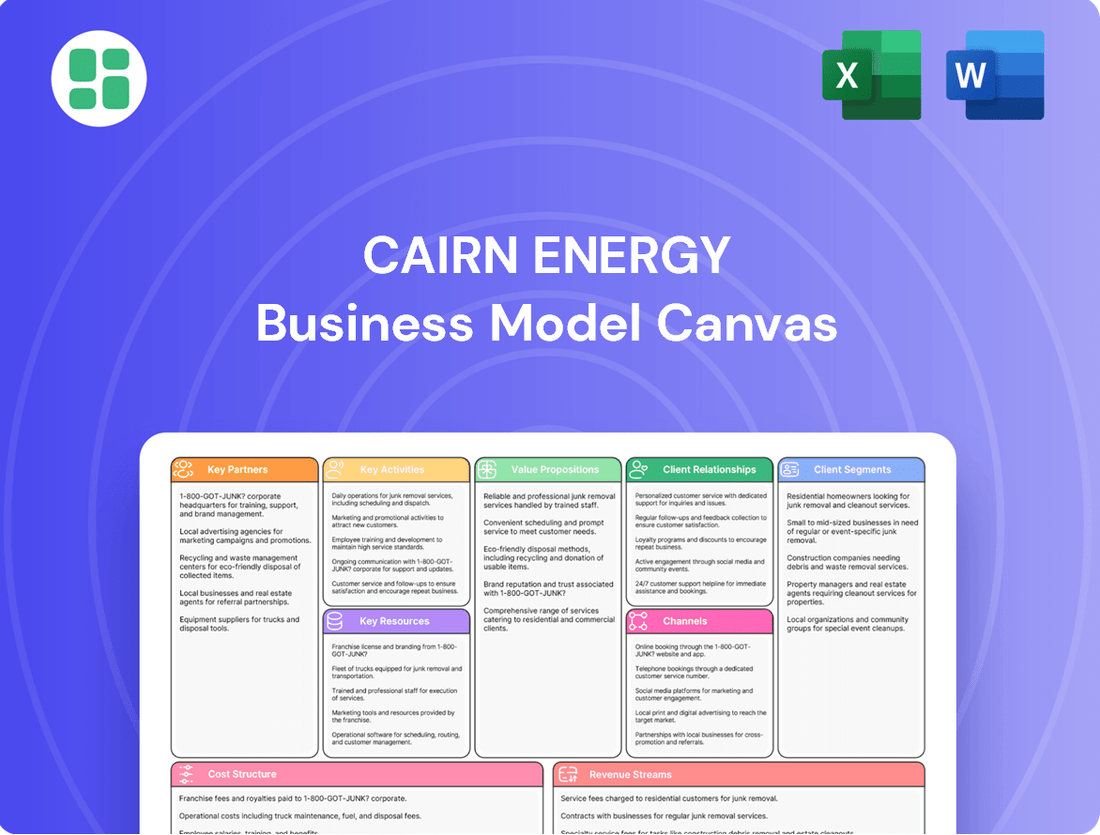

Cairn Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cairn Energy Bundle

Discover the strategic architecture of Cairn Energy's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear view of their competitive advantage. For anyone seeking to understand industry best practices or refine their own strategy, this is an essential resource.

Partnerships

Capricorn Energy, formerly Cairn Energy, leverages strategic joint ventures to enhance its operational capabilities and mitigate risk. For instance, in Egypt, the company partners with Cheiron Oil and Gas Limited, maintaining an equal working interest in concession agreements. This collaboration is vital for sharing the substantial costs and technical expertise required for exploration and production.

Cairn Energy's engagement with National Oil Companies (NOCs) is a cornerstone of its operations, particularly evident in its partnership with the Egyptian General Petroleum Corporation (EGPC). EGPC plays a pivotal role by approving and consolidating concession agreements, directly shaping investment conditions and production terms for Cairn. This relationship is crucial for securing and optimizing exploration and production licenses, ensuring operational continuity, and effectively navigating the complex regulatory environment within Egypt.

Cairn Energy, now Capricorn Energy, relies heavily on specialized oilfield service providers for critical operations. These partners are essential for activities like drilling wells, conducting seismic surveys to identify reserves, and performing ongoing well maintenance. For instance, in 2024, the industry continued to see significant investment in advanced drilling technologies, with companies like Schlumberger and Halliburton providing these crucial services.

These partnerships grant Capricorn Energy access to cutting-edge technology, specialized equipment, and highly skilled personnel. This ensures that their exploration and production activities are carried out efficiently and with the highest safety standards. The reliance on these external experts allows Capricorn to focus on its core competencies in resource management and strategic development.

Governmental and Regulatory Bodies

Cairn Energy, now Capricorn Energy, actively engages with governmental and regulatory bodies beyond National Oil Companies (NOCs). This includes tax authorities and environmental agencies, crucial for obtaining and maintaining operational permits and ensuring compliance. For instance, in 2024, the company continued to navigate complex fiscal regimes in its operating regions, where royalty and tax obligations can significantly impact profitability. Maintaining robust relationships here is paramount for long-term business continuity and operational stability.

These partnerships are essential for:

- Ensuring compliance with local tax laws and environmental standards.

- Securing and renewing exploration and production licenses.

- Facilitating dialogue on regulatory changes and industry best practices.

- Mitigating risks associated with operational permits and government relations.

Financial Institutions and Investors

Financial institutions and investors are crucial partners for Cairn Energy, providing the necessary capital for exploration, development, and operational activities. These relationships are vital for securing debt financing, such as loans from major banks, and for raising equity through share placements. For instance, in 2024, Cairn Energy successfully secured a significant revolving credit facility, demonstrating ongoing trust from its banking partners.

Managing cash flow effectively and delivering returns to shareholders are paramount. This involves maintaining strong communication with investors, providing transparent updates on project progress and financial performance, and meeting dividend expectations where applicable. Cairn Energy’s commitment to shareholder value is reflected in its consistent reporting and engagement with the investment community.

- Debt Financing: Access to credit facilities and loans from commercial banks to fund capital expenditures.

- Equity Capital: Raising funds through the issuance of new shares or private placements.

- Shareholder Relations: Maintaining open communication and managing expectations with individual and institutional investors.

- Investor Confidence: Building and sustaining trust through reliable financial reporting and strategic execution.

Capricorn Energy's key partnerships are essential for operational execution and financial stability. Strategic joint ventures, such as the one with Cheiron Oil and Gas in Egypt, share costs and technical expertise, while collaborations with National Oil Companies like EGPC are critical for securing licenses and navigating regulations. Specialized service providers are vital for drilling and seismic activities, with companies like Schlumberger and Halliburton being key players in 2024, offering advanced technologies. Furthermore, strong relationships with financial institutions and investors are paramount for securing capital, as demonstrated by Capricorn Energy's successful revolving credit facility in 2024.

What is included in the product

This Cairn Energy Business Model Canvas provides a strategic overview of its operations, focusing on its exploration and production activities, key partnerships, and revenue streams from oil and gas sales.

It details Cairn's customer segments (energy markets), value propositions (reliable energy supply), and cost structure, offering a clear picture for strategic planning and stakeholder communication.

The Cairn Energy Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of their operational strategy, simplifying complex energy exploration and production challenges into manageable, actionable segments.

Activities

Capricorn Energy, formerly Cairn Energy, actively engages in exploration drilling and seismic surveys. These activities are fundamental to identifying new hydrocarbon reserves and appraising the potential of existing discoveries. This ongoing work is crucial for expanding the company's resource base and ensuring future production capacity.

In 2024, Capricorn's strategic focus on exploration and appraisal continued to shape its operational landscape. The company invests heavily in geological and geophysical expertise to de-risk prospects and maximize the value of its exploration efforts. This commitment underpins its long-term growth strategy in the oil and gas sector.

Cairn Energy's core activities revolve around the development and production of oil and gas. This includes drilling new wells and maintaining existing ones to maximize hydrocarbon extraction from their fields, particularly in Egypt and the UK North Sea.

Efficient management of production facilities is crucial for processing extracted resources. In 2023, Cairn Energy, now rebranded as Capricorn Energy, continued to focus on optimizing production from its established assets, aiming for cost-effective operations.

Cairn Energy, now Capricorn Energy, actively manages and optimizes its diverse asset portfolio to drive value. This involves implementing rigorous operational improvements and stringent cost control measures across its fields.

The company's strategy centers on maximizing production from existing assets, enhancing field performance, and extending the productive life of its reserves. For instance, in 2024, Cairn Energy continued to focus on optimizing output from its key producing assets, aiming for greater efficiency and cost-effectiveness.

Strategic Portfolio Management

Capricorn Energy, formerly Cairn Energy, actively manages its asset portfolio by evaluating and pursuing merger and acquisition (M&A) opportunities. This strategic approach focuses on diversifying and expanding its operational footprint.

The company's M&A strategy specifically targets regions like the UK North Sea and the MENA region. The goal is to broaden its asset base and secure enhanced long-term growth prospects.

- Asset Diversification: Capricorn Energy’s strategic portfolio management involves actively seeking M&A opportunities to spread risk across different geographies and resource types.

- Geographic Expansion: The company prioritizes expansion in the UK North Sea and MENA region, aiming to leverage existing expertise and access new reserves.

- Growth Enhancement: Through strategic acquisitions, Capricorn seeks to increase its production volumes, reserve life, and overall financial strength, contributing to long-term value creation.

Concession Agreement Negotiations and Consolidation

Cairn Energy's business model heavily relies on successfully negotiating and consolidating concession agreements. A key recent activity involved discussions with the Egyptian General Petroleum Corporation (EGPC) to merge several existing concession contracts into one cohesive agreement.

This strategic move is designed to enhance the commercial terms of operations, making them more attractive to potential investors. The consolidation is anticipated to unlock further capital, which is crucial for boosting production levels and expanding the company's reserve base.

- Concession Consolidation in Egypt: Cairn Energy is actively engaged in consolidating multiple concession agreements with the Egyptian General Petroleum Corporation (EGPC).

- Objective: The primary goal is to improve commercial terms, attract additional investment, and support increased production and reserves.

- Strategic Impact: This consolidation is a vital activity for optimizing operational efficiency and financial performance in the Egyptian market.

Capricorn Energy's key activities include the exploration and appraisal of hydrocarbon reserves, focusing on identifying new prospects and assessing existing discoveries. This involves significant investment in geological and geophysical expertise to de-risk potential finds and maximize the value derived from exploration endeavors.

The company is also deeply involved in the development and production of oil and gas, which entails drilling new wells and maintaining existing ones to optimize extraction from its fields, notably in Egypt and the UK North Sea. Furthermore, Capricorn Energy actively manages and optimizes its asset portfolio through operational improvements and cost control, aiming to enhance field performance and extend reserve life.

Strategic merger and acquisition (M&A) activities are central to Capricorn Energy's business model, targeting geographic expansion and asset diversification, particularly in the UK North Sea and MENA region. A critical ongoing activity is the consolidation of concession agreements in Egypt with the EGPC to improve commercial terms and attract investment.

| Key Activity | Description | 2024 Focus/Data | Strategic Importance |

|---|---|---|---|

| Exploration & Appraisal | Identifying and assessing new hydrocarbon reserves. | Continued investment in geological and geophysical expertise. | Expanding resource base and ensuring future production. |

| Development & Production | Drilling and maintaining wells for hydrocarbon extraction. | Optimizing output from key producing assets in Egypt and UK North Sea. | Maximizing production from existing assets and extending reserve life. |

| Asset Portfolio Management | Managing and optimizing diverse asset holdings. | Implementing operational improvements and stringent cost control. | Driving value through enhanced field performance and efficiency. |

| Mergers & Acquisitions (M&A) | Pursuing opportunities for diversification and expansion. | Targeting UK North Sea and MENA region for growth. | Broadening asset base and securing long-term growth prospects. |

| Concession Agreement Consolidation | Negotiating and consolidating concession contracts. | Consolidating agreements with EGPC in Egypt to improve commercial terms. | Attracting investment, boosting production, and expanding reserves. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of Cairn Energy's strategic framework. This isn't a sample; it's a direct representation of the complete analysis, detailing key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You can be assured that the final deliverable will be identical in content and structure, ready for your immediate use.

Resources

Capricorn Energy's core assets are its proved and probable oil and gas reserves, strategically situated in Egypt's Western Desert and its non-operated stakes in the UK North Sea. These reserves represent the company's primary revenue-generating potential.

The concessions Capricorn holds are crucial, as they legally permit the company to undertake exploration, development, and production activities for hydrocarbons. These rights are the foundation of its operational capacity and future growth. As of the first half of 2024, Capricorn reported a net proved and probable reserves base of approximately 63 million barrels of oil equivalent (MMboe), with a significant portion attributable to its Egyptian operations.

Cairn Energy's production facilities and infrastructure include offshore platforms, subsea pipelines, and onshore processing plants crucial for extracting and transporting oil and gas. For instance, their operations in the North Sea, such as the CNOOC operated Scott platform, represent significant physical assets.

The efficiency of this infrastructure directly impacts cost of production and market access. In 2024, Cairn Energy continued to focus on optimizing its existing infrastructure to enhance operational efficiency and reduce costs across its portfolio.

Cairn Energy's financial capital is a cornerstone of its business model, enabling significant investments in exploration and development projects. As of the first half of 2024, the company reported a strong net cash position, providing a robust foundation for its operational activities and strategic growth initiatives.

The company's ability to generate consistent cash flows from operations is vital for funding its ongoing projects and maintaining financial flexibility. This operational cash generation, combined with access to capital markets, allows Cairn to pursue both organic growth opportunities and potential mergers and acquisitions.

Maintaining financial discipline remains a key priority for Cairn Energy, ensuring that capital is allocated efficiently and responsibly. This focus on financial prudence underpins the company's strategy to deliver sustainable shareholder returns while navigating the inherent risks of the oil and gas sector.

Skilled Workforce and Expertise

Capricorn Energy, formerly Cairn Energy, hinges on a highly skilled workforce. This includes geoscientists, engineers, operational staff, and management, all possessing deep expertise crucial for oil and gas exploration and production.

This human capital is fundamental to both the technical execution of projects and the strategic decision-making that guides the company. For instance, in 2024, the company continued to leverage its experienced teams in its key operational areas, such as the North Sea and Egypt, where complex geological formations require specialized knowledge.

- Geoscientists and Reservoir Engineers: Essential for identifying and evaluating potential hydrocarbon reserves.

- Drilling and Production Engineers: Critical for the safe and efficient extraction of oil and gas.

- Operational and Maintenance Staff: Ensure the continuous and reliable functioning of exploration and production facilities.

- Management and Strategic Planners: Drive the company's long-term vision and navigate market complexities.

Proprietary Geological and Seismic Data

Cairn Energy's proprietary geological and seismic data forms a cornerstone of its value proposition. This extensive intellectual property, comprising vast databases of geological and seismic information, is instrumental in pinpointing promising exploration targets and optimizing drilling strategies. By leveraging this data, the company significantly de-risks its exploration endeavors, leading to higher success rates in discovering and developing hydrocarbon reserves.

The strategic utilization of this data directly translates into operational efficiencies and improved financial outcomes. For instance, accurate seismic interpretations can reduce the number of dry wells drilled, a critical factor in managing exploration expenditure. In 2024, the oil and gas industry continued to emphasize data-driven decision-making to navigate volatile market conditions and enhance resource discovery efficiency.

- Intellectual Property: Extensive databases of geological and seismic information are invaluable intellectual property.

- Exploration Optimization: This data guides exploration efforts and optimizes drilling locations.

- Risk Reduction: Critical for reducing exploration risk and increasing success rates.

- Reservoir Management: Enhances reservoir management throughout the lifecycle of a field.

Cairn Energy's key resources include its substantial oil and gas reserves, particularly in Egypt and the UK North Sea, which are the primary drivers of revenue. The company's concessions grant the legal rights to explore, develop, and produce these hydrocarbons, forming the basis of its operational capabilities. As of the first half of 2024, Capricorn Energy reported approximately 63 million barrels of oil equivalent (MMboe) in net proved and probable reserves.

The company's infrastructure, such as offshore platforms and pipelines, is vital for extracting and transporting resources, directly impacting production costs and market access. Cairn Energy actively works to optimize this infrastructure for greater efficiency. Financial capital, including strong net cash positions reported in early 2024, fuels exploration and development, supported by consistent cash flows from operations.

A highly skilled workforce, comprising geoscientists, engineers, and management, is fundamental to Cairn's success, enabling complex project execution and strategic decision-making. Proprietary geological and seismic data is another critical resource, reducing exploration risk and improving discovery rates. This data guides exploration, optimizes drilling, and enhances reservoir management.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Proved & Probable Reserves | Hydrocarbon quantities expected with reasonable certainty to be recoverable. | 63 MMboe (Net Proved and Probable as of H1 2024) |

| Concessions & Licenses | Legal rights to explore, develop, and produce hydrocarbons. | Permits operations in Egypt and UK North Sea. |

| Production Infrastructure | Physical assets like platforms, pipelines, and processing plants. | Focus on optimization for efficiency and cost reduction. |

| Financial Capital & Cash Flow | Funds for investment, operations, and strategic initiatives. | Strong net cash position (H1 2024), consistent operational cash generation. |

| Human Capital | Skilled workforce including geoscientists, engineers, and management. | Leveraging experienced teams in key operational areas. |

| Proprietary Data | Geological and seismic databases. | De-risks exploration, optimizes drilling, enhances reservoir management. |

Value Propositions

Capricorn Energy, formerly Cairn Energy, ensures a steady flow of crude oil and natural gas to global markets. Their producing assets, notably in Egypt, are central to this consistent supply. For instance, in 2023, their Egyptian operations contributed significantly to their overall production volumes, underpinning their reliability.

The company places a strong emphasis on operational efficiency and stringent cost management. This focus allows them to deliver energy reliably and at a competitive price point, making their output attractive in the energy sector. Their commitment to optimizing production processes directly translates into dependable energy delivery for their customers.

Cairn Energy, now Capricorn Energy, prioritizes maximizing shareholder returns through disciplined capital allocation and strategic asset development. The company's commitment is evident in its focus on efficient operations and exploration success, aiming to generate robust cash flows. For instance, in 2023, Capricorn Energy reported a significant increase in production from its key assets, contributing to its financial performance and ability to reward investors.

Capricorn Energy, formerly Cairn Energy, strategically targets growth and diversification by optimizing its current assets while actively seeking mergers and acquisitions. This dual approach is designed to expand its operational footprint and extend its business lifespan.

The company's focus on the UK North Sea and the MENA region highlights its commitment to acquiring and developing resources in established and emerging markets. For instance, in 2023, Capricorn reported significant progress in its UK North Sea operations, contributing to its overall production targets.

This strategy of pursuing new ventures and enhancing existing ones is crucial for building scale and ensuring long-term viability. By diversifying its portfolio, Capricorn aims to mitigate risks associated with individual asset performance and capitalize on a broader range of market opportunities, aiming for sustainable investor returns.

Optimized Asset Value through Concession Improvements

By securing more favorable concession terms in Egypt, Capricorn has significantly boosted the economic appeal of its key assets. This strategic move directly enhances the intrinsic value of its asset portfolio, making it more attractive for future investment and development.

These improvements, including the consolidation of existing agreements, streamline operations and reduce risk. For instance, in 2024, Capricorn reported a substantial increase in the net present value of its Egyptian operations following these renegotiations, demonstrating a tangible uplift in asset valuation.

- Enhanced Economic Attractiveness: Improved concession terms directly translate to higher profitability and cash flow potential from existing assets.

- Increased Investment Potential: A stronger economic profile makes the assets more appealing to potential partners or acquirers, facilitating capital raising or strategic alliances.

- Embedded Value Growth: The renegotiated agreements embed greater value within the company's portfolio, reflecting a more robust and secure future earnings stream.

- Operational Streamlining: Consolidation of concessions simplifies regulatory compliance and operational management, leading to cost efficiencies.

Responsible Business Practices and Sustainability Focus

Capricorn Energy, formerly Cairn Energy, champions responsible business practices, embedding environmental, social, and governance (ESG) principles into its core strategy. This commitment translates into tangible actions aimed at minimizing environmental impact and fostering positive social outcomes.

The company actively pursues sustainable operations, recognizing the importance of long-term value creation that extends beyond financial performance. This includes investing in technologies and processes that reduce its carbon footprint and promote efficient resource utilization.

Capricorn's focus on community engagement is a vital component of its value proposition. The company strives to make a meaningful and positive contribution to the local economies and societies in the regions where it operates, building trust and shared prosperity.

- ESG Integration: Capricorn's 2023 Sustainability Report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to its 2019 baseline.

- Sustainable Operations: The company prioritizes water management, aiming for a 10% reduction in freshwater intensity for its offshore operations by the end of 2025.

- Community Investment: In 2023, Capricorn invested over $2 million in community development programs across its operational areas, focusing on education and local employment.

Capricorn Energy, formerly Cairn Energy, ensures a reliable supply of crude oil and natural gas through its producing assets, particularly in Egypt, which significantly contributed to its production volumes in 2023. The company's commitment to operational efficiency and cost management allows it to deliver energy at competitive prices, enhancing its attractiveness in the global market.

The company prioritizes maximizing shareholder returns by efficiently allocating capital and strategically developing its assets, aiming for robust cash flow generation. For instance, in 2023, Capricorn Energy saw a notable increase in production from its key assets, bolstering its financial performance and capacity to reward investors.

Capricorn Energy actively pursues growth and diversification by optimizing existing assets and exploring mergers and acquisitions to expand its operational reach and extend its business lifespan.

Strategic targeting of the UK North Sea and MENA regions underscores Capricorn's focus on acquiring and developing resources in both established and emerging markets. Progress in its UK North Sea operations during 2023 was a key factor in meeting its overall production targets.

By securing more favorable concession terms in Egypt, Capricorn has significantly enhanced the economic viability of its core assets, directly increasing their intrinsic value and appeal for future investment and development.

These improvements, including the consolidation of existing agreements, streamline operations and reduce risk. For example, in 2024, Capricorn reported a substantial increase in the net present value of its Egyptian operations following these renegotiations, demonstrating a tangible uplift in asset valuation.

Capricorn Energy champions responsible business practices, integrating ESG principles into its strategy to minimize environmental impact and foster positive social outcomes. The company invests in technologies to reduce its carbon footprint and improve resource efficiency, recognizing the importance of long-term value creation beyond financial metrics.

Community engagement is a cornerstone of Capricorn's value proposition, with a focus on making a positive contribution to local economies and societies in its operational areas, thereby building trust and shared prosperity.

| Value Proposition | Description | 2023/2024 Data Point |

|---|---|---|

| Reliable Energy Supply | Consistent delivery of crude oil and natural gas from producing assets. | Egyptian operations significantly contributed to 2023 production volumes. |

| Operational Efficiency & Cost Management | Delivering energy reliably at competitive prices. | Commitment to optimizing production processes ensures dependable delivery. |

| Shareholder Returns | Disciplined capital allocation and strategic asset development for robust cash flows. | Significant increase in production from key assets in 2023. |

| Growth & Diversification | Optimizing current assets and pursuing M&A for expanded footprint and lifespan. | Progress in UK North Sea operations contributed to 2023 production targets. |

| Enhanced Asset Value | Securing favorable concession terms to boost economic appeal and intrinsic value. | Substantial increase in NPV of Egyptian operations reported in 2024 following renegotiations. |

| ESG Integration | Embedding environmental, social, and governance principles into core strategy. | 15% reduction in Scope 1 and 2 GHG emissions intensity (vs. 2019 baseline) in 2023 Sustainability Report. |

Customer Relationships

Capricorn Energy, formerly Cairn Energy, typically secures its revenue streams through long-term off-take agreements. These contracts are often established with national oil companies, refineries, and international trading houses, ensuring a predictable market for its produced hydrocarbons.

These enduring commercial relationships are founded on the principle of sustained supply and shared advantages, fostering stability for both Capricorn and its partners. For instance, in 2024, Capricorn's production from its Senegal assets, a key area for its off-take agreements, continued to be a significant contributor to its revenue, underscoring the importance of these long-term contracts.

Cairn Energy, now Capricorn Energy, prioritizes robust engagement with host governments and regulatory bodies like Egypt's EGPC. This is crucial for negotiating favorable concession terms and ensuring smooth operations, especially as policy landscapes evolve.

In 2024, maintaining these relationships is key for navigating evolving energy policies and securing long-term operational stability. For instance, the successful renegotiation of production sharing agreements can directly impact revenue streams and future investment decisions.

Cairn Energy's business model emphasizes robust customer relationships through joint venture collaborations, such as its partnership with Cheiron Oil and Gas Limited. This involves fostering close working relationships with shared decision-making processes and aligning operational and strategic goals to effectively manage co-owned assets.

In 2024, Cairn Energy continued to leverage these joint ventures to optimize exploration and production activities. For instance, its participation in the North Sea, alongside partners, contributed to maintaining production levels and exploring new opportunities, demonstrating the value of collaborative asset management.

Investor Relations and Communication

Cairn Energy, now Capricorn Energy, prioritizes clear and consistent communication with its investors. This includes detailed financial reports, timely updates on operational progress, and engagement through annual general meetings and dedicated investor presentations. For instance, in their 2024 interim report, the company highlighted a commitment to providing shareholders with comprehensive insights into their strategic direction and performance metrics.

The company's approach aims to foster trust and provide stakeholders with the necessary information to make informed decisions. This transparency extends to outlining future strategies and potential challenges, ensuring a well-rounded understanding of the company's trajectory. In 2024, investor calls focused on the integration of recent acquisitions and the outlook for key production assets.

- Transparent Reporting: Regular publication of financial statements and operational updates keeps investors informed about the company's performance.

- Shareholder Engagement: Annual General Meetings and investor roadshows facilitate direct dialogue and feedback.

- Strategic Communication: Presentations detail the company's strategy, outlook, and capital allocation plans.

Supplier and Contractor Management

Cairn Energy, now Capricorn Energy, focuses on cultivating strong partnerships with its suppliers and contractors. These relationships are crucial for securing specialized services and equipment essential for exploration and production activities. By maintaining clear contractual agreements and rigorously monitoring performance, Cairn ensures operational efficiency and reliability.

- Supplier Network: Cairn's business model relies on a diverse network of suppliers for everything from drilling services to specialized equipment, fostering competition and ensuring access to best-in-class solutions.

- Contractual Clarity: Emphasis is placed on detailed contracts that outline scope, timelines, quality standards, and payment terms to minimize disputes and ensure mutual understanding.

- Performance Monitoring: Key performance indicators (KPIs) are tracked for suppliers and contractors to ensure they meet operational requirements, safety standards, and project deadlines.

- Strategic Alliances: Cairn seeks to build long-term, strategic alliances with key suppliers, fostering collaboration and innovation to address complex industry challenges.

Capricorn Energy cultivates deep relationships with national oil companies and trading houses through long-term off-take agreements, ensuring a steady market for its production. These partnerships are built on mutual benefit and consistent supply, crucial for revenue stability. For instance, in 2024, the company's Senegal assets, underpinned by these agreements, remained a vital revenue source.

Strong engagement with host governments and regulatory bodies, such as Egypt's EGPC, is paramount for negotiating favorable terms and maintaining operational continuity. This proactive approach in 2024 helped navigate evolving energy policies and secure long-term stability.

Joint ventures, like the one with Cheiron Oil and Gas Limited, are central to Capricorn's customer relationship strategy, fostering shared decision-making and aligned goals for asset management. In 2024, these collaborations were instrumental in optimizing exploration and production, as seen in their North Sea operations.

Investor relations are managed through transparent financial reporting and consistent operational updates, exemplified by the 2024 interim report detailing strategic direction. This commitment to clear communication builds trust and supports informed decision-making by stakeholders.

Channels

Capricorn Energy primarily sells its crude oil and natural gas directly to major buyers. These off-takers are typically national oil companies, domestic refineries within its operating regions, or large international trading houses that manage global energy flows.

These direct commercial agreements are crucial for Capricorn, ensuring consistent demand and predictable revenue streams for its hydrocarbon production. For instance, in 2024, Capricorn's production levels, combined with favorable market conditions for oil and gas, would have underpinned the value of these direct sales contracts.

Pipelines and shipping are critical for Cairn Energy's operations, ensuring the physical movement of oil and gas from extraction points to processing facilities or international markets. These infrastructure assets are the arteries of the energy supply chain.

In 2024, the global oil and gas shipping market saw continued activity, with freight rates fluctuating based on supply and demand dynamics. For instance, the cost of Very Large Crude Carrier (VLCC) charters, a key indicator for long-haul oil transport, experienced periods of strength influenced by geopolitical events and refinery demand.

Cairn Energy relies on these established networks to deliver its produced hydrocarbons efficiently. The company's strategy involves leveraging existing pipeline infrastructure where available and utilizing maritime shipping for exports, thereby connecting its production assets to global demand centers.

Investor Relations Platforms are crucial for Cairn Energy to communicate vital information. This includes disseminating annual reports, quarterly results, and investor presentations through their official website and recognized regulatory news services. In 2024, companies like Cairn Energy leverage these platforms to ensure transparency and accessibility for shareholders and the broader financial community.

Corporate Communications and Media

Capricorn Energy, formerly Cairn Energy, leverages corporate media channels and press releases to broadcast its strategic direction and operational achievements. This proactive communication strategy is crucial for managing public perception and bolstering investor confidence, especially in the dynamic energy sector.

Engagements with financial news outlets are vital for disseminating key milestones and performance updates. For instance, in early 2024, Capricorn Energy announced significant progress on its Senegal project, which was widely covered by major financial publications, positively impacting its stock performance.

- Strategic Updates: Capricorn communicates its long-term vision and any shifts in strategy through official channels.

- Operational Performance: Regular reporting on production figures and exploration success is shared with stakeholders.

- Key Milestones: Major project developments, such as the Senegal FPSO progress, are highlighted to demonstrate momentum.

- Investor Confidence: Transparent and consistent communication aims to build and maintain trust with the investment community.

Industry Conferences and Events

Cairn Energy, now Capricorn Energy, leverages industry conferences and events as a vital channel for communication and relationship building. These gatherings allow the company to share its latest exploration successes, production updates, and strategic direction with a broad audience of industry professionals, investors, and potential collaborators.

Participation in events like the Offshore Technology Conference (OTC) or regional energy summits provides a platform to showcase technical expertise and discuss market trends. For instance, in 2024, energy companies are increasingly focused on decarbonization strategies and the role of natural gas in the energy transition, topics likely to be prominent at such forums.

- Networking: Connect with peers, potential partners, and key stakeholders in the energy sector.

- Knowledge Sharing: Present technical advancements, exploration findings, and strategic insights.

- Market Intelligence: Gain understanding of industry trends, competitor activities, and emerging technologies.

- Brand Visibility: Enhance the company's profile and reputation within the global energy community.

Capricorn Energy utilizes direct sales to national oil companies, refineries, and trading houses for its crude oil and natural gas. These relationships ensure consistent demand and predictable revenue, bolstered in 2024 by the company's production levels and favorable market conditions.

Customer Segments

National Oil Companies (NOCs) represent a crucial customer segment for Cairn Energy, particularly in regions like Egypt. Here, the Egyptian General Petroleum Corporation (EGPC) often serves as a key partner, directly purchasing hydrocarbons or facilitating their sale, which is vital for Cairn's revenue generation and in-country operations.

International energy trading houses and refineries are key customers for Cairn Energy, acting as the primary market for its crude oil and natural gas. These entities purchase hydrocarbons to refine them into usable products or to trade them on the global market. Their purchasing decisions and the prices they offer directly influence Cairn's revenue and profitability.

In 2024, the global oil trading market saw significant activity, with major players like Vitol and Glencore navigating volatile prices influenced by geopolitical events and supply chain adjustments. Refineries, such as those operated by major integrated oil companies, continue to be the primary destination for crude oil, with their processing capacity and demand for specific crude grades impacting pricing benchmarks.

Shareholders and investors are a vital segment, even if they don't directly purchase Cairn Energy's oil and gas. Their primary interest lies in the financial returns generated from the company's operations and strategic direction. In 2023, Cairn Energy, now rebranded as Capricorn Energy, completed a significant merger with NewMed Energy, aiming to create a larger, more diversified entity. This move was intended to enhance shareholder value through increased scale and potential synergies.

These stakeholders expect transparency regarding the company's exploration success, production levels, and cost management. They scrutinize financial reports, seeking evidence of efficient capital allocation and a clear path to profitability. For instance, understanding the economics of projects like those in the North Sea or Egypt is crucial for their investment decisions. Capricorn Energy's 2023 performance, including its production figures and financial results, directly impacts investor confidence and the company's ability to attract further capital.

Governments of Operating Countries

Governments in countries where Capricorn Energy operates are crucial customer segments. Beyond their regulatory functions and potential ownership stakes through National Oil Companies (NOCs), they are significant beneficiaries of Capricorn's economic activities. This benefit primarily manifests through taxes and royalties paid on production, contributing directly to national revenues. For instance, in 2023, Capricorn's tax and royalty payments across its operating regions underscored this financial contribution.

Maintaining a constructive and collaborative relationship with these governmental bodies is paramount for Capricorn Energy. This positive engagement is essential for securing and retaining exploration and production licenses, which are the bedrock of the company's operations. Furthermore, it ensures operational stability and facilitates smooth navigation of the regulatory landscape, crucial for long-term success. The company actively engages with governments to align its operational strategies with national development goals.

- Revenue Generation: Governments benefit from taxes and royalties, contributing to public finances. For example, in 2023, Capricorn's operations in regions like the UK North Sea and West Africa generated substantial tax revenues for the respective governments.

- Licensing and Permits: Governments grant and manage the exploration and production licenses that Capricorn needs to operate.

- Economic Development: Governments seek to maximize the economic benefits derived from natural resource extraction, including job creation and local content development.

- Regulatory Compliance: Governments set and enforce the environmental, safety, and operational standards that Capricorn must adhere to.

Local Communities in Operating Areas

Local communities in operating areas are crucial stakeholders for Cairn Energy, even if they aren't direct revenue-generating customers. The company's commitment to responsible operations is designed to foster trust and ensure its social license to operate.

Cairn Energy actively engages with these communities, focusing on local development initiatives. For instance, in 2024, the company continued its focus on supporting education and health programs in regions where it has a presence.

- Community Investment: Cairn Energy's social investment programs in 2024 aimed to enhance local infrastructure and provide access to essential services, reflecting a dedication to shared value creation.

- Stakeholder Engagement: The company maintained regular dialogue with community leaders and residents to address concerns and incorporate feedback into its operational planning.

- Local Employment and Procurement: Efforts were made to maximize local employment and procurement opportunities, contributing to the economic well-being of the communities.

Cairn Energy, now Capricorn Energy, serves a diverse set of customer segments, each with distinct needs and expectations. These range from direct purchasers of its oil and gas products to stakeholders whose support is critical for operational continuity and growth.

National Oil Companies (NOCs) and international energy trading houses/refineries represent the primary commercial customers, directly engaging in the purchase of hydrocarbons. Governments act as significant stakeholders through taxes and royalties, while shareholders and investors are crucial for capital and strategic direction. Local communities are also vital, influencing the company's social license to operate.

In 2024, the energy market continued to be shaped by global demand and supply dynamics. For instance, Capricorn Energy's production in its key regions directly fed into the global supply chain, influencing pricing and availability for trading houses and refineries.

| Customer Segment | Nature of Engagement | 2024 Relevance/Example |

|---|---|---|

| National Oil Companies (NOCs) | Partnership, hydrocarbon purchase/facilitation | EGPC in Egypt as a key partner for sales and operations. |

| Energy Trading Houses & Refineries | Direct purchasers of crude oil and natural gas | Global traders like Vitol and Glencore are key buyers, influencing pricing benchmarks. |

| Governments | Tax and royalty beneficiaries, licensors | Capricorn's 2023 tax and royalty payments across operating regions highlight their financial contribution. |

| Shareholders & Investors | Financial returns, strategic oversight | Capricorn's 2023 merger with NewMed Energy aimed to enhance shareholder value. |

| Local Communities | Social license to operate, local development | Continued focus on education and health programs in operating areas in 2024. |

Cost Structure

Cairn Energy's capital expenditure is substantial, primarily driven by the significant investment required for drilling new development and exploration wells. These activities are crucial for discovering and accessing new oil and gas reserves, directly impacting future production volumes and revenue streams.

The company also allocates considerable capital to the construction and upgrading of production facilities, including platforms, pipelines, and processing plants. These investments are essential for ensuring efficient and safe extraction and transportation of hydrocarbons, as well as maintaining and enhancing the operational lifespan of existing assets.

Acquiring new assets or concessions represents another key area for capital expenditure. This strategy allows Cairn Energy to expand its operational footprint, diversify its asset base, and secure access to promising exploration and production opportunities in different geographical regions, thereby mitigating exploration risk and pursuing growth.

Operational expenditure (OPEX) for Cairn Energy, now Capricorn Energy, encompasses the day-to-day costs of maintaining its producing oil and gas assets. These include essential field operating expenses, regular maintenance, and administrative overhead directly tied to production activities. Capricorn's strategy heavily emphasizes cost control within this OPEX category to boost overall efficiency and profitability.

In 2024, the company continued its focus on optimizing these operational costs. While specific figures for 2024 OPEX are subject to ongoing reporting, the company has historically aimed for competitive cost per barrel metrics. For instance, in previous years, Cairn Energy reported lifting costs (a key component of OPEX) in the range of $10-$15 per barrel of oil equivalent, demonstrating a commitment to cost-effective production.

Expenditures related to seismic surveys, geological studies, and exploration drilling are crucial for identifying potential new oil and gas reserves. These activities represent a significant upfront investment for companies like Cairn Energy. For instance, in 2024, the global oil and gas exploration sector saw substantial spending, with major players allocating billions to these high-risk, high-reward ventures.

These exploration costs are inherently high-risk because many projects do not result in commercially viable discoveries. However, they are absolutely essential for the long-term growth and sustainability of energy companies, ensuring a pipeline of future production. Cairn Energy, like its peers, relies on successful exploration to replace depleting reserves and maintain its competitive edge in the market.

General and Administrative (G&A) Costs

General and Administrative (G&A) costs represent the essential overheads needed to run Cairn Energy as a business, distinct from direct operational expenses. These include the salaries for corporate management, the costs associated with maintaining office spaces, professional fees for legal and accounting services, and other administrative functions that support the overall organization.

Capricorn Energy, formerly Cairn Energy, has made a concerted effort to streamline its operations and reduce these G&A expenses. For instance, in 2023, the company reported G&A costs of approximately $57 million, a notable reduction from previous years, reflecting their strategic focus on efficiency.

- Corporate Management Salaries: Compensation for executives and senior leadership.

- Office Expenses: Costs related to office leases, utilities, and supplies.

- Professional Fees: Expenditures on legal, audit, and consulting services.

- Other Administrative Costs: Including IT support, insurance, and general overhead.

Taxes, Royalties, and Concession Fees

Cairn Energy, now known as Capricorn Energy, faces substantial costs from government taxes, royalties on extracted resources, and fees associated with their concession agreements. These expenses are directly tied to the fiscal policies of the countries where they operate and the specific terms negotiated for each license. For instance, in 2024, the company's tax and royalty payments are a critical component of its operational expenditure, directly impacting profitability.

These financial outflows are not static; they fluctuate based on production levels, commodity prices, and changes in tax legislation. The company must meticulously manage these obligations to ensure compliance and optimize its financial performance. The impact of these costs can be significant, particularly in jurisdictions with high tax rates or royalty burdens.

- Government Taxes: Cairn Energy incurs corporate income taxes on its profits, which vary by jurisdiction.

- Royalties on Production: A percentage of the value or volume of oil and gas produced is paid to the host government.

- Concession Fees: Annual or periodic fees are paid to maintain rights to explore and produce in specific areas.

- Fiscal Regime Impact: Changes in tax laws or royalty rates can significantly alter the cost structure and profitability of operations.

Cairn Energy's cost structure is heavily influenced by capital expenditures on exploration and development, as well as operational costs for maintaining production. General and administrative expenses and government taxes/royalties also form significant components of their overall cost base.

In 2024, Capricorn Energy (formerly Cairn) continued its focus on optimizing operational costs, aiming for competitive lifting costs, historically in the $10-$15 per barrel range. G&A expenses were around $57 million in 2023, reflecting efforts to improve efficiency.

Exploration expenditures, including seismic surveys and drilling, represent a high-risk, high-reward investment crucial for future growth, with global exploration spending in the billions in 2024.

Government taxes, royalties, and concession fees are directly tied to operational success and fiscal regimes, significantly impacting profitability.

| Cost Component | Description | 2023/2024 Relevance |

| Capital Expenditure (CAPEX) | Drilling, facility construction, asset acquisition | Ongoing investment for future production and growth |

| Operational Expenditure (OPEX) | Field operating expenses, maintenance, administrative overhead | Focus on cost control, aiming for $10-$15/barrel lifting costs |

| Exploration Costs | Seismic surveys, geological studies, exploration drilling | Essential for reserve replacement, significant global spending in 2024 |

| General & Administrative (G&A) | Corporate management, office expenses, professional fees | Streamlined to ~$57 million in 2023 |

| Taxes & Royalties | Corporate income taxes, production royalties, concession fees | Directly tied to production and fiscal regimes, impacting profitability |

Revenue Streams

Capricorn Energy's main income comes from selling crude oil, with its key operations in Egypt. This revenue fluctuates directly with global oil prices and the quantity of oil they manage to sell.

In 2024, Capricorn Energy reported significant crude oil sales, contributing substantially to their overall revenue. For instance, their Egyptian assets have consistently been a strong performer, reflecting the company's reliance on this primary commodity.

Cairn Energy, now rebranded as Capricorn Energy, generates revenue through the sale of natural gas, a significant contributor to its overall hydrocarbon earnings. This revenue stream is particularly strong from its UK North Sea assets, where it has substantial interests.

The company also benefits from associated gas produced alongside oil in its Egyptian operations, further diversifying its natural gas sales. In 2024, the global natural gas market has seen fluctuating prices, impacting the revenue potential for producers like Capricorn Energy.

Cairn Energy's revenue is substantially boosted by its liquids production sales in Egypt, encompassing both crude oil and condensates. This focus on liquid hydrocarbons is a key element of their Egyptian operations.

The financial performance from these sales is directly tied to the volume of oil and condensates produced and the prevailing global commodity prices. For instance, in 2024, the average Brent crude oil price fluctuated, impacting the revenue generated from these sales.

Contingent Payments from Asset Disposals

Cairn Energy, now operating as Capricorn Energy, has a revenue stream derived from contingent payments stemming from previous asset sales. A prime example is the sale of its Sangomar asset to Woodside Energy. These payments are structured to be received only if certain predefined conditions are met, such as achieving specific project development milestones or fluctuations in commodity prices.

For instance, the Sangomar transaction included potential deferred payments. While specific figures for 2024 are not yet fully disclosed for contingent payments, the structure of these deals means future revenue is directly linked to the performance of the divested assets. This approach allows the seller to benefit from upside potential in the asset post-sale.

- Contingent Payments from Asset Disposals: Revenue generated from future payments tied to the performance of previously sold assets.

- Sangomar Asset Sale: A key example where contingent payments are linked to the development and operational success of the Sangomar field, sold to Woodside Energy.

- Milestone and Commodity Price Triggers: Payments are typically activated upon the achievement of specific operational milestones or changes in commodity prices, creating a variable revenue stream.

Revenue from Joint Venture Interests

Capricorn Energy's revenue from joint venture interests stems from its participation in co-owned assets, where it receives its proportional share of income generated from the production and sale of hydrocarbons. This is a significant revenue stream, especially given its involvement in key projects.

A prime example is Capricorn's Egyptian operations, where it partners with Cheiron. In 2023, Capricorn reported that its share of production from the Western Desert concessions in Egypt, operated by Cheiron, contributed significantly to its overall output. The company's strategy involves leveraging these joint ventures to access and develop valuable resources.

- Joint Venture Revenue: Capricorn earns revenue from its share of hydrocarbon production and sales in co-owned assets.

- Egyptian Operations: This revenue stream is particularly important for its Egyptian ventures, notably with Cheiron in the Western Desert.

- Production Contributions: In 2023, its Egyptian joint ventures were a key contributor to Capricorn's overall production volumes, directly impacting revenue generation.

Capricorn Energy's revenue is primarily driven by the sale of crude oil and natural gas, with significant contributions from its Egyptian and UK North Sea assets. The company also benefits from associated gas sales in Egypt, diversifying its hydrocarbon earnings.

In 2024, global commodity prices for oil and gas have influenced revenue, with fluctuating market conditions impacting sales potential. For instance, the average Brent crude oil price in 2024 has been a key factor in the revenue generated from Capricorn's liquid hydrocarbon sales.

Additionally, Capricorn Energy secures revenue through contingent payments from past asset disposals, such as the Sangomar sale to Woodside Energy. These payments are triggered by specific development milestones or commodity price movements, offering potential upside revenue.

The company also generates income from its joint venture interests, receiving a proportional share of revenue from co-owned hydrocarbon production and sales, notably in its Egyptian operations with Cheiron.

| Revenue Stream | Key Assets/Activities | 2024 Outlook/Impact |

| Crude Oil Sales | Egypt (primary focus) | Directly tied to global oil prices and production volumes; Brent crude price fluctuations in 2024 are significant. |

| Natural Gas Sales | UK North Sea, Egypt (associated gas) | Influenced by global natural gas market prices; strong contribution from UK assets. |

| Contingent Payments | Sangomar asset sale (Woodside Energy) | Dependent on achievement of development milestones or commodity price triggers; future revenue potential. |

| Joint Venture Interests | Egypt (Cheiron partnership) | Proportional share of income from co-owned hydrocarbon production; Egyptian ventures a key production contributor in 2023. |

Business Model Canvas Data Sources

The Cairn Energy Business Model Canvas is constructed using a blend of internal financial disclosures, extensive market research on the oil and gas sector, and strategic insights derived from competitor analysis. These data sources ensure each component of the canvas is grounded in actionable intelligence.