Cairn Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cairn Energy Bundle

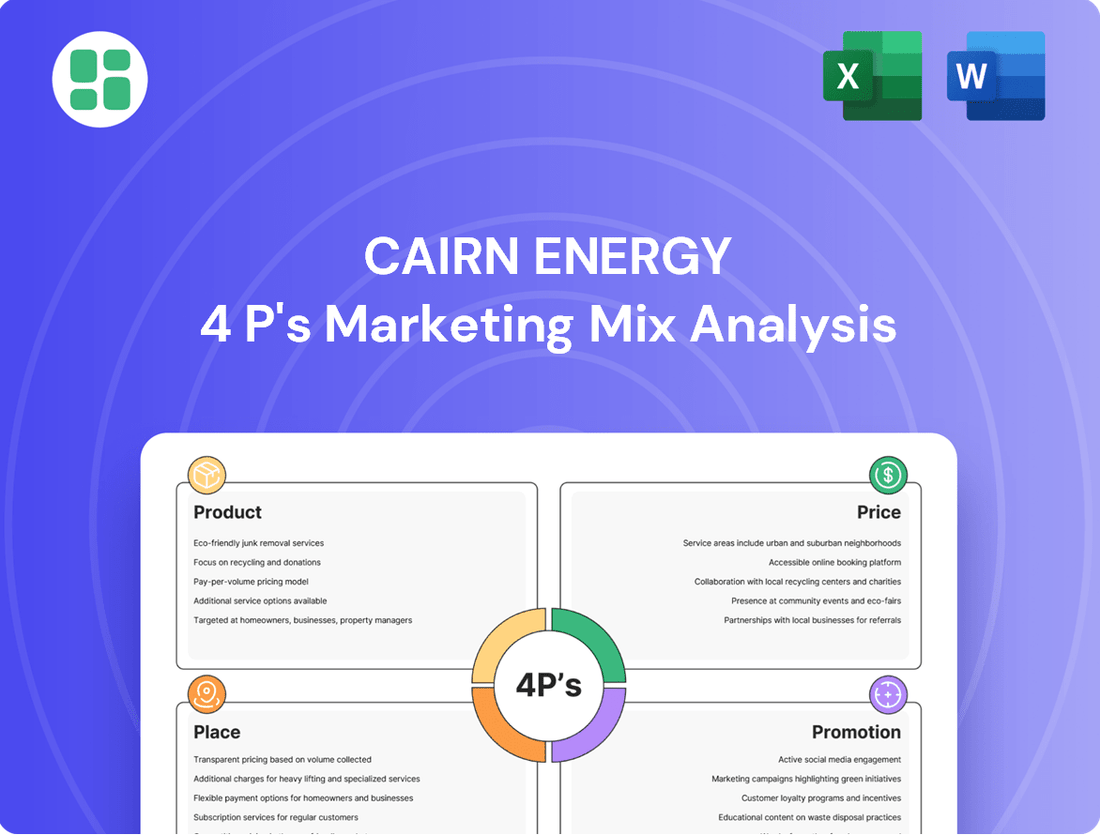

Unlock the strategic brilliance behind Cairn Energy's market dominance with our comprehensive 4Ps Marketing Mix Analysis. We delve into their product innovation, pricing agility, distribution networks, and promotional campaigns, revealing the secrets to their success.

Go beyond the surface—gain access to an in-depth, ready-made Marketing Mix Analysis covering Cairn Energy's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking actionable strategic insights.

Product

Capricorn Energy PLC's core product is the exploration, development, and production of crude oil and natural gas, encompassing the entire hydrocarbon lifecycle. This strategic focus is evident in their operations, particularly within the Egyptian Western Desert.

The company's operational strategy is heavily weighted towards a liquids-focused approach in its development drilling. For instance, in 2023, Capricorn Energy reported average production of approximately 36,000 barrels of oil equivalent per day (boepd), with a significant portion derived from liquids.

Capricorn Energy's hydrocarbon reserves and resources are a cornerstone of its product offering. This includes proven and probable reserves, alongside contingent resources, which are vital for assessing future production potential and company valuation.

The strategic consolidation of Egyptian concession agreements is a significant development, projected to boost hydrocarbon reserves by approximately 20 million barrels of oil equivalent by 2025. This expansion directly enhances the company's asset base and future revenue streams.

Capricorn Energy leverages its deep operational expertise, particularly in challenging geological settings, to enhance production and asset value. This capability extends to advanced development drilling and sophisticated reservoir management techniques.

The company's focus on optimizing existing assets is crucial. For instance, their operational improvements in Egypt were instrumental in meeting the higher end of their production forecasts for 2024, demonstrating tangible results from their technical proficiency.

Value Maximization from Existing Assets

Capricorn Energy is focused on extracting maximum value from its current oil and gas fields, with a significant emphasis on its Egyptian operations. This strategy is designed to boost production and improve profitability by optimizing existing resources.

The company is actively working to enhance its operational tempo in Egypt and renegotiate concession agreements. These efforts are geared towards securing more favorable terms that will directly translate into higher output and better financial returns from its Egyptian assets.

Capricorn's approach to unlocking the inherent value within its asset portfolio is underpinned by a commitment to both financial prudence and operational excellence. This dual focus ensures that strategic decisions are sound and execution is efficient.

- Enhanced Production: In 2023, Capricorn reported average working interest production of approximately 35,000 boepd, with Egypt contributing a substantial portion. The company aims to increase this through optimized field operations.

- Concession Agreement Review: Discussions around extending and amending existing concession agreements in Egypt are ongoing, with the goal of improving fiscal terms and supporting longer-term investment.

- Operational Efficiency: Investments in technology and improved operational practices are being implemented to reduce costs and maximize recovery rates from existing reservoirs.

- Financial Discipline: A rigorous approach to capital allocation ensures that investments in existing assets are prioritized where they offer the clearest path to value enhancement and shareholder returns.

New Exploration and Development Opportunities

Capricorn Energy is actively pursuing new exploration and development opportunities to bolster its product pipeline. This involves a dual strategy of organic growth within current licenses and strategic mergers and acquisitions.

The company is specifically evaluating potential M&A targets in key regions like the UK North Sea and the MENA region. This diversification is designed to broaden its asset base and enhance its market position.

The overarching goal of this expansion is to achieve greater scale and ensure the longevity of its operations. Ultimately, this strategic growth aims to deliver consistent and sustainable returns for its shareholders.

- Focus Areas: UK North Sea and MENA region for M&A.

- Strategic Objective: Diversify and expand asset base.

- Growth Aim: Build scale and longevity for shareholder returns.

Capricorn Energy's core product is the exploration, development, and production of crude oil and natural gas, with a strong emphasis on liquids. Their strategy focuses on optimizing existing assets, particularly in Egypt, to maximize value and production. The company is also actively seeking growth through new exploration and strategic acquisitions in regions like the UK North Sea and MENA.

| Product Aspect | Description | Key Data/Facts (2023/2024 Projections) |

|---|---|---|

| Core Offering | Exploration, development, and production of crude oil and natural gas. | Focus on liquids production. |

| Asset Optimization | Maximizing value and production from existing fields, notably in Egypt. | Targeting increased output through improved operational efficiency. |

| Growth Strategy | Pursuing new exploration and strategic M&A opportunities. | Evaluating targets in UK North Sea and MENA region to expand asset base. |

What is included in the product

This analysis offers a comprehensive examination of Cairn Energy's marketing mix, detailing their Product, Price, Place, and Promotion strategies with real-world examples.

It serves as a valuable resource for understanding Cairn Energy's market positioning and can be readily adapted for various strategic and reporting purposes.

Simplifies complex marketing strategies by clearly outlining Cairn Energy's Product, Price, Place, and Promotion, easing the burden of understanding their market approach.

Provides a clear, actionable framework for addressing marketing challenges, acting as a straightforward guide to improving Cairn Energy's market penetration and customer engagement.

Place

Capricorn Energy's sales strategy heavily relies on direct transactions with national oil companies, a key element of its marketing mix. For instance, in Egypt, the company engages directly with entities like the Egyptian General Petroleum Corporation (EGPC) for the sale of its crude oil and natural gas. This business-to-business approach bypasses intermediaries and focuses on large-scale, contractual agreements.

These direct sales are crucial for revenue generation, especially given the consolidation of concession agreements in Egypt, which simplifies the commercial landscape for Capricorn. In 2023, Capricorn Energy's total production averaged approximately 128,000 barrels of oil equivalent per day, with a significant portion of this output being channeled through these direct sales routes to national oil companies.

Capricorn Energy's operational 'place' is anchored by long-term concession agreements and licenses, primarily in Egypt and the UK North Sea. These agreements are crucial as they grant the company exclusive rights for hydrocarbon exploration, development, and production within defined geographical zones. For instance, their Egyptian assets are largely governed by production sharing agreements (PSAs) which dictate terms for cost recovery and profit sharing with the state.

The company actively engages in negotiations to amend and consolidate these terms. This strategic approach aims to create a more favorable environment for increased investment and enhanced returns on their existing and future projects. In 2024, Capricorn continued to focus on optimizing its portfolio, with ongoing discussions around extending or renegotiating key concession terms to ensure long-term operational viability and attract further capital.

Cairn Energy's integrated production and logistics infrastructure is the backbone of its operations, encompassing the physical network from wellheads to processing facilities. This robust system ensures the efficient movement of hydrocarbons from extraction sites to market entry points. The company's commitment to this area is evident in its significant capital expenditure, with for example, the North Sea assets requiring ongoing investment to maintain and enhance production flow.

Global Energy Market Access

While Capricorn Energy's direct sales are to national oil companies and governments, its true market is the global energy arena where crude oil and natural gas are traded. The company's success hinges on its capacity to access and participate effectively within these international markets, directly influencing its revenue generation from production. This requires a keen understanding of global energy demand and supply fluctuations.

Navigating the global energy market means Capricorn must stay attuned to international pricing benchmarks, geopolitical influences, and evolving energy transition policies. For instance, in early 2024, Brent crude oil prices have fluctuated around $80-$85 per barrel, influenced by supply concerns and demand forecasts. Capricorn's ability to secure favorable offtake agreements and manage its production costs against these global benchmarks is paramount.

- Global Demand Dynamics: The International Energy Agency (IEA) projected global oil demand to grow by 1.2 million barrels per day in 2024, reaching 103.2 million barrels per day, underscoring the persistent demand for Capricorn's products.

- Supply Chain Integration: Accessing global markets involves efficient logistics and transportation networks. Capricorn's operations in regions like the UK North Sea and Egypt necessitate robust supply chain management to deliver products to international buyers.

- Price Volatility Management: The company must actively manage its exposure to the inherent price volatility of oil and gas commodities, which are subject to a multitude of global economic and political factors.

- Market Access Agreements: Securing and maintaining agreements with international buyers and trading partners is fundamental to realizing the value of Capricorn's hydrocarbon reserves.

Strategic Partnerships and Joint Ventures

Capricorn Energy, formerly Cairn Energy, leverages strategic partnerships and joint ventures, notably in its Egyptian operations with entities like Cheiron Oil and Gas Limited. These collaborations are fundamental to efficient asset management, risk mitigation, and ensuring product delivery to market.

These alliances are crucial for enhancing operational efficiency and expanding market access. For instance, in 2023, Capricorn Energy's Egyptian assets, often operated through such joint ventures, contributed significantly to its overall production. The company reported average working interest production of approximately 30,000 barrels of oil equivalent per day from Egypt during the first half of 2024, underscoring the operational scale achieved through these partnerships.

- Risk Sharing: Joint ventures allow Capricorn to share the substantial financial and operational risks associated with exploration and production activities.

- Operational Expertise: Partnering with experienced operators like Cheiron brings specialized knowledge and technology, improving efficiency.

- Market Access: Collaborations can facilitate access to existing infrastructure and established routes for product offtake, ensuring smoother market entry.

- Capital Efficiency: By pooling resources, partners can undertake larger projects and optimize capital deployment more effectively.

Capricorn Energy's 'Place' strategy centers on its operational locations and market access, primarily through long-term concession agreements in Egypt and the UK North Sea. These agreements grant exclusive rights for exploration and production, forming the bedrock of its physical presence. The company actively negotiates to optimize these terms, ensuring long-term viability and attracting investment, with ongoing efforts in 2024 to extend key concessions.

The company's direct sales to national oil companies, such as Egypt's EGPC, simplify its market entry, focusing on large-scale contractual agreements. This business-to-business approach is vital for revenue, especially with consolidated concession agreements in Egypt. In 2023, Capricorn's total production averaged around 128,000 barrels of oil equivalent per day, with a substantial portion flowing through these direct sales channels.

Capricorn Energy's market is the global energy arena, requiring efficient logistics and an understanding of international pricing benchmarks, which saw Brent crude around $80-$85 per barrel in early 2024. The International Energy Agency projected global oil demand growth to 103.2 million barrels per day in 2024, highlighting consistent demand for Capricorn's products.

Strategic partnerships, like those in Egypt with Cheiron Oil and Gas Limited, are crucial for efficient asset management, risk mitigation, and market delivery. These collaborations enhance operational efficiency and market access, with Egyptian assets contributing significantly to production. In the first half of 2024, Egypt provided approximately 30,000 barrels of oil equivalent per day in working interest production.

| Operational Location | Key Agreements | Market Focus | 2023 Production (boepd) | H1 2024 Egypt Production (boepd) |

| Egypt | Production Sharing Agreements (PSAs) | Direct Sales to National Oil Companies (e.g., EGPC) | ~128,000 (Total Company) | ~30,000 (Working Interest) |

| UK North Sea | Concession Agreements | Global Energy Market | N/A | N/A |

Same Document Delivered

Cairn Energy 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Cairn Energy's 4P's Marketing Mix is fully complete and ready for immediate use.

Promotion

Capricorn Energy’s investor relations are a cornerstone of its promotional strategy, focusing on transparent communication with the investment community. This involves the regular dissemination of detailed financial and operational updates through annual reports, half-year results, and investor presentations.

These publications are critical for attracting and retaining a financially sophisticated stakeholder base. For instance, Capricorn Energy's 2023 Annual Report highlighted a significant increase in production, with average daily production reaching approximately 38,000 boepd, demonstrating operational strength to potential investors.

The company also emphasizes its commitment to shareholder value, as evidenced by its dividend policy and share buyback programs, which are clearly communicated in its financial reporting. This focus on returns is a key element in its promotional efforts to the financial markets.

Cairn Energy's corporate announcements are vital for promotion, highlighting operational achievements and strategic shifts. These releases, often disseminated through regulatory news services, foster transparency and keep stakeholders updated on company progress.

Recent disclosures in 2024 have underscored strong operational performance, including the finalization of key concession agreements. These updates provide crucial data points for investors evaluating Cairn's growth trajectory.

Furthermore, the company's commitment to shareholder value is evident through its ongoing share buyback programs, a significant promotional signal. These actions, coupled with financial updates, reinforce investor confidence and market perception.

Cairn Energy actively engages shareholders through its Annual General Meetings (AGMs) and direct communication channels, crucial for conveying its strategic direction and operational performance. These interactions provide a platform for leadership to clearly articulate the company's value proposition, address investor queries, and build confidence in future prospects. The successful passage of all resolutions at the 2025 AGM underscores a strong foundation of governance and shareholder alignment.

ESG Reporting and Sustainability Initiatives

Capricorn Energy, formerly Cairn Energy, actively promotes its dedication to responsible operations through its voluntary Environmental, Social, and Governance (ESG) reporting. This commitment underscores adherence to sustainability principles, a crucial factor for attracting ethically-minded investors and bolstering its corporate image. The company issued its inaugural ESG report in 2024, detailing its strategic focus areas.

The company's ESG reporting serves as a key element in its marketing mix, particularly within the promotion aspect. By transparently communicating its sustainability efforts, Capricorn Energy aims to resonate with a growing segment of the investment community prioritizing environmental stewardship and social responsibility. This proactive approach is vital in the current market landscape where sustainability performance directly influences investor sentiment and capital allocation.

- ESG Reporting: Capricorn Energy's first ESG report was released in 2024, establishing a baseline for its sustainability performance.

- Investor Attraction: The company's ESG initiatives are designed to attract ethically-minded investors, a growing demographic in the financial markets.

- Corporate Reputation: Transparent ESG reporting helps maintain and enhance Capricorn Energy's positive corporate reputation among stakeholders.

- Sustainability Focus: Key areas of focus within the ESG report include environmental impact reduction, social engagement, and robust governance practices.

Analyst Coverage and Industry Presence

Cairn Energy (now Capricorn Energy) actively cultivates relationships with financial analysts to ensure its investment narrative is clearly communicated. By engaging with analysts and participating in key industry forums, the company aims to bolster its visibility and credibility within the financial community. This proactive approach helps disseminate crucial information about its strategic direction and growth potential to a wide range of stakeholders.

The company's presence at industry events, such as the 2024 International Energy Week, allows for direct engagement with investors and peers. Such participation is vital for reinforcing its market positioning. For instance, in 2023, Capricorn Energy highlighted its commitment to sustainable development and exploration success, aiming to attract institutional investors looking for resilient energy portfolios. Positive analyst ratings, with several firms maintaining a 'buy' or 'outperform' stance in late 2024, underscore the effectiveness of this strategy.

- Analyst Engagement: Cairn Energy (Capricorn Energy) prioritizes maintaining robust relationships with financial analysts covering the energy sector.

- Industry Participation: The company actively participates in significant industry events to present its investment case and strategic outlook.

- Information Dissemination: Positive analyst coverage and a strong industry presence aid in circulating information and building credibility.

- Investor Relations: These efforts are designed to attract and retain institutional investors by clearly communicating strategic positioning and growth prospects.

Capricorn Energy's promotional efforts are deeply intertwined with its investor relations, focusing on clear, consistent communication of financial and operational performance. This includes detailed annual reports, half-year results, and investor presentations designed to attract and retain a sophisticated stakeholder base. The company's 2023 annual report, for example, showcased an average daily production of approximately 38,000 boepd, underscoring operational strength.

The company also actively promotes its commitment to shareholder value through transparent dividend policies and share buyback programs, key signals for the financial markets. Furthermore, its voluntary ESG reporting, initiated in 2024, aims to attract ethically-minded investors by highlighting sustainability efforts and responsible operations, bolstering its corporate image.

Cairn Energy, now Capricorn Energy, also cultivates relationships with financial analysts and actively participates in industry events like the 2024 International Energy Week to enhance its visibility and credibility. This strategy aims to disseminate crucial information about its strategic direction and growth potential, with several analyst firms maintaining 'buy' or 'outperform' ratings in late 2024.

| Metric | 2023 Performance | 2024 Outlook/Activity |

|---|---|---|

| Average Daily Production | ~38,000 boepd | Focus on maintaining/increasing production levels |

| ESG Report Release | N/A | First ESG report issued in 2024 |

| Analyst Ratings (Late 2024) | Positive sentiment | Several firms maintaining 'buy' or 'outperform' |

| Key Event Participation | 2023 Industry Engagements | 2024 International Energy Week |

Price

Capricorn Energy's revenue is directly tied to the fluctuating global commodity markets for oil and gas. Changes in international benchmarks like Brent crude and natural gas prices significantly influence the company's financial performance.

For instance, in 2024, Capricorn reported achieving an average oil price of $79.3 per barrel of oil equivalent (boe) and an average gas price of $2.9 per thousand standard cubic feet (mscf). These figures highlight the direct correlation between market prices and the company's top-line results.

Cairn Energy's realized prices are directly shaped by the specifics of its concession agreements with host governments. These contracts lay out the rules for profit sharing, royalty payments, and tax liabilities, all of which impact the net revenue from its oil and gas production.

For instance, in Egypt, Cairn has been actively negotiating to amend and consolidate existing concession terms. This strategic move in 2024 is designed to create a more favorable fiscal environment, ultimately supporting stronger returns and encouraging further investment in its Egyptian assets.

Capricorn Energy's pricing power is directly tied to its success in managing production costs and optimizing operations. Achieving a low cost per barrel, such as the $4.8/boe recorded on a working interest basis in 2024, is crucial for maintaining healthy profit margins, especially when oil and gas prices are volatile.

Receivables Management and Payment Regularity

The regularity and collection of receivables from national oil companies are crucial for Cairn Energy's (now Capricorn Energy) effective cash realization from sales. Delays in these payments can directly impact the company's liquidity and its capacity for reinvestment in future projects. This aspect of receivables management is a key component of their financial operations.

Capricorn Energy has actively worked to enhance the collection of outstanding receivables, particularly in Egypt. This focus has yielded positive results, with significant payments being received during 2024. The company anticipates continued positive developments in this area, with further expected payments in 2025.

The improved cash flow from receivables directly supports Cairn Energy's ability to fund its operational needs and strategic growth initiatives. For instance, the successful collection of receivables in Egypt contributes to the overall financial health and operational flexibility of the company.

- Receivables Collection: Focus on timely payment from national oil companies.

- Liquidity Impact: Delays in receivables affect cash availability for reinvestment.

- Egypt Focus: Significant progress made in collecting Egyptian receivables.

- Future Outlook: Expectations for continued positive cash realization in 2025.

Capital Discipline and Shareholder Returns

Capricorn Energy's approach to pricing and financial management underscores its dedication to capital discipline and consistent shareholder returns. The company carefully evaluates capital expenditures, share buybacks, and special dividends based on its generated cash flows and overall financial stability.

In 2024, Capricorn demonstrated this commitment by returning $57 million to shareholders, reflecting a strategic focus on rewarding investors while maintaining financial prudence.

- Capital Discipline: Decisions on capital allocation are directly tied to the cash generated from operations, ensuring responsible investment.

- Shareholder Returns: The company prioritizes returning value to shareholders through mechanisms like buybacks and dividends.

- Financial Health: All financial decisions, including shareholder returns, are made with a clear view of the company's overall financial well-being.

- 2024 Distributions: Capricorn returned $57 million to shareholders in 2024, a tangible example of its shareholder return policy.

Capricorn Energy's pricing strategy is fundamentally linked to global commodity markets and its operational efficiency. The company's ability to secure favorable concession agreements, as seen in its 2024 Egyptian negotiations, directly impacts its net revenue. Furthermore, maintaining low production costs, such as the $4.8/boe in 2024, is critical for profitability amidst price volatility.

The successful collection of receivables, particularly from Egyptian operations in 2024, bolsters Capricorn's liquidity and its capacity for reinvestment. This improved cash flow directly supports the company's commitment to capital discipline and shareholder returns, exemplified by the $57 million returned in 2024.

| Metric | 2024 Value | Impact on Pricing/Revenue |

| Average Oil Price (boe) | $79.3 | Directly influences top-line revenue. |

| Average Gas Price (mscf) | $2.9 | Directly influences top-line revenue. |

| Working Interest Production Cost (boe) | $4.8 | Crucial for maintaining profit margins. |

| Shareholder Distributions | $57 million | Reflects financial health and capital allocation strategy. |

4P's Marketing Mix Analysis Data Sources

Our Cairn Energy 4P's analysis is constructed using a comprehensive review of the company's official filings, investor relations materials, and publicly available operational data. We incorporate insights from industry reports and news archives to ensure a robust understanding of their product offerings, pricing strategies, exploration and production locations, and promotional activities.