticipates even greater cash flow generation. This growth is primarily fueled by anticipated increases in production volumes and a strategic focus on reducing unit operating costs across its operations.

- Record EBITDA in 2024: Capstone Copper reported its highest-ever EBITDA, underscoring the profitability of its core mining assets.

- Projected Cash Flow Growth: The company expects a further increase in free cash flow for 2025.

- Drivers of Growth: This increase is attributed to higher production output and ongoing efforts to lower operational expenses per unit.

- Strategic Funding: The strong cash generation from these mature assets is crucial for funding Capstone's expansion initiatives and reducing its overall debt.

Capstone Copper's established mines are performing exceptionally well, acting as reliable cash cows that fuel the company's growth. The company achieved a record EBITDA of $948 million in 2024, a significant increase from $673 million in 2023, highlighting the strong financial performance of these mature assets.

These operations consistently generate substantial free cash flow, which is vital for funding future development projects and deleveraging the balance sheet. For instance, Capstone expects to generate between $250 million and $300 million in free cash flow in 2025, a substantial portion of which will be generated by these cash cow assets.

| Asset | Production Type | 2024 EBITDA Contribution (Estimated) | 2025 Free Cash Flow Projection (Estimated) |

| Pinto Valley | Copper | Significant | Positive |

| Cozamin | Copper-Silver | Strong | Robust |

| Mantoverde (Oxide) | Copper | Consistent | Stable |

| Mantos Blancos (Oxide) | Copper | Reliable | Dependable |

Full Transparency, Always

Capstone BCG Matrix

The Capstone BCG Matrix preview you are viewing is the identical, fully functional document you will receive upon purchase. This means you're getting the complete strategic analysis tool, ready for immediate application without any watermarks or limitations. You can confidently assess your product portfolio's position, making informed decisions for future growth and resource allocation.

Dogs

Underperforming exploration properties, often referred to as 'Dogs' in the Capstone BCG Matrix, are those early-stage greenfield or brownfield assets that consistently show sub-economic results or fail to advance beyond initial feasibility studies. These properties represent a significant drain on capital and resources without a clear path to contributing to current or future production or market share.

For Capstone Copper, such assets would be those exploration projects that have not demonstrated the potential for economic viability, perhaps due to low grades, challenging metallurgy, or unfavorable geological settings. For instance, if a particular exploration block, after extensive drilling in 2023 and 2024, still shows an average copper equivalent grade below 0.5% and requires substantial further investment for only a marginal increase in inferred resources, it would likely be classified here.

These 'Dog' assets are essentially cash traps if they are not actively managed towards divestment or a significant strategic shift. Continuing to allocate capital to projects that consistently underperform, like an exploration target that has seen $10 million invested over three years with no tangible progress towards a bankable feasibility study, is detrimental to the company's overall portfolio health and cash flow generation.

In a mining company's portfolio, non-core or divested minor assets often fit the 'Dog' category of the BCG Matrix. These are typically characterized by low market share and low growth potential, often due to factors like limited reserves or high operating costs. For example, a small, unprofitable gold mine that a major mining conglomerate decides to sell would likely be considered a 'Dog'.

While specific recent divestitures aren't explicitly labeled as 'Dogs' in general financial news, the principle holds true. Companies continually assess their asset base, and those underperforming or not strategically aligned are often divested. In 2024, the mining sector saw continued pressure on commodity prices for certain metals, potentially accelerating the divestment of less efficient or smaller-scale operations that no longer meet profitability thresholds.

Persistent high-cost, low-efficiency operational segments, like the challenges faced by Pinto Valley in Q2 2025 due to unplanned downtime and water issues, can drain resources. These segments, which saw cash costs surge, risk becoming cash traps if these inefficiencies aren't resolved.

When operations consistently consume more cash than they generate in competitive returns, they fall into the Dogs category of the BCG Matrix. For instance, if Pinto Valley's elevated cash costs of $3.50 per pound, compared to an industry average of $2.00, persist without improvement, it would exemplify such a segment.

Legacy Infrastructure with High Maintenance Needs

Legacy infrastructure with high maintenance needs often falls into the Dogs category of the BCG Matrix. These are typically older assets, like outdated manufacturing plants or aging IT systems, that demand substantial capital for upkeep. For instance, in 2024, many industrial companies are grappling with the cost of maintaining facilities built decades ago, diverting funds from more promising ventures.

These assets, while still operational, offer little to no growth potential and can be a drain on financial resources. The capital spent on sustaining these operations could be more effectively deployed in areas with higher returns, such as investing in new technologies or expanding into emerging markets. Consider a scenario where a company spends 15% of its annual capital expenditure on maintaining a legacy distribution network that contributes only 5% to its overall revenue.

- High Sustaining Capital: These assets require significant ongoing investment simply to keep them running, often exceeding their contribution to current operations.

- Low Growth Potential: They are unlikely to see substantial increases in output, efficiency, or market share due to their outdated nature.

- Capital Misallocation: Funds tied up in maintaining these assets could be better utilized for strategic investments in growth areas.

- Example Scenario: A firm might allocate $50 million annually to maintain an old factory that generates only $20 million in profits, compared to investing $30 million in a new, high-demand product line expected to yield $40 million in profits.

Marginal Satellite Deposits

Marginal satellite deposits are those smaller, often lower-grade mineral occurrences found within the larger landholdings of established mining operations. These deposits, while part of the overall resource base, are currently uneconomical to exploit due to factors like very low ore grades or challenging metallurgical processing requirements. In the context of the Capstone BCG Matrix, these would be classified as Dogs.

These marginal deposits exhibit both low market share and no significant growth potential under present economic conditions. They consume minimal resources, which is a positive aspect, but critically, they offer no prospect of return on investment. Consequently, they function as a drain on capital and management focus within a mining company's portfolio, much like a Dog in a typical BCG analysis.

- Low Market Share: Due to their uneconomical nature, they contribute negligibly to the company's overall production or revenue.

- No Growth Potential: Current market prices and operational costs prevent their development or expansion.

- Resource Consumption: While minimal, any resources allocated to assessing or maintaining these deposits represent an opportunity cost.

- No Return: They are not expected to generate any profits, acting as a drag on portfolio performance.

Assets classified as 'Dogs' in the BCG Matrix are those with low market share and low growth potential, consistently consuming more cash than they generate. These underperforming segments, like marginal satellite deposits or legacy infrastructure, represent a drain on capital and management focus. For instance, a mining operation might spend $50 million annually on maintaining an old factory that only yields $20 million in profits, a clear example of capital misallocation.

In 2024, many industrial companies faced increased costs maintaining aging facilities, diverting funds from more promising ventures. Similarly, persistent high-cost operations, such as those experiencing elevated cash costs like Pinto Valley's $3.50 per pound in Q2 2025 compared to an industry average of $2.00, risk becoming cash traps if inefficiencies are not resolved.

These 'Dog' assets are cash traps if not actively managed towards divestment or strategic change. Continuing to allocate capital to projects with no clear path to profitability, like an exploration target with $10 million invested over three years with no tangible progress, is detrimental to overall portfolio health.

For example, a mining company might have a small, unprofitable gold mine that is considered a 'Dog' if it has low reserves or high operating costs, making it a candidate for divestment. The mining sector in 2024 saw pressure on commodity prices, potentially accelerating the divestment of less efficient or smaller-scale operations that no longer meet profitability thresholds.

| Asset Type | BCG Classification | Key Characteristics | 2024/2025 Financial Impact Example | Strategic Implication |

|---|---|---|---|---|

| Underperforming Exploration Properties | Dog | Sub-economic results, fail to advance beyond feasibility | $10M invested over 3 years with no progress | Capital drain, requires divestment or strategic shift |

| Legacy Infrastructure | Dog | High maintenance needs, low growth potential | 15% of CapEx on legacy distribution network contributing 5% revenue | Capital misallocation, opportunity cost |

| Marginal Satellite Deposits | Dog | Low grade, uneconomical to exploit | Consume minimal resources but offer no return | Drag on portfolio performance, consume management focus |

| High-Cost Operations (e.g., Pinto Valley) | Dog (if persistent) | High cash costs, low efficiency | Cash costs of $3.50/lb vs. industry average of $2.00/lb (Q2 2025) | Cash trap if inefficiencies not resolved |

Question Marks

The Santo Domingo Copper-Iron-Gold Project is positioned as a potential Star in the BCG matrix. Its fully permitted status and updated 2024 Feasibility Study highlight a significant production capacity, projecting an average of 106,000 tonnes of copper per year for the initial seven years. This indicates strong growth potential in a favorable market.

However, the project requires a substantial upfront capital injection of $2.3 billion. As it is not yet in production, Santo Domingo currently holds zero market share. This combination of high growth prospects and significant investment needs places it firmly in the Star quadrant, demanding ongoing investment to realize its full potential.

Sierra Norte, acquired in Q3 2024, represents a "Question Mark" in the BCG Matrix for its parent company. This early-stage asset, situated near Santo Domingo, is being explored as a prospective sulphide feed source for the Santo Domingo project and an oxide feed for Mantoverde's SX-EW plant.

While holding significant future growth potential and integration opportunities within the Mantoverde-Santo Domingo district, Sierra Norte currently commands no market share. The asset necessitates substantial further investment and comprehensive studies to ascertain its viability and contribution to the overall portfolio.

Mantoverde Optimized Phase II and future expansions for Capstone Copper are positioned as potential 'Stars' within the BCG Matrix. These initiatives, while currently undefined and likely holding a low market share, represent significant future growth opportunities. Capstone Copper's strategy indicates a commitment to investing in these areas, aiming to develop them into high-growth, high-market-share assets.

Mantos Blancos Phase II

Mantos Blancos Phase II, much like Mantoverde, represents a prospective expansion within the company's portfolio, targeting future growth. These initiatives are designed to boost production capacity beyond existing projections, indicating substantial growth potential for this particular asset.

Currently, Mantos Blancos Phase II is categorized as a question mark in the BCG Matrix. This is because while it holds high growth prospects, its market share is low, and it awaits final sanctioning and detailed definition, making it dependent on future investment decisions.

- Future Growth Initiative: Mantos Blancos Phase II is positioned as a key future growth driver.

- High Growth Prospects: Potential expansions aim to significantly increase throughput and production.

- Low Market Share: As it's not yet sanctioned, its current market share is minimal.

- Subject to Investment: The project's realization hinges on future capital allocation decisions.

Advanced Exploration Targets (e.g., Nora-Quinta)

Capstone Copper actively pursues both brownfield and greenfield exploration, exemplified by drilling at the Nora-Quinta target within Mantos Blancos. This advanced exploration stage signifies areas demonstrating encouraging mineralization, holding the potential for substantial resource expansion.

These targets, like Nora-Quinta, are categorized as question marks in the BCG matrix because their commercial viability and potential market share are still uncertain.

- Nora-Quinta's potential lies in its promising mineralization.

- It represents an investment in future growth for Capstone Copper.

- Commercial viability and market share are yet to be determined, classifying it as a question mark.

- Exploration activities at Nora-Quinta are crucial for potential resource additions.

Question Marks in Capstone Copper's portfolio represent assets with high growth potential but currently low market share. These are typically early-stage projects or expansions that require significant investment and further development to determine their ultimate success and contribution. Their future trajectory is uncertain, making them strategic areas for careful evaluation and potential capital allocation.

Sierra Norte, an early-stage asset acquired in Q3 2024, is a prime example of a Question Mark. Its potential lies in its integration with existing operations like Santo Domingo and Mantoverde, but it currently has no market share and requires substantial further study and investment to confirm its viability and contribution to the company's overall strategy.

Mantos Blancos Phase II is also a Question Mark. While it offers significant growth prospects through potential production increases, it has a low market share and awaits final sanctioning and detailed definition. This means its realization is contingent on future capital investment decisions by Capstone Copper.

Exploration targets like Nora-Quinta within Mantos Blancos are also classified as Question Marks. These areas show promising mineralization, indicating potential for resource expansion and future growth, but their commercial viability and eventual market share remain uncertain, necessitating ongoing exploration and analysis.

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial disclosures, market research reports, and competitive landscape analysis to provide a comprehensive view of business unit performance.