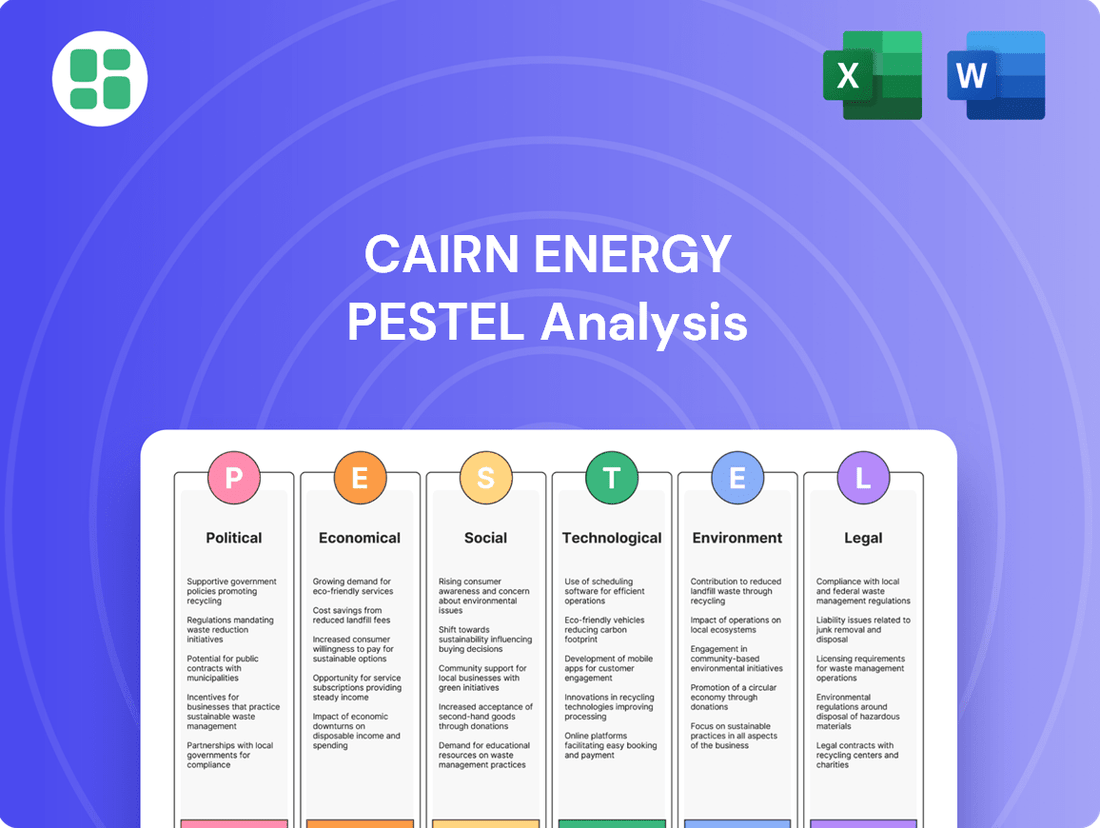

Cairn Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cairn Energy Bundle

Gain a critical advantage by understanding the external forces shaping Cairn Energy's path. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors influencing the company's operations and future growth. Unlock actionable intelligence to refine your strategy and anticipate market shifts. Download the full PESTLE analysis now and equip yourself with the insights you need to succeed.

Political factors

Capricorn Energy's operations in Egypt and the UK are significantly influenced by government stability and policy. For instance, the UK's commitment to net-zero targets by 2050, while promoting energy security, also signals a potential long-term reduction in reliance on fossil fuels, impacting licensing and investment in new exploration. Egypt, on the other hand, has been actively seeking foreign investment in its oil and gas sector, evidenced by recent licensing rounds and production sharing agreements, though political shifts could alter these frameworks.

Geopolitical tensions, particularly in regions like the Middle East, significantly influence global oil prices and supply chain stability. For Capricorn Energy, ongoing conflicts and international relations shifts can create operational risks and market volatility. For instance, the ongoing conflict in Ukraine has continued to impact global energy markets, with Brent crude oil prices fluctuating significantly throughout 2024, at times exceeding $90 per barrel, underscoring the direct link between geopolitical events and energy commodity prices.

Changes in fiscal regimes and taxation policies significantly influence Capricorn Energy's financial performance. For instance, a rise in corporate tax rates or the introduction of new production royalties directly reduces profitability and cash flow. The company's financial planning must also account for global minimum tax initiatives, which could impact its overall tax burden and investment decisions.

Energy Security Agendas

National energy security agendas significantly shape government policies concerning domestic oil and gas production, directly affecting companies like Capricorn Energy. Countries prioritizing reliable and affordable energy often implement measures to bolster exploration and production, which can include tax incentives or streamlined regulatory processes. For instance, the United Kingdom's North Sea Transition Authority continues to issue new oil and gas licenses, a move aimed at bolstering domestic supply amidst geopolitical uncertainties, even as the nation pursues net-zero targets.

This focus on energy security creates a complex operating environment, requiring companies to navigate the delicate balance between meeting immediate energy demands and aligning with long-term energy transition goals. The imperative to secure stable energy supplies can lead to policies that favor continued investment in fossil fuels, potentially creating opportunities for exploration and production. However, this must be weighed against growing international pressure and national commitments to reduce carbon emissions, influencing the long-term viability and public perception of oil and gas ventures.

- Government Support for Domestic Production: Policies often favor domestic extraction to reduce reliance on volatile international markets, as seen in the continued licensing of North Sea exploration in the UK.

- Energy Transition Conflicts: The drive for energy security can sometimes clash with ambitious climate targets, creating policy uncertainty for fossil fuel producers.

- Impact on Operational Outlook: Government decisions on exploration, production, and environmental regulations directly influence Capricorn Energy's investment decisions and long-term operational strategy.

International Sanctions and Trade Policies

International sanctions and trade policies significantly shape the global oil and gas landscape, directly impacting companies like Capricorn Energy. For instance, sanctions imposed on countries like Russia in 2022, following geopolitical events, led to significant disruptions in global energy markets. This resulted in increased price volatility and forced many companies to reassess their supply chains and operational strategies. Capricorn Energy, with its diverse portfolio, must navigate these complex geopolitical restrictions, which can affect access to specific markets, technology, and financing.

These restrictive measures can create substantial hurdles for energy firms. They might curtail exploration activities in sanctioned regions, disrupt established trade routes, and limit access to crucial upstream technologies or capital. For example, the ongoing geopolitical tensions in Eastern Europe have prompted many Western companies to divest from Russian assets, a move that alters investment flows and risk profiles across the industry. Capricorn Energy's investment decisions and risk assessments are therefore intrinsically linked to the evolving landscape of international trade regulations and sanctions.

- Impact on Supply and Demand: Sanctions can remove significant volumes of oil and gas from the global market, influencing supply-demand balances and driving price fluctuations.

- Access to Technology and Finance: Restrictive policies can limit access to advanced drilling technologies and international financing, hindering operational efficiency and expansion plans.

- Regional Market Access: Trade embargos can directly prevent companies from operating in or trading with specific countries, forcing a redirection of resources and strategic focus.

- Increased Operational Costs: Compliance with sanctions and the need to find alternative markets or suppliers often lead to higher operational and logistical costs.

Government policies aimed at energy security and transition significantly shape Capricorn Energy's operational landscape. The UK's commitment to net-zero by 2050, while promoting renewables, also impacts long-term fossil fuel investment, as seen in the continued North Sea licensing rounds. Egypt, conversely, actively courts foreign investment in its oil and gas sector through licensing rounds, though political stability is key.

Geopolitical tensions, like those stemming from the conflict in Ukraine, directly influence global oil prices. Brent crude oil prices in 2024 have shown significant volatility, often exceeding $90 per barrel, demonstrating the direct link between international relations and energy commodity markets, impacting Capricorn Energy's revenue streams.

Fiscal regimes and taxation policies are critical. Increased corporate tax rates or new royalties directly reduce profitability. Global minimum tax initiatives also factor into Capricorn Energy's financial planning and investment decisions, potentially altering its overall tax burden.

National energy security agendas drive policies that can bolster domestic oil and gas production. For example, the UK's North Sea Transition Authority continues to issue new licenses to enhance domestic supply, balancing energy needs with net-zero goals. This creates a complex environment where companies must navigate immediate energy demands alongside long-term climate objectives.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Cairn Energy, detailing how political, economic, social, technological, environmental, and legal forces present both challenges and strategic opportunities.

A concise PESTLE analysis for Cairn Energy provides a clear roadmap of external factors, streamlining strategic decision-making and mitigating potential market disruptions.

Economic factors

Global oil and gas price volatility significantly impacts Capricorn Energy's financial health. Fluctuations directly affect revenues and profitability, making long-term financial planning challenging. For instance, the average Brent crude oil price saw considerable swings, trading around $80-$90 per barrel in early 2024, a stark contrast to earlier periods. This sensitivity influences the company's capacity to fund new exploration and development projects, manage its debt obligations, and deliver consistent shareholder returns.

Supply and demand imbalances, coupled with geopolitical tensions, are key drivers of this price instability. Events such as production cuts by OPEC+ or disruptions in major oil-producing regions can rapidly alter market dynamics. In 2024, the ongoing conflict in Eastern Europe continued to inject uncertainty into energy markets, contributing to price spikes and subsequent corrections, directly impacting Capricorn Energy's operational costs and revenue streams.

Inflationary pressures in 2024 and into 2025 are a significant concern for Capricorn Energy. Rising costs for essential materials like steel and specialized services directly impact operational expenditures, potentially increasing the cost of extracting and transporting oil and gas. For instance, global inflation rates, which saw significant peaks in 2022 and continued to be a factor in 2023, are projected to remain elevated in certain sectors through 2024, impacting supply chains and labor costs for Capricorn.

Higher interest rates, a tool used by central banks to combat inflation, directly affect Capricorn Energy's financing costs. Increased borrowing expenses can make new exploration projects or capital-intensive developments less attractive, potentially delaying or canceling investments. This also impacts the cost of servicing existing debt, influencing the company's overall financial health and its ability to generate attractive returns on invested capital in a higher interest rate environment.

Foreign exchange rate fluctuations significantly impact Capricorn Energy's financial performance, given its operations in diverse regions like Egypt and the UK. Changes in the value of currencies, such as the Egyptian pound against the US dollar or the British pound, directly affect the reported value of its revenues and operating expenses. For instance, a stronger Egyptian pound could decrease the dollar-denominated value of its Egyptian earnings, while a weaker pound might increase the cost of its UK-based operations when translated into dollars.

These currency movements introduce considerable financial risk and complexity. When profits are repatriated from countries with weaker currencies to the company's reporting currency (likely USD or GBP), the realized value can be lower than anticipated. Conversely, a stronger local currency can boost repatriated profits. For example, if Capricorn Energy generates substantial revenue in Egyptian pounds, a depreciation of the EGP against the USD would reduce the USD equivalent of those earnings, impacting its overall profitability and cash flows. This dynamic necessitates robust hedging strategies to mitigate potential losses from adverse currency movements.

Investment Climate and Capital Availability

The investment climate for the oil and gas sector in 2024 and early 2025 remains a mixed landscape, influenced by fluctuating commodity prices and increasing pressure for energy transition. While capital availability for exploration and production (E&P) projects is present, it is becoming more discerning, with a clear preference for companies demonstrating strong operational efficiency and a commitment to lower carbon intensity.

Investor sentiment is heavily swayed by Environmental, Social, and Governance (ESG) factors. Companies with robust ESG strategies, including clear decarbonization plans and community engagement, are more likely to attract capital. For instance, many institutional investors are increasingly screening portfolios for alignment with net-zero targets, potentially limiting funding for projects perceived as high-carbon or lacking a credible transition pathway. Access to financing can therefore be directly tied to a company's ability to articulate and execute a sustainable business model.

- Investor Scrutiny: Capital providers are increasingly scrutinizing E&P projects based on their carbon footprint and long-term viability in a low-carbon future.

- ESG Integration: A strong ESG performance is becoming a prerequisite for attracting significant investment, impacting the cost and availability of capital.

- Competition for Capital: The oil and gas sector competes with renewable energy and other sectors for investment dollars, requiring companies to offer compelling returns and clear strategic direction.

- Financing Trends: As of mid-2025, many major banks and investment funds are setting stricter lending criteria for fossil fuel projects, emphasizing emissions reduction targets and diversification into cleaner energy.

Economic Growth and Energy Demand

Global economic growth is a primary driver of energy demand, directly impacting Capricorn Energy's market. When economies expand, industrial activity and consumer spending rise, leading to greater consumption of oil and natural gas. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 3.1% in 2023, signaling a potential increase in energy needs.

Conversely, economic slowdowns or recessions typically dampen energy demand. This reduced consumption can lead to lower oil and gas prices and decreased production volumes, affecting Capricorn Energy's revenue and profitability. A notable example was the economic contraction experienced during the COVID-19 pandemic, which saw a significant drop in global energy consumption.

Long-term trends in energy consumption are also crucial. While the transition to renewable energy sources is ongoing, oil and gas are expected to remain significant components of the global energy mix for the foreseeable future. The International Energy Agency (IEA) forecasts that oil demand will continue to grow until the mid-2030s, albeit at a slowing pace, before beginning to decline.

- Impact of GDP Growth: Higher GDP growth rates generally correlate with increased demand for oil and gas. For example, a 1% increase in global GDP often translates to a similar percentage increase in energy consumption.

- Recessionary Pressures: Economic downturns, such as the projected slowdowns in certain regions in late 2024 or early 2025, can reduce energy demand by 1-2%, impacting commodity prices.

- Energy Transition Influence: While demand for fossil fuels is projected to grow until around 2035, the accelerating adoption of renewables will gradually shift consumption patterns, influencing long-term investment strategies for companies like Capricorn Energy.

Economic growth is a significant factor for Capricorn Energy, as it directly influences energy demand. The International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a slight increase from 3.1% in 2023, suggesting a potential rise in energy consumption. Conversely, economic slowdowns can reduce demand, leading to lower prices and impacting Capricorn's revenues. The long-term outlook indicates continued, albeit slowing, growth in oil demand until the mid-2030s, according to the International Energy Agency (IEA).

| Economic Indicator | 2023 (Actual/Estimate) | 2024 (Projection) | Impact on Capricorn Energy |

|---|---|---|---|

| Global GDP Growth | 3.1% | 3.2% | Increased demand for oil and gas, potentially boosting revenue. |

| Inflation Rate (Global Average) | ~5.9% (peak 2022, moderating) | ~4.5% (projected) | Higher operational costs but potential for increased revenue if commodity prices rise faster. |

| Brent Crude Oil Price (Average) | ~$82/barrel | ~$85-$90/barrel | Directly impacts revenue and profitability; higher prices generally favorable. |

| Interest Rates (Major Economies) | ~5.25% (US Fed Funds Rate) | ~5.00%-5.25% (projected) | Affects cost of capital for new projects and servicing existing debt. |

What You See Is What You Get

Cairn Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cairn Energy PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain an in-depth understanding of the external forces shaping Cairn Energy's business landscape, from government regulations and market trends to societal expectations and technological advancements.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a critical overview essential for strategic planning and risk assessment within the dynamic energy sector.

Sociological factors

Public perception of fossil fuels significantly impacts Capricorn Energy's social license to operate. Growing awareness of climate change fuels negative sentiment towards oil and gas, leading to increased scrutiny and potential opposition to projects. For instance, in 2024, a significant portion of the public in key operating regions expressed concerns about the environmental footprint of oil exploration, impacting investor confidence.

Activist groups and negative media coverage can amplify these concerns, creating reputational damage and hindering project approvals. In 2024, several high-profile campaigns targeted energy companies, including those in Capricorn's sector, highlighting the need for proactive engagement. This pressure can translate into delays, increased compliance costs, and even outright project cancellations.

Transparent communication and robust community engagement are therefore crucial for maintaining a social license. By actively involving local communities and stakeholders in decision-making processes and demonstrating a commitment to environmental responsibility, Capricorn Energy can build trust and mitigate potential conflicts. In 2025, companies that prioritize these aspects are better positioned to navigate the evolving societal landscape.

The oil and gas sector, including companies like Capricorn Energy, faces a critical challenge with an aging workforce. In 2024, a significant portion of experienced professionals are nearing retirement age, creating a knowledge and skills gap. This demographic shift necessitates proactive talent acquisition and development strategies to ensure operational continuity and innovation.

Competition for skilled labor is intensifying, not only within the energy industry but also from sectors embracing new technologies. By 2025, the demand for expertise in areas like carbon capture, renewable energy integration, and digital transformation within oil and gas operations will surge. Capricorn Energy must focus on attracting and retaining talent by offering competitive compensation, robust training programs, and opportunities for career growth in these emerging fields.

Cairn Energy, now known as Capricorn Energy, places significant emphasis on fostering strong community relations, particularly in its operational regions like Egypt and the UK. Maintaining positive engagement is crucial for smooth operations, addressing concerns around land use, local employment opportunities, and potential disruptions from industrial activities.

In 2024, the company's commitment to local economic development is evident through initiatives aimed at creating jobs and supporting local businesses. For instance, in Egypt, efforts are made to prioritize local hiring for project phases, contributing to community well-being and ensuring operational continuity by minimizing social friction.

Health and Safety Standards and Culture

Societal expectations and stringent regulatory frameworks increasingly demand high health and safety standards within the oil and gas sector. Cairn Energy, like its peers, must foster a robust safety culture, implementing rigorous protocols to safeguard its workforce, contractors, and surrounding communities. Failure to do so can lead to severe operational disruptions and significant reputational damage.

The consequences of safety lapses are substantial. For instance, in 2023, the International Association of Oil & Gas Producers (IOGP) reported that while the industry continues to drive for zero incidents, even minor events can impact public perception and regulatory scrutiny. A major incident could halt operations, incur massive fines, and erode investor confidence, directly affecting Cairn Energy's financial performance and long-term viability.

- Zero-Harm Culture: The industry's goal is to achieve zero harm to people and the environment, a standard increasingly expected by stakeholders.

- Regulatory Compliance: Adherence to evolving safety regulations, such as those from OSHA in the US or similar bodies globally, is non-negotiable.

- Reputational Risk: Safety incidents can severely damage a company's brand, impacting its social license to operate and ability to attract talent.

- Operational Continuity: Robust safety management systems are crucial for preventing downtime and ensuring uninterrupted production, a key financial driver.

Consumer Behavior and Energy Transition Acceptance

Consumer behavior is a powerful driver in the energy transition. Growing awareness of climate change and a desire for sustainable solutions are leading more people to embrace electric vehicles (EVs) and renewable energy sources. For instance, global EV sales surged by an estimated 35% in 2023 compared to 2022, reaching over 13 million units, according to the International Energy Agency (IEA). This shift directly impacts the long-term demand for traditional hydrocarbons.

The increasing adoption of EVs and rooftop solar installations signals a significant change in how energy is consumed. By 2024, it's projected that renewable energy sources will account for over 30% of global electricity generation, a substantial increase from previous years. This trend necessitates that companies like Capricorn Energy (formerly Cairn Energy) evaluate their strategies, potentially exploring diversification into cleaner energy sectors or adapting their existing operations to meet evolving market expectations.

The pace of these global energy consumption shifts is accelerating. Consumer acceptance of new energy technologies, influenced by factors like cost parity, government incentives, and public perception, will dictate the speed at which demand for oil and gas declines. As more consumers prioritize sustainability, the market for fossil fuels faces increasing pressure, prompting strategic re-evaluations within the energy industry.

- Consumer Preference Shift: A notable segment of consumers, particularly in developed economies, are actively seeking lower-carbon alternatives, influencing purchasing decisions for vehicles and home energy.

- EV Adoption Growth: Global electric car sales are expected to continue their upward trajectory, potentially capturing a significant share of the new car market by 2025, impacting gasoline demand.

- Renewable Energy Integration: Increased consumer investment in and support for solar and wind power are contributing to a broader energy mix that relies less on fossil fuels.

Public sentiment regarding fossil fuels continues to shape the operational landscape for energy companies like Capricorn Energy. In 2024, heightened awareness of climate change fuels negative perceptions, leading to increased scrutiny and potential project opposition. This trend is expected to persist into 2025, demanding proactive stakeholder engagement.

The energy sector faces a significant demographic challenge with an aging workforce. By 2025, the demand for expertise in areas like carbon capture and digital transformation will surge, requiring companies to focus on talent acquisition and development to maintain operational continuity and foster innovation.

Consumer behavior, particularly the accelerating adoption of electric vehicles and renewable energy, directly impacts long-term demand for hydrocarbons. Global EV sales saw a substantial increase in 2023, and projections indicate continued growth through 2025, influencing strategic decisions within the oil and gas industry.

Technological factors

Innovations in seismic imaging, such as high-resolution 3D seismic, are significantly improving the accuracy of subsurface reservoir mapping for companies like Capricorn Energy. This allows for more precise identification of hydrocarbon deposits, reducing the risks associated with exploration. For example, advancements in seismic data processing have led to a notable increase in the success rate of discovering commercially viable reserves.

Automated drilling systems and sophisticated reservoir management software are streamlining operations and cutting costs. These technologies enable faster drilling times and more efficient extraction, directly impacting profitability. In 2024, the industry saw a continued push towards digitalization in drilling, with some operators reporting cost reductions of up to 15% on certain wells due to automation.

Enhanced Oil Recovery (EOR) techniques, including chemical and thermal methods, are proving crucial in maximizing hydrocarbon recovery from mature fields. These methods can increase the percentage of oil extracted from a reservoir, extending its productive life and improving overall resource utilization. The global EOR market is projected to grow substantially, driven by the need to boost production from existing assets.

The oil and gas industry, including companies like Capricorn Energy, is increasingly leveraging digitalization and advanced data analytics to streamline operations. Real-time data monitoring, powered by IoT sensors, allows for immediate identification of performance deviations and potential issues in exploration and production. This digital transformation is crucial for optimizing asset performance and reducing operational costs.

Artificial intelligence (AI) and big data analytics are playing a significant role in predictive maintenance, forecasting equipment failures before they occur. For instance, AI algorithms can analyze vast datasets from seismic surveys and well logs to improve reservoir characterization and drilling efficiency. This data-driven approach enhances decision-making, leading to improved recovery rates and reduced downtime.

The adoption of digital twins and cognitive fields represents a further advancement, creating virtual replicas of physical assets to simulate various operational scenarios and optimize production strategies. By mid-2024, many energy firms reported significant improvements in operational efficiency, with some seeing reductions in unplanned downtime by as much as 15-20% through these digital initiatives.

The development and deployment of Carbon Capture, Utilization, and Storage (CCUS) technologies are becoming crucial for oil and gas firms like Capricorn Energy to reduce their carbon footprint. These advancements allow for continued fossil fuel use while mitigating emissions, aligning with evolving environmental goals and potentially opening new business avenues or meeting stricter regulations.

CCUS projects aim to make fossil fuels more environmentally palatable, but their economic viability and scalability remain key considerations. For instance, the International Energy Agency (IEA) reported in its 2024 CCUS Special Brief that while global CCUS capacity is growing, significant investment is still needed to meet climate targets, with many projects facing challenges related to cost and infrastructure development.

Renewable Energy Integration and Hybrid Solutions

Technological advancements in renewable energy are increasingly enabling oil and gas companies like Capricorn Energy to integrate cleaner power sources. For instance, solar and wind power are becoming more efficient and cost-effective, making them viable options for supplementing or even replacing traditional power generation on offshore platforms and in remote operational sites. This integration helps reduce operational emissions and improve energy efficiency, aligning with sustainability goals.

Hybrid solutions, combining renewables with existing power infrastructure, offer a practical approach to decarbonization. These systems can provide a reliable and consistent energy supply, mitigating the intermittency challenges of some renewable sources. The operational benefits include lower fuel consumption for generators and reduced carbon footprints, while challenges can involve initial capital investment and the integration of new technologies into existing complex systems.

- Cost Reduction: The levelized cost of electricity (LCOE) for solar PV fell by approximately 89% between 2010 and 2023, making it a more competitive power source.

- Emissions Reduction: Implementing hybrid solutions can significantly cut Scope 1 and Scope 2 emissions for oil and gas operations.

- Operational Efficiency: Hybrid systems can enhance energy security and reduce reliance on volatile fossil fuel prices for power generation.

- Technological Adoption: Companies are exploring technologies like floating solar farms and advanced wind turbine designs for offshore applications.

Automation and Robotics in Operations

Capricorn Energy is increasingly leveraging automation and robotics to enhance operations, particularly in challenging offshore and remote locations. This technology is crucial for improving safety by minimizing human exposure to hazardous conditions. For instance, autonomous drones are now routinely used for infrastructure inspections, reducing the need for personnel in potentially dangerous environments. In 2024, the oil and gas industry saw significant investment in robotic systems, with reports indicating a 15% year-over-year increase in adoption for subsea operations.

The implementation of robotic drilling systems and advanced remote-controlled subsea vehicles allows Capricorn Energy to optimize complex operational processes, leading to greater efficiency and cost savings. These systems can perform tasks with higher precision and consistency than manual methods. The global market for oil and gas robotics was projected to reach $10 billion by the end of 2024, highlighting the widespread industry trend towards automation.

The shift towards automation necessitates a focus on workforce adaptation. Capricorn Energy must invest in training programs to equip its employees with the skills needed to operate and maintain these advanced technologies. This strategic upskilling is vital for ensuring the workforce can effectively manage new job roles that emerge alongside increased automation, such as robotics technicians and data analysts for operational efficiency.

- Enhanced Safety: Autonomous drones and subsea vehicles reduce human risk in hazardous environments.

- Improved Efficiency: Robotic drilling and remote operations optimize complex processes.

- Cost Reduction: Automation contributes to lower operational expenditures.

- Workforce Development: Training is essential for adapting to new technology-driven roles.

Technological advancements in seismic imaging, such as high-resolution 3D seismic, are significantly improving the accuracy of subsurface reservoir mapping for companies like Capricorn Energy. This allows for more precise identification of hydrocarbon deposits, reducing exploration risks. For example, advancements in seismic data processing have led to a notable increase in the success rate of discovering commercially viable reserves.

Automated drilling systems and sophisticated reservoir management software are streamlining operations and cutting costs. These technologies enable faster drilling times and more efficient extraction, directly impacting profitability. In 2024, the industry saw a continued push towards digitalization in drilling, with some operators reporting cost reductions of up to 15% on certain wells due to automation.

The oil and gas industry, including companies like Capricorn Energy, is increasingly leveraging digitalization and advanced data analytics to streamline operations. Real-time data monitoring, powered by IoT sensors, allows for immediate identification of performance deviations and potential issues in exploration and production. This digital transformation is crucial for optimizing asset performance and reducing operational costs.

| Technology Area | Impact | 2024/2025 Data/Trend |

|---|---|---|

| Seismic Imaging | Improved reservoir mapping, reduced exploration risk | Increased success rates in identifying viable reserves |

| Automation & Robotics | Streamlined operations, cost reduction, enhanced safety | 15% year-over-year increase in adoption for subsea operations (2024); global oil & gas robotics market projected to reach $10 billion (end of 2024) |

| Digitalization & AI | Optimized asset performance, predictive maintenance, improved decision-making | 15-20% reduction in unplanned downtime through digital initiatives (mid-2024) |

| Carbon Capture, Utilization, and Storage (CCUS) | Carbon footprint reduction, environmental compliance | Global CCUS capacity growing, but significant investment needed; cost and infrastructure remain key challenges (IEA 2024 CCUS Special Brief) |

Legal factors

Capricorn Energy navigates a complex regulatory landscape in its operating regions, particularly in Egypt and the UK. Licensing requirements, concession agreements, and operational permits are critical, dictating exploration, development, and production activities. These legal frameworks establish contractual obligations with national governments, influencing project timelines and profitability.

In Egypt, ongoing negotiations for concession consolidation are a significant factor, potentially reshaping Capricorn's operational footprint and contractual terms. Such consolidations can lead to streamlined operations but also introduce new compliance challenges and require careful adaptation to evolving legal frameworks.

Capricorn Energy's operations are significantly shaped by environmental laws, including stringent regulations on emissions, waste management, and water discharge. The company must navigate evolving standards for biodiversity protection, a critical aspect given the nature of oil and gas exploration. Failure to comply with these increasingly strict rules, such as those governing Scope 3 emissions, could lead to substantial penalties and legal hurdles.

Taxation laws significantly shape Capricorn Energy's profitability and investment strategy. Changes in corporate tax rates, royalty agreements, and specific fiscal terms directly impact net revenue. For instance, the introduction or adjustment of windfall taxes, often implemented during periods of high commodity prices, can substantially reduce retained earnings.

International tax reforms, such as the OECD's Pillar Two initiative aiming for a global minimum tax of 15%, present complex legal and financial considerations for companies operating across multiple jurisdictions. These reforms necessitate careful analysis to ensure compliance and manage potential tax liabilities, influencing where Capricorn Energy chooses to invest and develop its assets.

Health and Safety Regulations

Capricorn Energy, like all companies in the energy sector, must navigate a complex web of health and safety regulations across its global operations. These legal frameworks are designed to safeguard employees and prevent catastrophic industrial accidents, with significant penalties for non-compliance. For instance, in the UK, the Health and Safety at Work etc. Act 1974 imposes a general duty of care on employers, while specific regulations like COMAH (Control of Major Accident Hazards) apply to sites handling dangerous substances.

Failure to adhere to these stringent requirements can result in severe consequences. These can range from substantial financial penalties, such as the £1.4 million fine levied against BP in 2023 for safety breaches following an incident, to mandatory operational shutdowns that disrupt production and revenue streams. Furthermore, companies face potential civil liabilities, including costly lawsuits from injured workers or their families, impacting both financial performance and corporate reputation.

- UK Health and Safety Executive (HSE) enforcement actions: In 2023, the HSE reported over 10,000 prosecutions for health and safety breaches, resulting in significant fines.

- International Labour Organization (ILO) conventions: Many countries align their national legislation with ILO standards, emphasizing a global commitment to worker safety.

- Country-specific regulations: Capricorn Energy must comply with varied standards, such as OSHA in the United States and similar bodies in countries like Egypt and Mexico, each with unique reporting and safety protocols.

- Consequences of non-compliance: Beyond fines, companies can face criminal charges, reputational damage, and loss of operating licenses.

Corporate Governance and Reporting Requirements

Capricorn Energy, as a publicly traded entity, navigates a stringent legal landscape governing corporate governance and financial transparency. This includes adhering to regulations concerning shareholder rights, board diversity, and the public disclosure of payments made to governments, fostering accountability. For instance, the UK Corporate Governance Code sets expectations for board composition and remuneration, with listed companies expected to report on their compliance.

The company must also comply with evolving Environmental, Social, and Governance (ESG) reporting standards, a trend amplified by recent regulatory pushes. For example, the UK's Financial Conduct Authority (FCA) has introduced new rules for climate-related financial disclosures, requiring companies to report on their governance, strategy, risk management, and metrics and targets. This means Capricorn Energy must provide detailed information on its sustainability performance to maintain investor confidence and meet legal obligations.

- Shareholder Rights: Adherence to legal frameworks protecting shareholder voting rights and the ability to influence company decisions.

- Board Composition: Meeting requirements for independent directors and diversity on the board, as outlined by governance codes and listing rules.

- Government Payments Disclosure: Compliance with regulations requiring transparency on payments made to governments in the jurisdictions where it operates, such as under the UK's Companies (Strategic Report) (Climate-related Financial Disclosure) Regulations 2022.

- ESG Reporting: Meeting new mandates for disclosing climate-related risks and opportunities, as well as broader sustainability performance, to enhance investor understanding and trust.

Capricorn Energy's operations are heavily influenced by international tax treaties and evolving global tax reforms, like the OECD's Pillar Two initiative which aims for a 15% global minimum corporate tax rate. These legal frameworks directly impact profitability and investment decisions across its various operating regions, necessitating careful compliance strategies.

The company must also adhere to stringent health and safety regulations, as exemplified by the UK's Health and Safety at Work etc. Act 1974 and specific rules for hazardous sites. Non-compliance can lead to substantial fines, as seen in industry examples where breaches resulted in multi-million-pound penalties, alongside potential operational shutdowns and civil liabilities.

Corporate governance laws and ESG reporting mandates, such as the UK's Financial Conduct Authority rules on climate-related financial disclosures, require Capricorn Energy to maintain transparency on board composition, shareholder rights, and sustainability performance. This ensures accountability and meets investor expectations for responsible business practices.

Environmental factors

Global and national climate change policies, including carbon pricing and emissions reduction targets, directly affect the oil and gas sector. For instance, the European Union's Emissions Trading System (ETS) has seen carbon prices fluctuate, reaching over €100 per tonne of CO2 in early 2024, increasing operational costs for companies. These regulations, coupled with net-zero commitments by numerous countries, put pressure on firms like Capricorn Energy to decarbonize and adapt to a potential long-term decline in fossil fuel demand, influencing their strategic planning and investment decisions.

The global push towards decarbonization significantly impacts companies like Capricorn Energy, formerly Cairn Energy. Governments and investors are increasingly demanding a shift away from fossil fuels, pressuring oil and gas firms to reduce emissions and explore cleaner alternatives. For instance, the International Energy Agency reported in 2024 that global investment in clean energy technologies reached a record $2 trillion in 2023, highlighting the growing capital allocation towards low-carbon businesses.

This energy transition necessitates strategic adjustments for Capricorn Energy, potentially involving diversification into renewable energy projects or investing in carbon capture, utilization, and storage (CCUS) technologies. The company's future investment decisions must weigh the long-term viability of traditional oil and gas exploration against the growing opportunities and regulatory requirements in the low-carbon sector.

Capricorn Energy faces scrutiny over the environmental impact of its oil and gas operations, particularly concerning biodiversity loss in sensitive marine and desert habitats. Disruptions to these ecosystems, coupled with potential pollution, necessitate rigorous environmental impact assessments and effective mitigation strategies to meet increasingly stringent regulatory expectations.

The company's operations in regions like the North Sea and offshore West Africa highlight the need to balance energy production with the preservation of marine biodiversity. For instance, the International Union for Conservation of Nature (IUCN) Red List continues to grow, with many marine species facing significant threats, underscoring the importance of responsible operational practices.

Furthermore, the growing global emphasis on nature-related financial disclosures, such as those recommended by the Taskforce on Nature-related Financial Disclosures (TNFD), means Capricorn Energy must transparently report on its dependencies and impacts on natural capital. This shift reflects investor and stakeholder demand for greater accountability in minimizing ecological damage and ensuring sustainable resource development.

Water Stress and Resource Management

Capricorn Energy, formerly Cairn Energy, faces significant environmental challenges related to water stress, particularly in regions like Egypt where its operations are located. Efficient water use and responsible resource management are critical for sustainable oil and gas extraction, especially given that water scarcity is a growing global concern. For instance, by 2025, projections indicate that over two-thirds of the world's population could face water shortages, making water management a paramount issue for companies operating in such environments.

The company must prioritize advanced wastewater treatment technologies to meet stringent water quality regulations and minimize its environmental footprint. Failure to do so could lead to regulatory penalties, operational disruptions, and reputational damage, impacting its social license to operate. Effective water management strategies not only mitigate environmental risks but also contribute to cost savings through reduced water consumption and treatment expenses.

- Water Scarcity Impact: Regions like Egypt are particularly vulnerable to water stress, impacting operational feasibility and increasing costs for water acquisition.

- Regulatory Compliance: Adherence to evolving water quality standards and discharge permits is essential to avoid legal repercussions and maintain operational continuity.

- Operational Efficiency: Implementing technologies for water recycling and reuse can significantly reduce the demand for fresh water in extraction processes.

- Societal Implications: Responsible water management is crucial for maintaining positive community relations and avoiding conflicts over shared water resources.

Waste Management and Pollution Control

Cairn Energy, like all players in the oil and gas sector, faces significant environmental scrutiny regarding waste management and pollution control. The generation of drilling waste, including muds and cuttings, along with the handling of hazardous materials, necessitates robust disposal and treatment protocols. For instance, in 2024, the industry continued to grapple with the environmental impact of legacy operations, driving demand for advanced remediation technologies.

Pollution, particularly from potential oil spills and the release of air pollutants like sulfur dioxide and nitrogen oxides, remains a critical concern. Cairn Energy's commitment to environmental stewardship is demonstrated through its investments in spill prevention measures and pollution control technologies. The company's efforts in 2024 focused on enhancing operational safety to minimize the risk of incidents.

Reducing methane emissions and flaring is a key environmental objective for the industry. Methane is a potent greenhouse gas, and its capture or elimination is a priority. Globally, regulations are tightening, pushing companies to adopt innovative solutions. For example, by the end of 2025, many regions aim to see a significant reduction in routine flaring, a practice that releases unburned natural gas into the atmosphere.

- Waste Management: Implementing advanced techniques for drilling waste disposal and hazardous material containment is crucial for regulatory compliance and minimizing ecological footprint.

- Pollution Control: Investing in state-of-the-art technologies for spill prevention and the mitigation of air and water pollutants is paramount to operational integrity and environmental responsibility.

- Emissions Reduction: Focused efforts on reducing methane leaks and curtailing flaring activities are essential to meet global climate targets and enhance the company's sustainability profile.

- Regulatory Landscape: Navigating evolving environmental regulations, such as those targeting emissions and waste disposal, requires continuous adaptation and investment in compliance technologies.

Capricorn Energy, formerly Cairn Energy, operates within an increasingly stringent environmental regulatory framework. Global climate agreements and national policies, such as the EU's Emissions Trading System, directly influence operational costs and strategic investment, with carbon prices exceeding €100 per tonne of CO2 in early 2024. The company must adapt to decarbonization pressures and the long-term shift away from fossil fuels, a trend underscored by record $2 trillion in global clean energy investments in 2023.

The company faces significant biodiversity concerns, particularly in its North Sea and West Africa operations, requiring robust environmental impact assessments and mitigation strategies. Growing investor demand for nature-related financial disclosures, as promoted by the TNFD, necessitates transparent reporting on ecological impacts and dependencies.

Water scarcity poses a critical operational challenge, especially in regions like Egypt. Projections suggest over two-thirds of the world's population could face water shortages by 2025, emphasizing the need for efficient water management, advanced wastewater treatment, and water recycling technologies to ensure sustainability and regulatory compliance.

Waste management and pollution control are key environmental considerations. The industry is actively addressing legacy operational impacts and investing in advanced remediation technologies. Reducing methane emissions and flaring, with many regions targeting significant reductions by the end of 2025, is a priority for climate targets and operational integrity.

PESTLE Analysis Data Sources

Our Cairn Energy PESTLE Analysis is grounded in data from reputable sources including government energy departments, international financial institutions, and leading industry publications. We meticulously gather insights on political stability, economic forecasts, technological advancements, environmental regulations, and social trends impacting the energy sector.