Cairn Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cairn Energy Bundle

Cairn Energy faces a dynamic industry landscape, with intense competition and significant supplier power influencing its operations. Understanding these forces is crucial for any strategic decision-making.

The complete report reveals the real forces shaping Cairn Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The upstream oil and gas industry, where companies like Capricorn Energy operate, often faces a situation with a limited number of suppliers for highly specialized equipment and services. Think about things like advanced drilling rigs or cutting-edge seismic technology; there aren't countless companies that can provide these. This scarcity of specialized providers naturally gives them more sway.

This concentration means these suppliers can often dictate terms, as finding alternatives can be difficult and time-consuming. For example, the market for sophisticated IoT sensors used in exploration and production is relatively concentrated. In 2024, the global market for industrial IoT sensors was valued at approximately $25 billion, with a significant portion of that attributed to specialized upstream oil and gas applications, highlighting the critical role and thus, the bargaining power of a few key manufacturers.

The oil and gas sector's digital transformation fuels a significant demand for advanced hardware and technologies, including AI and machine learning. This surge in need for predictive analytics and operational optimization tools directly bolsters the pricing power of suppliers in this niche market. For instance, in 2024, the global market for AI in oil and gas was projected to reach billions, indicating substantial revenue streams for technology providers.

High switching costs significantly bolster the bargaining power of suppliers in the oil and gas sector, impacting companies like Capricorn Energy. The intricate nature of integrated systems and the necessity for specialized training when changing service providers create substantial financial and operational hurdles. For instance, in 2024, the average cost of switching major equipment suppliers in upstream oil and gas operations could range from millions to tens of millions of dollars, factoring in installation, calibration, and personnel retraining.

Specialized Labor and Expertise

The oil and gas sector, including companies like Cairn Energy, relies heavily on a specialized workforce. Think geologists, petroleum engineers, and experienced rig operators – these aren't roles you can easily fill. The demand for these skilled professionals often outstrips the available supply, which naturally strengthens their position.

This scarcity means that companies must compete fiercely for talent. Offering attractive salaries, comprehensive benefits packages, and opportunities for professional development becomes crucial for attracting and retaining these experts. This competition directly influences operational costs, as compensation and retention efforts are significant budget items.

For instance, in 2024, the average salary for a petroleum engineer in the US was reported to be around $130,000 annually, with many experienced professionals earning significantly more. This highlights the substantial investment required to secure and keep this specialized labor, a key factor in the bargaining power of suppliers within the industry.

- High Demand for Specialized Skills: Geologists, engineers, and drilling experts are essential for oil and gas operations.

- Limited Supply of Talent: The pool of qualified professionals is often smaller than the industry's needs.

- Competitive Compensation: Companies must offer attractive packages to attract and retain skilled labor.

- Impact on Operational Costs: Increased labor costs directly affect a company's bottom line.

Regulatory and Environmental Compliance Services

Suppliers of regulatory and environmental compliance services wield considerable bargaining power in the oil and gas sector. These services are critical for operations, making them non-negotiable for companies like Capricorn Energy. The increasing global focus on Environmental, Social, and Governance (ESG) initiatives and decarbonization directly amplifies the demand for and dependence on these specialized providers.

Capricorn Energy, for instance, must allocate resources to ensure adherence to evolving environmental standards and safety protocols to maintain its operational license. This necessity grants these service providers leverage, as their expertise is indispensable for continued business activity and meeting stringent industry requirements. As of early 2024, the global market for environmental consulting services, which includes compliance, was projected to continue its robust growth, underscoring the sustained importance and power of these suppliers.

- Critical Need: Compliance and environmental services are essential for maintaining a license to operate in the oil and gas industry.

- Growing Demand: Increased focus on ESG and decarbonization escalates the reliance on specialized service providers.

- Supplier Leverage: The non-negotiable nature of these services grants significant bargaining power to suppliers.

- Market Growth: The environmental consulting market, relevant to these services, shows continued strong growth, indicating sustained supplier importance.

Suppliers of specialized equipment and services in the upstream oil and gas sector, like those Capricorn Energy deals with, often have significant bargaining power. This is due to the limited number of providers for critical technologies such as advanced drilling equipment and seismic survey technology. The market for these specialized goods is concentrated, meaning fewer companies can meet the stringent demands of the industry.

This limited supply means suppliers can often dictate terms, as finding and integrating alternatives is costly and time-consuming. For instance, the market for specialized IoT sensors used in oil and gas exploration and production is relatively concentrated. In 2024, the global industrial IoT sensor market was valued at around $25 billion, with a substantial portion of this coming from niche upstream applications, underscoring the critical role and thus, the bargaining power of a few key manufacturers.

The bargaining power of specialized labor in the oil and gas industry is also a key factor for companies like Cairn Energy. There's a high demand for skilled professionals like geologists and petroleum engineers, but the supply of these experts is often limited. This scarcity means companies must compete intensely for talent, driving up labor costs and strengthening the position of these skilled workers.

For example, in 2024, the average salary for a petroleum engineer in the US was approximately $130,000 annually, with experienced professionals earning considerably more. This reflects the significant investment required to attract and retain this specialized workforce, directly impacting operational expenses and highlighting the bargaining power of these suppliers of human capital.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Companies (e.g., Cairn Energy) | 2024 Data/Context |

| Specialized Equipment Manufacturers | Limited number of providers, high switching costs, proprietary technology | Higher equipment costs, potential delays in acquiring critical assets | Global industrial IoT sensor market valued at ~$25 billion, with significant upstream oil & gas share. |

| Skilled Labor/Consultants | Scarcity of specialized expertise (e.g., petroleum engineers), high demand | Increased labor costs, competition for talent, potential project delays due to staffing shortages | Average US petroleum engineer salary ~ $130,000 annually. |

| Regulatory & Environmental Compliance Services | Critical need for operations, evolving regulations, specialized knowledge | Mandatory service costs, potential fines for non-compliance, dependence on expert advice | Global environmental consulting market showing robust growth, indicating sustained supplier importance. |

What is included in the product

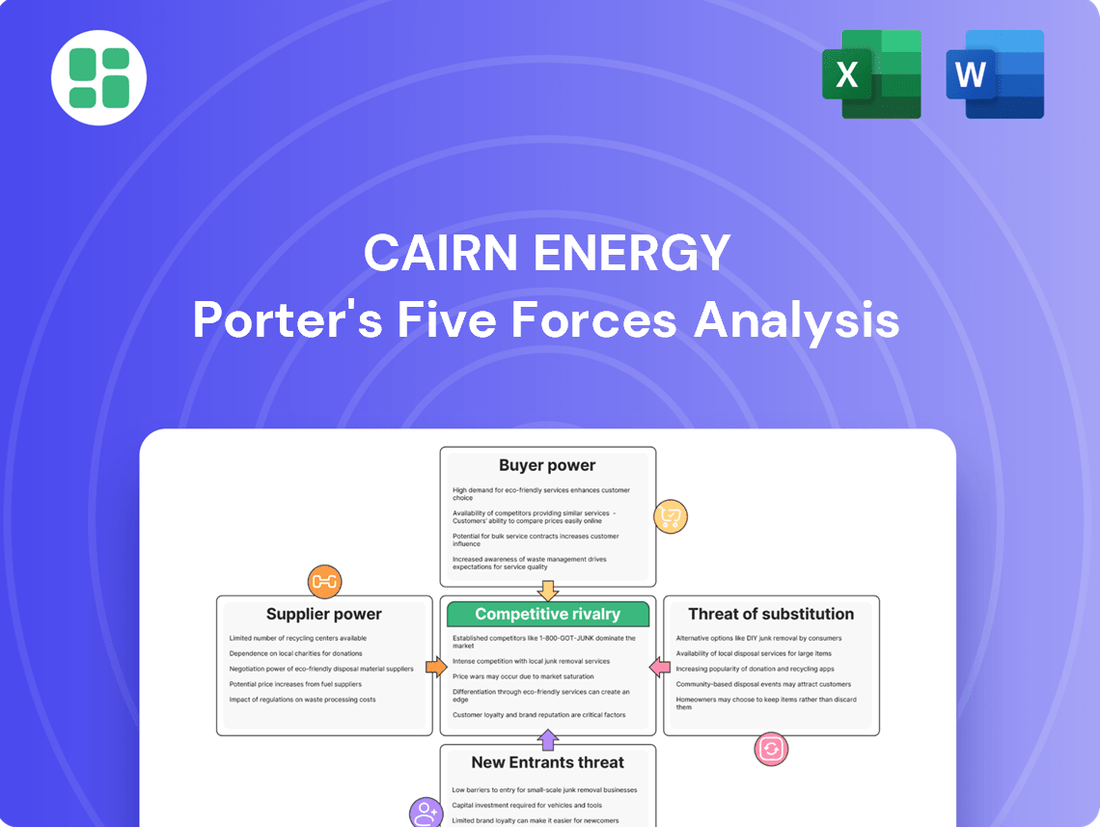

Analyzes the competitive intensity within the oil and gas exploration sector, focusing on Cairn Energy's strategic positioning against rivals, buyer power, supplier leverage, threat of new entrants, and substitute products.

Instantly visualize competitive intensity with a dynamic Porter's Five Forces chart, helping Cairn Energy anticipate and mitigate market pressures.

Customers Bargaining Power

The commodity nature of oil and gas significantly strengthens customer bargaining power. Refineries and traders, Capricorn Energy's main customers, can readily switch suppliers as the product is largely undifferentiated. This fungibility means price becomes the primary factor in purchasing decisions, limiting Capricorn's ability to set higher prices, particularly when market conditions are stable.

Global benchmarks like Brent crude dictate pricing, leaving individual producers with minimal leverage to influence the market. For instance, in 2024, the average price of Brent crude fluctuated, but the underlying commodity nature meant that even with supply disruptions, the price was largely dictated by broader market forces rather than the specific actions of a single producer like Capricorn Energy.

Capricorn Energy's primary customers are large entities such as national oil companies, major refineries, and international trading houses. These buyers, like Egypt's EGPC, purchase oil and gas in significant volumes, granting them considerable bargaining power.

The sheer scale of their purchases allows these large-volume buyers to negotiate more favorable terms, directly impacting Capricorn Energy's profit margins. For instance, in 2023, global oil prices fluctuated, with Brent crude averaging around $82 per barrel, creating a dynamic environment where buyers could leverage market conditions for better deals.

Given the global nature of the oil and gas market, where crude oil is a commodity, customers are acutely sensitive to price changes. For instance, in early 2024, fluctuations in Brent crude oil prices, which traded in a range of approximately $75 to $85 per barrel, directly influenced the cost of gasoline and other refined products. This sensitivity means that even small price hikes can lead consumers to reduce their consumption or seek alternatives, significantly pressuring producers to maintain competitive pricing.

Availability of Multiple Producers

The global oil and gas sector is characterized by a substantial number of producers, providing customers with a wide array of supply options. This abundance of choice inherently shifts leverage towards buyers.

While Capricorn Energy operates with its own distinct regional assets, the broader market allows customers to source their energy needs from various entities, diminishing their reliance on any single supplier. This accessibility to multiple producers is a key driver of customer bargaining power.

In 2024, the oil and gas industry continued to see significant production from major players and emerging producers alike. For instance, OPEC+ members, alongside non-OPEC countries like the United States, maintained robust output levels, ensuring a competitive landscape. This widespread availability means customers can readily compare pricing and terms from different suppliers, pushing for more favorable deals.

- Numerous Global Suppliers: The presence of many oil and gas producers worldwide means customers are not tied to a single source.

- Competitive Pricing Pressure: Customers can leverage the availability of alternatives to negotiate better prices and terms.

- Reduced Switching Costs: For many industrial or commercial buyers, the effort and cost to switch suppliers are relatively low, further empowering them.

- Market Volatility Benefits Buyers: Fluctuations in global supply and demand, often influenced by geopolitical events, can create opportunities for customers to secure advantageous contracts.

Impact of Downstream Market Dynamics

The bargaining power of Capricorn Energy's customers, primarily refiners and distributors, is significantly shaped by the health of the downstream market. When refining margins tighten or demand for specific refined products weakens, these downstream players exert greater pressure on upstream producers for lower crude oil and natural gas prices. For instance, in 2024, fluctuating gasoline demand and increased refining capacity in some regions created a more competitive environment, potentially increasing buyer leverage.

This downstream influence directly impacts Capricorn's pricing power. If refiners face profitability challenges, they are more inclined to negotiate harder on the cost of raw materials, directly affecting Capricorn's revenue and profit margins. This interconnectedness means that market dynamics far removed from the extraction process can ultimately diminish an upstream producer's ability to set favorable prices.

- Downstream Profitability: Challenges in the refining sector, such as reduced crack spreads, can lead to increased pressure on upstream suppliers for price concessions.

- Product Demand Shifts: Changes in consumer preferences for refined products, like a move towards electric vehicles, can alter demand for crude oil, impacting pricing leverage.

- Refining Capacity: Overcapacity in refining can lead to intense competition among refiners, making them more sensitive to input costs and thus increasing their bargaining power with suppliers.

- Interconnected Value Chain: Issues in the downstream market, such as logistical bottlenecks or inventory build-ups, can ripple upstream, affecting the pricing flexibility of producers like Capricorn.

The bargaining power of Capricorn Energy's customers is substantial due to the commodity nature of oil and gas, where price is the dominant factor. These buyers, often large refineries and trading houses, can easily switch suppliers given the undifferentiated product. For example, in 2024, the global oil market saw Brent crude prices fluctuating between approximately $75 and $85 per barrel, a benchmark that dictates terms for many producers.

The sheer volume of purchases made by these major clients, such as national oil companies, grants them significant leverage. This allows them to negotiate more favorable terms, directly impacting Capricorn's profitability. In 2023, with Brent crude averaging around $82 per barrel, market conditions often favored buyers seeking better deals.

Furthermore, the presence of numerous global suppliers in 2024, including major players and emerging producers like the United States, ensures customers have ample choice. This competitive landscape means buyers can readily compare prices and terms, pushing for advantageous contracts and diminishing reliance on any single producer.

| Customer Type | Bargaining Power Driver | Impact on Capricorn Energy | Example Data Point (2024) |

|---|---|---|---|

| Refineries & Traders | Commodity Nature & Low Switching Costs | Price sensitivity, limits pricing power | Brent Crude avg. price range: $75-$85/barrel |

| National Oil Companies | High Purchase Volume | Negotiate favorable terms, reduce margins | Significant portion of global oil demand |

| Global Market Participants | Abundance of Suppliers | Enables comparison shopping, drives competitive pricing | Continued robust production from OPEC+ and US |

Preview Before You Purchase

Cairn Energy Porter's Five Forces Analysis

This preview showcases the complete Cairn Energy Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the energy sector. You're looking at the actual, professionally written document that will be instantly available for download upon purchase, ensuring you receive an in-depth and actionable strategic overview without any hidden elements or placeholders.

Rivalry Among Competitors

The oil and gas exploration and production (E&P) sector is intensely competitive, featuring a multitude of established global giants like ExxonMobil and Shell, alongside national oil companies such as Saudi Aramco, and numerous independent E&P firms. These players possess substantial capital reserves, enabling significant investment in exploration, technology, and large-scale production projects, creating a high barrier to entry.

Capricorn Energy, now operating as Capricorn Energy PLC, navigates this crowded market where both diversified supermajors and nimble regional specialists compete for exploration blocks and production assets. For instance, in 2024, major IOCs continued to allocate billions to upstream activities, while regional players often leverage local expertise and relationships to secure advantageous positions.

The oil and gas sector is notoriously capital intensive, demanding billions for exploration, drilling, and infrastructure. This high barrier to entry naturally limits the number of major players. For instance, major offshore projects can easily cost upwards of $10 billion, requiring significant upfront investment before any revenue is generated.

This capital intensity fuels aggressive rivalry as companies strive to achieve economies of scale and recover their substantial fixed costs. The pressure to maintain production levels and secure profitable reserves often leads to intense competition for acreage and market share, especially as companies focus on strategic capital allocation towards high-return projects and maintaining capital discipline in the evolving energy landscape.

The oil and gas industry, especially in the US shale sector, experienced a surge in merger and acquisition (M&A) activity throughout 2024 and into early 2025. Companies pursued these deals to gain scale, boost cash flow, and improve overall returns. This trend of consolidation often intensifies competitive rivalry by forming larger, more efficient players capable of exploiting economies of scale and operational synergies.

Capricorn Energy, for instance, has been actively exploring M&A opportunities within the UK North Sea and the Middle East and North Africa (MENA) region. Such strategic moves by industry participants can significantly alter the competitive landscape, potentially leading to fewer, but stronger, competitors.

Technological Advancements and Innovation Race

The exploration and production (E&P) sector is experiencing a fierce race for technological superiority. Companies are investing heavily in cutting-edge solutions, with the global oil and gas technology market projected to reach over $300 billion by 2024. This rapid innovation, driven by advancements in artificial intelligence, machine learning, and the Internet of Things (IoT), is forcing all players to adapt or fall behind.

Staying competitive means continuously improving operational efficiency and slashing costs. For instance, AI-powered predictive maintenance can significantly reduce downtime, a critical factor in this capital-intensive industry. Companies that fail to embrace these digital transformations risk ceding ground to more technologically adept rivals, impacting their market share and profitability.

- AI in Exploration: AI algorithms are enhancing seismic data analysis, leading to more accurate prospect identification and potentially reducing dry hole rates.

- IoT for Efficiency: Connected sensors on equipment provide real-time data, enabling better monitoring, predictive maintenance, and optimized resource allocation.

- Automation in Operations: Automation is streamlining processes from drilling to production, lowering labor costs and improving safety.

- Data Analytics for Decision Making: Advanced analytics are crucial for interpreting vast datasets, informing strategic decisions and improving overall performance.

Impact of Geopolitical Factors and Regulatory Changes

Geopolitical tensions, like those impacting global energy supply chains, and OPEC+ production decisions directly influence oil and gas prices, affecting Capricorn Energy's revenue and profitability. For instance, in 2024, continued geopolitical instability in key oil-producing regions maintained upward pressure on crude prices, with Brent crude averaging around $82 per barrel in the first half of the year, a significant factor for exploration and production companies.

Evolving energy policies worldwide, including the push for decarbonization and the implementation of carbon pricing mechanisms, create both challenges and opportunities. Nations are increasingly setting ambitious emissions reduction targets, which can impact the demand for fossil fuels and necessitate significant investment in cleaner technologies. Capricorn Energy, like its peers, must adapt its strategy to comply with these shifting regulatory landscapes, such as the EU's Carbon Border Adjustment Mechanism, which could affect export markets.

Regulatory changes, particularly those concerning environmental compliance and methane emissions, can create competitive advantages or disadvantages. Companies that proactively invest in reducing their environmental footprint, such as implementing advanced methane detection and mitigation technologies, may gain a reputational boost and potentially lower operational costs in the long run. For example, stricter methane regulations implemented in 2024 across several jurisdictions are forcing companies to report and reduce fugitive emissions, with penalties for non-compliance.

- Geopolitical Instability: Continued geopolitical tensions in 2024 contributed to oil price volatility, with Brent crude averaging approximately $82/barrel in H1 2024, impacting revenue forecasts for exploration companies.

- OPEC+ Influence: OPEC+ production decisions remain a critical factor in global supply and price stability, influencing market dynamics for companies like Capricorn Energy.

- Energy Policy Shifts: Nations are accelerating decarbonization efforts, leading to evolving energy policies that can affect demand for fossil fuels and drive investment in alternative energy sources.

- Environmental Regulations: New regulations on methane emissions and environmental compliance, enforced in 2024, create competitive pressures, rewarding companies with robust mitigation strategies.

Competitive rivalry within the oil and gas sector is fierce, driven by a limited number of large, well-capitalized players and the high capital intensity of operations. Companies like Capricorn Energy face intense competition for exploration rights and production assets from global supermajors and national oil companies, all vying for market share and economies of scale.

The industry's capital-intensive nature, with projects often exceeding $10 billion, naturally limits the number of significant competitors but intensifies the struggle for profitable reserves. This dynamic fuels aggressive competition, pushing firms to optimize operations and secure advantageous positions in a market where scale and efficiency are paramount.

Mergers and acquisitions (M&A) have become a key strategy in 2024, consolidating the industry and creating larger entities with enhanced capabilities. This trend, seen with major players acquiring rivals to boost cash flow and scale, further intensifies rivalry by forming more formidable competitors focused on operational synergies and capital discipline.

Technological advancement is another critical battleground, with companies investing heavily in areas like AI and IoT to improve exploration accuracy and operational efficiency. The global oil and gas technology market, projected to exceed $300 billion by 2024, highlights the race to adopt innovations that reduce costs and enhance performance, with AI-driven predictive maintenance being a prime example.

| Factor | Description | 2024 Impact/Data |

|---|---|---|

| Industry Concentration | Dominated by a few supermajors and national oil companies. | High barriers to entry due to capital intensity (>$10 billion for offshore projects). |

| Mergers & Acquisitions | Consolidation trend to gain scale and efficiency. | Significant M&A activity in 2024, creating larger, more competitive entities. |

| Technological Advancement | Race for AI, IoT, and automation to boost efficiency. | Oil & Gas Tech Market >$300 billion in 2024; AI improving seismic analysis. |

| Operational Efficiency | Focus on cost reduction and economies of scale. | AI predictive maintenance reducing downtime; companies optimizing capital allocation. |

SSubstitutes Threaten

The escalating adoption of renewable energy sources such as solar and wind presents a substantial long-term threat to the demand for traditional fossil fuels. By the end of 2023, global renewable energy capacity additions reached a record 510 gigawatts (GW), a 50% increase from 2022, according to the International Energy Agency (IEA).

Governments and industries are channeling increased investments into clean energy technologies, spurred by ambitious decarbonization targets and evolving energy transition policies. For instance, the US Inflation Reduction Act alone is projected to drive hundreds of billions of dollars in clean energy investment through 2030.

While this shift is a gradual process, the expanding proportion of renewables within the global energy framework directly influences the future demand for oil and gas. In 2024, projections suggest that renewables will account for over 40% of global electricity generation by 2030, further pressuring fossil fuel markets.

The rapid advancement and increasing adoption of electric vehicles (EVs) represent a significant threat of substitution for traditional gasoline-powered vehicles, thereby impacting oil demand.

By 2024, global EV sales are expected to surpass 15 million units, a substantial increase from previous years, indicating a growing market share for this substitute technology.

This shift necessitates that oil companies, like Cairn Energy, consider strategic diversification as EVs directly replace a primary end-use for their core product.

Ongoing advancements in energy efficiency across industries and homes are a significant threat to oil and gas demand. For instance, in 2024, many countries are setting ambitious targets for reducing energy consumption, which directly impacts the volume of fossil fuels needed.

The increasing digitalization of energy grids and smart home technologies are further contributing to this trend. These innovations optimize energy usage, leading to a reduced reliance on traditional sources like oil and gas.

Development of Alternative Fuels and Technologies

The growing development and scaling of alternative fuels, like low-carbon hydrogen, biomethane, and advanced biofuels, present a significant threat of substitutes for traditional fossil fuels. These alternatives offer the potential for energy system benefits with considerably lower carbon emissions, directly challenging the market position of oil and gas companies such as Cairn Energy.

While investment in these alternatives by major oil and gas players still represents a relatively small fraction of their total energy expenditure, the momentum is undeniably building. For instance, global investment in the energy transition, which includes renewables and other low-carbon technologies, reached an estimated $1.1 trillion in 2023, a figure projected to grow. This increasing financial commitment indicates a shift that could eventually lead to the displacement of fossil fuel demand in various sectors.

The threat is particularly pronounced in applications where the energy density and infrastructure requirements of alternatives are becoming more aligned with existing systems. Consider these key areas:

- Transportation: Electric vehicles powered by renewable electricity and hydrogen fuel cell technology are increasingly viable substitutes for internal combustion engine vehicles.

- Industrial Processes: Low-carbon hydrogen is being explored as a clean alternative for high-heat industrial applications like steel and cement production, currently heavily reliant on natural gas.

- Heating and Power Generation: Biomethane and advanced biofuels can be blended with or replace natural gas in heating systems and power plants, offering a more sustainable energy source.

Policy and Regulatory Push for Decarbonization

Global energy policies and regulatory frameworks are increasingly pushing for decarbonization, directly impacting the threat of substitutes for traditional energy sources like those from Cairn Energy. Governments worldwide are implementing stringent emission reduction targets and carbon pricing mechanisms, making fossil fuels less attractive. For instance, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, a move that intensifies the appeal of renewable energy substitutes.

These governmental and international efforts accelerate the threat of substitution by making alternatives more economically viable and, in some cases, mandated. Incentives for renewable energy deployment, such as tax credits and subsidies, coupled with penalties for carbon-intensive activities, tilt the playing field. By 2024, global investment in clean energy is projected to reach significant figures, with the International Energy Agency (IEA) forecasting that clean energy technologies will account for over 90% of global power capacity additions in the coming years.

- Policy Impact: Stringent emission reduction targets and carbon pricing mechanisms in regions like the EU are making fossil fuels less competitive.

- Investment Trends: Global investment in clean energy is surging, with projections indicating that clean technologies will dominate new power capacity additions by 2024.

- Economic Viability: Government incentives and penalties are making renewable energy alternatives more economically attractive and increasingly mandatory.

The threat of substitutes for Cairn Energy's oil and gas products is significant and growing, driven by advancements in renewable energy, electric vehicles, and energy efficiency measures. These substitutes offer lower carbon emissions and are increasingly supported by government policies and investments.

By 2024, electric vehicles are projected to exceed 15 million global sales, directly impacting oil demand. Concurrently, renewable energy capacity additions reached a record 510 GW in 2023, signaling a powerful shift in the energy landscape. These trends highlight a clear move away from fossil fuels towards cleaner alternatives.

The increasing viability of alternatives like low-carbon hydrogen and advanced biofuels in sectors such as transportation and industrial processes further intensifies this threat. Global investment in the energy transition, estimated at $1.1 trillion in 2023, underscores the momentum behind these substitutes.

| Substitute Technology | Impact on Oil/Gas Demand | Key Data Point (2023-2024) |

| Renewable Energy (Solar, Wind) | Reduces demand for fossil fuels in power generation | 510 GW global capacity additions in 2023 |

| Electric Vehicles (EVs) | Directly substitutes gasoline for transportation | Projected 15+ million global sales in 2024 |

| Energy Efficiency | Decreases overall energy consumption | Ambitious national targets for energy reduction in 2024 |

| Alternative Fuels (Hydrogen, Biofuels) | Offers lower-emission options for industry and transport | $1.1 trillion global investment in energy transition (2023) |

Entrants Threaten

The oil and gas exploration and production sector demands enormous upfront capital. Companies need billions of dollars for seismic surveys, drilling equipment, offshore platforms, and pipeline infrastructure. For instance, a single deepwater exploration project can easily cost upwards of $100 million, with total development costs often reaching into the billions.

These substantial financial hurdles significantly deter new players from entering the market. The sheer scale of investment required to establish even a modest operational footprint creates a formidable barrier, effectively limiting competition to well-established entities with access to substantial funding and credit lines.

New entrants in the oil and gas sector, like Cairn Energy, encounter formidable regulatory hurdles. For instance, in 2024, the average time to secure exploration permits in some mature markets exceeded two years, coupled with significant upfront application fees that can run into millions of dollars. These extensive requirements, including environmental impact assessments and community consultations, demand substantial capital and expertise, effectively raising the barrier to entry.

Established national oil companies (NOCs) and major international oil companies (IOCs) hold a substantial share of the world's proven oil and gas reserves. This concentration of resources creates a significant barrier for new companies looking to enter the market, as access to prime exploration and production acreage is severely limited. Capricorn Energy, for instance, operates within existing concession agreements, highlighting the difficulty new entrants face in securing commercially viable assets.

Technological Sophistication and Expertise

The oil and gas sector, particularly upstream operations, is characterized by extremely high technological sophistication. New entrants face significant hurdles in acquiring the advanced expertise needed for deepwater exploration, complex seismic data interpretation, and efficient reservoir management. For instance, the cost of cutting-edge seismic acquisition and processing technology can run into tens of millions of dollars, a substantial initial investment.

Established players like Cairn Energy have built decades of experience and invested heavily in research and development to refine their technological capabilities. This continuous investment ensures they maintain a leading edge in efficiency and discovery success rates. In 2024, global oil and gas companies are projected to spend over $500 billion on exploration and production, a significant portion of which is allocated to technological advancements.

- High Capital Investment in Technology: Acquiring and maintaining state-of-the-art drilling, seismic, and data analytics equipment requires immense capital, deterring smaller or less capitalized new entrants.

- Specialized Skill Sets: The industry requires highly skilled geoscientists, petroleum engineers, and data scientists, whose training and recruitment represent a significant cost and time barrier.

- Ongoing R&D Expenditure: Leading companies consistently allocate substantial budgets to R&D, creating a moving target for new entrants to match in terms of innovation and operational efficiency.

- Intellectual Property and Patents: Proprietary technologies and patents held by incumbents can further restrict access for newcomers, necessitating costly licensing agreements or the development of alternative, often less efficient, methods.

Volatile Commodity Prices and Geopolitical Risks

The threat of new entrants to the oil and gas sector, particularly for a company like Cairn Energy, is significantly amplified by volatile commodity prices and pervasive geopolitical risks. The inherent price swings in oil and gas, influenced by global demand, supply dynamics, and speculative trading, present a formidable barrier. For instance, crude oil prices in 2024 have experienced considerable volatility, with Brent crude fluctuating between $75 and $90 per barrel at various points, impacting profitability projections.

New companies entering the market, especially those without the established infrastructure, hedging strategies, and financial depth of incumbents, are disproportionately exposed to these price fluctuations. Geopolitical tensions in major oil-producing regions, such as the Middle East and Eastern Europe, further exacerbate this vulnerability. These instabilities can disrupt supply chains, lead to sudden price spikes or drops, and increase operational costs through security measures or insurance premiums. In 2023, ongoing conflicts and sanctions continued to influence global energy markets, creating an unpredictable environment.

- Price Volatility: Brent crude oil prices saw a significant year-on-year increase of approximately 15% from early 2023 to early 2024, creating uncertainty for new capital investments.

- Geopolitical Impact: Events in 2024, such as regional conflicts, have led to premiums on oil prices, making it more expensive for new entrants to secure stable supply contracts.

- Financial Resilience: Established players like Cairn Energy often possess diversified asset bases and robust financial reserves, allowing them to weather price downturns, a luxury typically unavailable to new, smaller entities.

- Investment Deterrent: The combination of price instability and geopolitical risk makes the sector a less attractive proposition for new capital, thereby lowering the immediate threat of significant new competition.

The threat of new entrants for companies like Cairn Energy remains relatively low due to the sector's immense capital requirements, with new exploration projects often costing hundreds of millions to billions of dollars. Furthermore, stringent regulatory environments, requiring years and significant funds for permits and environmental assessments, act as a substantial deterrent. For instance, securing exploration permits in 2024 averaged over two years in some mature markets, with application fees reaching millions.

Access to prime exploration acreage is also a significant barrier, as established national and international oil companies control a vast majority of proven reserves. This concentration limits opportunities for newcomers to acquire commercially viable assets. Technological sophistication is another hurdle; acquiring advanced seismic and drilling technology can cost tens of millions, a sum that most new entrants cannot afford, especially when incumbents are investing over $500 billion globally in exploration and production in 2024 to maintain their technological edge.

| Barrier to Entry | Description | Example/Data Point (2024) |

|---|---|---|

| Capital Investment | Enormous upfront capital needed for exploration, drilling, and infrastructure. | Deepwater exploration projects can exceed $100 million; development costs can reach billions. |

| Regulatory Hurdles | Extensive permitting processes, environmental impact assessments, and application fees. | Average time for exploration permits in mature markets exceeded 2 years; application fees in the millions. |

| Access to Resources | Concentration of proven reserves with established players limits acreage availability. | Major IOCs and NOCs hold substantial shares, making new asset acquisition difficult. |

| Technological Sophistication | High cost of advanced exploration and production technology and specialized expertise. | Cutting-edge seismic technology can cost tens of millions; incumbents invest heavily in R&D. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cairn Energy is built upon a foundation of publicly available financial reports, industry-specific market research from firms like Wood Mackenzie, and news from reputable energy sector publications.