Cairn Energy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cairn Energy Bundle

Cairn Energy's strengths lie in its experienced management and strategic exploration assets, but it faces significant threats from volatile oil prices and regulatory changes. Understanding these dynamics is crucial for navigating the competitive energy landscape.

Want the full story behind Cairn Energy's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Capricorn Energy PLC's operational strategy is firmly rooted in generating robust cash flows, particularly from its key Egyptian assets. This deliberate focus allows the company to self-finance its Egyptian operations, meaning income from current production directly supports reinvestment in that same business unit.

This cash flow generation is a significant strength. For instance, in the first half of 2024, Capricorn reported strong operational performance in Egypt, contributing significantly to its overall financial health and enabling continued investment in exploration and development activities within the country.

Cairn Energy boasts a substantial foundation of producing oil and gas assets, predominantly located in Egypt's Western Desert. These assets are the backbone of the company's operational strategy and revenue generation.

The company's operational prowess in this core region was evident in 2024, when it successfully met the higher end of its production targets. This achievement underscores the efficiency and reliability of its Egyptian operations.

Capricorn's strategic consolidation of eight Egyptian concession agreements into one integrated deal, approved by EGPC and slated for completion in 2025, is a significant strength. This move streamlines operations and is anticipated to unlock further value.

The consolidation is projected to boost production and enhance returns by securing improved commercial terms and attracting additional investment. This proactive approach in Egypt's energy sector positions Capricorn for greater efficiency and profitability.

Prudent Financial Discipline

Cairn Energy's commitment to prudent financial discipline is a significant strength. The company achieved a net cash position of $23 million in 2024, showcasing effective cash management.

Furthermore, Cairn Energy successfully reduced its outstanding debt in Egypt, reinforcing its focus on a strong balance sheet.

- Net Cash Position: $23 million (2024)

- Debt Reduction: Significant reduction in Egyptian debt

- Capital Management: Disciplined approach supports investment and growth

Clear Strategic Direction for Value Creation

Capricorn Energy, following its strategic reset in 2024, has established a clear direction focused on unlocking value from its Egyptian portfolio. This strategy also encompasses actively seeking growth through accretive acquisitions in the UK North Sea and the Middle East and North Africa (MENA) region. The company's aim is to generate reliable shareholder returns while broadening its operational footprint.

This focused approach is designed to enhance shareholder value. For instance, Capricorn's 2024 performance indicators will be crucial in demonstrating the efficacy of this strategic shift. The company is targeting a balance between returning capital to shareholders and investing in growth opportunities.

- Clear focus on Egyptian asset optimization.

- Strategic expansion into UK North Sea and MENA.

- Objective to deliver consistent shareholder returns.

- 2024 strategic reset underpins future growth.

Capricorn Energy's primary strength lies in its substantial and producing asset base, particularly in Egypt's Western Desert. These assets are the engine for its revenue generation and operational strategy.

The company's financial discipline is another key strength, evidenced by its $23 million net cash position in 2024 and successful debt reduction in Egypt, which bolsters its balance sheet and capacity for investment.

Capricorn's strategic consolidation of Egyptian concession agreements, approved in 2024 and set for 2025 completion, is poised to streamline operations and unlock further value. This move is expected to enhance production and profitability through improved commercial terms and increased investment attraction.

| Strength | Description | Supporting Data (2024) |

|---|---|---|

| Producing Assets | Significant oil and gas reserves in Egypt | Key revenue driver; met higher end of production targets |

| Financial Discipline | Prudent cash management and debt reduction | $23 million net cash position; reduced Egyptian debt |

| Strategic Consolidation | Streamlining Egyptian operations for value | Eight concession agreements consolidated; anticipated 2025 completion |

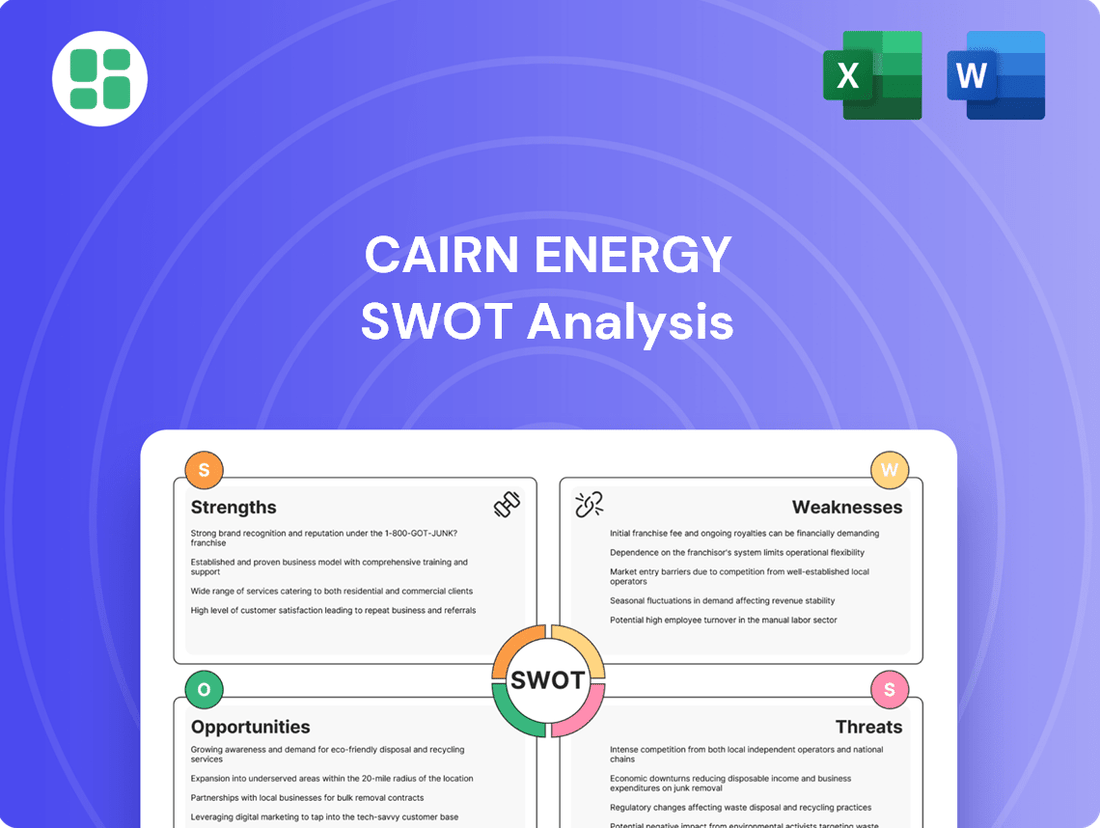

What is included in the product

Delivers a strategic overview of Cairn Energy’s internal and external business factors, highlighting its operational strengths, potential weaknesses, market opportunities, and industry threats.

A Cairn Energy SWOT analysis offers a clear, actionable framework to identify and address operational challenges, thereby relieving pain points related to strategic uncertainty and resource allocation.

Weaknesses

Capricorn Energy's heavy reliance on Egypt for its primary production, with assets like the Western Desert and Gulf of Suez, creates significant geographical concentration risk. This focus makes the company particularly vulnerable to any political instability, economic downturns, or adverse regulatory shifts within Egypt.

While Capricorn Energy does have interests in the UK North Sea, these operations are a smaller component of its overall portfolio compared to its Egyptian holdings. This imbalance means that disruptions in Egypt could disproportionately impact the company's financial performance and operational stability.

Capricorn Energy, like other oil and gas producers, faces significant risk from fluctuating commodity prices. For instance, Brent crude oil prices saw considerable volatility in 2023, trading in a range from below $70 to over $90 per barrel, directly impacting revenue streams. This inherent price sensitivity means that a sustained drop in oil and gas prices, a common occurrence in the energy sector, could severely hinder Capricorn's financial results and its ability to fund future exploration and development projects.

Capricorn Energy, formerly Cairn Energy, has grappled with inconsistent cash inflows due to outstanding receivables, particularly from its Egyptian operations. These delays in payment directly affect the company's liquidity and its capacity to distribute capital back to investors, a key concern for shareholders.

Further complicating matters, Capricorn experienced a missed payment from Waldorf Production UK in early 2025. Such instances highlight ongoing vulnerabilities in managing payment cycles, which can create short-term financial strain and necessitate careful cash flow management.

Non-Operated Interests in UK North Sea

Capricorn Energy's (formerly Cairn Energy) non-operated interests in the UK North Sea present a notable weakness. This structure inherently reduces the company's direct influence over crucial operational decisions, including the timing and scale of capital expenditure. Consequently, Capricorn may find it challenging to optimize the development and extraction from these assets according to its strategic objectives.

The lack of operational control can also translate into slower progress on field development and production enhancements. For instance, while Capricorn might be eager to implement new technologies or accelerate production from specific fields, its ability to do so is contingent on the operator's plans and priorities. This can create a disconnect between Capricorn's strategic vision and the actual execution on the ground, potentially impacting its overall return on investment from these North Sea holdings.

Furthermore, this non-operated status limits Capricorn's agility in responding to market shifts or unforeseen geological challenges within the North Sea. The company is reliant on the operator for critical updates and decision-making processes, which can introduce delays and reduce its capacity to proactively manage risks or capitalize on emerging opportunities. In 2024, the UK Continental Shelf continues to be a mature basin, where efficient operational management is paramount for profitability.

Key implications include:

- Limited operational control: Capricorn cannot directly dictate development timelines or operational strategies for its non-operated North Sea assets.

- Dependency on operators: The pace of development and capital allocation is largely determined by the designated field operators.

- Potential for suboptimal returns: Reduced influence may hinder Capricorn's ability to maximize the value and efficiency of these investments.

Capital Intensive Nature of E&P

The exploration and production (E&P) sector, which Cairn Energy operates within, is notoriously capital intensive. This means substantial upfront investment is needed for activities like drilling new wells, exploring for new reserves, and simply keeping existing fields running. For instance, a single offshore development project can easily run into billions of dollars. This high expenditure requirement can put a significant strain on a company's finances, especially when oil and gas prices are down or when unexpected operational issues arise, impacting cash flow and the ability to fund future growth.

This inherent capital intensity presents a significant weakness for E&P companies like Cairn. During 2023, for example, the industry saw continued high capital expenditure as companies invested in maintaining and growing production. Cairn Energy itself reported significant capital expenditure in its 2023 results, reflecting the ongoing need to invest in its asset base. This can lead to:

- High Debt Levels: To fund these large projects, companies often rely on debt, which increases financial risk.

- Vulnerability to Price Volatility: Lower commodity prices directly impact revenue, making it harder to service debt and fund new investments.

- Limited Financial Flexibility: A large portion of available capital can be tied up in long-term projects, reducing the ability to respond to new opportunities or market changes.

Capricorn Energy's geographic concentration in Egypt creates a significant vulnerability. Any political instability or regulatory changes in the country could severely impact its operations and financial performance. The company's reliance on Egypt, despite having some UK North Sea assets, means disruptions there have a disproportionate effect.

Fluctuating oil and gas prices pose another substantial weakness. With Brent crude prices experiencing volatility, trading between $70 and $90 per barrel in 2023, Capricorn's revenue streams are directly sensitive to these market swings. This price dependency can hinder its ability to fund future projects.

The company has also faced challenges with inconsistent cash inflows due to delayed payments, particularly from its Egyptian operations. A missed payment from Waldorf Production UK in early 2025 further underscores these payment cycle vulnerabilities, impacting liquidity and capital distribution.

Capricorn's non-operated interests in the UK North Sea limit its direct control over operational decisions and capital expenditure. This dependency on operators can slow down development and hinder its ability to optimize asset value, especially in a mature basin like the UK Continental Shelf in 2024.

What You See Is What You Get

Cairn Energy SWOT Analysis

This is the actual Cairn Energy SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key factors impacting Cairn Energy's market position and future growth potential.

Opportunities

Capricorn Energy is actively exploring merger and acquisition (M&A) opportunities, with a particular interest in the UK North Sea and the Middle East and North Africa (MENA) region. This strategic push is designed to broaden its operational footprint and diversify its asset base.

By pursuing these M&A activities, Capricorn Energy aims to bolster its cash flows and improve shareholder returns. The company's strategy hinges on acquiring assets that complement its existing portfolio and offer synergistic benefits.

Cairn Energy's consolidation of its Egyptian concession agreements, coupled with more favorable fiscal terms, presents a substantial opportunity for increased investment. This strategic move is anticipated to drive enhanced production and bolster reserves within its key operational area.

Cairn Energy is set to ramp up its oil and gas exploration efforts in Egypt. The company has plans to drill up to six wells, with the first exploration well scheduled to spud in February 2025. This strategic move aims to unlock new reserves and bolster future production volumes.

Technological Advancements in E&P

Technological advancements in exploration and production (E&P) present significant opportunities for Cairn Energy. Leveraging new technologies for enhanced oil recovery (EOR) and improved operational efficiency can directly boost the economic viability of existing assets and drive down operational costs. For instance, the adoption of advanced seismic imaging and digital oilfield technologies in 2024 and 2025 can lead to more precise reservoir characterization, thereby increasing the success rates of both infill drilling and new project developments.

Adopting cutting-edge methods is crucial for maximizing the value derived from current fields and enhancing the probability of success for new ventures. Companies are increasingly investing in AI-driven analytics for predictive maintenance and reservoir simulation, aiming to optimize production and reduce downtime. This focus on innovation is expected to be a key differentiator in the competitive E&P landscape throughout 2024-2025.

- Enhanced Oil Recovery (EOR): Implementing technologies like chemical EOR or CO2 injection can significantly boost production from mature fields, potentially increasing recovery factors by 5-15%.

- Operational Efficiency: Digitalization and automation in E&P operations, including remote monitoring and AI-powered optimization, can reduce operating expenses by 10-20%.

- Improved Project Success Rates: Advanced geological modeling and drilling technologies contribute to a higher success rate for exploration wells, reducing dry hole costs.

- Cost Reduction: Innovations in subsea technology and modular production facilities are lowering the capital expenditure required for new projects.

Potential for Shareholder Returns

Capricorn Energy, formerly Cairn Energy, has signaled a strong commitment to returning capital to its shareholders. This focus on shareholder returns is underpinned by improved financial discipline and the anticipation of contingent payments.

The company's strategy includes the potential for increased shareholder distributions, particularly following the successful resolution of tax obligations. For instance, Capricorn announced in late 2023 that it had resolved its tax dispute with the Indian government, which was a significant hurdle.

The receipt of outstanding payments, such as those related to past asset sales, could further bolster the company's ability to reward investors. This proactive approach to capital allocation aims to enhance shareholder value.

- Commitment to Shareholder Returns: Capricorn Energy has explicitly stated its intention to return capital to shareholders.

- Improved Financial Discipline: The company's focus on financial management strengthens its capacity for distributions.

- Contingent Payments and Tax Resolution: Expected receipts from contingent payments and the resolution of tax issues, like the Indian tax dispute, are key drivers for potential increased shareholder distributions.

- Enhancing Shareholder Value: The strategic allocation of capital is designed to maximize returns for investors.

Cairn Energy's strategic focus on M&A in the UK North Sea and MENA region presents a significant opportunity to expand its asset base and diversify revenue streams. The company's commitment to enhancing shareholder returns, bolstered by the resolution of its Indian tax dispute in late 2023, positions it favorably for increased capital distributions. Furthermore, the planned drilling of up to six exploration wells in Egypt, commencing in February 2025, offers the potential to unlock substantial new reserves and boost future production volumes.

Technological advancements in E&P, particularly in EOR and operational efficiency, provide avenues for cost reduction and increased production from existing assets. For example, digital oilfield technologies adopted in 2024-2025 can enhance reservoir characterization and optimize production, potentially reducing operating expenses by 10-20%.

| Opportunity Area | Key Initiatives | Potential Impact |

|---|---|---|

| M&A Activity | UK North Sea & MENA Expansion | Diversified asset base, broadened operational footprint |

| Shareholder Returns | Capital distributions, contingent payments, tax dispute resolution | Enhanced shareholder value, improved investor confidence |

| Exploration & Production | Egypt drilling program (up to 6 wells, starting Feb 2025) | Unlocking new reserves, boosting future production |

| Technological Adoption | EOR, Digital Oilfield, AI Analytics | Increased production, reduced operating costs (10-20%), improved project success rates |

Threats

The accelerating global transition to renewable energy sources presents a significant long-term challenge for companies like Cairn Energy, whose core business relies on fossil fuels. This shift is driven by increasing awareness of climate change and a growing demand for sustainable practices.

Stricter environmental regulations and a strong investor preference for Environmental, Social, and Governance (ESG) compliant investments could potentially limit Cairn's access to crucial funding and hinder its future expansion opportunities. For instance, in 2023, global investment in clean energy reached an estimated $1.7 trillion, a stark contrast to continued investment in fossil fuels, highlighting the changing financial landscape.

While Egypt has seen positive steps like new concession agreements, Cairn Energy's operations there remain susceptible to geopolitical shifts and evolving government policies. Changes in regulations or fiscal terms could impact operational efficiency and the predictability of revenue streams, a crucial consideration for the company's financial planning.

The risk of delayed payments, a recurring concern in some markets, could also affect Cairn's cash flow. For instance, Egypt's sovereign debt rating, while improving, still presents a factor in assessing the broader economic stability influencing timely financial settlements.

Global oil and gas prices are inherently volatile, susceptible to rapid shifts driven by factors like geopolitical tensions and fluctuating demand. For instance, the Brent crude oil price experienced a significant drop from over $100 per barrel in early 2024 to around $75 by mid-2024, illustrating this unpredictable nature. This price instability directly threatens Capricorn Energy's revenue streams and its capacity to finance ongoing projects and future investments, potentially impacting its financial health and strategic growth plans.

Operational and Execution Risks

Cairn Energy, like any company in the exploration and production sector, faces significant operational and execution risks. These can range from unexpected drilling failures and equipment malfunctions to potential environmental incidents that could disrupt operations and incur substantial costs.

Delays in bringing new projects online or encountering lower-than-anticipated production volumes from newly drilled wells, a challenge that impacted financial performance in 2023, represent key execution risks. For instance, if a major development project experiences a six-month delay, it could directly reduce projected revenue for that period.

- Drilling Failures: A failed exploration well can result in millions of dollars in lost investment and delay future drilling plans.

- Equipment Malfunctions: Unexpected downtime of critical production equipment, such as pumps or processing facilities, can halt output and lead to significant repair costs.

- Environmental Incidents: Spills or other environmental issues can lead to regulatory fines, cleanup expenses, and reputational damage, impacting operational continuity.

- Project Delays: In 2023, delays in key development phases for projects like the Rufisque Offshore block in Senegal could have cost millions in deferred revenue and increased capital expenditure.

Competition for New Opportunities

The exploration and production (E&P) sector is fiercely competitive, with many companies actively seeking new areas to explore, existing assets to acquire, and strategic alliances. This crowded landscape means Capricorn Energy, formerly Cairn Energy, faces significant hurdles in securing desirable mergers and acquisition targets or obtaining exploration permits. For instance, in 2024, the global upstream M&A market saw significant activity, with major oil and gas companies divesting non-core assets and smaller players consolidating to gain scale, making it harder for companies like Capricorn to find value accretive deals.

This intense competition directly impacts Capricorn's ability to diversify its portfolio and pursue growth avenues. The scarcity of attractive opportunities means higher acquisition costs and increased risk in exploration ventures. In 2025, the pressure on E&P companies to secure new reserves and production capacity is expected to intensify as global energy demand continues to rise, further exacerbating this competitive threat.

- Intense Competition: Numerous E&P companies actively compete for limited exploration acreage and acquisition targets.

- M&A Challenges: Securing attractive merger and acquisition opportunities is increasingly difficult and costly.

- Licensing Hurdles: Gaining new exploration licenses faces stiff competition from established and emerging players.

- Growth Limitation: Difficulty in acquiring new assets and licenses can constrain Capricorn's diversification and overall growth trajectory.

The global shift towards renewable energy poses a significant threat, as Cairn Energy's business is rooted in fossil fuels. This transition, fueled by climate change concerns and a demand for sustainability, is reshaping investment priorities. For instance, global clean energy investment reached approximately $1.7 trillion in 2023, highlighting a clear divergence from fossil fuel investments.

Stricter environmental regulations and a growing investor focus on ESG principles could restrict Cairn's access to capital and impede future growth. The volatility of oil and gas prices, exemplified by Brent crude dropping from over $100 per barrel in early 2024 to around $75 by mid-2024, directly impacts revenue and project financing.

Operational risks, including drilling failures and equipment malfunctions, can lead to substantial costs and project delays. For example, a six-month delay in a major development project could reduce projected revenue for that period. Furthermore, intense competition within the E&P sector makes securing attractive M&A targets and exploration permits increasingly challenging and expensive, potentially limiting diversification and growth.

| Threat Category | Specific Threat | Impact | Example/Data Point |

|---|---|---|---|

| Energy Transition | Shift to Renewables | Reduced demand for fossil fuels, stranded assets | Global clean energy investment ~$1.7 trillion in 2023 |

| Regulatory & Financial | Stricter Environmental Regulations & ESG Focus | Limited access to capital, higher cost of capital | Investor preference shifting away from fossil fuels |

| Market Volatility | Oil & Gas Price Fluctuations | Unpredictable revenue streams, impact on project economics | Brent crude price drop from >$100 to ~$75 per barrel (early-mid 2024) |

| Operational Risks | Drilling Failures & Project Delays | Increased costs, deferred revenue, reduced production | Potential millions in lost investment from a single failed well |

| Competitive Landscape | Intense E&P Competition | Difficulty in acquiring assets, higher M&A costs | Increased upstream M&A activity in 2024, making deals harder to secure |

SWOT Analysis Data Sources

This Cairn Energy SWOT analysis is built upon a foundation of credible data, including publicly available financial reports, comprehensive market research, and insights from industry experts to provide a robust and accurate strategic overview.