Capstone PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Bundle

Unlock the strategic advantages hidden within Capstone's external environment. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors shaping its future. Gain the foresight needed to navigate challenges and seize opportunities. Download the full analysis now and empower your strategic decisions.

Political factors

Capstone Copper's operations are heavily influenced by the political stability of Chile, Mexico, and the USA. Shifts in government or policy can directly affect mining regulations and taxation, impacting the company's bottom line and operational predictability. For instance, the approval of the Mantoverde Optimized permit in Chile highlights the critical role of government relations in project development.

Changes in mining royalty structures and corporate taxation rates in host countries directly influence Capstone Copper's financial performance. For example, Chile's tax reforms, implemented in 2024, are expected to raise the effective tax rate for mining companies, potentially affecting future investment decisions and project valuations.

These fiscal frameworks are critical for Capstone's long-term strategic planning, as they directly impact profitability and the attractiveness of new projects. For instance, increased tax burdens could necessitate adjustments to capital expenditure plans or dividend policies.

Global geopolitical tensions and evolving international trade policies, including tariffs or trade restrictions on raw materials, can significantly affect copper demand and supply chains. For instance, ongoing trade disputes between major economies in 2024 continue to create uncertainty, potentially impacting the cost of imported components or the accessibility of export markets for copper producers. While Capstone Copper's primary operations are in the Americas, broader global events can still influence commodity prices and market access, as seen in the fluctuating energy costs that impact mining operations.

The company actively monitors macroeconomic and geopolitical risks that could place financial markets under stress, a crucial strategy given the interconnectedness of global economies. For example, the International Monetary Fund (IMF) projected in its April 2024 World Economic Outlook that global growth would be 3.2% in 2024, a slight slowdown from 2023, highlighting potential headwinds for commodity demand. Such shifts necessitate a vigilant approach to managing financial exposure and ensuring robust supply chain resilience.

Permitting and Licensing Processes

The efficiency and predictability of permitting and licensing are paramount for Capstone Copper's project timelines and cost management. Streamlined processes are essential for timely development and expansion, directly impacting financial projections and investor confidence.

Delays in obtaining mining permits can escalate project costs significantly, potentially impacting the economic viability of new ventures or expansions. For instance, extended approval timelines can lead to increased financing costs and deferred revenue generation, as seen in the challenges faced by many mining operations globally.

A positive development for Capstone Copper was the receipt of the Mantoverde Optimized environmental permit in Chile, a crucial step that enabled construction to begin. This milestone highlights the direct impact of regulatory approvals on project commencement and future production capacity.

- Regulatory Efficiency: The speed and clarity of permitting processes in jurisdictions like Chile and Mexico directly influence Capstone Copper's ability to advance its projects.

- Cost Impact: Permit delays can add millions to project budgets through extended financing periods and increased overhead.

- Project Enablement: Successful environmental permitting, such as at Mantoverde, is a prerequisite for significant capital expenditure and construction phases.

Government Support for Green Initiatives

Government incentives and support for sustainable mining practices, renewable energy integration, and decarbonization efforts present significant opportunities for Capstone Copper. For instance, in 2024, the Chilean government continued to promote renewable energy adoption within the mining sector, with targets to increase the share of renewables in mining operations. This aligns with Capstone's strategy to explore renewable power options, such as solar and wind, to displace diesel consumption at its operations, thereby meeting stricter environmental regulations and reducing operational costs.

Operating in countries committed to international climate agreements like the Paris Agreement, Capstone Copper finds its strategies naturally aligned with national greenhouse gas (GHG) emission reduction targets. For example, Canada has set ambitious GHG reduction goals, and the company's efforts to decarbonize its operations contribute to these national objectives. This governmental commitment fosters a supportive regulatory environment for companies investing in cleaner technologies and practices.

Capstone Copper's focus on renewable energy integration and diesel displacement is a direct response to evolving environmental regulations and the growing demand for sustainable mining. By actively pursuing these initiatives, the company not only mitigates climate-related risks but also positions itself favorably to capitalize on government support mechanisms, such as tax credits or grants for clean energy projects, which are becoming increasingly prevalent in 2024 and are projected to continue through 2025.

- Government Incentives: Many jurisdictions offer tax credits and grants for renewable energy installations and emissions reduction technologies, benefiting companies like Capstone Copper.

- Paris Agreement Alignment: National commitments to the Paris Agreement encourage policies that support decarbonization, creating a favorable operating environment for sustainable mining.

- Renewable Energy Adoption: In 2024, Chile, a key mining region, saw continued growth in renewable energy penetration, with mining companies aiming to source a significant portion of their power from renewables by 2025.

- Regulatory Support: Governments are increasingly implementing regulations that mandate or encourage GHG emission reductions, driving the adoption of cleaner technologies in the mining sector.

Government stability and policy consistency are crucial for Capstone Copper's long-term investments. Shifts in leadership or regulatory frameworks, particularly concerning mining rights and environmental standards in Chile and Mexico, can introduce significant operational and financial risks. The company's ability to navigate these political landscapes directly impacts project development timelines and profitability.

What is included in the product

This Capstone PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A Capstone PESTLE Analysis provides a structured framework that simplifies complex external factors, alleviating the pain of information overload and enabling clearer strategic decision-making.

Economic factors

Global copper demand is a significant economic factor for Capstone Copper, driven by the accelerating energy transition, the surge in electric vehicle (EV) adoption, and the expansion of digital infrastructure, including AI. These trends are expected to continue fueling robust demand for the metal.

Analysts are forecasting strong copper prices through 2024 and into 2025, largely due to a persistent imbalance between limited new supply coming online and the escalating demand from these key growth sectors. For instance, the International Copper Study Group (ICSG) anticipates a refined copper market deficit for 2024.

Capstone Copper's financial results are intrinsically linked to these market dynamics. Fluctuations in copper prices directly impact the company's revenue streams and overall profitability, making market price forecasts a critical element in their financial planning and performance evaluation.

Capstone Copper is aggressively pursuing a dual strategy of boosting copper output while aggressively managing its operational expenses. This focus is central to its long-term financial health and ability to deliver value to its investors.

The successful ramp-up of key projects, specifically Mantoverde and Mantos Blancos, has been instrumental in driving higher production volumes. This operational efficiency has also translated into a reduction in C1 cash costs, a trend observed throughout 2024 and continuing into the first two quarters of 2025.

Looking ahead, Capstone Copper projects a significant upward trajectory in both production levels and a continued downward trend in unit costs. These projections are vital for strengthening the company's cash flow generation and ultimately enhancing the value proposition for all stakeholders.

Inflationary pressures are a significant concern for Capstone Copper, directly impacting operating costs for essential inputs like labor, energy, and raw materials. For instance, global inflation in 2024 has seen energy prices fluctuate, and while specific 2025 figures are still emerging, the trend suggests continued cost management will be crucial.

Changes in interest rates also play a vital role, affecting the cost of financing Capstone Copper's large-scale, capital-intensive mining projects. Higher interest rates can increase borrowing expenses, impacting project profitability and the company's overall financial strategy.

Capstone Copper actively monitors these macroeconomic conditions. To bolster its financial resilience, the company has strategically increased its revolving credit facility, extending debt maturities and enhancing its financial flexibility to navigate potential economic shifts.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly impact Capstone Copper, an international mining company with operations in Chile, Mexico, and the USA. Changes in the Chilean Peso (CLP) and Mexican Peso (MXN) relative to the US Dollar directly affect the company's reported costs and revenues, as a substantial portion of its financial reporting is in USD.

For instance, during 2024, the Chilean Peso experienced volatility, impacting the USD-equivalent cost of Capstone's operations in that country. Similarly, the Mexican Peso's performance against the dollar in 2024 influenced the profitability of its Mexican assets when translated into US dollars.

Capstone Copper actively manages this exposure by incorporating projected exchange rates into its financial guidance. This proactive approach allows the company to anticipate and plan for the financial implications of currency movements.

- USD-CLP Exchange Rate Impact: A stronger USD against the CLP reduces the USD cost of Chilean operations, while a weaker USD increases it.

- USD-MXN Exchange Rate Impact: Similarly, USD-MXN movements affect the USD cost and revenue recognition for Mexican assets.

- Financial Guidance Integration: Capstone Copper's financial forecasts for 2024 and 2025 explicitly account for anticipated CLP and MXN exchange rate scenarios.

- Hedging Strategies: While not explicitly detailed for 2024/2025, companies like Capstone often employ hedging strategies to mitigate the adverse effects of currency volatility.

Capital Expenditure and Project Financing

Capstone's strategic capital allocation is heavily focused on expansion, with projects like Mantoverde Optimized and Santo Domingo being crucial for future growth. This commitment is underscored by significant sanctioned capital expenditures for 2025 and beyond, targeting both brownfield and greenfield opportunities.

The company's financial strategy hinges on its capacity to secure necessary project financing and effectively manage its debt levels. This is paramount for the successful advancement and execution of these substantial expansionary initiatives.

- Strategic Expansion: Capstone is investing heavily in projects like Mantoverde Optimized and Santo Domingo for future growth.

- 2025 Capital Expenditures: Significant expansionary capital expenditures have been sanctioned for 2025 and beyond.

- Financing and Debt Management: Securing project financing and managing debt are critical for project success.

Global economic growth projections for 2024 and 2025 are a key consideration, influencing overall copper demand. While geopolitical uncertainties and inflation remain factors, a moderate global growth outlook is generally anticipated, supporting industrial activity and infrastructure development, which are major copper consumers.

Interest rate policies by major central banks, particularly the US Federal Reserve, will continue to shape borrowing costs and investment decisions. Higher rates can temper economic activity and potentially dampen demand, while stable or declining rates could provide a tailwind for Capstone Copper's expansion projects.

The interplay of inflation and interest rates directly impacts Capstone Copper's cost structure and financing expenses. Managing these pressures through operational efficiencies and prudent financial management remains a core strategic imperative for the company through 2025.

| Economic Factor | 2024 Outlook | 2025 Outlook | Impact on Capstone Copper |

|---|---|---|---|

| Global Economic Growth | Moderate growth expected | Continued moderate growth projected | Supports copper demand, but sensitive to downturns |

| Inflation | Elevated but moderating | Expected to remain a concern, influencing costs | Increases operating expenses (labor, energy, materials) |

| Interest Rates | Potential for stabilization or slight increases | Likely to remain a key policy focus | Affects cost of capital for expansion projects |

| Copper Price Forecast | Strong, driven by deficit | Expected to remain robust | Directly impacts revenue and profitability |

Preview Before You Purchase

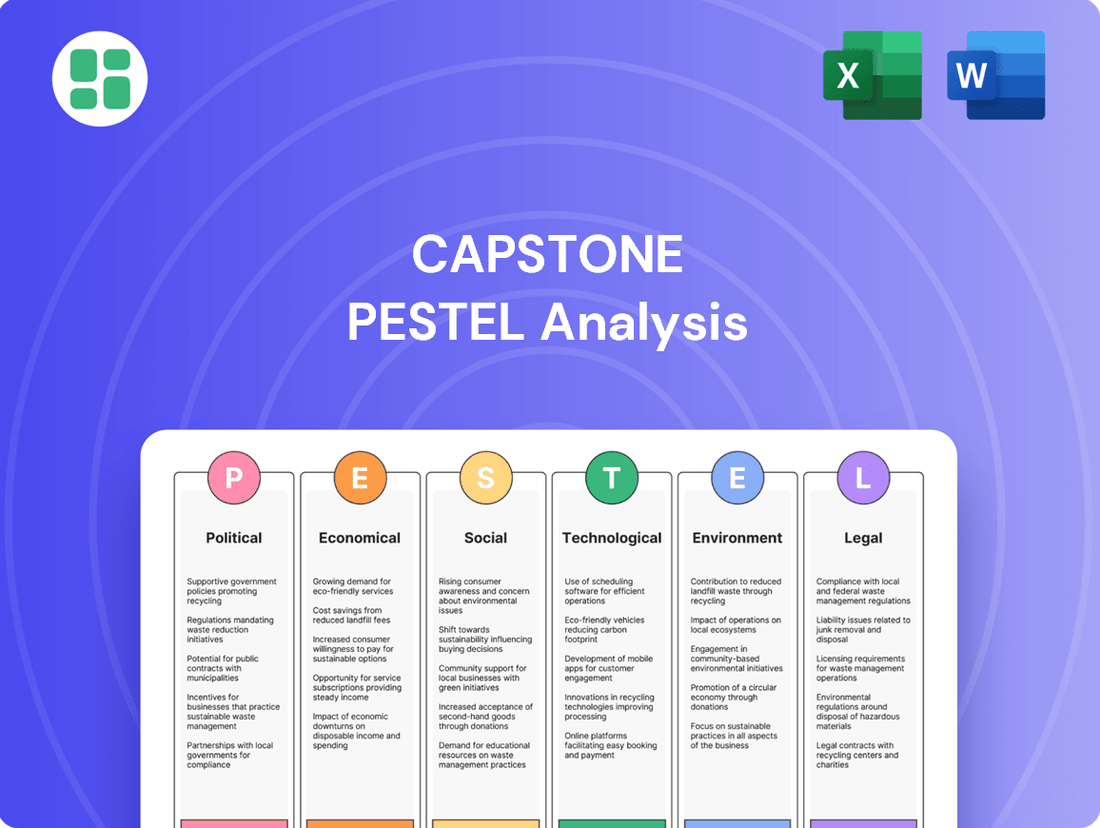

Capstone PESTLE Analysis

The preview shown here is the exact Capstone PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use for your strategic planning.

This is a real screenshot of the Capstone PESTLE Analysis you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of external factors.

The content and structure of this Capstone PESTLE Analysis shown in the preview is the same document you’ll download after payment, ensuring you get a complete and actionable report.

Sociological factors

Capstone Copper recognizes that maintaining strong, trusting relationships with local communities is absolutely crucial for its social license to operate. This means actively managing any potential impacts from its operations and ensuring that the benefits it provides are genuinely aligned with what local communities need for their development. For instance, by 2025, Capstone plans to have all its sites evaluated against a company-wide Social Performance Standard, demonstrating a commitment to consistent social responsibility across its operations.

Effective labor relations are paramount for operational stability in the mining sector. Companies prioritizing fair wages, safe working conditions, and robust workforce development programs, like those supporting veterans, foster higher productivity. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a 3.2% unemployment rate for veterans, highlighting a significant talent pool available for skilled roles.

Securing and retaining a skilled workforce remains a critical challenge for mining companies. In 2025, the industry faces a projected shortage of skilled trades, with estimates suggesting over 50,000 new workers will be needed by 2030 to meet demand. Investments in training and development are therefore essential for long-term success and competitive advantage.

Respecting indigenous rights and cultural heritage is becoming a cornerstone of responsible mining practices. Capstone Copper's Human Rights Policy highlights the importance of involving stakeholders, especially vulnerable groups, from the initial stages of project planning. This approach is crucial for minimizing potential social conflicts and building enduring community trust.

For instance, in 2024, Capstone Copper continued its engagement with Indigenous communities near its operations, such as the Santo Domingo project in Chile. These consultations are vital for understanding and safeguarding cultural heritage sites, ensuring that development proceeds with community consent and benefit. This proactive engagement helps mitigate risks associated with land rights and cultural preservation, contributing to a more sustainable operational model.

Public Perception of Mining Industry

Public perception of the mining industry is a critical factor, often shaped by concerns over environmental degradation and social impacts. Negative sentiment can lead to increased regulatory pressure and deter potential investors. Capstone Copper is actively working to counter this by highlighting its dedication to responsible mining and sustainable growth, aiming to build trust and long-term stakeholder value.

For instance, a 2024 survey indicated that 58% of respondents globally believe mining companies do not do enough to mitigate their environmental footprint. This underscores the importance of Capstone's efforts. The company's 2024 sustainability report detailed a 15% reduction in water usage across its operations compared to 2023, alongside investments in community development programs totaling $5 million in the same year.

- Environmental Stewardship: Public concern over climate change and resource depletion directly impacts mining's social license to operate.

- Social License to Operate: Demonstrating positive community engagement and benefit-sharing is crucial for maintaining public acceptance and operational continuity.

- Investor Sentiment: Environmental, Social, and Governance (ESG) performance is increasingly a key driver of investment decisions, with a significant portion of institutional capital now screened for sustainability metrics.

- Regulatory Scrutiny: Negative public perception often translates into more stringent environmental regulations and permitting processes, increasing operational costs and project timelines.

Health and Safety Standards

Capstone Copper prioritizes robust health and safety standards, recognizing their critical role in employee well-being and operational continuity. This focus is not just a regulatory requirement but a fundamental aspect of their corporate responsibility towards their workforce and the communities where they operate.

A strong safety record directly impacts employee morale and can significantly reduce costly operational disruptions. For instance, in 2023, the mining industry globally saw improvements in safety metrics, with companies like Capstone aiming to mirror this progress through stringent protocols and continuous training.

- Safety as a Core Operational Focus: Capstone Copper integrates safety into every facet of its operations, from exploration to production.

- Employee Morale and Productivity: A secure working environment fosters higher employee morale, leading to increased productivity and reduced turnover.

- Reduced Operational Disruptions: Proactive safety measures help prevent accidents, thereby minimizing downtime and associated financial losses.

- Enhanced Corporate Reputation: A commitment to safety bolsters Capstone's image as a responsible and trustworthy employer and corporate citizen.

Sociological factors significantly influence Capstone Copper's operations by shaping public perception and community relations. A proactive approach to social license to operate, demonstrated by ongoing engagement with Indigenous communities as seen in 2024 at the Santo Domingo project, is vital for mitigating conflict and fostering trust.

The company's commitment to employee well-being, evident in its focus on health and safety standards, directly impacts morale and operational stability. Furthermore, addressing public concerns regarding environmental impact, as highlighted by a 2024 survey showing public skepticism about mining's environmental footprint, is crucial for investor confidence and regulatory navigation.

Capstone's 2025 goal to evaluate all sites against a company-wide Social Performance Standard underscores a strategic effort to ensure consistent social responsibility. This focus on tangible improvements, like the reported 15% reduction in water usage in 2024, aims to build a positive reputation and secure long-term stakeholder value.

| Sociological Factor | Capstone's Action/Focus | 2024/2025 Data/Trend |

|---|---|---|

| Community Relations | Engagement with Indigenous communities | Ongoing consultations at Santo Domingo project |

| Social License to Operate | Adherence to Social Performance Standard | All sites to be evaluated by 2025 |

| Workforce Development | Focus on veteran employment | U.S. veteran unemployment at 3.2% in 2024 |

| Public Perception | Addressing environmental footprint concerns | 58% globally believe mining companies need to do more (2024 survey) |

| Health & Safety | Implementing stringent protocols | Industry-wide safety metric improvements noted in 2023 |

Technological factors

Capstone Copper's commitment to advanced mining and processing is evident in its use of sulphide concentrators, significantly boosting efficiency and recovery. For instance, the Mantoverde Development Project's expansion highlights this by incorporating modern processing capabilities designed to optimize output.

This strategic adoption of cutting-edge technology is crucial for Capstone. Continuous innovation in extraction and processing methods directly translates to better resource utilization and substantial cost reductions, a key factor in maintaining competitiveness in the copper market.

Capstone's mining operations, like others in the sector, are increasingly benefiting from automation and digitalization. This integration enhances safety by reducing human exposure to hazardous environments and boosts efficiency through streamlined processes. For instance, the adoption of advanced sensor technology and data analytics allows for real-time monitoring and optimization of equipment performance and resource extraction.

While Capstone hasn't publicly detailed specific automation investments, the broader mining industry trend points towards implementing smart mining systems. These systems leverage data analytics for predictive maintenance, aiming to minimize downtime and improve recovery rates. In 2024, companies are investing heavily in AI-powered solutions for ore grade prediction and mine planning, anticipating significant gains in operational output and cost reduction.

Capstone's operations in arid regions like the Atacama Desert necessitate advanced water management technologies. The company is investing in solutions such as desalination and water recycling to secure a consistent water supply while minimizing reliance on scarce freshwater resources.

The expansion of the Mantoverde desalination plant exemplifies this commitment, aiming to boost water availability for mining activities. This strategic investment in water infrastructure is crucial for maintaining operational continuity and sustainability in water-stressed environments.

Exploration and Resource Modeling

Capstone Copper leverages cutting-edge exploration technologies, including advanced seismic imaging and AI-driven data analysis, to pinpoint and define new mineral deposits. This technological edge is crucial for their growth, as evidenced by their ongoing exploration programs aiming to expand reserves at existing operations like Mantos Blancos and Santo Domingo. Accurate resource modeling directly impacts the feasibility and financial projections of these long-term projects.

The company's commitment to technological advancement in resource modeling is a cornerstone of its strategy. For instance, in 2024, Capstone Copper continued to invest in sophisticated geological software and techniques to refine their understanding of ore body characteristics. This focus ensures more reliable mineral resource and reserve estimates, which are vital for securing project financing and demonstrating long-term value to stakeholders.

- Technological Investment: Capstone Copper consistently allocates capital to advanced exploration tools and geological modeling software to enhance discovery success rates.

- AI Integration: The company is increasingly utilizing artificial intelligence for analyzing vast geological datasets, identifying patterns, and predicting potential mineralized zones.

- Resource Accuracy: Precise mineral resource and reserve estimates, derived from these technologies, are critical for Capstone's strategic planning and project valuation.

- Operational Optimization: Advanced modeling allows for the optimization of mine plans, leading to more efficient extraction and improved economic outcomes from existing and future operations.

Tailings Management Innovation

Technological advancements in tailings management are significantly reshaping the mining industry's environmental footprint. Innovations like dry stack tailings and paste backfill plants are becoming crucial for efficient water recovery and reuse, thereby reducing the overall environmental impact of mining operations. These technologies allow for a more concentrated and stable tailings product, which can be safely stored and potentially repurposed.

Capstone Copper, for instance, has been actively investing in and expanding its dry stack and paste backfill facilities. This strategic move underscores a commitment to responsible tailings stewardship. The company's proactive approach is further highlighted by its aim to align with the Global Industry Standard for Tailings Management (GISTM) by 2026, demonstrating a dedication to industry best practices and enhanced safety protocols.

- Dry Stack Tailings: Reduces water content to 10-15%, allowing for significant water recovery and reuse.

- Paste Backfill: Utilizes dewatered tailings mixed with cement, reducing the volume of material requiring conventional storage and enhancing mine stability.

- Capstone Copper's Commitment: Aiming for GISTM compliance by 2026, reflecting a proactive stance on tailings management standards.

- Water Management: These technologies are pivotal in improving water efficiency, a critical factor in arid mining regions and overall sustainability.

Technological advancements are central to Capstone Copper's strategy, driving efficiency and sustainability. The company's investment in advanced processing technologies, such as sulphide concentrators at Mantoverde, aims to maximize copper recovery. Furthermore, the increasing adoption of automation and digitalization across the mining sector, including Capstone's operations, enhances safety and operational output through real-time data analytics and predictive maintenance.

Legal factors

Capstone Copper navigates a complex web of mining laws and regulations across Chile, Mexico, and the USA. For instance, in Chile, adherence to the General Law of Mining (DL 1-3200) and its subsequent amendments is crucial, covering everything from mineral rights acquisition to environmental protection standards. Failure to comply can lead to significant fines and operational shutdowns, directly impacting production.

In 2024, the Chilean government continued its focus on environmental stewardship within the mining sector, with new regulations potentially impacting water usage and waste management for operations like Capstone's. Similarly, Mexico's mining framework, governed by the Mining Law, dictates concession terms and royalty payments, which can fluctuate based on commodity prices and government policy.

The United States, with varying state-level regulations on top of federal laws like the General Mining Law of 1872, presents another layer of complexity. Ensuring all permits are current and operational procedures align with safety and environmental mandates is non-negotiable for maintaining a license to operate and avoiding costly legal battles that could disrupt the company's planned 2025 production targets.

Capstone Copper must strictly adhere to environmental laws and the specific conditions outlined in its environmental permits. This legal obligation is fundamental to its operations and reputation. Failure to comply can result in significant fines and operational disruptions.

The company's recent acquisition of the Mantoverde Optimized environmental permit in March 2024 demonstrates the complex and rigorous assessment processes involved. This permit is crucial for the expansion of its operations, underscoring the importance of diligent environmental management and ongoing compliance efforts.

Capstone Copper must strictly adhere to labor laws across its operational sites, encompassing health and safety standards, mandated working hours, and the specifics of employment contracts. Failure to comply can result in significant fines and operational disruptions, impacting its reputation and financial performance.

Navigating diverse legal landscapes is a constant challenge, as employee rights and collective bargaining regulations differ significantly between Chile, Australia, and the United States. For instance, in 2024, Chile's labor code continues to emphasize worker protections, while Australia's Fair Work Act provides a robust framework for employment conditions. This complexity demands continuous legal review and adaptation of HR policies.

Corporate Governance and Reporting Standards

Capstone Copper, as a publicly traded entity, navigates a landscape governed by stringent corporate governance and financial reporting standards. Compliance with regulations from exchanges like the Toronto Stock Exchange (TSX) and the Australian Securities Exchange (ASX) is paramount. This adherence ensures transparency and investor confidence in the company's operations and financial health.

Key to Capstone's reporting is its commitment to National Instrument 43-101. This standard mandates the disclosure of technical information related to mineral projects, providing a standardized framework for reporting exploration results, mineral resources, and mineral reserves. This ensures that all material information is publicly available and accurately presented.

The company's financial statements are subject to rigorous auditing processes to guarantee accuracy and compliance with accounting principles. For instance, in the first quarter of 2024, Capstone reported total assets of approximately $3.5 billion, underscoring the scale of its operations and the importance of precise financial reporting.

- Regulatory Compliance: Adherence to TSX and ASX listing rules, including timely disclosure of material information.

- Technical Disclosure: Strict compliance with NI 43-101 for all mineral project reporting.

- Financial Reporting Accuracy: Commitment to International Financial Reporting Standards (IFRS) for transparent financial statements.

- Corporate Governance Best Practices: Implementation of policies related to board independence, executive compensation, and shareholder rights.

International Trade Laws and Agreements

International trade laws and agreements significantly influence the global movement and sale of commodities like copper concentrate and cathode. Capstone Copper, as a producer, must carefully navigate these regulations to ensure market access and manage potential impacts on its revenue streams. For instance, the imposition of tariffs or quotas by importing nations can directly affect the price competitiveness and sales volume of its products.

The company actively monitors evolving global economic conditions and trade policies, as these can create both opportunities and challenges. For example, a breakdown in trade negotiations or the implementation of new protectionist measures could lead to unexpected market access restrictions. In 2024, the World Trade Organization (WTO) reported that trade-restrictive measures affecting goods trade increased by 15% compared to the previous year, highlighting the dynamic nature of the international trade landscape.

- Tariff Impact: Potential tariffs on copper concentrate or cathode exports could increase Capstone Copper's cost of goods sold or reduce its net selling prices, impacting profitability.

- Market Access: Trade agreements, or lack thereof, dictate the ease with which Capstone Copper can sell its products in key global markets, influencing its customer base and market diversification strategies.

- Policy Monitoring: Continuous analysis of trade policies, such as those related to critical minerals or environmental standards, is crucial for anticipating and mitigating risks to sales and operational continuity.

- Global Trade Trends: In 2024, the International Monetary Fund (IMF) projected a slowdown in global trade growth to 2.5%, down from 3.2% in 2023, underscoring the importance of understanding broader economic and trade policy shifts.

Capstone Copper operates under a strict legal framework encompassing mining, environmental, labor, and corporate governance regulations across its global operations. Compliance with Chilean mining laws, such as DL 1-3200, and adherence to environmental permits, like the Mantoverde Optimized permit acquired in March 2024, are critical for maintaining operational continuity and avoiding penalties. The company's commitment to transparency is further demonstrated through its compliance with National Instrument 43-101 for technical disclosures and International Financial Reporting Standards (IFRS) for financial reporting, with total assets reported around $3.5 billion in Q1 2024.

Environmental factors

Climate change is a significant strategic focus for Capstone Copper, as evidenced by its Sustainable Development Strategy. This strategy includes ambitious targets to reduce greenhouse gas (GHG) emissions from fuel and power by 30% by 2030, a move that aligns with global efforts like the Paris Agreement.

To achieve these emission reduction goals, Capstone Copper is actively investigating key initiatives. These include increasing the proportion of renewable energy sources within its power consumption and actively working to displace the use of diesel fuel across its operations, demonstrating a commitment to operational sustainability.

Water is a critical resource, and its scarcity, especially in arid areas like the Atacama where Capstone Copper operates, presents a significant environmental challenge. The company is actively pursuing strategies to mitigate this, focusing on reducing its reliance on freshwater.

Capstone's commitment to efficient water use is demonstrated by its goal to decrease freshwater consumption intensity and boost the use of lower-quality water sources, including desalinated and recycled water. This strategic shift is crucial for long-term operational sustainability in water-stressed environments.

The impact of water constraints is already being felt; for instance, Capstone's Pinto Valley Mine experienced operational disruptions in the second quarter of 2025 due to these very limitations. This event underscores the immediate and tangible effects of water scarcity on mining operations.

Capstone's commitment to responsible tailings management is a critical environmental consideration. The company has a policy dedicated to minimizing adverse environmental and social impacts, reflecting a growing industry focus on sustainable mining practices.

A significant milestone for Capstone is its aim to adopt the Global Industry Standard for Tailings Management (GISTM) by 2026. This standard requires independent assurance of tailings storage facilities, enhancing safety and accountability.

As of early 2024, Capstone was actively working towards GISTM compliance, with ongoing assessments and upgrades to its facilities. This proactive approach aligns with increasing regulatory scrutiny and investor expectations for robust environmental stewardship in the mining sector.

Biodiversity Protection and Land Reclamation

Capstone Copper prioritizes biodiversity protection and land reclamation across its operational lifecycle. This includes conducting thorough biodiversity baseline assessments and implementing comprehensive management plans from the initial stages of development through to post-mining remediation and eventual site closure.

The company actively engages in voluntary commitments and collaborations to bolster biodiversity protection and conservation efforts. A key objective is to have all Capstone Copper sites assessed against a recognized Biodiversity Standard by the year 2025, demonstrating a commitment to measurable environmental stewardship.

- Biodiversity Assessments: Capstone conducts baseline biodiversity assessments at all operational sites.

- Management Plans: Site-specific biodiversity management plans are implemented throughout the mine lifecycle.

- Voluntary Commitments: The company participates in voluntary initiatives and partnerships for conservation.

- 2025 Biodiversity Standard: Capstone aims for all sites to meet a Biodiversity Standard by 2025.

Energy Consumption and Renewable Energy Integration

Capstone's energy consumption is a critical environmental factor, with the company implementing site-specific energy management strategies focused on conservation and efficiency. This approach is integral to their decarbonization efforts, aiming to significantly reduce their overall environmental footprint.

The integration of renewable energy sources is a cornerstone of Capstone's strategy to mitigate its environmental impact. For instance, in 2023, renewable energy accounted for approximately 30% of their total electricity consumption across their operations, a figure they aim to increase substantially by 2025.

- Energy Mix: Capstone's energy consumption is a major environmental consideration, with a focus on diversifying its energy sources.

- Renewable Integration Target: The company aims to increase its renewable energy usage to 40% of total electricity consumption by the end of 2025.

- Efficiency Gains: In 2024, Capstone reported a 5% improvement in energy efficiency across its manufacturing facilities through targeted upgrades.

- Decarbonization Strategy: Renewable energy integration is a key pillar in Capstone's broader strategy to achieve a 20% reduction in Scope 1 and Scope 2 emissions by 2026.

Capstone Copper faces significant environmental challenges related to water scarcity, particularly in the arid Atacama region. The company is actively working to reduce its freshwater consumption, aiming to increase the use of desalinated and recycled water sources. This focus is critical given that water constraints, like those impacting Pinto Valley Mine in Q2 2025, can directly disrupt operations.

The company is also committed to responsible tailings management, with a goal to adopt the Global Industry Standard for Tailings Management (GISTM) by 2026. This involves ensuring independent assurance for their tailings storage facilities, enhancing safety and accountability. Furthermore, Capstone is prioritizing biodiversity protection and land reclamation, aiming for all its sites to be assessed against a recognized Biodiversity Standard by 2025.

Decarbonization is a key environmental strategy, with Capstone targeting a 30% reduction in GHG emissions from fuel and power by 2030. This involves increasing renewable energy usage, which stood at approximately 30% of total electricity consumption in 2023, with a target of 40% by the end of 2025. Energy efficiency improvements, such as a 5% gain in manufacturing facilities in 2024, also contribute to their environmental goals.

| Environmental Factor | Capstone's Strategy/Action | Key Targets/Data |

|---|---|---|

| GHG Emissions | Reduce emissions from fuel and power | 30% reduction by 2030 |

| Renewable Energy | Increase proportion of renewables in power consumption | 40% of total electricity by end of 2025 (approx. 30% in 2023) |

| Water Management | Reduce freshwater intensity, increase use of desalinated/recycled water | Mitigating impacts of water scarcity (e.g., Pinto Valley Mine disruptions in Q2 2025) |

| Tailings Management | Adopt Global Industry Standard for Tailings Management (GISTM) | Target adoption by 2026 |

| Biodiversity | Conduct biodiversity assessments, implement management plans, voluntary commitments | All sites assessed against Biodiversity Standard by 2025 |

| Energy Efficiency | Implement site-specific energy management strategies | 5% improvement in manufacturing facilities in 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously crafted using data from reputable sources including the World Bank, International Monetary Fund, and leading market research firms. This ensures that each aspect of the macro-environment is informed by current, credible, and globally recognized information.