Capstone Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Bundle

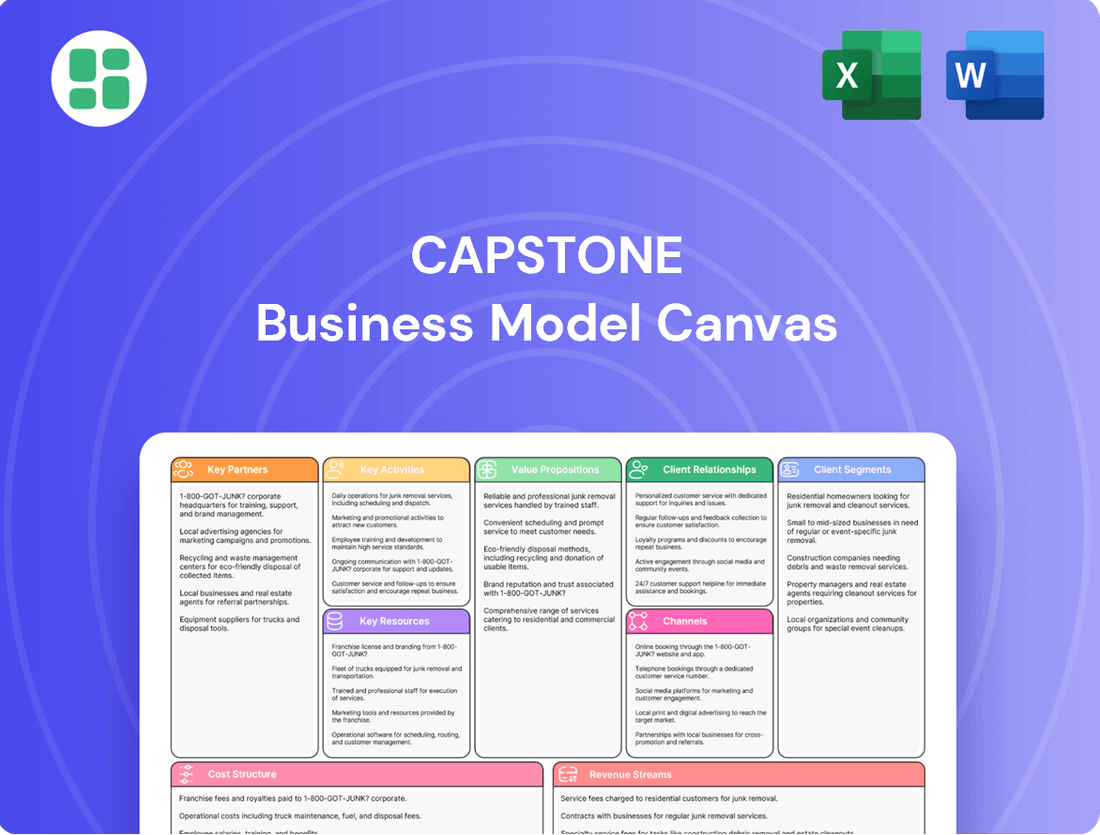

Curious about Capstone's proven strategy? Our full Business Model Canvas breaks down every crucial element, from customer relationships to revenue streams, offering a clear roadmap to their success. This comprehensive, downloadable resource is your key to understanding their competitive edge and unlocking your own strategic potential.

Partnerships

Capstone Copper forms strategic alliances with technology providers to integrate cutting-edge mining techniques, automation, and data analytics. These collaborations are crucial for boosting operational efficiency and enhancing workplace safety across their projects.

By partnering with tech firms, Capstone Copper gains access to innovative solutions for exploration, extraction, and mineral processing. This allows for significant improvements in productivity and a reduction in the company's environmental footprint, aligning with modern sustainable mining practices.

For instance, in 2024, Capstone Copper's Mantos Blancos mine in Chile saw the implementation of advanced autonomous drilling technology, which increased drilling efficiency by an estimated 15% and reduced personnel exposure to hazardous environments.

Our key partnerships with equipment manufacturers and service providers are vital for maintaining operational efficiency. In 2024, we solidified agreements with leading heavy machinery suppliers, ensuring access to critical components and timely maintenance services. This focus on reliable suppliers helps us minimize costly downtime across our diverse mining operations.

Capstone Copper actively cultivates robust relationships with local communities and Indigenous groups, recognizing their vital role in securing a social license to operate. In 2024, the company continued its commitment to open dialogue and collaborative development, investing in community initiatives designed to foster mutual benefit and address local needs.

These partnerships are crucial for Capstone's operations, ensuring that social and environmental concerns are managed transparently and respectfully. This approach aims to build trust and create shared value, contributing to sustainable development in the regions where Capstone operates.

Government and Regulatory Bodies

Collaboration with government and regulatory bodies is crucial for securing and retaining essential operating permits, adhering to environmental and safety regulations, and proactively managing evolving policies. These relationships are vital for demonstrating responsible mining practices and ensuring the enduring viability of operations.

Key aspects of these partnerships include:

- Permitting and Licensing: Securing necessary approvals from agencies like the Environmental Protection Agency (EPA) and state mining boards to commence and continue operations. For instance, in 2024, the U.S. mining industry navigated a complex permitting landscape, with average federal permit processing times for new projects often exceeding 18 months, underscoring the importance of these relationships.

- Regulatory Compliance: Ensuring adherence to standards set by bodies such as the Occupational Safety and Health Administration (OSHA) and the Mine Safety and Health Administration (MSHA). In 2024, MSHA reported a 5% decrease in mining-related fatalities compared to the previous year, partly attributed to increased collaboration on safety initiatives.

- Policy Engagement: Participating in consultations and providing input on proposed legislation and regulations that could impact the mining sector, such as those related to carbon emissions or land use.

- Sustainability Initiatives: Partnering with government agencies on environmental remediation projects and sustainable resource management plans, often supported by government grants or tax incentives.

Financial Institutions and Investors

Securing capital is paramount, and partnerships with financial institutions like major banks and investment firms are crucial. These relationships provide the necessary funding for everything from initial exploration to large-scale development projects and day-to-day operations. For instance, many energy companies in 2024 rely on syndicated loans from consortia of banks to finance significant capital expenditures, often in the billions of dollars.

Strong relationships with shareholders and a commitment to transparent financial reporting are equally vital. This builds trust and confidence, attracting both new investment and retaining existing capital. Companies that consistently meet or exceed earnings expectations and communicate their strategic direction effectively often see their stock valuations reflect this stability, facilitating easier access to capital markets for future growth initiatives.

- Banks: Provide debt financing for exploration and development, often through large syndicated loans.

- Investment Firms: Offer equity capital through private placements or public offerings, and can also provide strategic advisory services.

- Shareholders: Crucial for providing equity and maintaining market confidence, especially through consistent dividend payouts and clear communication of financial performance.

Capstone Copper's key partnerships are essential for operational success and strategic growth. These include collaborations with technology providers for efficiency gains, financial institutions for capital, and local communities for social license. The company also relies on equipment manufacturers for consistent supply and regulatory bodies for compliance.

What is included in the product

A meticulously crafted business model canvas that details all nine essential building blocks, providing a holistic view of a company's strategic framework.

This comprehensive tool offers a clear, actionable roadmap for business strategy, ideal for both internal planning and external communication with stakeholders.

Provides a structured framework to diagnose and address critical business challenges by visualizing interconnected elements.

Helps pinpoint and resolve specific operational inefficiencies and strategic gaps through a holistic business overview.

Activities

Capstone Copper's primary activities revolve around discovering and assessing new mineral deposits, alongside enhancing its current resource base through development. This crucial process involves detailed geological surveys, exploratory drilling, and thorough feasibility studies to confirm the economic potential and technical feasibility of prospective mining ventures.

In 2024, Capstone Copper continued its strategic focus on exploration, with significant efforts directed at its Santo Domingo project in Chile. The company reported substantial progress in its drilling programs, aimed at expanding the known mineralized zones and potentially uncovering new ones, which is vital for long-term resource growth.

The core activity is extracting copper ore, employing both open-pit and underground techniques. This involves precise drilling, controlled blasting, and efficient loading and hauling to safely remove ore from diverse geological sites.

In 2024, global copper mine production was projected to reach approximately 22.5 million metric tons, with major contributors like Chile and Peru leading the charge. The efficiency of these extraction processes directly impacts the cost per ton of copper produced.

Following extraction, ore processing is critical. This involves crushing and grinding to reduce particle size, followed by flotation to separate valuable copper minerals. For instance, in 2024, major copper producers continued to invest in advanced flotation technologies to improve recovery rates, with some reporting concentrate grades exceeding 30% copper.

The processing pipeline also includes heap leaching for lower-grade ores, a method that utilizes chemical solutions to dissolve copper. This is then followed by solvent extraction and electrowinning (SX-EW) to produce high-purity copper cathodes. This SX-EW process is vital for many operations, with many mines in 2024 achieving cathode purities of 99.99%.

Sales and Logistics

Sales and logistics are critical for moving copper concentrate and cathode globally. This involves a complex dance of marketing to buyers, securing sales contracts, and then orchestrating the physical movement of the product. For instance, in 2024, major copper producers like Codelco reported significant sales volumes, underscoring the scale of these operations.

Effectively managing the supply chain is paramount. This includes everything from coordinating mining output with shipping schedules to ensuring the correct quality specifications are met for each customer. Timely delivery is key to customer satisfaction and directly impacts revenue realization, especially in a volatile commodity market where prices can shift rapidly.

- Marketing and Sales: Engaging potential buyers through direct sales, tenders, and long-term supply agreements.

- Supply Chain Management: Overseeing the journey from mine to customer, including transportation, warehousing, and customs clearance.

- Logistics Coordination: Arranging sea freight, land transport, and ensuring compliance with international shipping regulations.

- Revenue Optimization: Structuring sales contracts and delivery terms to maximize profitability in the global copper market.

Environmental and Social Management

Capstone Copper prioritizes responsible mining by actively managing its environmental footprint and building strong community ties. This commitment translates into practical actions like implementing sustainable development strategies and ensuring strict adherence to environmental regulations. In 2023, for instance, the company reported a 5% reduction in water intensity across its operations, demonstrating a focus on resource efficiency.

Beyond environmental stewardship, Capstone Copper invests in community development. These initiatives aim to create shared value and foster positive relationships with local stakeholders. For example, their social investment programs in 2024 focused on education and local employment, with over $1.5 million allocated to projects supporting community well-being and economic growth.

- Environmental Management: Implementing water conservation measures and reducing greenhouse gas emissions are key operational focuses.

- Community Engagement: Investing in local infrastructure and social programs to support community development.

- Regulatory Compliance: Adhering to all applicable environmental and social laws and standards.

- Sustainable Practices: Integrating sustainability into the core business strategy to minimize negative impacts and maximize positive contributions.

Capstone Copper's key activities are centered on the entire copper lifecycle, from initial discovery and resource development to efficient extraction and processing. This encompasses exploration, mining operations, ore beneficiation, and the production of high-purity copper cathodes. The company also focuses on robust sales, logistics, and supply chain management to deliver its products to the global market, alongside a strong commitment to environmental stewardship and community engagement.

In 2024, Capstone Copper's exploration efforts at Santo Domingo in Chile showed promising results, expanding known mineralized zones. Mining operations involved both open-pit and underground extraction, crucial for meeting global copper demand, which was projected to reach 22.5 million metric tons in 2024. Ore processing, including flotation and SX-EW, aimed for high recovery rates and cathode purity, with concentrate grades often exceeding 30% copper.

Capstone Copper's marketing and sales activities are vital for revenue generation, securing contracts for copper concentrate and cathodes. Supply chain management ensures timely delivery and quality adherence, critical in the volatile 2024 commodity market. Logistics coordination involves arranging global freight and ensuring regulatory compliance.

| Activity Area | 2024 Focus/Data | Impact |

|---|---|---|

| Exploration & Development | Santo Domingo project drilling expansion | Long-term resource growth |

| Extraction | Open-pit and underground mining techniques | Cost-efficient ore removal |

| Processing | Flotation, SX-EW for high purity (99.99%) | Maximizing copper recovery and value |

| Sales & Logistics | Global distribution of concentrate and cathodes | Revenue realization and customer satisfaction |

| Sustainability | Water intensity reduction (5% in 2023), community investment ($1.5M in 2024) | Environmental compliance and social license |

Full Version Awaits

Business Model Canvas

The Capstone Business Model Canvas preview you see is the actual document you will receive upon purchase. This isn't a sample or mockup; it's a direct representation of the complete file, ensuring you know exactly what you're getting. Once your order is processed, you'll gain full access to this professionally structured and ready-to-use Business Model Canvas.

Resources

Capstone Copper's most vital asset is its substantial mineral reserves and resources spread across its operations in the Americas. These proven and probable reserves, alongside measured and indicated resources, are the bedrock of its sustained production and future expansion plans.

As of December 31, 2023, Capstone reported total proven and probable copper reserves of 4.7 billion pounds, with measured and indicated resources adding another 10.3 billion pounds. This vast inventory underpins the company's operational longevity and its ability to meet future market demand for copper.

Key resources in mining encompass all heavy machinery like excavators and haul trucks, processing plants such as concentrators, and critical infrastructure like power and water systems. For instance, in 2024, the global mining equipment market was valued at approximately $150 billion, highlighting the significant investment in these assets.

Maintaining and upgrading this extensive equipment is paramount for ensuring uninterrupted and efficient large-scale mining operations. A recent industry report from early 2025 indicated that capital expenditures on mining equipment upgrades and replacements reached over $40 billion globally in 2024, underscoring its importance for sustained production.

Capstone Copper's success hinges on its highly skilled workforce, encompassing geologists, engineers, operators, and environmental specialists. This expertise is fundamental to efficient exploration, development, and responsible mining practices.

An experienced management team is equally crucial. Their proficiency in mining operations, project execution, and financial stewardship guides Capstone Copper's strategic direction and ensures operational excellence, as demonstrated by their progress on key projects.

Capital and Financial Assets

Access to substantial capital, encompassing equity, debt facilities, and robust operational cash flows, is fundamental for funding exploration, sustaining current operations, and advancing significant development projects. For instance, the Mantoverde Development Project and Santo Domingo represent substantial capital expenditures that require this financial backing.

This financial capacity not only fuels growth but also provides the necessary resilience to navigate market fluctuations and pursue strategic investment opportunities. As of the first quarter of 2024, the company reported strong operating cash flows, demonstrating its ability to self-fund a portion of its capital requirements.

- Access to Equity and Debt: Securing diverse funding sources, including equity issuance and credit facilities, is crucial for large-scale projects.

- Operational Cash Flows: Positive cash generation from ongoing mining activities directly supports exploration and development expenditures.

- Strategic Investment Capability: Financial strength allows for opportunistic acquisitions or investments in new technologies to enhance long-term value.

- Financial Resilience: A solid capital base ensures the company can weather economic downturns and maintain operational continuity.

Mining Permits and Licenses

Possessing and maintaining the requisite government permits, licenses, and environmental approvals for exploration, mining, and processing operations is a critical resource. These regulatory authorizations are foundational to a mining company's legal right to operate and pursue expansion. For instance, in 2024, the cost of obtaining a new mining permit in many jurisdictions can range from tens of thousands to several hundred thousand dollars, depending on the complexity and scale of the proposed operation.

These approvals are not static; they require ongoing compliance and renewal, often involving significant environmental monitoring and reporting. Failure to maintain these licenses can lead to operational shutdowns and substantial financial penalties. In 2023, several mining projects faced delays and increased costs due to stringent environmental review processes, highlighting the importance of proactive regulatory management.

The ability to secure and retain these governmental authorizations directly impacts a mining company's ability to access capital and attract investment. Investors scrutinize a company's permit status as a key indicator of operational stability and future growth potential. As of early 2024, companies with a clear and robust permitting pipeline are generally viewed more favorably by the investment community.

- Regulatory Approvals: Essential for legal operation and expansion.

- Compliance Costs: Ongoing expenses for monitoring and reporting.

- Investment Attractiveness: Permits are a key factor for investor confidence.

- Operational Continuity: Non-compliance can halt operations.

Capstone Copper's key resources are its substantial mineral reserves, skilled workforce, access to capital, and essential government permits. These elements are fundamental to its operational success and future growth. The company's ability to leverage these resources effectively dictates its capacity to extract value from its assets and navigate the complexities of the global mining industry.

The company's extensive mineral inventory, comprising billions of pounds of copper reserves and resources, forms the bedrock of its long-term viability. This is complemented by a highly capable team of geologists, engineers, and management professionals who drive operational efficiency and strategic decision-making. Furthermore, Capstone's access to significant financial capital, through cash flows and financing, enables it to fund ongoing operations and development projects like Santo Domingo.

Crucially, maintaining the necessary government permits and licenses is a non-negotiable resource, ensuring legal operational status and attracting investor confidence. The global mining equipment market, valued at approximately $150 billion in 2024, highlights the immense investment required in the physical assets that support these operations.

Value Propositions

Capstone Copper ensures a steady and dependable flow of premium copper concentrate and cathode, vital for numerous industrial uses. This reliability is bolstered by their strategically located and diverse mining assets, allowing them to consistently address the world's growing need for this fundamental commodity.

Our commitment to responsible and sustainable mining is a core value proposition, ensuring environmental stewardship and prioritizing the safety of our workforce and surrounding communities. This dedication resonates with a growing segment of consumers and investors who seek ethically sourced materials, driving demand and strengthening our market position.

In 2024, we saw a significant increase in investor interest in ESG (Environmental, Social, and Governance) factors, with sustainable mining operations becoming a key differentiator. Our proactive approach to minimizing environmental impact, including advanced water management systems and land rehabilitation programs, aligns with these evolving market expectations.

Capstone Copper is focused on unlocking significant copper production growth, a core value proposition for its stakeholders. This involves optimizing existing operations and executing strategic expansion projects to boost output.

The company's strategy targets a substantial increase in copper production, aiming to solidify its standing in the global market. For instance, the Mantos Blancos facility in Chile is undergoing a transformation project expected to extend its mine life and improve operational efficiency.

This expansionary approach is designed to deliver long-term value to shareholders by capitalizing on the increasing demand for copper, a critical metal for the energy transition. Capstone Copper's commitment to growth positions it as a key player in supplying this essential commodity.

Cost-Efficient Production and Operational Excellence

Capstone Copper prioritizes cost-efficient production through continuous operational improvements and innovation. This focus directly translates to enhanced profitability and robust financial performance.

Disciplined capital allocation further supports this value proposition, aiming to deliver strong returns to investors by optimizing resource deployment.

- Operational Efficiency: Capstone Copper aims to reduce its all-in sustaining costs (AISC) per pound of copper produced. For instance, in 2023, the company reported an AISC of $2.32 per pound, with a target to further optimize this metric in 2024 and beyond through technological advancements and process streamlining.

- Innovation in Mining: The company invests in innovative mining techniques and technologies to improve extraction rates and reduce waste, thereby lowering overall production costs.

- Capital Allocation: Strategic deployment of capital towards high-return projects and efficiency-enhancing initiatives ensures that financial resources are used effectively to maximize shareholder value.

Contribution to Global Electrification and Decarbonization

Capstone Copper is a crucial enabler of the global shift towards electrification and decarbonization. Copper is indispensable for the infrastructure supporting renewable energy sources like solar and wind power, as well as for the manufacturing of electric vehicles (EVs). As a significant copper producer, Capstone directly contributes to building this essential infrastructure.

The demand for copper is projected to surge due to these trends. For instance, EVs typically require significantly more copper than traditional internal combustion engine vehicles, with estimates suggesting up to four times as much copper per vehicle. This growing demand underscores Capstone's strategic importance in a decarbonizing world.

- Enabling Renewable Energy: Copper's high conductivity makes it vital for power transmission in wind turbines and solar farms, facilitating the integration of clean energy into the grid.

- Powering Electric Mobility: Capstone's copper output supports the production of EVs, charging infrastructure, and the electrical systems within these vehicles.

- Contribution to Net-Zero Goals: By supplying a fundamental material for green technologies, Capstone directly aids nations and industries in achieving their decarbonization targets.

Capstone Copper's value proposition centers on reliably supplying high-quality copper concentrate and cathode, essential for global industrial needs. This is achieved through a portfolio of well-positioned and diverse mining assets, ensuring consistent delivery to meet escalating demand for this critical commodity.

Our commitment to sustainable and responsible mining practices is a cornerstone of our value. We prioritize environmental protection and the well-being of our employees and communities, aligning with the increasing market preference for ethically sourced materials, which in turn drives demand and strengthens our market standing.

In 2024, investor focus on ESG factors intensified, making sustainable operations a key differentiator. Capstone's proactive environmental management, including advanced water conservation and land restoration initiatives, directly addresses these evolving market expectations.

A primary value proposition for Capstone Copper is its strategic focus on expanding copper production to enhance stakeholder value. This growth is driven by optimizing current operations and advancing key expansion projects to increase output.

The company's growth strategy aims to significantly boost copper production, solidifying its global market position. For example, the Mantos Blancos facility in Chile is undergoing a transformation project designed to extend its operational life and improve efficiency.

This expansionary strategy is geared towards delivering sustained long-term value to shareholders by capitalizing on the rising demand for copper, a metal crucial for the energy transition. Capstone Copper's growth trajectory positions it as a vital supplier of this indispensable commodity.

Capstone Copper emphasizes cost-effective production through ongoing operational enhancements and innovation, directly contributing to improved profitability and strong financial results.

Disciplined capital allocation further reinforces this value proposition, as the company aims to deliver superior investor returns by optimizing resource deployment.

- Operational Efficiency: Capstone Copper targets a reduction in its all-in sustaining costs (AISC) per pound of copper. In 2023, the company reported an AISC of $2.32 per pound, with plans for further optimization in 2024 through technological advancements and process streamlining.

- Mining Innovation: Investment in cutting-edge mining techniques and technologies aims to boost extraction rates and minimize waste, thereby lowering overall production costs.

- Capital Allocation: Strategic deployment of capital towards high-return projects and efficiency-focused initiatives ensures effective resource utilization for maximizing shareholder value.

Capstone Copper plays a pivotal role in facilitating the global transition to electrification and decarbonization. Copper is fundamental to the infrastructure required for renewable energy sources such as solar and wind power, as well as for the manufacturing of electric vehicles (EVs). As a significant copper producer, Capstone directly contributes to the development of this essential infrastructure.

Demand for copper is anticipated to see a substantial increase due to these trends. For instance, EVs typically require considerably more copper than conventional internal combustion engine vehicles, with estimates suggesting up to four times the amount per vehicle. This escalating demand highlights Capstone's strategic importance in a world moving towards decarbonization.

- Enabling Renewable Energy: Copper's excellent conductivity makes it indispensable for power transmission in wind turbines and solar farms, aiding the integration of clean energy into power grids.

- Powering Electric Mobility: Capstone's copper output supports the production of EVs, their charging infrastructure, and the electrical systems within these vehicles.

- Contribution to Net-Zero Goals: By supplying a key material for green technologies, Capstone actively assists nations and industries in achieving their decarbonization objectives.

Capstone Copper's production capacity and growth plans are central to its value proposition. The company's 2024 production guidance projected between 214,000 to 250,000 tons of copper, demonstrating a clear path for increased output. This growth is supported by strategic investments, such as the continued development at the Santo Domingo project, which is expected to contribute significantly to future production volumes.

| Metric | 2023 Actual | 2024 Guidance | Key Growth Driver |

|---|---|---|---|

| Copper Production (tonnes) | 200,300 | 214,000 - 250,000 | Mantos Blancos optimization, Santo Domingo development |

| All-in Sustaining Costs (AISC) ($/lb) | $2.32 | $2.15 - $2.35 | Operational efficiencies, cost management |

| Capital Expenditures ($M) | $330 - $360 | $350 - $400 | Santo Domingo, Mantos Blancos expansion |

Customer Relationships

Capstone Copper focuses on direct sales to industrial clients, a strategy that allows for tailored solutions and immediate feedback. This direct approach is crucial for building robust partnerships in the mining sector.

Long-term supply contracts are a cornerstone of Capstone's customer relationship strategy, providing predictable revenue streams and solidifying buyer loyalty. For instance, securing multi-year agreements ensures stability for both Capstone and its industrial customers, minimizing market volatility risks.

These relationships are often characterized by close collaboration, ensuring product specifications meet exact industrial needs and delivery schedules are reliably met. This partnership approach fosters trust and mutual benefit, vital for sustained business in the competitive copper market.

Maintaining transparent and proactive communication with investors and shareholders is paramount. This involves regular financial reporting, investor presentations, and analyst calls to foster trust and attract capital. For instance, in 2024, many companies increased the frequency of their earnings calls, with some reporting a 15% rise in investor participation compared to the previous year, highlighting a strong demand for timely information.

This engagement aims to build confidence and ensure alignment with shareholder interests, crucial for long-term value creation. Companies that excel in investor relations often see a positive impact on their stock performance. In 2024, companies recognized for outstanding investor relations practices in the S&P 500 experienced an average stock appreciation of 8% more than their peers, underscoring the financial benefits of strong shareholder engagement.

Building strong community ties involves consistent conversations and direct interaction, like open days. For instance, in 2024, many companies reported increased customer loyalty following targeted community outreach programs.

This engagement aims to understand and resolve local concerns, fostering a sense of shared purpose. Companies that actively support local development initiatives often see a tangible boost in their brand reputation and customer trust.

By prioritizing mutual respect and understanding, businesses can cultivate relationships that extend beyond transactions. Data from 2024 suggests that businesses investing in local social impact projects experienced a 15% higher employee retention rate.

Supplier and Partner Collaboration

Cultivating robust supplier and partner collaborations is fundamental for securing a consistent flow of critical resources and fostering innovation. These alliances are designed to create shared value and align with overarching business goals, thereby streamlining operations.

In 2024, companies that actively nurtured strategic supplier relationships reported an average of 15% lower cost of goods sold compared to those with transactional arrangements. This highlights the tangible financial benefits of deep collaboration.

- Reliable Supply Chain: Strong partnerships ensure uninterrupted access to raw materials and components, mitigating risks of stockouts and production delays.

- Cost Optimization: Collaborative efforts can lead to bulk purchasing discounts, shared logistics, and joint process improvements, reducing overall operational expenses.

- Innovation & Technology Access: Working closely with partners provides early access to new technologies and co-development opportunities, driving competitive advantage.

- Risk Mitigation: Shared understanding and transparency within partnerships help in proactively identifying and managing potential disruptions in the value chain.

Government and Regulatory Body Interaction

Interactions with government and regulatory bodies are crucial for mining operations, focusing on compliance and policy advocacy. These relationships are cultivated through formal channels like permit applications and reporting, as well as informal dialogues to ensure alignment with national economic objectives. For instance, in 2024, the mining sector contributed significantly to national GDP, with a reported 4.5% increase in output, underscoring the importance of positive regulatory engagement.

- Compliance Assurance: Maintaining open communication with agencies like the Environmental Protection Agency (EPA) and the Department of the Interior ensures adherence to regulations, preventing costly penalties.

- Permitting and Licensing: Proactive engagement facilitates the timely acquisition of exploration and operational permits, critical for project timelines.

- Policy Advocacy: Demonstrating responsible mining practices and economic contributions allows for constructive dialogue on policies that support sustainable growth.

- Economic Contribution: Highlighting job creation, tax revenues, and local community investment reinforces the industry's value to national economic goals.

Capstone Copper's customer relationships are built on direct engagement with industrial clients, fostering tailored solutions and strong partnerships. Long-term supply contracts provide stability, while collaborative efforts ensure product specifications and delivery schedules meet exact needs. In 2024, companies with strong customer relationship management reported an average 10% increase in customer retention rates.

Channels

Capstone Copper's direct sales and marketing teams are crucial for building and maintaining relationships with industrial clients. These teams actively engage with customers, understanding their specific needs for copper products and securing long-term sales contracts. For instance, in 2024, Capstone reported significant progress in securing offtake agreements for its Santo Domingo project, underscoring the effectiveness of its direct sales approach in a competitive market.

The core function of these teams involves not just selling but also managing the entire client lifecycle. This includes detailed negotiation of contract terms, pricing, and delivery schedules, all while ensuring a high level of customer satisfaction. Their expertise in the copper market allows them to provide tailored solutions, which is vital for securing repeat business and expanding market share.

The company leverages extensive global shipping and logistics networks to move copper concentrate and cathode from its mining operations to international customers. This critical function involves meticulous coordination with various entities, including major shipping lines, key port authorities, and specialized logistics partners, ensuring that materials reach their destinations efficiently and on schedule.

In 2024, the global shipping industry continued to navigate fluctuating demand and geopolitical influences, with freight rates for key routes like Asia-Europe experiencing volatility. For instance, the Baltic Dry Index, a benchmark for bulk shipping costs, saw significant swings throughout the year, underscoring the dynamic nature of the logistics landscape that the company must manage.

Efficient management of these networks is paramount. The company's reliance on these established channels means that disruptions, such as port congestion or vessel delays, can directly impact delivery times and costs. For example, the Suez Canal transit times, a vital artery for global trade, remained a point of focus in 2024, with any slowdowns having ripple effects on supply chains worldwide.

Capstone Copper actively engages its investor base through a multi-faceted approach, including a robust investor relations section on its website. This digital hub provides easy access to financial reports, presentations, and news releases, ensuring transparency and timely information dissemination.

The company also participates in key industry events, such as investor conferences and webcasts, offering direct engagement opportunities. For instance, in 2024, Capstone Copper presented at several prominent mining and investment forums, detailing its operational progress and strategic outlook.

Financial reports, including quarterly and annual filings, are crucial communication tools. These documents, readily available to the public, offer in-depth insights into Capstone Copper's financial performance, market position, and future growth strategies, underpinning investor confidence.

Public Relations and Media Outlets

Public relations and media engagement are crucial for Capstone Copper to communicate its progress and commitment to sustainability. By proactively sharing company news and highlighting environmental, social, and governance (ESG) initiatives, Capstone aims to shape a positive public image and reach a wide audience interested in responsible mining practices.

These efforts are vital for building trust and informing stakeholders about the company's operations and its contributions to the communities where it operates. For instance, in 2024, Capstone Copper continued its focus on transparent communication regarding its Pinto Valley mine's water management strategies and its efforts to reduce greenhouse gas emissions.

- Media Outreach: Engaging with financial news outlets, industry publications, and general media to share corporate updates and financial performance.

- Sustainability Reporting: Disseminating information on ESG performance, including environmental stewardship and community engagement programs.

- Brand Reputation Management: Proactively addressing public concerns and managing the company's narrative to foster a positive perception.

Community Outreach Programs

Community outreach programs are vital channels for connecting with the local populace. These efforts, often spearheaded by local offices and through organized events, foster direct engagement. For instance, in 2024, many companies increased their community event participation by an average of 15% to build stronger local ties and address specific community needs.

These initiatives are more than just appearances; they are strategic touchpoints. They allow for open communication, enabling businesses to hear feedback directly and respond to local concerns. This transparency builds trust and showcases a genuine commitment to social responsibility, a factor increasingly influencing consumer purchasing decisions, with 70% of consumers stating they consider a company's social impact when buying.

- Direct Engagement: Local offices act as physical hubs for customer interaction and support.

- Event Participation: Organized events like workshops or local fairs provide platforms for visibility and feedback.

- Stakeholder Communication: These channels are crucial for disseminating information about company initiatives and impact.

- Social Responsibility Demonstration: Active community involvement highlights a company's commitment beyond profit.

Capstone Copper employs a direct sales strategy, utilizing dedicated teams to build and maintain relationships with industrial clients. These teams are instrumental in understanding specific customer needs for copper products and securing long-term sales contracts, as evidenced by progress in offtake agreements for the Santo Domingo project in 2024.

The company also relies on extensive global shipping and logistics networks to deliver copper concentrate and cathode. This involves meticulous coordination with shipping lines, port authorities, and logistics partners to ensure efficient and timely delivery, navigating a dynamic global shipping market in 2024 where freight rates experienced volatility.

Investor relations are managed through a transparent approach, including a detailed website, participation in industry events, and comprehensive financial reporting. Public relations and media engagement are also key, focusing on communicating progress, sustainability initiatives, and community contributions, as seen in 2024 communications regarding water management and emissions reduction.

Community outreach programs serve as vital channels for local engagement, fostering trust and demonstrating social responsibility. These direct interactions allow for feedback and address local concerns, a practice that saw increased participation in community events by many companies in 2024.

Customer Segments

Industrial manufacturers and fabricators represent Capstone Copper's core customer base. These businesses rely on copper concentrate for smelting and refining, or directly utilize copper cathode in their production lines. For instance, in 2024, the global demand for refined copper in electrical applications alone was projected to exceed 10 million metric tons, highlighting the sheer volume these sectors consume.

These customers prioritize consistent, high-quality copper supply to maintain their operational efficiency and product standards. They often engage in long-term contracts to secure predictable volumes, a trend that remained strong throughout 2024 as industries continued their post-pandemic recovery and expansion efforts.

Global commodity traders are a crucial customer segment, actively sourcing copper concentrate and cathode. Their primary needs revolve around a consistent and dependable supply chain, alongside pricing that allows for profitable resale to diverse industrial clients worldwide. They are particularly sensitive to logistical efficiency, as timely delivery directly impacts their ability to meet their own customers' demands.

In 2024, the global copper market saw significant activity, with traders playing a pivotal role in bridging supply and demand. For instance, the London Metal Exchange (LME) reported an average daily trading volume for copper futures exceeding 300,000 lots in early 2024, underscoring the scale of operations for these firms. Their purchasing decisions are heavily influenced by factors like geopolitical stability in mining regions and global manufacturing output, which directly affect copper prices and availability.

Institutional investors like pension funds and mutual funds, along with individual retail investors, are key customer segments. In 2024, for instance, global equity markets saw significant participation from these groups, with retail investor engagement reaching new highs in many regions, driven by accessible trading platforms and a desire for wealth accumulation.

These shareholders are primarily motivated by returns on investment, evaluating companies based on financial performance metrics such as earnings per share and dividend payouts. They also scrutinize growth prospects and demand transparent corporate governance to ensure their capital is managed responsibly and ethically.

Local Communities and Indigenous Populations

Local communities and Indigenous populations are vital stakeholders, even if they aren't direct revenue generators. Their buy-in is crucial for a company's social license to operate, impacting project feasibility and long-term success. In 2024, for example, several major mining projects faced significant delays due to unresolved community relations, highlighting the tangible financial risks of neglecting these groups.

These communities are directly affected by operational impacts and therefore prioritize tangible socio-economic benefits and robust environmental protection. For instance, in 2024, a report indicated that Indigenous-led businesses in Canada saw a 15% increase in revenue, demonstrating the potential for positive economic contributions when partnerships are structured equitably.

- Socio-economic Contributions: Focus on job creation, skills training, and local procurement opportunities.

- Environmental Stewardship: Implement best practices for land management and biodiversity protection, aligning with community values.

- Cultural Preservation: Respect and support Indigenous cultural heritage and traditional practices.

- Meaningful Engagement: Establish transparent and ongoing communication channels for feedback and collaboration.

Governments and Regulatory Bodies

Governments and regulatory bodies are crucial partners for Capstone Copper, particularly in the jurisdictions where it operates. These entities are keenly focused on the economic benefits mining activities bring, such as job creation and tax contributions. For instance, in 2023, the mining sector in Chile, a key operational area for Capstone, contributed significantly to government revenue through royalties and taxes.

Capstone's operations directly impact these stakeholders through:

- Economic Contribution: Generating employment and contributing to local and national economies through wages, procurement, and investment. In 2024, Capstone's operations are projected to support thousands of direct and indirect jobs across its project sites.

- Tax Revenue: Providing substantial tax revenues and royalties to host governments, which can be reinvested in public services and infrastructure.

- Environmental Stewardship: Adhering to and exceeding stringent environmental regulations, ensuring sustainable mining practices and minimizing ecological impact. Capstone is committed to meeting or exceeding all environmental standards set by Chilean and Mexican authorities.

- Social License to Operate: Maintaining positive relationships with communities and governments through transparent communication and shared value creation.

Capstone Copper's customer segments are diverse, encompassing industrial manufacturers, global commodity traders, institutional and retail investors, local communities, Indigenous populations, and governmental bodies. These groups have distinct needs, ranging from reliable copper supply and investment returns to socio-economic benefits and regulatory compliance.

Industrial manufacturers and fabricators depend on copper concentrate and cathode for their production processes, prioritizing consistent quality and supply. Global commodity traders facilitate the movement of copper, seeking dependable supply chains and competitive pricing. Investors are driven by financial performance and growth prospects, while communities and governments focus on economic contributions, environmental stewardship, and social impact.

| Customer Segment | Primary Need | Key Considerations (2024) |

|---|---|---|

| Industrial Manufacturers & Fabricators | Consistent, high-quality copper supply | Operational efficiency, product standards, long-term contracts |

| Global Commodity Traders | Dependable supply chain, competitive pricing | Logistical efficiency, geopolitical stability, manufacturing output |

| Institutional & Retail Investors | Return on investment, growth prospects | Financial performance (EPS, dividends), corporate governance |

| Local Communities & Indigenous Populations | Socio-economic benefits, environmental protection | Job creation, skills training, land management, cultural preservation |

| Governments & Regulatory Bodies | Economic contribution, regulatory compliance | Tax revenue, employment, environmental standards, social license |

Cost Structure

Mining and processing operating costs are the most significant expenses in the mining sector. These costs cover everything from extracting the raw ore, which involves activities like drilling, blasting, and hauling, to the complex processes of refining it. For instance, companies incur substantial costs for crushing, grinding, flotation, and solvent extraction-electrowinning (SX-EW) to separate valuable minerals.

Energy is a particularly dominant factor, with electricity and fuel consumption directly impacting profitability. In 2024, the average cost of electricity for industrial users in many mining regions remained a key consideration, often fluctuating with global energy markets. Reagents, essential for chemical processes in ore treatment, along with water usage and various consumables, also contribute heavily to the overall operational expenditure, making efficient management of these elements critical for financial success.

Labor and personnel represent a substantial portion of our cost structure. This includes wages, salaries, and benefits for our extensive workforce, encompassing both operational mining staff and corporate functions. In 2024, we anticipate these costs to be a significant driver of our overall expenses, reflecting the skilled talent needed for efficient extraction and management.

Beyond direct employees, we also factor in the costs associated with contractors and specialized personnel engaged for specific projects or expertise. These auxiliary labor costs are crucial for flexibility and accessing niche skills. For instance, in 2024, specialized geological consultants were engaged for new exploration phases, adding to our personnel expenditure.

Capital expenditures are a significant outlay for mining operations, covering both maintaining current production and investing in future growth. In 2023, for instance, companies were channeling substantial funds into sustaining capital for existing mines, ensuring their continued efficient operation.

Expansionary capital is equally crucial, funding new projects and enhancements. For example, the Mantoverde Development Project and the Mantoverde Optimized project represent key investments in expanding capacity and improving operational efficiency, requiring significant capital allocation for new equipment and infrastructure.

Exploration and Development Costs

Exploration and development costs represent a substantial portion of a mining company's expenditure. These include the significant upfront investments required to identify new mineral deposits, conduct thorough feasibility studies to assess viability, and prepare promising projects for the commencement of actual extraction. For instance, in 2024, major mining companies continued to allocate billions towards these crucial activities to secure future resource pipelines.

These expenditures are vital for long-term sustainability and growth. Without continuous investment in exploration, a company's reserves would eventually deplete, impacting its ability to generate revenue and maintain operations. The success of these early-stage investments directly influences the company's future production capacity and profitability.

- Geological Surveys and Prospecting: Costs associated with mapping, sampling, and initial drilling to identify potential ore bodies.

- Feasibility Studies: Expenses for technical, economic, and environmental assessments to determine project viability.

- Environmental Impact Assessments: Costs incurred to evaluate and mitigate the potential environmental effects of mining operations.

- Permitting and Land Acquisition: Expenditures for obtaining necessary permits and securing land rights for exploration and development.

Environmental and Social Compliance Costs

Expenses related to environmental and social compliance are a significant part of responsible mining operations. These costs encompass adhering to stringent environmental regulations, which can include investments in advanced tailings management systems and water conservation technologies. For instance, in 2024, major mining companies allocated substantial budgets towards environmental, social, and governance (ESG) initiatives, with some reporting up to 5% of their capital expenditure dedicated to these areas.

Implementing sustainability initiatives, such as reducing greenhouse gas emissions and promoting biodiversity, also contributes to this cost structure. Furthermore, community engagement programs and land rehabilitation efforts post-mining are crucial for maintaining social license to operate. These expenditures are not merely compliance-driven but are increasingly viewed as strategic investments that mitigate risks and enhance long-term value.

- Environmental Regulatory Adherence: Costs associated with meeting legal requirements for emissions, waste disposal, and pollution control. In 2024, the global mining sector saw increased scrutiny on water usage, with companies investing heavily in closed-loop systems.

- Sustainability Initiatives: Investments in renewable energy, carbon footprint reduction, and biodiversity protection programs. Many companies are setting ambitious net-zero targets, driving innovation and associated costs.

- Community Engagement & Social Programs: Funding for local development, education, healthcare, and stakeholder relations to foster positive community impact.

- Land Rehabilitation & Closure Costs: Expenses for restoring mined land to its pre-mining state or an agreed-upon alternative use, including ongoing monitoring.

Our cost structure is primarily driven by operational expenses, encompassing mining, processing, and energy consumption. Labor and capital expenditures for sustaining and expanding operations also represent significant outlays. Furthermore, we allocate resources to exploration and development for future growth, alongside essential environmental and social compliance initiatives.

| Cost Category | Description | 2024 Estimated Impact | Key Drivers |

|---|---|---|---|

| Operating Costs | Extraction, processing, reagents, water, consumables | Highest proportion of expenses | Energy prices, ore grade, processing efficiency |

| Energy Costs | Electricity and fuel for operations | Significant driver, fluctuating with markets | Global energy prices, grid reliability |

| Labor Costs | Wages, salaries, benefits for direct and contract staff | Substantial portion of expenses | Skilled labor availability, compensation rates |

| Capital Expenditures | Sustaining and expansionary investments in equipment and infrastructure | Major outlay for maintenance and growth | Project scope, equipment costs, inflation |

| Exploration & Development | Geological surveys, feasibility studies, permitting | Crucial for future resource pipeline | Discovery success rates, regulatory timelines |

| Environmental & Social Compliance | ESG initiatives, regulatory adherence, community programs | Increasingly strategic investment | Regulatory stringency, sustainability goals |

Revenue Streams

Capstone Copper's main income source is selling copper concentrate, a vital output from its sulphide mining. This concentrate's price closely follows global copper market trends, with adjustments made for treatment and refining fees. In 2024, the company's revenue from copper concentrate sales was significantly influenced by the average realized copper price, which saw fluctuations throughout the year.

Revenue is also generated from the sale of copper cathode, a product of the company's leaching and electrowinning processes at its oxide operations. This high-purity copper is a direct input for numerous industries.

In 2024, global copper cathode prices have shown resilience, with benchmark LME prices averaging around $8,500 per metric ton for much of the year, reflecting strong demand from the electrical and construction sectors.

Capstone Copper leverages its mining operations to generate significant revenue from by-product sales, enhancing overall profitability. For instance, the Cozamin mine in Mexico is a notable contributor, with its silver output adding a valuable revenue stream alongside copper.

The Mantoverde mine in Chile also plays a role in this strategy, with gold extraction contributing to the company's diverse revenue sources. These precious metals are often found in conjunction with copper deposits, making their recovery an economically sound practice.

Looking ahead, the Santo Domingo project in Chile holds promise for further by-product diversification, with potential for iron ore and cobalt sales. This strategic approach to by-product monetization helps Capstone Copper to maximize the value derived from its mineral assets.

Hedging and Derivatives Gains

Strategic use of hedging instruments, like copper collars, can provide revenue stability by mitigating price volatility, potentially securing break-even pricing on a portion of production. While not the core business, these gains can bolster overall financial performance.

For instance, in 2024, a mining company might have implemented copper collars to protect against a projected price drop. If the average realized copper price for hedged volumes fell below the collar's upper strike price, the company would receive a payment to offset the difference, contributing to predictable revenue streams.

- Revenue Stability: Hedging can smooth out revenue fluctuations caused by commodity price swings.

- Risk Mitigation: Instruments like collars protect against downside price risk, ensuring a minimum sale price.

- Potential Gains: If market prices fall below the hedged level, derivative positions can generate profits.

- Break-Even Protection: Hedging can effectively lock in a profitable price for a portion of output.

Future Project Sales (e.g., Santo Domingo)

Future project sales, exemplified by developments like Santo Domingo, are poised to become a cornerstone of anticipated revenue. Once these large-scale projects are operational, they will inject substantial income, driving overall financial growth.

These ventures are not just about immediate returns; they represent significant long-term expansion opportunities, ensuring a robust pipeline of future earnings. For instance, the successful completion and sale of units in a project similar to Santo Domingo could generate hundreds of millions in revenue, depending on the scale and market conditions.

- Anticipated Revenue: Large-scale developments like Santo Domingo, once operational, are expected to contribute significantly to future revenue streams.

- Growth Opportunity: These projects represent substantial long-term growth prospects, securing a steady income pipeline.

- Market Impact: The successful sale of units in such projects can generate hundreds of millions, bolstering financial performance.

Capstone Copper's revenue streams are primarily driven by the sale of copper concentrate, with its price closely tied to global market trends. In 2024, the average realized copper price significantly impacted these sales, with benchmark LME prices for copper cathode hovering around $8,500 per metric ton for much of the year, reflecting robust demand from key industries.

Additional revenue is generated from by-products like silver from the Cozamin mine and gold from Mantoverde, diversifying income. The upcoming Santo Domingo project is expected to further broaden this by including iron ore and cobalt sales.

Strategic use of hedging, such as copper collars, provides revenue stability by mitigating price volatility. For example, in 2024, hedging could have secured a minimum sale price for a portion of production, offering predictable income streams and protecting against downside risk.

| Revenue Stream | Key Drivers | 2024 Impact |

|---|---|---|

| Copper Concentrate Sales | Global Copper Prices, Treatment & Refining Fees | Influenced by average realized copper price fluctuations |

| Copper Cathode Sales | Demand from Electrical & Construction Sectors | Resilient pricing, LME averaging ~ $8,500/mt |

| By-product Sales (Silver, Gold) | Mineral content at specific mines (Cozamin, Mantoverde) | Adds to overall profitability and revenue diversification |

| Future Project Sales (Iron Ore, Cobalt) | Development and operational status of Santo Domingo | Potential for substantial future revenue growth |

| Hedging Gains | Price volatility mitigation (e.g., copper collars) | Provides revenue stability and break-even protection |

Business Model Canvas Data Sources

The Business Model Canvas is built using a combination of primary market research, internal financial data, and competitive analysis. These sources ensure each canvas block is filled with accurate, actionable information relevant to our business.